Middle East And Africa Deodorant Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

1.14 Million

USD

1.82 Million

2024

2032

USD

1.14 Million

USD

1.82 Million

2024

2032

| 2025 –2032 | |

| USD 1.14 Million | |

| USD 1.82 Million | |

|

|

|

|

Segmentação do mercado de desodorantes no Oriente Médio e África, por tipo de produto (spray, cremes, roll-on, outros), canal de distribuição (supermercados/hipermercados, lojas de conveniência, farmácias e drogarias, varejo online, outros), material de embalagem (metal, plástico, outros), usuário final (homens, mulheres, outros) – Tendências do setor e previsão até 2032

Análise do mercado de desodorantes no Oriente Médio e África

Com o aumento da participação feminina no mercado de trabalho, houve um enorme desenvolvimento na demanda por produtos de higiene pessoal ao longo dos anos. Além disso, as ações promocionais ativas dos fabricantes em diversas plataformas de mídia social contribuirão consideravelmente para a expansão do mercado. Como resultado, espera-se que o mercado cresça substancialmente ao longo do período previsto.

Tamanho do mercado de desodorantes no Oriente Médio e África

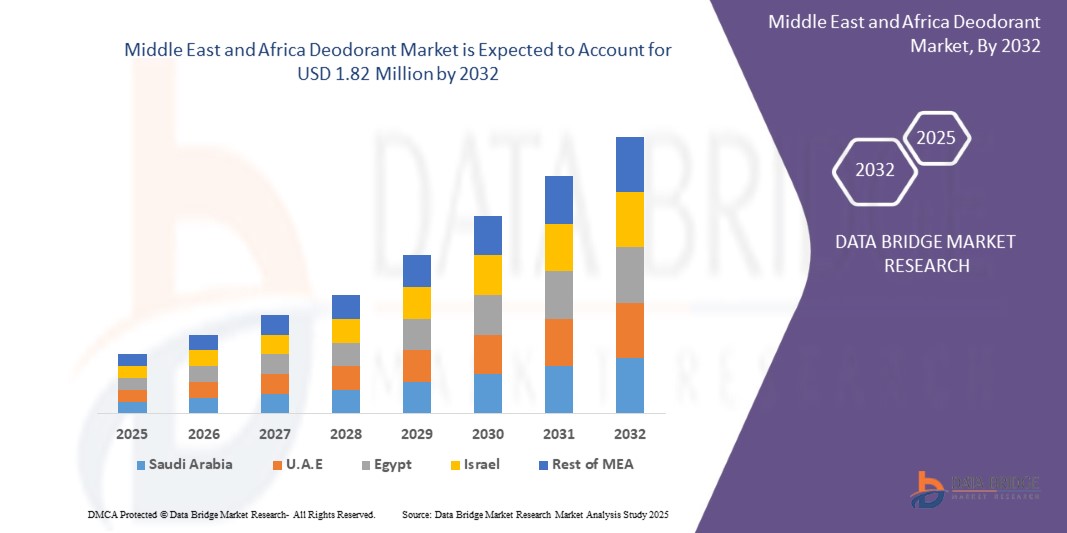

O tamanho do mercado de desodorantes do Oriente Médio e da África foi avaliado em US$ 1,14 milhão em 2024 e está projetado para atingir US$ 1,82 milhão até 2032, com um CAGR de 6,00% durante o período previsto de 2025 a 2032.

Escopo do Relatório e Segmentação do Mercado de Desodorantes

|

Atributos |

Principais insights do mercado de desodorantes |

|

Segmentação |

|

|

Países abrangidos |

Emirados Árabes Unidos, Arábia Saudita, Egito, África do Sul, Israel, Resto do Oriente Médio e África |

|

Principais participantes do mercado |

Unilever (Reino Unido), Procter & Gamble (EUA), Henkel AG & Co. KGaA (Alemanha), L'Oréal (França), Beiersdorf (Alemanha), group.loccitane (França), AVON PRODUCTS (Reino Unido), Elsa's Skincare (EUA), SPEICK Natural Cosmetics (Alemanha), Weleda (Suíça), Laverana GmbH & Co. KG (Alemanha), EO Products (EUA), Indus Valley (Índia), Lavanila (EUA), Sebapharma GmbH & CO. KG (Alemanha), Calvin Klein (EUA), Burberry plc (Reino Unido), REVLON (EUA), Dior (França) e Giorgio Armani SpA (Itália) |

|

Oportunidades de mercado |

|

Definição do Mercado de Desodorantes

Um desodorante é um produto químico aplicado no corpo para prevenir ou disfarçar o odor causado pela decomposição bacteriana do suor nas axilas, virilha e secreções dos pés e vaginais em algumas situações. São muito usados por homens e mulheres. Geralmente são à base de álcool. Quando os usamos, eles acidificam nossa pele, o que torna os germes menos atraídos por ela. Além disso, estão se tornando populares entre a geração Y, resultando em alta utilização.

Dinâmica do mercado de desodorantes

Esta seção aborda a compreensão dos impulsionadores, vantagens, oportunidades, restrições e desafios do mercado. Tudo isso é discutido em detalhes a seguir:

Motoristas:

- Alta demanda por desodorantes entre a população

O uso crescente de desodorantes não aerossóis e fatores demográficos, além do aumento da população trabalhadora que passa muito tempo ao ar livre, estão exigindo desodorantes para manter o corpo fresco, que são os principais fatores que devem criar uma demanda excepcional para o mercado de desodorantes durante o período previsto.

A crescente popularidade de produtos em bastão e orgânicos impulsionará ainda mais a taxa de crescimento do mercado de desodorantes . Além disso, a crescente demanda por produtos de higiene pessoal, juntamente com o aumento da participação feminina na força de trabalho, também impulsionará o crescimento do valor de mercado ao longo do prazo previsto. Além disso, as atividades promocionais agressivas dos fabricantes por meio de diversas plataformas de mídia social, aliadas à proliferação de canais de varejo de e-commerce, também impulsionam o crescimento geral do mercado.

Oportunidades

- Inovações e Conscientização

Além disso, a inovação em novos formatos e fragrâncias, como o desenvolvimento de desodorantes naturais e sem alumínio, juntamente com o número crescente de atividades promocionais e de marketing por meio das mídias sociais, ampliam ainda mais as oportunidades lucrativas para os participantes do mercado no período previsto de 2025 a 2032. Além disso, a crescente conscientização do consumidor em relação ao conteúdo do produto expandirá ainda mais o crescimento futuro do mercado de desodorantes.

Restrições/Desafios

- Efeitos adversos do desodorante

Os desodorantes contêm uma variedade de ingredientes que podem induzir reações alérgicas, como compostos de alumínio, ciclometicona e outros, o que provavelmente funcionará como um fator limitante para o crescimento do mercado de desodorantes no futuro próximo. Esse fator criará obstáculos ao crescimento do mercado de desodorantes.

- Altos custos

Além disso, espera-se que o alto preço do produto prejudique o crescimento do mercado entre consumidores preocupados com o preço, limitando a expansão do mercado de desodorantes. Prevê-se que esse fator desafie a taxa de crescimento do mercado de desodorantes.

- Disponibilidade de produtos falsificados

Espera-se que a disponibilidade de produtos falsificados dificulte o crescimento durante o período previsto.

Este relatório de mercado de desodorantes fornece detalhes sobre novos desenvolvimentos recentes, regulamentações comerciais, análise de importação e exportação, análise de produção, otimização da cadeia de valor, participação de mercado, impacto de participantes do mercado doméstico e local, análise de oportunidades em termos de fontes de receita emergentes, mudanças nas regulamentações de mercado, análise estratégica de crescimento de mercado, tamanho do mercado, crescimento de categorias de mercado, nichos de aplicação e dominância, aprovações de produtos, lançamentos de produtos, expansões geográficas e inovações tecnológicas no mercado. Para obter mais informações sobre o mercado de desodorantes, entre em contato com a Data Bridge Market Research para um Briefing de Analista. Nossa equipe ajudará você a tomar uma decisão de mercado informada para alcançar o crescimento do mercado.

Escopo do mercado de desodorantes no Oriente Médio e na África

O mercado de desodorantes é segmentado com base no tipo de produto, canal de distribuição, material de embalagem e usuário final. O crescimento entre esses segmentos ajudará você a analisar os segmentos de crescimento reduzido nos setores e fornecerá aos usuários uma visão geral e insights valiosos do mercado para ajudá-los a tomar decisões estratégicas para identificar as principais aplicações de mercado.

Tipo de produto

- Pulverizar

- Cremes

- Roll-On

- Outros

Canal de Distribuição

- Supermercados/Hipermercados

- Lojas de conveniência

- Farmácias e Drogarias

- Varejo online

- Outros

Material de embalagem

- Metal

- Plástico

- Outros

Usuário final

- Homens

- Mulheres

- Outros

Análise regional do mercado de desodorantes

O mercado de desodorantes é analisado e insights sobre o tamanho do mercado e tendências são fornecidos por país, tipo de produto, canal de distribuição, material de embalagem e usuário final, conforme referenciado acima.

Os países abrangidos pelo relatório de mercado de desodorantes são Arábia Saudita, Emirados Árabes Unidos, Israel, Egito, África do Sul, Resto do Oriente Médio e África (MEA) como parte do Oriente Médio e África (MEA).

A seção sobre países do relatório também apresenta fatores individuais que impactam o mercado e mudanças na regulamentação do mercado que impactam as tendências atuais e futuras do mercado. Pontos de dados como análise da cadeia de valor a montante e a jusante, tendências técnicas, análise das cinco forças de Porter e estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para cada país. Além disso, a presença e a disponibilidade de marcas globais e seus desafios enfrentados devido à concorrência forte ou escassa de marcas locais e nacionais, o impacto de tarifas domésticas e rotas comerciais são considerados na análise de previsão dos dados do país.

Participação no mercado de desodorantes

O cenário competitivo do mercado de desodorantes fornece detalhes por concorrente. Os detalhes incluem visão geral da empresa, finanças, receita gerada, potencial de mercado, investimento em pesquisa e desenvolvimento, novas iniciativas de mercado, presença global, locais e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento de produto, abrangência e amplitude do produto e domínio da aplicação. Os dados acima são apenas referentes ao foco das empresas no mercado de desodorantes.

Os líderes de mercado de desodorantes que operam no mercado são:

- Unilever (Reino Unido)

- Procter & Gamble (EUA)

- Henkel AG & Co. KGaA (Alemanha)

- L'Oréal (França)

- Beiersdorf (Alemanha)

- grupo.loccitane (França)

- PRODUTOS AVON (REINO UNIDO)

- Elsa's Skincare (EUA)

- SPEICK Cosméticos Naturais (Alemanha)

- Weleda (Suíça)

- Laverana GmbH & Co. KG (Alemanha)

- Produtos EO (EUA)

- Vale do Indo (Índia)

- Lavanila (EUA)

- Sebapharma GmbH & CO. KG (Alemanha)

- Calvin Klein (EUA)

- Burberry plc (Reino Unido)

- REVLON (EUA)

- Dior (França)

- Giorgio Armani SpA (Itália)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.