Middle East And Africa Industrial Machine Vision Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

4.92 Billion

USD

1.83 Billion

2024

2032

USD

4.92 Billion

USD

1.83 Billion

2024

2032

| 2025 –2032 | |

| USD 4.92 Billion | |

| USD 1.83 Billion | |

|

|

|

|

Segmentação do mercado de visão de máquina industrial do Oriente Médio e África, por componente (hardware e software), produto (sistema de visão de câmera inteligente/sensor inteligente, sistema de visão de câmera inteligente híbrido e baseado em PC), tipo (sistemas de visão 2D, sistemas de visão 3D e sistemas de visão 1D), implantação (célula robótica e geral), aplicações (detecção de defeitos, inspeção de produtos, inspeção de superfície, inspeção de embalagens, identificação, OCR/OCV, reconhecimento de padrões, medição, orientação e rastreamento de peças, inspeção da Web e outros), usuário final (automotivo, eletrônicos de consumo, alimentos e embalagens, produtos farmacêuticos, metais, impressão, aeroespacial, vidro, borracha e plásticos, mineração, têxteis, madeira e papel, máquinas, fabricação de painéis solares e outros) - Tendências do setor e previsão para 2032

Tamanho do mercado de visão computacional industrial no Oriente Médio e África

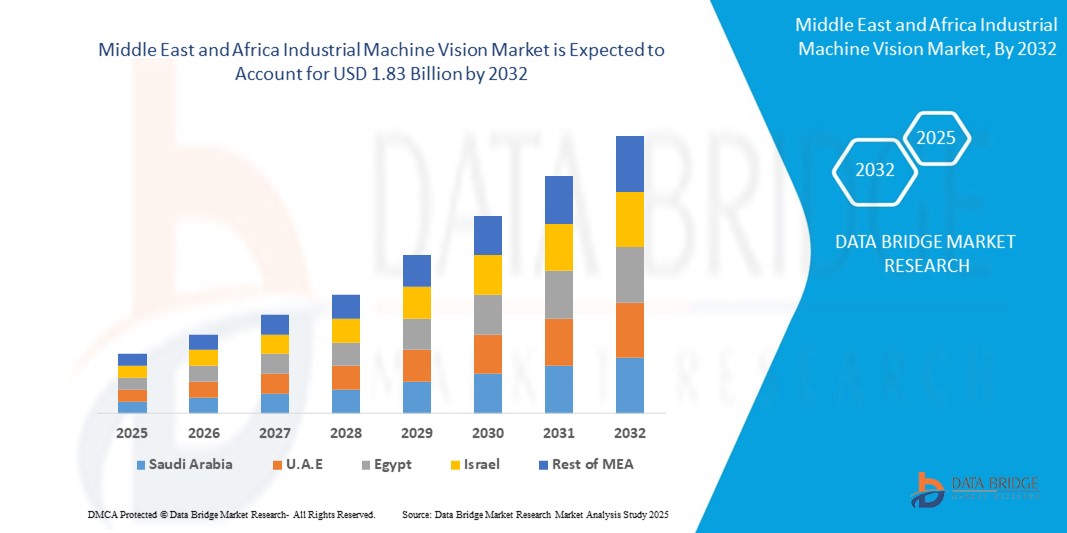

- O tamanho do mercado de visão industrial de máquinas do Oriente Médio e da África foi avaliado em US$ 4,92 bilhões em 2024 e deve atingir US$ 1,83 bilhão até 2032 , com um CAGR de 6,83% durante o período previsto.

- O crescente foco em controle de qualidade e inspeção é um importante impulsionador do mercado de visão computacional industrial, desempenhando um papel crucial em sua expansão. À medida que indústrias de diversos setores se esforçam para atender a rigorosos padrões de qualidade e manter vantagem competitiva, a demanda por sistemas avançados de visão computacional aumentou. Esses sistemas são essenciais para automatizar o processo de inspeção, garantindo consistência, precisão e eficiência no controle de qualidade, o que, em última análise, impulsiona o crescimento do mercado.

Análise de Mercado de Visão Industrial de Máquinas no Oriente Médio e África

- O crescente foco em controle de qualidade e inspeção é um importante impulsionador do mercado de visão computacional industrial, desempenhando um papel crucial em sua expansão. À medida que indústrias de diversos setores se esforçam para atender a rigorosos padrões de qualidade e manter vantagem competitiva, a demanda por sistemas avançados de visão computacional aumentou. Esses sistemas são essenciais para automatizar o processo de inspeção, garantindo consistência, precisão e eficiência no controle de qualidade, o que, em última análise, impulsiona o crescimento do mercado.

- Espera-se que o mercado de visão industrial de máquina dos Emirados Árabes Unidos domine com a maior participação de mercado de 53,12%, apoiado pela forte ênfase do país na fabricação inteligente, desenvolvimento de infraestrutura e indústrias orientadas à inovação.

- O mercado de visão industrial da Arábia Saudita deve crescer a uma CAGR mais rápida de 13,67% durante o período previsto, impulsionado pela iniciativa Visão 2030 do país, que prioriza a diversificação industrial e a adoção de tecnologia inteligente.

- O segmento de hardware dominou o mercado com a maior participação na receita de 67,4% em 2024, impulsionado pela forte demanda por câmeras, sensores, lentes e sistemas de iluminação que servem como base dos sistemas de visão

Escopo do relatório e segmentação do mercado de visão computacional industrial no Oriente Médio e África

|

Atributos |

Principais insights de mercado sobre visão industrial de máquinas no Oriente Médio e África |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de visão computacional industrial no Oriente Médio e na África

Adoção crescente de inspeção de qualidade e automação orientadas por IA

- Uma tendência importante e crescente no mercado de visão computacional industrial do Oriente Médio e África (MEA) é a crescente adoção de sistemas de visão com tecnologia de IA para inspeção automatizada, controle de qualidade e manutenção preditiva . A integração da inteligência artificial com a visão computacional aumenta a precisão, reduz o erro humano e permite a tomada de decisões em tempo real na manufatura e na logística.

- Por exemplo, empresas em toda a região estão implantando sistemas de visão computacional equipados com algoritmos de IA para detectar defeitos nas linhas de produção, garantindo maior consistência do produto e redução do desperdício. Isso é particularmente evidente em setores como o automotivo e o de processamento de alimentos e bebidas.

- O uso de visão de máquina orientada por IA também oferece suporte à manutenção preditiva, analisando dados visuais do equipamento para identificar sinais precoces de desgaste ou falhas potenciais, minimizando o tempo de inatividade.

- Além disso, as iniciativas de automação apoiadas por programas de digitalização industrial liderados pelo governo nos Emirados Árabes Unidos e na Arábia Saudita estão incentivando as empresas a adotar sistemas de inspeção e monitoramento mais inteligentes.

- Empresas como a OMRON e a Cognex estão expandindo sua presença na região do MEA, oferecendo sistemas de visão computacional industrial habilitados para IA, adaptados às necessidades locais de fabricação e logística.

- Essa tendência reflete a crescente mudança em direção às práticas da Indústria 4.0 no mercado MEA, à medida que as empresas priorizam cada vez mais a eficiência, a segurança e a inteligência operacional.

Dinâmica do mercado de visão computacional industrial no Oriente Médio e na África

Motorista

Aumento da automação industrial e iniciativas de manufatura inteligente

- A rápida expansão da automação industrial, apoiada por estratégias nacionais de transformação, como as iniciativas Saudi Vision 2030 e UAE Industry 4.0, é um importante impulsionador da adoção de sistemas de visão computacional na região

- Por exemplo, em maio de 2024, a Cognex Corporation fez parceria com distribuidores regionais para fornecer soluções de visão computacional em todo o Oriente Médio, permitindo que os fabricantes alcançassem maior produtividade e precisão.

- Os sistemas de visão computacional estão sendo implantados nos setores automotivo, de embalagens e farmacêutico para melhorar a garantia de qualidade, otimizar as operações e reduzir a dependência da inspeção manual

- A crescente demanda por controle de qualidade confiável, rastreabilidade e conformidade com os padrões globais de fabricação está acelerando o crescimento do mercado

- Além disso, a necessidade de transformação digital e competitividade nas cadeias de suprimentos globais está motivando os fabricantes de MEA a adotar tecnologias avançadas de automação, tornando a visão computacional industrial um facilitador essencial

Restrição/Desafio

Altos custos de implantação e conhecimento técnico limitado

- Apesar do crescente interesse, o mercado de MEA enfrenta desafios devido ao alto investimento inicial necessário para sistemas de visão computacional, incluindo câmeras, sensores e software baseado em IA. Para muitas pequenas e médias empresas (PMEs), esses custos representam uma barreira à adoção.

- Por exemplo, vários fabricantes locais em África continuam dependentes de processos de inspeção manual devido a restrições orçamentais, o que limita a penetração de soluções avançadas de visão computacional.

- Outra limitação importante é a escassez de profissionais qualificados capazes de integrar e manter sistemas de visão computacional. A falta de expertise técnica interna aumenta a dependência de fornecedores externos, aumentando os custos operacionais.

- As preocupações com a segurança cibernética relacionadas aos sistemas de visão conectados à nuvem desencorajam ainda mais a adoção em certos setores onde a sensibilidade dos dados é alta

- Empresas como a OMRON e a SICK AG estão enfrentando esses desafios oferecendo soluções modulares e econômicas, além de programas de treinamento para desenvolver expertise local. No entanto, a acessibilidade e a prontidão técnica continuam sendo obstáculos.

- Superar esses desafios por meio de parcerias regionais, incentivos governamentais e treinamento da força de trabalho será fundamental para a adoção sustentada de tecnologias de visão computacional no Oriente Médio e na África.

Escopo do mercado de visão computacional industrial no Oriente Médio e África

O mercado é segmentado com base em componente, produto, tipo, implantação, aplicações e usuário final.

- Por componente

Com base nos componentes, o mercado de visão computacional industrial é segmentado em hardware e software. O segmento de hardware dominou o mercado, com a maior participação na receita, de 67,4% em 2024, impulsionado pela forte demanda por câmeras, sensores, lentes e sistemas de iluminação que servem como base para sistemas de visão. A necessidade de dispositivos de aquisição de imagens de alto desempenho nas indústrias automotiva, eletrônica e de embalagens continua a impulsionar a adoção de hardware. Além disso, os avanços em sensores CMOS e câmeras de alta resolução estão fortalecendo essa dominância.

Espera-se que o segmento de software apresente o CAGR mais rápido, de 21,2%, entre 2025 e 2032, impulsionado pela crescente demanda por processamento de imagens com tecnologia de IA, algoritmos de aprendizado profundo e análise de dados para aprimorar a precisão e a automação da detecção. A crescente mudança para sistemas de visão inteligentes e adaptativos, que exigem menos intervenção humana, destaca o software como o principal impulsionador da futura expansão do mercado.

- Por produto

Com base no produto, o mercado de visão computacional industrial é segmentado em sistemas de visão com câmera inteligente/sensor inteligente, sistemas híbridos de visão com câmera inteligente e sistemas baseados em PC. O segmento baseado em PC representou a maior fatia da receita, 52,8% em 2024, apoiado por seu poder de processamento superior, flexibilidade e adequação a tarefas complexas de inspeção nos setores automotivo, de semicondutores e aeroespacial. Sua capacidade de lidar com configurações multicâmera e aplicativos de software avançados impulsiona sua preferência contínua.

Enquanto isso, o segmento de câmeras inteligentes/sistemas de visão com sensores inteligentes deverá registrar o CAGR mais rápido, de 22,6%, entre 2025 e 2032, devido à crescente demanda por soluções compactas, econômicas e fáceis de usar. Câmeras inteligentes reduzem a necessidade de fiação, exigem menos manutenção e integram recursos baseados em IA, tornando-as altamente atraentes para fabricantes de pequeno e médio porte nos setores de alimentos, embalagens e eletrônicos.

- Por tipo

Com base no tipo, o mercado de visão computacional industrial é segmentado em sistemas de visão 1D, sistemas de visão 2D e sistemas de visão 3D. O segmento de sistemas de visão 2D dominou, com a maior participação na receita, de 61,3% em 2024, impulsionado por sua ampla aplicação em detecção de defeitos, leitura de código de barras, inspeção de embalagens e verificação de montagem. A eficiência de custos, a facilidade de instalação e a confiabilidade consolidada sustentam sua posição de liderança em diversos setores.

Espera-se que o segmento de sistemas de visão 3D cresça a uma taxa composta de crescimento anual (CAGR) de 23,4% entre 2025 e 2032, impulsionado pela crescente adoção nos setores de robótica, automotivo e eletrônico. Os sistemas 3D oferecem percepção de profundidade, medição espacial precisa e recursos avançados de reconhecimento de padrões, tornando-os essenciais para aplicações como coleta de lixo, orientação robótica e inspeção de montagens complexas.

- Por implantação

Com base na implantação, o mercado de visão computacional industrial é segmentado em células robóticas e geral. O segmento de implantação geral deteve a maior participação de mercado, com 68,9% da receita em 2024, impulsionado pelo amplo uso em estações de inspeção autônomas, controle de qualidade e linhas de embalagem. Sua flexibilidade e custo-benefício o tornam amplamente adotado por PMEs e grandes empresas dos setores alimentício, de impressão e de bens de consumo.

Prevê-se que o segmento de células robóticas registre o CAGR mais rápido, de 20,8%, entre 2025 e 2032, à medida que a integração da visão computacional com robôs industriais se acelera. As células robóticas permitem orientação em tempo real, montagem precisa e detecção automatizada de defeitos, alinhando-se às iniciativas da Indústria 4.0 e da manufatura inteligente. O aumento dos custos com mão de obra e a demanda por automação nos setores automotivo e eletrônico estão impulsionando ainda mais essa tendência.

- Por aplicação

Com base na aplicação, o mercado de visão computacional industrial é segmentado em detecção de defeitos, inspeção de produtos, inspeção de superfícies, inspeção de embalagens, identificação, OCR/OCV, reconhecimento de padrões, medição, orientação e rastreamento de peças, inspeção de bandas, entre outros. O segmento de inspeção de produtos dominou, com uma participação de receita de 26,5% em 2024, visto que a garantia da qualidade continua sendo um fator crítico na fabricação automotiva, eletrônica e farmacêutica. Sua capacidade de reduzir recalls e aumentar a conformidade fortalece a demanda.

O segmento de orientação e rastreamento de peças deverá crescer a uma taxa composta de crescimento anual (CAGR) de 24,1% entre 2025 e 2032, à medida que os fabricantes adotam cada vez mais sistemas de visão robótica para montagem, coleta de peças e movimentação de materiais. A ascensão de robôs autônomos e colaborativos na manufatura impulsiona ainda mais a demanda por rastreamento e navegação precisos de peças.

- Por usuário final

Com base no usuário final, o mercado de visão computacional industrial é segmentado em automotivo, eletrônicos de consumo, alimentos e embalagens, farmacêutico, metais, impressão, aeroespacial, vidro, borracha e plástico, mineração, têxteis, madeira e papel, máquinas, fabricação de painéis solares e outros. O segmento automotivo dominou, com a maior participação na receita, de 31,7% em 2024, impulsionado pela crescente automação nas linhas de montagem, pela demanda por inspeção de precisão e pelos requisitos de garantia de qualidade. Os sistemas de visão são essenciais para detecção de defeitos, orientação robótica e verificação de peças na fabricação automotiva.

Espera-se que o segmento farmacêutico apresente o CAGR mais rápido, de 22,9%, entre 2025 e 2032, impulsionado por padrões regulatórios rigorosos, pela demanda por serialização e pela necessidade de inspeção precisa na embalagem e rotulagem de medicamentos. A crescente adoção da visão computacional para garantir a conformidade, reduzir erros e manter a segurança dos produtos posiciona este segmento como a área de crescimento mais dinâmica.

Análise regional do mercado de visão computacional industrial

- Espera-se que o mercado de visão industrial de máquina dos Emirados Árabes Unidos domine com a maior participação de mercado de 53,12%, apoiado pela forte ênfase do país na fabricação inteligente, desenvolvimento de infraestrutura e indústrias orientadas à inovação.

- As soluções da Industrial Vision estão sendo integradas às linhas de logística, embalagens e montagem automotiva, refletindo o impulso dos Emirados Árabes Unidos em direção à automação e à garantia de qualidade avançada. Dubai e Abu Dhabi lideram com investimentos em transformação digital e tecnologias baseadas em IA, ampliando ainda mais as perspectivas de crescimento do mercado.

- Além disso, o papel dos Emirados Árabes Unidos como um centro comercial regional alimenta a demanda por sistemas de inspeção confiáveis para apoiar as exportações e a conformidade regulatória

Visão do mercado de visão computacional industrial da Arábia Saudita

O mercado de visão computacional industrial da Arábia Saudita deverá crescer a uma taxa composta de crescimento anual (CAGR) de 13,67% durante o período previsto, impulsionado pela iniciativa Visão 2030 do país, que prioriza a diversificação industrial e a adoção de tecnologias inteligentes. O setor manufatureiro está integrando cada vez mais sistemas avançados de inspeção para atender aos padrões globais de qualidade, especialmente nos setores automotivo, de alimentos e bebidas e farmacêutico. A rápida urbanização e os projetos de desenvolvimento de infraestrutura também estão impulsionando a demanda por soluções de visão computacional em inspeções de embalagens, identificação e segurança. Fortes programas de transformação digital apoiados pelo governo e o investimento estrangeiro em indústrias inteligentes estão acelerando ainda mais a adoção.

Visão do mercado de visão computacional industrial da África do Sul

O mercado de visão computacional industrial da África do Sul está pronto para um crescimento constante, impulsionado pelas crescentes necessidades de automação nos setores de mineração, automotivo e processamento de alimentos. As indústrias locais estão adotando sistemas baseados em visão para aumentar a eficiência operacional, reduzir erros e garantir a conformidade com os padrões internacionais de qualidade. A crescente demanda por sistemas de inspeção, detecção de defeitos e orientação de embalagens é particularmente forte nas indústrias de bens de consumo e voltadas para a exportação. Além disso, o esforço do governo para modernizar as operações industriais e a crescente adoção de robótica e práticas de manufatura inteligentes estão impulsionando a demanda por soluções de visão computacional em todo o país.

Participação no mercado de visão computacional industrial no Oriente Médio e África

O setor de visão computacional industrial é liderado principalmente por empresas bem estabelecidas, incluindo:

- OMRON Corporation (Japão)

- Sony Semiconductor Solutions Corporation (Japão)

- Cognex Corporation (EUA)

- SICK AG (EUA)

- Teledyne FLIR LLC (EUA)

- NATIONAL INSTRUMENTS CORP. (EUA)

- Intel Corporation (EUA)

- Cadence Design Systems, Inc. (EUA)

Quais são os desenvolvimentos recentes no mercado de visão computacional industrial do Oriente Médio e da África?

- Em março de 2024, a Cognex lançou o DataMan Série 8700, um leitor de código de barras portátil de última geração, desenvolvido em uma plataforma totalmente nova. O dispositivo oferece desempenho avançado, facilidade de uso e não requer ajustes prévios ou treinamento do operador. Este lançamento reforça o foco da Cognex em simplificar as operações, ao mesmo tempo em que oferece soluções de leitura de alto desempenho para as indústrias.

- Em fevereiro de 2024, a OMRON Automation lançou os Robôs Colaborativos da Série TM S na Índia, equipados com articulações mais rápidas e recursos de segurança aprimorados. Essas inovações melhoram significativamente a eficiência da fábrica em espaços de trabalho compartilhados. O lançamento destaca o compromisso da OMRON com o avanço da robótica colaborativa segura e produtiva para automação industrial.

- Em março de 2023, a KEYENCE CORPORATION revelou seu Sistema de Visão Série VS, projetado para aprimorar a automação industrial por meio de processamento avançado de imagens, inspeção de alta velocidade e operação intuitiva. O sistema é particularmente adequado para aprimorar o controle de qualidade e a eficiência da fabricação. Esta apresentação demonstra a dedicação da Keyence em fornecer tecnologia de visão de ponta para uma ampla gama de aplicações industriais.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.