Middle East And Africa Polyglycerol Esters Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

23.30 Billion

USD

27.69 Billion

2024

2032

USD

23.30 Billion

USD

27.69 Billion

2024

2032

| 2025 –2032 | |

| USD 23.30 Billion | |

| USD 27.69 Billion | |

|

|

|

|

Segmentação do mercado de ésteres de poliglicerol do Oriente Médio e África, por grau (grau alimentício, grau farmacêutico e grau industrial), forma (espessantes, solubilizantes, agentes de espalhamento, aditivos, sólidos cerosos e ingredientes inertes), valor de hidroxila (50 a 150, 30 a 49, menos de 30 e mais de 150), cor (amarelo claro, âmbar, bege claro e marrom), aplicação (alimentos, cuidados pessoais, produtos farmacêuticos, surfactantes e detergentes e outros) - Tendências do setor e previsão até 2032

Tamanho do mercado de ésteres de poliglicerol no Oriente Médio e África

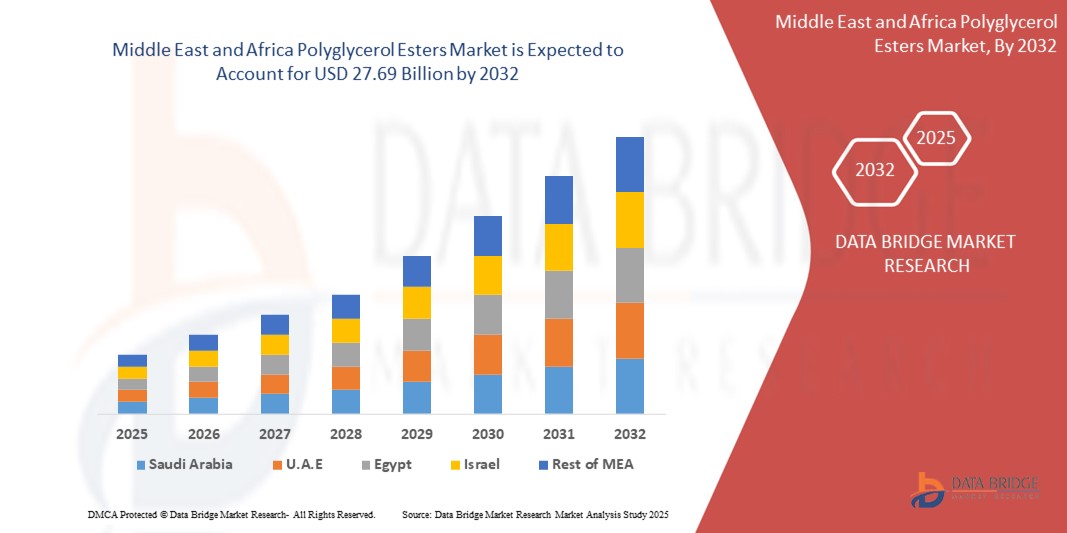

- O tamanho do mercado de ésteres de poliglicerol do Oriente Médio e da África foi avaliado em US$ 23,30 bilhões em 2024 e deve atingir US$ 27,69 bilhões até 2032 , com um CAGR de 2,18% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente demanda por emulsificantes e estabilizantes de alimentos de rótulo limpo em aplicações de panificação, confeitaria e laticínios, já que os consumidores preferem cada vez mais ingredientes naturais e vegetais.

- As crescentes aplicações de ésteres de poliglicerol em cuidados pessoais, cosméticos e produtos farmacêuticos por suas propriedades multifuncionais, como emulsificação, solubilização e condicionamento da pele, estão impulsionando ainda mais a expansão do mercado

Análise de mercado de ésteres de poliglicerol no Oriente Médio e África

- O mercado de ésteres de poliglicerol está apresentando um crescimento robusto, com os fabricantes priorizando ingredientes sustentáveis e multifuncionais nos setores alimentício, de cuidados pessoais e industrial. A crescente conscientização dos consumidores em relação a produtos mais saudáveis e ecologicamente corretos está reforçando a demanda.

- Espera-se que a inovação em formulações de produtos, aliada ao apoio regulatório para ingredientes de origem biológica, gere oportunidades a longo prazo. No entanto, a flutuação dos custos das matérias-primas e a necessidade de tecnologias avançadas de processamento podem representar desafios para uma adoção mais ampla.

- A Arábia Saudita dominou o mercado de ésteres de poliglicerol no Oriente Médio e na África em 2024, impulsionada pelo crescimento dos setores de processamento de alimentos e cuidados pessoais. A adoção de EGPs melhora a estabilidade, a textura e a vida útil dos produtos de panificação, laticínios e cosméticos.

- Espera-se que os Emirados Árabes Unidos testemunhem a maior taxa de crescimento anual composta (CAGR) no mercado de ésteres de poliglicerol do Oriente Médio e da África devido à rápida industrialização, expansão das indústrias de processamento de alimentos e cosméticos e iniciativas governamentais de apoio à promoção da produção de ingredientes químicos e especiais.

- O segmento de grau alimentício deteve a maior fatia de mercado em 2024, impulsionado pela crescente demanda por emulsificantes naturais em aplicações de panificação, confeitaria e laticínios. Sua capacidade de aprimorar a textura, melhorar a estabilidade e apoiar o desenvolvimento de produtos com rótulos limpos o tornou altamente popular entre os fabricantes de alimentos.

Escopo do Relatório e Segmentação do Mercado de Ésteres de Poliglicerol no Oriente Médio e África

|

Atributos |

Principais insights de mercado sobre ésteres de poliglicerol no Oriente Médio e na África |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

• Saudi Basic Industries Corporation – SABIC (Arábia Saudita) |

|

Oportunidades de mercado |

• Adoção crescente de ingredientes de base biológica e sustentáveis |

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de consumo de produção, análise de tendência de preço, cenário de mudança climática, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matéria-prima/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de ésteres de poliglicerol no Oriente Médio e na África

Crescente demanda por ingredientes alimentícios sustentáveis e com rótulos limpos

• A crescente mudança para formulações de rótulos limpos está remodelando o mercado de EGP, à medida que os fabricantes de alimentos e bebidas priorizam cada vez mais emulsificantes naturais, sustentáveis e de fácil utilização. Os EGP, derivados de fontes vegetais, são amplamente reconhecidos por sua segurança e propriedades multifuncionais, tornando-os uma alternativa preferencial aos aditivos sintéticos. Essa tendência corrobora a crescente demanda por transparência e dietas voltadas para a saúde.

• A adoção de EGPs está se acelerando em aplicações de panificação, confeitaria e laticínios devido à sua capacidade de melhorar a textura, a estabilidade e a vida útil, ao mesmo tempo em que atende às expectativas regulatórias e de sustentabilidade dos consumidores. A tendência é ainda mais apoiada por empresas globais de alimentos que reformulam seus produtos para reduzir a dependência de emulsificantes artificiais e aumentar a credibilidade da marca em mercados preocupados com a saúde.

• A acessibilidade, a versatilidade e o perfil ecológico dos EGPs estão impulsionando sua adoção em alimentos e bebidas embalados, especialmente em mercados onde soluções derivadas de plantas estão ganhando força. Os fabricantes se beneficiam de formulações econômicas que atendem às demandas dos consumidores sem comprometer a funcionalidade ou a qualidade, permitindo maior competitividade no mercado.

• Por exemplo, em 2023, diversos produtores de panificação reformularam suas linhas de pães e bolos com ésteres de poliglicerol, melhorando a aeração, a maciez do miolo e a estabilidade na prateleira, em linha com a demanda do consumidor por produtos de panificação naturais e com rótulos limpos. Essa mudança não apenas aumentou o apelo do produto, mas também fortaleceu a marca de sustentabilidade.

• Embora os EGPs estejam se tornando cada vez mais populares na indústria global de alimentos e bebidas, seu impacto mais amplo depende da inovação contínua, da harmonização regulatória regional e da escalabilidade. Os fabricantes devem se concentrar em P&D direcionado, na educação do consumidor e no fornecimento sustentável para alavancar totalmente essa demanda crescente.

Dinâmica do mercado de ésteres de poliglicerol no Oriente Médio e na África

Motorista

Crescente demanda por emulsificantes naturais, vegetais e multifuncionais

• A crescente preferência dos consumidores por produtos alimentícios naturais e de origem vegetal está levando os fabricantes de alimentos a adotar os EGPs como uma solução emulsificante de rótulo limpo. Com fortes aplicações em panificação, confeitaria, laticínios e alimentos processados, os EGPs oferecem diversos benefícios, como melhor aeração, retenção de umidade e maior prazo de validade. Essa demanda está alinhada às tendências globais de saúde e bem-estar.

• Os produtores de alimentos estão cada vez mais cientes da vantagem competitiva oferecida pelos EGPs para atender à demanda dos consumidores por ingredientes mais saudáveis, sustentáveis e multifuncionais. Ao substituir os emulsificantes sintéticos, os EGPs não apenas melhoram a qualidade dos alimentos, mas também fortalecem o posicionamento do produto nos mercados premium e convencional.

• Iniciativas governamentais e associações industriais que promovem aditivos alimentares naturais estão impulsionando ainda mais a adoção de EGPs. De aprovações regulatórias a programas de certificação de rótulos limpos, essas estruturas estão incentivando as empresas alimentícias a expandir o uso de EGPs no desenvolvimento de novos produtos.

• Por exemplo, em 2022, vários fabricantes de alimentos integraram PGEs em alternativas de laticínios, bebidas à base de plantas e sobremesas congeladas, melhorando a estabilidade e a textura do produto, ao mesmo tempo em que se alinhavam à crescente demanda do consumidor por opções sustentáveis à base de plantas.

• Embora a conscientização e o apoio institucional estejam impulsionando a adoção, desafios como competitividade de custos, conscientização do consumidor e padronização nos mercados globais ainda precisam ser enfrentados para garantir a sustentabilidade do crescimento a longo prazo.

Restrição/Desafio

Volatilidade dos preços das matérias-primas e conhecimento limitado nos mercados emergentes

• A dependência dos EGPs de matérias-primas como glicerol e ácidos graxos expõe a indústria a flutuações de preços e vulnerabilidades na cadeia de suprimentos. O aumento dos custos de matérias-primas de origem vegetal e a incerteza global das commodities representam desafios significativos para os fabricantes na manutenção da competitividade de preços.

• Em muitos mercados emergentes, a conscientização sobre os benefícios funcionais e de rótulo limpo dos EGPs permanece limitada em comparação aos emulsificantes tradicionais. A falta de conhecimento técnico e ênfase em marketing dificulta sua adoção nas indústrias alimentícias locais, retardando a penetração em regiões sensíveis a custos.

• O crescimento do mercado é ainda mais limitado por marcos regulatórios globais inconsistentes que regem os emulsificantes alimentícios. Processos de aprovação e requisitos de rotulagem divergentes entre os países criam barreiras adicionais à expansão internacional e à padronização de produtos.

• Por exemplo, em 2023, vários processadores de alimentos relataram dificuldades em obter PGEs com boa relação custo-benefício devido aos picos de preços das matérias-primas e às complexidades regulatórias, o que atrasou as reformulações dos produtos e limitou a adoção mais ampla

• Embora os PGEs apresentem grandes oportunidades, superar a volatilidade das matérias-primas, melhorar a educação do consumidor e garantir a harmonização regulatória são etapas cruciais para desbloquear seu potencial de mercado a longo prazo

Escopo do mercado de ésteres de poliglicerol no Oriente Médio e África

O mercado é segmentado com base em grau, forma, valor de hidroxila, cor e aplicação.

- Por grau

Com base na classificação, o mercado de ésteres de poliglicerol do Oriente Médio e África é segmentado em grau alimentício, grau farmacêutico e grau industrial. O segmento de grau alimentício deteve a maior participação de mercado na receita em 2024, impulsionado pela crescente demanda por emulsificantes naturais em aplicações de panificação, confeitaria e laticínios. Sua capacidade de aprimorar a textura, melhorar a estabilidade e apoiar o desenvolvimento de produtos com rótulos limpos o tornou altamente popular entre os fabricantes de alimentos.

Espera-se que o segmento de grau farmacêutico apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado por seu papel crescente como excipiente seguro em formulações de medicamentos. Seu uso em sistemas de solubilização, aumento da biodisponibilidade e liberação controlada o torna a escolha preferencial para empresas farmacêuticas que buscam ingredientes confiáveis e multifuncionais.

- Por Formulário

Com base na forma, o mercado de ésteres de poliglicerol do Oriente Médio e África é segmentado em espessantes, solubilizantes, agentes de espalhamento, aditivos, sólidos cerosos e ingredientes inertes. O segmento de solubilizantes deteve a maior participação de mercado em 2024, impulsionado por seu amplo uso em bebidas, alternativas a laticínios e produtos de cuidados pessoais, onde melhor dispersão e estabilidade são essenciais.

Espera-se que o segmento de agentes de espalhamento apresente a maior taxa de crescimento entre 2025 e 2032, devido à expansão de suas aplicações em cosméticos e produtos farmacêuticos. Sua capacidade de aprimorar propriedades sensoriais, aprimorar a aplicação e auxiliar na liberação de ingredientes ativos está acelerando sua adoção em formulações premium.

- Por valor de hidroxila

Com base no valor de hidroxila, o mercado de ésteres de poliglicerol do Oriente Médio e África é segmentado em 50 a 150, 30 a 49, menos de 30 e mais de 150. O segmento de 50 a 150 deteve a maior participação de receita de mercado em 2024, pois essa linha oferece desempenho versátil em emulsificação de alimentos, melhoria de textura e estabilidade em diversas formulações.

Espera-se que o segmento com menos de 30 unidades apresente a maior taxa de crescimento entre 2025 e 2032, visto que esses PGEs são cada vez mais utilizados em aplicações especializadas que exigem alta hidrofobicidade. Seu uso em lubrificantes industriais, revestimentos e certos produtos de cuidados pessoais está em constante expansão.

- Por cor

Com base na cor, o mercado de ésteres de poliglicerol do Oriente Médio e África é segmentado em amarelo-claro, âmbar, bege-claro e marrom. O segmento amarelo-claro deteve a maior fatia de mercado em 2024, sendo preferido por fabricantes de alimentos e cuidados pessoais por sua aparência limpa e adequação a produtos finais transparentes ou de cores claras.

Espera-se que o segmento âmbar apresente a maior taxa de crescimento entre 2025 e 2032, com crescente aceitação em alimentos processados, usos industriais e formulações onde as variações naturais de cor não afetam o desempenho. Essa tendência reflete a crescente demanda por emulsificantes sustentáveis e minimamente processados.

- Por aplicação

Com base na aplicação, o mercado de ésteres de poliglicerol do Oriente Médio e África é segmentado em alimentos, cuidados pessoais, produtos farmacêuticos, surfactantes e detergentes, entre outros. O segmento alimentício deteve a maior participação na receita de mercado em 2024, impulsionado pela forte demanda nos setores de panificação, confeitaria e laticínios. Os ésteres de poliglicerol (EGPs) são cada vez mais valorizados por melhorar a aeração, a estabilidade e a qualidade geral do produto, além de apoiar as tendências de rótulos limpos.

Espera-se que o segmento de cuidados pessoais apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pelo uso crescente de EGPs em cremes, loções e cosméticos. Seu papel multifuncional como emulsificantes, estabilizantes e agentes de espalhamento está impulsionando o crescimento de produtos premium para cuidados com a pele e cabelos em toda a região.

Análise regional do mercado de ésteres de poliglicerol no Oriente Médio e África

- A Arábia Saudita dominou o mercado de ésteres de poliglicerol no Oriente Médio e na África em 2024, impulsionada pelo crescimento dos setores de processamento de alimentos e cuidados pessoais. A adoção de EGPs melhora a estabilidade, a textura e a vida útil dos produtos de panificação, laticínios e cosméticos.

- O mercado conta com o apoio de fabricantes e distribuidores regionais que fornecem EGPs de alta qualidade. Iniciativas governamentais que promovem a segurança alimentar e os padrões de qualidade incentivam a adoção. A crescente urbanização e o aumento da renda disponível impulsionam a demanda por alimentos processados e embalados.

- A presença de fabricantes em escala industrial garante fornecimento confiável e alto consumo. No geral, a Arábia Saudita é o maior mercado de EGP na região do Oriente Médio e África.

Insights sobre o mercado de ésteres de poliglicerol dos Emirados Árabes Unidos

Espera-se que os Emirados Árabes Unidos testemunhem a maior taxa de crescimento entre 2025 e 2032, devido à crescente demanda por alimentos processados, produtos de panificação e confeitaria. Os fabricantes estão adotando EGPs para melhorar a emulsificação, a textura e a estabilidade de prateleira. O crescimento em aplicações de cuidados pessoais e cosméticos impulsiona ainda mais a expansão do mercado. A crescente conscientização sobre saúde e a preferência por ingredientes de rótulo limpo estão impulsionando a adoção. Colaborações estratégicas com fornecedores internacionais de ingredientes aumentam a penetração no mercado. De modo geral, os Emirados Árabes Unidos estão emergindo como um mercado de alto crescimento para EGPs na região do Oriente Médio e África.

Participação no mercado de ésteres de poliglicerol no Oriente Médio e África

A indústria de ésteres de poliglicerol do Oriente Médio e da África é liderada principalmente por empresas bem estabelecidas, incluindo:

- Saudi Basic Industries Corporation – SABIC (Arábia Saudita)

- Companhia Nacional de Industrialização – Tasnee (Arábia Saudita)

- Gulf Chemicals and Industrial Oils Company (Arábia Saudita)

- Reda Chemicals (Emirados Árabes Unidos)

- United Oil (EAU)

- AECI Limited (África do Sul)

- Sasol Limited (África do Sul)

- Farabi Petrochemicals Company (Arábia Saudita)

- Nama Chemicals (Arábia Saudita)

- Empresa Egípcia de Etileno e Derivados – ETHYDCO (Egito)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.