Middle East And Africa Surgical Power Tools Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

73.97 Million

USD

96.65 Million

2025

2033

USD

73.97 Million

USD

96.65 Million

2025

2033

| 2026 –2033 | |

| USD 73.97 Million | |

| USD 96.65 Million | |

|

|

|

|

Mercado de ferramentas elétricas cirúrgicas do Médio Oriente e África, por produto (peça de mão, descartáveis e acessórios), tecnologia (ferramentas elétricas, ferramentas elétricas alimentadas a bateria, ferramentas elétricas pneumáticas e outras), tipo de dispositivo (ferramentas elétricas para ossos grandes, ferramentas elétricas para ossos pequenos). Ferramentas elétricas, ferramentas elétricas para ossos médios e outras), Aplicação (Cirurgia ortopédica, cirurgia otorrinolaringológica, cirurgia neurológica, cirurgia dentária, cirurgia cardiotorácica, outras), Utilizador final (hospitais, centros de cirurgia ambulatória (ASC), clínicas e outros), Canal de distribuição (Licitações diretas e distribuição por terceiros), país (Arábia Saudita, África do Sul, Emirados Árabes Unidos, Israel, Egito e resto do Médio Oriente e África), tendências e previsões do setor até 2028.

Análise de mercado e insights: mercado de ferramentas elétricas cirúrgicas do Médio Oriente e África

Análise de mercado e insights: mercado de ferramentas elétricas cirúrgicas do Médio Oriente e África

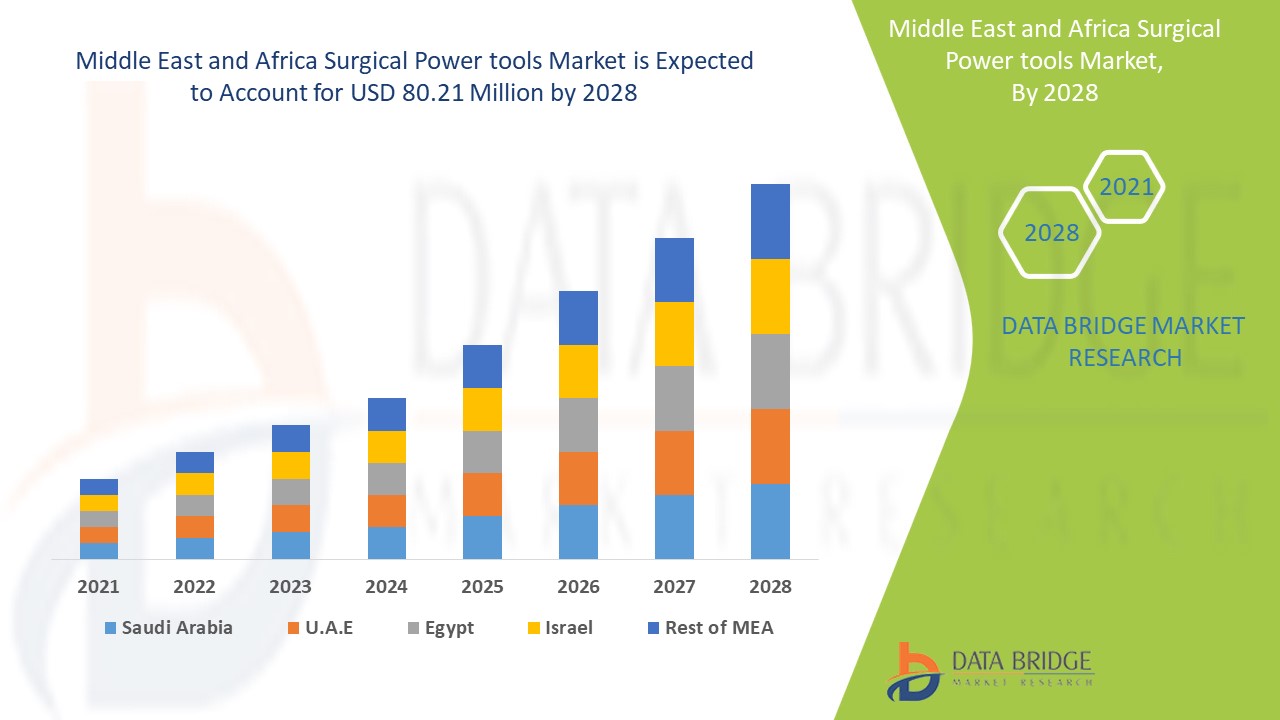

Espera-se que o mercado de ferramentas elétricas cirúrgicas do Médio Oriente e África ganhe crescimento de mercado no período previsto de 2021 a 2028. A Data Bridge Market Research analisa que o mercado está a crescer com um CAGR de 3,4% no período previsto de 2021 a 2028 e prevê-se que atinja os 80,21 milhões de dólares até 2028, face aos 62,59 milhões de dólares em 2020. A crescente procura por ferramentas elétricas cirúrgicas e o aumento das cirurgias ortopédicas são os principais impulsionadores que impulsionaram a procura do mercado no período previsto.

O aumento de distúrbios neurológicos e ortopédicos são os principais impulsionadores da procura de ferramentas cirúrgicas elétricas utilizadas para realizar cirurgias em ossos ou fragmentos ósseos, entre outros tipos. Estas ferramentas elétricas ajudam a alargar, serrar, furar, aparafusar e outros procedimentos. Inclui uma peça de mão, descartáveis e acessórios. As peças de mão utilizadas para cirurgias são geralmente de dois tipos: peças de mão elétricas e peças de mão pneumáticas; no entanto, com uma rápida investigação e desenvolvimento, também foram descobertas peças de mão elétricas de elevado binário. Os principais procedimentos cirúrgicos em que estas ferramentas podem ser empregues envolvem a cirurgia ortopédica, a cirurgia otorrinolaringológica, a cirurgia neurológica, a cirurgia dentária e a cirurgia cardiotorácica. A descoberta destas ferramentas elétricas revolucionou os procedimentos cirúrgicos, tornando todo o procedimento eficiente e perfeito.

Os instrumentos cirúrgicos elétricos desempenham um papel importante durante as cirurgias. As ferramentas elétricas cirúrgicas são equipamentos e instrumentos utilizados durante diversas cirurgias e oferecem diversas vantagens, incluindo a otimização da potência, a aplicação suave e a compatibilidade com uma vasta gama de acessórios, o que melhora a sua utilização entre os cirurgiões. Além disso, a introdução de ferramentas cirúrgicas elétricas atraiu os cirurgiões, que geralmente preferem estes instrumentos elétricos pela sua elevada velocidade, o que aumenta a taxa de flexibilidade das cirurgias.

O relatório de mercado de ferramentas elétricas cirúrgicas fornece detalhes sobre a quota de mercado, novos desenvolvimentos e análise de pipeline de produtos, impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações de mercado, aprovações de produtos, decisões estratégicas, lançamentos de produtos , expansões geográficas e inovações tecnológicas no mercado. Para compreender a análise e o cenário de mercado, contacte-nos para um Briefing de Analista.

Âmbito e dimensão do mercado de ferramentas elétricas cirúrgicas

Âmbito e dimensão do mercado de ferramentas elétricas cirúrgicas

O mercado das ferramentas elétricas cirúrgicas está categorizado em seis segmentos notáveis que se baseiam no produto, tecnologia, tipo de dispositivo, aplicação, utilizador final e canal de distribuição. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e a diferença nos seus mercados-alvo.

- Com base no produto, o mercado das ferramentas elétricas cirúrgicas está segmentado em peças de mão, descartáveis e acessórios. Em 2021, prevê-se que o segmento das peças de mão domine o mercado devido à sua característica de otimização automática da potência, administração cirúrgica suave e elevada taxa de compatibilidade com uma vasta gama de acessórios e descartáveis. As peças de mão são utilizadas para diversos procedimentos cirúrgicos, desde a perfuração ao alargamento, impulsionando o crescimento do mercado.

- Com base na tecnologia, o mercado das ferramentas elétricas cirúrgicas está segmentado em ferramentas elétricas operadas eletricamente, ferramentas elétricas movidas a bateria , ferramentas elétricas pneumáticas, entre outras. Em 2021, espera-se que o segmento das ferramentas elétricas domine o mercado, uma vez que este instrumento oferece um binário constante mesmo com uma resistência elevada e uma carga mais elevada. Além disso, as precauções de segurança reforçadas associadas a ferimentos acidentais foram reduzidas com a introdução de ferramentas elétricas, acelerando o crescimento do mercado. As ferramentas elétricas não produzem qualquer sensação vibratória, o que aumenta a sua procura no mercado.

- Com base no tipo de dispositivo, o mercado das ferramentas elétricas cirúrgicas está segmentado em ferramentas elétricas para ossos grandes , ferramentas elétricas para ossos pequenos, ferramentas elétricas para ossos médios e outras. Em 2021, prevê-se que o segmento das ferramentas elétricas para ossos grandes domine o mercado devido ao aumento da prevalência de osteoartrite, osteoporose e fraturas da anca, entre outras lesões ósseas de grandes dimensões. Além disso, o número crescente de artroplastias do joelho, entre outras, está a proporcionar ao mercado um crescimento rentável.

- Com base na aplicação, o mercado das ferramentas elétricas cirúrgicas está segmentado em cirurgia ortopédica, cirurgia otorrinolaringológica, cirurgia neurológica, cirurgia dentária, cirurgia cardiotorácica, entre outras. Em 2021, prevê-se que o segmento da cirurgia ortopédica domine o mercado devido ao aumento de diversos tipos de acidentes de viação e à elevada adoção de procedimentos cirúrgicos minimamente invasivos.

- Com base no utilizador final, o mercado das ferramentas elétricas cirúrgicas está segmentado em hospitais , centros de cirurgia ambulatória (ASC), clínicas e outros. Em 2021, prevê-se que o segmento hospitalar domine o mercado devido ao aumento do número de cirurgias e à procura de dispositivos que possam reduzir o tempo total da cirurgia e a pressão de alto custo.

- Com base no canal de distribuição, o mercado das ferramentas elétricas cirúrgicas está segmentado em concursos diretos e distribuição terceirizada. Em 2021, prevê-se que o segmento das licitações diretas chegue ao mercado devido ao baixo custo de aquisição de dispositivos e à grande dependência dos hospitais, entre outros utilizadores finais, das licitações diretas.

Análise ao nível do país do mercado de ferramentas elétricas cirúrgicas

O mercado das ferramentas elétricas cirúrgicas é analisado e são fornecidas informações sobre o tamanho do mercado com base em seis segmentos notáveis, que são por produto, tecnologia, tipo de dispositivo, aplicação, utilizador final e canal de distribuição, conforme referenciado acima.

Os países abrangidos pelo relatório de mercado de ferramentas elétricas cirúrgicas são a Arábia Saudita, a África do Sul, os Emirados Árabes Unidos, Israel, o Egito e o resto do Médio Oriente e África.

Espera-se que o Médio Oriente e África cresçam com um CAGR de 3,4% no período previsto devido às inovações nos cuidados de saúde e ao crescente foco nas ferramentas cirúrgicas elétricas, para além dos avanços tecnológicos nas ferramentas cirúrgicas elétricas multifuncionais.

A secção do relatório sobre os países também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado nacional que impactam as tendências atuais e futuras do mercado. Pontos de dados como novas vendas, vendas de reposição, demografia do país, atos regulamentares e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade de marcas globais e os desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, bem como o impacto dos canais de vendas, são considerados ao fornecer uma análise de previsão dos dados do país.

As iniciativas estratégicas dos participantes do mercado estão a criar novas oportunidades no mercado das ferramentas elétricas cirúrgicas

O mercado das ferramentas elétricas cirúrgicas também fornece análises de mercado detalhadas para o crescimento de cada país nas ferramentas elétricas cirúrgicas, o impacto do avanço nas ferramentas elétricas cirúrgicas e as mudanças nos cenários regulamentares com o seu apoio ao mercado das ferramentas elétricas cirúrgicas. Os dados estão disponíveis para o período histórico de 2010 a 2019.

Análise do panorama competitivo e da quota de mercado das ferramentas elétricas cirúrgicas

O panorama competitivo do mercado de ferramentas elétricas cirúrgicas fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos, pipelines de testes de produto, aprovações de produto, patentes, largura do produto e respiração, domínio da aplicação, curva de salvação da tecnologia. Os pontos de dados fornecidos acima estão apenas relacionados com o foco da empresa no mercado das ferramentas elétricas cirúrgicas.

As principais empresas que fornecem ferramentas cirúrgicas elétricas são a Medtronic, Stryker, Zimmer Biomet, DePuy Synthes (The Orthopaedic Company of Johnson & Johnson Services, Inc.), 3M, CONMED Corporation, entre outras. Os analistas do DBMR compreendem os pontos fortes competitivos e fornecem análises competitivas para cada concorrente em separado.

Muitos lançamentos e acordos de produtos são também iniciados por empresas de todo o mundo, o que está também a acelerar o mercado das ferramentas elétricas cirúrgicas.

Por exemplo,

- Em dezembro de 2020, a Zimmer Biomet anunciou que concluiu a aquisição da A&E Medical Corporation. Este acordo teve um impacto imaterial no resultado líquido da empresa em 2020

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.