Middle East And Africa Recovered Carbon Black Rcb Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

3.55 Million

USD

11.88 Million

2024

2032

USD

3.55 Million

USD

11.88 Million

2024

2032

| 2025 –2032 | |

| USD 3.55 Million | |

| USD 11.88 Million | |

|

|

|

|

Segmentação do mercado de negro de fumo recuperado (rCB) no Oriente Médio e na África, por tipo (negro de fumo primário e cinzas inorgânicas), grau (comum e especial), aplicação (pneus, borracha não relacionada a pneus, plásticos, tintas, revestimentos e outros), usuário final (transporte, indústria, impressão e embalagem, construção civil e outros) - Tendências e previsões do setor até 2032

Tamanho do mercado de negro de fumo recuperado (rCB) no Oriente Médio e na África

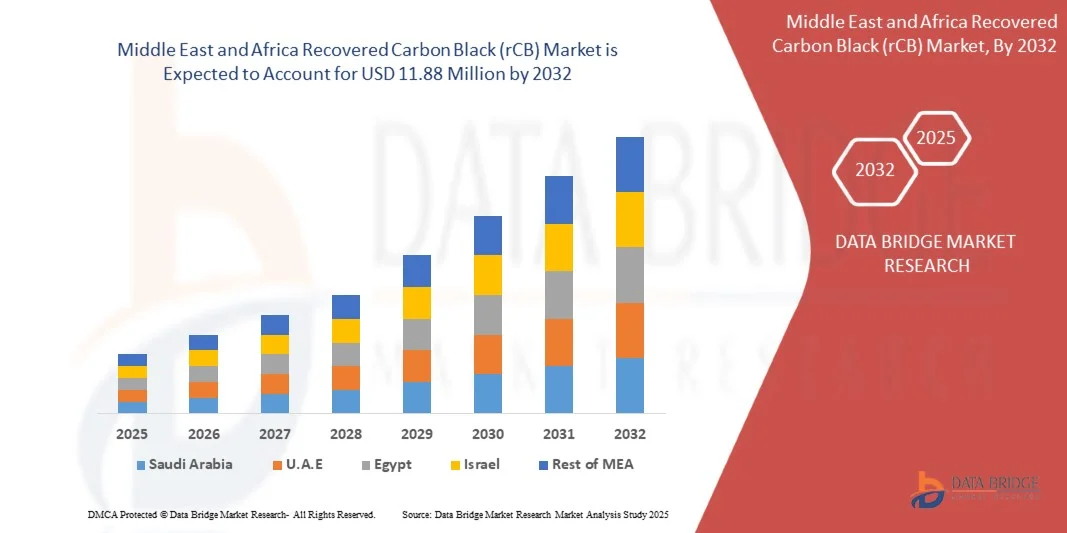

- O mercado de negro de fumo recuperado (rCB) no Oriente Médio e na África foi avaliado em US$ 3,55 milhões em 2024 e deverá atingir US$ 11,88 milhões até 2032 , com uma taxa de crescimento anual composta (CAGR) de 16,3% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pelo aumento das regulamentações ambientais e iniciativas de sustentabilidade, que incentivam os fabricantes a adotar materiais reciclados, como o negro de fumo recuperado. A crescente conscientização sobre o impacto ambiental da produção de negro de fumo virgem está levando as indústrias, principalmente as de pneus, plásticos e revestimentos, a integrar o negro de fumo recuperado em seus processos de produção, aumentando assim a demanda do mercado.

- Além disso, a crescente demanda por alternativas de alto desempenho e custo-benefício ao negro de fumo virgem está consolidando o rCB como uma opção viável e sustentável em diversas aplicações industriais. Por exemplo, a colaboração da Continental AG com a Pyrum Innovations AG para o uso de rCB na fabricação de pneus exemplifica como parcerias estratégicas e a adoção industrial estão acelerando o crescimento do mercado.

Análise do mercado de negro de fumo recuperado (rCB) no Oriente Médio e na África

- O negro de fumo recuperado, produzido através da pirólise de pneus usados e outros resíduos de borracha, é cada vez mais reconhecido como uma matéria-prima essencial em iniciativas de economia circular. Sua capacidade de proporcionar desempenho comparável ao do negro de fumo virgem no reforço de borracha, plásticos e revestimentos aumenta seu apelo entre os fabricantes que buscam soluções de produção sustentáveis.

- A crescente adoção do rCB também é impulsionada pelos avanços tecnológicos no processamento e na granulação, que melhoram a consistência, o manuseio e o transporte do material. Inovações como as operações de granulação da Pyrum Innovations AG na Alemanha permitem uma integração mais eficiente do rCB nas cadeias de suprimentos industriais, ampliando sua escalabilidade no mercado.

- Os Emirados Árabes Unidos dominaram o mercado de negro de carbono recuperado (rCB) em 2024, devido aos seus fortes setores de fabricação de pneus, de reposição automotiva e de borracha industrial.

- A África do Sul deverá ser o país com o crescimento mais rápido no mercado de negro de fumo recuperado (rCB) durante o período de previsão, devido à sua crescente capacidade de reciclagem de pneus e à ênfase em práticas industriais sustentáveis.

- O segmento de negro de fumo primário dominou o mercado com uma participação de 70,5% em 2024, devido ao seu uso generalizado como carga de reforço em produtos de borracha, principalmente pneus. Seu tamanho de partícula consistente, alta pureza e desempenho no aumento da durabilidade e resistência ao desgaste o tornam a escolha preferida de muitos fabricantes de pneus e produtos de borracha. O segmento se beneficia de cadeias de suprimentos e processos de fabricação estabelecidos, garantindo confiabilidade para aplicações em larga escala. Sua versatilidade em produtos de borracha, tanto para pneus quanto para outros tipos de produtos, fortalece sua dominância de mercado. Além disso, a pesquisa contínua em formulações otimizadas apoia ainda mais sua ampla adoção. Os fabricantes preferem o negro de fumo primário devido ao desempenho previsível e à relação custo-benefício.

Escopo do relatório e segmentação do mercado de negro de fumo recuperado (rCB) no Oriente Médio e na África

|

Atributos |

Análises de mercado essenciais para o negro de fumo recuperado (rCB) no Oriente Médio e na África |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de produção e consumo, análise de tendências de preços, cenário de mudanças climáticas, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de negro de fumo recuperado (rCB) no Oriente Médio e na África

“Aumento do uso de negro de fumo recuperado em pneus e aplicações industriais”

- O mercado de negro de fumo recuperado (rCB) está experimentando um forte crescimento, impulsionado pela crescente adoção na fabricação de pneus e em diversas aplicações industriais. O rCB, derivado principalmente de pneus descartados por meio de pirólise, oferece uma alternativa sustentável ao negro de fumo virgem, reduzindo o impacto ambiental e alinhando-se aos princípios da economia circular.

- Por exemplo, fabricantes líderes de pneus, como a Michelin, comprometeram-se a integrar até 40% de materiais reciclados, incluindo rCB (cimento reciclado), na produção de pneus novos até 2030. Essa crescente demanda reflete o esforço da indústria em direção à sustentabilidade, mantendo o desempenho do produto e a relação custo-benefício.

- Os avanços tecnológicos nos processos de pirólise e recuperação melhoraram a qualidade do negro de carbono reciclado (rCB), expandindo sua aplicação além de pneus para revestimentos, plásticos e tintas. A durabilidade e o desempenho comparáveis ao negro de carbono virgem tornam o material atraente para fabricantes com restrições de custos e preocupados com o meio ambiente.

- Além disso, as regulamentações governamentais que exigem a reciclagem de pneus e a crescente conscientização ambiental entre os consumidores estão impulsionando a adoção do rCB em todo o mundo. O esforço para reduzir o descarte em aterros sanitários e as emissões de carbono está fomentando o investimento e a colaboração da indústria para ampliar a capacidade de produção de rCB.

- A crescente industrialização nas economias emergentes, aliada a mandatos ESG mais rigorosos nas regiões desenvolvidas, aumenta a demanda por matérias-primas recicladas, como o rCB (papelão reciclado). Essa dinâmica de mercado impulsiona a inovação, expande os diferentes níveis de qualidade do rCB e incentiva modelos de cadeia de suprimentos circulares.

- A transição para o fornecimento sustentável de negro de fumo por meio de materiais recuperados deverá continuar, remodelando o panorama do mercado de negro de fumo, oferecendo benefícios econômicos e contribuindo para a redução de resíduos e a mitigação de emissões.

Dinâmica do mercado de negro de fumo recuperado (rCB) no Oriente Médio e na África

Motorista

“Forte pressão das regulamentações ambientais e das iniciativas de sustentabilidade”

- Regulamentações ambientais cada vez mais rigorosas e metas de sustentabilidade são os principais fatores que impulsionam o mercado de negro de carbono recuperado. Políticas voltadas para a redução de resíduos em aterros sanitários, a diminuição das emissões de carbono e a promoção de materiais reciclados obrigam os fabricantes de pneus, borracha e plástico a incorporar o negro de carbono recuperado em seus produtos.

- Por exemplo, o Plano de Ação para a Economia Circular da União Europeia e estruturas semelhantes na América do Norte incentivam o uso de papelão reciclado (rCB) ao impor mandatos sobre a reciclagem de pneus e os níveis de conteúdo reciclado. Essas iniciativas incentivam fabricantes e fornecedores, como a Klean Carbon, a Bolder Industries e a Scandinavian Enviro Systems, a desenvolver produtos de rCB avançados e de alta qualidade.

- Iniciativas de sustentabilidade de fabricantes de equipamentos originais (OEMs), como Michelin e Bridgestone, estão impulsionando os setores automotivo e de pneus a atingirem metas ambiciosas de integração de materiais reciclados, aumentando ainda mais a adoção do negro de carbono reciclado (rCB). Essa mudança apoia a responsabilidade ambiental corporativa, ao mesmo tempo que oferece uma alternativa econômica à dependência do negro de carbono virgem derivado de combustíveis fósseis.

- Além disso, o crescente foco dos investidores no desempenho ESG e o endurecimento dos regimes de precificação de carbono motivam um aumento do fluxo de capital para usinas modulares de pirólise de rCB e soluções de cadeia de suprimentos circular. Esses fatores garantem perspectivas de crescimento a longo prazo, apesar das flutuações do mercado.

- O contínuo impulso regulatório e de mercado em direção a ecossistemas de manufatura circular e de baixo carbono posiciona o rCB como um material crítico para o desenvolvimento industrial sustentável em diversos setores.

Restrição/Desafio

“Qualidade inconsistente em comparação com o negro de fumo virgem”

- Um dos principais desafios no mercado de negro de fumo reciclado é a inconsistência na qualidade em comparação com o negro de fumo virgem. A variabilidade na composição da matéria-prima, nas condições do processo de recuperação e nos níveis de contaminação pode afetar a distribuição do tamanho das partículas, a pureza e o desempenho geral do material.

- Por exemplo, os fabricantes enfrentam dificuldades em manter a uniformidade devido às diferenças na quantidade de resíduos de pneus utilizados e à separação incompleta de aditivos ou metais durante a pirólise. Essa inconsistência pode resultar em variações na resistência mecânica e nas características de dispersão, que são cruciais para aplicações em pneus e borracha.

- Além disso, alcançar a paridade de desempenho com o negro de fumo virgem em aplicações especiais de alto valor agregado exige capacidades avançadas de processamento e refino, elevando os custos de produção. Os produtores devem investir continuamente em sistemas de controle de qualidade e otimização de processos para atender às rigorosas especificações dos fabricantes de equipamentos originais (OEMs).

- Os desafios de integração da cadeia de suprimentos, incluindo a disponibilidade de matéria-prima, a logística e a padronização da produção, complicam ainda mais a garantia de qualidade consistente do rCB. Essas barreiras podem limitar as taxas de adoção e restringir o uso do rCB em aplicações premium ou sensíveis.

- Os esforços contínuos de P&D concentram-se na melhoria das tecnologias de pirólise, no refinamento dos processos de pós-tratamento e no desenvolvimento de protocolos robustos de avaliação da qualidade. Resolver a inconsistência de qualidade será crucial para a expansão do negro de fumo recuperado em mercados mais amplos e para garantir sua viabilidade competitiva a longo prazo.

Escopo do mercado de negro de fumo recuperado (rCB) no Oriente Médio e na África

O mercado está segmentado com base no tipo, grau, aplicação e usuário final.

- Por tipo

Com base no tipo, o mercado de negro de fumo recuperado é segmentado em negro de fumo primário e cinzas inorgânicas. O segmento de negro de fumo primário detém a maior participação na receita de mercado, com 70,5% em 2024, impulsionado por seu uso generalizado como carga de reforço em produtos de borracha, principalmente pneus. Seu tamanho de partícula consistente, alta pureza e desempenho no aumento da durabilidade e resistência ao desgaste o tornam a escolha preferida de muitos fabricantes de pneus e produtos de borracha. O segmento se beneficia de cadeias de suprimentos e processos de fabricação estabelecidos, garantindo confiabilidade para aplicações em larga escala. Sua versatilidade em produtos de borracha, tanto para pneus quanto para outros tipos de produtos, fortalece sua dominância de mercado. Além disso, a pesquisa contínua em formulações otimizadas apoia ainda mais sua ampla adoção. Os fabricantes preferem o negro de fumo primário devido ao desempenho previsível e à relação custo-benefício.

O segmento de cinzas inorgânicas deverá apresentar o crescimento mais rápido entre 2025 e 2032, devido às suas aplicações em indústrias especializadas que requerem materiais de enchimento com propriedades químicas específicas. Indústrias como a de especialidades químicas, eletrônica e plásticos de alto desempenho demandam negro de fumo com composição e teor de cinzas controlados. Seu crescimento também é impulsionado pelo crescente interesse em materiais sustentáveis e reciclados que atendam a regulamentações ambientais rigorosas. As cinzas inorgânicas oferecem propriedades térmicas e elétricas únicas, tornando-as adequadas para aplicações industriais avançadas. A crescente adoção em nichos de mercado que requerem enchimentos de alto desempenho contribui para a aceleração da participação de mercado. Os fabricantes estão explorando cada vez mais as cinzas inorgânicas para formulações personalizadas, o que sustenta sua expansão projetada.

- Por série

Com base na qualidade, o mercado de negro de fumo reciclado é segmentado em commodities e especiais. O negro de fumo de grau commodity dominou o mercado em 2024 devido à sua ampla aplicabilidade nas indústrias de borracha para pneus e outros produtos, onde grandes volumes são necessários a preços competitivos. Suas propriedades padronizadas, custo-benefício e fácil disponibilidade o tornam a escolha preferida para processos de produção em larga escala. O negro de fumo de grau commodity atende a uma ampla gama de aplicações em borracha, incluindo correias industriais, mangueiras e produtos moldados. O segmento se beneficia de economias de escala e infraestrutura de fabricação consolidada. Qualidade consistente e cadeias de suprimentos confiáveis ajudam a manter sua liderança no mercado. Além disso, seu desempenho em aplicações de uso geral garante demanda contínua em diversos setores de uso final.

Espera-se que o negro de fumo especial apresente o crescimento mais rápido entre 2025 e 2032, impulsionado pela demanda de aplicações de alto desempenho, como tintas, revestimentos e plásticos, onde propriedades aprimoradas, como melhor dispersão e tamanho de partícula específico, são cruciais. Os negros de fumo especiais são projetados para atender a rigorosos requisitos de qualidade e desempenho, muitas vezes personalizados para necessidades industriais precisas. A crescente demanda por materiais sustentáveis e de alta eficiência em aplicações avançadas acelera sua adoção. Indústrias como revestimentos automotivos, eletrônica e plásticos especiais dependem desses tipos de negro de fumo para obter funcionalidade aprimorada. A pesquisa em métodos de processamento inovadores também impulsiona o crescimento do negro de fumo especial. Além disso, a crescente conscientização sobre materiais ecológicos e reciclados alimenta o interesse em tipos de alto desempenho. O negro de fumo especial garante qualidade superior ao produto final, o que impulsiona sua expansão de mercado.

- Por meio de aplicação

Com base na aplicação, o mercado de negro de fumo reciclado é segmentado em pneus, borracha não relacionada a pneus, plásticos, tintas, revestimentos e outros. O segmento de pneus representou a maior participação na receita do mercado em 2024, impulsionado pela crescente demanda por veículos automotivos e pela consequente necessidade de pneus duráveis e de alto desempenho. Os pneus requerem negro de fumo para reforço, resistência ao desgaste e longevidade, tornando-o uma matéria-prima essencial. O segmento se beneficia dos ciclos contínuos de produção e substituição de automóveis em todo o mundo. Os altos padrões de durabilidade e desempenho dos pneus fortalecem ainda mais a demanda por negro de fumo. Além disso, o aumento das vendas de veículos em economias emergentes contribui para a participação na receita do segmento. Os fabricantes se concentram em formulações otimizadas para atender aos requisitos de desempenho, custo e sustentabilidade, consolidando a dominância do segmento.

O segmento de tintas e revestimentos deverá apresentar o crescimento mais rápido entre 2025 e 2032, impulsionado pelo aumento do uso nas indústrias de impressão e embalagem que buscam alternativas sustentáveis e econômicas ao negro de fumo virgem. O negro de fumo reciclado oferece intensidade de cor, opacidade e consistência adequadas para diversas tintas e revestimentos. A mudança para soluções de impressão ecologicamente corretas e embalagens sustentáveis impulsiona a adoção. O crescimento do comércio eletrônico e da demanda por embalagens alimenta ainda mais a necessidade de pigmentos de alta qualidade. As indústrias estão explorando o negro de fumo reciclado para reduzir a pegada de carbono, mantendo o desempenho do produto. Os avanços tecnológicos em dispersão e formulação melhoram a compatibilidade com diferentes substratos, acelerando o crescimento do mercado. O crescente foco regulatório em sustentabilidade reforça a adoção do negro de fumo reciclado nessas aplicações.

- Por usuário final

Com base no usuário final, o mercado de negro de fumo reciclado é segmentado em transporte, indústria, impressão e embalagem, construção civil e outros. O segmento de transporte detém a maior participação na receita em 2024, impulsionado pela forte dependência da indústria automotiva em relação ao negro de fumo para a fabricação de pneus e outros componentes de borracha. As aplicações automotivas exigem alta durabilidade, resistência ao desgaste e consistência, características que o negro de fumo reciclado proporciona com eficiência. O segmento também se beneficia do crescimento da produção de veículos e da demanda por peças de reposição. Pneus, correias, mangueiras e componentes de borracha moldados utilizam amplamente o negro de fumo para melhorar o desempenho. Além disso, a relação custo-benefício e as considerações ambientais reforçam sua adoção em aplicações de transporte. As inovações contínuas em materiais automotivos sustentam a posição de liderança do segmento.

O segmento de impressão e embalagem deverá apresentar o crescimento mais rápido entre 2025 e 2032, devido à crescente demanda por tintas de impressão ecológicas e soluções de embalagem sustentáveis. O negro de fumo reciclado oferece propriedades de pigmentação superiores, ao mesmo tempo que possibilita práticas de economia circular. O crescimento das embalagens para e-commerce, alimentos e bens de consumo impulsiona a demanda. Os fabricantes estão integrando cada vez mais o negro de fumo reciclado para atender às regulamentações ambientais e reduzir a pegada de carbono. O segmento industrial também se beneficia do negro de fumo reciclado em aplicações como produtos de borracha moldada, revestimentos e plásticos especiais. A crescente conscientização sobre sustentabilidade e redução de custos acelera a adoção tanto na indústria de impressão quanto na de embalagem. A expansão dos setores de usuários finais deverá continuar impulsionando o crescimento do mercado.

Análise Regional do Mercado de Negro de Fumo Recuperado (rCB) no Oriente Médio e África

- Os Emirados Árabes Unidos dominaram o mercado de negro de carbono recuperado (rCB) com a maior participação na receita em 2024, impulsionados por seus fortes setores de fabricação de pneus, mercado de reposição automotiva e borracha industrial.

- As instalações de reciclagem avançadas do país e as iniciativas de economia circular apoiadas pelo governo aceleraram a recuperação e a utilização do negro de fumo proveniente de pneus descartados. Colaborações estratégicas entre recicladores locais e fornecedores internacionais de tecnologia estão aprimorando a eficiência do processo, a qualidade do material e a capacidade de produção.

- Os crescentes investimentos em programas de sustentabilidade, infraestrutura de gestão de resíduos e políticas industriais verdes reforçam a posição de liderança dos Emirados Árabes Unidos no mercado regional. O foco do país na recuperação de recursos e na manufatura sustentável continua a fortalecer sua posição dominante no mercado.

Análise do Mercado de Negro de Fumo Recuperado na Arábia Saudita

A Arábia Saudita deverá testemunhar um crescimento robusto entre 2025 e 2032, impulsionado pela expansão das indústrias de pneus, petroquímica e automotiva do Reino, bem como pelo seu foco estratégico em sustentabilidade ambiental, conforme a Visão 2030. O país está aumentando a adoção de negro de fumo reciclado para apoiar a produção nacional, reduzindo simultaneamente o desperdício e as emissões de carbono. A crescente colaboração entre empresas de reciclagem locais e empresas de tecnologia internacionais está facilitando a transferência de conhecimento e a expansão da capacidade produtiva. Iniciativas governamentais de economia circular e o aumento dos investimentos em usinas de reciclagem de pneus estão ampliando o potencial de mercado. O compromisso da Arábia Saudita com a inovação industrial e a sustentabilidade está impulsionando o crescimento constante do seu mercado.

Análise do Mercado de Negro de Fumo Recuperado na África do Sul

Prevê-se que a África do Sul registre a taxa de crescimento anual composta (CAGR) mais rápida no mercado de negro de carbono recuperado (rCB) do Oriente Médio e da África durante o período de 2025 a 2032, impulsionada por sua crescente capacidade de reciclagem de pneus e pela ênfase em práticas industriais sustentáveis. A sólida base de mineração e recuperação de materiais do país fornece a base para a produção eficiente de rCB a partir de pneus descartados. Os avanços na tecnologia de pirólise e o aumento do apoio governamental à gestão de resíduos estão impulsionando operações de reciclagem em larga escala. As colaborações entre recicladores locais, fabricantes de pneus e programas globais de sustentabilidade estão impulsionando a inovação de processos e a visibilidade do mercado. O foco da África do Sul na proteção ambiental, na adoção da economia circular e na autossuficiência industrial sustenta sua posição como o mercado de crescimento mais rápido da região.

Participação de mercado do negro de fumo recuperado (rCB) no Oriente Médio e na África

O setor de negro de fumo recuperado (rCB) é liderado principalmente por empresas consolidadas, incluindo:

- Tyrepress (Reino Unido)

- Black Bear Carbon BV (Países Baixos)

- Indústrias Klean (Canadá)

- Grupo Radhe de Energia (Índia)

- Scandinavian Enviro Systems AB (Suécia)

- DVA Energia Renovável JSC. (Vietnã)

- Bolder Industries Corporativo (EUA)

- Wild Bear Carbon BV (Países Baixos)

- Saudações Green Carbon (Índia)

- Pyrolyx AG (Alemanha)

- Enrestec Inc. (Taiwan)

- Recuperação Coordenada de Recursos, Inc. (EUA)

- Delta-Energy, LLC (EUA)

- Alfa Carbono (França)

- SR2O Holdings, LLC (EUA)

Últimos desenvolvimentos no mercado de negro de fumo recuperado (rCB) no Oriente Médio e na África

- Em agosto de 2025, a ASTM International propôs uma nova norma (WK91069) específica para negro de fumo recuperado, projetada para reduzir o tempo de teste e aprimorar os recursos de garantia de qualidade. A introdução de uma norma dedicada aumenta a confiança entre fabricantes e recicladores, garantindo qualidade e desempenho consistentes dos produtos de negro de fumo recuperado. Esse desenvolvimento também atenua uma das principais barreiras que limitam a adoção do negro de fumo recuperado em aplicações de alto desempenho, como pneus, revestimentos e plásticos especiais. Além disso, espera-se que a norma facilite as aprovações regulatórias e incentive uma aceitação mais ampla nos mercados globais, impulsionando assim o crescimento do mercado.

- Em junho de 2025, a Nexen Tire anunciou um acordo de fornecimento de longo prazo com a LD Carbon Co., Ltd. para negro de fumo recuperado, possibilitando a adoção do rCB em suas fábricas de pneus em todo o mundo. Este acordo fortalece a demanda do mercado, fornecendo um parceiro de escoamento confiável, o que incentiva os produtores de rCB a expandirem suas operações. Também apoia a integração de materiais sustentáveis na produção convencional de pneus, aumentando a viabilidade comercial do negro de fumo reciclado. Além disso, o acordo demonstra a crescente confiança da indústria no rCB como uma alternativa de alto desempenho e custo-benefício ao negro de fumo virgem, provavelmente acelerando sua adoção por outras grandes fabricantes de pneus.

- Em agosto de 2025, a ASTM International propôs uma nova norma (WK91069) específica para negro de fumo recuperado, projetada para reduzir o tempo de teste e aprimorar os recursos de garantia de qualidade. A introdução de uma norma dedicada aumenta a confiança entre fabricantes e recicladores, garantindo qualidade e desempenho consistentes dos produtos de negro de fumo recuperado. Esse desenvolvimento também atenua uma das principais barreiras que limitam a adoção do negro de fumo recuperado em aplicações de alto desempenho, como pneus, revestimentos e plásticos especiais. Além disso, espera-se que a norma facilite as aprovações regulatórias e incentive uma aceitação mais ampla nos mercados globais, impulsionando assim o crescimento do mercado.

- Em junho de 2024, a Klean Industries anunciou planos para expandir a capacidade de processamento de negro de carbono recuperado (rCB) na Índia e na Malásia, com a construção de quatro novas fábricas projetadas para converter o carvão de pneus descartados em negro de carbono recuperado de alto valor agregado. Essa expansão visa solucionar diretamente as restrições de oferta em regiões-chave, garantindo uma produção de rCB mais confiável e escalável. O aumento da capacidade de processamento também permite que os fabricantes acessem materiais reciclados de alta qualidade, acelerando o uso de rCB em pneus, plásticos e produtos de borracha. A iniciativa reforça a importância estratégica dos polos de produção regionais para apoiar o crescimento do mercado global e, ao mesmo tempo, promover práticas de reciclagem sustentáveis.

- Em maio de 2022, a Pyrum Innovations AG iniciou os testes operacionais de uma nova granuladora em suas instalações na Alemanha, permitindo a conversão de negro de fumo recuperado em grânulos. Esse avanço melhora a eficiência do transporte, reduz a complexidade do manuseio e simplifica a logística de armazenamento, o que, em conjunto, aumenta a escalabilidade do mercado. Ao oferecer um formato mais conveniente para uso industrial, o negro de fumo recuperado em grânulos amplia o potencial de adoção em diversas aplicações, incluindo pneus, plásticos e revestimentos. A inovação também demonstra as melhorias tecnológicas contínuas voltadas para a otimização da usabilidade do negro de fumo recuperado e a redução dos custos operacionais.

- Em março de 2022, a Continental AG expandiu sua parceria com a Pyrum Innovations AG para impulsionar a reciclagem de pneus inservíveis utilizando a tecnologia de pirólise. Essa colaboração concentra-se na produção de negro de carbono recuperado de alta qualidade para uso nas operações de fabricação de pneus da Continental. A iniciativa apoia os objetivos de sustentabilidade da empresa e destaca a crescente tendência do setor de integrar materiais reciclados às linhas de produção. Ao utilizar o negro de carbono recuperado na fabricação de pneus, a Continental reduz o impacto ambiental e também abre caminho para uma maior adoção nos setores automotivo e de borracha, fomentando o crescimento geral do mercado.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.