Middle East And Africa Lyophilized Injectable Drugs Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

176.55 Million

USD

245.37 Million

2024

2032

USD

176.55 Million

USD

245.37 Million

2024

2032

| 2025 –2032 | |

| USD 176.55 Million | |

| USD 245.37 Million | |

|

|

|

|

Segmentação do mercado de medicamentos injetáveis liofilizados no Oriente Médio e África, por embalagem (frascos, seringas de câmara dupla, cartuchos de câmara dupla e outros), classe de medicamento (anti-infecciosos, antineoplásicos, diuréticos, inibidores da bomba de prótons, anestésicos, anticoagulantes, AINEs, corticosteroides e outros), forma (pó e líquido), indicação (oncologia, doenças autoimunes, distúrbios hormonais, doenças respiratórias, distúrbios gastrointestinais, distúrbios dermatológicos, doenças oftálmicas e outras), via de administração (intravenosa/infusão, intramuscular e outras), usuário final (hospitais, clínicas, assistência domiciliar e outros), canal de distribuição (licitação direta, vendas no varejo e outros) - Tendências e previsões do setor até 2032.

Tamanho do mercado de medicamentos injetáveis liofilizados no Oriente Médio e na África

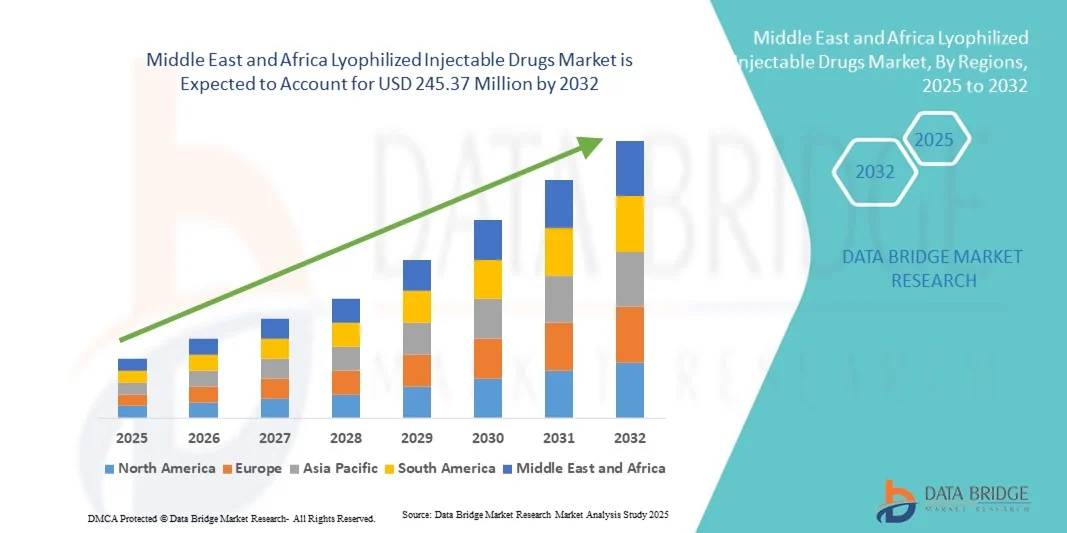

- O mercado de medicamentos injetáveis liofilizados no Oriente Médio e na África foi avaliado em US$ 176,55 milhões em 2024 e deverá atingir US$ 245,37 milhões até 2032 , com uma taxa de crescimento anual composta (CAGR) de 4,2% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela crescente prevalência de doenças crônicas e infecciosas, pela demanda cada vez maior por formulações com longa vida útil e pela expansão da capacidade de produção biofarmacêutica em toda a região.

- Além disso, os crescentes investimentos em infraestrutura de saúde, juntamente com a maior conscientização sobre formulações injetáveis estéreis e estáveis, estão fomentando a adoção de medicamentos liofilizados tanto em ambientes hospitalares quanto ambulatoriais. Esses fatores, em conjunto, estão impulsionando a expansão do mercado no Oriente Médio e na África.

Análise do mercado de medicamentos injetáveis liofilizados no Oriente Médio e na África

- Os medicamentos injetáveis liofilizados, que utilizam a liofilização para melhorar a estabilidade e o prazo de validade, estão sendo cada vez mais adotados no Oriente Médio e na África, à medida que os sistemas de saúde priorizam formulações confiáveis, termoestáveis e estéreis para terapias biológicas e de pequenas moléculas.

- O crescimento do mercado é impulsionado pela crescente prevalência de doenças crônicas e infecciosas , pela expansão da produção de produtos biológicos e pelo foco cada vez maior em soluções avançadas de gerenciamento da cadeia de frio para garantir a eficácia do produto em diversas condições climáticas.

- A Arábia Saudita dominou o mercado de medicamentos injetáveis liofilizados no Oriente Médio e na África, com a maior participação de mercado, de 32,8% em 2024. Esse resultado foi atribuído a fortes reformas governamentais na área da saúde, iniciativas robustas de fabricação farmacêutica no âmbito da Visão 2030 e à expansão da infraestrutura hospitalar.

- Prevê-se que a África do Sul seja o mercado de crescimento mais rápido durante o período analisado, impulsionada pelo aumento dos investimentos em instalações de saúde, pela expansão das parcerias público-privadas e pelo aumento da demanda por medicamentos biológicos injetáveis e antibióticos.

- O segmento de frascos dominou o mercado com a maior participação, de 46,5% em 2024, devido à sua estabilidade superior, ampla compatibilidade com medicamentos e preferência contínua por formulações reconstituíveis em hospitais e ambientes clínicos.

Escopo do relatório e segmentação do mercado de medicamentos injetáveis liofilizados no Oriente Médio e na África.

|

Atributos |

Análises de mercado essenciais para medicamentos injetáveis liofilizados no Oriente Médio e na África |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais players, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, epidemiologia de pacientes, análise de projetos em desenvolvimento, análise de preços e estrutura regulatória. |

Tendências do mercado de medicamentos injetáveis liofilizados no Oriente Médio e na África

Crescente demanda por formulações com estabilidade térmica e longa vida útil.

- Uma tendência significativa e crescente no mercado de medicamentos injetáveis liofilizados no Oriente Médio e na África é a demanda cada vez maior por formulações com estabilidade térmica e longa vida útil, que atendam aos desafios climáticos da região e à infraestrutura limitada de cadeia de frio. Essa tendência está remodelando as estratégias de fabricação e distribuição farmacêutica.

- Por exemplo, a Saudi Pharmaceutical Industries and Medical Appliances Corporation (SPIMACO) expandiu suas capacidades de liofilização para aumentar a estabilidade dos medicamentos e atender à crescente demanda regional por produtos biológicos e vacinas sensíveis à temperatura. Da mesma forma, a Julphar (Gulf Pharmaceutical Industries) tem aprimorado suas linhas de produção de injetáveis para fortalecer a durabilidade e a segurança dos produtos.

- O crescente foco em formulações liofilizadas está possibilitando maior eficiência no manuseio, transporte e armazenamento em redes hospitalares e clínicas, principalmente em áreas rurais com acesso irregular à refrigeração. Isso garante que medicamentos injetáveis que salvam vidas mantenham sua potência ao longo de toda a cadeia de suprimentos.

- Além disso, a liofilização apoia o crescente setor biofarmacêutico na região, permitindo que as empresas produzam produtos biológicos e vacinas de alto valor agregado com estabilidade prolongada, facilitando uma distribuição mais ampla em mercados com logística complexa.

- Essa tendência em direção a uma produção focada na estabilidade está incentivando empresas farmacêuticas internacionais e locais a investir em novas tecnologias de liofilização e instalações de produção. Por exemplo, a Eva Pharma, do Egito, introduziu unidades avançadas de liofilização para aprimorar seu portfólio de injetáveis.

- A crescente ênfase na estabilidade das formulações e na inovação da fabricação deverá fortalecer a resiliência farmacêutica da região e reduzir a dependência de importações, impulsionando o crescimento do mercado a longo prazo.

Dinâmica do mercado de medicamentos injetáveis liofilizados no Oriente Médio e na África

Motorista

Expansão da produção biofarmacêutica e investimentos em saúde

- O crescente estabelecimento de instalações biofarmacêuticas e os investimentos cada vez maiores em infraestrutura de saúde no Oriente Médio e na África são os principais impulsionadores do crescimento do mercado de medicamentos injetáveis liofilizados.

- Por exemplo, em março de 2024, o Fundo de Investimento Público da Arábia Saudita anunciou novas parcerias com empresas farmacêuticas globais para localizar a produção de produtos biológicos e injetáveis estéreis, fomentando a capacidade nacional para formulações liofilizadas.

- À medida que os governos priorizam a expansão e a autossuficiência dos serviços de saúde, a demanda por soluções injetáveis avançadas com estabilidade prolongada continua a crescer, apoiando tanto o abastecimento hospitalar quanto a prontidão para atendimento de emergência.

- Além disso, as iniciativas em curso para fortalecer as cadeias de frio farmacêuticas e melhorar o acesso a produtos biológicos estão impulsionando a adoção de medicamentos liofilizados, que oferecem vantagens práticas em regiões com condições de armazenamento limitadas.

- O foco reforçado em P&D, aliado a incentivos para a produção local e pesquisa clínica, está posicionando os países do Oriente Médio e da África como polos emergentes para a produção de injetáveis estéreis.

- Espera-se que a crescente colaboração entre agências de saúde pública e empresas farmacêuticas privadas acelere a inovação e impulsione o crescimento sustentável no mercado de medicamentos injetáveis liofilizados em toda a região.

- Reformas regulatórias favoráveis, incluindo aprovações aceleradas de medicamentos e políticas de substituição de importações na Arábia Saudita e no Egito, estão impulsionando ainda mais a produção local de medicamentos injetáveis liofilizados e sua acessibilidade ao mercado.

Restrição/Desafio

Altos custos de produção e infraestrutura tecnológica limitada.

- O alto custo dos equipamentos de liofilização, aliado à limitada experiência e infraestrutura tecnológica regionais, representa um grande desafio para a expansão do mercado no Oriente Médio e na África.

- Por exemplo, os pequenos fabricantes em países africanos frequentemente enfrentam dificuldades para estabelecer instalações de produção estéreis em conformidade com as normas, devido à natureza intensiva em capital da tecnologia de liofilização e aos requisitos de manutenção.

- O acesso limitado a equipamentos avançados de liofilização e a pessoal técnico qualificado restringe a adoção em larga escala e retarda a transferência de tecnologia por parte das principais empresas farmacêuticas globais.

- Além disso, os custos associados à validação, garantia de qualidade e conformidade regulatória aumentam as despesas gerais de produção, desestimulando algumas empresas locais a entrarem no mercado.

- Abordar esses desafios por meio de parcerias internacionais, treinamento da força de trabalho e incentivos governamentais para o avanço tecnológico será essencial para aprimorar as capacidades de liofilização nacionais e fomentar o desenvolvimento de mercado a longo prazo.

- A disponibilidade limitada de financiamento e apoio de capital de risco para a inovação farmacêutica em diversas economias africanas continua a restringir a expansão da capacidade de produção de medicamentos liofilizados.

- Atrasos nas aprovações regulatórias e padrões inconsistentes de controle de qualidade entre os diferentes países da região dificultam a distribuição adequada dos produtos e desestimulam o investimento estrangeiro direto em instalações de liofilização.

Escopo do mercado de medicamentos injetáveis liofilizados no Oriente Médio e na África

O mercado é segmentado com base na embalagem, classe do medicamento, forma farmacêutica, indicação, via de administração, usuário final e canal de distribuição.

- Por embalagem

Com base na embalagem, o mercado é segmentado em frascos, seringas de câmara dupla, cartuchos de câmara dupla e outros. O segmento de frascos dominou o mercado com a maior participação na receita, de 46,5% em 2024, impulsionado pelo seu uso extensivo no armazenamento de medicamentos liofilizados devido à proteção superior contra contaminação e exposição ambiental. Os frascos são econômicos, fáceis de manusear e adequados para múltiplas reconstituições, tornando-os ideais para farmácias hospitalares. Sua durabilidade e compatibilidade com diversas classes terapêuticas, incluindo vacinas, antibióticos e produtos biológicos, reforçam sua dominância. Além disso, os fabricantes farmacêuticos na Arábia Saudita e no Egito preferem os frascos devido aos seus mecanismos de vedação simples e à compatibilidade com linhas de envase automatizadas. O crescimento do segmento é ainda impulsionado pelo aumento da produção de formulações injetáveis de alto volume para o tratamento de doenças crônicas.

O segmento de seringas de câmara dupla deverá apresentar o crescimento mais rápido durante o período de previsão, impulsionado pela crescente adoção de formulações prontas para uso em ambientes hospitalares e de cuidados domiciliares. As seringas de câmara dupla permitem a reconstituição do medicamento imediatamente antes da administração, reduzindo o risco de contaminação e o tempo de preparo. Por exemplo, empresas farmacêuticas nos Emirados Árabes Unidos estão introduzindo sistemas de câmara dupla para aumentar a segurança e a conveniência do paciente. A facilidade de manuseio e o design de uso único tornam essas seringas altamente adequadas para produtos biológicos e aplicações em cuidados de emergência. A crescente aceitação de injetáveis autoadministrados entre os médicos também está impulsionando a rápida expansão desse segmento.

- Por classe de medicamento

Com base na classe de medicamentos, o mercado é segmentado em anti-infecciosos, antineoplásicos, diuréticos, inibidores da bomba de prótons, anestésicos, anticoagulantes, AINEs, corticosteroides e outros. O segmento de anti-infecciosos dominou o mercado em 2024 devido à alta prevalência de infecções bacterianas e virais no Oriente Médio e na África. Os anti-infecciosos liofilizados oferecem longa vida útil e maior estabilidade em temperaturas extremas, atendendo às limitações da cadeia de frio em diversos países africanos. Hospitais na Arábia Saudita, Egito e Quênia dependem fortemente desses medicamentos para cuidados críticos e de emergência. O crescente foco na redução da resistência antimicrobiana levou ao aumento do uso de antibióticos injetáveis em formulações controladas. Além disso, os programas governamentais de aquisição de injetáveis anti-infecciosos essenciais fortaleceram ainda mais o crescimento desse segmento.

Prevê-se que o segmento de antineoplásicos apresente o crescimento mais rápido durante o período de previsão, impulsionado pelo aumento da incidência de câncer e pela expansão da infraestrutura de tratamento oncológico. Os medicamentos antineoplásicos liofilizados são preferidos devido à sua maior estabilidade e precisão na dosagem. Por exemplo, centros de oncologia egípcios e sul-africanos estão investindo em formulações liofilizadas para manter a potência dos medicamentos citotóxicos. Os avanços em terapias biológicas e tratamentos direcionados também dependem fortemente de formatos de administração liofilizados. O segmento se beneficia da crescente conscientização dos pacientes e do acesso facilitado ao tratamento oncológico, apoiado por programas nacionais de tratamento do câncer.

- Por formulário

Com base na forma, o mercado é segmentado em pó e líquido. O segmento de pó dominou o mercado em 2024, representando a maior participação na receita devido à sua excepcional estabilidade e maior prazo de validade. Os medicamentos liofilizados em pó são mais fáceis de armazenar e transportar em condições de temperatura variáveis, uma vantagem crucial em regiões com refrigeração limitada. Empresas farmacêuticas na Arábia Saudita e no Egito adotam amplamente formulações em pó para produtos biológicos, vacinas e antibióticos. A facilidade de reconstituição e o menor risco de degradação os tornam ideais para farmácias hospitalares. Além disso, sua relação custo-benefício na produção em larga escala contribui para a demanda sustentada no mercado.

Prevê-se que o segmento de líquidos apresente a taxa de crescimento mais rápida durante o período de previsão, impulsionado pela crescente preferência por formulações injetáveis prontas para uso. Esses produtos reduzem o tempo de preparo e são especialmente úteis em ambientes de emergência e terapia intensiva. Por exemplo, empresas farmacêuticas sediadas nos Emirados Árabes Unidos estão produzindo cada vez mais injetáveis líquidos liofilizados para anestésicos e anticoagulantes. Os avanços na tecnologia de envase asséptico e seringas pré-carregadas estão impulsionando o crescimento do mercado. Além disso, o segmento se beneficia da crescente tendência de medicamentos injetáveis de fácil administração e autoadministração.

- Por indicação

Com base na indicação, o mercado é segmentado em oncologia, doenças autoimunes, distúrbios hormonais, doenças respiratórias, distúrbios gastrointestinais, distúrbios dermatológicos, doenças oftálmicas e outros. O segmento de oncologia dominou o mercado com a maior participação em 2024, impulsionado pelo aumento da incidência de câncer e pelo crescente acesso a terapias de tratamento avançadas. As formulações liofilizadas garantem a estabilidade e a eficácia dos agentes quimioterápicos, que geralmente são sensíveis à temperatura. Hospitais de referência na Arábia Saudita, Egito e África do Sul utilizam injetáveis oncológicos liofilizados para obter resultados terapêuticos consistentes. Essas formulações também permitem uma gestão eficiente do estoque em farmácias hospitalares centralizadas. A expansão contínua de centros de tratamento de câncer em toda a região continua impulsionando o crescimento do segmento.

Espera-se que o segmento de doenças autoimunes registre a taxa de crescimento anual composta (CAGR) mais rápida durante o período de previsão, devido ao aumento do diagnóstico de artrite reumatoide, psoríase e lúpus. Os medicamentos biológicos liofilizados estão se tornando essenciais para o tratamento dessas doenças crônicas devido à sua maior estabilidade e menor risco de degradação. Por exemplo, profissionais de saúde no Egito e nos Emirados Árabes Unidos estão adotando cada vez mais anticorpos monoclonais liofilizados para terapia autoimune. Os avanços tecnológicos no desenvolvimento de medicamentos biológicos e as estruturas de reembolso favoráveis estão impulsionando ainda mais o crescimento desse segmento.

- Por via administrativa

Com base na via de administração, o mercado é segmentado em intravenosa/infusão, intramuscular e outras. O segmento de intravenosa/infusão dominou o mercado em 2024, devido ao seu uso disseminado em hospitais para a administração de antibióticos, quimioterapia e medicamentos biológicos. A administração intravenosa garante biodisponibilidade imediata e efeito terapêutico rápido, o que é crucial em cuidados intensivos. Hospitais na Arábia Saudita e nos Emirados Árabes Unidos utilizam amplamente medicamentos intravenosos liofilizados devido à sua estabilidade e esterilidade. Além disso, a crescente demanda por medicamentos biológicos e tratamentos de emergência continua a reforçar a dominância desse segmento. Os investimentos contínuos em infraestrutura hospitalar e centros de infusão fortalecem ainda mais as perspectivas de crescimento.

Prevê-se que o segmento intramuscular apresente a taxa de crescimento mais rápida durante o período de previsão, impulsionado pela sua conveniência para cuidados ambulatoriais e domiciliares. As formulações intramusculares são mais fáceis de administrar e requerem equipamentos mínimos, tornando-as adequadas para ambientes com recursos limitados. Por exemplo, o Quênia e o Egito estão expandindo seus programas de vacinação utilizando medicamentos intramusculares liofilizados. A menor necessidade de supervisão profissional e os tempos de recuperação mais rápidos para o paciente tornam essa via de administração cada vez mais popular. A crescente conscientização sobre a autoadministração e os injetáveis de longa duração também contribui para o seu crescimento.

- Por usuário final

Com base no usuário final, o mercado é segmentado em hospitais, clínicas, assistência domiciliar e outros. O segmento hospitalar detinha a maior participação em 2024, impulsionado pelo alto volume de uso de medicamentos injetáveis em ambientes hospitalares e de emergência. Os hospitais são o principal ponto de atendimento para oncologia, doenças infecciosas e condições críticas que requerem medicamentos liofilizados. Seus sistemas centralizados de aquisição e ambientes de armazenamento controlados favorecem as formulações liofilizadas. Por exemplo, hospitais na Arábia Saudita e no Egito implementaram soluções avançadas de cadeia de frio para o gerenciamento em larga escala de medicamentos injetáveis. A disponibilidade de profissionais médicos treinados também contribui para a dominância do segmento.

Prevê-se que o segmento de cuidados de saúde domiciliares apresente o crescimento mais rápido em termos de taxa composta de crescimento anual (CAGR), impulsionado pela crescente tendência para terapias injetáveis autoadministradas e monitoramento remoto de pacientes. Os pacientes preferem injetáveis liofilizados devido à facilidade de reconstituição e portabilidade. Por exemplo, nos Emirados Árabes Unidos e na África do Sul, pacientes com distúrbios hormonais e autoimunes estão utilizando cada vez mais kits de injeção para uso domiciliar. O crescimento da telemedicina e das plataformas de saúde digital melhorou o acesso a orientações para administração em casa. O aumento dos custos com saúde também está incentivando os pacientes a optarem por tratamentos convenientes em casa.

- Por canal de distribuição

Com base no canal de distribuição, o mercado é segmentado em licitação direta, vendas no varejo e outros. O segmento de licitação direta dominou o mercado em 2024, visto que hospitais públicos e sistemas de saúde governamentais adquirem medicamentos liofilizados em grandes quantidades por meio de licitações centralizadas. Isso garante um fornecimento consistente e o controle de custos em toda a rede de saúde. O sistema unificado de compras da Arábia Saudita, sob a responsabilidade da National Unified Procurement Company (NUPCO), e os programas de compras em grande escala do Ministério da Saúde do Egito sustentam essa dominância. A licitação direta também garante o controle de qualidade e a transparência de preços para medicamentos essenciais. O segmento se beneficia do forte apoio governamental à acessibilidade à saúde e à localização da produção farmacêutica.

Espera-se que o segmento de vendas no varejo cresça no ritmo mais acelerado durante o período de previsão, devido à crescente presença de farmácias especializadas e redes de distribuição que oferecem formulações injetáveis. Por exemplo, redes de farmácias privadas nos Emirados Árabes Unidos e na África do Sul estão aumentando seus estoques de produtos biológicos liofilizados e injetáveis para doenças crônicas. A crescente conscientização do consumidor e a conveniência de comprar em farmácias locais impulsionam o crescimento desse segmento. O crescimento das farmácias online e dos distribuidores online licenciados também contribui para a expansão do alcance do varejo em mercados urbanos e semiurbanos.

Análise Regional do Mercado de Medicamentos Liofilizados Injetáveis no Oriente Médio e África

- A Arábia Saudita dominou o mercado de medicamentos injetáveis liofilizados no Oriente Médio e na África, com a maior participação de mercado, de 32,8% em 2024. Esse resultado foi atribuído a fortes reformas governamentais na área da saúde, iniciativas robustas de fabricação farmacêutica no âmbito da Visão 2030 e à expansão da infraestrutura hospitalar.

- Países como a Arábia Saudita, os Emirados Árabes Unidos e a África do Sul estão liderando a adoção, devido à expansão da capacidade de produção farmacêutica e aos investimentos governamentais em infraestrutura de saúde.

- Além disso, a crescente prevalência de doenças crônicas, como câncer, doenças autoimunes e problemas respiratórios, aumentou a demanda por medicamentos liofilizados que garantam maior prazo de validade e eficácia consistente.

Análise do Mercado de Medicamentos Liofilizados Injetáveis na Arábia Saudita

O mercado de medicamentos injetáveis liofilizados da Arábia Saudita detinha a maior participação de receita no Oriente Médio e na África em 2024, impulsionado por investimentos governamentais robustos na produção nacional de medicamentos no âmbito da Visão 2030 e pela crescente demanda por formulações parenterais avançadas. O setor biofarmacêutico em expansão do país e a ênfase na autossuficiência em produtos de saúde são fatores-chave para o crescimento. Além disso, parcerias estratégicas com empresas farmacêuticas globais para estabelecer unidades de produção locais estão fortalecendo o fornecimento de medicamentos liofilizados. A crescente infraestrutura hospitalar e o foco cada vez maior em tratamentos oncológicos e de doenças infecciosas contribuem ainda mais para o crescimento do mercado.

Análise do Mercado de Medicamentos Liofilizados Injetáveis nos Emirados Árabes Unidos

Prevê-se que o mercado de medicamentos injetáveis liofilizados nos Emirados Árabes Unidos cresça a uma taxa composta de crescimento anual (CAGR) substancial durante o período de previsão, impulsionado pela expansão da infraestrutura de saúde, por fortes marcos regulatórios e pelo foco do governo na inovação em ciências da vida. A crescente preferência por injetáveis liofilizados em ambientes de atendimento especializado e o investimento do país em zonas francas farmacêuticas, como o Parque Científico de Dubai, estão acelerando a adoção. Além disso, o aumento das colaborações entre distribuidores locais e fabricantes multinacionais de medicamentos está ampliando o acesso a injetáveis estéreis de alta qualidade. O papel dos Emirados Árabes Unidos como um centro médico na região do Golfo continua a atrair grandes empresas para fortalecer sua presença no mercado.

Análise do Mercado de Medicamentos Liofilizados Injetáveis na África do Sul

Prevê-se que o mercado de medicamentos injetáveis liofilizados na África do Sul cresça a uma taxa composta de crescimento anual (CAGR) significativa durante o período de previsão, impulsionado pela crescente prevalência de doenças crônicas e infecciosas e pelo aumento dos gastos públicos com saúde. A indústria farmacêutica do país está focando na expansão de sua capacidade de produção estéril, particularmente em medicamentos oncológicos e anti-infecciosos. Iniciativas governamentais para melhorar a capacidade de produção local e reduzir a dependência de importações estão fomentando o desenvolvimento do mercado. Além disso, a crescente conscientização sobre os benefícios das formulações liofilizadas para garantir a estabilidade dos medicamentos e prolongar sua vida útil está impulsionando a adoção nos setores de saúde público e privado.

Análise do Mercado de Medicamentos Liofilizados Injetáveis no Egito

O mercado egípcio de medicamentos injetáveis liofilizados deverá apresentar um crescimento robusto durante o período de previsão, atribuído à rápida expansão populacional, ao aumento dos gastos com saúde e aos crescentes investimentos na produção nacional de medicamentos. Os esforços do governo para nacionalizar a produção farmacêutica e as parcerias com empresas internacionais para introduzir tecnologias avançadas de liofilização estão ampliando a capacidade do mercado. A forte demanda por injetáveis oncológicos e anti-infecciosos também impulsiona a expansão do segmento. Além disso, políticas regulatórias favoráveis e iniciativas que promovem o acesso à saúde em regiões rurais estão contribuindo para uma adoção mais ampla de formulações liofilizadas.

Participação de mercado de medicamentos injetáveis liofilizados no Oriente Médio e na África

O setor de medicamentos injetáveis liofilizados no Oriente Médio e na África é liderado principalmente por empresas consolidadas, incluindo:

- Pfizer Inc. (EUA)

- Sanofi (França)

- GSK plc. (Reino Unido)

- F. Hoffmann-La Roche Ltda. (Suíça)

- Novartis AG (Suíça)

- Merck & Co., Inc., (EUA)

- Johnson & Johnson Services, Inc. (EUA)

- Baxter (EUA)

- Fresenius Kabi AG (Alemanha)

- B. Braun SE (Alemanha)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Hikma Pharmaceuticals PLC (Jordânia)

- Indústrias Farmacêuticas do Golfo (Emirados Árabes Unidos)

- Aspen Pharmacare Holdings Limited (África do Sul)

- Cipla (Índia)

- Viatris Inc. (EUA)

- Amgen Inc. (EUA)

- Novo Nordisk A/S (Dinamarca)

- Biocon Limitada (Índia)

Quais são os desenvolvimentos recentes no mercado de medicamentos injetáveis liofilizados no Oriente Médio e na África?

- Em fevereiro de 2025, o Centro Africano de Controle e Prevenção de Doenças (Africa CDC) relatou progressos concretos por meio de seu “2º Fórum de Fabricação de Vacinas e Outros Produtos de Saúde” (realizado no Cairo), onde novas parcerias e marcos operacionais foram anunciados sob a égide da AVMA (Associação Americana de Fabricantes de Produtos de Saúde). Por exemplo, a empresa egípcia EVA Pharma firmou parceria com empresas de biotecnologia europeias para estabelecer uma “plataforma completa de desenvolvimento e produção de biológicos/mRNA” na África.

- Em junho de 2024, a Gavi, Aliança para Vacinas, em colaboração com os Centros Africanos de Controle e Prevenção de Doenças (Africa CDC) e a União Africana, lançou oficialmente o Acelerador Africano de Fabricação de Vacinas (AVMA), um mecanismo de financiamento que deverá investir entre US$ 1,0 e 1,2 bilhão ao longo de dez anos no desenvolvimento da fabricação de vacinas (e produtos de saúde) na África.

- Em setembro de 2021, a Sinovac Biotech anunciou que estava em negociações para estabelecer uma unidade de produção na África do Sul (ou firmar parceria com uma) que abrangeria a produção de vacinas para a África, incluindo envase, rotulagem e, eventualmente, produção completa.

- Em agosto de 2021, o Egito anunciou que sua nova unidade VACSERA (apelidada de "cidade das vacinas" pela mídia) começaria a operar por volta de novembro de 2021, com o objetivo de atingir uma capacidade anual de aproximadamente um bilhão de doses, posicionando o Egito como um centro de fornecimento de vacinas para a África.

- Em junho de 2021, a VACSERA (Egito) e a Sinovac Biotech assinaram um acordo para iniciar a produção local da vacina contra a COVID-19 da Sinovac no Egito e em toda a região africana, marcando um primeiro passo na regionalização da fabricação de vacinas injetáveis. Segundo a Reuters, o Egito planejava começar a produzir os frascos por volta de meados de junho, após receber a matéria-prima para um lote inicial de doses.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.