Middle East and Africa System Integrator Market for Retail and Consumer Goods, By Service Type (Consulting Services, Application System Integration and Infrastructure Integration), Technology (Supervisory Control and Data Acquisition (SCADA), Distributed Control System (DCS), Human Machine Interface (HMI), Product Lifecycle Management (PLM), Safety Automation System, Programmable Controller Logic (PLC), Manufacturing Execution System (MES), Advanced Process Control (APC) and Operator Training Simulators (OTS)), Product Type (Barcode and RFID, Point of Sales, Camera, Electronic Shelf Labels, Others), End User (Retail and Consumer Goods) – Industry Trends and Forecast to 2029

Market Analysis and Size

Retail system integrators are being highly deployed in the recent years as they deliver services including business process outsourcing (BPO) and strategic consulting to IT, among others. This technology allows plants to deploy and upgrade software and hardware solution.

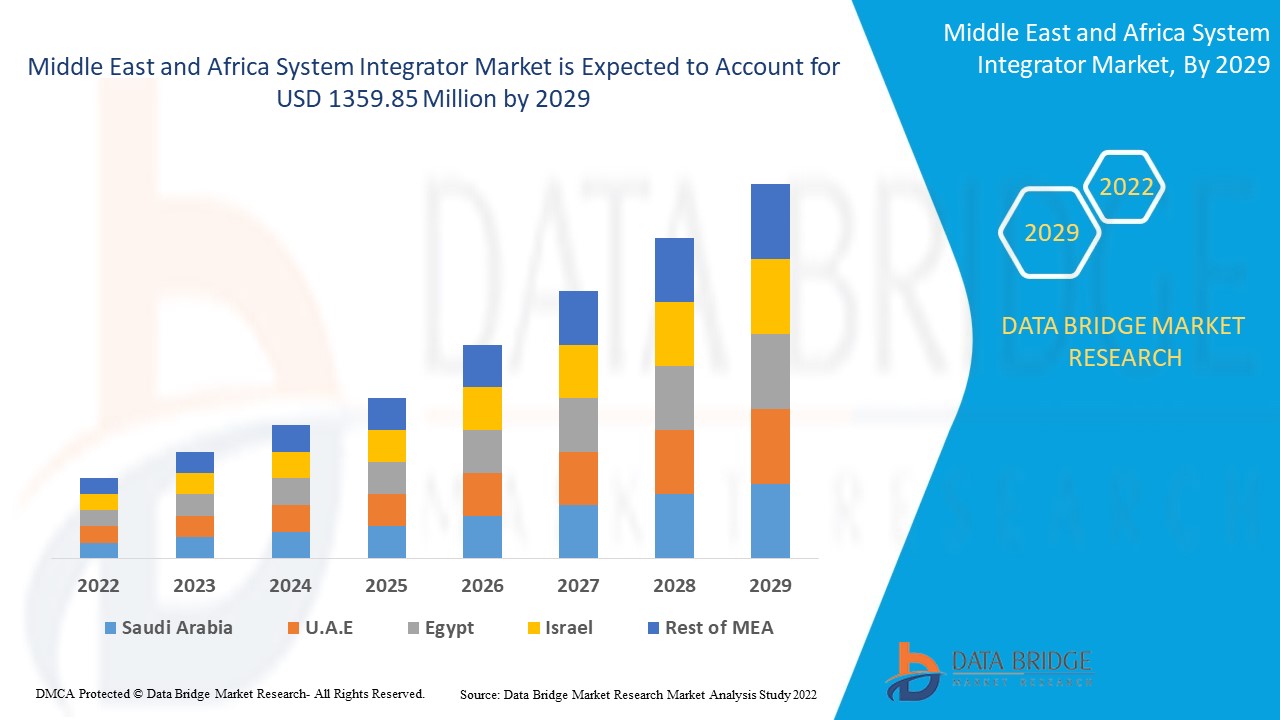

Middle East and Africa System Integrator Market for Retail and Consumer Goods was valued at USD 474.20 million in 2021 and is expected to reach USD 1359.85 million by 2029, registering a CAGR of 11.30% during the forecast period of 2022-2029. Barcode and RFID accounts for the largest product type segments in the respective market owing to the rise in digitalization in the retail sector. . The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Market Definition

System integration is a cost efficient method for IT application software and infrastructure exist around the world. It guarantees the improved infrastructure management, it lessens data redundancy, and provides data integrity, causing in enhanced organizational efficiency and effectiveness. Moreover, the organizations situated around the world are impacted by technological developments for example as the hardware and software solutions, flexibility applications, and big data management software.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Service Type (Consulting Services, Application System Integration and Infrastructure Integration), Technology (Supervisory Control and Data Acquisition (SCADA), Distributed Control System (DCS), Human Machine Interface (HMI), Product Lifecycle Management (PLM), Safety Automation System, Programmable Controller Logic (PLC), Manufacturing Execution System (MES), Advanced Process Control (APC) and Operator Training Simulators (OTS)), Product Type (Barcode and RFID, Point of Sales, Camera, Electronic Shelf Labels, Others), End User (Retail and Consumer Goods) |

|

Countries Covered |

Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA) |

|

Market Players Covered |

Capgemini (France), Accenture (Ireland), IBM Corporation (US), Logic (India), Infosys Limited (India), Magic Software Enterprises (Isreal), HCL Technologies Limited (India), Atos SE (France), SAP SE (Germany), Schneider Electric (France), Wipro Limited (India), Cognizant (US), Tata Consultancy Services Limited (India), among others |

|

Market Opportunities |

|

Middle East and Africa System Integrator Market for Retail and Consumer Goods Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Inclination for Computerisation Technologies

The rise in inclination for computerisation technologies acts as one of the major factors driving the growth of system integrator market for retail and consumer goods. The increase in need from the corporations to increase the effectiveness of their present systems has a positive impact on the market.

- Advancements in Cloud Technologies

The rise in advancements in cloud technologies along with use of the Internet of Things (IoT) accelerate the market growth. Also, the rise in investment in distributed information technology systems drive the growth of market.

- Advent of Big Data Technology

The increase in the advent of big data technology offering benefits to organizations in implementing big data further influence the market. Organizations require advanced data integration tools for combining the information silos assisting to get valuable business insights.

Opportunities

Furthermore, demand for remote operating owing to COVID-19 and emergence of Industry 4.0 extend profitable opportunities to the market players in the forecast period of 2022 to 2029.

Restraints/Challenges

On the other hand, high investments required for automation implementation and maintenance, and fall in crude oil prices are expected to obstruct market growth. Also, system interoperability and Security vulnerability in SCADA systems are projected to challenge the system integrator market for retail and consumer goods in the forecast period of 2022-2029.

This system integrator market for retail and consumer goods report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on system integrator market for retail and consumer goods contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Middle East and Africa System Integrator Market for Retail and Consumer Goods

The COVID-19 had a negative impact on the system integrator market for retail and consumer goods. The COVID-19 epidemic has caused a number of initiatives to be postponed, including infrastructure construction, reorganization, and renovation. Increased government attention on overcompensating for impacts by enhancing operations when opportunities occur would accelerate industry growth. Government actions to reopen major industries, manufacturing facilities, and infrastructure projects, on the other hand, will support corporate growth.

Middle East and Africa System Integrator Market for Retail and Consumer Goods Scope and Market Size

The system integrator market for retail and consumer goods is segmented on the basis of service type, product type, technology and end user. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Service Type

- Consulting Services

- Application System Integration

- Infrastructure Integration

Technology

- Supervisory Control and Data Acquisition (SCADA)

- Distributed Control System (DCS)

- Human Machine Interface (HMI)

- Product Lifecycle Management (PLM)

- Safety Automation System, Programmable Controller Logic (PLC)

- Manufacturing Execution System (MES)

- Advanced Process Control (APC)

- Operator Training Simulators (OTS)

Product Type

- Barcode and RFID

- Point Of Shelf

- Camera

- Electronic Shelf Labels

- Others

End User

- Retail

- Consumer Goods

Middle East and Africa System Integrator Market for Retail and Consumer Goods Regional Analysis/Insights

The system integrator market for retail and consumer goods is analysed and market size insights and trends are provided by country, service type, product type, technology and end user as referenced above.

The countries covered in the Middle East and Africa system integrator market for retail and consumer goods report are Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

The U.A.E. is dominating in the Middle East and Africa system integrator market for retail and consumer goods as the central government increase their investment in the e-commerce industry which has increased integration of system for the retail and consumer goods.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East and Africa System Integrator Market for Retail and Consumer Goods

The system integrator market for retail and consumer goods competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to system integrator market for retail and consumer goods.

Some of the major players operating in the system integrator market for retail and consumer goods are

- Capgemini (France)

- Accenture (Ireland)

- IBM Corporation (US)

- Logic (India)

- Infosys Limited (India)

- Magic Software Enterprises (Isreal)

- HCL Technologies Limited (India)

- Atos SE (France)

- SAP SE (Germany)

- Schneider Electric (France)

- Wipro Limited (India)

- Cognizant (US)

- Tata Consultancy Services Limited (India)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS

1.4 SCOPE OF THE MARKET STUDY

1.5 CURRENCY AND PRICING

1.6 LIMITATIONS

1.7 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 SERVICE TYPE TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING USE OF INTERNET OF THINGS (IOT)

5.1.2 GROWING CONCERN FOR ENTERPRISE RESOURCE PLANNING

5.1.3 INCREASE IN SMARTPHONE PENETRATION AND BROADBAND INFRASTRUCTURE

5.1.4 INCREASING ORGANIZATIONAL AND CONSUMER DATA

5.1.5 INCREASING DIGITAL TRANSFORMATION IN RETAIL AND CONSUMER GOODS INDUSTRY

5.2 RESTRAINTS

5.2.1 HIGH IMPLEMENTATION COST AND TIME

5.2.2 LACK OF TECHNICAL SKILLED EMPLOYEE IN THE DEVELOPING COUNTRIES

5.2.3 LACK OF ADOPTION RATE IN SMALL SCALE BUSINESS

5.3 OPPORTUNITIES

5.3.1 HIGH INVESTMENTS IN INFORMATION TECHNOLOGY BY THE MARKET PLAYERS

5.3.2 DIGITIZATION AND CENTRALIZATION OF BUSINESS PROCESSES

5.3.3 RISING ADOPTION OF INDUSTRY 4.0 IN RETAIL SECTOR

5.3.4 RISING INVESTMENTS OF RETAIL SECTOR IN CLOUD SERVICES

5.4 CHALLENGES

5.4.1 SECURITY VULNERABILITY IN SYSTEMS

5.4.2 COMPLEXITIES FOR INTEGRATING SYSTEMS

6 COVID-19 IMPACT ON SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON DEMAND AND SUPPLY CHAIN

6.4 CONCLUSION

7 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SERVICE

7.1 OVERVIEW

7.2 INFRASTRUCTURE INTEGRATION

7.2.1 ENTERPRISE MANAGEMENT

7.2.2 NETWORK MANAGEMENT

7.2.3 DATA CENTER MANAGEMENT

7.2.4 CLOUD BASED MANAGEMENT

7.2.5 BUILDLING MANAGEMENT

7.2.6 SECURITY & SURVEILLANCE MANAGEMENT

7.3 APPLICATION INTEGRATION

7.3.1 APPLICATION SOFTWARE INTEGRATION

7.3.2 SYSTEM & DATA INTEGRATION

7.3.3 UNIFIED COMMUNICATION

7.3.4 INTERGRATED SOCIAL SOFTWARE

7.3.5 OTHERS

7.4 CONSULTING SERVICES

7.4.1 BUSINESS PROCESS INTEGRATION

7.4.2 BUSINESS TRANSFORMATION

7.4.3 APPLICATION LIFECYCLE MANAGEMENT

8 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS , BY PRODUCT TYPE

8.1 OVERVIEW

8.2 BARCODE & RFID

8.3 POINT OF SALES

8.4 CAMERA

8.5 ELECTRONIC SHELF LABELS

8.6 OTHERS

9 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY TECHNOLOGY

9.1 OVERVIEW

9.2 PRODUCT LIFECYCLE MANAGEMENT(PLM)

9.3 MANUFACTURING EXECUTION SYSTEM(MES)

9.4 SAFETY AUTOMATION SYSTEM

9.5 ADVANCED PROCESS CONTROL

9.6 DISTRIBUTED CONTROL SYSTEM(DCS)

9.7 SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA)

9.8 HUMAN MACHINE INTERFACE(HMI)

9.9 PROGRAMMABLE CONTROLLER LOGIC(PLC)

9.1 OPERATOR TRAINING SIMULATOR

10 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY END-USER

10.1 OVERVIEW

10.2 RETAIL

10.3 CONSUMER GOODS

11 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY GEOGRAPHY

11.1 MIDDLE EAST AND AFRICA

11.1.1 U.A.E

11.1.2 SAUDI ARABIA

11.1.3 SOUTH AFRICA

11.1.4 EGYPT

11.1.5 ISRAEL

11.1.6 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 IBM CORPORATION

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 SERVICE PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 ACCENTURE

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 CAPGEMINI

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 SERVICE PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 COGNIZANT

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 SERVICE PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 HCL TECHNOLOGIES LIMITED

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 SERVICE PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ATOS SE

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 SOLUTION PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 AISG

14.7.1 COMPANY SNAPSHOT

14.7.2 SERVICE PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 BTM MIDDLE EAST & AFRICA

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 JITTERBIT

14.9.1 COMPANY SNAPSHOT

14.9.2 SOLUTION PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 INFOSYS LIMITED

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 LOGIC

14.11.1 COMPANY SNAPSHOT

14.11.2 SERVICEPORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 MAGIC SOFTWARE ENTERPRISES

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENTS

14.13 TATA CONSULTANCY SERVICES LIMITED

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 SOLUTION PORTFOLIO

14.13.4 RECENT DEVELOPMENT

14.14 SADA, INC.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 SOPRA STERIA

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENT

14.16 SAP SE

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENTS

14.17 SCHNEIDER ELECTRIC

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 SOLUTION PORTFOLIO

14.17.4 RECENT DEVELOPMENTS

14.18 WIPRO LIMITED

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 SERVICE PORTFOLIO

14.18.4 RECENT DEVELOPMENTS

14.19 TYCO.

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tabela

LIST OF TABLES

TABLE 1 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SERVICE, 2018-2027 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA INFRASTRUCTURE INTEGRATION IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY REGION,2018-2027, (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA APPLICATION INTEGRATION IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY REGION,2018-2027, (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA CONSULTING SERVICES IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY REGION,2018-2027, (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA BARCODE & RFID IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY REGION, 2018-2027 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA POINT OF SALES IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY REGION,2018-2027, (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA CAMERA IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY REGION,2018-2027, (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA ELECTRONIC SHELF LABELS IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY REGION,2018-2027, (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA OTHERS IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY REGION,2018-2027, (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA PRODUCT LIFECYCLE MANAGEMENT(PLC) IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY REGION,2018-2027, (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA MANUFACTURING EXECUTION SYSTEM(MES) IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY REGION,2018-2027, (USD MILLION)/

TABLE 14 MIDDLE EAST & AFRICA SAFETY AUTOMATION SYSTEM IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY REGION,2018-2027, (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA ADVANCED PROCESS CONTROL IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY REGION,2018-2027, (USD MILLION)/

TABLE 16 MIDDLE EAST & AFRICA DISTRIBUTED CONTROL SYSTEM(DCS) IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY REGION,2018-2027, (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA) IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY REGION,2018-2027, (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA HUMAN MANCHINE INTERFACE(HMI) IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY REGION,2018-2027, (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA PROGRAMMABLE CONTROLLER LOGIC(PLC) IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY REGION,2018-2027, (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA OPERATOR TRAINING SIMULATOR IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY REGION,2018-2027, (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY DATA CENTER TYPE, 2018-2027 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA RETAIL IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA CONSUMER GOODS DATA CENTER IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 24 MIDDLE EAST AND AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SERVICES TYPE, 2018-2027 (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA INFRASTRUCTURE INTEGRATION IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SOLUTIONS, 2018-2027 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA APPLICATION INTEGRATION IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SOLUTIONS, 2018-2027 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA CONSULTING IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SOLUTIONS, 2018-2027 (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY END-USE, 2018-2027 (USD MILLION)

TABLE 32 U.A.E SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SERVICES TYPE, 2018-2027 (USD MILLION)

TABLE 33 U.A.E INFRASTRUCTURE INTEGRATION IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SOLUTIONS, 2018-2027 (USD MILLION)

TABLE 34 U.A.E APPLICATION INTEGRATION IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SOLUTIONS, 2018-2027 (USD MILLION)

TABLE 35 U.A.E CONSULTING IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SOLUTIONS, 2018-2027 (USD MILLION)

TABLE 36 U.A.E SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 37 U.A.E SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 38 U.A.E SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY END-USE, 2018-2027 (USD MILLION)

TABLE 39 SAUDI ARABIA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SERVICES TYPE, 2018-2027 (USD MILLION)

TABLE 40 SAUDI ARABIA INFRASTRUCTURE INTEGRATION IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SOLUTIONS, 2018-2027 (USD MILLION)

TABLE 41 SAUDI ARABIA APPLICATION INTEGRATION IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SOLUTIONS, 2018-2027 (USD MILLION)

TABLE 42 SAUDI ARABIA CONSULTING IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SOLUTIONS, 2018-2027 (USD MILLION)

TABLE 43 SAUDI ARABIA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 44 SAUDI ARABIA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 45 SAUDI ARABIA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY END-USE, 2018-2027 (USD MILLION)

TABLE 46 SOUTH AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SERVICES TYPE, 2018-2027 (USD MILLION)

TABLE 47 SOUTH AFRICA INFRASTRUCTURE INTEGRATION IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SOLUTIONS, 2018-2027 (USD MILLION)

TABLE 48 SOUTH AFRICA APPLICATION INTEGRATION IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SOLUTIONS, 2018-2027 (USD MILLION)

TABLE 49 SOUTH AFRICA CONSULTING IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SOLUTIONS, 2018-2027 (USD MILLION)

TABLE 50 SOUTH AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 51 SOUTH AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 52 SOUTH AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY END-USE, 2018-2027 (USD MILLION)

TABLE 53 EGYPT SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SERVICES TYPE, 2018-2027 (USD MILLION)

TABLE 54 EGYPT INFRASTRUCTURE INTEGRATION IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SOLUTIONS, 2018-2027 (USD MILLION)

TABLE 55 EGYPT APPLICATION INTEGRATION IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SOLUTIONS, 2018-2027 (USD MILLION)

TABLE 56 EGYPT CONSULTING IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SOLUTIONS, 2018-2027 (USD MILLION)

TABLE 57 EGYPT SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 58 EGYPT SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 59 EGYPT SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY END-USE, 2018-2027 (USD MILLION)

TABLE 60 ISRAEL SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SERVICES TYPE, 2018-2027 (USD MILLION)

TABLE 61 ISRAEL INFRASTRUCTURE INTEGRATION IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SOLUTIONS, 2018-2027 (USD MILLION)

TABLE 62 ISRAEL APPLICATION INTEGRATION IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SOLUTIONS, 2018-2027 (USD MILLION)

TABLE 63 ISRAEL CONSULTING IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SOLUTIONS, 2018-2027 (USD MILLION)

TABLE 64 ISRAEL SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 65 ISRAEL SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 66 ISRAEL SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY END-USE, 2018-2027 (USD MILLION)

TABLE 67 REST OF MIDDLE EAST AND AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SERVICES TYPE, 2018-2027 (USD MILLION)

Lista de Figura

LIST OF FIGURES

FIGURE 1 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: SEGMENTATION

FIGURE 10 GROWING USE OF INTERNET OF THINGS (IOT) IS EXPECTED TO DRIVE MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 11 INFRASTRUCTURE INTEGRATION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS IN 2020 & 2027

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS

FIGURE 13 SIZE OF THE IOT MARKET WORLDWIDE FROM 2017 TO 2019, FORECAST FOR 2020-2025

FIGURE 14 NUMBER OF SMARTPHONE USERS WORLDWIDE, FROM 2016 TO 2020

FIGURE 15 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 16 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: BY SERVICE, 2019

FIGURE 17 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: BY PRODUCT TYPE, 2019

FIGURE 18 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: BY TECHNOLOGY, 2019

FIGURE 19 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: BY DATA CENTER TYPE, 2019

FIGURE 20 MIDDLE EAST AND AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: SNAPSHOT (2019)

FIGURE 21 MIDDLE EAST AND AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: BY COUNTRY (2019)

FIGURE 22 MIDDLE EAST AND AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: BY COUNTRY (2020 & 2027)

FIGURE 23 MIDDLE EAST AND AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: BY COUNTRY (2019 & 2027)

FIGURE 24 MIDDLE EAST AND AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: BY SERVICE TYPE (2020-2027)

FIGURE 25 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: COMPANY SHARE 2019 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.