Middle East and Africa Process Safety Services Market, By Offering (Solution and Services), Safety Integrity Level (Level 1, Level 2, Level 3, and Level 4), End User (Process Manufacturing, Automotive and Discrete Manufacturing, Utilities, Government, Construction and Real Estate, Retail, and Others) Industry Trends and Forecast to 2030.

Middle East and Africa Process Safety Services Market Analysis and Size

The process safety services market has witnessed high growth due to the increasing adoption of safety norms and standards in various industry verticals such as oil and gas, pharmaceuticals, food and beverages, and others. The industries have become more stringent towards safety norms as the incidents can incur a high loss to the industry both in terms of life and property. The industries focus on incorporating safety solutions and conducting hazard analysis to determine the risk factors and further processes to mitigate those risks. Moreover, with increasing digitalization, the development of process safety systems provides automation in compliance and easy integration with the organizations' control systems. This enables fail-safe control of the entire process and helps to optimize productivity and profit.

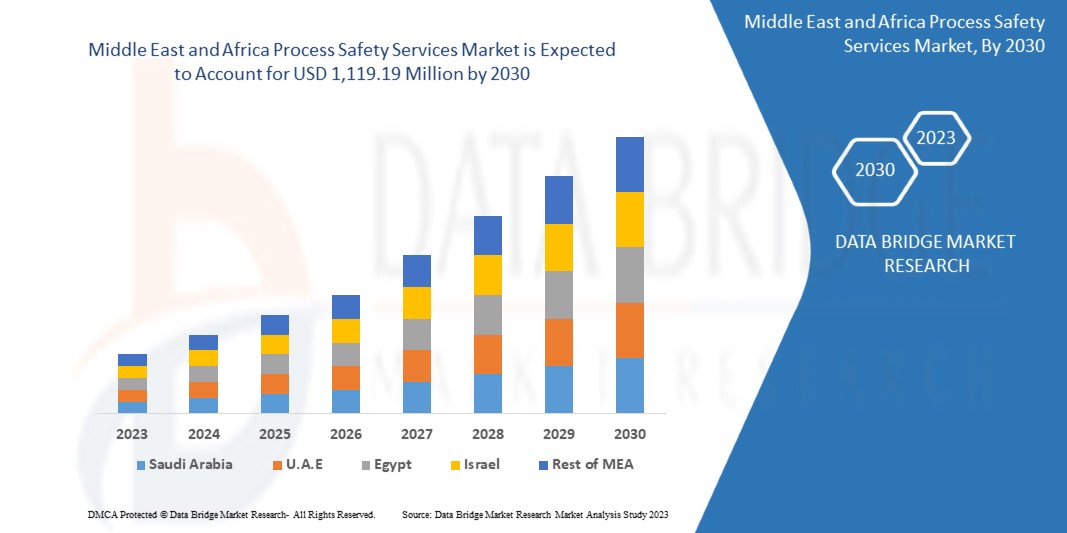

Data Bridge Market Research analyses that the Middle East and Africa process safety services market is expected to reach a value of USD 1,119.19 million by 2030, at a CAGR of 8.0% during the forecast period. The Middle East and Africa process safety services market report also comprehensively covers pricing analysis, patent analysis, and technological advancements.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in Million, Pricing in USD |

|

Segments Covered |

By Offering (Solution and Services), Safety Integrity Level (Level 2., Level 3, Level 1, and Level 4), End User (Process Manufacturing, Automotive and Discrete Manufacturing, Utilities, Government, Construction and Real Estate, Retail, and Others) |

|

Regions Covered |

U.A.E., Saudi Arabia, Israel, Egypt, South Africa, and the rest of the Middle East and Africa |

|

Market Players Covered |

Siemens, Johnson Controls, Honeywell International Inc., Emerson Electric Co., Schneider Electric, Bureau Veritas, SGS SA, Rockwell Automation, ABB, DEKRA, OMRON Corporation, Intertek Group plc, TÜV SÜD, SOCOTEC, MISTRAS Group, HIMA, Ingenero, Inc., Smith & Burgess Process Safety Consulting, Process Engineering Associates, and LLC, ioKinetic, LLC and others |

Market Definition

Process safety is a framework for managing the integrity of operating systems and processes that handle hazardous substances. It relies on good design principles, engineering, and operating and maintenance practices. It deals with the prevention and control of events that can release hazardous materials and energy. Process safety services and management include designing, certifying, inspecting, and testing processes in concerned industries or organizations to prevent hazardous accidents, quality issues, supply chain damages, and equipment damages. Process safety services aid in assisting clients in meeting their process safety and risk management needs. Process safety services assist clients in all aspects of process safety, from setting up complete process safety management programs and assisting with the execution of various elements.

Middle East and Africa Process Safety Services Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail as below:

DRIVERS

- Rising need for improvement in manufacturing management and product efficiency

Process safety services aid in managing the integrity of operating systems and processes that handle hazardous materials. It can help in identifying, understanding, controlling, and preventing process-related incidents. If any incident occurs, it can cause an adverse effect on the manufacturing process and product efficiency in case of any incident during the ongoing process. The product may get leaked or damaged in case of an accident. However, with the implementation of process safety solutions, the loss of product can be minimized, and manufacturing efficiency can be enhanced, leading to high growth of the process safety services market.

- Surging growth in the number of hazardous incidents

A hazardous incident refers to a spill or release of chemicals, radioactive materials, or biological materials inside a building or the environment, which causes a huge loss of people, infrastructure, or the environment. Hazardous materials can cause hazardous incidents, including explosives, flammable and combustible substances, poisons, and radioactive materials.

Many industries, such as chemical and pharmaceutical plants, mining, consumer goods, pulp and paper, automotive, oil and gas, and manufacturing operations, contain hazardous environments where fire and explosions are major safety concerns. A small spark in an oil & gas industry, refinery, or chemical plant triggers fires, or explosions blast, which could damage machinery and the environment and, even worse, loss of lives.

Thus, due to the increasing number of hazardous incidents or accidents and explosions, manufacturers were implementing and opting for various process safety services to ensure the safety of workers, manufacturing plants, and the environment, which is driving the growth of the market.

OPPORTUNITIES

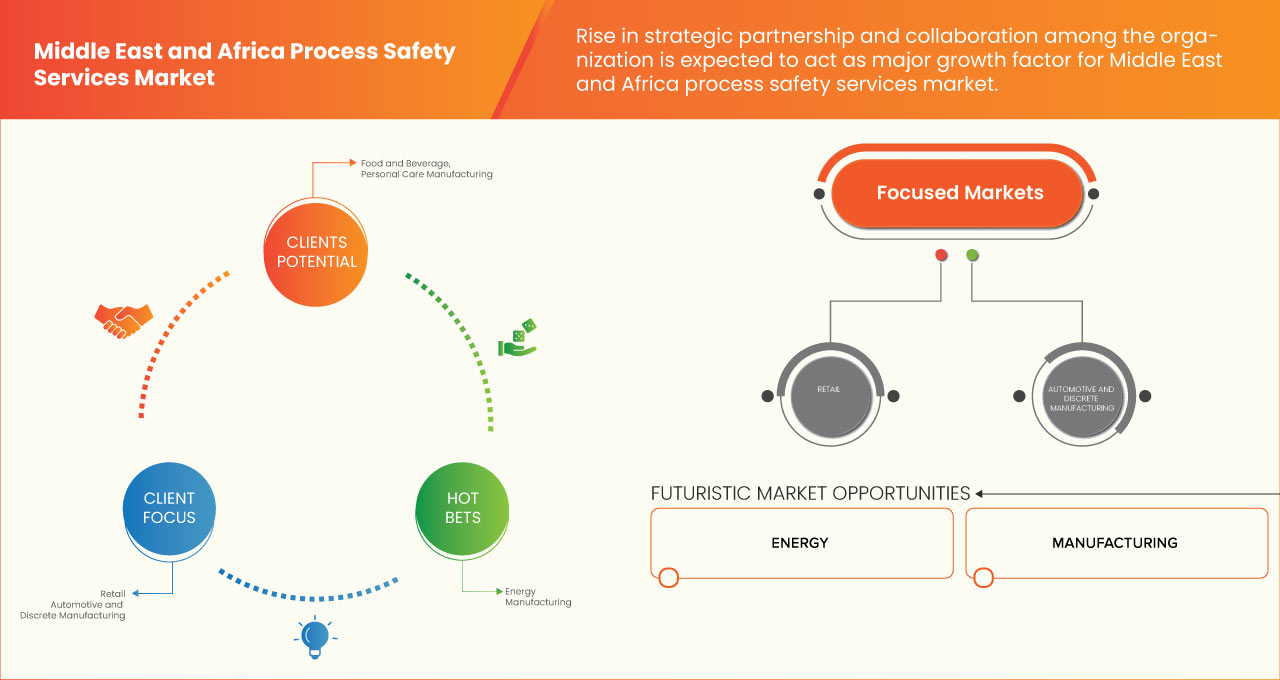

- Rising demand for process safety services in pharmaceutical and food processing industries

With the growing Middle East and Africa population, standard of living, and urbanization, the demand for quality food, medicines, and medical care is also rising. Unforeseen outbreaks of epidemics and pandemics have alerted the governments of the world of the lack of healthcare infrastructure. Governments are investing highly in the healthcare sector and the research and development of modern pharmaceuticals. Food processing needs to be properly supervised, and several quality checks and inspections need to be catered to create a new window of opportunity for the growth of the Middle East and Africa process safety services market.

RESTRAINT/CHALLENGE

- Complexities associated with implementation standards

Industries heavily rely on a useful set of tools for reducing the likelihood of incidents and injuries in the workplace. These include several rules, policies, procedures, and various mechanical safeguards, such as personal protective equipment and machine guards. These are highly useful to incorporate but can also be highly insufficient. No matter how well designed or assimilated, these devices cannot prevent all incidents in complex workplaces. Moreover, several complexities can arise while implementing safety standards. All the equipment and systems need to be aligned with the safety systems.

Industrial safety standards can mitigate the risk and protect from probable risk. However, implementing those standards can lead to several changes in the industry and incur additional costs that can act as a major restraint for the growth of process safety services market.

- Lack of awareness among industries for process safety

Industries need to implement process safety services in their business operation for multiple reasons, such as compliance with regulations, securing supply chains, preventing accidents and hazardous events, compliance with pollution prevention and standardizing and certifying packaging, distribution, and product quality, among others.

Many small and medium-sized enterprises lack the awareness and resources to hire services to ensure process safety. Due to this, their ability to compete in the market is hindered, where consumers mostly look for vendors who are certified in compliance with regulations and quality. Companies developing products without following safety protocols and regulations laid down by the government risk their product being discontinued.

Thus, the lack of awareness among various manufacturing companies to implement adequate safety systems and solutions can restrict the growth of the process safety services market.

Recent Development

- In October 2020, ABB digitalized process safety lifecycle management with the launch of ABB Ability Safety Insight which is a suite of digital software applications which supports companies across the energy and process sectors throughout the entire lifecycle of process safety management. This has helped the company to enhance its process safety management offerings in the market.

- In August 2018, Honeywell International Inc. entered into a reseller agreement with Applied Engineering Solutions, Inc. Under this agreement, the company integrated Applied Engineering Solutions, Inc's aeSolutions' software and aeShield into their new process safety suite. This integration paired the HAZOP/LOPA, SRS, and SIL Verification requirements from aeShield with Honeywell's Safety Builder, Process Safety Analyzer, and Trace into a Process Safety Suite. This has helped the company to enhance its process safety suite in the market.

Middle East and Africa Process Safety Services Market Scope

The Middle East and Africa process safety services market is segmented on the basis of offering, safety integrity level, and end user. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Offering

- Solution

- Services

On the basis of offering, the process safety services market is segmented into solution and services.

By Safety Integrity Level

- Level 1

- Level 2

- Level 3

- Level 4

On the basis of safety integrity level, the process safety services market is segmented into level 1, level 2, level 3, and level 4.

By End User

- Process manufacturing

- Automotive and Discrete Manufacturing

- Utilities

- Government

- Construction and Real Estate

- Retail

- Others

On the basis of end user, the process safety services market is segmented into process manufacturing, automotive and discrete manufacturing, utilities, government, construction and real estate, retail, and others.

Middle East and Africa Process Safety Services Market Regional Analysis/Insights

The Middle East and Africa process safety services market is analyzed, and market size insights and trends are provided by region, offering, safety integrity level, and end user as referenced above.

The countries covered in the Middle East and Africa process safety services market report are U.A.E., Saudi Arabia, Israel, Egypt, South Africa, and the rest of the Middle East and Africa.

In 2023, Saudi Arabia is expected to dominate the Middle East and Africa process safety services market. One of the primary reasons is the growth of the region's oil and gas industry.

The region section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the region data.

Competitive Landscape and Middle East and Africa Process Safety Services Market Share Analysis

Middle East and Africa process safety services market competitive landscape provide details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to the Middle East and Africa Process Safety Services market.

Some of the major players operating in the Middle East and Africa process safety services market are Siemens, Johnson Controls, Honeywell International Inc., Emerson Electric Co., Schneider Electric, Bureau Veritas, SGS SA, Rockwell Automation, ABB, DEKRA, OMRON Corporation, Intertek Group plc, TÜV SÜD, SOCOTEC, MISTRAS Group, HIMA, Ingenero, Inc., and Smith & Burgess Process Safety Consulting among others.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA PROCESS SAFETY SERVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OFFERING TIMELINE CURVE

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCE ANALYSIS

4.2 REGULATORY STANDARDS

4.2.1 OVERVIEW

4.2.2 COMAH

4.2.3 CONTROL OF MAJOR ACCIDENT HAZARDS REGULATIONS 1999 (COMAH): EMERGENCY PLANNING FOR MAJOR ACCIDENTS

4.2.4 CONTROL OF MAJOR ACCIDENT HAZARDS REGULATIONS 2015 (COMAH):

4.2.5 HAZOP

4.2.6 SIF-PRO

4.2.7 IEC 61508

4.2.8 IEC 61511

4.2.9 BATTERY TESTING

4.2.9.1 UL-9540

4.2.9.2 UL-9540A

4.2.9.3 IEC 62133

4.2.9.4 IS 1651

4.2.10 NFPA 855

4.2.11 DSEAR

4.3 STANDARDS AND DIRECTIVES ANALYSIS

4.3.1 OVERVIEW

4.3.2 PROCESS SAFETY MANAGEMENT (PSM)

4.3.3 UNITED STATES ENVIRONMENTAL PROTECTION AGENCY (EPA)

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING NEED FOR IMPROVEMENT IN MANUFACTURING MANAGEMENT AND PRODUCT EFFICIENCY

5.1.2 STRINGENT GOVERNMENT REGULATIONS FOR HEALTH, SAFETY, AND ENVIRONMENT (HSE)

5.1.3 SURGING GROWTH IN THE NUMBER OF HAZARDOUS INCIDENTS

5.1.4 HIGH BENEFITS OFFERED BY PROCESS SAFETY SOLUTIONS AND SERVICES

5.2 RESTRAINTS

5.2.1 HIGH COST OF EXPENDITURE FOR PROCESS SAFETY SYSTEMS

5.2.2 COMPLEXITIES ASSOCIATED WITH IMPLEMENTATION STANDARDS

5.3 OPPORTUNITIES

5.3.1 RISING DEMAND FOR PROCESS SAFETY SERVICES IN PHARMACEUTICAL AND FOOD PROCESSING INDUSTRIES

5.3.2 INCREASING NEED TO REDUCE HAZARDOUS EVENTS IN OIL AND GAS INDUSTRY

5.3.3 RISING NEED FOR TRAINING FOR THE ENGINEER, OPERATOR, AND MAINTENANCE PROFESSIONALS

5.3.4 INCREASING GROWTH OF INDUSTRY 4.0

5.4 CHALLENGE

5.4.1 LACK OF AWARENESS AMONG INDUSTRIES FOR PROCESS SAFETY

6 MIDDLE EAST & AFRICA PROCESS SAFETY SERVICES MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOLUTION

6.2.1 PSM PROGRAM MANAGEMENT

6.2.2 MECHANICAL INTEGRITY PROGRAM

6.2.3 EMERGENCY PLANNING AND RESPONSE

6.2.4 PROCESS SAFETY INFORMATION (PSI)

6.2.5 PROCESS HAZARD ANALYSIS (PHA)

6.2.6 CONTRACTOR MANAGEMENT PROGRAM

6.2.7 PRE-STARTUP SAFETY REVIEW (PSSR)

6.2.8 STANDARD OPERATING PROCEDURES (SOP)

6.2.9 DUST HAZARD ANALYSIS (DSA)

6.2.10 MANAGEMENT OF CHANGE (MOC)

6.2.11 COMPLIANCE MANAGEMENT

6.2.12 AUDITS, INCIDENT INVESTIGATION, AND RESPONSE

6.2.13 OTHERS

6.3 SERVICES

6.3.1 TESTING

6.3.2 CERTIFICATION AND INSPECTION

6.3.3 CONSULTING

6.3.4 TRAINING

6.3.5 AUDITING

7 MIDDLE EAST & AFRICA PROCESS SAFETY SERVICES MARKET, BY SAFETY INTEGRITY LEVEL

7.1 OVERVIEW

7.2 LEVEL 2

7.3 LEVEL 3

7.4 LEVEL 1

7.5 LEVEL 4

8 MIDDLE EAST & AFRICA PROCESS SAFETY SERVICES MARKET, BY END USER

8.1 OVERVIEW

8.2 PROCESS MANUFACTURING

8.2.1 PROCESS MANUFACTURING, BY OFFERING

8.2.1.1 SOLUTION

8.2.1.1.1 PSM PROGRAM MANAGEMENT

8.2.1.1.2 MECHANICAL INTEGRITY PROGRAM

8.2.1.1.3 EMERGENCY PLANNING AND RESPONSE

8.2.1.1.4 PROCESS SAFETY INFORMATION (PSI)

8.2.1.1.5 PROCESS HAZARD ANALYSIS (PHA)

8.2.1.1.6 CONTRACTOR MANAGEMENT PROGRAM

8.2.1.1.7 PRE-STARTUP SAFETY REVIEW (PSSR)

8.2.1.1.8 STANDARD OPERATING PROCEDURES (SOP)

8.2.1.1.9 DUST HAZARD ANALYSIS (DSA)

8.2.1.1.10 MANAGEMENT OF CHANGE (MOC)

8.2.1.1.11 COMPLIANCE MANAGEMENT

8.2.1.1.12 AUDITS, INCIDENT INVESTIGATION, AND RESPONSE

8.2.1.1.13 OTHERS

8.2.1.2 SERVICES

8.2.1.2.1 TESTING

8.2.1.2.2 CERTIFICATION AND INSPECTION

8.2.1.2.3 CONSULTING

8.2.1.2.4 TRAINING

8.2.1.2.5 AUDITING

8.2.2 PROCESS MANUFACTURING, BY TYPE

8.2.2.1 CHEMICAL

8.2.2.2 CONSUMER GOODS

8.2.2.2.1 FOOD AND BEVERAGE

8.2.2.2.2 PERSONAL CARE MANUFACTURING

8.2.2.2.3 OTHERS

8.2.2.3 PHARMACEUTICAL

8.2.2.4 METALS AND MINING

8.2.2.5 OIL AND GAS

8.2.2.6 PULP AND PAPER

8.2.2.7 OTHERS

8.3 AUTOMOTIVE AND DISCRETE MANUFACTURING

8.3.1 SOLUTION

8.3.1.1 PSM PROGRAM MANAGEMENT

8.3.1.2 MECHANICAL INTEGRITY PROGRAM

8.3.1.3 EMERGENCY PLANNING AND RESPONSE

8.3.1.4 PROCESS SAFETY INFORMATION (PSI)

8.3.1.5 PROCESS HAZARD ANALYSIS (PHA)

8.3.1.6 CONTRACTOR MANAGEMENT PROGRAM

8.3.1.7 PRE-STARTUP SAFETY REVIEW (PSSR)

8.3.1.8 STANDARD OPERATING PROCEDURES (SOP)

8.3.1.9 DUST HAZARD ANALYSIS (DSA)

8.3.1.10 MANAGEMENT OF CHANGE (MOC)

8.3.1.11 COMPLIANCE MANAGEMENT

8.3.1.12 AUDITS, INCIDENT INVESTIGATION, AND RESPONSE

8.3.1.13 OTHERS

8.3.2 SERVICES

8.3.2.1 TESTING

8.3.2.2 CERTIFICATION AND INSPECTION

8.3.2.3 CONSULTING

8.3.2.4 TRAINING

8.3.2.5 AUDITING

8.4 UTILITIES

8.4.1 UTILITIES, BY OFFERING

8.4.1.1 SOLUTION

8.4.1.1.1 PSM PROGRAM MANAGEMENT

8.4.1.1.2 MECHANICAL INTEGRITY PROGRAM

8.4.1.1.3 EMERGENCY PLANNING AND RESPONSE

8.4.1.1.4 PROCESS SAFETY INFORMATION (PSI)

8.4.1.1.5 PROCESS HAZARD ANALYSIS (PHA)

8.4.1.1.6 CONTRACTOR MANAGEMENT PROGRAM

8.4.1.1.7 PRE-STARTUP SAFETY REVIEW (PSSR)

8.4.1.1.8 STANDARD OPERATING PROCEDURES (SOP)

8.4.1.1.9 DUST HAZARD ANALYSIS (DSA)

8.4.1.1.10 MANAGEMENT OF CHANGE (MOC)

8.4.1.1.11 COMPLIANCE MANAGEMENT

8.4.1.1.12 AUDITS, INCIDENT INVESTIGATION, AND RESPONSE

8.4.1.1.13 OTHERS

8.4.1.2 SERVICES

8.4.1.2.1 TESTING

8.4.1.2.2 CERTIFICATION AND INSPECTION

8.4.1.2.3 CONSULTING

8.4.1.2.4 TRAINING

8.4.1.2.5 AUDITING

8.4.2 UTILITIES, BY TYPE

8.4.2.1 WASTE DISPOSAL

8.4.2.2 ELECTRICITY

8.4.2.3 HEAT

8.4.2.4 WATER

8.5 GOVERNMENT

8.5.1 SOLUTION

8.5.1.1 PSM PROGRAM MANAGEMENT

8.5.1.2 MECHANICAL INTEGRITY PROGRAM

8.5.1.3 EMERGENCY PLANNING AND RESPONSE

8.5.1.4 PROCESS SAFETY INFORMATION (PSI)

8.5.1.5 PROCESS HAZARD ANALYSIS (PHA)

8.5.1.6 CONTRACTOR MANAGEMENT PROGRAM

8.5.1.7 PRE-STARTUP SAFETY REVIEW (PSSR)

8.5.1.8 STANDARD OPERATING PROCEDURES (SOP)

8.5.1.9 DUST HAZARD ANALYSIS (DSA)

8.5.1.10 MANAGEMENT OF CHANGE (MOC)

8.5.1.11 COMPLIANCE MANAGEMENT

8.5.1.12 AUDITS, INCIDENT INVESTIGATION, AND RESPONSE

8.5.1.13 OTHERS

8.5.2 SERVICES

8.5.2.1 TESTING

8.5.2.2 CERTIFICATION AND INSPECTION

8.5.2.3 CONSULTING

8.5.2.4 TRAINING

8.5.2.5 AUDITING

8.6 CONSTRUCTION AND REAL ESTATE

8.6.1 SOLUTION

8.6.1.1 PSM PROGRAM MANAGEMENT

8.6.1.2 MECHANICAL INTEGRITY PROGRAM

8.6.1.3 EMERGENCY PLANNING AND RESPONSE

8.6.1.4 PROCESS SAFETY INFORMATION (PSI)

8.6.1.5 PROCESS HAZARD ANALYSIS (PHA)

8.6.1.6 CONTRACTOR MANAGEMENT PROGRAM

8.6.1.7 PRE-STARTUP SAFETY REVIEW (PSSR)

8.6.1.8 STANDARD OPERATING PROCEDURES (SOP)

8.6.1.9 DUST HAZARD ANALYSIS (DSA)

8.6.1.10 MANAGEMENT OF CHANGE (MOC)

8.6.1.11 COMPLIANCE MANAGEMENT

8.6.1.12 AUDITS, INCIDENT INVESTIGATION, AND RESPONSE

8.6.1.13 OTHERS

8.6.2 SERVICES

8.6.2.1 TESTING

8.6.2.2 CERTIFICATION AND INSPECTION

8.6.2.3 CONSULTING

8.6.2.4 TRAINING

8.6.2.5 AUDITING

8.7 RETAIL

8.7.1 SOLUTION

8.7.1.1 PSM PROGRAM MANAGEMENT

8.7.1.2 MECHANICAL INTEGRITY PROGRAM

8.7.1.3 EMERGENCY PLANNING AND RESPONSE

8.7.1.4 PROCESS SAFETY INFORMATION (PSI)

8.7.1.5 PROCESS HAZARD ANALYSIS (PHA)

8.7.1.6 CONTRACTOR MANAGEMENT PROGRAM

8.7.1.7 PRE-STARTUP SAFETY REVIEW (PSSR)

8.7.1.8 STANDARD OPERATING PROCEDURES (SOP)

8.7.1.9 DUST HAZARD ANALYSIS (DSA)

8.7.1.10 MANAGEMENT OF CHANGE (MOC)

8.7.1.11 COMPLIANCE MANAGEMENT

8.7.1.12 AUDITS, INCIDENT INVESTIGATION, AND RESPONSE

8.7.1.13 OTHERS

8.7.2 SERVICES

8.7.2.1 TESTING

8.7.2.2 CERTIFICATION AND INSPECTION

8.7.2.3 CONSULTING

8.7.2.4 TRAINING

8.7.2.5 AUDITING

8.8 OTHERS

9 MIDDLE EAST & AFRICA PROCESS SAFETY SERVICES MARKET, BY REGION

9.1 MIDDLE EAST AND AFRICA

9.1.1 SAUDI ARABIA

9.1.2 U.A.E

9.1.3 ISRAEL

9.1.4 EGYPT

9.1.5 SOUTH AFRICA

9.1.6 REST OF MIDDLE EAST AND AFRICA

10 MIDDLE EAST & AFRICA PROCESS SAFETY SERVICES MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

11 SWOT ANALYSIS

12 COMPANY PROFILE

12.1 SIEMENS

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENTS

12.2 JOHNSON CONTROLS

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENT

12.3 TÜV SÜD

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENTS

12.4 EMERSON ELECTRIC CO.

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT DEVELOPMENTS

12.5 SCHNEIDER ELLECTRIC

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT DEVELOPMENTS

12.6 ABB

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENTS

12.7 BUREAU VERITAS

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENTS

12.8 DEKRA

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 HONEYWELL INTERNATIONAL INC.

12.9.1 COMPANY SNAPSHOT

12.9.2 REVENUE ANALYSIS

12.9.3 SOLUTION PORTFOLIO

12.9.4 RECENT DEVELOPMENTS

12.1 HIMA

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENTS

12.11 INGENERO, INC

12.11.1 COMPANY SNAPSHOT

12.11.2 SERVICE PORTFOLIO

12.11.3 RECENT DEVELOPMENT

12.12 INTERTEK GROUP PLC

12.12.1 COMPANY SNAPSHOT

12.12.2 REVENUE ANALYSIS

12.12.3 PRODUCT PORTFOLIO

12.12.4 RECENT DEVELOPMENTS

12.13 IOKINETIC, LLC

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENTS

12.14 MISTRAS GROUP, INC.

12.14.1 COMPANY SNAPSHOT

12.14.2 REVENUE ANALYSIS

12.14.3 PRODUCT PORTFOLIO

12.14.4 RECENT DEVELOPMENTS

12.15 OMRON CORPORATION

12.15.1 COMPANY SNAPSHOT

12.15.2 REVENUE ANALYSIS

12.15.3 PRODUCT PORTFOLIO

12.15.4 RECENT DEVELOPMENTS

12.16 PROCESS ENGINEERING ASSOCIATES, LLC

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 RECENT DEVELOPMENT

12.17 ROCKWELL AUTOMTAION

12.17.1 COMPANY SNAPSHOT

12.17.2 REVENUE ANALYSIS

12.17.3 PRODUCT PORTFOLIO

12.17.4 RECENT DEVELOPMENTS

12.18 SGS SA

12.18.1 COMPANY SNAPSHOT

12.18.2 REVENUE ANALYSIS

12.18.3 PRODUCT PORTFOLIO

12.18.4 RECENT DEVELOPMENTS

12.19 SMITH & BURGESS PROCESS SAFETY CONSULTING

12.19.1 COMPANY SNAPSHOT

12.19.2 PRODUCT PORTFOLIO

12.19.3 RECENT DEVELOPMENTS

12.2 SOCOTEC

12.20.1 COMPANY SNAPSHOT

12.20.2 PRODUCT PORTFOLIO

12.20.3 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

Lista de Tabela

TABLE 1 MIDDLE EAST & AFRICA PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA PROCESS SAFETY SERVICES MARKET, BY SAFETY INTEGRITY LEVEL, 2021-2030 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA LEVEL 2 IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA LEVEL 3 IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA LEVEL 1 IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA LEVEL 4 IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA PROCESS SAFETY SERVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA CONSUMER GOODS IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA AUTOMOTIVE AND DISCRETE MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA AUTOMOTIVE AND DISCRETE MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA GOVERNMENT IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA GOVERNMENT IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA CONSTRUCTION AND REAL ESTATE IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA CONSTRUCTION AND REAL ESTATE IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA RETAIL IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA RETAIL IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA OTHERS IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA PROCESS SAFETY SERVICES MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA PROCESS SAFETY SERVICES MARKET, BY SAFETY INTEGRITY LEVEL, 2021-2030 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA PROCESS SAFETY SERVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 48 MIDDLE EAST AND AFRICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 MIDDLE EAST AND AFRICA CONSUMER GOODS IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA AUTOMOTIVE AND DISCRETE MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 53 MIDDLE EAST AND AFRICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 54 MIDDLE EAST AND AFRICA UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 55 MIDDLE EAST AND AFRICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 56 MIDDLE EAST AND AFRICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 57 MIDDLE EAST AND AFRICA UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 MIDDLE EAST AND AFRICA GOVERNMENT IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 59 MIDDLE EAST AND AFRICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 60 MIDDLE EAST AND AFRICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 61 MIDDLE EAST AND AFRICA CONSTRUCTION AND REAL ESTATE IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 62 MIDDLE EAST AND AFRICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 63 MIDDLE EAST AND AFRICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 64 MIDDLE EAST AND AFRICA RETAIL IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 65 MIDDLE EAST AND AFRICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 66 MIDDLE EAST AND AFRICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 67 SAUDI ARABIA PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 SAUDI ARABIA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 69 SAUDI ARABIA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 SAUDI ARABIA PROCESS SAFETY SERVICES MARKET, BY SAFETY INTEGRITY LEVEL, 2021-2030 (USD MILLION)

TABLE 71 SAUDI ARABIA PROCESS SAFETY SERVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 72 SAUDI ARABIA PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 73 SAUDI ARABIA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 74 SAUDI ARABIA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 75 SAUDI ARABIA PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 76 SAUDI ARABIA CONSUMER GOODS IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 77 SAUDI ARABIA AUTOMOTIVE AND DISCRETE MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 78 SAUDI ARABIA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 79 SAUDI ARABIA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 80 SAUDI ARABIA UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 81 SAUDI ARABIA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 82 SAUDI ARABIA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 83 SAUDI ARABIA UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 84 SAUDI ARABIA GOVERNMENT IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 85 SAUDI ARABIA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 86 SAUDI ARABIA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 87 SAUDI ARABIA CONSTRUCTION AND REAL ESTATE IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 88 SAUDI ARABIA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 89 SAUDI ARABIA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 90 SAUDI ARABIA RETAIL IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 91 SAUDI ARABIA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 92 SAUDI ARABIA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 93 U.A.E. PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 94 U.A.E. SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 95 U.A.E. SERVICES IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 96 U.A.E. PROCESS SAFETY SERVICES MARKET, BY SAFETY INTEGRITY LEVEL, 2021-2030 (USD MILLION)

TABLE 97 U.A.E. PROCESS SAFETY SERVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 98 U.A.E. PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 99 U.A.E. SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 100 U.A.E. SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 101 U.A.E. PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 102 U.A.E. CONSUMER GOODS IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 103 U.A.E. AUTOMOTIVE AND DISCRETE MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 104 U.A.E. SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 105 U.A.E. SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 106 U.A.E. UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 107 U.A.E. SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 108 U.A.E. SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 109 U.A.E. UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 110 U.A.E. GOVERNMENT IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 111 U.A.E. SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 112 U.A.E. SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 113 U.A.E. CONSTRUCTION AND REAL ESTATE IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 114 U.A.E. SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 115 U.A.E. SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 116 U.A.E. RETAIL IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 117 U.A.E. SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 118 U.A.E. SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 119 ISRAEL PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 120 ISRAEL SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 121 ISRAEL SERVICES IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 122 ISRAEL PROCESS SAFETY SERVICES MARKET, BY SAFETY INTEGRITY LEVEL, 2021-2030 (USD MILLION)

TABLE 123 ISRAEL PROCESS SAFETY SERVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 124 ISRAEL PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 125 ISRAEL SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 126 ISRAEL SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 127 ISRAEL PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 128 ISRAEL CONSUMER GOODS IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 129 ISRAEL AUTOMOTIVE AND DISCRETE MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 130 ISRAEL SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 131 ISRAEL SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 132 ISRAEL UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 133 ISRAEL SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 134 ISRAEL SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 135 ISRAEL UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 136 ISRAEL GOVERNMENT IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 137 ISRAEL SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 138 ISRAEL SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 139 ISRAEL CONSTRUCTION AND REAL ESTATE IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 140 ISRAEL SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 141 ISRAEL SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 142 ISRAEL RETAIL IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 143 ISRAEL SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 144 ISRAEL SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 145 EGYPT PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 146 EGYPT SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 147 EGYPT SERVICES IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 148 EGYPT PROCESS SAFETY SERVICES MARKET, BY SAFETY INTEGRITY LEVEL, 2021-2030 (USD MILLION)

TABLE 149 EGYPT PROCESS SAFETY SERVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 150 EGYPT PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 151 EGYPT SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 152 EGYPT SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 153 EGYPT PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 154 EGYPT CONSUMER GOODS IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 155 EGYPT AUTOMOTIVE AND DISCRETE MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 156 EGYPT SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 157 EGYPT SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 158 EGYPT UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 159 EGYPT SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 160 EGYPT SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 161 EGYPT UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 162 EGYPT GOVERNMENT IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 163 EGYPT SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 164 EGYPT SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 165 EGYPT CONSTRUCTION AND REAL ESTATE IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 166 EGYPT SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 167 EGYPT SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 168 EGYPT RETAIL IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 169 EGYPT SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 170 EGYPT SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 171 SOUTH AFRICA PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 172 SOUTH AFRICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 173 SOUTH AFRICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 174 SOUTH AFRICA PROCESS SAFETY SERVICES MARKET, BY SAFETY INTEGRITY LEVEL, 2021-2030 (USD MILLION)

TABLE 175 SOUTH AFRICA PROCESS SAFETY SERVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 176 SOUTH AFRICA PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 177 SOUTH AFRICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 178 SOUTH AFRICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 179 SOUTH AFRICA PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 180 SOUTH AFRICA CONSUMER GOODS IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 181 SOUTH AFRICA AUTOMOTIVE AND DISCRETE MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 182 SOUTH AFRICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 183 SOUTH AFRICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 184 SOUTH AFRICA UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 185 SOUTH AFRICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 186 SOUTH AFRICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 187 SOUTH AFRICA UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 188 SOUTH AFRICA GOVERNMENT IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 189 SOUTH AFRICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 190 SOUTH AFRICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 191 SOUTH AFRICA CONSTRUCTION AND REAL ESTATE IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 192 SOUTH AFRICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 193 SOUTH AFRICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 194 SOUTH AFRICA RETAIL IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 195 SOUTH AFRICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 196 SOUTH AFRICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 197 REST OF MIDDLE EAST AND AFRICA PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

Lista de Figura

FIGURE 1 MIDDLE EAST & AFRICA PROCESS SAFETY SERVICES MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA PROCESS SAFETY SERVICES MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA PROCESS SAFETY SERVICES MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA PROCESS SAFETY SERVICES MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA PROCESS SAFETY SERVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA PROCESS SAFETY SERVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA PROCESS SAFETY SERVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA PROCESS SAFETY SERVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA PROCESS SAFETY SERVICES MARKET: MULTIVARIATE MODELLING

FIGURE 10 MIDDLE EAST & AFRICA PROCESS SAFETY SERVICES MARKET: OFFERING TIMELINE CURVE

FIGURE 11 MIDDLE EAST & AFRICA PROCESS SAFETY SERVICES MARKET: END USER COVERAGE GRID

FIGURE 12 MIDDLE EAST & AFRICA PROCESS SAFETY SERVICES MARKET: SEGMENTATION

FIGURE 13 HIGH BENEFITS OFFERED BY PROCESS SAFETY SOLUTIONS AND SERVICES IS EXPECTED TO DRIVE MIDDLE EAST & AFRICA PROCESS SAFETY SERVICES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 SOLUTION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST & AFRICA PROCESS SAFETY SERVICES MARKET IN 2023 & 2030

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF MIDDLE EAST & AFRICA PROCESS SAFETY SERVICES MARKET

FIGURE 16 MIDDLE EAST & AFRICA PROCESS SAFETY SERVICES MARKET: BY OFFERING, 2022

FIGURE 17 MIDDLE EAST & AFRICA PROCESS SAFETY SERVICES MARKET: BY SAFETY INTEGRITY LEVEL, 2022

FIGURE 18 MIDDLE EAST & AFRICA PROCESS SAFETY SERVICES MARKET: BY END USER, 2022

FIGURE 19 MIDDLE EAST AND AFRICA PROCESS SAFETY SERVICES MARKET: SNAPSHOT (2022)

FIGURE 20 MIDDLE EAST AND AFRICA PROCESS SAFETY SERVICES MARKET: BY COUNTRY (2022)

FIGURE 21 MIDDLE EAST AND AFRICA PROCESS SAFETY SERVICES MARKET: BY COUNTRY (2023 & 2030)

FIGURE 22 MIDDLE EAST AND AFRICA PROCESS SAFETY SERVICES MARKET: BY COUNTRY (2022 & 2030)

FIGURE 23 MIDDLE EAST AND AFRICA PROCESS SAFETY SERVICES MARKET: BY TYPE (2023-2030)

FIGURE 24 MIDDLE EAST & AFRICA PROCESS SAFETY SERVICES MARKET: COMPANY SHARE 2022(%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.