Mercado de açúcar derivado de plantas e sintético do Médio Oriente e África, por tipo (açúcar derivado de plantas e açúcar sintético), forma (seco e líquido), aplicação (alimentos e bebidas, suplementos alimentares , produtos farmacêuticos, nutrição desportiva e outros) Tendências da indústria e Previsão para 2029.

Análise e dimensão do mercado de açúcar sintético e derivado de plantas no Médio Oriente e África

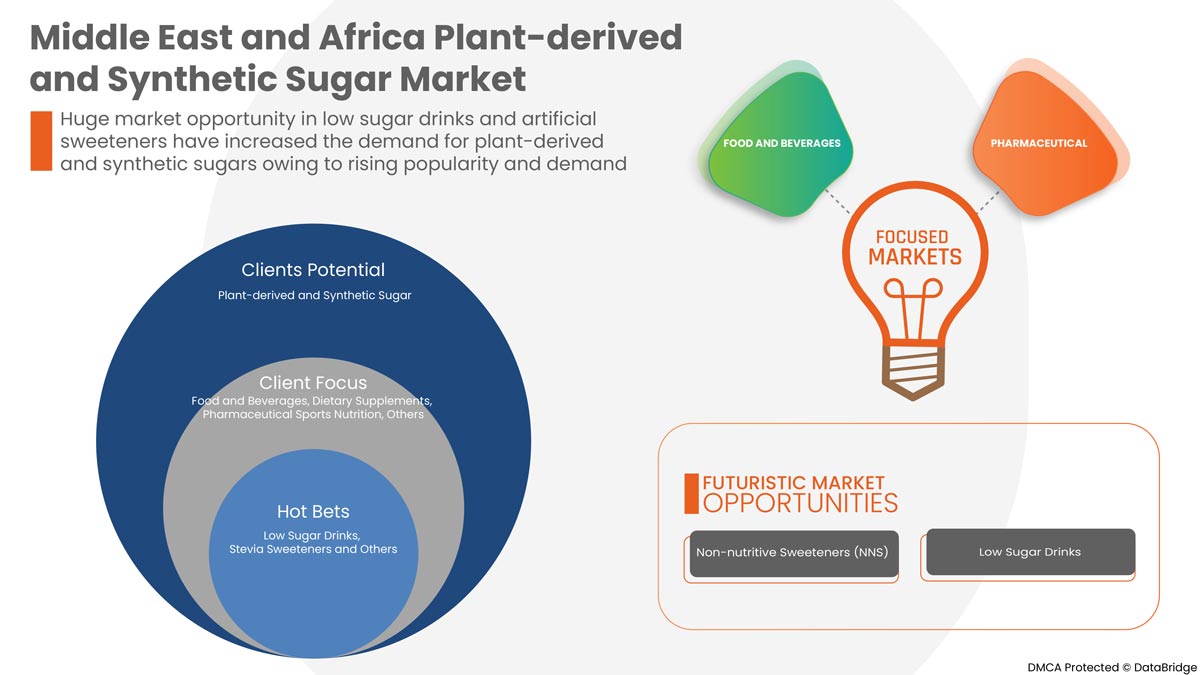

O mercado do Médio Oriente e de África é impulsionado pelos inúmeros benefícios que oferecem aos consumidores. A crescente consciencialização sobre a saúde está também a impulsionar o mercado da população para o açúcar derivado de plantas e sintético e a procura por ingredientes alimentares naturais. Por esta razão, tem havido um aumento subtil no crescimento do açúcar derivado de plantas nos últimos anos. Os principais factores que limitam o mercado do açúcar sintético e derivado de plantas no Médio Oriente e em África são os elevados preços do açúcar vegetal e as consequências adversas para a saúde, como a diabetes e a obesidade. Como resultado da crescente procura por ingredientes alimentares saudáveis na indústria alimentar e de bebidas, espera-se que o mercado do açúcar derivado de plantas e do açúcar sintético seja impulsionado. Os produtores estão a esforçar-se mais para produzir novas bebidas e produtos com baixo teor de açúcar. Estas escolhas acabam por auxiliar na expansão do mercado.

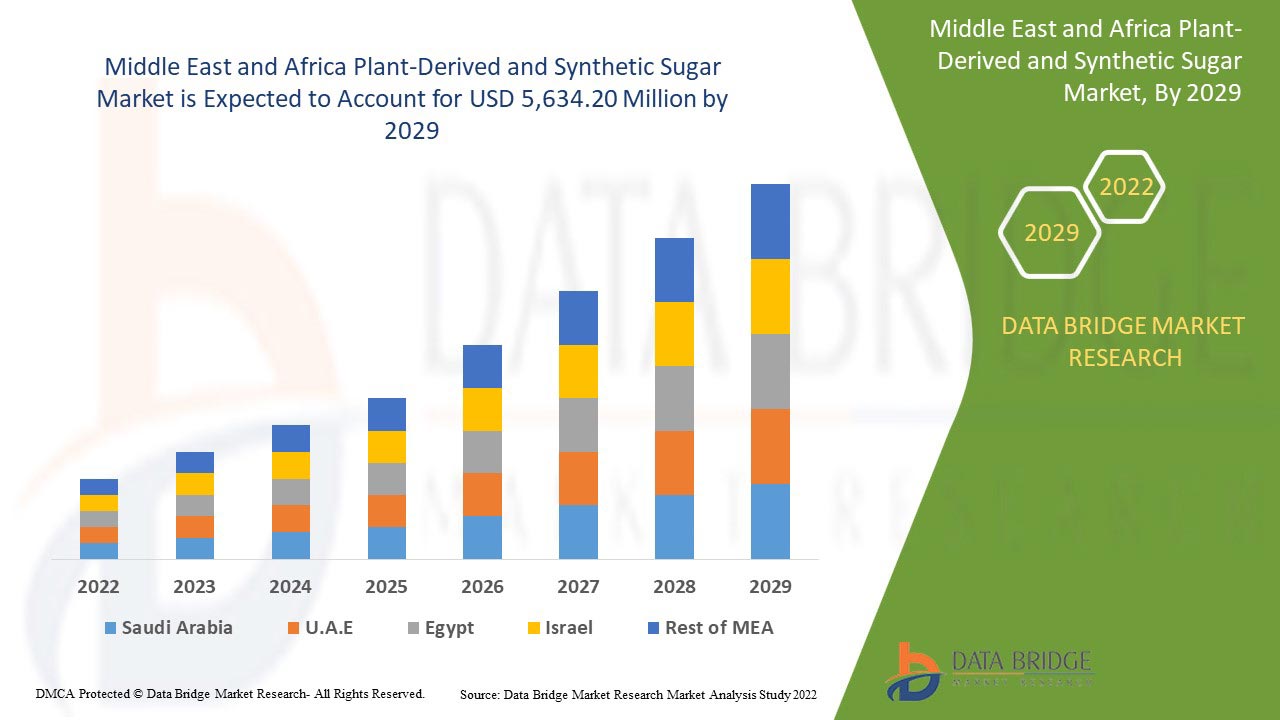

A Data Bridge Market Research analisa que o mercado de açúcar sintético e derivado de plantas do Médio Oriente e África deverá atingir um valor de 5.634,20 milhões de dólares até 2029, com um CAGR de 2,8% durante o período previsto.

|

Métrica de Reporte |

Detalhes |

|

Período de previsão |

2022 a 2029 |

|

Ano base |

2021 |

|

Ano Histórico |

2020 (Personalizável para 2019 - 2015) |

|

Unidades quantitativas |

Receita em milhões de dólares americanos, preço em dólares americanos |

|

Segmentos abrangidos |

Por tipo (açúcar derivado de plantas e açúcar sintético ), forma (seco e líquido), aplicação (alimentos e bebidas, suplementos alimentares , produtos farmacêuticos, nutrição desportiva e outros) |

|

Países abrangidos |

África do Sul, Emirados Árabes Unidos. Arábia Saudita, Kuwait, Omã, Qatar, Resto do Médio Oriente e África. |

|

Atores do mercado abrangidos |

ADM, Cargill, Incorporated, Ingredion, Ajinomoto Co., Inc., DuPont, NOW Foods, Tate & Lyle, Hermes Sweeteners Ltd., Südzucker AG, Layn Corp. |

Definição de Mercado

O açúcar de origem vegetal e sintético são produtos utilizados para adoçar. O açúcar derivado de plantas é definido como o açúcar que é retirado diretamente de uma fonte vegetal e vendido aos consumidores sem alterações. Os açúcares sintéticos, por outro lado, são produzidos indiretamente a partir de uma fonte separada de açúcar. Alguns açúcares derivados de plantas, incluindo a stévia , o xilitol, o eritritol, o xarope de yacon e outros, são substitutos adequados do açúcar para reduzir o risco de contrair diferentes doenças causadas pelo açúcar. Além disso, os consumidores de todo o mundo estão a favorecer uma dieta saudável e a evitar produtos açucarados, ricos em calorias e associados a doenças cardíacas. Devido à crescente popularidade dos produtos de origem vegetal, o açúcar vegetal está a receber cada vez mais atenção. No entanto, o elevado preço de ambos os açúcares em comparação com o açúcar comum está entre os fatores restritivos do mercado do açúcar derivado de plantas e sintético.

Dinâmica do mercado do açúcar sintético e derivado de plantas

Esta secção trata da compreensão dos impulsionadores, vantagens, oportunidades, restrições e desafios do mercado. Tudo isto é discutido em detalhe abaixo:

Motorista:

- Aumento da procura por ingredientes alimentares saudáveis no setor alimentar e das bebidas

Muitas pessoas preferem incluir ingredientes naturais na dieta diária. Os ingredientes naturais estão a tornar-se cada vez mais importantes no setor alimentar e das bebidas, e os consumidores e produtores estão a recorrer a eles. Consequentemente, a utilização de ingredientes naturais no sector alimentar e das bebidas está a aumentar a procura de açúcar de origem vegetal. Os clientes procuram uma alternativa saudável ao açúcar. Existem várias alternativas de açúcar de origem vegetal no mercado, incluindo stévia, xarope de yacon, xilitol, eritritol, açúcar de coco e xarope de ácer. A stévia é uma boa opção para os doentes diabéticos que preferem substitutos do açúcar sem calorias. Como a stévia não contém calorias e não tem consequências adversas para a saúde, a sua procura está a aumentar. O xilitol, derivado do milho e também presente em muitas frutas e legumes, é outro açúcar de origem vegetal.

RESTRIÇÃO

- ALTOS CUSTOS DO AÇÚCAR DERIVADO DE PLANTAS E DO AÇÚCAR SINTÉTICO

Comparado com o açúcar comum, o custo dos açúcares derivados de plantas e sintéticos é excecionalmente elevado. Este elevado custo resulta do elevado custo das matérias-primas e dos métodos de produção utilizados para criar açúcares naturais e artificiais. Os açúcares derivados de plantas e sintéticos são muito afetados pelas alterações nos custos das matérias-primas; por isso, as empresas continuam a praticar preços que maximizam os seus lucros.

Assim sendo, prevê-se que a enorme diferença de preço entre os produtos de açúcar sintético e de origem vegetal e os produtos de açúcar tradicionais deverá dificultar a expansão do mercado.

OPORTUNIDADE

- EXPANSÃO E LANÇAMENTO DE NOVOS PRODUTOS NESTE SETOR

Como alternativa ao açúcar, os adoçantes artificiais estão a tornar-se cada vez mais comuns. A prevalência de obesidade, diabetes e síndrome metabólica aumentou. Isto, combinado com o aumento do conhecimento do consumidor, resultou numa mudança contínua de paradigma a favor dos adoçantes artificiais com poucas calorias. Estes adoçantes artificiais, adoçantes não nutritivos (ANN), adoçantes de baixas calorias e adoçantes intensos proporcionam mais doçura por grama, mas têm zero ou poucas calorias. São utilizados em bebidas, suplementos nutricionais, medicamentos e elixires bucais. São utilizados por pessoas obesas e magras, diabéticos e não diabéticos, adultos e crianças, e a sua utilização geral é o resultado de um marketing intensivo e de uma maior consciencialização sobre a saúde. Oferecem mais opções alimentares para quem deseja reduzir a ingestão de calorias e aumentar a palatabilidade da dieta. Devido à crescente aplicabilidade destes adoçantes artificiais, as empresas estão a lançar muito mais produtos novos e a desenvolver ou expandir a empresa.

DESAFIO

- Restrições e regulamentos rigorosos impostos pelo governo

Os consumidores estão cada vez mais inclinados para alimentos saudáveis, e a natureza preocupada com a saúde aumentou significativamente a utilização de produtos sem adição de açúcar e adoçantes. O governo estabeleceu regras e ações específicas para reduzir o consumo de açúcar através de impostos seletivos, reformulações e rótulos de embalagens. O governo tem monitorizado continuamente a situação no sector do açúcar, incluindo a produção, o consumo, a exportação e as tendências dos preços do açúcar nos mercados grossista e retalhista em todo o país.

Embora os produtos aprovados pela Food and Drug Administration (FDA) sejam considerados seguros, existem desvantagens questionáveis para a saúde associadas aos adoçantes artificiais e não nutritivos. No caso dos adoçantes naturais, o consumo excessivo pode levar a problemas de saúde, como cáries e má nutrição.

Impacto pós-COVID-19 no mercado de açúcar sintético e derivado de plantas do Médio Oriente e África

A pandemia da COVID-19 afetou significativamente o mercado do açúcar derivado de plantas e do açúcar sintético do Médio Oriente e de África. A persistência da COVID-19 durante um período mais longo afetou a cadeia de abastecimento, uma vez que foi interrompida e tornou-se difícil fornecer os produtos aos consumidores, diminuindo inicialmente a procura dos produtos. Entretanto, após a COVID, a procura pelos produtos aumentou significativamente.

Desta forma, a recuperação da pandemia da COVID-19 em todas as regiões está a aumentar a procura do produto no mercado.

Desenvolvimentos recentes

- Em fevereiro de 2022, a IFF irá adquirir os produtos da Health Wright. A HWP é líder em saúde e nutrição do consumidor no Médio Oriente e em África, fornecendo suplementos nutricionais da mais alta qualidade. A aquisição trará recursos de formulação e formato final aos negócios de probióticos, extratos naturais e produtos botânicos de Saúde e Biociências da IFF, permitindo a inovação em formulações personalizadas e produtos combinados através de recursos conjuntos.

- In May 2022, Suduzeker subsidiary Beneo acquired a company named meatless BV With the acquisition, BENEO is expanding its existing product portfolio to offer an even more comprehensive range of texturizing solutions for meat and fish alternatives and leading to the growth of the market in the food região.

Âmbito do mercado do açúcar sintético e derivado de plantas no Médio Oriente e em África

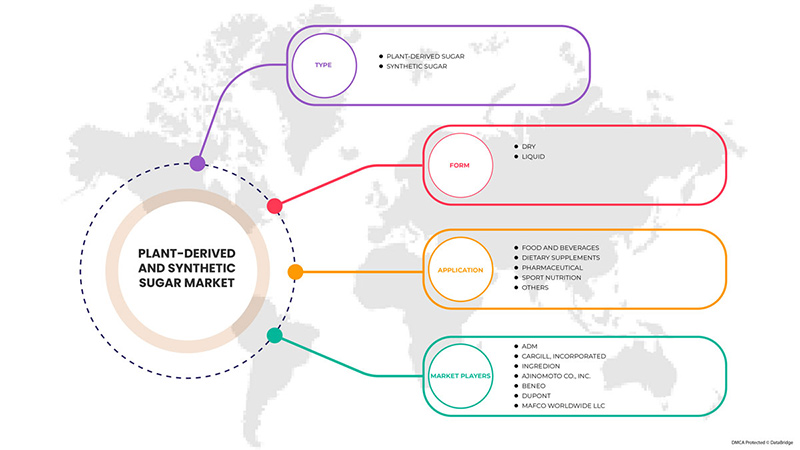

O mercado do açúcar sintético e derivado de plantas do Médio Oriente e de África está segmentado em três segmentos notáveis com base no tipo, aplicação e forma. O crescimento entre estes segmentos irá ajudá-lo a analisar os principais segmentos de crescimento nos setores e fornecerá aos utilizadores uma visão geral e informações valiosas do mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Tipo

- Açúcar de origem vegetal

- Açúcar sintético

Com base no tipo, o mercado de açúcar derivado de plantas e sintético do Médio Oriente e África está segmentado em açúcar derivado de plantas e açúcar sintético.

Aplicação

- Alimentos e Bebidas

- Suplementos alimentares

- Farmacêutico

- Nutrição Desportiva

- Outros

Com base na aplicação, o mercado do açúcar sintético e derivado de plantas do Médio Oriente e de África está segmentado em alimentos e bebidas, suplementos alimentares, produtos farmacêuticos, nutrição desportiva e outros.

Forma

- Seco

- Líquido

Com base na forma, o mercado do açúcar sintético e derivado de plantas do Médio Oriente e de África está segmentado em seco e líquido.

Análise regional/perspetivas do mercado de açúcar sintético e derivado de plantas

O mercado do açúcar derivado de plantas e sintético é analisado, e o país fornece informações sobre o tamanho do mercado e as tendências sobre o tipo, aplicação e forma, conforme referenciado acima.

Os países abrangidos pelo relatório de mercado do açúcar sintético e derivado de plantas do Médio Oriente e África são a África do Sul, os Emirados Árabes Unidos, a Arábia Saudita, o Kuwait, o Omã, o Qatar e o resto do Médio Oriente e África.

A África do Sul domina os mercados de açúcar sintético e derivado de plantas no Médio Oriente e em África. A África do Sul é o maior mercado para o açúcar derivado de plantas e sintético. As expiações nos canais de retalho e distribuição online ajudarão a alcançar a elevada procura mundial, que é a principal razão para o crescimento dos mercados de açúcar derivado de plantas e sintético na África do Sul. No entanto, o elevado custo de matérias-primas excelentes restringe provavelmente o crescimento do mercado.

A secção de países do relatório também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado que impactam as tendências atuais e futuras do mercado. Pontos de dados como a análise da cadeia de valor a montante e a jusante, tendências técnicas, análise das cinco forças de Porter e estudos de caso são alguns indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade de marcas do Médio Oriente e de África e os seus desafios enfrentados devido à concorrência significativa ou escassa de marcas locais e nacionais, o impacto das tarifas domésticas e das rotas comerciais são considerados ao fornecer uma análise de previsão dos dados do país.

Análise do cenário competitivo e da quota de mercado do açúcar derivado de plantas e sintético

O panorama competitivo do mercado do açúcar derivado de plantas e sintético fornece detalhes dos concorrentes. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença no Médio Oriente e África, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento do produto, amplitude do produto e amplitude e domínio da aplicação. Os pontos de dados acima estão apenas relacionados com as empresas focadas no mercado do açúcar derivado de plantas e sintético.

Alguns dos principais participantes que operam no mercado do açúcar derivado de plantas e sintético são a ADM, Cargill, Incorporated, Ingredion, Ajinomoto Co., Inc., DuPont, NOW Foods, Tate & Lyle, Hermes Sweeteners Ltd., Südzucker AG e Layn Corp .

Metodologia de Investigação: Mercado de Açúcar Sintético e Derivado de Plantas no Médio Oriente e África

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com grandes tamanhos de amostra. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear todos os dados adquiridos do avanço passado. Envolve também o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise de tendências críticas são os principais fatores de sucesso no relatório de mercado. Solicite uma chamada de analista ou envie o seu pedido para saber mais.

A metodologia de investigação fundamental utilizada pela equipa de investigação do DBMR é a triangulação de dados, que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha do tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, Médio Oriente e África versus região e análise da participação dos fornecedores. Para saber mais sobre a metodologia do inquérito, envie um pedido para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos atuais e novos clientes com dados e análises que correspondem e são adequados aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado de países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado recondicionado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser feita desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em ficheiros Excel brutos, tabelas dinâmicas (Factbook) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 FACTORS INFLUENCING THE PURCHASE DECISION

4.2 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.3 IMPORT-EXPORT ANALYSIS

4.3.1 IMPORT-EXPORT ANALYSIS- MIDDLE EAST & AFRICA PLANT BASED SUGAR MARKET

4.3.2 IMPORT-EXPORT ANALYSIS- MIDDLE EAST & AFRICA SYNTHETIC SUGAR MARKET

4.4 INDUSTRY TRENDS FOR MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET

4.4.1 INDUSTRY TRENDS

4.4.1.1 DEMAND FOR SYNTHETIC SUGAR

4.4.1.2 GROWING POPULARITY OF PLANT DERIVED SUGAR

4.4.2 FUTURE PERSPECTIVE

4.5 NEW PRODUCT LAUNCH STRATEGY

4.5.1 PROMOTING BY EMPHASIZING THEIR HEALTH BENEFITS

4.5.2 WEIGHT MANAGEMENT

4.5.3 LAUNCHING ORGANIC PRODUCTS

4.5.4 CONCLUSION

4.6 PRODUCTION AND CONSUMPTION

4.7 TECHNOLOGICAL ADVANCEMENT IN THE PLANT-DERIVED AND SYNTHETIC SUGAR MARKET

5 POST-COVID IMPACT

5.1 AFTERMATH OF COVID-19

5.2 IMPACT ON DEMAND AND SUPPLY CHAIN

5.3 IMPACT ON PRICE

5.4 CONCLUSION

6 VALUE CHAIN ANALYSIS: MIDDLE EAST & AFRICA PLANT DERIVED SUGAR AND SYNTHETIC SUGAR MARKET

7 REGULATORY FRAMEWORK AND GUIDELINES

7.1 ASIAN REGION

7.2 NORTH AMERICA

7.3 EUROPE

8 SUPPLY CHAIN OF MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET

8.1 SUPPLY CHAIN OF PLANT-DERIVED SUGAR

8.1.1 RAW MATERIAL PROCUREMENT

8.1.2 PREPARATION OF SUGAR IN SUGAR MILLS

8.1.3 MARKETING AND DISTRIBUTION

8.1.4 END USERS

8.2 SUPPLY CHAIN OF SYNTHETIC SUGAR

8.2.1 RAW MATERIAL PROCUREMENT

8.2.2 PREPARATION OF SYNTHETIC SUGAR IN THE LAB

8.2.3 MARKETING AND DISTRIBUTION

8.2.4 END USERS

9 MARKET OVERVIEW

9.1 DRIVERS

9.1.1 RISE IN THE DEMAND FOR HEALTHY FOOD INGREDIENTS IN THE FOOD AND BEVERAGE SECTOR

9.1.2 WIDE APPLICATION OF PLANT-DERIVED AND SYNTHETIC SUGAR IN VARIOUS MIDDLE EAST & AFRICA INDUSTRIES

9.1.3 GROWTH IN THE DEMAND FOR NATURAL SWEETENERS AS A SAFER ALTERNATIVE TO ARTIFICIAL SWEETENERS

9.1.4 GROWTH IN THE CONSUMER DEMAND FOR IN CONFECTIONERY PRODUCTS

9.1.5 RISE IN THE HEALTH BENEFITS ASSOCIATED WITH SYNTHETIC SUGAR

9.2 RESTRAINTS

9.2.1 HIGH COSTS OF PLANT-DERIVED AND SYNTHETIC SUGAR

9.2.2 ARTIFICIAL SWEETENERS' ADOPTION IS BEING HAMPERED BY THE GROWING UNCERTAINTY AROUND THEIR SAFETY IN NUMEROUS FOOD PRODUCTS.

9.2.3 GROWTH HEALTH PROBLEMS DUE TO HIGH SUGAR INTAKE

9.2.4 AVAILABILITY OF SUBSTITUTE FOR PLANT-DERIVED AND SYNTHETIC SUGARS

9.3 OPPORTUNITIES

9.3.1 EXPANSION AND NEW PRODUCT LAUNCHES IN THIS INDUSTRY

9.3.2 INCREASE IN THE HEALTH-CONSCIOUSNESS AMONG MIDDLE EAST & AFRICA CONSUMERS

9.3.3 CHANGES IN LIFESTYLE AND DEMOGRAPHICS TO ENCOURAGE VARIOUS EATING HABITS

9.3.4 CONSUMERS SHIFTING PREFERENCE TOWARD LOW-SUGAR DRINKS

9.4 CHALLENGES

9.4.1 IMPACT OF COVID-19 ON THE SUPPLY CHAIN OF FINAL PRODUCTS AND RAW MATERIAL

9.4.2 GOVERNMENT- IMPOSED STRICT RESTRICTIONS AND REGULATIONS

9.4.3 PRODUCT LABELING AND TRADE ISSUES

9.4.4 INADEQUATE RAW MATERIAL AVAILABILITY

10 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE

10.1 OVERVIEW

10.2 PLANT-DERIVED SUGAR

10.2.1 PLANT DERIVED SUGAR, BY TYPE

10.2.1.1 CANE SUGAR

10.2.1.2 SUGAR BEET SUGAR

10.2.1.3 STEVIA

10.2.1.4 MONK FRUIT SWEETENER

10.2.1.5 COCONUT SUGAR

10.2.1.6 MAPLE SUGAR

10.2.1.7 MOLASSES SUGAR

10.2.1.8 BROWN RICE SUGAR

10.2.1.9 MALTITOL

10.2.1.10 ALLULOSE

10.2.1.11 ERYTHRITOL

10.2.1.12 XYLITOL

10.2.1.13 OTHERS

10.2.2 PLANT DERIVED SUGAR, BY CATEGORY

10.2.2.1 CONVENTIONAL SUGAR

10.2.2.2 ORGANIC SUGAR

10.3 SYNTHETIC SUGAR

10.3.1 SYNTHETIC SUGAR, BY TYPE

10.3.1.1 ASPARTAME

10.3.1.2 SACCHARINE

10.3.1.3 ACE-K

10.3.1.4 CYCLAMATE

10.3.1.5 SUCROLOSE

10.3.1.6 GLYCYRRHIZIN

10.3.1.7 ALITAME

10.3.1.8 ADVANTAME

10.3.1.9 NEOTAME

10.3.1.10 OTHERS

11 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY FORM

11.1 OVERVIEW

11.2 DRY

11.2.1 DRY, BY TYPE

11.2.1.1 POWDER

11.2.1.2 CRYSTAL

11.2.1.3 CRYSTALIZED POWDER

11.3 LIQUID

12 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FOOD AND BEVERAGE

12.2.1 FOOD & BEVERAGE, BY TYPE

12.2.1.1 TABLE TOP SUGAR

12.2.1.2 BEVERAGES

12.2.1.2.1 DAIRY BASED DRINKS

12.2.1.2.1.1 REGULAR

12.2.1.2.1.2 PROCESSED MILK

12.2.1.2.1.3 MILK SHAKES

12.2.1.2.1.4 FLAVORED MILK

12.2.1.2.2 JUICES

12.2.1.2.3 SMOOTHIES

12.2.1.2.4 PLANT BASED MILK

12.2.1.2.5 ENERGY DRINKS

12.2.1.2.6 SPORTS DRINKS

12.2.1.2.7 OTHERS

12.2.1.3 FROZEN DESSERTS

12.2.1.3.1 GELATO

12.2.1.3.2 CUSTARD

12.2.1.3.3 OTHERS

12.2.1.4 PROCESSED FOOD

12.2.1.4.1 READY MEALS

12.2.1.4.2 JAMS, PRESERVES & MARMALADES

12.2.1.4.3 SAUCES, DRESSINGS & CONDIMENTS

12.2.1.4.4 SOUPS

12.2.1.4.5 OTHERS

12.2.1.5 CONVENIENCE FOOD

12.2.1.5.1 INSTANT NOODLES

12.2.1.5.2 PIZZA & PASTA

12.2.1.5.3 SNACKS & EXTRUDED SNACKS

12.2.1.5.4 OTHERS

12.2.1.6 CONFECTIONERY

12.2.1.6.1 HARD-BOILED SWEETS

12.2.1.6.2 MINTS

12.2.1.6.3 GUMS & JELLIES

12.2.1.6.4 CHOCOLATE

12.2.1.6.5 CHOCOLATE SYRUPS

12.2.1.6.6 CARAMELS & TOFFEES

12.2.1.6.7 OTHERS

12.2.1.7 BAKERY

12.2.1.7.1 BREAD & ROLLS

12.2.1.7.2 CAKES, PASTRIES & TRUFFLE

12.2.1.7.3 BISCUIT, COOKIES & CRACKERS

12.2.1.7.4 BROWNIES

12.2.1.7.5 TART & PIES

12.2.1.7.6 OTHERS

12.2.1.8 DAIRY PRODUCTS

12.2.1.8.1 YOGURT

12.2.1.8.2 ICE CREAM

12.2.1.8.3 CHEESE

12.2.1.8.4 OTHERS

12.2.1.9 BREAKFAST CEREAL

12.2.1.10 INFANT FORMULA

12.2.1.10.1 FIRST INFANT FORMULA

12.2.1.10.2 ANTI-REFLUX (STAY DOWN) FORMULA

12.2.1.10.3 COMFORT FORMULA

12.2.1.10.4 HYPOALLERGENIC FORMULA

12.2.1.10.5 FOLLOW-ON FORMULA

12.2.1.10.6 OTHERS

12.2.1.11 NUTRITIONAL BARS

12.2.1.12 FUNCTIONAL FOOD

12.2.2 FOOD & BEVERAGE, BY SWEETENER TYPE

12.2.2.1 PLANT-DERIVED SUGAR

12.2.2.2 SYNTHETIC SUGAR

12.3 DIETARY SUPPLEMENTS

12.3.1 DIETARY SUPPLEMENTS, BY TYPE

12.3.1.1 IMMUNITY SUPPLEMENTS

12.3.1.2 OVERALL WELLBEING SUPPLEMENTS

12.3.1.3 SKIN HEALTH SUPPLEMENTS

12.3.1.4 BONE AND JOINT HEALTH SUPPLEMENTS

12.3.1.5 BRAIN HEALTH SUPPLEMENTS

12.3.1.6 OTHERS

12.3.2 DIETARY SUPPLEMENTS, BY SWEETENER TYPE

12.3.2.1 PLANT-DERIVED SUGAR

12.3.2.2 SYNTHETIC SUGAR

12.4 PHARMACEUTICAL

12.4.1 PHARMACEUTICAL, BY TYPE

12.4.1.1 TABLETS

12.4.1.2 CAPSULES

12.4.1.3 OTHERS

12.4.2 PHARMACEUTICAL, BY SWEETENER TYPE

12.4.2.1 PLANT-DERIVED SUGAR

12.4.2.2 SYNTHETIC SUGAR

12.5 SPORTS NUTRITION

12.5.1 SPORTS NUTRITION, BY TYPE

12.5.1.1 PROTEIN POWDERS

12.5.1.2 SPORTS NUTRITION BARS

12.5.1.3 SPORT DRINK MIXES

12.5.1.4 ENERGY GELS

12.5.1.5 OTHERS

12.5.2 SPORTS NUTRITION, BY SWEETENER TYPE

12.5.2.1 PLANT-DERIVED SUGAR

12.5.2.2 SYNTHETIC SUGAR

12.6 OTHERS

12.6.1 OTHERS, BY SWEETENER TYPE

12.6.1.1 PLANT-DERIVED SUGAR

12.6.1.2 SYNTHETIC SUGAR

13 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY REGION

13.1 MIDDLE EAST AND AFRICA

13.1.1 SOUTH AFRICA

13.1.2 UNITED ARAB EMIRATES

13.1.3 SAUDI ARABIA

13.1.4 KUWAIT

13.1.5 OMAN

13.1.6 QATAR

13.1.7 REST OF MIDDLE EAST & AFRICA

14 COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 ADM

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 SUDZUKER AG

16.2.1 COMPANY SNAPSHOT

16.2.2 RECENT FINANCIALS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 CARGILL, INCORPORATED

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 INGREDION INCORPORATED

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 WILMAR INTERNATIONAL LTD

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 AJINOMOTO CO., INC

16.6.1 COMPANY SNAPSHOT

16.6.2 RECENT FINANCIALS

16.6.3 COMPANY SHARE ANALYSIS

16.6.4 PRODUCT PORTFOLIO

16.6.5 RECENT DEVELOPMENTS

16.7 BENEO

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 CELANESE CORPORATION

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENT

16.9 DUPONT

16.9.1 COMPANY SNAPSHOT

16.9.2 RECENT FINANCIALS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 GRUPO PSA

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 HERMES SWEETENERS LTD.

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 HSWT

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 JK SUCRALOSE INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 LAYN CORP

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 MAFCO WORLDWIDE LLC.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 NOW FOODS

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 NUTRASWEETM CO

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 PYURE BRANDS LLC.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 ROQUETTE FRÈRES.

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 TATE&LYLE

16.20.1 COMPANY SNAPSHOT

16.20.2 RECENT FINANCIALS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tabela

TABLE 1 TOP IMPORT OF PLANT BASED SUGAR, 2020-2021, IN TONS

TABLE 2 TOP EXPORT OF PLANT BASED SUGAR, 2020-2021, IN TONS

TABLE 3 TOP IMPORT OF SYNTHETIC SUGAR, 2020-2021, IN TONS

TABLE 4 TOP EXPORT OF SYNTHETIC SUGAR, 2020-2021, IN TONS

TABLE 5 PRODUCTION OF SUGAR IN 2021/2022

TABLE 6 CONSUMPTION OF SUGAR IN 2021/2022

TABLE 7 PRICES OF PLANT-DERIVED SUGAR:

TABLE 8 PRICES OF SYNTHETIC SUGAR:

TABLE 9 PRICES OF REGULAR SUGAR:

TABLE 10 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA SYNTHETIC SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA SYNTHETIC SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA DRY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA DRY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE , 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA LIQUID IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA FOOD & BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA FOOD & BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA BEVERAGES PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA DAIRY BASED DRINKS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA FROZEN DESSERTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA PROCESSED FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA CONVENIENCE FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA CONFECTIONERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA BAKERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA DAIRY PRODUCTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA INFANT FORMULA IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA FOOD & BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA OTHERS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA OTHERS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, 2020-2029

TABLE 45 MIDDLE EAST AND AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST AND AFRICA PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA SYNTHETIC SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST AND AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA DRY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 MIDDLE EAST AND AFRICA FOOD & BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 54 MIDDLE EAST AND AFRICA BAKERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 55 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 MIDDLE EAST AND AFRICA PROCESSED FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 MIDDLE EAST AND AFRICA CONFECTIONERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 MIDDLE EAST AND AFRICA FROZEN DESSERTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 59 MIDDLE EAST AND AFRICA INFANT FORMULA IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 60 MIDDLE EAST AND AFRICA CONVENIENCE FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 MIDDLE EAST AND AFRICA BEVERAGES PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 MIDDLE EAST AND AFRICA DAIRY BASED DRINKS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 MIDDLE EAST AND AFRICA FOOD AND BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 64 MIDDLE EAST AND AFRICA DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 65 MIDDLE EAST AND AFRICA DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 66 MIDDLE EAST AND AFRICA PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 67 MIDDLE EAST AND AFRICA PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 68 MIDDLE EAST AND AFRICA SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 69 MIDDLE EAST AND AFRICA SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 70 MIDDLE EAST AND AFRICA OTHERS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 71 SOUTH AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, 2020-2029

TABLE 72 SOUTH AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 SOUTH AFRICA PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 74 SOUTH AFRICA PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 75 SOUTH AFRICA SYNTHETIC SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 76 SOUTH AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 77 SOUTH AFRICA DRY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 SOUTH AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 79 SOUTH AFRICA FOOD & BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 80 SOUTH AFRICA BAKERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 81 SOUTH AFRICA DAIRY PRODUCTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 SOUTH AFRICA PROCESSED FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 SOUTH AFRICA CONFECTIONERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 SOUTH AFRICA FROZEN DESSERTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 85 SOUTH AFRICA INFANT FORMULA IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 86 SOUTH AFRICA CONVENIENCE FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 SOUTH AFRICA BEVERAGES PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 SOUTH AFRICA DAIRY BASED DRINKS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 SOUTH AFRICA FOOD AND BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 90 SOUTH AFRICA DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 91 SOUTH AFRICA DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 92 SOUTH AFRICA PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 93 SOUTH AFRICA PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 94 SOUTH AFRICA SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 95 SOUTH AFRICA SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 96 SOUTH AFRICA OTHERS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 97 UNITED ARAB EMIRATES PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, 2020-2029

TABLE 98 UNITED ARAB EMIRATES PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 UNITED ARAB EMIRATES PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 100 UNITED ARAB EMIRATES PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 101 UNITED ARAB EMIRATES SYNTHETIC SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 102 UNITED ARAB EMIRATES PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 103 UNITED ARAB EMIRATES DRY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 UNITED ARAB EMIRATES PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 105 UNITED ARAB EMIRATES FOOD & BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 106 UNITED ARAB EMIRATES BAKERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 107 UNITED ARAB EMIRATES DAIRY PRODUCTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 UNITED ARAB EMIRATES PROCESSED FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 UNITED ARAB EMIRATES CONFECTIONERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 UNITED ARAB EMIRATES FROZEN DESSERTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 111 UNITED ARAB EMIRATES INFANT FORMULA IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 112 UNITED ARAB EMIRATES CONVENIENCE FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 UNITED ARAB EMIRATES BEVERAGES PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 UNITED ARAB EMIRATES DAIRY BASED DRINKS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 UNITED ARAB EMIRATES FOOD AND BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 116 UNITED ARAB EMIRATES DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 117 UNITED ARAB EMIRATES DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 118 UNITED ARAB EMIRATES PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 119 UNITED ARAB EMIRATES PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 120 UNITED ARAB EMIRATES SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 121 UNITED ARAB EMIRATES SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 122 UNITED ARAB EMIRATES OTHERS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 123 SAUDI ARABIA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, 2020-2029

TABLE 124 SAUDI ARABIA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 SAUDI ARABIA PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 126 SAUDI ARABIA PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 127 SAUDI ARABIA SYNTHETIC SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 128 SAUDI ARABIA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 129 SAUDI ARABIA DRY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 SAUDI ARABIA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 131 SAUDI ARABIA FOOD & BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 132 SAUDI ARABIA BAKERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 133 SAUDI ARABIA DAIRY PRODUCTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 SAUDI ARABIA PROCESSED FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 SAUDI ARABIA CONFECTIONERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 SAUDI ARABIA FROZEN DESSERTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 137 SAUDI ARABIA INFANT FORMULA IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 138 SAUDI ARABIA CONVENIENCE FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 SAUDI ARABIA BEVERAGES PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 SAUDI ARABIA DAIRY BASED DRINKS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 SAUDI ARABIA FOOD AND BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 142 SAUDI ARABIA DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 143 SAUDI ARABIA DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 144 SAUDI ARABIA PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 145 SAUDI ARABIA PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 146 SAUDI ARABIA SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 147 SAUDI ARABIA SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 148 SAUDI ARABIA OTHERS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 149 KUWAIT PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, 2020-2029

TABLE 150 KUWAIT PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 KUWAIT PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 152 KUWAIT PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 153 KUWAIT SYNTHETIC SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 154 KUWAIT PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 155 KUWAIT DRY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 KUWAIT PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 157 KUWAIT FOOD & BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 158 KUWAIT BAKERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 159 KUWAIT DAIRY PRODUCTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 KUWAIT PROCESSED FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 161 KUWAIT CONFECTIONERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 KUWAIT FROZEN DESSERTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 163 KUWAIT INFANT FORMULA IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 164 KUWAIT CONVENIENCE FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 165 KUWAIT BEVERAGES PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 KUWAIT DAIRY BASED DRINKS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 KUWAIT FOOD AND BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 168 KUWAIT DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 169 KUWAIT DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 170 KUWAIT PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 171 KUWAIT PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 172 KUWAIT SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 173 KUWAIT SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 174 KUWAIT OTHERS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 175 OMAN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, 2020-2029

TABLE 176 OMAN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 177 OMAN PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 178 OMAN PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 179 OMAN SYNTHETIC SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 180 OMAN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 181 OMAN DRY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 182 OMAN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 183 OMAN FOOD & BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 184 OMAN BAKERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 185 OMAN DAIRY PRODUCTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 186 OMAN PROCESSED FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 187 OMAN CONFECTIONERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 188 OMAN FROZEN DESSERTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 189 OMAN INFANT FORMULA IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 190 OMAN CONVENIENCE FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 OMAN BEVERAGES PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 192 OMAN DAIRY BASED DRINKS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 193 OMAN FOOD AND BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 194 OMAN DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 195 OMAN DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 196 OMAN PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 197 OMAN PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 198 OMAN SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 199 OMAN SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 200 OMAN OTHERS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 201 QATAR PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, 2020-2029

TABLE 202 QATAR PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 203 QATAR PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 204 QATAR PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 205 QATAR SYNTHETIC SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 206 QATAR PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 207 QATAR DRY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 208 QATAR PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 209 QATAR FOOD & BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 210 QATAR BAKERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 211 QATAR DAIRY PRODUCTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 212 QATAR PROCESSED FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 213 QATAR CONFECTIONERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 214 QATAR FROZEN DESSERTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 215 QATAR INFANT FORMULA IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 216 QATAR CONVENIENCE FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 217 QATAR BEVERAGES PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 218 QATAR DAIRY BASED DRINKS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 219 QATAR FOOD AND BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 220 QATAR DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 221 QATAR DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 222 QATAR PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 223 QATAR PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 224 QATAR SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 225 QATAR SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 226 QATAR OTHERS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 227 REST OF MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, 2020-2029

TABLE 228 REST OF MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

Lista de Figura

FIGURE 1 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: MIDDLE EAST & AFRICA VS REGIONAL ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: DBMR POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: SEGMENTATION

FIGURE 10 THE HIGH DEMAND FOR HEALTHY FOOD INGREDIENTS IN FOOD AND BEVERAGE SECTOR IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 THE PLANT DERIVED SUGAR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 VALUE CHAIN OF PLANT DERIVED SUGAR AND SYNTHETIC SUGAR

FIGURE 13 SUPPLY CHAIN OF PLANT-DERIVED SUGAR

FIGURE 14 SUPPLY CHAIN OF SYNTHETIC SUGAR

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET

FIGURE 16 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2021

FIGURE 17 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY FORM, 2021

FIGURE 18 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET : BY APPLICATION, 2021

FIGURE 19 MIDDLE EAST AND AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: SNAPSHOT (2021)

FIGURE 20 MIDDLE EAST AND AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: BY COUNTRY (2021)

FIGURE 21 MIDDLE EAST AND AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: BY COUNTRY (2022 & 2029)

FIGURE 22 MIDDLE EAST AND AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: BY COUNTRY (2021 & 2029)

FIGURE 23 MIDDLE EAST AND AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: BY PRODUCT TYPE (2021 - 2029)

FIGURE 24 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: COMPANY SHARE 2021 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.