Mercado de gestão de despesas de telecomunicações do Médio Oriente e África, por oferta (solução, serviço), modo de entrega de serviços (software licenciado, serviços geridos e outsourcing completo, alojado), dimensão da empresa (grandes empresas, pequenas e médias empresas ), utilização final (TI e telecomunicações, BFSI, manufatura, saúde, transporte e logística, bens de consumo e retalho, energia e poder, media e entretenimento, outros) e tendências da indústria do país (Arábia Saudita, Israel, África do Sul , Egito e resto do Médio Oriente e África) Previsão para 2028

Análise de Mercado e Insights: Mercado de Gestão de Despesas de Telecomunicações no Médio Oriente e África

Análise de Mercado e Insights: Mercado de Gestão de Despesas de Telecomunicações no Médio Oriente e África

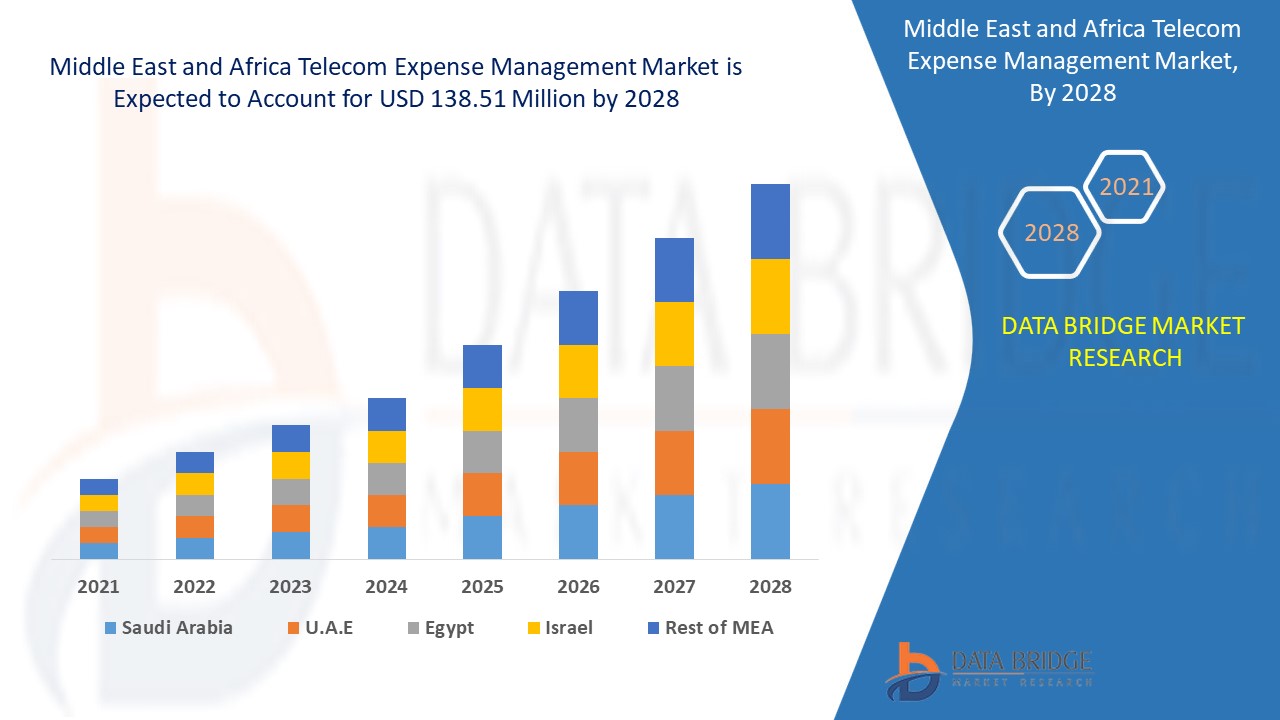

Espera-se que o mercado de gestão de despesas de telecomunicações do Médio Oriente e África ganhe crescimento de mercado no período previsto de 2021 a 2028. A Data Bridge Market Research analisa que o mercado está a crescer com um CAGR de 2,8% no período previsto de 2021 a 2028 e espera-se atingir os 138,51 milhões de dólares até 2028. O aumento da procura de TEM devido à IoT e às aplicações baseadas na cloud está a impulsionar o mercado.

A gestão de despesas de telecomunicações (TEM) é uma abordagem de gestão de todas as despesas de serviços de telecomunicações, como voz, dados e wireless, com uma combinação de ferramentas de software e auditoria manual. Ao gerir todos estes serviços e processos relacionados, o seu principal objetivo é minimizar os custos e maximizar a eficiência do processo. Para uma pequena empresa, pode ser tão simples como verificar a sua conta telefónica todos os meses para ter a certeza de que não está a ser cobrado por serviços que não deseja. Para as empresas de maior dimensão, é um programa mais formal para otimizar as despesas com serviços de telecomunicações. A maior parte da atenção está focada na auditoria de contas e na obtenção de reembolsos por erros de faturação, mas um programa TEM eficaz pode fazer mais do que isso.

O aumento da procura de gestão de despesas de telecomunicações devido à IoT e às aplicações baseadas na nuvem é o principal fator impulsionador do mercado. A previsão de gastos futuros pode ser um desafio, mas o baixo custo de implementação e a crescente procura por soluções TEM com uma boa relação custo-benefício revelam-se uma oportunidade. As restrições devido à falta de interoperabilidade entre soluções e diferentes fornecedores são os fatores restritivos.

O relatório de mercado de gestão de despesas de telecomunicações fornece detalhes sobre a quota de mercado, novos desenvolvimentos e análise do pipeline de produtos, impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações do mercado , aprovações de produtos, decisões estratégicas, lançamentos de produtos , expansões geográficas e inovações tecnológicas no mercado. Para compreender a análise e o cenário de mercado da Gestão de Despesas de Telecomunicações, contacte a Data Bridge Market Research para obter um briefing de analista.

Âmbito e dimensão do mercado de gestão de despesas de telecomunicações no Médio Oriente e África

Âmbito e dimensão do mercado de gestão de despesas de telecomunicações no Médio Oriente e África

O mercado de gestão de despesas de telecomunicações do Médio Oriente e de África está segmentado com base na oferta, modo de prestação de serviço, dimensão da empresa e utilização final. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e a diferença nos seus mercados-alvo.

- Com base na oferta, o mercado global de gestão de despesas de telecomunicações está segmentado em soluções e serviços . Em 2021, prevê-se que o segmento de soluções domine o mercado global de gestão de despesas de telecomunicações, uma vez que ajuda a reduzir custos desnecessários e a otimizar os gastos com telecomunicações.

- Com base no modo de prestação de serviços, o mercado global de gestão de despesas de telecomunicações foi segmentado em software licenciado, serviços geridos e outsourcing completo e alojado. Em 2021, prevê-se que o segmento de software licenciado domine o mercado global de gestão de despesas de telecomunicações, uma vez que todas as operações são realizadas pelo próprio cliente, conferindo transparência a todos os gastos realizados.

- Com base na dimensão da empresa, o mercado global de gestão de despesas de telecomunicações foi segmentado em grandes empresas e pequenas e médias empresas. Em 2021, prevê-se que o segmento das grandes empresas domine o mercado global de gestão de despesas de telecomunicações, uma vez que a maior parte do trabalho de muitas grandes empresas é realizado através das telecomunicações, o que aumenta a procura de soluções TEM para reduzir os seus gastos com telecomunicações.

- Com base na utilização final, o mercado global de gestão de despesas de telecomunicações foi segmentado em TI e telecomunicações, BFSI , manufatura, saúde, transporte e logística, bens de consumo e retalho, energia e eletricidade, media e entretenimento e outros. Em 2021, prevê-se que o segmento de TI e telecomunicações domine o mercado global de gestão de despesas de telecomunicações, uma vez que a utilização de telemóveis para fins de comunicação aumentou tremendamente e a necessidade de soluções de TEM no mercado também está a aumentar.

Análise ao nível do país do mercado de gestão de despesas de telecomunicações no Médio Oriente e África

O mercado de gestão de despesas de telecomunicações do Médio Oriente e de África está segmentado com base na oferta, modo de prestação de serviço, dimensão da empresa e utilização final.

Os países abrangidos pelo relatório de mercado de Gestão de Despesas de Telecomunicações são a Arábia Saudita, Israel, África do Sul, Egito e Resto do Médio Oriente e África. A Arábia Saudita domina o mercado devido à presença do setor de serviços de telecomunicações de TI na região e à procura.

A secção do relatório sobre os países também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado nacional que impactam as tendências atuais e futuras do mercado. Pontos de dados como novas vendas, vendas de reposição, demografia do país, atos regulamentares e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade de marcas do Médio Oriente e de África e os desafios enfrentados devido à grande ou escassa concorrência das marcas locais e nacionais, bem como o impacto dos canais de venda, são considerados quando se fornece uma análise de previsão dos dados do país.

A crescente utilização da biometria no governo para segurança e vigilância está a impulsionar o crescimento do mercado de gestão de despesas de telecomunicações no Médio Oriente e em África

O mercado de gestão de despesas de telecomunicações do Médio Oriente e África também fornece análises de mercado detalhadas para o crescimento de cada país num mercado específico. Além disso, fornece informações detalhadas sobre a estratégia dos participantes do mercado e a sua presença geográfica. Os dados estão disponíveis para o período histórico de 2010 a 2019.

Análise do cenário competitivo e da quota de mercado na gestão de despesas de telecomunicações no Médio Oriente e em África

O cenário competitivo do mercado de gestão de despesas de telecomunicações fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos, pipelines de testes de produto, aprovações de produto, patentes, largura e amplitude do produto, domínio da aplicação, curva de vida da tecnologia. Os pontos de dados fornecidos acima estão apenas relacionados com o foco da empresa no mercado de Gestão de Despesas de Telecomunicações.

As principais empresas que lidam com a gestão de despesas de telecomunicações são a Vodafone Group, CGI Inc., Dimension Data, Accenture, Econocom, Asignet. Tecnologia DNA, AVOTUS, Calero-MDSL, Cass Information Systems, Inc., Network Control, One Source, RadiusPoint, Saaswedo, Sakon, Tangoe, Tellennium, Upland Software, Inc., VALICOM, vMOX, LLC., WidePoint Corporation e outros em jogadores nacionais. Os analistas do DBMR compreendem os pontos fortes competitivos e fornecem análises competitivas para cada concorrente em separado.

Muitos contratos e acordos são também iniciados por empresas em todo o mundo, o que está também a acelerar o mercado de gestão de despesas de telecomunicações.

Por exemplo,

- Em abril de 2021, a Calero-MDSL, uma empresa sediada nos EUA, anunciou a aquisição da MetaPort, uma empresa sediada nos EUA que é líder em software de mapeamento de redes de telecomunicações. Com esta aquisição, a empresa poderá fornecer às organizações de CIO e CTO uma visualização de inventário única, que proporcionará um novo nível de visibilidade nos seus ativos de telecomunicações. Desta forma, a empresa poderá expandir o seu negócio no segmento de software de gestão de despesas com tecnologia.

- Em julho de 2020, a WidePoint Corporation, uma empresa sediada nos EUA, anunciou que garantiu um novo contrato com a Virginia Alcoholic Beverage Control Authority (Virginia ABC) para prestar serviços de gestão de despesas de telecomunicações. O contrato é de um ano e contém quatro períodos adicionais de renovação de um ano. Desta forma, a empresa ajudará a Virginia ABC a enfrentar os desafios da pandemia, gerindo as despesas de telecomunicações das empresas.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OFFERING TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 USE CASE ANALYSIS

4.1.1 CASE STUDY 1:

4.1.2 CASE STUDY 2:

4.2 PORTERS FIVE FORCES ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SIGNIFICANT COST REDUCTION

5.1.2 INCREASE IN ADOPTION OF MOBILE PHONES AND OTHER PORTABLE DEVICES

5.1.3 PROVIDING EXPENSE TRANSPARENCY

5.1.4 INCREASE IN DEMAND FOR TEM DUE TO IOT AND CLOUD-BASED APPLICATION

5.1.5 RISE IN DEMAND OF TEM IN THE HEALTHCARE SECTOR

5.1.6 RISE IN DEMAND FOR TEM MARKET FOR MID-SIZED BUSINESSES

5.2 RESTRAINT

5.2.1 LACK OF INTEROPERABILITY BETWEEN SOLUTIONS AND DIFFERENT VENDORS

5.3 OPPORTUNITIES

5.3.1 AUTOMATION TECHNOLOGY FOR TEM

5.3.2 OUTSOURCING OF TEM MARKET

5.3.3 LOW DEPLOYMENT COST AND GROWING DEMAND FOR COST-EFFICIENT TEM SOLUTIONS

5.4 CHALLENGES

5.4.1 FORECASTING FUTURE SPEND

5.4.2 TRACKING INVENTORY ON BILLS

6 IMPACT OF COVID-19 ON THE MIDDLE EAST AND AFRICA TELECOM EXPENSE MNAGEMENT MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 AFTERMATH OF COVID-19

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 IMPACT ON DEMAND

6.5 CONCLUSION

7 MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING

7.1 OVERVIEW

7.2 SOLUTION

7.2.1 ORDERING & PROVISIONING MANAGEMENT

7.2.2 SOURCING MANAGEMENT

7.2.3 REPORTING & BUSINESS MANAGEMENT

7.2.4 INVOICE MANAGEMENT

7.2.5 USAGE MANAGEMENT

7.2.6 DISPUTE MANAGEMENT

7.2.7 OTHERS

7.3 SERVICES

7.3.1 IMPLEMENTATION & INTEGRATION

7.3.2 TRAINING & CONSULTING

7.3.3 SUPPORT & MAINTENANCE

8 MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET, BY SERVICE DELIVERY MODE

8.1 OVERVIEW

8.2 LICENSED SOFTWARE

8.3 MANAGED SERVICES AND COMPLETE OUTSOURCING

8.4 HOSTED

9 MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET, BY ENTERPRISE SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISES

9.3 SMALL & MEDIUM ENTERPRISES

10 MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET, BY END USE

10.1 OVERVIEW

10.2 IT & TELECOM

10.2.1 SOLUTION

10.2.2 SERVICES

10.3 BFSI

10.3.1 SOLUTION

10.3.2 SERVICES

10.4 MANUFACTURING

10.4.1 SOLUTION

10.4.2 SERVICES

10.5 HEALTHCARE

10.5.1 SOLUTION

10.5.2 SERVICES

10.6 TRANSPORTATION & LOGISTICS

10.6.1 SOLUTION

10.6.2 SERVICES

10.7 CONSUMER GOODS & RETAIL

10.7.1 SOLUTION

10.7.2 SERVICES

10.8 ENERGY & POWER

10.8.1 SOLUTION

10.8.2 SERVICES

10.9 MEDIA & ENTERTAINMENT

10.9.1 SOLUTION

10.9.2 SERVICES

10.1 OTHERS

10.10.1 SOLUTION

10.10.2 SERVICES

11 MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET, BY REGION

11.1 MIDDLE EAST AND AFRICA

11.1.1 SAUDI ARABIA

11.1.2 ISRAEL

11.1.3 SOUTH AFRICA

11.1.4 EGYPT

11.1.5 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 VODAFONE GROUP

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 CGI INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 DIMENSION DATA

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 ACCENTURE

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 ECONOCOM

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ASIGNET. TECHNOLOGY DNA

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 AVOTUS

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 CALERO-MDSL

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 CASS INFORMATION SYSTEMS, INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 NETWORK CONTROL

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 ONE SOURCE

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 RADIUSPOINT

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 SAASWEDO

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 SAKON

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

14.15 TANGOE

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 TELLENNIUM

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 UPLAND SOFTWARE, INC.

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENT

14.18 VALICOM

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 VMOX, LLC

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENTS

14.2 WIDEPOINT CORPORATION

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO

14.20.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tabela

TABLE 1 MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 2 MIDDLE EAST AND AFRICA SOLUTION IN TELECOM EXPENSE MANAGEMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 3 MIDDLE EAST AND AFRICA SOLUTION IN TELECOM EXPENSE MANAGEMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 4 MIDDLE EAST AND AFRICA SERVICES IN TELECOM EXPENSE MANAGEMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 5 MIDDLE EAST AND AFRICA SERVICES IN TELECOM EXPENSE MANAGEMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 6 MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET, BY SERVICE DELIVERY MODE, 2019-2028 (USD MILLION)

TABLE 7 MIDDLE EAST AND AFRICA LICENSED SOFTWARE IN TELECOM EXPENSE MANAGEMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 8 MIDDLE EAST AND AFRICA MANAGED SERVICES AND COMPLETE OUTSOURCING IN TELECOM EXPENSE MANAGEMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 9 MIDDLE EAST AND AFRICA HOSTED IN TELECOM EXPENSE MANAGEMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 10 MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET, BY ENTERPRISE SIZE, 2019-2028 (USD MILLION)

TABLE 11 MIDDLE EAST AND AFRICA LARGE ENTERPRISES IN TELECOM EXPENSE MANAGEMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 12 MIDDLE EAST AND AFRICA SMALL & MEDIUM ENTERPRISES IN TELECOM EXPENSE MANAGEMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 13 MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 14 MIDDLE EAST AND AFRICA IT & TELECOM IN TELECOM EXPENSE MANAGEMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 15 MIDDLE EAST AND AFRICA IT & TELECOM IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 16 MIDDLE EAST AND AFRICA BFSI IN TELECOM EXPENSE MANAGEMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 17 MIDDLE EAST AND AFRICA BFSI IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 18 MIDDLE EAST AND AFRICA MANUFACTURING IN TELECOM EXPENSE MANAGEMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 19 MIDDLE EAST AND AFRICA MANUFACTURING IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 20 MIDDLE EAST AND AFRICA HEALTHCARE IN TELECOM EXPENSE MANAGEMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 21 MIDDLE EAST AND AFRICA HEALTHCARE IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 22 MIDDLE EAST AND AFRICA TRANSPORTATION & LOGISTICS IN TELECOM EXPENSE MANAGEMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 23 MIDDLE EAST AND AFRICA TRANSPORTATION & LOGISTICS IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 24 MIDDLE EAST AND AFRICA CONSUMER GOODS & RETAIL IN TELECOM EXPENSE MANAGEMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA CONSUMER GOODS & RETAIL IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA ENERGY & POWER IN TELECOM EXPENSE MANAGEMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA ENERGY & POWER IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA MEDIA & ENTERTAINMENT IN TELECOM EXPENSE MANAGEMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA MEDIA & ENTERTAINMENT IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA OTHERS IN TELECOM EXPENSE MANAGEMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA OTHERS IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA SOLUTION IN TELECOM EXPENSE MANAGEMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA SERVICES IN TELECOM EXPENSE MANAGEMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET, BY SERVICE DELIVERY MODE, 2019-2028 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET, BY ENTERPRISE SIZE, 2019-2028 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET, BY END USE, 2019-2028 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA IT & TELECOM IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA BFSI IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA MANUFACTURING IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA HEALTHCARE IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA TRANSPORTATION & LOGISTICS IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA CONSUMER GOODS & RETAIL IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA ENERGY & POWER IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA MEDIA & ENTERTAINMENT IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA OTHERS IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 48 SAUDI ARABIA TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 49 SAUDI ARABIA SOLUTION IN TELECOM EXPENSE MANAGEMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 50 SAUDI ARABIA SERVICES IN TELECOM EXPENSE MANAGEMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 51 SAUDI ARABIA TELECOM EXPENSE MANAGEMENT MARKET, BY SERVICE DELIVERY MODE, 2019-2028 (USD MILLION)

TABLE 52 SAUDI ARABIA TELECOM EXPENSE MANAGEMENT MARKET, BY ENTERPRISE SIZE, 2019-2028 (USD MILLION)

TABLE 53 SAUDI ARABIA TELECOM EXPENSE MANAGEMENT MARKET, BY END USE, 2019-2028 (USD MILLION)

TABLE 54 SAUDI ARABIA IT & TELECOM IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 55 SAUDI ARABIA BFSI IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 56 SAUDI ARABIA MANUFACTURING IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 57 SAUDI ARABIA HEALTHCARE IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 58 SAUDI ARABIA TRANSPORTATION & LOGISTICS IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 59 SAUDI ARABIA CONSUMER GOODS & RETAIL IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 60 SAUDI ARABIA ENERGY & POWER IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 61 SAUDI ARABIA MEDIA & ENTERTAINMENT IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 62 SAUDI ARABIA OTHERS IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 63 ISRAEL TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 64 ISRAEL SOLUTION IN TELECOM EXPENSE MANAGEMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 65 ISRAEL SERVICES IN TELECOM EXPENSE MANAGEMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 66 ISRAEL TELECOM EXPENSE MANAGEMENT MARKET, BY SERVICE DELIVERY MODE, 2019-2028 (USD MILLION)

TABLE 67 ISRAEL TELECOM EXPENSE MANAGEMENT MARKET, BY ENTERPRISE SIZE, 2019-2028 (USD MILLION)

TABLE 68 ISRAEL TELECOM EXPENSE MANAGEMENT MARKET, BY END USE, 2019-2028 (USD MILLION)

TABLE 69 ISRAEL IT & TELECOM IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 70 ISRAEL BFSI IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 71 ISRAEL MANUFACTURING IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 72 ISRAEL HEALTHCARE IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 73 ISRAEL TRANSPORTATION & LOGISTICS IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 74 ISRAEL CONSUMER GOODS & RETAIL IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 75 ISRAEL ENERGY & POWER IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 76 ISRAEL MEDIA & ENTERTAINMENT IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 77 ISRAEL OTHERS IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 78 SOUTH AFRICA TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 79 SOUTH AFRICA SOLUTION IN TELECOM EXPENSE MANAGEMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 80 SOUTH AFRICA SERVICES IN TELECOM EXPENSE MANAGEMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 81 SOUTH AFRICA TELECOM EXPENSE MANAGEMENT MARKET, BY SERVICE DELIVERY MODE, 2019-2028 (USD MILLION)

TABLE 82 SOUTH AFRICA TELECOM EXPENSE MANAGEMENT MARKET, BY ENTERPRISE SIZE, 2019-2028 (USD MILLION)

TABLE 83 SOUTH AFRICA TELECOM EXPENSE MANAGEMENT MARKET, BY END USE, 2019-2028 (USD MILLION)

TABLE 84 SOUTH AFRICA IT & TELECOM IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 85 SOUTH AFRICA BFSI IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 86 SOUTH AFRICA MANUFACTURING IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 87 SOUTH AFRICA HEALTHCARE IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 88 SOUTH AFRICA TRANSPORTATION & LOGISTICS IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 89 SOUTH AFRICA CONSUMER GOODS & RETAIL IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 90 SOUTH AFRICA ENERGY & POWER IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 91 SOUTH AFRICA MEDIA & ENTERTAINMENT IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 92 SOUTH AFRICA OTHERS IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 93 EGYPT TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 94 EGYPT SOLUTION IN TELECOM EXPENSE MANAGEMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 95 EGYPT SERVICES IN TELECOM EXPENSE MANAGEMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 96 EGYPT TELECOM EXPENSE MANAGEMENT MARKET, BY SERVICE DELIVERY MODE, 2019-2028 (USD MILLION)

TABLE 97 EGYPT TELECOM EXPENSE MANAGEMENT MARKET, BY ENTERPRISE SIZE, 2019-2028 (USD MILLION)

TABLE 98 EGYPT TELECOM EXPENSE MANAGEMENT MARKET, BY END USE, 2019-2028 (USD MILLION)

TABLE 99 EGYPT IT & TELECOM IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 100 EGYPT BFSI IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 101 EGYPT MANUFACTURING IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 102 EGYPT HEALTHCARE IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 103 EGYPT TRANSPORTATION & LOGISTICS IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 104 EGYPT CONSUMER GOODS & RETAIL IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 105 EGYPT ENERGY & POWER IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 106 EGYPT MEDIA & ENTERTAINMENT IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 107 EGYPT OTHERS IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 108 REST OF MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

Lista de Figura

FIGURE 1 MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET: SEGMENTATION

FIGURE 11 SIGNIFICANT COST REDUCTION IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 12 SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET IN 2021 & 2028

FIGURE 13 DRIVERS, RESTRAINT, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET

FIGURE 14 MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2020

FIGURE 15 MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET, BY SERVICE DELIVERY MODE, 2020

FIGURE 16 MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET, BY ENTERPRISE SIZE, 2020

FIGURE 17 MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET, BY END USER, 2020

FIGURE 18 MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET: SNAPSHOT (2020)

FIGURE 19 MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET: BY COUNTRY (2020)

FIGURE 20 MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET: BY COUNTRY (2021 & 2028)

FIGURE 21 MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET: BY COUNTRY (2020 & 2028)

FIGURE 22 MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET: BY OFFERING (2021-2028)

FIGURE 23 MIDDLE EAST AND AFRICA TELECOM EXPENSE MANAGEMENT MARKET: COMPANY SHARE 2020 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.