Mercado de ferramentas elétricas do Médio Oriente e África , por tipo (ferramentas de corte e serradura, ferramentas de perfuração e fixação, ferramentas de demolição, ferramentas de encaminhamento, mordiscadores portáteis, ferramentas pneumáticas, ferramentas de remoção de material, cabos e fichas elétricas, acessórios, outros), modo de Funcionamento (Elétrica, Ferramenta de Combustível Líquido, Hidráulica, Pneumática, Ferramentas Acionadas por Pó), Aplicação (Betão e Construção, Carpintaria, Metalurgia, Soldadura, Outros), Material (Betão, Madeira/Metal, Tijolo /Bloco, Vidro, Outros) , Utilizador final (industrial/profissional, residencial), Canal de vendas (vendas indiretas, vendas diretas) – Tendências e previsões do setor até 2029

Análise de Mercado e Tamanho

Vários tipos de ferramentas elétricas disponíveis em plataformas com e sem fios, com capacidade de potência, estão a ser amplamente utilizadas. A funcionalidade e a penetração de utilização para trabalhos de grande escala melhoraram devido aos mecanismos e baterias melhorados .

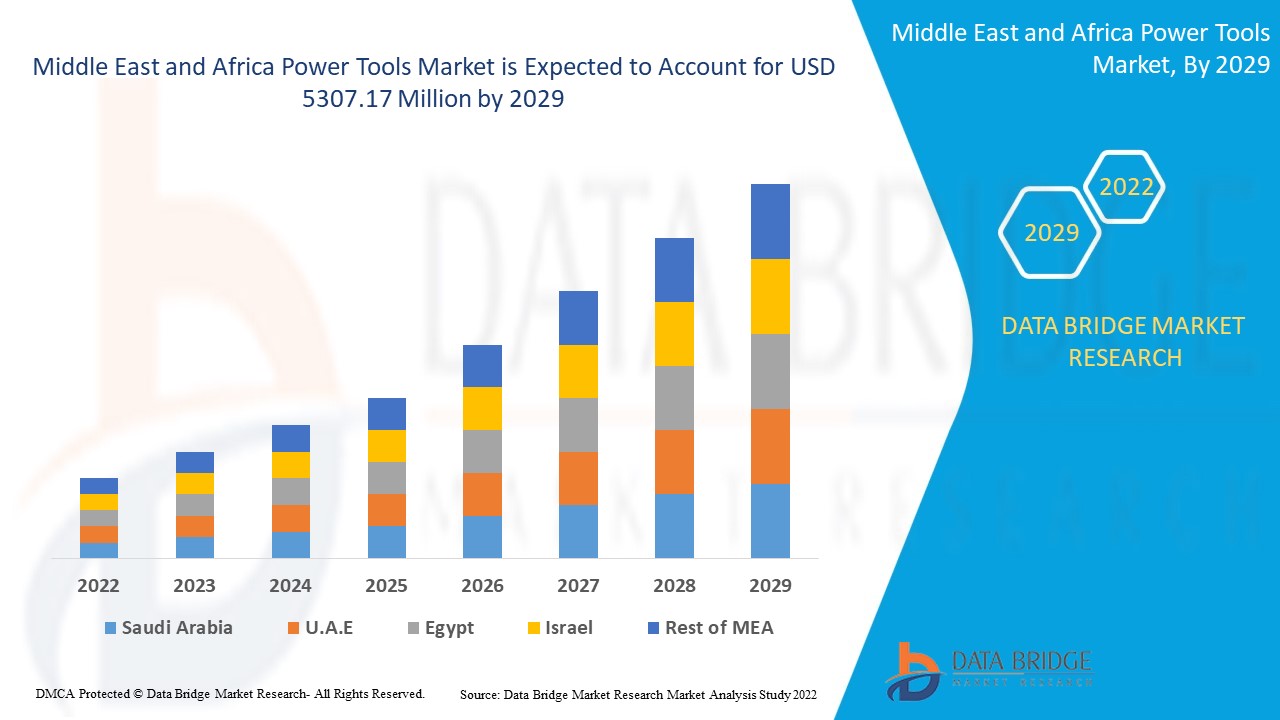

O mercado de ferramentas elétricas do Médio Oriente e África foi avaliado em 3.721,31 milhões de dólares em 2021 e deverá atingir os 5.307,17 milhões de dólares até 2029, registando um CAGR de 6,10% durante o período previsto de 2022-2029. As ferramentas de perfuração e fixação representam o maior segmento de tipos na indústria de utilização final devido à sua facilidade de utilização e são mais baratas quando comparadas com outras ferramentas elétricas . O relatório de mercado selecionado pela equipa de pesquisa de mercado da Data Bridge inclui uma análise aprofundada de especialistas, análise de importação/exportação, análise de preços, análise de consumo de produção e análise Pilstle.

Definição de Mercado

Pelo próprio nome, é claro que as ferramentas elétricas são ferramentas semicondutoras utilizadas numa variedade de aplicações industriais quando acionadas por uma fonte de energia adicional. Serras circulares, serras de tico-tico, berbequins, martelos perfuradores, lixadoras, rebarbadoras, fresadoras e muitas outras são exemplos de ferramentas elétricas. No entanto, se não forem utilizadas com as devidas considerações e cuidado, as ferramentas elétricas podem trazer inúmeros perigos.

Âmbito do Relatório e Segmentação de Mercado

|

Métrica de Reporte |

Detalhes |

|

Período de previsão |

2022 a 2029 |

|

Ano base |

2021 |

|

Anos históricos |

2020 (Personalizável para 2019 - 2014) |

|

Unidades quantitativas |

Receita em milhões de dólares americanos, volumes em unidades, preços em dólares americanos |

|

Segmentos abrangidos |

Tipo (ferramentas de corte e serra, ferramentas de perfuração e fixação, ferramentas de demolição, ferramentas de encaminhamento, roedores portáteis, ferramentas pneumáticas, ferramentas de remoção de material, cabos e fichas elétricas, acessórios, outros), modo de funcionamento (elétrico, ferramenta de combustível líquido, Ferramentas hidráulicas, pneumáticas, acionadas por pólvora), Aplicação (betão e construção, carpintaria, metalurgia, soldadura, outros), Material (betão, madeira/metal, tijolo/bloco, vidro, outros), Utilizador final ( industrial/profissional, residencial ), Canal de Vendas (Vendas Indiretas, Vendas Diretas) |

|

Países abrangidos |

Arábia Saudita, Emirados Árabes Unidos, África do Sul, Egito, Israel, Resto do Médio Oriente e África (MEA). |

|

Atores do mercado abrangidos |

Stanley Black & Decker, Inc. (EUA), Robert Bosch GmbH (Alemanha), Techtronic Industries Co. Ltd. (Hong Kong), Makita Corporation (Japão), Hilti Corporation (Liechtenstein), Atlas Copco AB (Suécia), Ingersoll Rand (EUA), Snap-on Incorporated (EUA), Apex Tool Group (EUA), Koki Holding Co., Ltd. (Japão), Honeywell International Inc. (EUA), 3M (EUA), Emerson Electric Co. (EUA) , Festool GmbH (Alemanha), KYOCERA Corporation (Japão), Makita Corporation (Japão), Hilti AG (Liechtenstein) e Husqvarna AB (Suécia) |

|

Oportunidades de Mercado |

|

Dinâmica do mercado de ferramentas elétricas no Médio Oriente e em África

Esta secção trata da compreensão dos impulsionadores, oportunidades, restrições e desafios do mercado. Tudo isto é discutido em detalhe abaixo:

Motoristas:

- Crescimento do investimento em investigação e desenvolvimento abre caminho a inovações

O número crescente de colaborações estratégicas de mercado levou ao aumento de fundos a serem alocados para o crescimento e desenvolvimento de tecnologia/maquinaria avançada e automatizada. Além disso, o crescimento do nível de investimento na proficiência em investigação e desenvolvimento abriria caminho para inovações na tecnologia de fabrico.

- Aumento da proliferação de produtos eletrónicos a nível global para induzir maior procura e oferta nos países emergentes

A crescente proliferação e penetração de ferramentas e equipamentos eletrónicos é um dos principais fatores que promovem o crescimento do mercado. Por outras palavras, o aumento da procura e da disponibilidade de chaves de porcas elétricas, serras elétricas, aparafusadoras elétricas, martelos elétricos e compactadores elétricos está a influenciar diretamente a taxa de crescimento do mercado. Além disso, a crescente aceitação e aplicação por parte da indústria aeroespacial abrirá caminho para o crescimento do mercado.

- Crescimento e expansão de setores verticais de utilizadores finais para apresentar inúmeras oportunidades para as pequenas empresas

Devido ao crescimento económico global, existe um enorme âmbito de crescimento para a indústria de semicondutores e eletrónica. Há um foco crescente dos principais fabricantes na aplicação de tecnologias avançadas, o que alargará o âmbito de crescimento.

Oportunidades:

- Os edifícios e a indústria da construção civil apresentam muitas oportunidades

A crescente urbanização, modernização e globalização impulsionam o crescimento do valor de mercado. Por outras palavras, o número crescente de edifícios e actividades de construção, especialmente nas economias em desenvolvimento, para desenvolver as infra-estruturas, apresentará muitas oportunidades para o crescimento do mercado.

O crescimento das infraestruturas industriais e a remodelação das estruturas de betão, o crescente avanço na tecnologia para melhorar o funcionamento das ferramentas semicondutoras e a maior consciencialização sobre a segurança dos veículos e os avanços tecnológicos da indústria automóvel são outros determinantes do crescimento do mercado. Além disso, os avanços na tecnologia de fabrico estendem oportunidades lucrativas aos participantes do mercado no período previsto de 2022 a 2029. Além disso, a crescente adoção de ferramentas elétricas alimentadas por bateria em todo o mundo e a crescente procura de ferramentas elétricas de fixação no ambiente industrial irão expandir ainda mais o crescimento futuro.

Restrições/desafios Mercado de ferramentas elétricas no Médio Oriente e África

- Aumento do número de regulamentações para limitar o âmbito do crescimento a longo prazo

A crescente aplicação de regulamentos ambientais rigorosos impostos às indústrias criará obstáculos ao crescimento do mercado. Além disso, as regulamentações rigorosas sobre as aprovações de produtos restringirão o âmbito de crescimento do mercado. Além disso, a suspensão da atividade comercial devido à pandemia do coronavírus criará novamente obstáculos.

- As perturbações na cadeia de abastecimento representarão uma ameaça à crescente procura do mercado sem precedentes

Com o número crescente de restrições em todo o mundo devido à pandemia, houve um impacto na procura e na oferta de materiais de exposição. Além disso, as flutuações nos preços das matérias-primas serão um demérito para o mercado. Portanto, isto desafiará a taxa de crescimento do mercado.

Além disso, a falta de sensibilização nas regiões subdesenvolvidas e os elevados custos associados às atividades de fabrico atuarão como restrições ao crescimento do mercado. A falta de infraestruturas sólidas nas economias atrasadas, a queda das vendas de veículos comerciais devido à COVID-19 e os acidentes e problemas de saúde associados às ferramentas elétricas também desafiarão a taxa de crescimento do mercado.

Este relatório de mercado de ferramentas elétricas fornece detalhes de novos desenvolvimentos recentes, regulamentos comerciais, análise de importação e exportação, análise de produção, otimização da cadeia de valor, quota de mercado, impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações no mercado regulamentações, análise estratégica de crescimento de mercado, tamanho de mercado, crescimento de mercado de categorias, nichos de aplicação e dominância, aprovações de produtos, lançamentos de produtos, expansões geográficas, inovações tecnológicas no mercado. Para mais informações sobre o mercado de ferramentas elétricas, contacte a Data Bridge Market Research para obter um briefing de analista.

Impacto da Covid-19 no mercado de ferramentas elétricas do Médio Oriente e África

A COVID-19 impactou o mercado das ferramentas elétricas. Os custos limitados de investimento e a falta de colaboradores prejudicaram as vendas e a produção de tecnologia de ferramentas elétricas. No entanto, o governo e os principais intervenientes no mercado adoptaram novas medidas de segurança para desenvolver as práticas. Os avanços na tecnologia aumentaram a taxa de vendas dos sensores de temperatura termopar, uma vez que atingiram o público certo. Espera-se que o aumento da industrialização em todo o mundo impulsione ainda mais o crescimento do mercado no panorama pós-pandemia.

Desenvolvimentos recentes

- Em março de 2020, a Robert Bosch GmbH anunciou o lançamento de uma perfuração praticamente isenta de poeiras. O aspirador sem fios é instalado nos martelos Bosch para proteção contra o pó durante a perfuração e a construção de andaimes. O novo produto aumentou o portefólio de produtos da empresa.

- Em março de 2019, a Festool GmbH anunciou o lançamento da ferramenta oscilante sem fios Vecturo OSC 18. A nova ferramenta sem fios consiste numa bateria de iões de lítio de 18 volts e num motor EC-TEC sem escovas. O produto oferece um corte, raspagem e serragem precisos. O novo produto aumentou o portefólio de produtos da empresa.

Âmbito do mercado de ferramentas elétricas no Médio Oriente e África

O mercado das ferramentas elétricas é segmentado com base no tipo, modo de operação, aplicação, material, utilizador final e canal de vendas. O crescimento entre estes segmentos irá ajudá-lo a analisar segmentos de baixo crescimento nos setores e fornecerá aos utilizadores uma visão geral e informações valiosas do mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Tipo

- Ferramentas de serra e corte

- Ferramentas de perfuração e fixação

- Ferramentas de demolição

- Ferramentas de encaminhamento

- Nibblers portáteis

- Ferramentas pneumáticas

- Ferramentas de remoção de material

- Fios e fichas elétricas

- Acessórios

- Outros

Modo de operação

- Elétrico

- Ferramenta de combustível líquido

- Hidráulico

- Pneumático

- Ferramentas acionadas por pólvora

Aplicação

- Betão e Construção

- Marcenaria

- Metalurgia

- Soldagem

- Outros

Material

- Betão

- Madeira/Metal

- Tijolo/Bloco

- Copo

- Outros

Utilizador final

- Industrial/Profissional

- residencial

Análise/Insights Regionais do Mercado de Ferramentas Elétricas do Médio Oriente e África

O mercado das ferramentas elétricas é analisado e são fornecidos insights e tendências sobre o tamanho do mercado por país, tipo, modo de operação, aplicação, material, utilizador final e canal de vendas, conforme referenciado acima.

Os países abrangidos pelo relatório de mercado de ferramentas elétricas são a Arábia Saudita, os Emirados Árabes Unidos, a África do Sul, o Egito, Israel, o Resto do Médio Oriente e África (MEA).

Israel está a dominar a região do Médio Oriente e África devido ao aumento das iniciativas governamentais tomadas para impulsionar os projectos de construção que exigem ferramentas eléctricas para uma melhor produtividade e eficiência no trabalho.

A secção do relatório sobre os países também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado nacional que impactam as tendências atuais e futuras do mercado. Pontos de dados como a análise da cadeia de valor a montante e a jusante, tendências técnicas e análise das cinco forças de Porter, estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade de marcas globais e os seus desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, ao impacto de tarifas domésticas e rotas comerciais são considerados ao fornecer uma análise de previsão dos dados do país.

Cenário competitivo e mercado de ferramentas elétricas no Médio Oriente e África

O panorama competitivo do mercado de ferramentas elétricas fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença global, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa , lançamento do produto, amplitude e abrangência do produto, aplicação domínio. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas relacionadas com o mercado de ferramentas elétricas.

Alguns dos principais participantes que operam no mercado das ferramentas elétricas são

- Stanley Black & Decker, Inc. (EUA)

- Robert Bosch GmbH (Alemanha)

- Techtronic Industries Co. Ltd (Hong Kong)

- Makita Corporation (Japão)

- Hilti Corporation (Liechtenstein)

- Atlas Copco AB (Suécia)

- Ingersoll Rand (EUA)

- Snap-on Incorporated (EUA)

- Apex Tool Group (EUA)

- Koki Holding Co., Ltd. (Japão)

- Honeywell International Inc. (EUA)

- 3M (EUA)

- Emerson Electric Co. (EUA)

- Festool GmbH (Alemanha)

- KYOCERA Corporation (Japão)

- Makita Corporation (Japão),

- Hilti AG (Liechtenstein)

- Husqvarna AB (Suécia)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA POWER TOOLS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN THE GROWTH OF CORDLESS POWER TOOLS

5.1.2 INTEGRATION OF BRUSHLESS MOTORS IN POWER TOOLS

5.1.3 INCREASING GROWTH IN INFRASTRUCTURE PROJECTS MIDDLE EAST AND AFRICALY

5.1.4 BETTER OFFERING THAN HAND TOOLS

5.1.5 EXPANSION OF THE MOTOR VEHICLE MAINTENANCE MARKET AS VEHICLE OWNERSHIP RATE INCREASES

5.2 RESTRAINTS

5.2.1 HIGH MAINTENANCE OF POWER TOOLS

5.2.2 FLUCTUATION IN THE PRICES OF RAW MATERIALS

5.2.3 LIMITATIONS INVOLVED IN LI-ION BATTERY USAGE FOR CORDLESS POWER TOOLS

5.3 OPPORTUNITIES

5.3.1 GROWTH IN WIND ENERGY INDUSTRY AIDING THE POWER TOOLS MARKET

5.3.2 SMART CONNECTIVITY IN POWER TOOLS

5.3.3 TECHNOLOGICAL INNOVATIONS IN INDUSTRY 4.0

5.3.4 POWER TOOLS BEING MADE AVAILABLE ON E-COMMERCE PLATFORM

5.4 CHALLENGES

5.4.1 DESIGNING ERGONOMIC AND LIGHTWEIGHT POWER TOOLS

5.4.2 REGULATORY COMPLIANCE AND POWER TOOL SAFETY

6 ANALYSIS OF IMPACT OF COVID-19 PANDEMIC ON THE MIDDLE EAST AND AFRICA POWER TOOLS MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON DEMAND

6.4 IMPACT ON SUPPLY CHAIN

6.5 CONCLUSION

7 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY TYPE

7.1 OVERVIEW

7.2 SAWING AND CUTTING TOOLS

7.2.1 CIRCULAR SAWS

7.2.2 JIGSAWS

7.2.3 MULTI-CUTTER SAWS

7.2.4 CHOP SAWS

7.2.5 BAND SAWS

7.2.6 RECIPROCATING SAWS

7.2.7 SHEARS AND NIBBLERS

7.3 DRILLING AND FASTENING TOOLS

7.3.1 DRILLS

7.3.2 SCREWDRIVERS AND NUTRUNNERS

7.3.3 IMPACT WRENCHES

7.3.4 IMPACT DRIVERS

7.4 DEMOLITION TOOLS

7.4.1 DEMOLITION HAMMER

7.4.2 HAMMER DRILL

7.4.3 BREAKER

7.4.4 ROTARY HAMMER

7.4.5 OTHERS

7.5 ROUTING TOOLS

7.5.1 ROUTERS/PLANER

7.5.2 JOINERS

7.6 PORTABLE NIBBLERS

7.7 AIR-POWERED TOOLS

7.7.1 AIR HOSES

7.7.2 AIR HAMMERS

7.7.3 AIR SCALERS

7.7.4 OTHERS

7.8 MATERIAL REMOVAL TOOLS

7.8.1 GRINDERS

7.8.1.1 DIE AND STRAIGHT GRINDER

7.8.1.2 ANGLE GRINDER

7.8.1.3 ROTARY FILES

7.8.1.4 BENCH GRINDER

7.8.1.5 PENCIL GRINDERS

7.8.2 SANDERS

7.8.3 POLISHERS/BUFFERS

7.9 ELECTRIC CORDS AND PLUGS

7.1 ACCESSORIES

7.11 OTHERS

8 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY MODE OF OPERATION

8.1 OVERVIEW

8.2 ELECTRIC

8.2.1 CORDED TOOL

8.2.2 CORDLESS TOOL

8.3 LIQUID FUEL TOOL

8.4 HYDRAULIC

8.5 PNEUMATIC

8.6 POWDER-ACTUATED TOOLS

9 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 CONCRETE AND CONSTRUCTION

9.3 WOODWORKING

9.4 METALWORKING

9.5 WELDING

9.6 OTHERS

10 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY MATERIAL

10.1 OVERVIEW

10.2 CONCRETE

10.3 WOOD/METAL

10.4 BRICK/BLOCK

10.5 GLASS

10.6 OTHERS

11 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY END USER

11.1 OVERVIEW

11.2 INDUSTRIAL/PROFESSIONAL

11.2.1 BY TYPE

11.2.1.1 Sawing and Cutting Tools

11.2.1.2 Drilling and Fastening Tools

11.2.1.3 Demolition Tools

11.2.1.4 Routing Tools

11.2.1.5 Portable Nibblers

11.2.1.6 Air-Powered Tools

11.2.1.7 Material Removal Tools

11.2.1.8 Electric Cords and Plugs

11.2.1.9 Others

11.2.2 BY MODE OF OPERATION

11.2.2.1 Electric

11.2.2.2 Liquid Fuel Tool

11.2.2.3 Hydraulic

11.2.2.4 Pneumatic

11.2.2.5 Powder-Actuated Tools

11.3 RESIDENTIAL

11.3.1 ELECTRIC

11.3.2 LIQUID FUEL TOOL

11.3.3 HYDRAULIC

11.3.4 PNEUMATIC

11.3.5 POWDER-ACTUATED TOOLS

12 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY SALES CHANNEL

12.1 OVERVIEW

12.2 INDIRECT SALES

12.3 DIRECT SALES

13 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY GEOGRAPHY

13.1 MIDDLE EAST AND AFRICA

13.1.1 ISRAEL

13.1.2 SAUDI ARABIA

13.1.3 SOUTH AFRICA

13.1.4 U.A.E.

13.1.5 EGYPT

13.1.6 REST OF MIDDLE EAST AND AFRICA

14 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

15 SWOT

16 COMPANY PROFILES

16.1 TECHTRONIC INDUSTRIES CO. LTD.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 STANLEY BLACK & DECKER, INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 MAKITA CORPORATION

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 ROBERT BOSCH GMBH

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 HILTI AG

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 3M

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 APEX TOOL GROUP, LLC

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 ATLAS COPCO AB

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENT

16.9 C. & E. FEIN GMBH

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 DELTA POWER EQUIPMENT CORPORATION

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 EMERSON ELECTRIC CO.

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 FERM INTERNATIONAL B.V.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 FESTOOL GMBH

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 HUSQVARNA AB

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENTS

16.15 INGERSOLL RAND

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENT

16.16 INTERSKOL

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 KOKI HOLDINGS CO., LTD.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 KYOCERA CORPORATION

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 PANASONIC CORPORATION OF NORTH AMERICA (A SUBSIDIARY OF PANASONIC CORPORATION)

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENT

16.2 SNAP-ON INCORPORATED

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tabela

LIST OF TABLES

TABLE 1 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY TYPE, MARKET FORECAST 2020-2027 (USD MILLION)

TABLE 2 MIDDLE EAST AND AFRICA SAWING AND CUTTING TOOLS IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 3 MIDDLE EAST AND AFRICA SAWING AND CUTTING TOOLS IN POWER TOOLS MARKET, BY TYPE,2018-2027, (USD MILLION)

TABLE 4 MIDDLE EAST AND AFRICA SERVICES IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 5 MIDDLE EAST AND AFRICA DRILLING AND FASTENING TOOLS IN POWER TOOLS MARKET, BY TYPE,2018-2027, (USD MILLION)

TABLE 6 MIDDLE EAST AND AFRICA DEMOLITION TOOLS IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 7 MIDDLE EAST AND AFRICA DEMOLITION TOOLS IN POWER TOOLS MARKET, BY TYPE,2018-2027, (USD MILLION)

TABLE 8 MIDDLE EAST AND AFRICA ROUTING TOOLS IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 9 MIDDLE EAST AND AFRICA ROUTING TOOLS IN POWER TOOLS MARKET, BY TYPE,2018-2027, (USD MILLION)

TABLE 10 MIDDLE EAST AND AFRICA PORTABLE NIBBLERS IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 11 MIDDLE EAST AND AFRICA AIR-POWERED TOOLS IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 12 MIDDLE EAST AND AFRICA AIR-POWERED TOOLS IN POWER TOOLS MARKET, BY TYPE,2018-2027, (USD MILLION)

TABLE 13 MIDDLE EAST AND AFRICA MATERIAL REMOVAL TOOLS IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 14 MIDDLE EAST AND AFRICA MATERIAL REMOVAL TOOLS IN POWER TOOLS MARKET, BY TYPE,2018-2027, (USD MILLION)

TABLE 15 MIDDLE EAST AND AFRICA GRINDERS IN POWER TOOLS MARKET, BY TYPE,2018-2027, (USD MILLION)

TABLE 16 MIDDLE EAST AND AFRICA ELECTRIC CORDS AND PLUGS IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 17 MIDDLE EAST AND AFRICA ACCESSORIES IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 18 MIDDLE EAST AND AFRICA OTHERS IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 19 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY MODE OF OPERATION, MARKET FORECAST 2020-2027 (USD MILLION)

TABLE 20 MIDDLE EAST AND AFRICA ELECTRIC IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 21 MIDDLE EAST AND AFRICA ELECTRIC TOOLS IN POWER TOOLS MARKET, BY TYPE,2018-2027, (USD MILLION)

TABLE 22 MIDDLE EAST AND AFRICA LIQUID FUEL TOOL IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 23 MIDDLE EAST AND AFRICA HYDRAULIC IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 24 MIDDLE EAST AND AFRICA LIQUID FUEL TOOL IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA LIQUID FUEL TOOL IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY APPLICATION, MARKET FORECAST 2020-2027 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA CONCRETE AND CONSTRUCTION IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA WOODWORKING IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA METALWORKING IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA WELDING IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA OTHERS IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY MATERIAL, MARKET FORECAST 2020-2027 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA CONCRETE IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA WOOD/METAL IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA BRICK/BLOCK IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA GLASS IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA OTHERS IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY END USER, MARKET FORECAST 2020-2027 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA AUTOMOTIVE LOAN IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY TYPE,2018-2027, (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY MODE OF OPERATION,2018-2027, (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA RESIDENTIAL IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA RESIDENTIAL IN POWER TOOLS MARKET, BY MODE OF OPERATION,2018-2027, (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY SALES CHANNEL, MARKET FORECAST 2020-2027 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA INDIRECT SALES IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA DIRECT SALES IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 48 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA SAWING AND CUTTING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 50 MIDDLE EAST AND AFRICA DRILLING AND FASTENING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA DEMOLITION TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA ROUTING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 53 MIDDLE EAST AND AFRICA AIR-POWERED TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 54 MIDDLE EAST AND AFRICA MATERIAL REMOVAL TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 55 MIDDLE EAST AND AFRICA GRINDERS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 56 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 57 MIDDLE EAST AND AFRICA ELECTRIC IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 58 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 59 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 60 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 61 MIDDLE EAST AND AFRICA INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 62 MIDDLE EAST AND AFRICA INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 63 MIDDLE EAST AND AFRICA RESIDENTIAL IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 64 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2027 (USD MILLION)

TABLE 65 ISRAEL POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 66 ISRAEL SAWING AND CUTTING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 67 ISRAEL DRILLING AND FASTENING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 68 ISRAEL DEMOLITION TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 69 ISRAEL ROUTING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 70 ISRAEL AIR-POWERED TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 71 ISRAEL MATERIAL REMOVAL TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 72 ISRAEL GRINDERS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 73 ISRAEL POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 74 ISRAEL ELECTRIC IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 75 ISRAEL POWER TOOLS MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 76 ISRAEL POWER TOOLS MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 77 ISRAEL POWER TOOLS MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 78 ISRAEL INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 79 ISRAEL INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 80 ISRAEL RESIDENTIAL IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 81 ISRAEL POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2027 (USD MILLION)

TABLE 82 SAUDI ARABIA POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 83 SAUDI ARABIA SAWING AND CUTTING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 84 SAUDI ARABIA DRILLING AND FASTENING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 85 SAUDI ARABIA DEMOLITION TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 86 SAUDI ARABIA ROUTING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 87 SAUDI ARABIA AIR-POWERED TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 88 SAUDI ARABIA MATERIAL REMOVAL TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 89 SAUDI ARABIA GRINDERS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 90 SAUDI ARABIA POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 91 SAUDI ARABIA ELECTRIC IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 92 SAUDI ARABIA POWER TOOLS MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 93 SAUDI ARABIA POWER TOOLS MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 94 SAUDI ARABIA POWER TOOLS MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 95 SAUDI ARABIA INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 96 SAUDI ARABIA INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 97 SAUDI ARABIA RESIDENTIAL IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 98 SAUDI ARABIA POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2027 (USD MILLION)

TABLE 99 SOUTH AFRICA POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 100 SOUTH AFRICA SAWING AND CUTTING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 101 SOUTH AFRICA DRILLING AND FASTENING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 102 SOUTH AFRICA DEMOLITION TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 103 SOUTH AFRICA ROUTING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 104 SOUTH AFRICA AIR-POWERED TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 105 SOUTH AFRICA MATERIAL REMOVAL TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 106 SOUTH AFRICA GRINDERS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 107 SOUTH AFRICA POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 108 SOUTH AFRICA ELECTRIC IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 109 SOUTH AFRICA POWER TOOLS MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 110 SOUTH AFRICA POWER TOOLS MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 111 SOUTH AFRICA POWER TOOLS MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 112 SOUTH AFRICA INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 113 SOUTH AFRICA INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 114 SOUTH AFRICA RESIDENTIAL IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 115 SOUTH AFRICA POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2027 (USD MILLION)

TABLE 116 U.A.E. POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 117 U.A.E. SAWING AND CUTTING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 118 U.A.E. DRILLING AND FASTENING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 119 U.A.E. DEMOLITION TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 120 U.A.E. ROUTING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 121 U.A.E. AIR-POWERED TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 122 U.A.E. MATERIAL REMOVAL TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 123 U.A.E. GRINDERS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 124 U.A.E. POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 125 U.A.E. ELECTRIC IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 126 U.A.E. POWER TOOLS MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 127 U.A.E. POWER TOOLS MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 128 U.A.E. POWER TOOLS MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 129 U.A.E. INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 130 U.A.E. INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 131 U.A.E. RESIDENTIAL IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 132 U.A.E. POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2027 (USD MILLION)

TABLE 133 EGYPT POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 134 EGYPT SAWING AND CUTTING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 135 EGYPT DRILLING AND FASTENING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 136 EGYPT DEMOLITION TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 137 EGYPT ROUTING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 138 EGYPT AIR-POWERED TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 139 EGYPT MATERIAL REMOVAL TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 140 EGYPT GRINDERS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 141 EGYPT POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 142 EGYPT ELECTRIC IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 143 EGYPT POWER TOOLS MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 144 EGYPT POWER TOOLS MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 145 EGYPT POWER TOOLS MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 146 EGYPT INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 147 EGYPT INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 148 EGYPT RESIDENTIAL IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 149 EGYPT POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2027 (USD MILLION)

TABLE 150 REST OF MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

Lista de Figura

LIST OF FIGURES

FIGURE 1 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: SEGMENTATION

FIGURE 11 INCREASE IN THE GROWTH OF CORDLESS POWER TOOLS IS EXPECTED TO DRIVE MIDDLE EAST AND AFRICA POWER TOOLS MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 12 SAWING AND CUTTING TOOLS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST AND AFRICA POWER TOOLS MARKET IN 2020 & 2027

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF MIDDLE EAST AND AFRICA POWER TOOLS MARKET

FIGURE 14 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: BY TYPE, 2019

FIGURE 15 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: BY MODE OF OPERATION, 2019

FIGURE 16 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: BY APPLICATION, 2019

FIGURE 17 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: BY MATERIAL, 2019

FIGURE 18 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: BY END USER, 2019

FIGURE 19 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: BY SALES CHANNEL, 2019

FIGURE 20 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: SNAPSHOT (2019)

FIGURE 21 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: BY COUNTRY (2019)

FIGURE 22 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: BY COUNTRY (2020 & 2027)

FIGURE 23 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: BY COUNTRY (2019 & 2027)

FIGURE 24 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: BY TYPE (2020-2027)

FIGURE 25 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: COMPANY SHARE 2019 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.