Middle East And Africa Ultrasound Imaging Devices Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

1.17 Billion

USD

2.17 Billion

2021

2029

USD

1.17 Billion

USD

2.17 Billion

2021

2029

| 2022 –2029 | |

| USD 1.17 Billion | |

| USD 2.17 Billion | |

|

|

|

Mercado de dispositivos de imagem de ultrassons do Médio Oriente e África, por formato de matriz (matriz em fase, matriz linear, matriz linear curva, outros), visor do dispositivo (dispositivos de ultrassons a cores, dispositivos de ultrassons a preto e branco (P /B)), portabilidade do dispositivo (carrinho/ Dispositivos de ultrassons baseados em carrinho, Dispositivos de ultrassons compactos/portáteis, Dispositivos de ultrassons estacionários, Dispositivos de ultrassons no ponto de atendimento ), Tecnologia (Ecografia de diagnóstico, Ecografia terapêutica), Aplicação ( Radiologia/Imagem geral, Obstetrícia e ginecologia, Cardiovascular, Gastrenterologia, Vascular , Urológico, Ortopédico e Músculo-Esquelético , Gestão da Dor, Departamento de Urgência, Cuidados Críticos, Outros), Utilizador Final (Hospitais, Blocos Operatórios, Investigação e Ginásio, Maternidades, Centros de Atendimento Ambulatório, Centros de Diagnóstico, Outros), Canal de Distribuição (Concurso Directo , Distribuidores Terceirizados, Vendas a Retalho) – Tendências e Previsões do Sector até 2029

Análise de Mercado e Tamanho

Os procedimentos de tratamento urológico estão a tornar-se cada vez mais populares em todo o mundo. O número crescente de operações médicas envolvendo rins, ureteres, bexiga, uretra, próstata e saúde reprodutiva alargou o campo de expansão dos instrumentos de imagiologia ecográfica. Aumentar a implementação de novas tecnologias nestes sistemas médicos aumentaria ainda mais a sua eficiência nos processos de cuidados de saúde.

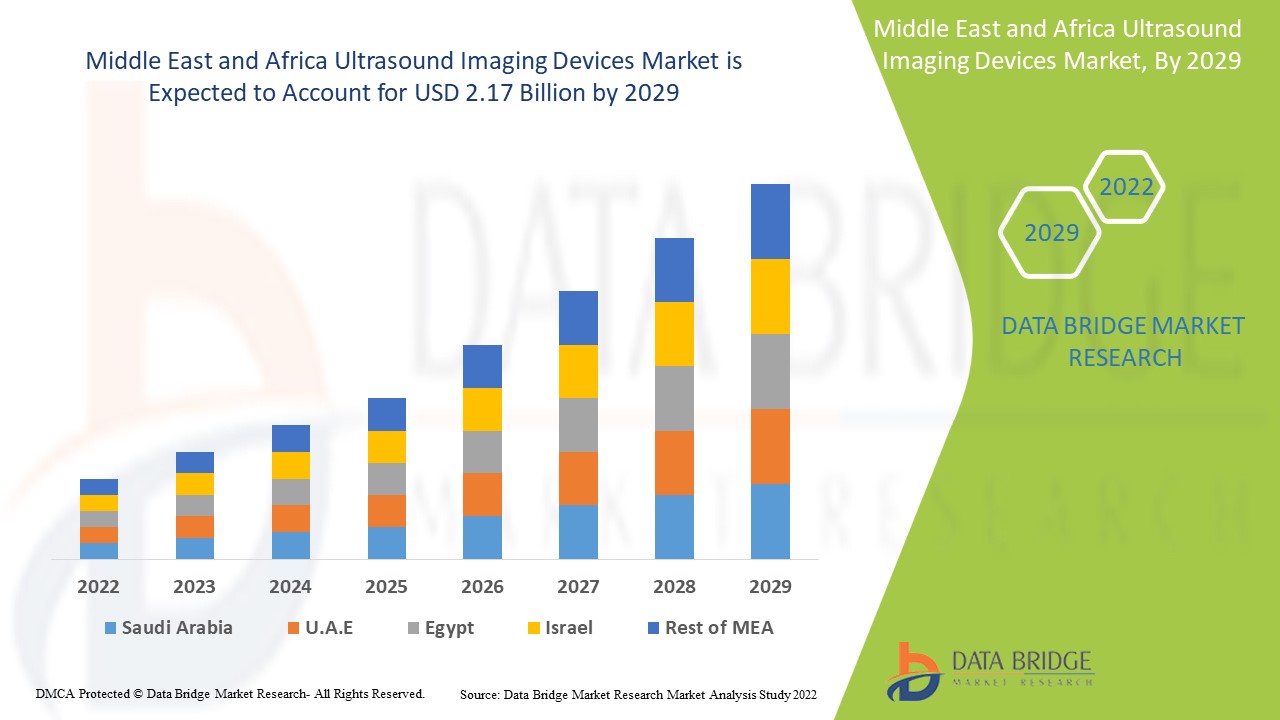

A Data Bridge Market Research analisa que o mercado de dispositivos de imagem por ultrassons, que era de 1,17 mil milhões de dólares em 2021, dispararia para 2,17 mil milhões de dólares até 2029, e deverá sofrer um CAGR de 8,00% durante o período previsto de 2022 a 2029. Além disso, os insights de mercado, tais como o valor de mercado, a taxa de crescimento, os segmentos de mercado, a cobertura geográfica, os participantes do mercado e o cenário de mercado, o relatório de mercado com curadoria da equipa de investigação de mercado da Data Bridge também inclui análise aprofundada de especialistas, epidemiologia do paciente, análise de pipeline, preços análise e estrutura regulatória.

Definição de Mercado

Os dispositivos de imagem por ultrassons são dispositivos que utilizam ondas sonoras de alta frequência para produzir imagens do interior do corpo. O sistema de ultrassons utiliza tecnologia de imagem ultrassónica. Os equipamentos de ultrassons podem gerar imagens em tempo real de componentes biológicos que demonstram como o corpo se move. Um transdutor e um detetor ultrassónico, ou sonda, compõem um sistema de ultrassons. Esta tecnologia de diagnóstico minimamente invasiva não utiliza radiação ionizante para diagnosticar ou tratar doenças do corpo.

Âmbito do Relatório e Segmentação de Mercado

|

Métrica de Reporte |

Detalhes |

|

Período de previsão |

2022 a 2029 |

|

Ano base |

2021 |

|

Anos históricos |

2020 (Personalizável para 2014 - 2019) |

|

Unidades quantitativas |

Receita em biliões de dólares americanos, volumes em unidades, preços em dólares americanos |

|

Segmentos abrangidos |

Formato de matriz (matriz em fase, matriz linear, matriz linear curva, outros), visualização do dispositivo (dispositivos de ultrassons a cores, dispositivos de ultrassons a preto e branco (P/B)), portabilidade do dispositivo (dispositivos de ultrassons baseados em carrinho/carrinho, dispositivos de ecografia compactos/portáteis). Dispositivos, Dispositivos de ecografia estacionários, Dispositivos de ecografia no local de atendimento), Tecnologia (Ecografia de diagnóstico, Ecografia terapêutica), Aplicação (Radiologia/Imagem geral, Obstetrícia e ginecologia, Cardiovascular, Gastrenterologia, Vascular, Urológica, Ortopédica e musculoesquelética, Controlo da dor, Departamento de Urgência, Cuidados Críticos, Outros), Utilizador Final (Hospitais, Centros Cirúrgicos, Investigação e Ginásio, Centros de Maternidade, Centros de Atendimento Ambulatório, Centros de Diagnóstico, Outros ), Canal de Distribuição (Concurso Directo, Distribuidores Terceirizados, Venda a Retalho) |

|

Países abrangidos |

Arábia Saudita, Emirados Árabes Unidos, África do Sul, Egito, Israel, Resto do Médio Oriente e África (MEA) como parte do Médio Oriente e África (MEA) |

|

Atores do mercado abrangidos |

Koninklijke Philips NV (Holanda), CANON MEDICAL SYSTEMS CORPORATION (Japão), Hitachi, Ltd. (Japão), Siemens (Alemanha), Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China), ALPINION MEDICAL SYSTEMS Co., Ltd (EUA), CHISON Medical Technologies Co., Ltd. (EUA), EDAN Instruments, Inc. (China), ESAOTE SPA (Itália), FUJIFILM Corporation (Japão), FUKUDA DENSHI (Japão), Hologic, Inc. (EUA) , SAMSUNG HEALTHCARE (EUA), Analogic Corporation (EUA), General Electric (EUA), TOSHIBA CORPORATION (Japão), Trivitron Healthcare (Índia) |

|

Oportunidades de Mercado |

|

Dinâmica do mercado de dispositivos de imagem por ultrassons

Motoristas

- Aumento da prevalência de doenças

A frequência crescente de doenças e distúrbios agudos e crónicos em todo o mundo, devido a várias razões, é um dos principais fatores que impulsionam o crescimento do mercado. Por exemplo, a crescente prevalência de tumores cancerígenos, cálculos biliares, doença hepática gordurosa e outros distúrbios impacta direta e positivamente o crescimento do mercado. Em 2015, 415 milhões de pessoas no mundo tinham diabetes; até 2040, este número aumentará para 642 milhões.

- Proficiência em investigação e desenvolvimento

O aumento dos gastos em investigação e desenvolvimento, especialmente nos países desenvolvidos e em desenvolvimento, na área dos equipamentos e dispositivos médicos, proporcionará perspectivas de crescimento do mercado ainda mais rentáveis. A taxa de crescimento do mercado é ainda reforçada por recursos de investigação e desenvolvimento relevantes para os desenvolvimentos em tecnologias de imagiologia médica.

- Investimento crescente em instalações de saúde

Outro elemento importante que impulsiona a expansão do mercado é o foco renovado na melhoria do estado das instalações de saúde e da infraestrutura geral de saúde. O número crescente de parcerias público-privadas e de cooperação estratégica no financiamento e na implantação de tecnologias novas e melhoradas está a proporcionar perspetivas de mercado ainda mais rentáveis. Além disso, o aumento das medidas governamentais para sensibilizar para a necessidade do diagnóstico precoce está a impulsionar a taxa de crescimento do mercado mais uma vez.

- Procura por dispositivos de imagem por ultrassons

Com a crescente procura por utilizações diagnósticas e terapêuticas minimamente invasivas de dispositivos de imagem por ultrassons e o lançamento de equipamentos de ultrassons tecnologicamente mais avançados, a procura por dispositivos de imagem por ultrassons aumentou em comparação com o ano anterior. Além disso, as medidas governamentais para sensibilizar para a necessidade de diagnóstico precoce aumentaram a procura de instrumentos de imagem ultrassónica.

Oportunidades

Prevê-se que a incidência de doenças crónicas aumente, resultando num aumento de doentes que necessitam de melhores opções de diagnóstico e terapêutica. Os mercados emergentes seriam os mais afectados, uma vez que o crescimento populacional nos países em desenvolvimento, particularmente na Índia e na China, deverá ser grande, aumentando os gastos em saúde nestes países. Os avanços na identificação e diagnóstico de doenças também ajudarão a manter os custos do tratamento de doenças crónicas sob controlo. De acordo com a Organização Mundial de Saúde, a prevalência de doenças crónicas deverá aumentar 57% até 2020, com as taxas de obesidade e incidências de doenças como a diabetes a aumentar, aumentando a necessidade de dispositivos de ecografia para identificar os doentes. A utilização de tecnologias de ultrassons para diagnosticar os pacientes mais precocemente ajuda a reduzir os custos totais de saúde. Prevê-se que a utilização de dispositivos de ultrassons aumente à medida que o número de doentes com doenças crónicas aumenta, impulsionando a expansão do mercado.

Restrições/Desafios

Por outro lado, a expansão do mercado será provavelmente prejudicada pelos elevados custos associados às capacidades de investigação e desenvolvimento, às instalações de infra-estruturas inadequadas, à distribuição desigual dos serviços médicos e à falta de sensibilização nas nações atrasadas. Além disso, no período previsto de 2022-2029, espera-se que o mercado seja desafiado pela falta de um cenário favorável de reembolso e penetração de tecnologia nas economias em desenvolvimento, um declínio nas despesas de saúde nos países avançados, aumento da expiração de patentes, pressão governamental sobre os preços, elevado custo dos aparelhos de ecografia e falta de infraestruturas adequadas nos países de baixo e médio rendimento.

A expansão do mercado de dispositivos de imagem por ultrassons está a ser prejudicada por autorizações e regulamentos rigorosos de entidades governamentais, como a Food and Drug Administration (FDA) dos EUA. Além do processo de registo padrão, os fabricantes devem cumprir uma série de regras, incluindo o controlo de qualidade do dispositivo, a rotulagem, a aprovação pré-comercialização, a investigação do dispositivo e os relatórios.

Este relatório de mercado de dispositivos de imagem de ultrassons fornece detalhes de novos desenvolvimentos recentes, regulamentos comerciais, análise de importação e exportação, análise de produção, otimização da cadeia de valor, quota de mercado, impacto dos participantes do mercado doméstico e localizado, analisa oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações de mercado, análise estratégica do crescimento do mercado, tamanho do mercado, crescimento do mercado de categorias, nichos de aplicação e dominância, aprovações de produtos, lançamentos de produtos, expansões geográficas, inovações tecnológicas no mercado. Para mais informações sobre o mercado de dispositivos de imagem por ultrassons, contacte a Data Bridge Market Research para um briefing de analista.

Impacto da COVID-19 no mercado dos dispositivos de imagem por ultrassons

A resposta do mercado à COVID-19 tem sido mínima. A redução da taxa de fabrico de dispositivos médicos teve um impacto negativo na receita. A procura por equipamentos de ecografia caiu à medida que o uso de sistemas de imagem caiu devido à redução da necessidade de tratamento de emergência. Por outro lado, projeta-se que o período pós-pandemia coloque o mercado de volta nos carris. A COVID-19 é uma doença infecciosa que pode danificar diversos tecidos e órgãos à medida que se desenvolve. Como resultado, o impacto da doença em todos os estádios e órgãos necessita de uma tecnologia de imagem funcional e versátil, capaz de detetar dinamicamente particularidades ou anormalidades. A ecografia cumpre todos estes critérios e apresenta diversas vantagens em relação a outras modalidades de imagem, como a portabilidade, acessibilidade e biossegurança. Durante a epidemia de COVID-19, a ecografia desempenhou um papel fundamental no rastreio, monitorização, deteção de danos nos órgãos e permitiu que os doentes tomassem decisões terapêuticas personalizadas. Esta revisão centra-se nos principais resultados patogénicos associados às alterações ecográficas induzidas pela COVID-19 nos pulmões, coração e fígado.

Desenvolvimento recente

- A Hitachi, Ltd. iniciou as vendas internacionais do ARIETTA 750, um novo modelo da série de plataformas de ecografia de diagnóstico ARIETTA, em março de 2020. A Hitachi, Ltd. melhorou o seu portefólio de produtos e a procura do mercado com este novo lançamento, resultando num aumento de receita no futuro .

- Em fevereiro de 2022, a Butterfly Network, Inc. e a Ambra Health anunciaram uma colaboração para acelerar e simplificar a troca de dados de imagens à beira da cama. Esta parceria irá melhorar o acesso e a capacidade de partilha de informações valiosas sobre ultrassons entre hospitais e sistemas de saúde, aumentando a escalabilidade do Butterfly Blueprint, a plataforma empresarial da Butterfly.

Âmbito do mercado de dispositivos de imagem de ultrassons no Médio Oriente e África

O mercado de dispositivos de imagem por ultrassons é segmentado com base no produto, no ecrã do dispositivo, na portabilidade do dispositivo, na aplicação, no utilizador final e no canal de distribuição. O crescimento entre estes segmentos irá ajudá-lo a analisar segmentos de baixo crescimento nos setores e fornecerá aos utilizadores uma visão geral e informações valiosas do mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Formato de matriz

- Matriz em fases

- Matriz Linear

- Matriz Linear Curva

- Outros

Tecnologia

- Sistemas de Ultrassom Diagnóstico

- Sistemas de imagem 2D

- Sistemas de imagem 3D e 4D

- Imagem Doppler

- Sistemas de Ecografia Terapêutica

- Ultrassom Focalizado de Alta Intensidade (HIFU)

- Litotrícia extracorporal por ondas de choque (LECO)

Exibição do dispositivo

- Aparelhos de ultrassons coloridos

- Dispositivos de ultrassons a preto e branco (P/B)

Portabilidade do dispositivo

- Dispositivos de ultrassons baseados em carrinhos/carrinhos

- Dispositivos de ultrassons compactos/portáteis

Aplicação

- Radiologia/Imagem Geral

- Cardiologia

- Obstetrícia/Ginecologia

- Vascular

- Urologia

- Outros

Utilizador final

- Hospitais

- Centros Cirúrgicos

- Investigação e Academia

- Centros de Maternidade

- Centros de Atendimento Ambulatório

- Centros de Diagnóstico

- Outros

Canal de distribuição

- Licitação Direta

- Distribuidores Terceirizados

- Vendas no retalho

Análise/Insights regionais do mercado de dispositivos de imagem por ultrassons

O mercado de dispositivos de imagem por ultrassons é analisado e são fornecidos insights e tendências sobre o tamanho do mercado por país, produto, ecrã do dispositivo, portabilidade do dispositivo, aplicação, utilizador final e canal de distribuição, conforme referenciado acima.

Os países abrangidos pelo relatório de mercado de dispositivos de imagem por ultrassons são a Arábia Saudita, os Emirados Árabes Unidos, a África do Sul, o Egito, Israel, o Resto do Médio Oriente e África (MEA) como parte do Médio Oriente e África (MEA).

A África do Sul está a dominar o mercado do Médio Oriente e África com a rápida transição na infra-estrutura de cuidados de saúde, o que leva a uma elevada procura de equipamento médico, incluindo dispositivos de imagem por ultra-sons. Como o ultrassom é mais barato do que outras modalidades de imagem, existe uma procura significativa por estes equipamentos na região.

A secção do relatório sobre os países também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado nacional que impactam as tendências atuais e futuras do mercado. Pontos de dados como a análise da cadeia de valor a montante e a jusante, tendências técnicas e análise das cinco forças de Porter, estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade de marcas globais e os seus desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, ao impacto de tarifas domésticas e rotas comerciais são considerados ao fornecer uma análise de previsão dos dados do país.

Crescimento da infraestrutura de saúde Base instalada e penetração de novas tecnologias

The ultrasound imaging devices market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for ultrasound imaging devices market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the ultrasound imaging devices market. The data is available for historic period 2010-2020.

Competitive Landscape and Ultrasound Imaging Devices Market Share Analysis

The ultrasound imaging devices market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to ultrasound imaging devices market.

Some of the major players operating in the ultrasound imaging devices market are:

- Koninklijke Philips N.V. (Netherlands)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Hitachi, Ltd. (Japan)

- Siemens (Germany)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- ALPINION MEDICAL SYSTEMS Co., Ltd (U.S.)

- CHISON Medical Technologies Co., Ltd. (U.S.)

- EDAN Instruments, Inc. (China)

- ESAOTE SPA (Italy)

- FUJIFILM Corporation (Japan)

- FUKUDA DENSHI (Japan)

- Hologic, Inc. (U.S.)

- SAMSUNG HEALTHCARE (U.S.)

- Analogic Corporation (U.S.)

- General Electric (U.S.)

- TOSHIBA CORPORATION (Japan)

- Trivitron Healthcare (India)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 MULTIVARIATE MODELLING

2.8 ARRAY FORMAT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 TECHNOLOGICAL ADVANCEMENTS IN ULTRASOUND IMAGING SYSTEM

5.1.2 INCREASE INCIDENCE RATES OF CHRONIC DISEASES

5.1.3 INCREASE IN NUMBER OF ULTRASOUND DIAGNOSTIC IMAGING PROCEDURES IN OBSTETRICS & GYNECOLOGY FIELD

5.1.4 RISE IN AWARENESS FOR EARLY DISEASE DIAGNOSIS

5.1.5 REIMBURSEMENT FOR ULTRASOUND GUIDED PROCEDURES

5.2 RESTRAINTS

5.2.1 HIGH COST OF ULTRASOUND IMAGING DEVICES

5.2.2 DEARTH OF SKILLED AND EXPERIENCED SONOGRAPHERS WORLDWIDE.

5.2.3 STRINGENT GOVERNMENT REGULATIONS

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND FOR MINIMALLY INVASIVE TECHNOLOGY

5.3.2 RISING DISPOSABLE INCOME

5.3.3 EMERGENCE OF POC ULTRASOUND DEVICES

5.4 CHALLENGES

5.4.1 LIMITATIONS OF ULTRASOUND IMAGING

5.4.2 INCREASING ADOPTION OF REFURBISHED IMAGING SYSTEM

6 IMPACT OF COVID-19 PANDEMIC ON THE MARKET

6.1 PRICE IMPACT

6.2 IMPACT ON DEMAND

6.3 IMPACT ON SUPPLY CHAIN

6.4 STRATEGIC DECISIONS FOR MANUFACTURERS

6.5 CONCLUSION

7 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY ARRAY FORMAT

7.1 OVERVIEW

7.2 CURVED LINEAR ARRAY

7.3 LINEAR ARRAY

7.4 PHASED ARRAY

7.5 OTHERS

8 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY

8.1 OVERVIEW

8.2 COLOR ULTRASOUND DEVICES

8.2.1 MID-END COLOR DOPPLER

8.2.2 LOW-END COLOR DOPPLER

8.2.3 HIGH-END COLOR DOPPLER

8.2.4 PREMIUM-END COLOR DOPPLER

8.3 BLACK AND WHITE (B/W) ULTRASOUND DEVICES

9 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY

9.1 OVERVIEW

9.2 TROLLEY/CART-BASED ULTRASOUND DEVICES

9.2.1 MID-RANGE

9.2.2 LOW-END

9.2.3 HIGH-END

9.2.4 PREMIUM

9.3 STATIONARY ULTRASOUND DEVICES

9.3.1 MID-RANGE

9.3.2 LOW-END

9.3.3 HIGH-END

9.3.4 PREMIUM

9.4 POINT-OF-CARE ULTRASOUND DEVICES

9.5 COMPACT/HANDHELD ULTRASOUND DEVICES

9.5.1 MID-RANGE

9.5.2 LOW-END

9.5.3 HIGH-END

9.5.4 PREMIUM

10 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 DIAGNOSTIC ULTRASOUND

10.2.1 3D AND 4D ULTRASOUND

10.2.2 2D IMAGING

10.2.3 DOPPLER IMAGING

10.3 THERAPEUTIC ULTRASOUND

10.3.1 SHOCKWAVE LITHOTRIPSY

10.3.2 OTHERS

11 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 RADIOLOGY/GENERAL IMAGING

11.3 CARDIOVASCULAR

11.4 OBSTETRICS AND GYNECOLOGY

11.5 UROLOGICAL

11.6 ORTHOPEDIC AND MUSCULOSKELETAL

11.7 GASTROENTEROLOGY

11.8 EMERGENCY DEPARTMENT

11.9 CRITICAL CARE

11.1 PAIN MANAGEMENT

11.11 VASCULAR

11.12 OTHERS

12 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 RETAIL SALES

12.4 THIRD PARTY DISTRIBUTORS

13 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY END USER

13.1 OVERVIEW

13.2 HOSPITALS

13.3 DIAGNOSTIC CENTERS

13.4 MATERNITY CENTERS

13.5 AMBULATORY CARE CENTERS

13.6 SURGICAL CENTERS

13.7 RESEARCH AND ACADEMIA

13.8 OTHERS

14 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY GEOGRAPHY

14.1 MIDDLE EAST & AFRICA

14.1.1 SOUTH AFRICA

14.1.2 SAUDI ARABIA

14.1.3 U.A.E.

14.1.4 ISRAEL

14.1.5 EGYPT

14.1.6 REST OF MIDDLE EAST & AFRICA

15 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 GE HEALTHCARE (A SUBSIDIARY OF GENERAL ELECTRIC)

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 KONINKLIJKE PHILIPS N.V.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 CANON MEDICAL SYSTEMS CORPORATION (A SUBSIDIARY OF CANON INC.)

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 HITACHI, LTD.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 SIEMENS HEALTHCARE GMBH

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 ALPINION MEDICAL SYSTEMS CO., LTD

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 CHISON

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 EDAN INSTRUMENTS, INC.

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 ESAOTE SPA

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 FUJIFILM CORPORATION (A SUBSIDIARY OF FUJIFILM HOLDINGS CORPORATION)

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 FUKUDA DENSHI

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 HOLOGIC, INC.

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENTS

17.14 MOBISANTE

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 SAMSUNGHEALTHCARE (A SUBSIDIARY OF SAMSUNG ELECTRONICS CO., LTD.)

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENTS

17.16 SHIMADZU MEDICAL SYSTEMS USA NORTHWEST BRANCH (A SUBSIDIARY OF SHIMADZU CORPORATION)

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUE ANALYSIS

17.16.3 PRODUCT PORTFOLIO

17.16.4 RECENT DEVELOPMENTS

17.17 SONOSCAPE MEDICAL CORP.

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 TRIVITRON HEALTHCARE

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

18 CONCLUSION

19 QUESTIONNAIRE

20 RELATED REPORTS

Lista de Tabela

TABLE 1 ULTRASOUND DEVICES USED IN OBSTETRICS & GYNECOLOGY

TABLE 2 LIST OF PRIZES OF ULTRASOUND IMAGING DEVICES

TABLE 3 POC ULTRASOUND DEVICES

TABLE 4 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY ARRAY FORMAT, 2018-2027 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA CURVED LINEAR ARRAY IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA LINEAR ARRAY IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA PHASED ARRAY IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA OTHERS IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (UNITS)

TABLE 10 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA COLOR ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA COLOR ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA BLACK AND WHITE (B/W) ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA TROLLEY/CART-BASED ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA TROLLEY/CART-BASED ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA STATIONARY ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA STATIONARY ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA POINT-OF-CARE ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA COMPACT/HANDHELD ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA COMPACT/HANDHELD ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA DIAGNOSTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA DIAGNOSTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA THERAPEUTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA THERAPEUTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA RADIOLOGY/GENERAL IMAGING IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA CARDIOVASCULAR IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA OBSTETRICS AND GYNECOLOGY IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA UROLOGICAL IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA ORTHOPEDIC AND MUSCULOSKELETAL IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA GASTROENTEROLOGY IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA EMERGENCY DEPARTMENT IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA CRITICAL CARE IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA PAIN MANAGEMENT IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA VASCULAR IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA OTHERS IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA DIRECT TENDER IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA RETAIL SALES IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA THIRD PARTY DISTRIBUTORS IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA HOSPITALS IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA DIAGNOSTIC CENTERS IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA MATERNITY CENTERS IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA AMBULATORY CARE CENTERS IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA SURGICAL CENTERS IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA RESEARCH AND ACADEMIA IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA OTHERS IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 51 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY ARRAY FORMAT, 2018-2027 (USD MILLION)

TABLE 53 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (UNITS)

TABLE 55 MIDDLE EAST & AFRICA COLOR ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 57 MIDDLE EAST & AFRICA TROLLEY/CART-BASED ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA STATIONARY ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 59 MIDDLE EAST & AFRICA COMPACT/HANDHELD ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 60 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 61 MIDDLE EAST & AFRICA DIAGNOSTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 62 MIDDLE EAST & AFRICA THERAPEUTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 63 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 64 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 65 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 66 SOUTH AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY ARRAY FORMAT, 2018-2027 (USD MILLION)

TABLE 67 SOUTH AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 68 SOUTH AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (UNITS)

TABLE 69 SOUTH AFRICA COLOR ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 70 SOUTH AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 71 SOUTH AFRICA TROLLEY/CART-BASED ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 72 SOUTH AFRICA STATIONARY ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 73 SOUTH AFRICA COMPACT/HANDHELD ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 74 SOUTH AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 75 SOUTH AFRICA DIAGNOSTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 76 SOUTH AFRICA THERAPEUTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 77 SOUTH AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 78 SOUTH AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 79 SOUTH AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 80 SAUDI ARABIA ULTRASOUND IMAGING DEVICES MARKET, BY ARRAY FORMAT, 2018-2027 (USD MILLION)

TABLE 81 SAUDI ARABIA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 82 SAUDI ARABIA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (UNITS)

TABLE 83 SAUDI ARABIA COLOR ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 84 SAUDI ARABIA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 85 SAUDI ARABIA TROLLEY/CART-BASED ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 86 SAUDI ARABIA STATIONARY ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 87 SAUDI ARABIA COMPACT/HANDHELD ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 88 SAUDI ARABIA ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 89 SAUDI ARABIA DIAGNOSTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 90 SAUDI ARABIA THERAPEUTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 91 SAUDI ARABIA ULTRASOUND IMAGING DEVICES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 92 SAUDI ARABIA ULTRASOUND IMAGING DEVICES MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 93 SAUDI ARABIA ULTRASOUND IMAGING DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 94 U.A.E. ULTRASOUND IMAGING DEVICES MARKET, BY ARRAY FORMAT, 2018-2027 (USD MILLION)

TABLE 95 U.A.E. ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 96 U.A.E. ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (UNITS)

TABLE 97 U.A.E. COLOR ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 98 U.A.E. ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 99 U.A.E. TROLLEY/CART-BASED ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 100 U.A.E. STATIONARY ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 101 U.A.E. COMPACT/HANDHELD ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 102 U.A.E. ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 103 U.A.E. DIAGNOSTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 104 U.A.E. THERAPEUTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 105 U.A.E. ULTRASOUND IMAGING DEVICES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 106 U.A.E. ULTRASOUND IMAGING DEVICES MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 107 U.A.E. ULTRASOUND IMAGING DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 108 ISRAEL ULTRASOUND IMAGING DEVICES MARKET, BY ARRAY FORMAT, 2018-2027 (USD MILLION)

TABLE 109 ISRAEL ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 110 ISRAEL ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (UNITS)

TABLE 111 ISRAEL COLOR ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 112 ISRAEL ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 113 ISRAEL TROLLEY/CART-BASED ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 114 ISRAEL STATIONARY ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 115 ISRAEL COMPACT/HANDHELD ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 116 ISRAEL ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 117 ISRAEL DIAGNOSTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 118 ISRAEL THERAPEUTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 119 ISRAEL ULTRASOUND IMAGING DEVICES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 120 ISRAEL ULTRASOUND IMAGING DEVICES MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 121 ISRAEL ULTRASOUND IMAGING DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 122 EGYPT ULTRASOUND IMAGING DEVICES MARKET, BY ARRAY FORMAT, 2018-2027 (USD MILLION)

TABLE 123 EGYPT ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 124 EGYPT ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (UNITS)

TABLE 125 EGYPT COLOR ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 126 EGYPT ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 127 EGYPT TROLLEY/CART-BASED ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 128 EGYPT STATIONARY ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 129 EGYPT COMPACT/HANDHELD ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 130 EGYPT ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 131 EGYPT DIAGNOSTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 132 EGYPT THERAPEUTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 133 EGYPT ULTRASOUND IMAGING DEVICES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 134 EGYPT ULTRASOUND IMAGING DEVICES MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 135 EGYPT ULTRASOUND IMAGING DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 136 REST OF MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY ARRAY FORMAT, 2018-2027 (USD MILLION)

Lista de Figura

FIGURE 1 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET : MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET : COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET : INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: SEGMENTATION

FIGURE 11 TECHNOLOGICAL ADVANCEMENT IN ULTRASOUND IMAGING SYSTEM AND INCREASED INCIDENCE RATES OF CHRONIC DISEASES ARE DRIVING THE MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET IN THE FORECAST PERIOD 2020 TO 2027

FIGURE 12 CURVED LINEAR ARRAY IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET IN 2020 & 2027

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET

FIGURE 14 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY ARRAY FORMAT, 2019

FIGURE 15 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY ARRAY FORMAT, 2019-2027 (USD MILLION)

FIGURE 16 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY ARRAY FORMAT, CAGR (2020-2027)

FIGURE 17 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY ARRAY FORMAT, LIFELINE CURVE

FIGURE 18 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY DEVICE DISPLAY, 2019

FIGURE 19 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY DEVICE DISPLAY, 2019-2027 (USD MILLION)

FIGURE 20 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY DEVICE DISPLAY, CAGR (2020-2027)

FIGURE 21 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY DEVICE DISPLAY, LIFELINE CURVE

FIGURE 22 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY DEVICE PORTABILITY, 2019

FIGURE 23 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY DEVICE PORTABILITY, 2019-2027 (USD MILLION)

FIGURE 24 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY DEVICE PORTABILITY, CAGR (2020-2027)

FIGURE 25 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY DEVICE PORTABILITY, LIFELINE CURVE

FIGURE 26 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY TECHNOLOGY, 2019

FIGURE 27 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY TECHNOLOGY, 2019-2027 (USD MILLION)

FIGURE 28 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY TECHNOLOGY, CAGR (2020-2027)

FIGURE 29 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 30 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY APPLICATION, 2019

FIGURE 31 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY APPLICATION, 2019-2027 (USD MILLION)

FIGURE 32 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY APPLICATION, CAGR (2020-2027)

FIGURE 33 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 34 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2019

FIGURE 35 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

FIGURE 36 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY DISTRIBUTION CHANNEL, CAGR (2020-2027)

FIGURE 37 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY END USER, 2019

FIGURE 39 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY END USER, 2019-2027 (USD MILLION)

FIGURE 40 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY END USER, CAGR (2020-2027)

FIGURE 41 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY END USER, LIFELINE CURVE

FIGURE 42 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: SNAPSHOT (2019)

FIGURE 43 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY COUNTRY (2019)

FIGURE 44 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY COUNTRY (2020 & 2027)

FIGURE 45 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY COUNTRY (2019 & 2027)

FIGURE 46 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY ARRAY FORMAT (2020-2027)

FIGURE 47 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: COMPANY SHARE 2019 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.