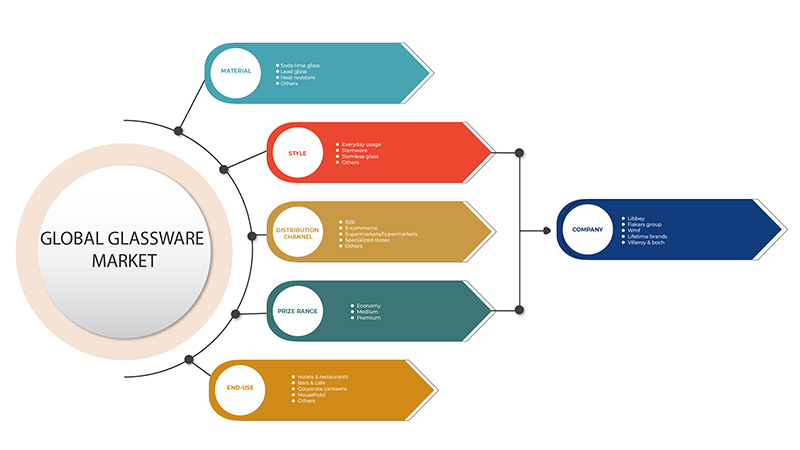

Mercado de artigos de vidro do Médio Oriente e África, por material (vidro de cal sodada, vidro de chumbo, resistente ao calor e outros), estilo (vidro sem pé, taças, uso diário e outros), canal de distribuição (B2B, lojas especializadas, supermercados/hipermercados, E -Comércio e outros), Intervalo de preços (médio, premium e económico), Utilização final (hotéis e restaurantes, bares e cafés, residências, cantinas corporativas e outros), Tendências e previsões do sector até 2029.

Análise de Mercado e Tamanho

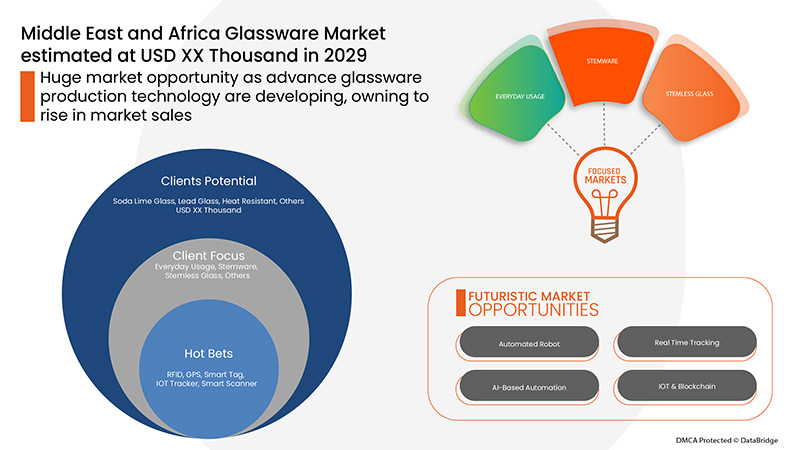

Espera-se que os níveis crescentes de investimento no setor da hotelaria e buffet atuem como um impulsionador do crescimento do mercado de artigos de vidro no período previsto. Espera-se que as mudanças no estilo de vida dos consumidores atuem como um impulsionador do crescimento do mercado de artigos de vidro no período previsto de 2022-2029. Espera-se que os avanços nas tecnologias de produção de vidro tragam oportunidades de crescimento para o mercado do vidro no futuro.

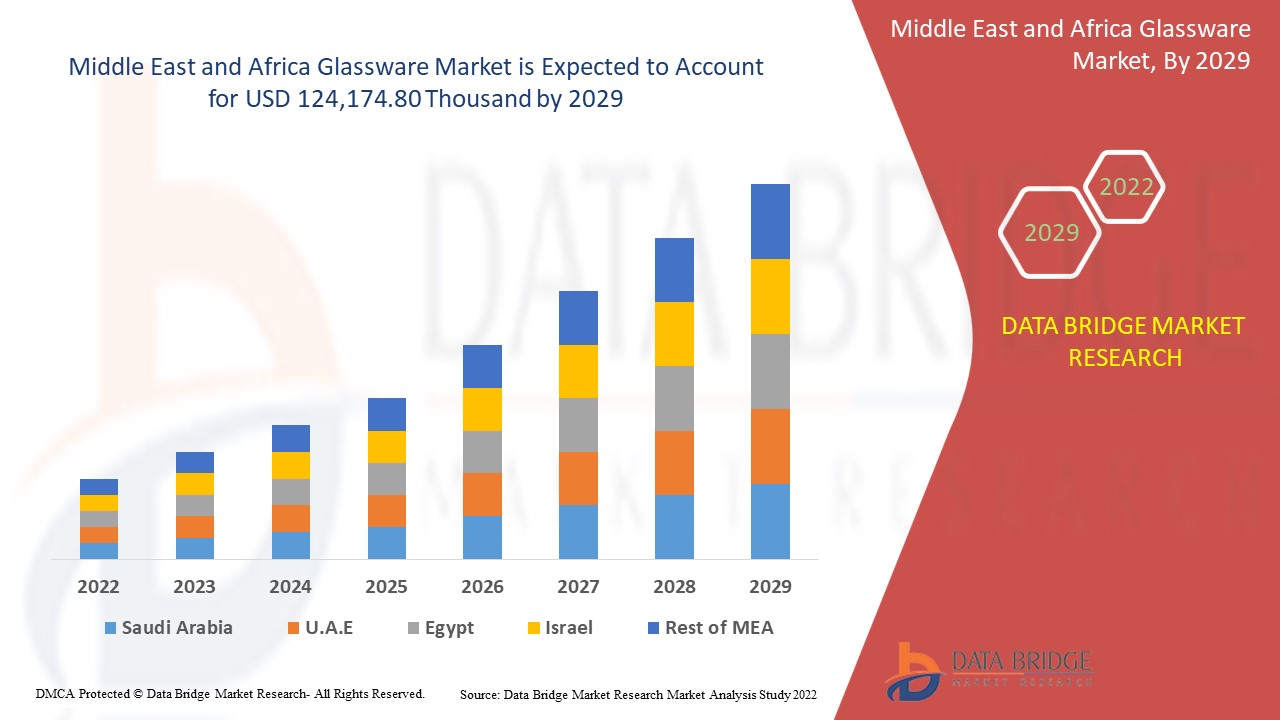

A Data Bridge Market Research analisa que o mercado de artigos de vidro deverá atingir o valor de 124.174,80 mil dólares até 2029, com um CAGR de 4,2% durante o período previsto. "cal sodada" representa o segmento de material mais proeminente, uma vez que este tipo de vidro proporciona superfícies resistentes a riscos. O relatório do Mercado do Vidro também abrange análises de preços, análises de patentes e avanços tecnológicos em profundidade.

|

Métrica de Reporte |

Detalhes |

|

Período de previsão |

2022 a 2029 |

|

Ano base |

2021 |

|

Anos históricos |

2020 |

|

Unidades quantitativas |

Receita em USD mil, volume em unidades, preço em USD |

|

Segmentos abrangidos |

Por material (vidro de cal sodada, vidro de chumbo, resistente ao calor e outros), estilo (vidro sem pé, taças, uso diário e outros), canal de distribuição (B2B, lojas especializadas, supermercados/hipermercados, comércio eletrónico e outros ), intervalo de preços ( Médio, Premium e Económico), Utilização Final (Hotéis e Restaurantes, Bares e Cafés, Residências, Cantinas Corporativas e Outros) |

|

Países abrangidos |

Emirados Árabes Unidos, Arábia Saudita, África do Sul, Egito, Israel, Resto do Médio Oriente e África |

|

Atores do mercado abrangidos |

Hrastnik1860, Oneida, NoritakeUAE, Ocean Glass Public Company Limited, Lenox Corporation, Treo.in, Libbey Inc, Fiskars Group, WMF (uma subsidiária do Groupe SEB), Lifetime Brands, Inc, Villeroy & Boch, Bormioli Rocco SpA, Wonderchef Home Appliances Soldado. Ltd., The Zrike Company, Inc., Shandong Hikingpac Co., Ltd., Addresshome, Stölzle Lausitz GmbH, Eagle Glass Deco (P.) Ltd., Degrenne, Cello World, MYBOROSIL, Jiangsu Rongtai Glass Products Co., Ltd. , Cumbria Crystal, Garbo Glassware entre outros |

Definição de Mercado

O vidro é um material quebradiço e rígido que é geralmente transparente ou translúcido. Pode ser feito a partir de uma mistura de areia, soda, cal ou outros minerais. O método mais comum de formação de vidro envolve o aquecimento de ingredientes brutos até se tornarem líquidos derretidos e, em seguida, o arrefecimento rápido da mistura para produzir vidro temperado. As variedades de vidro podem ser classificadas com base nas suas qualidades mecânicas e térmicas para identificar quais as aplicações mais adequadas.

Vidro sodo-cálcico: O vidro sodo-cálcico é o tipo de vidro mais comum utilizado em vidros e recipientes de vidro, como garrafas e jarros para bebidas, alimentos e certos artigos básicos.

Vidro de chumbo: O vidro de chumbo é um vidro com uma elevada percentagem de óxido de chumbo, com uma clareza e brilho excecionais.

Resistente ao calor: o vidro resistente ao calor foi concebido para suportar o stress térmico e é normalmente utilizado em cozinhas e aplicações industriais.

Dinâmica do mercado de artigos de vidro

Esta secção trata da compreensão dos impulsionadores, vantagens, oportunidades, restrições e desafios do mercado. Tudo isto é discutido em detalhe abaixo:

- Níveis crescentes de investimento na indústria hoteleira e de restauração

O turismo impulsionou os negócios do setor hoteleiro e de restauração em todo o mundo e proporcionou um grande alcance para a indústria hoteleira. A indústria floresceu principalmente através do turismo e devido à diversidade de paisagens, crenças e sociedades nos diferentes países, o que proporcionou uma grande atração aos turistas de diferentes regiões. Os sectores da hotelaria e da restauração de muitas nações têm-se expandido gradualmente nas últimas duas décadas, prevendo-se o desenvolvimento para os próximos anos, juntamente com um aumento da procura de vários tipos de produtos de vidro.

- Mudanças no estilo de vida dos consumidores

A vida dos consumidores está em constante evolução. Os hábitos e valores do consumidor são influenciados pelas tendências existentes e novas, bem como pela combinação demográfica em constante mudança, pelas convulsões culturais mundiais e pelos rápidos desenvolvimentos na tecnologia. As empresas podem capitalizar novas possibilidades adquirindo uma compreensão profunda das preferências dos clientes após mudanças de comportamento e crenças. Ultimamente, os consumidores de todas as gerações estão a concentrar-se mais em produtos de marca em muitas áreas do seu dia-a-dia.

- Crescente popularidade da gastronomia requintada em todo o mundo

Um restaurante requintado é um estabelecimento especializado ou de cozinha variada que valoriza ingredientes de qualidade, apresentação e serviço irrepreensível. A categoria está a crescer a um ritmo respeitável de 15%, o que encorajou a chegada de restaurantes premium com estrelas Michelin e outros concorrentes locais. Por conseguinte, a crescente procura por pratos requintados e delicados é alcançada principalmente pelas operações bem-sucedidas de diferentes tipos de marcas de produtos de vidro em hotéis e restaurantes.

- Disponibilidade de produtos de qualidade baratos

O vidro é um dos materiais mais complexos e adaptáveis, sendo utilizado em quase todos os setores. O uso extensivo de vidro contribui para a criação de um aspeto moderno e de alta tecnologia em estruturas residenciais e comerciais. O vidro apresenta uma variedade de formas e tamanhos para se adequar a uma variedade de aplicações e é utilizado em diversas aplicações arquitetónicas, como portas, janelas e divisórias. O vidro percorreu um longo caminho desde o seu humilde início como vidro de janela até se tornar um componente estrutural sofisticado nos dias de hoje.

- Aumento da procura de copos de aço e papel

O papel e o plástico estão a ser cada vez mais utilizados para fazer pratos e copos descartáveis, devido ao seu ótimo desempenho ambiental e à crescente procura por serviços de comércio eletrónico e de entregas. Os consumidores, as marcas e os retalhistas têm grandes expectativas em relação aos produtos recicláveis feitos de papel. A taxa de reciclagem de materiais à base de papel é de cerca de 85%, e a cadeia de valor do papel está a melhorar de dia para dia. Para atingir objetivos de reciclagem ainda maiores e, ao mesmo tempo, alargar a utilidade das embalagens de papel, é fundamental, desde o início, a fase de conceção, tendo em conta tanto a finalidade pretendida como o fim de vida.

Impacto pós-COVID-19 no mercado de artigos de vidro

A COVID-19 causou um grande impacto no mercado de artigos de vidro, uma vez que quase todos os países optaram pelo encerramento de todas as unidades de produção, exceto as que produzem produtos essenciais. O governo tomou algumas medidas rigorosas, como a paragem da produção e venda de bens não essenciais, bloqueou o comércio internacional e muitas outras para impedir a propagação da COVID-19. Os únicos negócios que estão a lidar com esta situação de pandemia são os serviços essenciais que estão autorizados a abrir e executar os processos.

O crescimento do mercado de artigos de vidro está a aumentar devido às políticas governamentais para impulsionar o comércio internacional pós-COVID-19. Além disso, a abertura do confinamento está a impulsionar o sector da hotelaria, o que está a aumentar a procura de artigos de vidro no mercado. No entanto, factores como o congestionamento associado às rotas comerciais e as restrições comerciais entre algumas nações estão a restringir o crescimento do mercado. A paragem das unidades de produção durante a situação de pandemia teve um impacto significativo no mercado.

Os fabricantes estão a tomar várias decisões estratégicas para recuperar após a COVID-19. Os jogadores estão a realizar diversas atividades de investigação e desenvolvimento para melhorar a tecnologia envolvida no Glassware. Com isto, as empresas levarão para o mercado soluções avançadas e precisas. Além disso, as iniciativas governamentais para impulsionar o comércio internacional levaram ao crescimento do mercado.

Desenvolvimentos recentes

- Em outubro de 2020, a Libbey Inc. anunciou a confirmação de um plano de reorganização e esperava concluir a sua reestruturação supervisionada pelo tribunal e emergir com um balanço mais forte nas próximas semanas. A empresa fez este anúncio para ter sucesso no atual ambiente operacional empresarial.

- Em outubro de 2021, a Lenox Corporation adquiriu a Oneida Consumer LLC com a sua marca de produtos de mesa, incluindo talheres, louça e utensílios de cozinha. A colaboração foi realizada para comercializar um portefólio líder de marcas e produtos inovadores com um reconhecimento incomparável do cliente numa ampla variedade de canais de retalho.

Âmbito do mercado de artigos de vidro no Médio Oriente e África

O mercado de artigos de vidro é segmentado com base no material, estilo, canal de distribuição, gama de preços e utilização final. O crescimento entre estes segmentos irá ajudá-lo a analisar segmentos de crescimento escassos nos setores e fornecerá aos utilizadores uma visão geral e informações valiosas do mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Por material

- Copo de Soda Cal

- Vidro de chumbo

- Resistente ao calor

- Outros

Com base no material, o mercado do vidro está segmentado em vidro sodo-cálcico, vidro de chumbo, resistente ao calor e outros.

Por estilo

- Vidro sem haste

- Taças

- Uso diário

- Outros

Com base no estilo, o mercado de artigos de vidro foi segmentado em vidro sem haste, taças, uso diário e outros.

Por canal de distribuição

- B2B

- Lojas especializadas

- Supermercados/Hipermercados

- Comércio eletrónico

- Outros

Com base no canal de distribuição, o mercado de artigos de vidro foi segmentado em b2b, lojas especializadas, supermercados/hipermercados, comércio eletrónico e outros.

Por gama de preço

- Médio

- Prémio

- Economia

Com base na gama de preços, o mercado de artigos de vidro foi segmentado em médio, premium e económico.

Por uso final

- Hotéis e Restaurantes

- Bares e Cafés

- Agregado familiar

- Cantinas Corporativas

- Outros

Com base na utilização final, o mercado de artigos de vidro foi segmentado em hotéis e restaurantes, bares e cafés, residências, cantinas corporativas e outros.

Análise regional/Insights do mercado de artigos de vidro

O mercado de artigos de vidro é analisado e são fornecidos insights sobre o tamanho do mercado e as tendências por país, material, estilo, canal de distribuição, intervalo de preços e utilização final, conforme referenciado acima.

Os países abrangidos pelo relatório de mercado de artigos de vidro são os Emirados Árabes Unidos, Arábia Saudita, África do Sul, Egito, Israel, Resto do Médio Oriente e África.

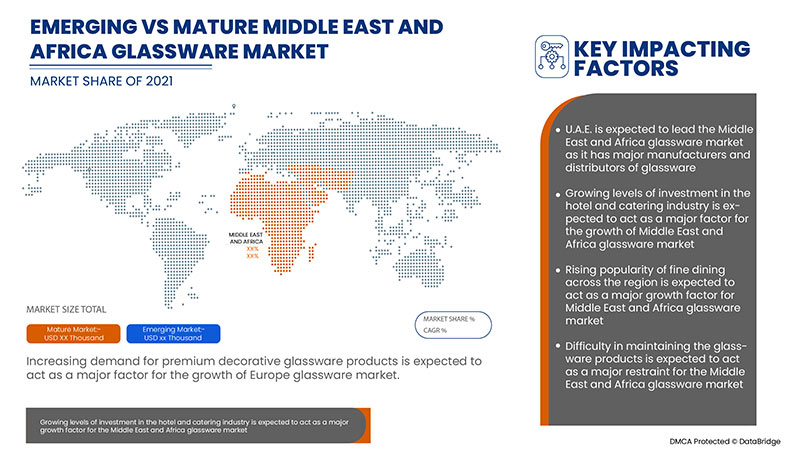

Os Emirados Árabes Unidos dominam o mercado de vidro do Médio Oriente e de África. É provável que os EAU sejam o mercado de artigos de vidro com o crescimento mais rápido no Médio Oriente e em África. O crescente desenvolvimento de infraestruturas, comercial e industrial em países emergentes como os Emirados Árabes Unidos é creditado ao domínio do mercado. Com o crescente desenvolvimento nos países, o número de restaurantes e bares está a aumentar, o que aumentará a procura de produtos de vidro na região do Médio Oriente e África.

A secção de países do relatório também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado que impactam as tendências atuais e futuras do mercado. Pontos de dados como a análise da cadeia de valor a montante e a jusante, tendências técnicas e análise das cinco forças de Porter, estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade de marcas do Médio Oriente e de África e os seus desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, ao impacto de tarifas domésticas e rotas comerciais são considerados ao fornecer uma análise de previsão dos dados do país.

Análise do cenário competitivo e da quota de mercado dos artigos de vidro

O panorama competitivo do mercado do vidro fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença no Médio Oriente e África, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento do produto, amplitude do produto e amplitude, domínio da aplicação. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas no mercado de artigos de vidro.

Alguns dos principais participantes que operam no mercado de artigos de vidro são a Hrastnik1860, Oneida, Noritake China, Ocean Glass Public Company Limited, Lenox Corporatio, Treo.in, Libbey Inc, Fiskars Group, WMF (uma subsidiária do Groupe SEB), Lifetime Brands , Inc. , Villeroy & Boch, Bormioli Rocco SpA, Wonderchef Home Appliances Pvt. Ltd., The Zrike Company, Inc, Shandong Hikingpac Co., Ltd., Addresshome, Stölzle Lausitz GmbH, Eagle Glass Deco (P.) Ltd., Degrenne. Cello World, MYBOROSIL, Jiangsu Rongtai Glass Products Co., Ltd., Cumbria Crystal, Garbo Glassware.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA GLASSWARE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MATERIAL TIME LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S MODEL

4.2 CONSUMER BEHAVIOUR PATTERN

4.3 FACTORS INFLUENCING BUYING DECISION

4.3.1 PSYCHOLOGICAL FACTORS

4.3.2 SOCIAL FACTORS

4.3.3 CULTURAL FACTORS

4.3.4 PERSONAL FACTORS

4.3.5 ECONOMIC FACTORS

4.4 KEY TRENDS

4.4.1 BOROSILICATE GLASSWARE IS A GAME-CHANGER

4.4.2 OMNI-CHANNEL STRATEGY USAGE IS ENCOURAGING THE GROWTH OF THE GLASSWARE MARKET

4.4.3 BEVERAGE INDUSTRY TO REGISTER SIGNIFICANT GROWTH

4.4.4 INCREASE IN TABLEWARE PRODUCTS

4.5 PRICING ANALYSIS

4.6 PRODUCT ADOPTION SCENARIO

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING LEVELS OF INVESTMENT IN THE HOTEL AND CATERING INDUSTRY

5.1.2 CHANGES IN LIFESTYLE OF THE CONSUMERS

5.1.3 RISING POPULARITY OF FINE DINING ACROSS THE GLOBE

5.1.4 INCREASING DEMAND FOR PREMIUM DECORATIVE GLASSWARE PRODUCTS

5.2 RESTRAINTS

5.2.1 AVAILABILITY OF CHEAP QUALITY PRODUCTS

5.2.2 RISING DEMAND FOR STEEL AND PAPER BASE DRINKWARE

5.2.3 DIFFICULTY IN MAINTAINING THE GLASSWARE PRODUCTS

5.3 OPPORTUNITIES

5.3.1 ADVANCEMENTS IN GLASSWARE PRODUCTION TECHNOLOGIES

5.3.2 RISING DEMAND FOR GLASSWARE PRODUCTS FOR CLINICAL USE IN HOSPITALS AND FORENSIC LABORATORIES

5.4 CHALLENGES

5.4.1 COMPLEXITY IN MANUFACTURING GLASSWARE PRODUCTS

5.4.2 RISING DIFFICULTY IN RECYCLING GLASSWARE PRODUCTS

6 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY MATERIAL

6.1 OVERVIEW

6.2 SODA LIME GLASS

6.3 LEAD GLASS

6.4 HEAT RESISTANT

6.5 OTHERS

7 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY STYLE

7.1 OVERVIEW

7.2 STEMWARE

7.2.1 RED WINE GLASS

7.2.1.1 BORDEAUX

7.2.1.2 CABERNET

7.2.1.3 ZINFANDEL

7.2.1.4 BURGUNDY

7.2.1.5 PINOT NOIR

7.2.1.6 ROSE

7.2.2 WHITE WINE GLASS

7.2.2.1 SPARKLING

7.2.2.2 CHARDONNAY

7.2.2.3 VIOGNIER

7.2.2.4 SWEET WINE

7.2.2.5 VINTAGE

7.3 STEMLESS GLASS

7.3.1 LIQUOR GLASS

7.3.2 BEER GLASS

7.4 EVERYDAY USAGE

7.5 OTHERS

8 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL

8.1 OVERVIEW

8.2 B2B

8.3 SPECIALIZED STORES

8.4 SUPERMARKETS/HYPERMARKETS

8.5 E-COMMERCE

8.6 OTHERS

9 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY PRICE RANGE

9.1 OVERVIEW

9.2 MEDIUM

9.3 PREMIUM

9.4 ECONOMY

10 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY END-USE

10.1 OVERVIEW

10.2 HOTELS & RESTAURANTS

10.3 BARS & CAFE

10.4 HOUSEHOLD

10.5 CORPORATE CANTEENS

10.6 OTHERS

11 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY GEOGRAPHY

11.1 MIDDLE EAST AND AFRICA

11.1.1 U.A.E.

11.1.2 SAUDI ARABIA

11.1.3 SOUTH AFRICA

11.1.4 EGYPT

11.1.5 ISRAEL

11.1.6 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST & AFRICA GLASSWARE MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 LIBBEY, INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT UPDATE

14.2 FISKARS GROUP

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT UPDATE

14.3 WMF (A SUBSIDIARY OF GROUPE SEB)

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT UPDATE

14.4 LIFETIME BRANDS, INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT UPDATE

14.5 VILLEROY & BOCH

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT UPDATES

14.6 ADDRESSHOME

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATE

14.7 BORMIOLI ROCCO S.P.A.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT UPDATE

14.8 CELLO WORLD

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATE

14.9 CUMBRIA CRYSTAL

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATE

14.1 DEGRENNE

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT UPDATE

14.11 EAGLE GLASS DECO (P.) LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT UPDATE

14.12 GARBO GLASSWARE

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT UPDATES

14.13 HRASTNIK1860

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT UPDATES

14.14 JIANGSU RONGTAI GLASS PRODUCTS CO., LTD.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT UPDATES

14.15 LENOX CORPORATION

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT UPDATE

14.16 MYBOROSIL

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT UPDATE

14.17 NORITAKECHINA

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT UPDATE

14.18 OCEAN GLASS PUBLIC COMPANY LIMITED

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT UPDATE

14.19 ONEIDA

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT UPDATE

14.2 SHANDONG HIKINGPAC CO., LTD.

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT UPDATE

14.21 STÖLZLE LAUSITZ GMBH

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT UPDATES

14.22 TREO.IN

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT UPDATE

14.23 THE ZRIKE COMPANY, INC.

14.23.1 COMPANY SNAPSHOT

14.23.2 PRODUCT PORTFOLIO

14.23.3 RECENT UPDATE

14.24 WONDERCHEF HOME APPLIANCES PVT. LTD

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCT PORTFOLIO

14.24.3 RECENT UPDATES

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tabela

TABLE 1 TYPE OF REUSABLE CUPS CONSUMERS WOULD PREFER FOR DRINKWARE IN U.S, 2015

TABLE 2 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (USD THOUSAND)

TABLE 3 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (THOUSAND UNITS)

TABLE 4 MIDDLE EAST & AFRICA SODA LIME GLASS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA SODA LIME GLASS IN GLASSWARE MARKET, BY REGION, 2016-2029 (THOUSAND UNITS)

TABLE 6 MIDDLE EAST & AFRICA LEAD GLASS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA LEAD GLASS IN GLASSWARE MARKET, BY REGION, 2016-2029 (THOUSAND UNITS)

TABLE 8 MIDDLE EAST & AFRICA HEAT RESISTANT IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA HEAT RESISTANT IN GLASSWARE MARKET, BY REGION, 2016-2029 (THOUSAND UNITS)

TABLE 10 MIDDLE EAST & AFRICA OTHERS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA OTHERS IN GLASSWARE MARKET, BY REGION, 2016-2029 (THOUSAND UNITS)

TABLE 12 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY STYLE, 2016-2029 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA STEMWARE IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA STEMWARE IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA STEMLESS GLASS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA EVERYDAY USAGE IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA OTHERS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2016-2029 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA B2B IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA SPECIALIZED STORES IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA SUPERMARKETS/HYPERMARKETS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA E-COMMERCE IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA OTHERS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY PRICE RANGE, 2016-2029 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA MEDIUM IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA PREMIUM IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA ECONOMY IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY END-USE, 2016-2029 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA HOTELS & RESTAURANTS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA BARS & CAFÉ IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 34 MIDDLE EAST & AFRICA HOUSEHOLD IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 35 MIDDLE EAST & AFRICA CORPORATE CANTEENS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 36 MIDDLE EAST & AFRICA OTHERS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY COUNTRY, 2016-2029 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY COUNTRY, 2016-2029 (THOUSAND UNITS)

TABLE 39 MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (THOUSAND UNITS)

TABLE 41 MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY STYLE, 2016-2029 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA STEMWARE IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2016-2029 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY PRICE RANGE, 2016-2029 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY END-USE, 2016-2029 (USD THOUSAND)

TABLE 49 U.A.E. GLASSWARE MARKET, BY MATERIAL, 2016-2029 (USD THOUSAND)

TABLE 50 U.A.E. GLASSWARE MARKET, BY MATERIAL, 2016-2029 (THOUSAND UNITS)

TABLE 51 U.A.E. GLASSWARE MARKET, BY STYLE, 2016-2029 (USD THOUSAND)

TABLE 52 U.A.E. STEMWARE IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 53 U.A.E. RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 54 U.A.E. WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 55 U.A.E. STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 56 U.A.E. GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2016-2029 (USD THOUSAND)

TABLE 57 U.A.E. GLASSWARE MARKET, BY PRICE RANGE, 2016-2029 (USD THOUSAND)

TABLE 58 U.A.E. GLASSWARE MARKET, BY END-USE, 2016-2029 (USD THOUSAND)

TABLE 59 SAUDI ARABIA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (USD THOUSAND)

TABLE 60 SAUDI ARABIA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (THOUSAND UNITS)

TABLE 61 SAUDI ARABIA GLASSWARE MARKET, BY STYLE, 2016-2029 (USD THOUSAND)

TABLE 62 SAUDI ARABIA STEMWARE IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 63 SAUDI ARABIA RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 64 SAUDI ARABIA WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 65 SAUDI ARABIA STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 66 SAUDI ARABIA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2016-2029 (USD THOUSAND)

TABLE 67 SAUDI ARABIA GLASSWARE MARKET, BY PRICE RANGE, 2016-2029 (USD THOUSAND)

TABLE 68 SAUDI ARABIA GLASSWARE MARKET, BY END-USE, 2016-2029 (USD THOUSAND)

TABLE 69 SOUTH AFRICA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (USD THOUSAND)

TABLE 70 SOUTH AFRICA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (THOUSAND UNITS)

TABLE 71 SOUTH AFRICA GLASSWARE MARKET, BY STYLE, 2016-2029 (USD THOUSAND)

TABLE 72 SOUTH AFRICA STEMWARE IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 73 SOUTH AFRICA RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 74 SOUTH AFRICA WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 75 SOUTH AFRICA STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 76 SOUTH AFRICA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2016-2029 (USD THOUSAND)

TABLE 77 SOUTH AFRICA GLASSWARE MARKET, BY PRICE RANGE, 2016-2029 (USD THOUSAND)

TABLE 78 SOUTH AFRICA GLASSWARE MARKET, BY END-USE, 2016-2029 (USD THOUSAND)

TABLE 79 EGYPT GLASSWARE MARKET, BY MATERIAL, 2016-2029 (USD THOUSAND)

TABLE 80 EGYPT GLASSWARE MARKET, BY MATERIAL, 2016-2029 (THOUSAND UNITS)

TABLE 81 EGYPT GLASSWARE MARKET, BY STYLE, 2016-2029 (USD THOUSAND)

TABLE 82 EGYPT STEMWARE IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 83 EGYPT RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 84 EGYPT WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 85 EGYPT STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 86 EGYPT GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2016-2029 (USD THOUSAND)

TABLE 87 EGYPT GLASSWARE MARKET, BY PRICE RANGE, 2016-2029 (USD THOUSAND)

TABLE 88 EGYPT GLASSWARE MARKET, BY END-USE, 2016-2029 (USD THOUSAND)

TABLE 89 ISRAEL GLASSWARE MARKET, BY MATERIAL, 2016-2029 (USD THOUSAND)

TABLE 90 ISRAEL GLASSWARE MARKET, BY MATERIAL, 2016-2029 (THOUSAND UNITS)

TABLE 91 ISRAEL GLASSWARE MARKET, BY STYLE, 2016-2029 (USD THOUSAND)

TABLE 92 ISRAEL STEMWARE IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 93 ISRAEL RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 94 ISRAEL WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 95 ISRAEL STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 96 ISRAEL GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2016-2029 (USD THOUSAND)

TABLE 97 ISRAEL GLASSWARE MARKET, BY PRICE RANGE, 2016-2029 (USD THOUSAND)

TABLE 98 ISRAEL GLASSWARE MARKET, BY END-USE, 2016-2029 (USD THOUSAND)

TABLE 99 REST OF MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (USD THOUSAND)

TABLE 100 REST OF MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (THOUSAND UNITS)

Lista de Figura

FIGURE 1 MIDDLE EAST & AFRICA GLASSWARE MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA GLASSWARE MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA GLASSWARE MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA GLASSWARE MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA GLASSWARE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA GLASSWARE MARKET: MATERIAL TIME LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA GLASSWARE MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA GLASSWARE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA GLASSWARE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA GLASSWARE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA GLASSWARE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA GLASSWARE MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA GLASSWARE MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA GLASSWARE MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 RISING POPULARITY OF FINE DINING ACROSS THE GLOBE IS DRIVING THE MIDDLE EAST & AFRICA GLASSWARE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 SODA LIME GLASS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA GLASSWARE MARKET IN 2022 & 2029

FIGURE 17 FACTOR INFLUENCING PURCHASE OF PRODUCT

FIGURE 18 PRICE RANGE COMPARISON OF KEY PLAYERS BY STEMLESS GLASSES

FIGURE 19 PRICE RANGE COMPARISON OF KEY PLAYERS BY STEMWARE GLASSES

FIGURE 20 PRICE RANGE COMPARISON OF KEY PLAYERS BY EVERYDAY USAGE GLASSES

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA GLASSWARE MARKET

FIGURE 22 MIDDLE EAST & AFRICA LUXURY HOTEL COUNT, IN LUXURY CLASS, 2002-2018 (APPROXIMATE)

FIGURE 23 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY MATERIAL, 2021

FIGURE 24 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY STYLE, 2021

FIGURE 25 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 26 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY PRICE RANGE, 2021

FIGURE 27 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY END-USE, 2021

FIGURE 28 MIDDLE EAST AND AFRICA GLASSWARE MARKET: SNAPSHOT (2021)

FIGURE 29 MIDDLE EAST AND AFRICA GLASSWARE MARKET: BY COUNTRY (2021)

FIGURE 30 MIDDLE EAST AND AFRICA GLASSWARE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 31 MIDDLE EAST AND AFRICA GLASSWARE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 32 MIDDLE EAST AND AFRICA GLASSWARE MARKET: BY MATERIAL (2022-2029)

FIGURE 33 MIDDLE EAST & AFRICA GLASSWARE MARKET: COMPANY SHARE 2021 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.