Middle East And Africa Health Insurance Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

155.16 Billion

USD

207.49 Billion

2024

2032

USD

155.16 Billion

USD

207.49 Billion

2024

2032

| 2025 –2032 | |

| USD 155.16 Billion | |

| USD 207.49 Billion | |

|

|

|

|

Mercado de seguros de saúde do Oriente Médio e África por tipo (produtos e soluções), serviços (tratamento hospitalar, tratamento ambulatorial, assistência médica e outros), nível de cobertura (bronze, prata, ouro e platina), provedores de serviços (provedores de seguro saúde público e provedores de seguro saúde privado), planos de seguro saúde (ponto de atendimento (POS), organização de provedores exclusivos (EPOS), seguro saúde de indenização, conta poupança saúde (HSA), acordos de reembolso de saúde para pequenos empregadores qualificados (QSEHRAS), organização de provedores preferenciais (PPO), organização de manutenção da saúde (HMO) e outros), dados demográficos (adultos, menores e idosos), tipo de cobertura (cobertura vitalícia, cobertura temporária), usuário final (empresas, indivíduos e outros), canal de distribuição (vendas diretas, instituições financeiras, comércio eletrônico, hospitais, clínicas e outros), - tendências do setor e previsão até 2032

Tamanho do mercado de seguros de saúde no Oriente Médio e na África

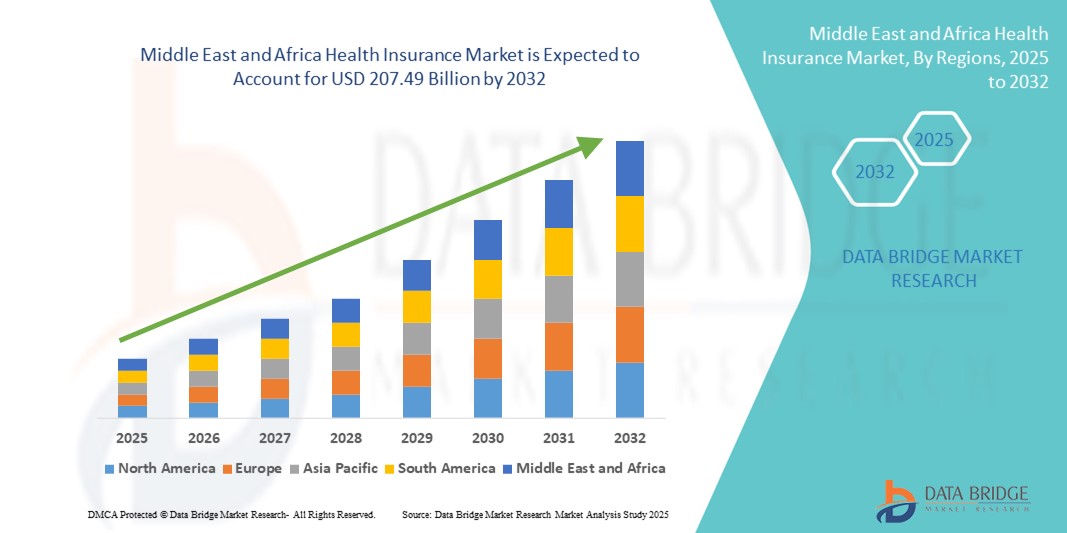

- O tamanho do mercado de seguros de saúde do Oriente Médio e da África foi avaliado em US$ 155,16 bilhões em 2024 e deve atingir US$ 207,49 bilhões até 2032 , com um CAGR de 3,70% durante o período previsto.

- O mercado de seguros de saúde do Oriente Médio e da África está testemunhando um forte crescimento, impulsionado pela crescente conscientização sobre a importância da cobertura de saúde, especialmente à luz do aumento das taxas de doenças crônicas, das altas despesas com saúde e da expansão da população de classe média em toda a região.

- As reformas no sistema de saúde lideradas pelo governo, a introdução de políticas obrigatórias de seguro saúde em países como os Emirados Árabes Unidos e a Arábia Saudita e o aumento dos investimentos em infraestrutura de saúde digital estão impulsionando ainda mais a adoção de seguro saúde entre indivíduos, famílias e empresas.

Análise do mercado de seguros de saúde no Oriente Médio e na África

- O mercado de seguros de saúde do Oriente Médio e da África está testemunhando um crescimento significativo devido à crescente demanda por serviços de saúde acessíveis e acessíveis, ao aumento da prevalência de doenças crônicas e à expansão das iniciativas governamentais e do setor privado para melhorar a cobertura de saúde em toda a região.

- O crescimento do mercado é impulsionado pela crescente conscientização sobre os benefícios do seguro saúde, pelo aumento dos gastos com assistência médica, por reformas regulatórias favoráveis e pela crescente necessidade de proteção financeira contra emergências médicas e altos custos de tratamento.

- A Arábia Saudita dominou o mercado de seguros de saúde no Oriente Médio e na África com uma participação de receita de 34,7% em 2024, impulsionada por sólidos planos de seguro de saúde liderados pelo governo, expansão do setor de seguros privados e requisitos de seguro obrigatório para expatriados e funcionários do setor privado.

- Os Emirados Árabes Unidos estão projetados para serem o país com crescimento mais rápido no mercado de seguros de saúde do Oriente Médio e da África, com expectativa de registrar um CAGR de 11,6% durante 2025–2032, impulsionado pelo crescente turismo médico, plataformas de seguros digitais aprimoradas e o impulso do governo para cobertura universal de saúde.

- O segmento de Seguro Saúde Individual dominou o mercado de seguros saúde do Oriente Médio e da África com uma participação na receita de 53,1% em 2024, atribuída ao aumento de inscrições entre autônomos, freelancers e funcionários do setor informal que buscam cobertura de saúde abrangente e personalizada.

Escopo do relatório e segmentação do mercado de seguros de saúde no Oriente Médio e na África

|

Atributos |

Insights sobre o mercado de seguros de saúde no Oriente Médio e na África |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de seguros de saúde no Oriente Médio e na África

Reformas governamentais e transformação digital impulsionam o mercado de seguros de saúde no Oriente Médio e na África

- Uma tendência significativa que molda o mercado de seguros de saúde no Oriente Médio e na África é a rápida digitalização dos serviços de seguros, com as seguradoras integrando plataformas alimentadas por IA, soluções de telemedicina e aplicativos de saúde móvel para melhorar o acesso do cliente e a eficiência operacional.

- Governos de países como a Arábia Saudita e os Emirados Árabes Unidos estão introduzindo regulamentações obrigatórias de seguro saúde para expatriados e funcionários do setor privado, expandindo significativamente a população segurada e melhorando o acesso à saúde.

- As startups de Insurtech e as seguradoras tradicionais estão aproveitando a tecnologia blockchain e os sistemas baseados em nuvem para aumentar a transparência das reivindicações, prevenir fraudes e otimizar o processo de gerenciamento de apólices, atraindo consumidores mais jovens e experientes em tecnologia.

- Há um investimento crescente em parcerias público-privadas para expandir a infraestrutura de saúde e a cobertura de seguros em regiões rurais carentes da África do Sul, Nigéria e Quénia, apoiando iniciativas de financiamento de saúde inclusivas.

- A conscientização pós-pandemia sobre proteção financeira contra custos médicos inesperados aumentou significativamente a demanda por planos de saúde individuais e familiares, especialmente entre trabalhadores autônomos e do setor informal.

- Países como o Egipto e Marrocos estão a implementar estruturas de cobertura universal de saúde (CUS), integrando seguradoras públicas e privadas para reduzir despesas diretas e melhorar o acesso a serviços médicos essenciais.

- Espera-se que esta onda de reformas regulatórias, juntamente com a inovação tecnológica e uma mudança em direção aos cuidados preventivos, transforme o cenário do mercado de seguros de saúde no Oriente Médio e na África, promovendo maior penetração de seguros e crescimento sustentado até 2032.

Dinâmica do mercado de seguros de saúde no Oriente Médio e na África

Motorista

Demanda crescente impulsionada por reformas regulatórias, expansão digital e participação do setor privado

- O mercado de seguros de saúde do Oriente Médio e da África está testemunhando um crescimento robusto, impulsionado pelas reformas regulatórias em andamento, pela expansão do ecossistema de saúde digital e pelo envolvimento crescente do setor privado para preencher as lacunas de acesso à saúde entre as populações urbanas e rurais.

- Em abril de 2024, o Banco Central Saudita (SAMA) lançou um programa de sandbox de seguro saúde digital para permitir que as empresas de InsurTech pilotassem plataformas de cobertura de saúde alimentadas por IA sob supervisão regulatória, refletindo a mudança da região em direção a modelos de seguro baseados em tecnologia.

- Países como o Egipto, o Quénia e Marrocos estão a expandir os programas de cobertura universal de saúde (CUS), integrando regimes de seguros privados para reduzir as despesas diretas e melhorar a acessibilidade a serviços essenciais de saúde para populações de baixos rendimentos.

- A crescente penetração de plataformas de seguros móveis na África Subsaariana — impulsionada pela adoção de smartphones e pela infraestrutura de dinheiro móvel — está permitindo planos de microsseguro saúde sob demanda, adaptados para trabalhadores do setor informal e participantes da economia gig.

- As seguradoras sediadas nos Emirados Árabes Unidos estão fazendo parceria com startups de saúde digital para fornecer serviços de teleconsulta, farmácia eletrônica e gerenciamento de doenças crônicas agrupados em seus planos de seguro saúde, melhorando o envolvimento do paciente e os resultados dos cuidados preventivos.

- Os governos da região do GCC estão a exigir cobertura de seguro de saúde baseada no empregador para expatriados e trabalhadores do setor privado, contribuindo para um conjunto de riscos mais amplo e para uma melhor sustentabilidade do sistema de saúde.

- A expansão de provedores de seguros e resseguradoras internacionais para mercados como Nigéria, África do Sul e Gana está introduzindo modelos avançados de subscrição, opções de políticas personalizáveis e melhores práticas globais em ecossistemas locais

- Campanhas de educação sobre seguros de saúde, apoiadas por parcerias público-privadas em países como Ruanda e Tanzânia, estão ajudando os cidadãos a entender os benefícios da cobertura, os procedimentos de reivindicação e os direitos sob os programas nacionais de seguro de saúde.

- Até 2032, a convergência da inovação em saúde digital, ambientes de políticas de apoio e a crescente demanda por cuidados acessíveis e acessíveis continuarão a acelerar a formalização e o crescimento do mercado de seguros de saúde no Oriente Médio e na África.

Restrição/Desafio

Barreiras de acessibilidade, fragmentação regulatória e lacunas de infraestrutura

- Apesar do crescimento do mercado, o mercado de seguros de saúde do Oriente Médio e da África enfrenta desafios relacionados à acessibilidade, padronização regulatória limitada e infraestrutura de saúde subdesenvolvida em regiões rurais e de baixa renda

- Por exemplo, em vários países da África Subsariana, mais de 60% da população continua sem seguro devido aos elevados custos dos prémios e à falta de modelos de seguro patrocinados pelo empregador, o que limita a escala de adopção de seguros formais.

- Estruturas regulatórias fragmentadas entre países — como diferenças em mandatos de cobertura, protocolos de tratamento de sinistros e requisitos de solvência — criam complexidades operacionais para seguradoras regionais e multinacionais

- Em regiões como o Sudão, a Somália e partes da África Central, a instabilidade política persistente, a fraca capacidade institucional e os sistemas de saúde públicos subfinanciados restringem severamente o alcance dos prestadores de seguros de saúde públicos e privados.

- O ceticismo cultural em relação aos seguros e a falta geral de conhecimento sobre os benefícios das apólices levam a uma baixa adesão, especialmente em comunidades rurais, onde as práticas tradicionais de assistência muitas vezes prevalecem sobre os sistemas formais de saúde.

- Preocupações com a privacidade de dados, literacia digital inadequada e acesso precário a registos de saúde fiáveis continuam a dificultar a implementação de modelos de seguros que privilegiem o digital, especialmente entre as populações mais velhas

- Para superar estes obstáculos, os esforços devem concentrar-se em subsídios de prémios para grupos de baixos rendimentos, harmonização regulamentar entre regiões, parcerias público-privadas em infra-estruturas e campanhas de sensibilização agressivas para melhorar a penetração dos seguros de saúde até 2032.

Escopo do mercado de seguros de saúde no Oriente Médio e na África

O mercado é segmentado com base no tipo, serviços, nível de cobertura, provedores de serviços, planos de seguro saúde, demografia, tipo de cobertura, usuário final e canal de distribuição.

- Por tipo

Com base no tipo, o mercado de seguros de saúde do Oriente Médio e África é segmentado em produtos e soluções. O segmento de produtos detinha a maior participação de mercado, de 62,4% em 2024, devido à ampla adoção de ofertas padronizadas de apólices de seguro, como cobertura básica de saúde, planos para doenças graves e benefícios de saúde baseados no empregador. Esses produtos são populares devido aos seus benefícios estruturados, facilidade de comparação e conformidade regulatória.

Espera-se que o segmento de soluções registre o CAGR mais rápido, de 9,8%, entre 2025 e 2032, impulsionado pela crescente demanda por serviços de seguros personalizados e tecnológicos, como gestão digital de apólices, integração de telessaúde, subscrição com tecnologia de IA e plataformas de detecção de fraudes. Essas inovações estão revolucionando a experiência do usuário e a eficiência operacional em todo o ecossistema de seguros de saúde.

- Por serviços

Com base nos serviços, o mercado de seguros de saúde no Oriente Médio e na África é segmentado em tratamento hospitalar, tratamento ambulatorial, assistência médica e outros. O segmento de tratamento hospitalar liderou o mercado com a maior participação na receita, de 41,9% em 2024, principalmente devido ao aumento da carga de doenças crônicas e aos altos custos de tratamento associados a cirurgias, internações prolongadas e terapia intensiva. O seguro de saúde desempenha um papel fundamental na redução do estresse financeiro para pacientes hospitalizados.

O segmento de assistência médica deverá crescer na mais rápida CAGR de 11,2% entre 2025 e 2032, impulsionado pela crescente necessidade de serviços de resposta a emergências 24 horas por dia, 7 dias por semana, suporte de ambulância, segundas opiniões médicas e consultas virtuais de saúde, especialmente em áreas remotas e carentes.

- Por nível de cobertura

Com base no nível de cobertura, o mercado de seguros de saúde no Oriente Médio e África é segmentado em bronze, prata, ouro e platina. O segmento prata dominou o mercado, com uma participação de receita de 36,8% em 2024, oferecendo uma combinação equilibrada de prêmios acessíveis e despesas moderadas. É particularmente procurado por famílias de renda média que buscam proteção adequada sem excesso de prêmios.

Espera-se que o segmento de platina cresça na mais rápida CAGR de 11,1% de 2025 a 2032, impulsionado pela crescente demanda por planos premium e abrangentes que cubram uma ampla gama de serviços com compartilhamento mínimo de custos, especialmente entre indivíduos de alto patrimônio líquido e pacientes com necessidades médicas complexas.

- Por provedores de serviços

Com base nos prestadores de serviços, o mercado de seguros de saúde no Oriente Médio e na África é segmentado em seguradoras públicas e privadas. O segmento de seguradoras privadas detinha a maior participação de mercado, 69,1% em 2024, devido à sua capacidade de oferecer processamento de sinistros mais rápido, redes hospitalares mais amplas e opções de cobertura mais personalizadas. Muitos empregadores e indivíduos preferem seguradoras privadas por sua eficiência e serviços centrados no cliente.

Espera-se que o segmento de provedores de seguro saúde público cresça na taxa composta de crescimento anual (CAGR) mais rápida, de 8,9%, de 2025 a 2032, apoiado pelo aumento do investimento governamental em programas nacionais de saúde, esquemas de seguro social e políticas destinadas a expandir o acesso à saúde para populações rurais e de baixa renda.

- Por Planos de Saúde

Com base nos planos de saúde, o mercado de seguros de saúde do Oriente Médio e África é segmentado em POS, EPOS, indenização, HSA, QSEHRAs, PPO, HMO e outros. O segmento HMO liderou o mercado com a maior participação na receita, de 31,6% em 2024, devido à sua relação custo-benefício e ao modelo de atendimento coordenado, que exige que os pacientes acessem os serviços por meio de um médico de atenção primária dentro de uma rede definida. Esse modelo é atraente tanto para seguradoras quanto para segurados devido aos prêmios mais baixos e à gestão simplificada.

A projeção é de que o segmento HSA cresça na taxa composta de crescimento anual (CAGR) mais rápida, de 10,9%, entre 2025 e 2032, à medida que mais consumidores estão optando por planos de saúde com franquias altas vinculados a contas poupança com vantagens fiscais, proporcionando flexibilidade e controle sobre os gastos com saúde.

- Por Demografia

Com base na demografia, o mercado de seguros de saúde no Oriente Médio e na África é segmentado em adultos, menores e idosos. O segmento de adultos dominou o mercado, com uma participação de receita de 54,8% em 2024, representando a maior população segurada que busca ativamente cobertura por meio de empregadores, planos individuais ou programas governamentais. Os adultos são os principais tomadores de decisão sobre a cobertura de saúde familiar e contribuem significativamente para o conjunto de prêmios do seguro.

Espera-se que o segmento de idosos cresça na taxa composta de crescimento anual (CAGR) mais rápida, de 12,3%, de 2025 a 2032, impulsionado pelo aumento da população geriátrica, pela maior prevalência de doenças relacionadas à idade e pela necessidade de cuidados de longo prazo e benefícios de hospitalização.

- Por tipo de cobertura

Com base no tipo de cobertura, o mercado de seguros de saúde no Oriente Médio e na África é segmentado em cobertura vitalícia e cobertura a termo. O segmento de cobertura a termo detinha a maior participação de mercado, 60,2% em 2024, impulsionado por sua acessibilidade e popularidade entre populações mais jovens e novos segurados que buscam proteção temporária ou de curto a médio prazo.

Espera-se que o segmento de cobertura vitalícia cresça na taxa composta de crescimento anual (CAGR) mais rápida, de 9,6%, de 2025 a 2032, à medida que os consumidores se tornam cada vez mais conscientes da importância da proteção financeira vitalícia contra riscos à saúde, especialmente em vista das crescentes condições relacionadas ao estilo de vida e da inflação médica.

- Por usuário final

Com base no usuário final, o mercado de seguros de saúde no Oriente Médio e na África é segmentado em empresas, pessoas físicas e outros. O segmento de seguros de saúde individuais dominou o mercado, com uma participação de receita de 53,1% em 2024, atribuída ao aumento de inscrições entre autônomos, freelancers e empregados do setor informal que buscam cobertura de saúde abrangente e personalizada.

O segmento de indivíduos também deverá crescer na CAGR mais rápida de 11,4% entre 2025 e 2032, à medida que profissionais autônomos, trabalhadores da economia gig e populações sem seguro recorrem cada vez mais a planos de seguro saúde pessoais facilitados pela integração digital e ofertas de produtos simplificadas.

- Por canal de distribuição

Com base no canal de distribuição, o mercado de seguros de saúde do Oriente Médio e África é segmentado em vendas diretas, instituições financeiras, comércio eletrônico, hospitais, clínicas e outros. O segmento de vendas diretas dominou o mercado, com uma participação de receita de 36,5% em 2024, graças à eficácia das redes de distribuição baseadas em agentes e das interações presenciais na construção de confiança, na explicação dos benefícios das apólices e no oferecimento de recomendações personalizadas.

Espera-se que o segmento de comércio eletrônico cresça a uma CAGR mais rápida, de 12,6%, entre 2025 e 2032, apoiado pela crescente penetração da internet, acessibilidade móvel e pela crescente adoção de plataformas online que permitem aos usuários comparar, comprar e gerenciar apólices em tempo real.

Análise regional do mercado de seguros de saúde no Oriente Médio e na África

- O mercado de seguros de saúde do Oriente Médio e da África foi responsável por 8,4% da participação de mercado global em 2024 e está projetado para crescer a um CAGR de 10,7% de 2025 a 2032, impulsionado pela crescente conscientização sobre saúde pública, aumento dos gastos com saúde e iniciativas políticas destinadas a expandir o acesso a cuidados de qualidade entre diversas populações.

- Os governos da região estão a implementar ativamente reformas regulatórias, estratégias de digitalização e regimes de seguros obrigatórios para fazer face à baixa penetração dos seguros e aos elevados custos dos cuidados de saúde.

- O mercado está testemunhando uma participação crescente de seguradoras privadas, startups de InsurTech e empresas de resseguros internacionais, introduzindo plataformas digitais inovadoras, planos personalizados e modelos de subscrição baseados em risco adaptados a segmentos carentes.

Visão do mercado de seguros de saúde da Arábia Saudita

O mercado de seguros de saúde da Arábia Saudita dominou o país, com uma participação de 34,7% na receita em 2024, impulsionado por robustos planos de saúde liderados pelo governo, pela expansão do setor de seguros privados e pela obrigatoriedade de cobertura para expatriados e funcionários do setor privado. As reformas da Visão 2030 do país estão impulsionando investimentos em larga escala em infraestrutura digital de saúde e na expansão da cobertura de seguros. O Conselho Cooperativo de Seguros de Saúde (CCHI) está acelerando a adoção de sistemas digitais padronizados de sinistros e modelos de atendimento integrados, ao mesmo tempo em que aumenta a transparência e a conformidade entre os provedores. A crescente demanda por pacotes de seguros privados complementares entre populações urbanas de alta renda está impulsionando ainda mais o crescimento do mercado em cidades como Riad, Jidá e Dammam.

Visão do mercado de seguros de saúde dos Emirados Árabes Unidos

O mercado de seguros de saúde dos Emirados Árabes Unidos conquistou 22,1% da participação de mercado regional em 2024 e projeta-se que seja o país com crescimento mais rápido, registrando um CAGR de 11,6% entre 2025 e 2032. O crescimento é impulsionado pelo crescente status do país como um polo de turismo médico, pela ampla adoção de plataformas digitais de seguros de saúde e pela pressão do governo por cobertura universal de saúde por meio de mandatos regulatórios como a Lei de Seguros de Saúde de Dubai e o Programa Thiqa de Abu Dhabi. A integração de telemedicina, farmácia eletrônica e análises de saúde baseadas em IA está aprimorando a eficiência e a acessibilidade dos serviços de seguros de saúde. As seguradoras sediadas nos Emirados Árabes Unidos estão colaborando cada vez mais com startups de saúde digital para oferecer serviços de valor agregado e cobertura personalizada, atraindo ainda mais expatriados e pacientes internacionais que buscam pacotes de cuidados premium.

Participação no mercado de seguros de saúde no Oriente Médio e na África

O mercado de seguros de saúde é liderado principalmente por empresas bem estabelecidas, incluindo:

- Bupa (Reino Unido)

- Agora Saúde Internacional (China)

- Cigna (EUA)

- Aetna Inc. (EUA)

- AXA (França)

- HBF Health Limited (Austrália)

- Vitalidade (Reino Unido)

- Centene Corporation (EUA)

- International Medical Group, Inc. (EUA)

- Anthem Insurance Companies, Inc. (EUA)

- Broadstone Corporate Benefits Limited (Reino Unido)

- Allianz Care (França)

- HealthCare International Middle East and Africa Network Ltd (Reino Unido)

- Assicurazioni Generali SPA (Itália)

- Aviva (Reino Unido)

- Vhi Group (Irlanda)

- UnitedHealth Group (EUA)

- MAPFRE (Espanha)

- AIA Group Limited (China)

Últimos desenvolvimentos no mercado de seguros de saúde no Oriente Médio e na África

- Em fevereiro de 2025, a Bupa Arabia lançou sua plataforma CareConnect e o serviço Bupa Pro para revolucionar o seguro saúde digital na Arábia Saudita. O CareConnect permite que os usuários acessem cartões de saúde digitais, acompanhem solicitações de reembolso e armazenem dados médicos, enquanto o Bupa Pro elimina a necessidade de pré-aprovações ambulatoriais para mais de 200.000 membros por meio da validação de API em tempo real. Essas inovações visam reduzir o tempo de espera dos pacientes e melhorar a acessibilidade aos serviços de saúde em toda a região.

- Em maio de 2025, a Fundação OMS assinou uma parceria estratégica com a Tawuniya, uma das principais seguradoras da Arábia Saudita, para impulsionar a inovação e a resiliência do sistema de saúde na região do Mediterrâneo Oriental. A colaboração concentra-se na gestão da saúde da população, na aceleração da saúde digital e na cobertura universal de saúde, marcando um marco na transformação regional da saúde.

- Em abril de 2025, a Autoridade de Serviços Financeiros de Omã lançou a Dhamani , uma plataforma digital nacional de seguros de saúde com o objetivo de automatizar solicitações de reembolso, aumentar a transparência e otimizar os fluxos de trabalho dos seguros. A iniciativa apoia a visão de Omã de digitalizar o ecossistema da saúde e expandir a cobertura de seguros para mais cidadãos e residentes.

- Em janeiro de 2024, a AXA Egypt lançou um novo produto chamado AXA Health Advantage , oferecendo consultas por telemedicina, suporte à saúde mental e gerenciamento de doenças crônicas como parte de seus planos de saúde individuais e corporativos. Esta iniciativa atende à crescente demanda por modelos híbridos de saúde em todo o país.

- Em março de 2024, a Discovery Health South Africa anunciou sua intenção de integrar o processamento de solicitações de reembolso com tecnologia de IA até 2026, com o objetivo de reduzir fraudes, automatizar decisões e aumentar a satisfação do cliente. A iniciativa faz parte do esforço mais amplo da Discovery em direção à transformação digital e à melhoria da eficiência operacional.

- Em junho de 2024, a Medgulf Insurance, na Arábia Saudita, firmou parceria com a Altibbi, uma provedora líder de saúde digital, para oferecer serviços de telessaúde em conjunto com planos de saúde. A integração permite que os segurados acessem consultas remotas 24 horas por dia, 7 dias por semana, e prescrições eletrônicas por meio de um aplicativo móvel, refletindo uma tendência importante para serviços de seguros com tecnologia na região.

- Em junho de 2021, a Vitality anunciou uma parceria com a Samsung UK para integrar o Samsung Health ao Programa Vitality, oferecendo aos membros mais maneiras de monitorar suas atividades e melhorar sua saúde. A nova parceria com a Samsung desbloqueará todos os benefícios do Programa Vitality para usuários de Android, já que os membros poderão vincular seu perfil Samsung Health à sua conta Vitality Member Zone para registrar automaticamente os passos diários e a frequência cardíaca para ganhar pontos de atividade Vitality.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.