Middle East And Africa Renting And Leasing Test And Measurement Equipment Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

334.44 Million

USD

443.81 Million

2024

2032

USD

334.44 Million

USD

443.81 Million

2024

2032

| 2025 –2032 | |

| USD 334.44 Million | |

| USD 443.81 Million | |

|

|

|

|

Segmentação do mercado de equipamentos de teste e medição para locação e arrendamento no Oriente Médio e África, por oferta (hardware e serviços), componente (conjuntos de cabos, conectores, acessórios de valor agregado e outros), tipo de sistema (sistema de detecção, sistema de conectividade, sistema de segurança, interface homem-máquina (HMI), sistema de gerenciamento de energia e energia, sistema de controle de motor e sistema de iluminação), tipo (aluguel e arrendamento), recursos (equipamentos de diagnóstico, detecção elétrica, ICS de medição e outros), usuário final (TI e telecomunicações, automotivo, aeroespacial e defesa, industrial, eletrônicos de consumo, energia e serviços públicos, equipamentos médicos e outros) - tendências e previsões do setor até 2032

Tamanho do mercado de equipamentos de teste e medição para locação e arrendamento no Oriente Médio e África

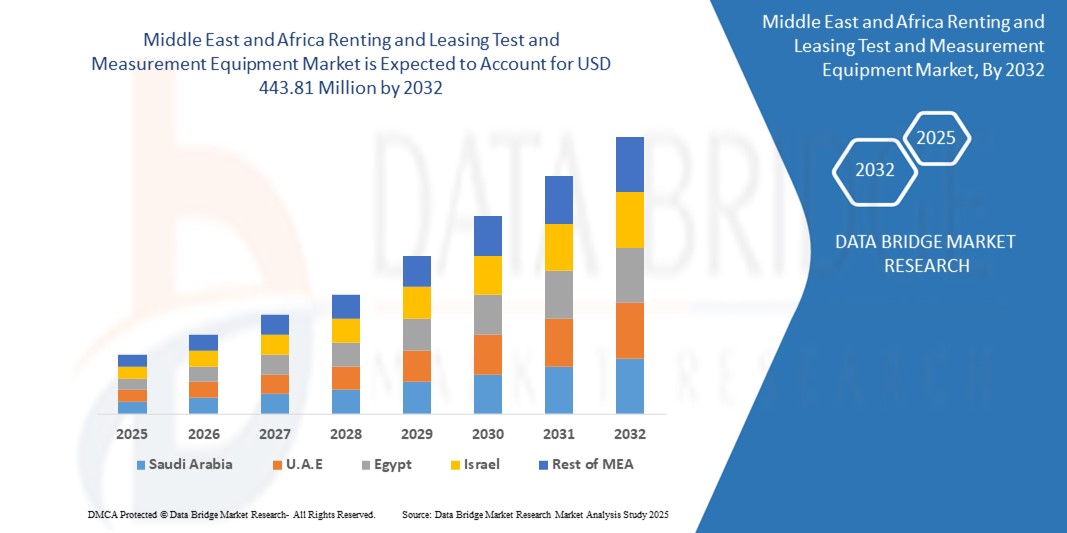

- O tamanho do mercado de equipamentos de teste e medição para locação e arrendamento no Oriente Médio e na África foi avaliado em US$ 334,44 milhões em 2024 e deverá atingir US$ 443,81 milhões até 2032 , com um CAGR de 3,60% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente demanda por acesso econômico a soluções de teste avançadas e pela crescente adoção de modelos de negócios flexíveis em todos os setores

- A crescente ênfase na redução das despesas de capital, ao mesmo tempo que se garante o acesso às tecnologias mais recentes, também está a acelerar a adopção pelo mercado

Análise de mercado de equipamentos de teste e medição para locação e arrendamento no Oriente Médio e África

- O mercado está testemunhando um forte crescimento, à medida que empresas dos setores de eletrônicos, telecomunicações, automotivo e manufatura optam por modelos de aluguel e leasing para otimizar custos e manter a agilidade operacional

- A crescente complexidade tecnológica, os ciclos de vida mais curtos dos produtos e a necessidade de atualizações regulares estão a obrigar as empresas a adotar o acesso flexível em vez de compras diretas

- A Arábia Saudita dominou o mercado de aluguel e leasing de equipamentos de teste e medição no Oriente Médio e na África em 2024, impulsionada por projetos industriais de grande escala, investimentos crescentes nos setores de telecomunicações e energia e iniciativas governamentais de apoio à adoção de tecnologia

- Espera-se que os Emirados Árabes Unidos testemunhem a maior taxa de crescimento anual composta (CAGR) no mercado de equipamentos de teste e medição para aluguel e arrendamento no Oriente Médio e na África devido à rápida adoção tecnológica, à crescente ênfase em iniciativas de cidades inteligentes e ao aumento dos investimentos nos setores de telecomunicações, aeroespacial e energia renovável.

- O segmento de Serviços deteve a maior fatia de mercado na receita em 2024, impulsionado pela crescente preferência por soluções de leasing que oferecem serviços completos, incluindo calibração, manutenção e suporte técnico. Contratos baseados em serviços oferecem conveniência operacional e reduzem a necessidade de expertise interna, tornando-os altamente populares entre as empresas.

Escopo do relatório e segmentação do mercado de equipamentos de teste e medição para locação e arrendamento no Oriente Médio e África

|

Atributos |

Aluguel e Leasing de Equipamentos de Teste e Medição no Oriente Médio e África Principais Insights de Mercado |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além de insights de mercado, como valor de mercado, taxa de crescimento, segmentos de mercado, cobertura geográfica, participantes do mercado e cenário de mercado, o relatório de mercado selecionado pela equipe de pesquisa de mercado da Data Bridge inclui análise aprofundada de especialistas, análise de importação/exportação, análise de preços, análise de consumo de produção e análise Pilstle. |

Tendências do mercado de aluguel e leasing de equipamentos de teste e medição no Oriente Médio e na África

Mudança para modelos de acesso flexíveis

- A crescente preferência por modelos de aluguel e leasing está remodelando o setor de equipamentos de teste e medição, permitindo que as organizações acessem ferramentas avançadas sem grandes investimentos iniciais. Essa abordagem promove a otimização de custos e permite que as empresas se adaptem às rápidas mudanças nos ciclos tecnológicos.

- A crescente necessidade de acesso de curto prazo a sistemas de teste de alto desempenho em setores como telecomunicações, eletrônicos e automotivo está acelerando a adoção de contratos de aluguel flexíveis. Esses modelos proporcionam às empresas a agilidade necessária para dimensionar a capacidade de teste com base nos requisitos do projeto.

- A acessibilidade e a conveniência operacional dos contratos de leasing os tornam atraentes para pequenas e médias empresas, permitindo o acesso a equipamentos que, de outra forma, seriam proibitivos em termos de custo. Isso garante melhores capacidades de teste sem compromissos financeiros de longo prazo.

- Por exemplo, em 2023, vários fabricantes de eletrônicos adotaram modelos de aluguel para osciloscópios avançados e analisadores de espectro para dar suporte ao desenvolvimento de produtos, evitando grandes despesas de capital e mantendo padrões de teste de alta qualidade.

- Embora os modelos de aluguel e leasing estejam expandindo o acesso e reduzindo o risco financeiro, seu sucesso depende da inovação contínua na oferta de serviços, da transparência nos preços e de um suporte robusto ao cliente. Os provedores devem se concentrar em acordos personalizados e serviços combinados para atender à crescente demanda.

Dinâmica do mercado de equipamentos de teste e medição para locação e arrendamento no Oriente Médio e na África

Motorista

Crescente demanda por otimização de custos e acesso às mais recentes tecnologias

- O aumento do custo de equipamentos avançados de teste está levando as empresas a optar pelo aluguel e leasing como uma alternativa econômica. Ao evitar grandes despesas iniciais, as organizações podem redirecionar o capital para as operações principais e atividades de P&D. Essa abordagem também permite que as empresas respondam rapidamente às demandas flutuantes dos projetos sem ficarem presas à depreciação de ativos, garantindo flexibilidade operacional.

- As empresas estão cada vez mais conscientes dos benefícios de acessar as tecnologias de teste mais recentes sem o ônus da propriedade. Isso levou a um aumento nos contratos de curto e médio prazo em setores com ciclos de produtos em rápida evolução. O leasing permite que as empresas testem novos instrumentos, atualizem regularmente e mantenham a vantagem competitiva sem se comprometer com investimentos de longo prazo.

- O crescimento do mercado é ainda apoiado por prestadores de serviços que oferecem calibração, manutenção e atualizações como parte de contratos de leasing, garantindo operações ininterruptas e a confiabilidade dos equipamentos. As empresas também se beneficiam de suporte técnico, atualizações de software e garantias de substituição de equipamentos, reduzindo o tempo de inatividade e os riscos operacionais.

- Por exemplo, em 2022, diversas operadoras de telecomunicações adotaram contratos de leasing para instrumentos de teste 5G para acelerar a implantação e, ao mesmo tempo, minimizar o risco financeiro, impulsionando a demanda por soluções flexíveis de aluguel. Essa prática as ajudou a escalar a infraestrutura de teste de forma rápida e eficiente, possibilitando uma implementação mais rápida de serviços de rede críticos.

- Embora a redução de custos e o acesso à tecnologia sejam fortes impulsionadores do crescimento, o mercado exige inovação contínua na prestação de serviços, personalização aprimorada e disponibilidade global para garantir a adoção sustentada. Provedores que investem em plataformas digitais para rastreamento de ativos, manutenção preditiva e suporte remoto provavelmente verão um crescimento acelerado.

Restrição/Desafio

Alta dependência da disponibilidade do equipamento e da confiabilidade do serviço

- A disponibilidade limitada de equipamentos especializados de teste e medição em determinados mercados cria gargalos, pois as locadoras nem sempre conseguem atender à demanda por instrumentos de nicho ou de alta qualidade. Isso restringe o acesso em tempo hábil e atrasa projetos críticos. As empresas frequentemente enfrentam conflitos de cronograma, o que pode impactar os cronogramas de desenvolvimento de produtos e a eficiência operacional geral.

- Em muitas regiões em desenvolvimento, há uma falta de prestadores de serviços de aluguel confiáveis, capazes de manter a qualidade dos equipamentos e garantir um desempenho consistente. Isso cria problemas de confiança e limita a adoção entre as empresas. Lacunas na manutenção, atrasos na calibração e ausência de pessoal treinado agravam ainda mais os desafios nessas regiões.

- A penetração no mercado também é limitada por desafios logísticos, incluindo atrasos no transporte, instalação e calibração, especialmente para sistemas grandes ou complexos. Esses obstáculos aumentam o tempo de inatividade e reduzem a eficiência operacional. As empresas podem enfrentar custos adicionais para instalação no local, prazos de entrega estendidos e riscos de transporte, o que pode desencorajar a adoção em locais remotos.

- Por exemplo, em 2023, diversas pequenas empresas na região relataram atrasos em projetos devido à indisponibilidade de equipamentos alugados e suporte técnico inadequado, evidenciando lacunas na qualidade e acessibilidade do serviço. Esses atrasos também afetaram a conformidade com os padrões regulatórios e os cronogramas de testes, demonstrando a necessidade crítica de redes de provedores robustas.

- Embora os modelos de aluguel e leasing reduzam os custos iniciais, garantir a adoção generalizada depende do fortalecimento das cadeias de suprimentos, da melhoria do serviço pós-venda e da expansão das redes de provedores para fornecer soluções confiáveis e em tempo hábil. A integração de monitoramento digital, manutenção preditiva e contratos de serviço escaláveis pode mitigar riscos e aumentar a confiança entre potenciais usuários.

Escopo do mercado de equipamentos de teste e medição para locação e arrendamento no Oriente Médio e África

O mercado é segmentado com base na oferta, componente, tipo de sistema, tipo, recursos e usuário final.

- Ao oferecer

Com base na oferta, o mercado é segmentado em Hardware e Serviços. O segmento de Serviços deteve a maior participação de mercado na receita em 2024, impulsionado pela crescente preferência por soluções de leasing que oferecem serviços completos, incluindo calibração, manutenção e suporte técnico. Contratos baseados em serviços oferecem conveniência operacional e reduzem a necessidade de expertise interna, tornando-os muito populares entre as empresas.

Espera-se que o segmento de Hardware apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente disponibilidade de instrumentos de teste avançados para aluguel ou leasing. O aluguel de hardware permite que as empresas acessem os equipamentos mais recentes sem grandes investimentos de capital, apoiando projetos de curto prazo e atualizações tecnológicas rápidas.

- Por componente

Com base nos componentes, o mercado é segmentado em Conjuntos de Cabos, Conectores, Acessórios de Valor Agregado e Outros. O segmento de Acessórios de Valor Agregado deteve a maior fatia da receita em 2024, impulsionado pela demanda por pacotes completos de aluguel que incluem adaptadores, sondas e kits de calibração, garantindo uma operação perfeita com equipamentos alugados.

Espera-se que o segmento de conectores testemunhe a maior taxa de crescimento entre 2025 e 2032, devido à crescente demanda por conectores compatíveis e de alto desempenho que melhorem a usabilidade de dispositivos de teste alugados ou arrendados em diversas aplicações.

- Por tipo de sistema

Com base no tipo de sistema, o mercado é segmentado em Sistema de Detecção, Sistema de Conectividade, Sistema de Segurança, Interface Homem-Máquina (IHM), Sistema de Gerenciamento de Energia, Sistema de Controle de Motor e Sistema de Iluminação. O segmento de Sistemas de Conectividade deteve a maior fatia da receita de mercado em 2024, impulsionado pela maior adoção nos setores de TI, telecomunicações e eletrônicos, que exigem testes confiáveis de redes e dispositivos de comunicação.

Espera-se que o segmento de sistemas de detecção testemunhe a maior taxa de crescimento entre 2025 e 2032, devido à crescente demanda por ferramentas de medição de precisão e aquisição de dados em tempo real oferecidas por meio de modelos de leasing flexíveis.

- Por tipo

Com base no tipo, o mercado é segmentado em Aluguel e Leasing. O segmento de Aluguel deteve a maior participação na receita em 2024, com as empresas cada vez mais preferindo aluguéis de curto prazo para testes e prototipagem específicos de projetos, o que reduz os custos iniciais e minimiza a obsolescência dos equipamentos.

Espera-se que o segmento de leasing testemunhe a maior taxa de crescimento entre 2025 e 2032, impulsionado por contratos de longo prazo que fornecem acesso contínuo a dispositivos de teste e medição de ponta, juntamente com serviços de valor agregado, garantindo eficiência operacional e otimização de custos.

- Por recursos

Com base em suas características, o mercado é segmentado em Equipamentos de Diagnóstico, Detecção Elétrica, Sistemas Integrados de Medição (ICS) e Outros. O segmento de Equipamentos de Diagnóstico deteve a maior fatia da receita de mercado em 2024, impulsionado pela alta demanda nos setores industrial, automotivo e de telecomunicações por testes de precisão e solução de problemas.

Espera-se que o segmento de detecção elétrica testemunhe a maior taxa de crescimento entre 2025 e 2032, devido à crescente adoção de instrumentos de teste elétrico alugados e arrendados para monitoramento de energia, conformidade e aplicações de segurança.

- Por usuário final

Com base no usuário final, o mercado é segmentado em TI e Telecomunicações, Automotivo, Aeroespacial e Defesa, Industrial, Eletrônicos de Consumo, Energia e Serviços Públicos, Equipamentos Médicos e Outros. O segmento de TI e Telecomunicações deteve a maior fatia da receita em 2024, impulsionado pela rápida implantação de infraestrutura de rede e pela crescente adoção de soluções de aluguel e leasing para testar sistemas de comunicação de alta velocidade.

Espera-se que o segmento automotivo testemunhe a maior taxa de crescimento entre 2025 e 2032, devido à crescente dependência de equipamentos avançados de teste e diagnóstico em P&D de veículos e processos de fabricação oferecidos por meio de modelos flexíveis de aluguel e leasing.

Análise regional do mercado de equipamentos de teste e medição para locação e arrendamento no Oriente Médio e África

- A Arábia Saudita dominou o mercado de aluguel e leasing de equipamentos de teste e medição no Oriente Médio e na África em 2024, impulsionada por projetos industriais de grande escala, investimentos crescentes nos setores de telecomunicações e energia e iniciativas governamentais de apoio à adoção de tecnologia

- As empresas estão cada vez mais utilizando modelos de aluguel e leasing para acessar instrumentos de teste de ponta para projetos industriais, de energia e de infraestrutura sem grandes despesas de capital

- Essa ampla adoção é ainda apoiada pela necessidade de eficiência operacional, flexibilidade de projeto e serviços confiáveis de manutenção de equipamentos, tornando as soluções de aluguel e leasing a escolha preferida das empresas.

Mercado de equipamentos de teste e medição para locação e arrendamento nos Emirados Árabes Unidos

Espera-se que o mercado de aluguel e leasing de equipamentos de teste e medição nos Emirados Árabes Unidos apresente a maior taxa de crescimento entre 2025 e 2032, devido à crescente adoção de modelos flexíveis de acesso a equipamentos nos setores de TI, telecomunicações e indústria. As empresas estão optando por soluções de aluguel e leasing para reduzir custos iniciais, manter o acesso a tecnologias avançadas de teste e apoiar a execução rápida de projetos. Os crescentes investimentos em iniciativas de cidades inteligentes, automação industrial e projetos de infraestrutura avançada estão contribuindo significativamente para o crescimento acelerado do mercado na região.

Participação no mercado de aluguel e arrendamento de equipamentos de teste e medição no Oriente Médio e na África

O setor de aluguel e arrendamento de equipamentos de teste e medição no Oriente Médio e na África é liderado principalmente por empresas bem estabelecidas, incluindo:

- Ar condicionado Zamil (Arábia Saudita)

- SKM Ar Condicionado LLC (Emirados Árabes Unidos)

- Cool Tech (Arábia Saudita)

- Al Salem Johnson Controls (Arábia Saudita)

- Qatar Cool (Catar)

- Emirates Advanced Refrigeration (EAU)

- Grupo Bahri & Mazroei (EAU)

- Companhia Nacional de Ar Condicionado (Arábia Saudita)

- Frigoglass Industries (África do Sul)

- Soluções de Resfriamento AFCON (Egito)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.