Middle East And Africa Small Scale Lng Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

118.47 Million

USD

232.62 Million

2021

2029

USD

118.47 Million

USD

232.62 Million

2021

2029

| 2022 –2029 | |

| USD 118.47 Million | |

| USD 232.62 Million | |

|

|

|

Middle East and Africa Small Scale Liquefied Natural Gas (LNG) Market, By Type (Liquefaction Terminal, Regasification Terminal), Mode of Supply (Trucks, Shipment and Bunkering, Rail Tanks, Pipeline, Others), Storage tank Capacity (Atmospheric, Pressurized and Floating Storage (FSU)), Application (Transportation, Heavy-Duty Vehicles, Industrial and Power, Others) – Industry Trends and Forecast to 2029

Market Analysis and Size

Over the recent years, there has been a massive shift toward liquefied natural gas (LNG) over the traditionally used fuel sources as it has complete combustion and fewer carbon emissions. Furthermore, the expanding consumer preference for greener and cleaner fuel sources and the increasing use of liquefied natural gas (LNG) as a ship fuel over heavy fuel oil, marine gas oil, and diesel oil are driving expansion. Consequently, the market is anticipated to flourish over forecast period.

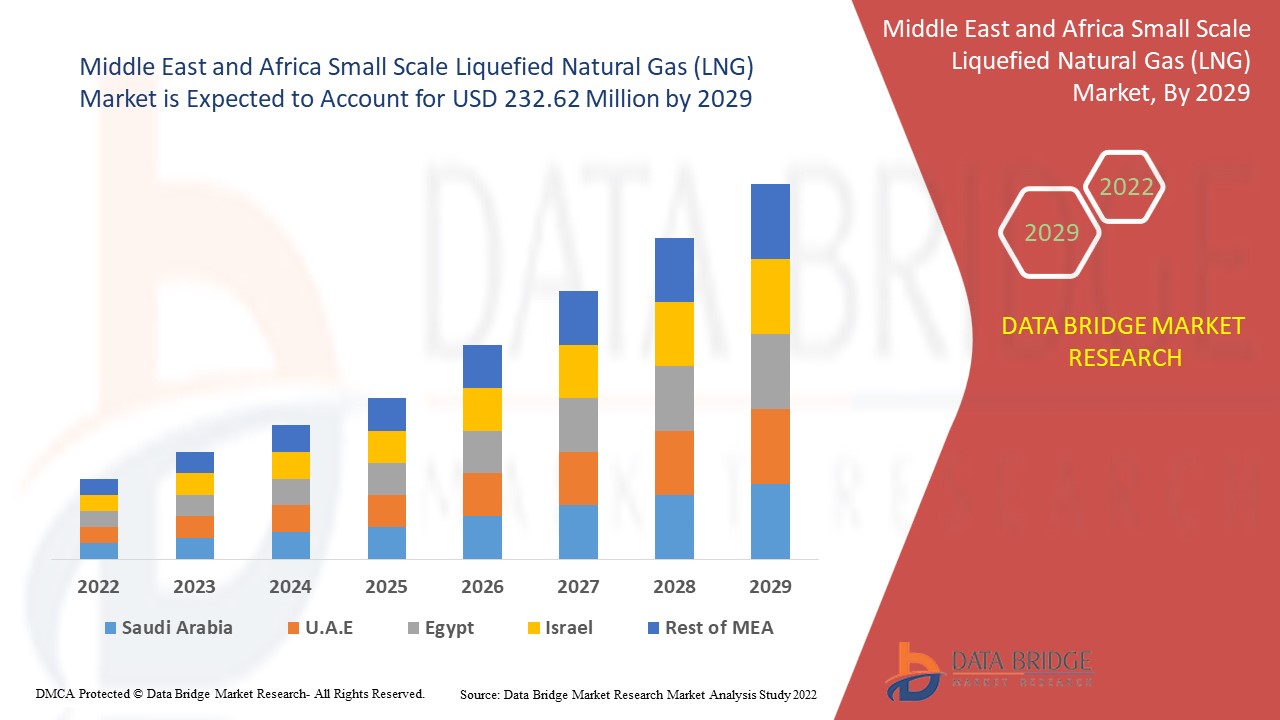

Middle East and Africa Small scale liquefied natural gas (LNG) Market was valued at USD 118.47 million in 2021 and is expected to reach USD 232.62 million by 2029, registering a CAGR of 8.80% during the forecast period of 2022-2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

Market Definition

Small-scale liquefied natural gas (LNG) refers to liquefied natural gas that is processed in industrial units with limited capacity. The gas is transformed into an odorless and colorless liquid that can be re-gasified for numerous uses after being cooled to extremely low temperatures. Small-scale LNG is more environmentally benign than oil and diesel, and it is commonly used to meet off-grid power generation needs in isolated industrial and residential complexes. In addition, it is widely employed in the industrial, commercial, and residential sectors as a transportation fuel, an industrial feedstock, and for heating.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Type (Liquefaction Terminal, Regasification Terminal), Mode of Supply (Trucks, Shipment and Bunkering, Rail Tanks, Pipeline, Others), Storage tank Capacity (Atmospheric, Pressurized and Floating Storage (FSU)), Application (Transportation, Heavy-Duty Vehicles, Industrial and Power, Others) |

|

Countries Covered |

U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa |

|

Market Players Covered |

Gazprom (Russia), Engie (France), Honeywell International Inc. (U.S.), Wärtsilä (Finland), Linde plc (Germany), Gasum Ltd., (Norway), IHI Corporation (Japan), Excelerate Energy L.P (U.S), Prometheus Fuels (U.S), Cryostar (U.S.), General Electric (U.S.), Novatek (Russia), Engie (France), NYK Line (Japan), Mitsui O.S.K.Lines (Japan), Teekay Corporation (Bermuda), Hyundai Heavy Industries Co., Ltd., (South Korea), HANJIN HEAVY INDUSTRIES & CONSTRUCTION HOLDINGS CO., LTD. (South Korea) and Kawasaki Heavy Industries, Ltd., (Japan) |

|

Market Opportunities |

|

Small Scale Liquefied Natural Gas (LNG) Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- High Demand For Small-Scale Liquefied Natural Gas (LNG)

One of the primary reasons driving the market's growth is the growing demand for energy-efficient and cost-effective energy sources. Furthermore, the transportation industry's broad acceptance of the product is boosting market growth. The rising demand for energy has increased the need for liquefied natural gas (LNG), resulting in increased LNG output (LNG). Furthermore, numerous remote areas are without electricity, and government measures to improve rural electrification have increased demand for liquefied natural gas (LNG).

The rapid industrialization and high demand for natural gas as a transportation fuel will further prop the growth rate of small-scale liquefied natural gas (LNG) market. Liquefied natural gas (LNG) is also used for cooking and heating, and the development potential for the small-scale liquefied natural gas (LNG) market is predicted to increase throughout the projection period due to rising population. In addition to this, the reduction in the prices of natural gas and fluctuation in the prices of crude oil caused by excessive production of crude oil will also drive market value growth.

Opportunities

- Integration of Technologies and Government Policies

Furthermore, the integration of new technology and the increasing investments and the implementation of favorable government policies promoting the adoption of liquefied natural gas (LNG) extend profitable opportunities to the market players in the forecast period of 2022 2029. Additionally, the easy establishment in small-scale reserve sites will further expand the future growth of the small-scale liquefied natural gas (LNG) market.

Restraints/Challenges

- Issues Associated with Price and Funding

The liquefied natural gas (LNG) supplies to a growing number of small purchasers, who are concerned about calculating netbacks that are sufficient to either justify the turn of events and liquefaction of their flammable gas reserves or the higher costs of setting up and operating a center and communication network. When it comes to establishing liquefaction offices, providers are concerned about securing long-term agreements with dependable clients that will enable them obtain sufficient funding.

- Drawbacks of Natural Resources

Moreover, depleting natural resources are also expected to hamper growth of the global small-scale liquefied natural gas (LNG) market, which will challenge the small scale liquefied natural gas (LNG) market growth rate.

This small scale liquefied natural gas (LNG) market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the small scale liquefied natural gas (LNG) market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Small Scale Liquefied Natural Gas (LNG) Market

The recent outbreak of coronavirus had a significant impact on the small-scale liquefied natural gas (LNG) market due to disruptions in the inventory network, lower energy use, and waning interest in more recent breakthroughs. However, as the demand for large-scale L.N.G. plants to provide returns to investors grows, the working organizations are increasingly supporting small-scale L.N.G. pushes. Coronavirus has had the opposite effect on the global economy, as various duties have come to a standstill. Oil and gas, maritime, auto, assembly, and force age are some of the major industries that use limited scope L.N.G. Organizations are dealing with some issues in the force age area as a result of a drop in the popularity of power post-COVID-19. Furthermore, enterprises such as development and assembly have completely ceased operations, which has had a global impact on the restricted scale L.N.G. industry.

Recent Development

- In August 2020, Uniper Global Commodities SE and its 100% LNG-for-trucks subsidiary Liqvis GmbH implemented a block chain-based small-scale liquefied natural gas (ssLNG) trading/fulfillment platform, according to Wipro Limited, a leading global information technology, consulting, and business process services company. Uniper SE, headquartered in Germany, is a significant multinational energy corporation.

- In November 2020, The First Philippine Industrial Park's L.N.G. development was being investigated by FGEN LNG, a subsidiary of First Gen Corporation (FPIP). FGEN LNG's Interim Offshore L.N.G. terminal could feed FPIP with L.N.G. via trucks and concentrated shielded compartments. This is projected to aid the market's development.

Middle East and Africa Small Scale Liquefied Natural Gas (LNG) Market Scope

The small scale liquefied natural gas (LNG) market is segmented on the basis of type, mode of supply, storage tank capacity and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Liquefaction Terminal

- Regasification Terminal

Mode of Supply

- Trucks

- Shipment and Bunkering

- Rail Tanks

- Pipeline

- Others

Storage Tank Capacity

- Atmospheric

- Pressurized and Floating Storage (FSU)

Application

- Transportation

- Heavy-Duty Vehicles

- Industrial and Power

- Others

Small Scale Liquefied Natural Gas (LNG) Market Regional Analysis/Insights

The small scale liquefied natural gas (LNG) market is analyzed and market size insights and trends are provided by country, type, mode of supply, storage tank capacity and application as referenced above.

The countries covered in the small scale liquefied natural gas (LNG) market report are Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Small Scale Liquefied Natural Gas (LNG) Market Share Analysis

The small scale liquefied natural gas (LNG) market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to small scale liquefied natural gas (LNG) market.

Some of the major players operating in the small scale liquefied natural gas (LNG) market are

- Gazprom (Russia)

- Engie (France)

- Honeywell International Inc. (U.S.)

- Wärtsilä (Finland)

- Linde plc (Germany)

- Gasum Ltd., (Norway)

- IHI Corporation (Japan)

- Excelerate Energy L.P (U.S)

- Prometheus Fuels (U.S)

- Cryostar (U.S.)

- General Electric (U.S.)

- Novatek (Russia)

- Engie (France)

- NYK Line (Japan)

- Mitsui O.S.K.Lines (Japan)

- Teekay Corporation (Bermuda)

- Hyundai Heavy Industries Co., Ltd., (South Korea)

- HANJIN HEAVY INDUSTRIES & CONSTRUCTION HOLDINGS CO., LTD. (South Korea)

- Kawasaki Heavy Industries, Ltd., (Japan)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA SMALL-SCALE LNG MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 STORAGE TANKLIFE LINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 DBMR MARKET CHALLENGE MATRIX

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND OF NATURAL GASES IN INDUSTRIAL, COMMERCIAL & RESIDENTIAL SECTOR

5.1.2 FISCAL REGIME AND SUBSIDIES

5.1.3 INCREASING USAGE OF NATURAL GAS AS A PRIMARY SOURCE OF FUEL

5.1.4 GROWING USAGE OF NATURAL GAS IN TRANSPORTATION

5.1.5 STRENGTHENING OF REGULATIONS AGAINST CLIMATE CHANGE

5.2 RESTRAINTS

5.2.1 DEPLETING NATURAL RESOURCES

5.2.2 HIGH PER KG OPERATING COST AS COMPARED TO MID-SIZE LNG AND LARGE-SIZE LNG

5.3 OPPORTUNITY

5.3.1 EASY ESTABLISHMENT IN SMALL-SCALE RESERVE SITES

5.4 CHALLENGE

5.4.1 EXPENSIVE SUPPLY CHAIN

6 MIDDLE EAST AND AFRICA SMALL-SCALE LNG MARKET, BY TYPE

6.1 OVERVIEW

6.2 LIQUEFACTION TERMINAL

6.2.1 ONSHORE

6.2.2 OFFSHORE

6.3 REGASSIFICATION TERMINAL

6.3.1 ONSHORE

6.3.2 OFFSHORE

7 MIDDLE EAST AND AFRICA SMALL-SCALE LNG MARKET, BY MODE OF SUPPLY

7.1 OVERVIEW

7.2 TRUCKS

7.3 RAIL TANKS

7.4 SHIPMENT & BUNKERING

7.5 PIPELINE

7.6 OTHERS

8 MIDDLE EAST AND AFRICA SMALL-SCALE LNG MARKET, BY STORAGE TANK

8.1 OVERVIEW

8.2 ATMOSPHERIC

8.2.1 FLAT

8.2.2 BULLET

8.3 PRESSURIZED

8.3.1 SPHERICAL

8.3.2 BULLET

8.4 FLOATING STORAGE (FSU)

9 MIDDLE EAST AND AFRICA SMALL-SCALE LNG MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 TRANSPORTATION

9.2.1 ROAD

9.2.2 MINING

9.2.3 MARINE

9.3 INDUSTRIAL AND POWER

9.4 OTHERS

10 MIDDLE EAST AND AFRICA SMALL-SCALE LNG MARKET, BY GEOGRAPHY

10.1 MIDDLE EAST AND AFRICA

10.1.1 UNITED ARAB EMIRATES

10.1.2 SAUDI ARABIA

10.1.3 EGYPT

10.1.4 ISRAEL

10.1.5 SOUTH AFRICA

10.1.6 REST OF MIDDLE EAST AND AFRICA

11 COMPANY PROFILES

11.1 BP P.L.C.

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 COMPANY SHARE ANALYSIS

11.1.4 PRODUCT PORTFOLIO

11.1.5 RECENT UPDATE

11.2 ENGIE

11.2.1 COMPANY SNAPSHOT

11.2.2 REVENUE ANALYSIS

11.2.3 COMPANY SHARE ANALYSIS

11.2.4 PRODUCT PORTFOLIO

11.2.5 RECENT UPDATE

11.3 ENI S.P.A.

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 COMPANY SHARE ANALYSIS

11.3.4 PRODUCT PORTFOLIO

11.3.5 RECENT UPDATE

11.4 LINDE

11.4.1 COMPANY SNAPSHOT

11.4.2 REVENUE ANALYSIS

11.4.3 PRODUCT PORTFOLIO

11.4.4 RECENT UPDATE

11.5 SIEMENS

11.5.1 COMPANY SNAPSHOT

11.5.2 REVENUE ANALYSIS

11.5.3 COMPANY SHARE ANALYSIS

11.5.4 SOLUTION PORTFOLIO

11.5.5 RECENT UPDATE

11.6 ROYAL DUTCH SHELL PLC

11.6.1 COMPANY SNAPSHOT

11.6.2 REVENUE ANALYSIS

11.6.3 PRODUCT PORTFOLIO

11.6.4 RECENT UPDATES

11.7 TOTAL

11.7.1 COMPANY SNAPSHOT

11.7.2 REVENUE ANALYSIS

11.7.3 PRODUCT PORTFOLIO

11.7.4 RECENT UPDATES

11.8 BAKER HUGHES, A GE COMPANY LLC (A SUBSIDIARY OF GENERAL ELECTRIC)

11.8.1 COMPANY SNAPSHOT

11.8.2 REVENUE ANALYSIS

11.8.3 PRODUCT PORTFOLIO

11.8.4 RECENT UPDATE

11.9 HONEYWELL (A SUBSIDIARY OF HONEYWELL INTERNATIONAL INC)

11.9.1 COMPANY SNAPSHOT

11.9.2 REVENUE ANALYSIS

11.9.3 COMPANY SHARE ANALYSIS

11.9.4 SOLUTION PORTFOLIO

11.9.5 RECENT UPDATE

11.1 AIR PRODUCTS AND CHEMICALS, INC.

11.10.1 COMPANY SNAPSHOT

11.10.2 REVENUE ANALYSIS

11.10.3 PRODUCT PORTFOLIO

11.10.4 RECENT UPDATES

11.11 BLACK & VEATCH HOLDING COMPANY

11.11.1 COMPANY SNAPSHOT

11.11.2 PRODUCT PORTFOLIO

11.11.3 RECENT UPDATE

11.12 CHINA NATIONAL OFFSHORE OIL CORPORATION

11.12.1 COMPANY SNAPSHOT

11.12.2 PRODUCT PORTFOLIO

11.12.3 RECENT UPDATE

11.13 EQUINOR ASA

11.13.1 COMPANY SNAPSHOT

11.13.2 REVENUE ANALYSIS

11.13.3 PRODUCT PORTFOLIO

11.13.4 RECENT UPDATE

11.14 EXCELERATE ENERGY. L. P.

11.14.1 COMPANY SNAPSHOT

11.14.2 PRODUCT PORTFOLIO

11.14.3 RECENT UPDATES

11.15 GASUM OY

11.15.1 COMPANY SNAPSHOT

11.15.2 REVENUE ANALYSIS

11.15.3 PRODUCT PORTFOLIO

11.15.4 RECENT UPDATES

11.16 GAZPROM

11.16.1 COMPANY SNAPSHOT

11.16.2 REVENUE ANALYSIS

11.16.3 PRODUCT PORTFOLIO

11.16.4 RECENT UPDATE

11.17 KUNLUN ENERGY COMPANY LIMITED

11.17.1 COMPANY SNAPSHOT

11.17.2 REVENUE ANALYSIS

11.17.3 PRODUCT PORTFOLIO

11.17.4 RECENT UPDATES

11.18 PT PERTAMINA(PERSERO)

11.18.1 COMPANY SNAPSHOT

11.18.2 REVENUE ANALYSIS

11.18.3 PRODUCT PORTFOLIO

11.18.4 RECENT UPDATE

11.19 SOFREGAZ COMPANY

11.19.1 COMPANY SNAPSHOT

11.19.2 PRODUCT PORTFOLIO

11.19.3 RECENT UPDATE

11.2 STABILIS ENERGY

11.20.1 COMPANY SNAPSHOT

11.20.2 REVENUE ANALYSIS

11.20.3 PRODUCT PORTFOLIO

11.20.4 RECENT UPDATES

11.21 WÄRTSILÄ

11.21.1 COMPANY SNAPSHOT

11.21.2 REVENUE ANALYSIS

11.21.3 PRODUCT PORTFOLIO

11.21.4 RECENT UPDATE

12 QUESTIONNAIRE

13 RELATED REPORTS

Lista de Tabela

LIST OF TABLES

TABLE 1 IMPORT DATA of Natural gas, liquefied; HS Code - 271111 (USD million )

TABLE 2 EXPORT DATA OF NATURAL GAS, LIQUEFIED; HS CODE - 271111 (USD MILLION )

TABLE 3 Middle East and Africa Small-Scale LNG Market, By Type, 2018-2027 (Kilo Tons)

TABLE 4 Middle East and Africa Small-Scale LNG Market, By Type, 2018-2027 (USD Million)

TABLE 5 Middle East and Africa Liquefaction terminal in Small-Scale LNG Market, By Region, 2018-2027 (Kilo Tons)

TABLE 6 Middle East and Africa Liquefaction terminal in Small-Scale LNG Market, By Region, 2018-2027 (USD Million)

TABLE 7 Middle East and Africa Liquefaction Terminal in Small-Scale LNG Market, By Liquefaction Terminal Type, 2018-2027 (USD Million)

TABLE 8 Middle East and Africa Regassification Terminal in SMALL-SCALE LNG MARKET, BY REGION, 2018-2027 (KILO TONS)

TABLE 9 Middle East and Africa Regassification Terminal in SMALL-SCALE LNG MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 10 Middle East and Africa Regassification Terminal in Small-Scale LNG Market, By Regassification Terminal Type, 2018-2027 (USD Million)

TABLE 11 Middle East and Africa SMALL-SCALE LNG Market, By MODE OF SUPPLY, 2018-2027 (USD Million)

TABLE 12 Middle East and Africa Trucks in SMALL-SCALE LNG MARKET, BY REGION, 2018-2027 (USD Million)

TABLE 13 MIDDLE EAST AND AFRICA Rail Tanks IN SMALL-SCALE LNG MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 14 Middle East and Africa Shipment & Bunkering in SMALL-SCALE LNG market, By Region, 2018-2027 (USD MILLION)

TABLE 15 Middle East and Africa Pipeline in SMALL-SCALE LNG market, By Region, 2018-2027 (USD MILLION)

TABLE 16 Middle East and Africa Others in SMALL-SCALE LNG market, By Region, 2018-2027 (USD MILLION)

TABLE 17 Middle East and Africa SMALL-SCALE LNG Market, By STORAGE TANK, 2018-2027 (USD Million)

TABLE 18 Middle East and Africa Atmospheric in Small-Scale LNG Market, By Region, 2018-2027 (Kilo Tons)

TABLE 19 Middle East and Africa Atmospheric in Small-Scale LNG Market, By Atmospheric Storage Tank, 2018-2027 (USD Million)

TABLE 20 Middle East and Africa Pressurized IN SMALL-SCALE LNG MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 21 Middle East and Africa Pressurized in Small-Scale LNG Market, By Pressurized Storage Tank, 2018-2027 (USD Million)

TABLE 22 MIDDLE EAST AND AFRICA Floating Storage (FSU) IN SMALL-SCALE LNG MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 23 Middle East and Africa SMALL-SCALE LNG Market, By Application, 2018-2027 (USD Million)

TABLE 24 Middle East and Africa Transportation IN SMALL-SCALE LNG MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 25 Middle East and AfricaTransportation in Small Scale LNG Market, By Transportation Application, 2018-2027 (USD Million)

TABLE 26 MIDDLE EAST AND AFRICA Industrial and Power IN SMALL-SCALE LNG MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 27 Middle East and Africa Others in SMALL-SCALE LNG market, By Region, 2018-2027 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA Small-Scale LNG Market, By Region, 2018-2027 (Kilo Tons)

TABLE 29 MIDDLE EAST AND AFRICA Small-Scale LNG Market, By Region, 2018-2027 (USD Million)

TABLE 30 MIDDLE EAST AND AFRICA Small-Scale LNG Market, By Type, 2018-2027 (Kilo Tons)

TABLE 31 MIDDLE EAST AND AFRICA Small-Scale LNG Market, By Type, 2018-2027 (USD Million)

TABLE 32 MIDDLE EAST AND AFRICA Liquefaction Terminal in Small-Scale LNG Market, By Liquefaction Terminal Type, 2018-2027 (USD Million)

TABLE 33 MIDDLE EAST AND AFRICA Regassification Terminal in Small-Scale LNG Market, By Regassification Terminal Type, 2018-2027 (USD Million)

TABLE 34 MIDDLE EAST AND AFRICA Small-Scale LNG Market, By Mode of Supply, 2018-2027 (USD Million)

TABLE 35 MIDDLE EAST AND AFRICA Small-Scale LNG Market, By Storage Tank, 2018-2027 (USD Million)

TABLE 36 MIDDLE EAST AND AFRICA Atmospheric in Small-Scale LNG Market, By Atmospheric Storage Tank, 2018-2027 (USD Million)

TABLE 37 Middle East and Africa Pressurized in Small-Scale LNG Market, By Pressurized Storage Tank, 2018-2027 (USD Million)

TABLE 38 Middle East and Africa Small-Scale LNG Market, By Application, 2018-2027 (USD Million)

TABLE 39 Middle East and Africa Transportation in Small-Scale LNG Market, By Transportation Application, 2018-2027 (USD Million)

TABLE 40 UNITED ARAB EMIRATES Small-Scale LNG Market, By Type, 2018-2027 (Kilo Tons)

TABLE 41 UNITED ARAB EMIRATES Small-Scale LNG Market, By type, 2018-2027 (USD Million)

TABLE 42 UNITED ARAB EMIRATES Liquefaction Terminal in Small-Scale LNG Market, By Liquefaction Terminal Type, 2018-2027 (USD Million)

TABLE 43 UNITED ARAB EMIRATES Regassification Terminal in Small-Scale LNG Market, By Regassification Terminal Type, 2018-2027 (USD Million)

TABLE 44 UNITED ARAB EMIRATES Small-Scale LNG Market, By Mode of Supply, 2018-2027 (USD Million)

TABLE 45 UNITED ARAB EMIRATES Small-Scale LNG Market, By Storage Tank, 2018-2027 (USD Million)

TABLE 46 UNITED ARAB EMIRATES Atmospheric in Small-Scale LNG Market, By Atmospheric Storage Tank, 2018-2027 (USD Million)

TABLE 47 United Arab Emirates Pressurized in Small-Scale LNG Market, By Pressurized Storage Tank, 2018-2027 (USD Million)

TABLE 48 United Arab Emirates Small-Scale LNG Market, By Application, 2018-2027 (USD Million)

TABLE 49 United Arab Emirates Transportation in Small-Scale LNG Market, By Transportation Application, 2018-2027 (USD Million)

TABLE 50 SAUDI ARABIA Small-Scale LNG Market, By Type, 2018-2027 (Kilo Tons)

TABLE 51 SAUDI ARABIA Small-Scale LNG Market, By type, 2018-2027 (USD Million)

TABLE 52 SAUDI ARABIA Liquefaction Terminal in Small-Scale LNG Market, By Liquefaction Terminal Type, 2018-2027 (USD Million)

TABLE 53 SAUDI ARABIA Regassification Terminal in Small-Scale LNG Market, By Regassification Terminal Type, 2018-2027 (USD Million)

TABLE 54 SAUDI ARABIA Small-Scale LNG Market, By Mode of Supply, 2018-2027 (USD Million)

TABLE 55 SAUDI ARABIA Small-Scale LNG Market, By Storage Tank, 2018-2027 (USD Million)

TABLE 56 SAUDI ARABIA Atmospheric in Small-Scale LNG Market, By Atmospheric Storage Tank, 2018-2027 (USD Million)

TABLE 57 SAUDI ARABIA Pressurized in Small-Scale LNG Market, By Pressurized Storage Tank, 2018-2027 (USD Million)

TABLE 58 SAUDI ARABIA Small-Scale LNG Market, By Application, 2018-2027 (USD Million)

TABLE 59 SAUDI ARABIA Transportation in Small-Scale LNG Market, By Transportation Application, 2018-2027 (USD Million)

TABLE 60 EGYPT Small-Scale LNG Market, By Type, 2018-2027 (Kilo Tons)

TABLE 61 EGYPT Small-Scale LNG Market, By type, 2018-2027 (USD Million)

TABLE 62 EGYPT Liquefaction Terminal in Small-Scale LNG Market, By Liquefaction Terminal Type, 2018-2027 (USD Million)

TABLE 63 EGYPT Regassification Terminal in Small-Scale LNG Market, By Regassification Terminal Type, 2018-2027 (USD Million)

TABLE 64 EGYPT Small-Scale LNG Market, By Mode of Supply, 2018-2027 (USD Million)

TABLE 65 EGYPT Small-Scale LNG Market, By Storage Tank, 2018-2027 (USD Million)

TABLE 66 EGYPT Atmospheric in Small-Scale LNG Market, By Atmospheric Storage Tank, 2018-2027 (USD Million)

TABLE 67 Egypt Pressurized in Small-Scale LNG Market, By Pressurized Storage Tank, 2018-2027 (USD Million)

TABLE 68 Egypt Small-Scale LNG Market, By Application, 2018-2027 (USD Million)

TABLE 69 Egypt Transportation in Small-Scale LNG Market, By Transportation Application, 2018-2027 (USD Million)

TABLE 70 ISRAEL Small-Scale LNG Market, By Type, 2018-2027 (Kilo Tons)

TABLE 71 ISRAEL Small-Scale LNG Market, By type, 2018-2027 (USD Million)

TABLE 72 ISRAEL Liquefaction Terminal in Small-Scale LNG Market, By Liquefaction Terminal Type, 2018-2027 (USD Million)

TABLE 73 ISRAEL Regassification Terminal in Small-Scale LNG Market, By Regassification Terminal Type, 2018-2027 (USD Million)

TABLE 74 ISRAEL Small-Scale LNG Market, By Mode of Supply, 2018-2027 (USD Million)

TABLE 75 ISRAEL Small-Scale LNG Market, By Storage Tank, 2018-2027 (USD Million)

TABLE 76 ISRAEL Atmospheric in Small-Scale LNG Market, By Atmospheric Storage Tank, 2018-2027 (USD Million)

TABLE 77 Israel Pressurized in Small-Scale LNG Market, By Pressurized Storage Tank, 2018-2027 (USD Million)

TABLE 78 Israel Small-Scale LNG Market, By Application, 2018-2027 (USD Million)

TABLE 79 Israel Transportation in Small-Scale LNG Market, By Transportation Application, 2018-2027 (USD Million)

TABLE 80 SOUTH AFRICA Small-Scale LNG Market, By Type, 2018-2027 (Kilo Tons)

TABLE 81 SOUTH AFRICA Small-Scale LNG Market, By Type, 2018-2027 (USD Million)

TABLE 82 SOUTH AFRICA Liquefaction Terminal in Small-Scale LNG Market, By Liquefaction Terminal Type, 2018-2027 (USD Million)

TABLE 83 SOUTH AFRICA Regassification Terminal in Small-Scale LNG Market, By Regassification Terminal Type, 2018-2027 (USD Million)

TABLE 84 SOUTH AFRICA Small-Scale LNG Market, By Mode of Supply, 2018-2027 (USD Million)

TABLE 85 SOUTH AFRICA Small-Scale LNG Market, By Storage Tank, 2018-2027 (USD Million)

TABLE 86 SOUTH AFRICA Atmospheric in Small-Scale LNG Market, By Atmospheric Storage Tank, 2018-2027 (USD Million)

TABLE 87 South Africa Pressurized in Small-Scale LNG Market, By Pressurized Storage Tank, 2018-2027 (USD Million)

TABLE 88 South Africa Small-Scale LNG Market, By Application, 2018-2027 (USD Million)

TABLE 89 South Africa Transportation in Small-Scale LNG Market, By Transportation Application, 2018-2027 (USD Million)

TABLE 90 REST OF MIDDLE EAST AND AFRICA Small-Scale LNG Market, By Type, 2018-2027 (Kilo Tons)

TABLE 91 REST OF MIDDLE EAST AND AFRICA Small-Scale LNG Market, By type, 2018-2027 (USD Million)

Lista de Figura

LIST OF FIGURES

FIGURE 1 MIDDLE EAST AND AFRICA SMALL-SCALE LNG MARKET: segmentation

FIGURE 2 MIDDLE EAST AND AFRICA SMALL-SCALE LNG MARKET: data triangulation

FIGURE 3 MIDDLE EAST AND AFRICA SMALL-SCALE LNG MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA SMALL-SCALE LNG MARKET: Middle East and Africa vs regional market analysis

FIGURE 5 MIDDLE EAST AND AFRICA SMALL-SCALE LNG MARKET: company research analysis

FIGURE 6 MIDDLE EAST AND AFRICA SMALL-SCALE LNG MARKET: THE Storage TankLIFE LINE CURVE

FIGURE 7 MIDDLE EAST AND AFRICA SMALL-SCALE LNG MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST AND AFRICA SMALL-SCALE LNG MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST AND AFRICA Small-scale LNG MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST AND AFRICA Small-scale LNG MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 Middle East and Africa SMALL-SCALE LNG Market: vendor share analysis

FIGURE 12 MIDDLE EAST AND AFRICA SMALL-SCALE LNG MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 13 MIDDLE EAST AND AFRICA SMALL-SCALE LNG MARKET: SEGMENTATION

FIGURE 14 Increasing demand of natural gases in industrial, commercial & residential sector drives the MIDDLE EAST AND AFRICA small-scale LNG market in the forecast period of 2020 to 2027

FIGURE 15 Liquefaction Terminal SEGMENT is expected to account for the largest share of the MIDDLE EAST AND AFRICA SMALL-SCALE LNG MARKET in 2020 & 2027

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITY AND CHALLENGE OF Middle East and Africa SMALL-SCALE LNG market

FIGURE 17 U.S. Natural gas consumption by sector, 2018 (in %)

FIGURE 18 North America Natural gas consumption from 2015-2018 (BCM Units)

FIGURE 19 Asia-Pacific Natural gas consumption, 2015-2018 (BCM Units)

FIGURE 20 MIDDLE EAST AND AFRICA SMALL-SCALE LNG MARKET, BY TYPE, 2019

FIGURE 21 MIDDLE EAST AND AFRICA SMALL-SCALE LNG MARKET, BY MODE OF SUPPLY, 2019

FIGURE 22 MIDDLE EAST AND AFRICA SMALL-SCALE LNG MARKET, BY MODE OF SUPPLY, 2019

FIGURE 23 MIDDLE EAST AND AFRICA SMALL-SCALE LNG MARKET, BY application, 2019

FIGURE 24 MIDDLE EAST AND AFRICA small-scale LNG market: SNAPSHOT (2019)

FIGURE 25 MIDDLE EAST AND AFRICA small-scale LNG market: by COUNTRY (2019)

FIGURE 26 MIDDLE EAST AND AFRICA small-scale LNG market: by COUNTRY (2020 & 2027)

FIGURE 27 MIDDLE EAST AND AFRICA small-scale LNG market: by COUNTRY (2019 & 2027)

FIGURE 28 MIDDLE EAST AND AFRICA small-scale LNG market: by TYPE (2020-2027)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.