Middle East And Africa Ready To Drink High Strength Premixes Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

35,539.62 Million

USD

48,265.64 Million

2021

2029

USD

35,539.62 Million

USD

48,265.64 Million

2021

2029

| 2022 –2029 | |

| USD 35,539.62 Million | |

| USD 48,265.64 Million | |

|

|

|

Middle East and Africa Ready to Drink/High Strength Premixes Market By Type (Malt Based RTDs, Spirit Based RTDs, Wine Based RTDs, Others), Processing Type (Single Compound and Blended), Gender (Male and Female), Packaging Type (Bottle, Cans and Others), Trade (Off- Trade, On-Trade) – Industry Trends and Forecast to 2029

Market Analysis and Size

The ready-to-drinks (RTDs) category has undergone several critical shifts in response to the changing dynamic of Middle East and Africa consumer drinking preferences and habits. Despite significant criticism the large strides made in the demand for and marketing of beverage alcohol products have earned a respectable place in the RTDs category. The demand momentum hasn't lost much lustre as a result of the high level of convenience provided to consumers, who have been instrumental in fuelling the popularity of easy-to-make alcoholic beverages.

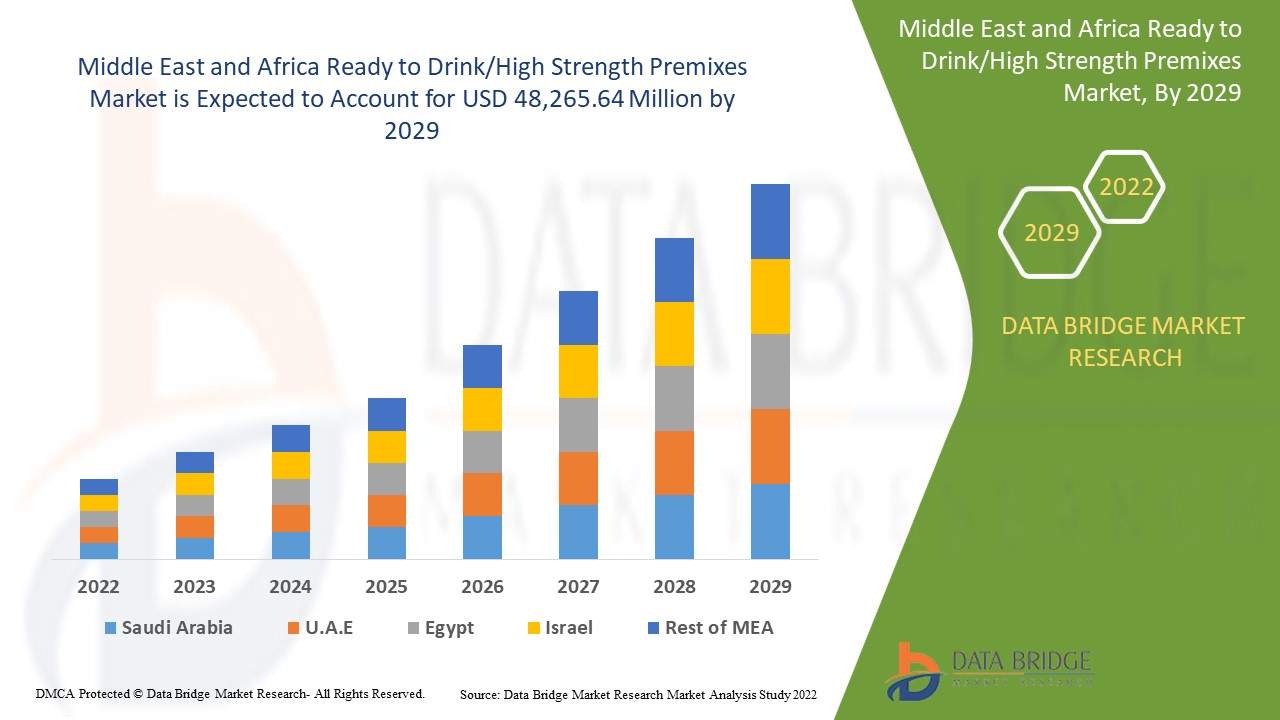

Data Bridge Market Research analyses that the ready to drink/high strength premixes market was valued at USD 35,539.62 million in 2021 and is expected to reach the value of USD 48,265.64 million by 2029, at a CAGR of 3.9% during the forecast period of 2022 to 2029.

Market Definition

Ready-to-drink (RTD) premixes are drinks that have been pre-mixed and are ready to drink at any time. There are two kinds of ready-to-drink premixes: RTDs and high-strength premixes. RTD beverages primarily consist of spirit-based, wine-based, or malt-based alcoholic beverages. High-strength premixes include pre-mixed alcohol-based beverages.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Malt Based RTDs, Spirit Based RTDs, Wine Based RTDs, Others), Processing Type (Single Compound and Blended), Gender (Male and Female), Packaging Type (Bottle, Cans and Others), Trade (Off- Trade, On-Trade) |

|

Countries Covered |

South Africa, U.A.E, Saudi Arabia, Oman, Kuwait, rest of Middle East & Africa |

|

Market Players Covered |

Davide Campari-Milano N.V. (Netherlands), Diageo PLC (UK), Halewood International Limited (UK), Asahi Group Holdings, Ltd. (Japan), Accolade Wines (Australia), Bacardi Limited (Bermuda), Mike's Hard Lemonade Co. (US), Castel Group (France), Suntory Holdings Limited (Japan), Anheuser-Busch InBev SA/NV (Belgium), The Brown-Forman Corporation (US), United Brands Company, Inc. (US), PernodRicard SA (France), The Miller Brewing Company (US) |

|

Opportunities |

|

Ready to Drink/High Strength Premixes Market Dynamics

Drivers

- Growing popularity of low spirit flavoured beverages

The rising popularity of low-spirit and flavoured beverages among a growing number of young adults is a major driver of the alcoholic RTDs/high strength premixes market. The growing popularity of healthy alcoholic drinks, particularly among millennials, is driving up demand for alcoholic RTDs/high strength premixes. The growing proclivity of consumers for high strength to substitute hard liquors has fuelled demand significantly.

- Innovative marketing strategies for the target consumers

Customers' changing lifestyles, increased demand for ready-to-drink premixes from youth, the growing importance of new and ethnic flavours, and innovative advancements in marketing and promotional activities all contribute to the Middle East and Africa ready-to-drink premixes market's growth. The penetration of e-commerce, low prices, easy access, the introduction of natural and health-beneficial ingredient cocktails in Ready-to-drink premixes, growing investment in pubs and bars, and a variety of flavours available in Ready-to-drink premixes drive Middle East and Africa market growth for this product.

Opportunity

Emerging economies provide numerous opportunities for ready-to-drink premix manufacturers to expand their operations. During the forecast period, the market for ready-to-drink premixes is expected to grow at an exponential rate. However, the Wine-based RTDs and Spirit-based RTDs will show the most robust growth in the product category of the market for ready-to-drink premixes. consumers' desire for convenience is driving companies to expand their premixes business.

Restraints

However, factors such as religious or cultural beliefs in several countries, heavy taxation and duties, and the negative health effects of alcohol may impede market growth. Furthermore, stringent rules and regulations on the advertising of alcoholic products, as well as an increase in the number of anti-alcohol campaigns, are having a negative impact on the growth of the high strength premixes market.

This ready to drink/high strength premixes market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the ready to drink/high strength premixes market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Ready to Drink/High Strength Premixes Market

The COVID-19 outbreak has had a significant impact on the market for ready-to-drink premixes. Many countries' governments do not include alcohol on their list of essential goods during a lockdown. All distribution channels have been closed. Pubs and clubs, which accounted for the majority of ready-to-drink premixes sales, have also closed because social distancing has discouraged people from visiting such establishments. Furthermore, import-export activities have caused supply chain disruption. Both the production and consumption have been affected severely due to the corona Pandemic.

Middle East and Africa Ready to Drink/High Strength Premixes Market Scope

The ready to drink/high strength premixes market is segmented on the basis of type, processing type, gender, packaging type and trade. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Malt-based RTDS

- Beer

- Flavoured malt beverages (FMB)

- Spirit-based RTDS

- Vodka

- Whiskey

- Rum

- Tequila

- Others

- Wine-based RTDS

- Others

Processing type

- Single compound

- Blended

Gender

- Male

- Female

Packaging type

- Bottle

- Can

- Others

Trade

- On trade

- Off trade

Ready to Drink/High Strength Premixes Market Regional Analysis/Insights

The ready to drink/high strength premixes market is analysed and market size insights and trends are provided by country, type, processing type, gender, packaging type and trade as referenced above.

The countries covered in the ready to drink/high strength premixes market report are South Africa, U.A.E, Saudi Arabia, Oman, Kuwait, rest of Middle East & Africa.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Ready to Drink/High Strength Premixes Market Share Analysis

The ready to drink/high strength premixes market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to ready to drink/high strength premixes market.

Some of the major players operating in the ready to drink/high strength premixes market are:

- Davide Campari-Milano N.V. (Netherlands)

- Diageo PLC (UK),

- Halewood International Limited (UK),

- Asahi Group Holdings, Ltd. (Japan),

- Accolade Wines (Australia),

- Bacardi Limited (Bermuda),

- Mike's Hard Lemonade Co. (US),

- Castel Group (France),

- Suntory Holdings Limited (Japan),

- Anheuser-Busch InBev SA/NV (Belgium),

- The Brown-Forman Corporation (US),

- United Brands Company, Inc. (US),

- PernodRicard SA (France),

- The Miller Brewing Company (US).

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 VENDOR SHARE ANALYSIS

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

2.11 MULTIVARIATE MODELING

2.12 PRODUCT TIMELINE CURVE

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PARENT MARKET ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR LOW ALCOHOLIC CONTENT DRINKS

5.1.2 INCREASING PREFERENCE FOR READY-TO-DRINK PREMIXES

5.1.3 RISING INITIATIVE OF COMPANIES TO EXPAND THEIR BUSINESS MIDDLE EAST & AFRICALY

5.2 RESTRAINTS

5.2.1 HEAVY TAXATION AND DUTIES

5.2.2 STRINGENT RULES AND REGULATIONS

5.3 OPPORTUNITY

5.3.1 EMERGING MARKETS

5.4 CHALLENGES

5.4.1 INCREASE IN COST OF PRODUCTION

5.4.2 AVAILABILITY OF SUBSTITUTES

6 MIDDLE EAST & AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TYPE

6.1 OVERVIEW

6.2 MALT-BASED RTDS

6.2.1 BEER

6.2.2 FLAVORED MALT BEVERAGES (FMB)

6.3 SPIRIT-BASED RTDS

6.3.1 VODKA

6.3.2 WHISKEY

6.3.3 RUM

6.3.4 TEQUILA

6.3.5 OTHERS

6.4 WINE-BASED RTDS

6.5 OTHERS

7 MIDDLE EAST & AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY PROCESSING TYPE

7.1 OVERVIEW

7.2 SINGLE COMPOUND

7.3 BLENDED

8 MIDDLE EAST & AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY GENDER

8.1 OVERVIEW

8.2 MALE

8.3 FEMALE

9 MIDDLE EAST & AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY PACKAGING TYPE

9.1 OVERVIEW

9.2 BOTTLE

9.3 CAN

9.4 OTHERS

10 MIDDLE EAST & AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TRADE

10.1 OVERVIEW

10.2 OFF-TRADE

10.2.1 STORE-BASED RETAILING

10.2.1.1 LIQUOR SPECIALIST STORE

10.2.1.2 SUPERMARKETS/HYPERMARKETS

10.2.1.3 GROCERY STORES

10.2.1.4 CONVENIENCE STORES

10.2.1.5 DUTY-FREE STORES

10.2.1.6 OTHERS

10.2.2 NON-STORE RETAILING

10.2.2.1 ONLINE

10.2.2.2 VENDING

10.3 ON-TRADE

10.3.1 CLUB

10.3.2 BARS & RESTAURANTS

10.3.3 OTHERS

11 MIDDLE EAST & AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY GEOGRAPHY

11.1 MIDDLE EAST AND AFRICA

11.1.1 SOUTH AFRICA

11.1.2 U.A.E.

11.1.3 QATAR

11.1.4 OMAN

11.1.5 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST & AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13 SWOT & DBMR ANALYSIS

13.1 STRENGTH: - WIDE RANGE OF PRODUCT OFFERING

13.2 WEAKNESS: - RESTRICTED GEOGRAPHICAL PRESENCE

13.3 OPPORTUNITY: - HIGH DEMAND FOR LOW ALCOHOLIC CONTENT BEVERAGES

13.4 THREAT: - STIFF COMPETITION

13.5 DATA BRIDGE MARKET RESEARCH ANALYSIS

14 COMPANY PROFILES

14.1 ANHEUSER-BUSCH INBEV

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 CARLSBERG BREWERIES A/S

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 SUNTORY HOLDINGS LIMITED

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 BRAND PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 ASAHI GROUP HOLDINGS, LTD.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 BROWN-FORMAN

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 BRAND PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 BACARDI & COMPANY LIMITED

14.6.1 COMPANY SNAPSHOT

14.6.2 BRAND PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 CEBU BREWING CO.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 CONSTELLATION BRANDS, INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 BRAND PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 DIAGEO

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT

14.1 DAVIDE CAMPARI-MILANO S.P.A.

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 BRAND PORTFOLIO

14.10.4 RECENT DEVELOPMENT

14.11 DESTILERIA LIMTUACO & COMPANY, INC.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 MG SPIRIT

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 SAIGON BEER

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 SAN MIGUEL BREWERY INC.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENT

14.15 SIAM WINERY TRADING PLUS CO., LTD

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 THAI BEVERAGE PLC.

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENT

14.17 THAI SPIRIT INDUSTRY CO.,LTD.

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 THE BOSTON BEER COMPANY

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENT

14.19 WHISTLER WINE & SPIRITS PTE LTD

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 WINEPAK CORPORATION(M) SDN BHD

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

15 CONCLUSION

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tabela

LIST OF TABLES

TABLE 1 MIDDLE EAST & AFRICA MALT-BASED RTDS IN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA MALT-BASED RTDS IN READY TO DRINK/HIGH STRENGTH PREMIXES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA SPIRIT-BASED RTDS IN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA SPIRIT-BASED RTDS IN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA WINE-BASED RTDS IN READY TO DRINK/HIGH STRENGTH PREMIXES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA OTHERS IN READY TO DRINK/HIGH STRENGTH PREMIXES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA READY TO DRINK/HIGH STRENGTH PREMIXES MARKET, BY PROCESSING TYPE, 2018-2027 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA SINGLE COMPOUND IN READY TO DRINK/HIGH STRENGTH PREMIXES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA BLENDED IN READY TO DRINK/HIGH STRENGTH PREMIXES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA READY TO DRINK/HIGH STRENGTH PREMIXES MARKET, BY GENDER, 2018-2027 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA MALE IN READY TO DRINK/HIGH STRENGTH PREMIXES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA FEMALE IN READY TO DRINK/HIGH STRENGTH PREMIXES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA READY TO DRINK/HIGH STRENGTH PREMIXES MARKET, BY PACKAGING TYPE, 2018-2027 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA BOTTLE IN READY TO DRINK/HIGH STRENGTH PREMIXES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA CAN IN READY TO DRINK/HIGH STRENGTH PREMIXES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA OTHERS IN READY TO DRINK/HIGH STRENGTH PREMIXES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA READY TO DRINK/HIGH STRENGTH PREMIXES MARKET, BY TRADE, 2018-2027 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA OFF-TRADE IN READY TO DRINK/HIGH STRENGTH PREMIXES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA OFF-TRADE IN READY TO DRINK/HIGH STRENGTH PREMIXES MARKET, BY TRADE, 2018-2027 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA STORE RETAILING IN READY TO DRINK/HIGH STRENGTH PREMIXES MARKET, BY TRADE, 2018-2027 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA NON-STORE RETAILING IN READY TO DRINK/HIGH STRENGTH PREMIXES MARKET, BY TRADE, 2018-2027 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA ON-TRADE IN READY TO DRINK/HIGH STRENGTH PREMIXES MARKET, BY REGION, 2018-2027 (USD MILLION))

TABLE 24 MIDDLE EAST & AFRICA ON-TRADE IN READY TO DRINK/HIGH STRENGTH PREMIXES MARKET, BY TRADE, 2018-2027 (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA SPIRIT-BASED RTDS IN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA MALT-BASED RTDS IN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY PROCESSING TYPE, 2018-2027 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY GENDER, 2018-2027 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY PACKAGING TYPE, 2018-2027 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TRADE, 2018-2027 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA ON-TRADE IN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TRADE, 2018-2027 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA OFF-TRADE IN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TRADE, 2018-2027 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA STORE-BASED RETAILING IN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TRADE, 2018-2027 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA NON-STORE RETAILING IN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TRADE, 2018-2027 (USD MILLION)

TABLE 37 SOUTH AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 38 SOUTH AFRICA SPIRIT-BASED RTDS IN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 39 SOUTH AFRICA MALT-BASED RTDS IN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 40 SOUTH AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY PROCESSING TYPE, 2018-2027 (USD MILLION)

TABLE 41 SOUTH AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY GENDER, 2018-2027 (USD MILLION)

TABLE 42 SOUTH AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY PACKAGING TYPE, 2018-2027 (USD MILLION)

TABLE 43 SOUTH AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TRADE, 2018-2027 (USD MILLION)

TABLE 44 SOUTH AFRICA ON-TRADE IN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TRADE, 2018-2027 (USD MILLION)

TABLE 45 SOUTH AFRICA OFF-TRADE IN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TRADE, 2018-2027 (USD MILLION)

TABLE 46 SOUTH AFRICA STORE-BASED RETAILING IN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TRADE, 2018-2027 (USD MILLION)

TABLE 47 SOUTH AFRICA NON-STORE-BASED RETAILING IN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TRADE, 2018-2027 (USD MILLION)

TABLE 48 U.A.E. READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 49 U.A.E. SPIRIT-BASED RTDS IN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 50 U.A.E. MALT-BASED RTDS IN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 51 U.A.E. READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY PROCESSING TYPE, 2018-2027 (USD MILLION)

TABLE 52 U.A.E. READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY GENDER, 2018-2027 (USD MILLION)

TABLE 53 U.A.E. READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY PACKAGING TYPE, 2018-2027 (USD MILLION)

TABLE 54 U.A.E. READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TRADE, 2018-2027 (USD MILLION)

TABLE 55 U.A.E. ON-TRADE IN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TRADE, 2018-2027 (USD MILLION)

TABLE 56 U.A.E. OFF-TRADE IN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TRADE, 2018-2027 (USD MILLION)

TABLE 57 U.A.E. STORE-BASED RETAILING IN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TRADE, 2018-2027 (USD MILLION)

TABLE 58 U.A.E. NON-STORE-BASED RETAILING IN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TRADE, 2018-2027 (USD MILLION)

TABLE 59 QATAR READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 60 QATAR SPIRIT-BASED RTDS IN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 61 QATAR MALT-BASED RTDS IN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 62 QATAR READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY PROCESSING TYPE, 2018-2027 (USD MILLION)

TABLE 63 QATAR READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY GENDER, 2018-2027 (USD MILLION)

TABLE 64 QATAR READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY PACKAGING TYPE, 2018-2027 (USD MILLION)

TABLE 65 QATAR READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TRADE, 2018-2027 (USD MILLION)

TABLE 66 QATAR ON-TRADE IN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TRADE, 2018-2027 (USD MILLION)

TABLE 67 QATAR OFF-TRADE IN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TRADE, 2018-2027 (USD MILLION)

TABLE 68 QATAR STORE-BASED RETAILING IN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TRADE, 2018-2027 (USD MILLION)

TABLE 69 QATAR NON-STORE RETAILING IN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TRADE, 2018-2027 (USD MILLION)

TABLE 70 OMAN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 71 OMAN SPIRIT-BASED RTDS IN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 72 OMAN MALT-BASED RTDS IN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 73 OMAN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY PROCESSING TYPE, 2018-2027 (USD MILLION)

TABLE 74 OMAN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY GENDER, 2018-2027 (USD MILLION)

TABLE 75 OMAN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY PACKAGING TYPE, 2018-2027 (USD MILLION)

TABLE 76 OMAN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TRADE, 2018-2027 (USD MILLION)

TABLE 77 OMAN ON-TRADE IN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TRADE, 2018-2027 (USD MILLION)

TABLE 78 OMAN OFF-TRADE IN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TRADE, 2018-2027 (USD MILLION)

TABLE 79 OMAN STORE-BASED RETAILING IN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TRADE, 2018-2027 (USD MILLION)

TABLE 80 OMAN NON-STORE RETAILING IN READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TRADE, 2018-2027 (USD MILLION)

TABLE 81 REST OF MIDDLE EAST AND AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET, BY TYPE, 2018-2027 (USD MILLION)

Lista de Figura

LIST OF FIGURES

FIGURE 1 MIDDLE EAST & AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA READY TO DRINK/HIGH STRENGTH PREMIXES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET: SEGMENTATION

FIGURE 10 INCREASING PREFERNCE OF LOW ALCOHOLIC CONTENT BEVERAGES IS THE MAJOR FACTOR TO DRIVE THE MIDDLE EAST & AFRICA READY TO DRINK/HIGH STRENGTH PREMIXES MARKET IN THE FORECAST PERIOD 2020 TO 2027

FIGURE 11 MALT-BASED RTDS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET IN 2020 & 2027

FIGURE 12 DRIVERS, RESTRAINT, OPPORTUNITIES AND CHALLENGES OF MIDDLE EAST & AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET

FIGURE 13 MIDDLE EAST & AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET: BY TYPE

FIGURE 14 MIDDLE EAST & AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET: BY PROCESSING TYPE, 2019

FIGURE 15 MIDDLE EAST & AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET: BY GENDER, 2019

FIGURE 16 MIDDLE EAST & AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET: BY PACKAGING TYPE, 2019

FIGURE 17 MIDDLE EAST & AFRICA READY TO READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET: BY TRADE, 2019

FIGURE 18 MIDDLE EAST AND AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET: SNAPSHOT (2019)

FIGURE 19 MIDDLE EAST AND AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET: BY COUNTRY (2019)

FIGURE 20 MIDDLE EAST AND AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET: BY COUNTRY (2020 & 2027)

FIGURE 21 MIDDLE EAST AND AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET: BY COUNTRY (2019 & 2027)

FIGURE 22 MIDDLE EAST AND AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET: BY TYPE (2020-2027)

FIGURE 23 MIDDLE EAST & AFRICA READY TO DRINK/ HIGH STRENGTH PREMIXES MARKET: COMPANY SHARE 2019 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.