Middle East And Africa Cooling System For Edge Computing Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

82.93 Million

USD

183.01 Million

2024

2032

USD

82.93 Million

USD

183.01 Million

2024

2032

| 2025 –2032 | |

| USD 82.93 Million | |

| USD 183.01 Million | |

|

|

|

|

Segmentação do mercado de sistemas de resfriamento para computação de ponta no Oriente Médio e África, por tipo de sistema de resfriamento (baseado em ar, líquido e híbrido), capacidade de resfriamento (sistemas de resfriamento de média escala, sistemas de resfriamento de pequena escala e sistemas de resfriamento de grande escala (acima de 200 kW)), tipo de implantação (unidades de resfriamento baseadas em sala, unidades de resfriamento em rack, unidades de resfriamento externas, unidades de resfriamento líquido direto para chip, unidades de resfriamento portáteis e unidades de resfriamento por imersão), sistema de gerenciamento de resfriamento (sistemas integrados de gerenciamento de resfriamento e sistemas autônomos de gerenciamento de resfriamento), método de resfriamento (resfriamento por água gelada, resfriamento por expansão direta (DX), resfriamento líquido e outros), vertical (TI e telecomunicações, manufatura, setores governamentais e públicos, saúde, transporte e logística, varejo e bens de consumo e outros) - tendências e previsões do setor até 2032

Tamanho do mercado de sistemas de resfriamento para computação de ponta no Oriente Médio e África

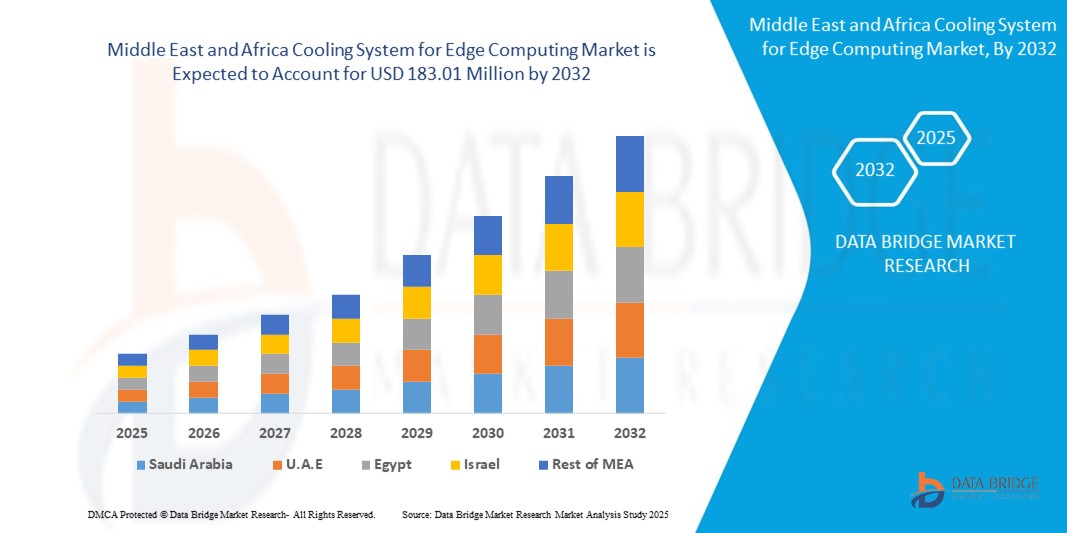

- O tamanho do mercado de sistemas de resfriamento para computação de ponta no Oriente Médio e na África foi avaliado em US$ 82,93 milhões em 2024 e deve atingir US$ 183,01 milhões até 2032 , com um CAGR de 10,40% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente adoção da computação de ponta em todos os setores, pela crescente demanda por tecnologias de resfriamento eficientes e sustentáveis e pela crescente necessidade de gerenciar o calor em ambientes de computação de alta densidade.

- Os avanços nas soluções de resfriamento líquido e resfriamento por imersão, juntamente com os crescentes investimentos em data centers mais próximos dos usuários finais, estão contribuindo ainda mais para a expansão do mercado

Análise de mercado de sistemas de resfriamento para computação de ponta no Oriente Médio e África

- O mercado de sistemas de resfriamento para computação de ponta no Oriente Médio e na África está passando por um momento significativo, à medida que as empresas aceleram a transformação digital e implantam infraestrutura de ponta para processamento de dados mais rápido.

- O foco crescente na redução da latência e na garantia do desempenho ininterrupto do sistema aumentou a necessidade de tecnologias de resfriamento inovadoras que minimizem o consumo de energia, mantendo alta eficiência operacional.

- A Arábia Saudita dominou o mercado de sistemas de resfriamento para computação de ponta no Oriente Médio em 2024, impulsionada por investimentos em larga escala em projetos de transformação digital e pela expansão de iniciativas de cidades inteligentes como NEOM

- Espera-se que os Emirados Árabes Unidos testemunhem a maior taxa de crescimento anual composta (CAGR) no mercado de sistemas de resfriamento para computação de ponta no Oriente Médio e na África devido à crescente adoção da computação de ponta nos setores de telecomunicações e nuvem, à crescente demanda por soluções de resfriamento sustentáveis e aos investimentos contínuos em inovação de data center.

- O segmento aéreo deteve a maior fatia de mercado em 2024, impulsionado por sua relação custo-benefício, ampla disponibilidade e fácil integração com a infraestrutura existente. O resfriamento a ar continua sendo uma opção preferencial para implantações de ponta de pequeno e médio porte, onde os requisitos de eficiência são moderados.

Escopo do relatório e segmentação do mercado de sistemas de resfriamento para computação de ponta no Oriente Médio e África

|

Atributos |

Principais insights de mercado sobre sistemas de resfriamento para computação de ponta no Oriente Médio e na África |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, produção e capacidade de empresas representadas geograficamente, layouts de rede de distribuidores e parceiros, análises detalhadas e atualizadas de tendências de preços e análises de déficit da cadeia de suprimentos e demanda. |

Tendências do mercado de sistemas de resfriamento para computação de ponta no Oriente Médio e na África

Adoção de tecnologias de resfriamento líquido e resfriamento por imersão

- A mudança para sistemas avançados de resfriamento líquido e de imersão está remodelando o mercado de sistemas de resfriamento para computação de ponta, abordando altas densidades de calor em infraestruturas compactas. Essas tecnologias permitem um gerenciamento eficiente do calor na borda, garantindo tempo de atividade e desempenho consistentes do sistema, mesmo sob cargas de trabalho pesadas.

- A crescente demanda por métodos de resfriamento sustentáveis está acelerando a adoção de sistemas à base de líquidos, que consomem menos energia e água em comparação com o resfriamento a ar tradicional. Essa tendência é particularmente forte em regiões com metas rigorosas de redução de carbono, onde operações com eficiência energética são priorizadas.

- A escalabilidade e o design modular dos sistemas de resfriamento por imersão os tornam adequados para implantações de ponta de pequeno e médio porte, ajudando a reduzir custos operacionais e prolongando a vida útil dos equipamentos. Sua adaptabilidade oferece uma grande vantagem para empresas que expandem redes de ponta em áreas urbanas e remotas.

- Por exemplo, em 2023, diversas operadoras de telecomunicações implantaram unidades modulares de resfriamento líquido em data centers de ponta, resultando em reduções significativas no consumo de energia e maior confiabilidade dos serviços de rede. Isso não apenas melhora o desempenho, mas também apoia as metas de sustentabilidade de longo prazo.

- Embora o resfriamento líquido e por imersão esteja possibilitando maior eficiência e maiores benefícios ambientais, seu impacto generalizado depende da redução de custos iniciais, do desenvolvimento de padrões industriais e do treinamento dos operadores. Os fornecedores devem se concentrar em estratégias de implantação localizadas para maximizar a adoção em diversos ambientes de ponta.

Dinâmica do mercado de sistemas de resfriamento para computação de ponta no Oriente Médio e na África

Motorista

Aumento do tráfego de dados e crescente demanda por processamento de baixa latência

- O aumento exponencial do tráfego de dados impulsionado por dispositivos IoT, redes 5G e aplicações em tempo real está colocando uma pressão imensa na infraestrutura de computação de ponta. Para manter o desempenho e evitar o tempo de inatividade, o resfriamento eficiente tornou-se um facilitador essencial da implantação de ponta.

- As empresas estão cada vez mais conscientes dos riscos financeiros e operacionais associados ao superaquecimento, incluindo danos a equipamentos, ineficiência energética e interrupções de serviços. Essa conscientização se traduziu em uma maior adoção de sistemas de refrigeração de última geração que garantem operações contínuas.

- Governos e reguladores do setor estão apoiando o desenvolvimento de infraestrutura de ponta por meio de iniciativas de eficiência energética e políticas de TI verde. Essas estruturas incentivam as empresas a investir em soluções de refrigeração modernas que reduzem a pegada de carbono e se alinham aos mandatos de sustentabilidade.

- Por exemplo, em 2022, vários operadores de data centers estão adotando cada vez mais sistemas avançados de resfriamento por imersão para cumprir com as diretivas de eficiência energética, aumentando a demanda do mercado por tecnologias de resfriamento de alto desempenho.

- Embora a demanda por processamento de baixa latência seja um fator-chave, abordar o consumo de energia, a integração de sistemas e o treinamento operacional será essencial para garantir a adoção sustentada de sistemas de resfriamento avançados na borda

Restrição/Desafio

Altos custos de implantação e barreiras técnicas em ambientes de ponta

- O alto investimento de capital necessário para soluções avançadas de resfriamento, como imersão em líquido e resfriamento direto no chip, continua sendo uma grande barreira à adoção, especialmente para pequenas empresas e mercados emergentes. Muitas organizações ainda dependem de sistemas convencionais devido a restrições de custo.

- A falta de técnicos qualificados e a experiência limitada no manuseio de tecnologias de resfriamento especializadas em locais remotos ou distribuídos restringem ainda mais a implantação. Esse desafio é agravado pela ausência de práticas padronizadas e diretrizes técnicas em todo o setor.

- A penetração no mercado também é prejudicada por desafios de infraestrutura, incluindo disponibilidade de energia e problemas de manutenção em determinados ambientes periféricos. Essas restrições podem atrasar a implantação de sistemas de resfriamento eficientes, forçando a dependência de alternativas menos eficazes.

- Por exemplo, em 2023, muitos data centers de ponta de pequena escala continuarão a usar sistemas de resfriamento baseados em ar legados devido aos altos custos e à disponibilidade limitada de tecnologias avançadas de resfriamento líquido.

- Embora a inovação continue a melhorar a eficiência dos sistemas de refrigeração, superar barreiras relacionadas a custos, infraestrutura e habilidades é essencial. Os stakeholders do mercado devem investir em soluções modulares, econômicas e de fácil implementação para garantir uma adoção mais ampla em todo o ecossistema de ponta.

Escopo do mercado de sistemas de resfriamento para computação de ponta no Oriente Médio e África

O mercado é segmentado com base no tipo de sistema de resfriamento, capacidade de resfriamento, tipo de implantação, sistema de gerenciamento de resfriamento, método de resfriamento e vertical.

- Por tipo de sistemas de refrigeração

Com base no tipo de sistema de resfriamento, o mercado de sistemas de resfriamento para edge computing no Oriente Médio e África é segmentado em sistemas baseados em ar, líquidos e híbridos. O segmento baseado em ar deteve a maior participação de mercado na receita em 2024, graças à sua relação custo-benefício, ampla disponibilidade e fácil integração com a infraestrutura existente. O resfriamento a ar continua sendo uma opção preferencial para implantações de edge computing de pequena e média escala, onde os requisitos de eficiência são moderados.

Espera-se que o segmento de refrigeração líquida apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado por sua capacidade superior de dissipação de calor e crescente adoção em data centers de ponta de alta densidade. Soluções de refrigeração líquida estão ganhando força por sua capacidade de reduzir o consumo de energia e atender às metas de sustentabilidade, tornando-as ideais para ambientes de computação de última geração.

- Por capacidade de resfriamento

Com base na capacidade de refrigeração, o mercado é categorizado em sistemas de refrigeração de médio porte, sistemas de refrigeração de pequeno porte e sistemas de refrigeração de grande porte (acima de 200 kW). O segmento de sistemas de refrigeração de médio porte foi responsável pela maior fatia da receita em 2024, principalmente devido à sua adoção em instalações regionais e periféricas que exigem cargas de refrigeração moderadas.

Espera-se que o segmento de sistemas de refrigeração de larga escala apresente a maior taxa de crescimento entre 2025 e 2032, à medida que a computação de ponta se expande para grandes hubs de telecomunicações e instalações de nível empresarial. Sua capacidade de gerenciar cargas de trabalho intensivas e manter alta confiabilidade do sistema os posiciona como uma escolha crucial para redes de ponta de larga escala.

- Por tipo de implantação

Com base no tipo de implantação, o mercado é segmentado em unidades de resfriamento baseadas em sala, unidades de resfriamento em rack, unidades de resfriamento externo, unidades de resfriamento líquido direto no chip, unidades de resfriamento portáteis e unidades de resfriamento por imersão. O segmento de unidades de resfriamento baseadas em sala dominou a participação de mercado em 2024, devido ao seu uso consolidado em instalações de ponta tradicionais e data centers.

Espera-se que o segmento de unidades de resfriamento líquido direto no chip apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente demanda por soluções de resfriamento com eficiência energética e economia de espaço. Esses sistemas oferecem gerenciamento de calor direcionado e são cada vez mais implantados em ambientes de ponta de alto desempenho.

- Por Sistema de Gerenciamento de Resfriamento

Com base em sistemas de gerenciamento de refrigeração, o mercado se divide em sistemas integrados de gerenciamento de refrigeração e sistemas autônomos de gerenciamento de refrigeração. O segmento de sistemas integrados de gerenciamento de refrigeração deteve a maior participação em 2024, com as empresas cada vez mais priorizando sistemas centralizados que aprimoram o monitoramento, a automação e a otimização energética.

Espera-se que o segmento de sistemas autônomos de gerenciamento de resfriamento testemunhe a maior taxa de crescimento entre 2025 e 2032, principalmente entre instalações de pequena escala e operadores sensíveis a custos que preferem configurações flexíveis e independentes.

- Por método de resfriamento

Com base no método de resfriamento, o mercado de sistemas de resfriamento para edge computing no Oriente Médio e África é segmentado em resfriamento a água gelada, resfriamento por expansão direta (DX), resfriamento líquido e outros. O segmento de resfriamento a água gelada foi responsável pela maior fatia da receita em 2024, devido à sua confiabilidade, escalabilidade e ampla adoção em instalações de edge computing de médio a grande porte.

Espera-se que o segmento de resfriamento líquido testemunhe a maior taxa de crescimento entre 2025 e 2032, impulsionado pelo aumento da densidade de energia na borda e pela necessidade de tecnologias de resfriamento altamente eficientes e sustentáveis.

- Por Vertical

Com base na vertical, o mercado é segmentado em TI e telecomunicações, manufatura, setores governamentais e públicos, saúde, transporte e logística, varejo e bens de consumo, entre outros. O segmento de TI e telecomunicações dominou o mercado em 2024, impulsionado pela implantação em larga escala de redes 5G e pela crescente demanda por data centers de ponta.

Espera-se que o segmento de saúde testemunhe a maior taxa de crescimento entre 2025 e 2032, à medida que a adoção da computação de ponta em telemedicina, imagens médicas e monitoramento de pacientes em tempo real impulsiona a necessidade de sistemas de resfriamento confiáveis e com baixo consumo de energia.

Análise regional do mercado de sistemas de resfriamento para computação de ponta no Oriente Médio e África

- A Arábia Saudita dominou o mercado de sistemas de resfriamento para computação de ponta no Oriente Médio em 2024, impulsionada por investimentos em larga escala em projetos de transformação digital e pela expansão de iniciativas de cidades inteligentes como NEOM

- As empresas do país estão implantando soluções avançadas de resfriamento para dar suporte a data centers de alta capacidade e infraestrutura de telecomunicações

- O domínio é apoiado por forte financiamento governamental, rápida adoção digital e integração de sistemas de ponta em petróleo e gás, logística e operações do setor público

Sistema de resfriamento dos Emirados Árabes Unidos para o mercado de computação de ponta

Espera-se que o mercado de sistemas de resfriamento para computação de ponta dos Emirados Árabes Unidos apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pela rápida expansão de serviços em nuvem, fintechs e aplicativos baseados em IA. O país está testemunhando uma forte demanda por tecnologias de resfriamento sustentáveis para apoiar suas metas de neutralidade de carbono. Além disso, a presença de grandes operadoras globais de data centers, aliada a políticas governamentais favoráveis e iniciativas de cidades inteligentes, está impulsionando a adoção acelerada.

Participação no mercado de sistemas de resfriamento para computação de ponta no Oriente Médio e África

O sistema de resfriamento do Oriente Médio e da África para a indústria de computação de ponta é liderado principalmente por empresas bem estabelecidas, incluindo:

- Ar condicionado Zamil (Arábia Saudita)

- SKM Ar Condicionado LLC (Emirados Árabes Unidos)

- Cool Tech (Arábia Saudita)

- Al Salem Johnson Controls (Arábia Saudita)

- Qatar Cool (Catar)

- Grupo Bin Dasmal (Emirados Árabes Unidos)

- Arabian Air Conditioning Company (Arábia Saudita)

- Petra Engineering Industries Co. (Jordânia)

- Gulf Air Conditioning Manufacturing Industries (Arábia Saudita)

- Ar condicionado Clima Tech (Egito)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.