Middle East And Africa Commercial Jar Blender Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

17.41 Million

USD

21.89 Million

2025

2033

USD

17.41 Million

USD

21.89 Million

2025

2033

| 2026 –2033 | |

| USD 17.41 Million | |

| USD 21.89 Million | |

|

|

|

|

Segmentação do mercado de liquidificadores comerciais no Oriente Médio e África, por tipo de produto (jarra de plástico, jarra de metal, jarra de vidro e outros), tipo (liquidificadores para uso pesado, liquidificadores para uso médio e liquidificadores para uso leve), aplicação (alimentos e bebidas), tipo de controle (controle eletrônico, controle por botão e outros), modo de operação (automático e manual), usuário final (estabelecimentos de processamento de alimentos, estabelecimentos de serviços de alimentação e outros), canal de distribuição (lojas físicas e online) - Tendências e previsões do setor até 2033.

Qual é o tamanho e a taxa de crescimento do mercado de liquidificadores comerciais no Oriente Médio e na África?

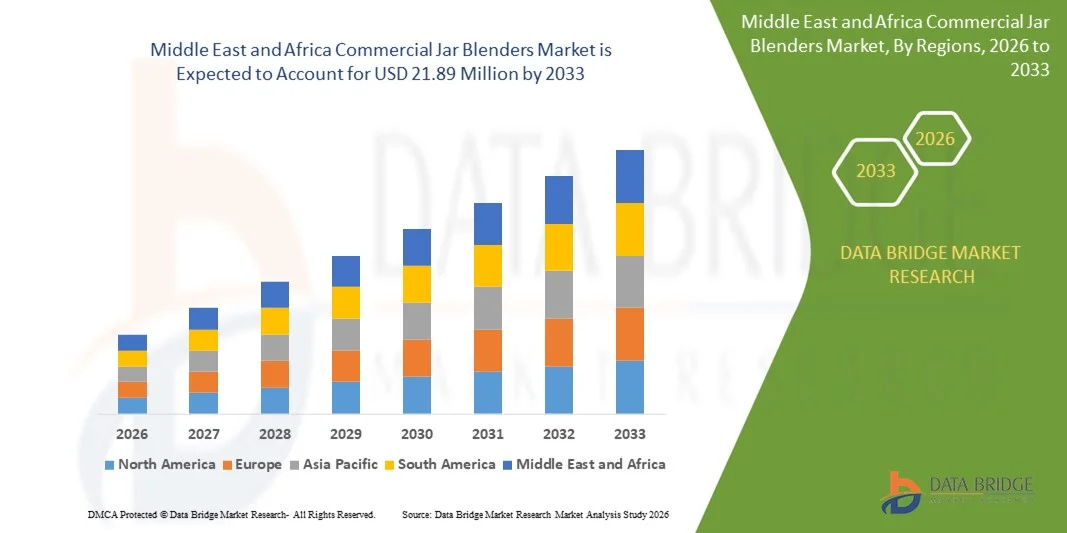

- O mercado de liquidificadores comerciais de jarra no Oriente Médio e na África foi avaliado em US$ 17,41 milhões em 2025 e deverá atingir US$ 21,89 milhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 2,9% durante o período de previsão.

- Os fatores que impulsionam o crescimento do mercado são a crescente demanda por liquidificadores comerciais com isolamento acústico, a preferência cada vez maior pelo consumo de bebidas à base de frutas, a crescente adoção de tecnologias de ponta em liquidificadores, e o aumento no número de revendedores e lojas de eletrônicos.

Quais são os principais destaques do mercado de liquidificadores comerciais de jarra?

- Devido à facilidade de uso e segurança que proporciona aos usuários, os liquidificadores de imersão ganharam significativa popularidade tanto entre a população economicamente ativa quanto entre aqueles que não trabalham.

- O surgimento dos liquidificadores de mão coincide com uma tendência de preferência dos consumidores por produtos naturais, o que deverá impulsionar as vendas desses aparelhos em um futuro próximo.

- Os Emirados Árabes Unidos dominaram o mercado de liquidificadores comerciais do Oriente Médio e da África, com uma participação de mercado estimada em 28,3% em 2025, impulsionados pelo rápido crescimento de cafés, restaurantes e redes de serviços de alimentação.

- Na África do Sul, espera-se que o mercado registre a taxa de crescimento anual composta (CAGR) mais rápida, de 7,1%, entre 2026 e 2033, impulsionado pela crescente cultura de cafés, pelo crescimento de redes de sucos e smoothies e pela expansão dos serviços de hotelaria e alimentação.

- O segmento de potes plásticos dominou o mercado com uma participação estimada em 39,2% em 2025, impulsionado pela acessibilidade, design leve, resistência a impactos e facilidade de limpeza, tornando-os ideais para serviços de alimentação em grande escala e preparação de bebidas comerciais.

Escopo do relatório e segmentação do mercado de liquidificadores comerciais de jarra

|

Atributos |

Liquidificadores de Jarra Comerciais: Principais Análises de Mercado |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marcas, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Qual é a principal tendência no mercado de liquidificadores comerciais de jarra?

Tendência crescente em direção a liquidificadores comerciais de alto desempenho, eficientes em termos energéticos e multifuncionais.

- O mercado de liquidificadores comerciais está testemunhando uma forte adoção de liquidificadores potentes, duráveis e versáteis, projetados para cozinhas profissionais, cafés, bares de smoothies e operações de serviços de alimentação.

- Os fabricantes estão expandindo seus portfólios com liquidificadores específicos para cada aplicação, incluindo motores de alto torque, controles de velocidade variável, configurações pré-programadas e tecnologias de redução de ruído adaptadas para uso comercial.

- A crescente demanda por eficiência, consistência e multifuncionalidade está impulsionando a adoção em restaurantes, bares de sucos, hotéis e empresas de catering.

- Por exemplo, empresas como Vitamix, Blendtec, Hamilton Beach, Waring e NutriBullet estão investindo em designs de jarras robustos, sensores inteligentes e interfaces programáveis para melhorar o desempenho da mistura.

- A crescente ênfase na preparação sob demanda, em texturas personalizáveis e na facilidade de limpeza está acelerando a demanda por liquidificadores comerciais de alta qualidade.

- À medida que os operadores de serviços de alimentação valorizam cada vez mais a durabilidade, a velocidade e a versatilidade, os liquidificadores comerciais de jarra continuarão sendo essenciais para operações culinárias e de bebidas profissionais.

Quais são os principais fatores que impulsionam o mercado de liquidificadores comerciais?

- A crescente demanda por liquidificadores de alta eficiência, versáteis e duráveis em restaurantes, cafés, bares de sucos e serviços de catering em todo o mundo.

- Por exemplo, entre 2024 e 2025, marcas líderes como Vitamix, Blendtec, Hamilton Beach, Waring e NutriBullet atualizaram suas linhas de produtos com motores mais potentes, jarras de maior capacidade e programas de mistura inteligentes.

- A crescente adoção de smoothies, sucos e tendências alimentares focadas na saúde nos EUA, Europa, Oriente Médio e África está impulsionando o consumo de liquidificadores comerciais.

- Avanços na eficiência do motor, redução de ruído, durabilidade do material do recipiente e controles de interface digital aprimoram o desempenho, a velocidade e a confiabilidade.

- A crescente demanda por textura consistente do produto, funcionalidade multiuso e preparo rápido sustenta o crescimento do mercado a longo prazo.

- Impulsionado pelo crescente número de cafés, restaurantes voltados para a saúde e cozinhas comerciais, o mercado de liquidificadores comerciais deve apresentar um forte crescimento global.

Que fator está dificultando o crescimento do mercado de liquidificadores comerciais?

- Os altos custos iniciais de liquidificadores comerciais de alta qualidade, jarras robustas e controles eletrônicos avançados limitam a adoção por pequenas empresas.

- Por exemplo, durante o período de 2024–2025, as flutuações nos preços dos componentes, nos custos dos motores e nas tarifas de importação afetaram os preços dos produtos de diversas marcas globais.

- A intensa concorrência de liquidificadores de baixo custo e modelos para uso doméstico pessoal cria pressão sobre os preços e reduz a diferenciação.

- O baixo conhecimento sobre os benefícios dos liquidificadores de nível profissional entre pequenos restaurantes e negócios caseiros dificulta a penetração no mercado.

- Requisitos de manutenção, peças de reposição e consumo de energia podem representar desafios operacionais para alguns usuários.

- Para solucionar esses problemas, as empresas estão se concentrando em motores com baixo consumo de energia, materiais duráveis para o copo, componentes modulares, suporte pós-venda e recursos inteligentes de valor agregado para expandir a adoção global de liquidificadores comerciais com copo.

Como é segmentado o mercado de liquidificadores comerciais de jarra?

O mercado é segmentado com base no tipo de produto, tipo de aplicação, tipo de controle, modo de operação, usuário final e canal de distribuição .

- Por tipo de produto

Com base no tipo de produto, o mercado de liquidificadores comerciais com jarra é segmentado em jarra de plástico, jarra de metal, jarra de vidro e outros. O segmento de jarra de plástico dominou o mercado com uma participação estimada em 39,2% em 2025, impulsionado pela acessibilidade, design leve, resistência a impactos e facilidade de limpeza, tornando-o ideal para serviços de alimentação em grande volume e preparação de bebidas comerciais. As jarras de plástico são amplamente adotadas em cafés, bares de sucos e redes de fast-food devido à durabilidade, baixo custo e compatibilidade com operações de mistura em alta velocidade.

O segmento de liquidificadores com jarra de vidro deverá apresentar o maior crescimento anual composto (CAGR) entre 2026 e 2033, impulsionado pela crescente demanda por liquidificadores de alta qualidade, livres de produtos químicos e com design atraente. As jarras de vidro oferecem resistência superior ao calor, transparência e mistura sem odores, tornando-as a opção preferida por empresas e estabelecimentos preocupados com a saúde que buscam equipamentos de nível profissional para smoothies, sopas e molhos.

- Por tipo

Com base no tipo de liquidificador, o mercado é segmentado em Liquidificadores de Alta Potência, Liquidificadores de Média Potência e Liquidificadores de Baixa Potência. O segmento de Liquidificadores de Alta Potência dominou o mercado com uma participação de 41,8% em 2025, impulsionado pela demanda em cozinhas comerciais de grande volume, bares de smoothies e unidades de processamento de alimentos, onde a operação contínua, motores potentes e durabilidade prolongada são essenciais. Os liquidificadores de alta potência garantem textura consistente, velocidade e confiabilidade para chefs e operadores profissionais que trabalham com ingredientes densos.

O segmento de equipamentos de uso médio deverá apresentar o maior crescimento anual composto (CAGR) entre 2026 e 2033, impulsionado pela adoção em pequenos e médios cafés, bares de sucos e restaurantes boutique. Os modelos de uso médio oferecem um equilíbrio entre preço acessível, potência e versatilidade, atendendo à crescente demanda em centros urbanos e operações de serviços de alimentação de pequena escala que buscam desempenho confiável sem as especificações de nível industrial.

- Por meio de aplicação

Com base na aplicação, o mercado de liquidificadores comerciais é segmentado principalmente em Alimentos e Bebidas. O segmento de Alimentos e Bebidas dominou o mercado com uma participação estimada em 88,5% em 2025, impulsionado pelo uso extensivo em cafés, bares de sucos, restaurantes e serviços de catering. Os liquidificadores são essenciais para smoothies, sopas, molhos, manteigas de nozes e preparo de bebidas, garantindo consistência, rapidez e higiene. A crescente popularidade de bebidas saudáveis, shakes de proteína e preparo de bebidas sob demanda continua a impulsionar a adoção desses produtos.

Prevê-se que o segmento mantenha um forte crescimento, impulsionado pela crescente demanda do consumidor por alimentos e bebidas frescos, personalizados e visualmente atraentes. Receitas especializadas, mistura em alta velocidade e versatilidade de ingredientes reforçam o papel dos liquidificadores comerciais como ferramentas indispensáveis na indústria global de serviços de alimentação e hotelaria.

- Por tipo de controle

Com base no tipo de controle, o mercado é segmentado em Controle Eletrônico, Controle por Botão e Outros. O segmento de Controle Eletrônico dominou o mercado com uma participação de 53,4% em 2025, devido à regulação precisa da velocidade, ciclos de mistura pré-programados e interfaces digitais fáceis de usar. Os controles eletrônicos permitem que os operadores comerciais alcancem resultados consistentes, reduzam erros humanos e integrem fluxos de trabalho automatizados em cozinhas movimentadas.

O segmento de liquidificadores com controle por alavanca deverá apresentar o maior crescimento anual composto (CAGR) entre 2026 e 2033, impulsionado pela simplicidade, baixa manutenção e confiabilidade em pequenos cafés e lanchonetes. Os liquidificadores com controle por alavanca são econômicos, duráveis e a opção preferida por estabelecimentos que necessitam de operação descomplicada, sem a necessidade de componentes eletrônicos complexos.

- Por modo de operação

Com base no modo de operação, o mercado é segmentado em liquidificadores automáticos e manuais. O segmento automático dominou o mercado com uma participação de 61,1% em 2025, impulsionado por configurações programáveis, mistura com temporizador e controle de velocidade otimizado que reduzem o esforço do operador em ambientes de alto volume. Os liquidificadores automáticos aumentam a eficiência, a consistência e a segurança, especialmente em redes de restaurantes e cozinhas comerciais.

O segmento Manual deverá apresentar o crescimento mais rápido em CAGR (Taxa de Crescimento Anual Composta) entre 2026 e 2033, impulsionado pela demanda em pequenos restaurantes, negócios domésticos e cozinhas experimentais, onde o controle prático sobre a velocidade, duração e textura da mistura é preferido.

- Por usuário final

Com base no usuário final, o mercado é segmentado em estabelecimentos de processamento de alimentos, estabelecimentos de serviços de alimentação e outros. O segmento de estabelecimentos de serviços de alimentação dominou o mercado com uma participação de 48,7% em 2025, impulsionado pela alta adoção em cafés, restaurantes, hotéis e empresas de catering que necessitam de misturas confiáveis e de alta velocidade para diversos itens de cardápio. Os liquidificadores são essenciais para garantir qualidade consistente, eficiência operacional e preparo rápido de bebidas e molhos.

Prevê-se que o segmento de estabelecimentos de processamento de alimentos apresente o crescimento mais rápido em termos de taxa composta de crescimento anual (CAGR) entre 2026 e 2033, impulsionado pelo aumento do uso de liquidificadores em cozinhas industriais, na produção de alimentos embalados e na fabricação de bebidas prontas para consumo, onde grandes volumes, consistência e durabilidade são essenciais.

- Por canal de distribuição

Com base no canal de distribuição, o mercado é segmentado em canais com lojas físicas e canais sem lojas físicas. O segmento de lojas físicas dominou o mercado com uma participação de 51,3% em 2025, impulsionado por varejistas de eletrodomésticos comerciais, lojas de utensílios de cozinha e lojas especializadas em equipamentos que oferecem acesso direto, suporte à instalação e serviços pós-venda.

O segmento de vendas online (sem lojas físicas) deverá apresentar o maior crescimento anual composto (CAGR) entre 2026 e 2033, impulsionado por marketplaces online, plataformas de e-commerce e canais de vendas diretas para empresas. Conveniência, preços competitivos, informações detalhadas sobre os produtos e entrega em domicílio estão impulsionando a adoção por pequenas empresas, cafés e startups em todo o mundo.

Qual região detém a maior participação no mercado de liquidificadores comerciais?

- Os Emirados Árabes Unidos dominaram o mercado de liquidificadores comerciais do Oriente Médio e da África, com uma participação de mercado estimada em 28,3% em 2025, impulsionados pelo rápido crescimento de cafés, restaurantes e redes de serviços de alimentação.

- A crescente preferência do consumidor por bebidas saudáveis, smoothies e bebidas preparadas sob demanda, combinada com o aumento dos investimentos em cozinhas comerciais modernas e na importação de equipamentos de alta qualidade, impulsiona a adoção generalizada desses produtos.

- Redes de distribuição avançadas, penetração do comércio eletrônico e uma sólida infraestrutura de hotelaria reforçam ainda mais a liderança dos Emirados Árabes Unidos no mercado regional.

Análise do Mercado de Liquidificadores Comerciais de Jarra na África do Sul

Na África do Sul, espera-se que o mercado registre a taxa de crescimento anual composta (CAGR) mais rápida, de 7,1%, entre 2026 e 2033, impulsionado pela crescente cultura de cafés, pelo crescimento de redes de smoothies e sucos e pela expansão dos serviços de hotelaria e alimentação. Liquidificadores com múltiplas velocidades, jarras de alta capacidade e operação automatizada estão ganhando popularidade. A crescente adoção do comércio eletrônico, a distribuição moderna no varejo e a maior conscientização sobre as tendências de saúde e nutrição aceleram ainda mais a penetração de liquidificadores comerciais em todo o país.

Análise do Mercado de Liquidificadores Comerciais de Jarra no Egito

No Egito, observa-se um crescimento constante devido ao aumento dos investimentos em serviços de alimentação urbana, restaurantes de serviço rápido e serviços de catering. A demanda por liquidificadores comerciais confiáveis, duráveis e eficientes, com controles eletrônicos e jarras de grande capacidade, está aumentando em bares de sucos e pequenas unidades de produção de alimentos. A expansão do varejo organizado, os canais de importação de eletrodomésticos e os programas governamentais de apoio impulsionam a adoção no mercado.

Quais são as principais empresas no mercado de liquidificadores comerciais de jarra?

O setor de liquidificadores comerciais é liderado principalmente por empresas consolidadas, incluindo:

- Newell Brands Inc. (EUA)

- Whirlpool Corp. (EUA)

- Vita-Mix Corp (EUA)

- Spectrum Brands, Inc. (EUA)

- Blendtec Inc. (EUA)

- Hamilton Beach Brands (EUA)

- Zhongshan CRANDDI Electrical Appliance Co., Ltd (China)

- Ceado Srl (Itália)

- Foshan Canmax Eletrodomésticos Co (China)

- Aviso (EUA)

- Sammic SL (Espanha)

- NutriBullet, LLC (EUA)

- HANS APPLIANCES (Índia)

- Bianco di puro GmbH & Co. KG (Alemanha)

Quais são os desenvolvimentos recentes no mercado global de liquidificadores comerciais de jarra?

- Em fevereiro de 2025, a União Europeia aprovou regulamentações atualizadas sobre equipamentos de processamento de alimentos, incluindo liquidificadores comerciais, que exigem padrões de segurança e higiene mais rigorosos (Comunicado de Imprensa da Comissão Europeia). Essa mudança regulatória incentivou os fabricantes a aprimorarem seus produtos, criando oportunidades para inovação e maior conformidade em todo o mercado de liquidificadores comerciais.

- Em maio de 2024, a Hamilton Beach Brands Holding Corporation concluiu a aquisição da Silverson Machines, uma importante fabricante de equipamentos industriais de mistura, incluindo misturadores de jarra comerciais (arquivo da SEC). Essa aquisição permitiu à Hamilton Beach diversificar suas fontes de receita, expandir seu portfólio de produtos e fortalecer sua presença nos mercados industriais e comerciais.

- Em março de 2024, a Waring Commercial e a Blendtec firmaram uma parceria estratégica para comercializar e distribuir modelos selecionados da Blendtec sob a marca Waring (Bloomberg). Essa colaboração alavancou os pontos fortes de ambas as empresas, expandiu o alcance de mercado e aprimorou a oferta combinada de produtos para clientes comerciais.

- Em janeiro de 2024, a Bosch Appliance Corporation lançou seu novo liquidificador de uso profissional, o PowerMaster Pro, com motor de 3 cavalos de potência e capacidade de 12 litros (Reuters). Esse lançamento ampliou a linha de liquidificadores profissionais da Bosch, atendendo a grandes empresas e aplicações industriais, e reforçou sua posição no mercado de liquidificadores profissionais.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.