Middle East And Africa Medical Device Warehouse And Logistics Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

192.40 Billion

USD

263.31 Billion

2024

2032

USD

192.40 Billion

USD

263.31 Billion

2024

2032

| 2025 –2032 | |

| USD 192.40 Billion | |

| USD 263.31 Billion | |

|

|

|

|

Segmentação do mercado de logística e depósito de dispositivos médicos no Oriente Médio e África, por ofertas (serviços, hardware e software), temperatura (ambiente, refrigerada, congelada e outras), modo de transporte (logística de frete marítimo, logística de frete aéreo e logística terrestre), aplicação (dispositivos de diagnóstico, dispositivos terapêuticos, dispositivos de monitoramento, dispositivos cirúrgicos e outros), uso final (hospitais e clínicas, empresas de dispositivos médicos, institutos acadêmicos e de pesquisa, laboratórios de referência e diagnóstico, empresas de serviços médicos de emergência e outros), canal de distribuição (logística convencional e terceirizada) - tendências e previsões do setor até 2032

Tamanho do mercado de logística e armazenamento de dispositivos médicos no Oriente Médio e na África

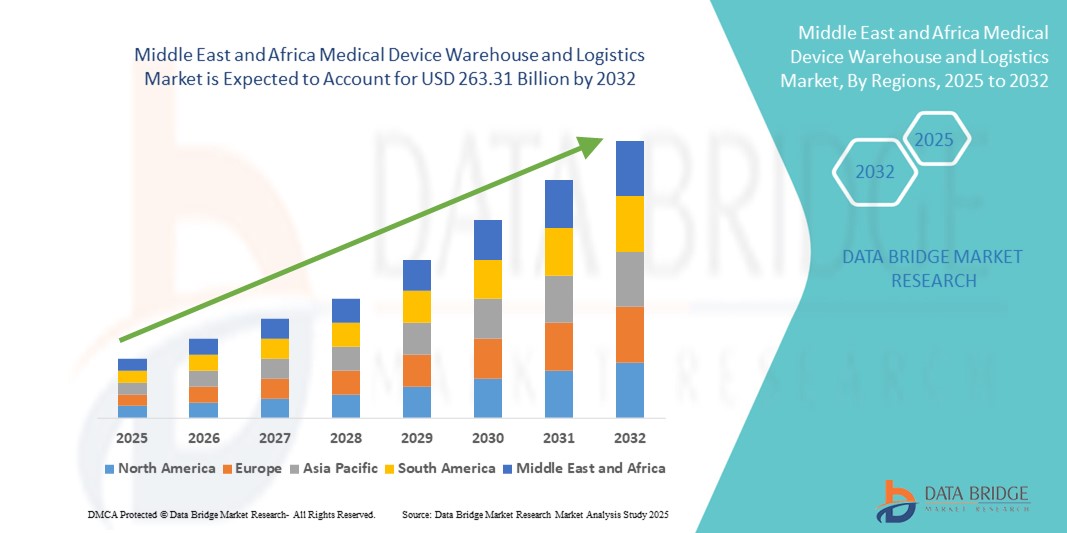

- O tamanho do mercado de armazenagem e logística de dispositivos médicos do Oriente Médio e da África foi avaliado em US$ 192,4 bilhões em 2024 e deve atingir US$ 263,31 bilhões até 2032 , com um CAGR de 4,00% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela expansão da infraestrutura de saúde e pelo aumento da demanda por sistemas eficientes de cadeia de suprimentos médicos no Oriente Médio e na África, impulsionado pela crescente prevalência de doenças crônicas, digitalização da saúde e pela crescente necessidade de distribuição oportuna de dispositivos médicos essenciais.

- Além disso, a crescente demanda de consumidores e instituições por soluções de armazenagem seguras, com temperatura controlada e tecnologicamente integradas está consolidando a logística especializada em dispositivos médicos como um pilar fundamental da prestação de serviços de saúde na região. Esses fatores convergentes estão acelerando a adoção de serviços avançados de armazenagem e logística para dispositivos médicos, impulsionando significativamente o crescimento do setor nos setores público e privado de saúde no Oriente Médio e na África.

Análise do Mercado de Armazéns e Logística de Dispositivos Médicos no Oriente Médio e África

- Os sistemas de armazenagem e logística de dispositivos médicos são cada vez mais essenciais para garantir a entrega pontual, segura e em conformidade de produtos de saúde em todo o Oriente Médio e África. Esses sistemas oferecem suporte a armazenamento com temperatura controlada, rastreamento em tempo real e distribuição eficiente, essenciais para dispositivos e equipamentos médicos que salvam vidas.

- A crescente demanda é impulsionada pelo crescente desenvolvimento da infraestrutura de saúde, pelo aumento da importação e exportação de tecnologias médicas e pelos rigorosos requisitos regulatórios para rastreabilidade da cadeia de suprimentos e gerenciamento da cadeia de frio.

- A Arábia Saudita dominou o mercado de logística e armazenamento de dispositivos médicos no Oriente Médio e na África, com uma participação de receita de 34,7% em 2024, apoiada pelas reformas de saúde da Visão 2030, investimentos massivos em cidades médicas e modernização da infraestrutura logística para dar suporte à distribuição centralizada de dispositivos médicos.

- Os Emirados Árabes Unidos estão projetados para serem o país de crescimento mais rápido no mercado de armazenamento e logística de dispositivos médicos, com expectativa de registrar um CAGR de 10,3% durante 2025–2032, impulsionado pela rápida transformação digital, aumento das importações de produtos farmacêuticos e dispositivos médicos e integração de armazéns inteligentes em centros como Dubai Healthcare City e KIZAD

- O segmento de logística terrestre dominou o mercado de armazenagem e logística de dispositivos médicos com uma participação de mercado de 51,4% em 2024, refletindo seu amplo uso em entregas de dispositivos médicos de curto a médio alcance em MEA, apoiado por uma extensa rede de transporte rodoviário que permite distribuição oportuna e econômica

Escopo do relatório e segmentação do mercado de logística e depósito de dispositivos médicos no Oriente Médio e na África

|

Atributos |

Insights sobre o mercado de logística e armazenamento de dispositivos médicos no Oriente Médio e na África |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de logística e armazenagem de dispositivos médicos no Oriente Médio e na África

“ Crescente integração de tecnologias inteligentes de logística e conformidade no mercado de armazenagem e logística de dispositivos médicos ”

- Uma tendência significativa que molda o mercado de armazenagem e logística de dispositivos médicos é o aumento da automação e das tecnologias de logística inteligente, projetadas para otimizar o armazenamento, o manuseio e a distribuição de dispositivos médicos de alto valor. Essas inovações estão melhorando a precisão, a rastreabilidade e a conformidade regulatória em um setor onde a precisão e a segurança são primordiais.

- Sistemas de gestão de estoque baseados em nuvem e sensores habilitados para IoT são cada vez mais utilizados para monitorar condições de armazenamento em tempo real, como temperatura, umidade e exposição a choques — especialmente críticos para dispositivos sensíveis de diagnóstico ou implantáveis. Essas tecnologias oferecem visibilidade de ponta a ponta e alertas oportunos, ajudando a reduzir a deterioração e as perdas.

- Grandes players nos EUA e Canadá estão integrando robótica e veículos guiados automatizados (AGVs) às operações de armazenagem para aumentar a eficiência e reduzir erros humanos na coleta e expedição de pedidos. Esses sistemas são particularmente benéficos para centros de distribuição de alto volume que lidam com uma gama diversificada e complexa de dispositivos.

- A otimização da cadeia fria também é uma área de foco importante. As empresas estão investindo em infraestrutura inteligente de armazenamento refrigerado com monitoramento remoto e sistemas de energia de reserva para proteger produtos sensíveis à temperatura, como implantes cirúrgicos, stents e dispositivos cardiovasculares.

- As colaborações entre provedores de logística e fabricantes de dispositivos médicos estão permitindo uma maior personalização das cadeias de suprimentos, com serviços de logística terceirizada (3PL) oferecendo soluções personalizadas de conformidade, embalagem e logística reversa.

- A conformidade regulatória continua sendo um impulsionador da transformação digital. Os requisitos de Identificação Única de Dispositivos (UDI) da FDA dos EUA e os regulamentos de dispositivos médicos da Health Canada incentivaram a adoção de ferramentas de serialização, rastreamento em tempo real e relatórios automatizados para aumentar a responsabilização em toda a cadeia de suprimentos.

- Essa crescente convergência de inovação logística, automação de conformidade e sistemas de rastreamento em tempo real está remodelando o cenário de armazenagem e distribuição de dispositivos médicos no Oriente Médio e na África, posicionando o mercado para um crescimento sustentado até 2032.

Dinâmica do mercado de logística e armazenamento de dispositivos médicos no Oriente Médio e na África

Motorista

“Crescente demanda devido à expansão da infraestrutura de saúde e às necessidades da cadeia de frio”

- O mercado de armazenagem e logística de dispositivos médicos no Oriente Médio e na África está experimentando um crescimento substancial devido ao aumento dos investimentos em infraestrutura de saúde, à crescente demanda por dispositivos médicos avançados e ao foco crescente em logística de dispositivos e produtos farmacêuticos sensíveis à temperatura.

- Por exemplo, em abril de 2024, a CEVA Logistics expandiu sua presença logística de saúde no Oriente Médio ao lançar uma nova instalação certificada pelas Boas Práticas de Distribuição (BPD) em Dubai, com o objetivo de fornecer serviços especializados para dispositivos médicos e produtos farmacêuticos.

- Com o rápido crescimento dos procedimentos diagnósticos e cirúrgicos na região, os provedores de logística estão se concentrando cada vez mais em soluções personalizadas de armazenamento e transporte que garantem a integridade, a segurança e a conformidade dos dispositivos.

- As iniciativas governamentais para melhorar o acesso aos cuidados de saúde, particularmente nos países do CCG e na África do Sul, estão a apoiar a expansão de sistemas de armazenagem centralizados e centros de distribuição de equipamento médico e consumíveis.

- O aumento de doenças crônicas e a importação crescente de dispositivos médicos de ponta levaram a uma maior necessidade de serviços de logística com temperatura controlada, especialmente nas categorias de temperatura ambiente, refrigerada e congelada, que estão se tornando essenciais para garantir a eficácia e a segurança dos produtos.

- Além disso, a crescente adoção de tecnologias digitais de saúde e sistemas de rastreamento inteligentes, como RFID e sensores baseados em IoT, está aumentando a transparência da cadeia de suprimentos e a eficiência operacional, impulsionando ainda mais o crescimento do mercado nos setores de saúde pública e privada.

Restrição/Desafio

“ Altos custos e lacunas de infraestrutura em regiões de baixa renda ”

- Apesar da forte procura, o mercado enfrenta desafios importantes, como infraestrutura logística limitada em vários países da África Subsaariana, ambientes regulatórios inconsistentes e altos custos operacionais associados à cadeia de frio e instalações de armazenamento seguras.

- Por exemplo, enquanto a África do Sul e os Emirados Árabes Unidos desenvolveram centros de armazenagem avançados, os países com infraestruturas menos maduras continuam a enfrentar problemas como fornecimento inconsistente de eletricidade, acesso limitado a soluções de transporte especializadas e redes de transporte fragmentadas.

- Os altos custos associados à criação de instalações de armazenamento refrigerado em conformidade com o GDP e à garantia do rastreamento de dispositivos de ponta a ponta são barreiras para os pequenos e médios operadores de logística

- Além disso, as regulamentações alfandegárias e de importação rigorosas em vários países da região muitas vezes levam a atrasos e ineficiências, afetando a entrega oportuna dos dispositivos e os resultados dos pacientes.

- Para superar essas restrições, parcerias público-privadas, incentivos logísticos apoiados pelo governo e colaborações internacionais são essenciais para padronizar processos e expandir o acesso à logística confiável de dispositivos médicos em áreas remotas e subdesenvolvidas da região.

Escopo do mercado de logística e armazenamento de dispositivos médicos no Oriente Médio e na África

O mercado é segmentado com base em ofertas, temperatura, modo de transporte, aplicação, uso final e canal de distribuição.

- Por Ofertas

Com base na oferta, o mercado de armazenagem e logística de dispositivos médicos no Oriente Médio e na África é segmentado em serviços, hardware e software. O segmento de hardware dominou o mercado, com a maior participação na receita de 42,8% em 2024, impulsionado pela crescente necessidade de soluções avançadas de armazenamento, infraestrutura de cadeia fria e sistemas de rastreamento RFID. Os componentes de hardware constituem a espinha dorsal de operações eficientes de armazenagem, apoiando o armazenamento e a movimentação de dispositivos médicos sob condições regulamentadas.

O segmento de software deverá testemunhar o CAGR mais rápido de 12,9% de 2025 a 2032, impulsionado pela crescente digitalização nas operações de logística, pela crescente demanda por sistemas de gerenciamento de armazém (WMS) baseados em nuvem e pela necessidade de visibilidade em tempo real e rastreamento de conformidade.

- Por temperatura

Com base na temperatura, o mercado de armazenagem e logística de dispositivos médicos do Oriente Médio e África é segmentado em temperatura ambiente, refrigerado/refrigerado, congelado e outros. O segmento de temperatura ambiente dominou o mercado, com uma participação de receita de 47,3% em 2024, devido ao alto volume de dispositivos médicos não sensíveis à temperatura, como instrumentos cirúrgicos e equipamentos de diagnóstico.

Espera-se que o segmento refrigerado/refrigerado testemunhe o crescimento mais rápido, projetado em um CAGR de 10,2% de 2025 a 2032, devido à crescente demanda por armazenamento com temperatura controlada de vacinas, reagentes de diagnóstico e dispositivos implantáveis.

- Por meio de transporte

Com base no modo de transporte, o mercado é segmentado em logística terrestre, logística de frete aéreo e logística de frete marítimo. O segmento de logística terrestre detinha a maior participação de mercado, 51,4% em 2024, impulsionado pelo amplo uso de redes de transporte rodoviário em toda a região do Oriente Médio e África (MEA) para entregas de dispositivos médicos de curta e média distância.

Espera-se que o segmento de logística de frete aéreo cresça a uma CAGR mais rápida, de 11,7%, entre 2025 e 2032, pois é cada vez mais usado para remessas de dispositivos urgentes e sensíveis à temperatura, principalmente em regiões remotas ou carentes.

- Por aplicação

Com base na aplicação, o mercado de armazenagem e logística de dispositivos médicos do Oriente Médio e África é segmentado em dispositivos de diagnóstico, dispositivos terapêuticos, dispositivos de monitoramento, dispositivos cirúrgicos e outros dispositivos. O segmento de dispositivos de diagnóstico representou a maior fatia da receita, 33,6% em 2024, impulsionado pelo aumento do volume de testes, especialmente após a COVID-19, e pela necessidade de armazenamento seguro de ferramentas de diagnóstico sensíveis.

Espera-se que o segmento de dispositivos de monitoramento cresça a uma CAGR mais rápida, de 10,5%, entre 2025 e 2032, apoiado pelo aumento na demanda por tecnologias de monitoramento remoto e vestíveis da saúde.

- Por uso final

Com base no uso final, o mercado é segmentado em hospitais e clínicas, empresas de dispositivos médicos, institutos acadêmicos e de pesquisa, laboratórios de referência e diagnóstico, empresas de serviços médicos de emergência e outros. O segmento de hospitais e clínicas detinha a maior participação de mercado, de 38,9% em 2024, devido às necessidades de aquisição em larga escala e à demanda constante por dispositivos médicos em ambientes clínicos.

O segmento de empresas de dispositivos médicos deverá testemunhar o CAGR mais rápido de 11,2% durante 2025 a 2032, à medida que mais fabricantes terceirizam operações de logística para fornecedores terceirizados para escalabilidade e eficiência de custos.

- Por canal de distribuição

Com base no canal de distribuição, o mercado de armazenagem e logística de dispositivos médicos do Oriente Médio e África é segmentado em logística convencional e logística terceirizada (3PL). O segmento de logística terceirizada (3PL) dominou, com uma participação de mercado de 62,4% em 2024, impulsionado pela tendência crescente de terceirização de operações logísticas, especialmente para dispositivos médicos sensíveis à temperatura e em conformidade com as regulamentações.

O segmento de logística convencional testemunhará o CAGR mais rápido de 2025 a 2032, amplamente utilizado por hospitais e instituições de saúde administradas pelo governo com capacidades logísticas internas.

Análise regional do mercado de armazenagem e logística de dispositivos médicos no Oriente Médio e na África

- O mercado de armazenagem e logística de dispositivos médicos do Oriente Médio e da África representou 8,4% da participação de mercado global em 2024 e deverá crescer a uma CAGR de 10,7% de 2025 a 2032.

- O mercado é impulsionado pelo aumento dos gastos com saúde, pelo crescimento do turismo médico e pela crescente demanda por soluções eficientes de cadeia de suprimentos e cadeia de frio para dispositivos médicos de alto valor e sensíveis à temperatura.

- Reformas governamentais, investimentos em infraestrutura de saúde e a adoção de padrões globais de distribuição estão impulsionando a eficiência logística da região. A expansão de parques logísticos e zonas francas, especialmente nos países do Conselho de Cooperação do Golfo (GCC), está apoiando fabricantes internacionais de dispositivos médicos na criação de centros de distribuição regionais.

Visão geral do mercado de armazenagem e logística de dispositivos médicos na Arábia Saudita

O mercado de armazenagem e logística de dispositivos médicos da Arábia Saudita deteve a maior fatia de receita, 34,7%, no mercado do Oriente Médio e África em 2024. O país está investindo fortemente no programa Visão 2030, priorizando a modernização do setor de saúde, a fabricação local de dispositivos médicos e parques logísticos inteligentes. Megaprojetos como o NEOM e o King Salman Park Logistics Hub foram projetados para incluir zonas de armazenagem em conformidade com as normas do GDPR, com robótica avançada, rastreamento por IA e soluções de cadeia fria baseadas em IoT, adaptadas para equipamentos médicos. A estrutura regulatória atualizada da Autoridade Saudita de Alimentos e Medicamentos (SFDA) garante padrões rigorosos de manuseio para dispositivos cirúrgicos e de diagnóstico, incentivando a entrada de players globais no mercado.

Visão do mercado de armazenagem e logística de dispositivos médicos dos Emirados Árabes Unidos

O mercado de armazenagem e logística de dispositivos médicos dos Emirados Árabes Unidos conquistou 22,1% da participação de mercado regional em 2024, posicionando-se como o centro nevrálgico da logística de dispositivos médicos no Oriente Médio. A presença de diversas zonas francas, como o Dubai Science Park, a Jebel Ali Free Zone (JAFZA) e o Dubai South, torna o país um destino preferencial de reexportação para empresas globais de dispositivos médicos. Com infraestrutura de ponta, sistemas automatizados de gerenciamento de armazéns e monitoramento de temperatura em tempo real, os distribuidores sediados nos Emirados Árabes Unidos podem manusear produtos biológicos, implantes e dispositivos de diagnóstico de alto risco com precisão. Parcerias estratégicas com fornecedores de tecnologia e companhias aéreas estão aprimorando ainda mais a capacidade de entrega de última milha.

Visão do mercado de armazenagem e logística de dispositivos médicos na África do Sul

O mercado de armazenagem e logística de dispositivos médicos da África do Sul representou 17,6% da participação de mercado regional em 2024, tornando-se o principal polo logístico da África Austral. O país se beneficia de uma rede de transporte bem desenvolvida, portos de águas profundas e grandes capacidades de armazenagem, atendendo à importação de dispositivos cirúrgicos, equipamentos de diagnóstico por imagem e consumíveis hospitalares. Esforços de empresas privadas e parcerias governamentais, incluindo aquelas com o Ministério da Saúde e iniciativas financiadas por doadores (por exemplo, o Fundo Global), estão possibilitando a instalação de armazéns com controle digital e rastreamento baseado em RFID. A crescente demanda por produtos oncológicos e de cuidados respiratórios sensíveis à temperatura está impulsionando ainda mais o desenvolvimento da infraestrutura da cadeia de frio.

Visão geral do mercado de logística e armazenamento de dispositivos médicos no Egito

O mercado de armazenagem e logística de dispositivos médicos do Egito contribuiu com 11,8% da participação de mercado regional em 2024, graças à expansão agressiva das zonas logísticas e à implementação da cobertura universal de seguro saúde. A posição do Cairo como rota comercial central entre a África, a Europa e a Ásia a torna estrategicamente importante para o transbordo de produtos médicos. Novos corredores logísticos no âmbito do Egypt Vision 2030 e parcerias com o setor privado estão fomentando o crescimento da armazenagem de produtos farmacêuticos e dispositivos, especialmente nas zonas de Alexandria e do Canal de Suez. A demanda por armazenagem também está sendo impulsionada pelo aumento das importações de dispositivos ortopédicos, oftálmicos e cardiovasculares.

Participação no mercado de armazenagem e logística de dispositivos médicos no Oriente Médio e na África

O mercado de armazenagem e logística de dispositivos médicos é liderado principalmente por empresas bem estabelecidas, incluindo:

- Deutsche Post AG (Alemanha)

- FedEx (EUA)

- Kuehne+Nagel (Reino Unido)

- AWL India Private Limited (Índia)

- CH Robinson Worldwide, Inc. (EUA)

- CEVA (França)

- Dimerco (Taiwan)

- DSV (Dinamarca)

- Hansa Internacional (China)

- Hellmann Worldwide Logistics SE & Co. KG (Alemanha)

- Imperial (África do Sul)

- Mercury Business Services (EUA)

- OIA Global (EUA)

- Omni Logistics, LLC (EUA)

- Grupo Rhenus (Alemanha)

- SEKO (EUA)

- TIBA (Espanha)

- Toll Holdings Limited (Austrália)

Últimos desenvolvimentos no mercado de armazenagem e logística de dispositivos médicos no Oriente Médio e na África

- Em novembro de 2023, a DHL Express inaugurou oficialmente seu Hub expandido para a Ásia Central em Hong Kong, investindo 562 milhões de euros para aprimorar suas capacidades em meio ao crescimento do comércio global. O hub, crucial para conectar a Ásia ao mundo, aumentou sua capacidade de manuseio de remessas de pico em quase 70% e agora consegue gerenciar seis vezes o volume desde sua criação em 2004. Essa expansão reforça o compromisso da DHL em apoiar o crescimento dos clientes e consolidar o status de Hong Kong como um importante hub internacional de aviação.

- Em dezembro de 2022, a DHL Supply Chain anunciou um investimento de US$ 10,93 milhões para expandir sua capacidade de armazenagem no norte de Taiwan, com foco especial nos setores de semicondutores, ciências da vida e saúde. O recém-inaugurado Centro de Distribuição de Taoyuan-Jian Guo adiciona 10.000 metros quadrados à área total de armazenagem da DHL em Taoyuan, aumentando-a para 37.000 metros quadrados. Esta instalação melhora a conectividade para operações logísticas eficientes e apoia a meta da empresa de atingir 200.000 metros quadrados de área total em Taiwan até 2027.

- Em setembro de 2024, a FedEx lançou a plataforma fdx, uma solução de comércio baseada em dados, agora disponível para empresas dos EUA. A plataforma utiliza a rede da FedEx para aprimorar a experiência do cliente, melhorando o crescimento da demanda, as taxas de conversão e a otimização do atendimento. Recursos notáveis incluem estimativas preditivas de entrega, insights de sustentabilidade, rastreamento de pedidos com a marca e processos de devolução simplificados. Raj Subramaniam, CEO da FedEx, destacou o papel da plataforma em cadeias de suprimentos mais inteligentes durante o evento Dreamforce 2024.

- Em março de 2024, a UPS Healthcare lançou o UPS Supply Chain Symphony R, uma plataforma em nuvem projetada para integrar e gerenciar dados da cadeia de suprimentos de saúde de diversos sistemas operacionais. Essa ferramenta oferece aos clientes do setor de saúde visibilidade total de sua logística, capacitando-os a tomar decisões informadas, aprimorar o planejamento e fazer previsões precisas. Ao aprimorar o controle, a eficiência e a transparência, essa plataforma atende à necessidade crítica de cadeias de suprimentos otimizadas na área da saúde. Kate Gutmann enfatizou seu potencial transformador na otimização de operações globais e no atendimento ao paciente.

- Em setembro de 2024, a Kuehne+Nagel, uma importante provedora de logística, inaugurou um novo centro de distribuição com temperatura controlada para a Medtronic em Milton, Ontário, a apenas 50 km de Toronto. Com uma área de 25.000 m², a instalação distribuirá dispositivos médicos para hospitais e abrigará os centros de serviço, reparo e manutenção preventiva da Medtronic para seus equipamentos.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.