Middle East And Africa Clinical Laboratory Services Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

12.71 Billion

USD

18.35 Billion

2025

2033

USD

12.71 Billion

USD

18.35 Billion

2025

2033

| 2026 –2033 | |

| USD 12.71 Billion | |

| USD 18.35 Billion | |

|

|

|

|

Segmentação do mercado de serviços de laboratório clínico no Oriente Médio e África, por especialidade (testes de química clínica, testes hematológicos, testes microbiológicos , testes imunológicos, testes de drogas de abuso, testes citológicos e testes genéticos ), provedor (laboratórios independentes e de referência, laboratórios hospitalares e laboratórios em consultórios médicos e de enfermagem), aplicação (serviços relacionados à descoberta de medicamentos, serviços relacionados ao desenvolvimento de medicamentos, serviços de bioanálise e química laboratorial, serviços de testes toxicológicos, serviços relacionados à terapia celular e gênica, serviços relacionados a ensaios pré-clínicos e clínicos e outros serviços de laboratório clínico), tipo de serviço (serviços de testes de rotina, serviços esotéricos e serviços de patologia anatômica) - Tendências e previsões do setor até 2033.

Tamanho do mercado de serviços de laboratório clínico no Oriente Médio e na África

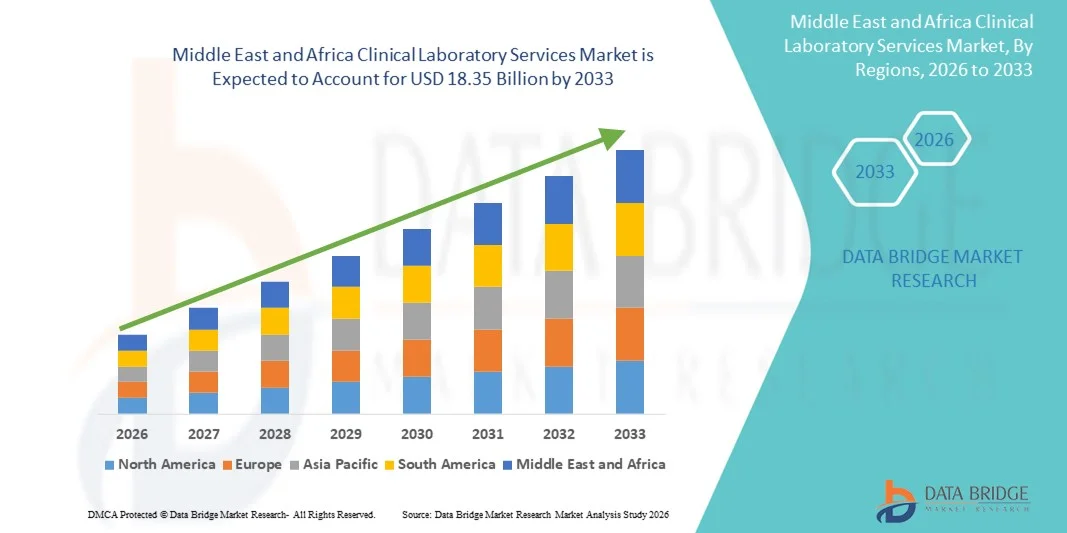

- O mercado de serviços de laboratório clínico no Oriente Médio e na África foi avaliado em US$ 12,71 bilhões em 2025 e deverá atingir US$ 18,35 bilhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 4,70% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela crescente demanda por testes diagnósticos precisos, oportunos e de alta qualidade, motivada pela crescente prevalência de doenças crônicas, doenças infecciosas e problemas de saúde relacionados ao estilo de vida em todo o mundo.

- Além disso, a crescente conscientização sobre cuidados preventivos de saúde, os avanços nas tecnologias laboratoriais, a automação no diagnóstico clínico e a expansão da infraestrutura de saúde estão acelerando a adoção de soluções de serviços de laboratório clínico, impulsionando significativamente o crescimento geral do mercado de Serviços de Laboratório Clínico.

Análise do Mercado de Serviços de Laboratório Clínico no Oriente Médio e na África

- Os serviços de laboratório clínico, que abrangem testes diagnósticos, patologia e outras análises laboratoriais, são cada vez mais essenciais na área da saúde moderna para a detecção precoce de doenças, o monitoramento de condições crônicas e o suporte a planos de tratamento personalizados.

- O crescimento do mercado é impulsionado principalmente pela crescente prevalência de doenças crônicas, pela demanda cada vez maior por cuidados preventivos de saúde, pelos avanços tecnológicos em automação laboratorial e plataformas de diagnóstico, e pela expansão da infraestrutura de saúde em todo o mundo.

- A Arábia Saudita dominou o mercado de serviços de laboratório clínico, representando aproximadamente 39,8% da receita regional em 2025, impulsionada por fortes iniciativas governamentais na área da saúde, investimentos em instalações de diagnóstico avançadas e ampla adoção de tecnologias laboratoriais modernas em hospitais, clínicas e centros de diagnóstico especializados. A presença de importantes fornecedores regionais de serviços de laboratório e a crescente conscientização dos pacientes sobre a importância de diagnósticos de qualidade reforçam ainda mais a posição dominante da Arábia Saudita no mercado.

- Prevê-se que os Emirados Árabes Unidos sejam o país com o crescimento mais rápido, com uma taxa de crescimento anual composta (CAGR) estimada em 9,1% entre 2026 e 2033, impulsionada pela rápida expansão da infraestrutura de saúde privada, pelo aumento das iniciativas governamentais para a saúde preventiva, pelo crescimento do turismo médico e pela crescente adoção de tecnologias avançadas de diagnóstico e automação em laboratórios clínicos.

- O segmento de Laboratórios Independentes e de Referência dominou a maior fatia de receita do mercado, com 45,1% em 2025, devido ao seu amplo portfólio de serviços, recursos de teste de última geração e capacidade de atender a múltiplos hospitais e clínicas.

Escopo do relatório e segmentação do mercado de serviços de laboratório clínico

|

Atributos |

Principais informações de mercado sobre serviços de laboratório clínico |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

• LabCorp (EUA) |

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, epidemiologia de pacientes, análise de projetos em desenvolvimento, análise de preços e estrutura regulatória. |

Tendências do mercado de serviços de laboratório clínico no Oriente Médio e na África

Expansão dos Serviços Avançados de Diagnóstico

- Uma tendência significativa e crescente no mercado de serviços de laboratório clínico no Oriente Médio e na África é a expansão de serviços avançados de diagnóstico e testes, impulsionada pela demanda crescente por medicina de precisão e capacidades de teste especializadas.

- Por exemplo, em 2024, importantes fornecedores de diagnóstico, como a Al Borg Diagnostics, expandiram seus serviços de testes moleculares e genômicos nos Emirados Árabes Unidos e na Arábia Saudita para atender à crescente demanda dos pacientes. A adoção de plataformas de testes de alto rendimento e a automação em laboratórios estão aumentando a eficiência, reduzindo os tempos de resposta e melhorando a precisão.

- A integração de sistemas de informação laboratorial (LIS) com redes hospitalares e clínicas permite o gerenciamento e a geração de relatórios de dados de pacientes de forma integrada. Hospitais e centros de diagnóstico estão investindo cada vez mais em recursos avançados de testes para oncologia, doenças infecciosas e distúrbios metabólicos.

- A conscientização dos pacientes e a demanda por diagnóstico precoce e cuidados preventivos estão impulsionando a adoção de testes clínicos especializados. Iniciativas governamentais que promovem o desenvolvimento da infraestrutura de saúde e o monitoramento da saúde pública aceleram ainda mais esse crescimento.

- Acreditações e certificações de qualidade, como ISO e CAP, estão incentivando os laboratórios a modernizarem suas tecnologias e portfólios de serviços. A colaboração entre provedores de serviços de diagnóstico e instituições de pesquisa aprimora as capacidades de teste e o suporte a ensaios clínicos.

- A adoção de serviços de teste integrados em vários locais permite um acesso mais amplo dos pacientes e maior eficiência operacional. Os programas de treinamento para a equipe do laboratório garantem o manuseio adequado de testes complexos e a conformidade com as normas regulamentares.

Dinâmica do mercado de serviços de laboratório clínico no Oriente Médio e na África

Motorista

Crescente demanda por testes especializados e de alta precisão.

- A crescente prevalência de doenças crônicas, doenças infecciosas e distúrbios genéticos no Oriente Médio e na África é um dos principais impulsionadores do crescimento do mercado.

- Por exemplo, em 2025, a Al Borg Diagnostics introduziu serviços de sequenciamento de nova geração e diagnóstico molecular na Arábia Saudita, aprimorando significativamente suas capacidades de serviço.

- Os profissionais de saúde buscam soluções de diagnóstico precisas, rápidas e abrangentes para orientar o gerenciamento do paciente e as decisões de tratamento.

- A expansão de hospitais e redes de diagnóstico em áreas urbanas e semiurbanas permite um maior volume de testes.

- Iniciativas governamentais na área da saúde e parcerias público-privadas estão promovendo a modernização e a expansão da capacidade laboratorial.

- O aumento da pesquisa clínica e da participação em estudos epidemiológicos regionais cria uma demanda adicional por testes especializados.

- A preferência dos pacientes por detecção precoce, cuidados preventivos de saúde e tratamento personalizado impulsiona a adoção de serviços laboratoriais avançados.

- As melhorias tecnológicas nos equipamentos de laboratório e a adoção de plataformas automatizadas garantem maior produtividade e taxas de erro reduzidas.

- A colaboração entre laboratórios e empresas farmacêuticas para ensaios clínicos está impulsionando a demanda por testes especializados. O treinamento contínuo e o desenvolvimento de habilidades para profissionais de laboratório melhoram a qualidade e a precisão dos serviços.

- A expansão da cobertura de seguro e do reembolso para exames diagnósticos contribui para a acessibilidade e a adesão. De modo geral, o aumento da demanda clínica, o avanço tecnológico e as políticas de saúde favoráveis impulsionam o mercado de serviços de laboratório clínico na região.

Restrição/Desafio

Altos custos operacionais e mão de obra qualificada limitada.

- O alto custo de instalação e manutenção de laboratórios clínicos avançados representa um desafio significativo para centros de diagnóstico de menor porte.

- Por exemplo, o investimento em plataformas automatizadas de testes moleculares e analisadores de alto rendimento pode chegar a milhões de dólares, limitando a expansão de novos participantes.

- A escassez de técnicos de laboratório treinados e de patologistas especializados limita a capacidade de expandir os serviços de forma eficiente.

- Os processos de conformidade regulamentar e acreditação de qualidade podem ser demorados e dispendiosos. A manutenção de equipamentos avançados e a garantia de calibração e controle de qualidade aumentam os custos operacionais.

- As limitações de infraestrutura em regiões remotas e rurais reduzem o acesso dos pacientes a serviços laboratoriais avançados.

- Os altos custos de reagentes, consumíveis e kits de teste podem aumentar ainda mais os preços dos serviços, afetando a acessibilidade.

- O conhecimento e a baixa adesão aos testes preventivos em algumas populações podem restringir a penetração no mercado.

- Apesar da crescente demanda, a escassez de profissionais qualificados continua sendo um obstáculo fundamental para a prestação consistente de serviços de diagnóstico de alta qualidade.

- Parcerias estratégicas, programas de treinamento e modelos de compartilhamento de custos são essenciais para superar esses desafios.

- O desenvolvimento de soluções laboratoriais escaláveis e economicamente viáveis, bem como iniciativas regionais de treinamento, pode mitigar problemas relacionados à força de trabalho e aos custos.

- Superar essas barreiras é crucial para sustentar o crescimento a longo prazo no mercado de serviços de laboratório clínico no Oriente Médio e na África.

Escopo do mercado de serviços de laboratório clínico no Oriente Médio e na África

O mercado está segmentado com base na especialidade, no fornecedor, na aplicação e no tipo de serviço.

- Por especialidade

Com base na especialidade, o mercado de Serviços de Laboratório Clínico é segmentado em Testes de Química Clínica, Testes Hematológicos, Testes Microbiológicos, Testes Imunológicos, Testes de Detecção de Drogas de Abuso, Testes Citológicos e Testes Genéticos. O segmento de Testes de Química Clínica dominou a maior participação de mercado em receita, com 38,6% em 2025, impulsionado pela alta prevalência de doenças crônicas como diabetes, distúrbios cardiovasculares e síndromes metabólicas no Oriente Médio e na África. Painéis bioquímicos de rotina, testes de função hepática e testes de função renal são amplamente solicitados em hospitais e clínicas ambulatoriais, estabelecendo a Química Clínica como um serviço laboratorial essencial. Os avanços em analisadores automatizados e plataformas de alto rendimento aumentaram a eficiência e a precisão, reduzindo os tempos de resposta e aprimorando a confiabilidade. As instituições de saúde priorizam os Testes de Química Clínica por sua capacidade de fornecer dados diagnósticos rápidos e abrangentes. A adoção de sistemas integrados de informação laboratorial permite o gerenciamento simplificado dos dados do paciente, garantindo uma melhor tomada de decisões clínicas. Além disso, iniciativas governamentais que promovem a saúde preventiva e o diagnóstico precoce incentivam a realização regular de testes bioquímicos. A expansão das redes hospitalares e de laboratórios independentes em regiões urbanas e semiurbanas também sustenta a alta demanda. Além disso, as colaborações com entidades farmacêuticas e de pesquisa para ensaios clínicos reforçam a utilização de análises de química clínica. As práticas de acreditação e padronização em laboratórios aumentam ainda mais a confiabilidade dos resultados dos testes. A crescente conscientização dos pacientes sobre o monitoramento rotineiro da saúde fortalece a dominância do mercado. Os testes de química clínica permanecem essenciais para o diagnóstico clínico devido à sua relação custo-benefício, acessibilidade e ampla aplicabilidade em diversas doenças.

O segmento de Testes Hematológicos deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 15,9%, entre 2026 e 2033, impulsionado pela crescente demanda por hemogramas completos, perfis de coagulação e análises hematológicas especializadas em hospitais e centros de diagnóstico. O aumento nos casos de anemia, leucemia e outras doenças do sangue está impulsionando o volume de testes. A expansão da capacidade hospitalar, especialmente na Arábia Saudita, Emirados Árabes Unidos e Egito, contribui para o crescimento. A automação dos analisadores hematológicos reduz erros e melhora o tempo de resposta. A crescente adoção em pacotes de saúde preventiva, exames de rotina e testes cobertos por planos de saúde acelera a adesão. Os testes hematológicos são essenciais para avaliações pré-operatórias, manejo de doenças crônicas e monitoramento terapêutico. Parcerias estratégicas entre laboratórios e fornecedores de tecnologia diagnóstica introduzem soluções inovadoras. Além disso, o foco crescente em pesquisa e ensaios clínicos para distúrbios hematológicos impulsiona o crescimento do segmento. O treinamento de pessoal de laboratório qualificado garante a execução confiável de testes complexos. A integração de testes hematológicos em painéis diagnósticos mais amplos melhora a eficiência do fluxo de trabalho. A crescente conscientização sobre a saúde do sangue e o diagnóstico precoce incentiva a realização de testes mais frequentes. Programas governamentais regionais de saúde que promovem o monitoramento da anemia e de doenças contribuem ainda mais para esse crescimento. De forma geral, os testes hematológicos se posicionam como o segmento de especialidades que mais cresce devido à sua importância clínica e à crescente acessibilidade.

- Por fornecedor

Com base no tipo de fornecedor, o mercado é segmentado em Laboratórios Independentes e de Referência, Laboratórios Hospitalares e Laboratórios em Consultórios Médicos e de Enfermagem. O segmento de Laboratórios Independentes e de Referência dominou a maior participação de mercado em receita, com 45,1% em 2025, devido ao seu amplo portfólio de serviços, recursos de teste de última geração e capacidade de atender a múltiplos hospitais e clínicas. Esses laboratórios oferecem serviços de teste especializados e diagnósticos de alto rendimento, frequentemente integrando ensaios moleculares, genéticos e esotéricos. Os pacientes preferem cada vez mais os laboratórios independentes pela conveniência, rapidez na obtenção de resultados e opções abrangentes de testes. O crescimento de centros de diagnóstico centralizados em regiões urbanas garante ampla cobertura geográfica. Investimentos em automação e sistemas LIS aprimoram a eficiência operacional e a precisão dos resultados. Parcerias com empresas farmacêuticas para ensaios clínicos e serviços bioanalíticos fortalecem as fontes de receita. A acreditação pelas normas ISO e CAP garante qualidade e confiabilidade, atraindo clientes institucionais. Os laboratórios independentes também oferecem serviços de coleta de amostras em domicílio e por transportadora, melhorando o acesso dos pacientes. A expansão estratégica para áreas semiurbanas apoia a penetração no mercado. A colaboração com instituições de pesquisa facilita a adoção de testes de ponta. A reputação do segmento em termos de precisão, eficiência e diversidade de serviços reforça sua posição dominante.

Espera-se que os laboratórios hospitalares apresentem a taxa de crescimento anual composta (CAGR) mais rápida, de 16,7%, entre 2026 e 2033, impulsionados pelo crescente número de hospitais e instalações de saúde na região. Os laboratórios hospitalares integram os testes diretamente ao atendimento ao paciente, garantindo resultados oportunos para diagnóstico e tratamento. A expansão de hospitais multiespecializados na Arábia Saudita, Emirados Árabes Unidos e Egito sustenta a demanda. A crescente adoção de testes no local de atendimento, automação e integração com sistemas de informação laboratorial (LIS) aprimora a eficiência dos serviços. Os laboratórios hospitalares também desempenham um papel fundamental em ensaios clínicos e estudos farmacogenômicos, contribuindo para o crescimento do segmento. A crescente conscientização entre os médicos sobre a realização de testes internos para tomada de decisões clínicas rápidas promove a adoção dessa tecnologia. Investimentos em equipamentos modernos para hematologia, diagnóstico molecular e imunologia fortalecem as capacidades. A colaboração com operadoras de planos de saúde melhora a acessibilidade aos testes. O desenvolvimento de mão de obra qualificada nos hospitais garante a precisão em ensaios complexos. O segmento se beneficia do maior fluxo de pacientes e da prestação de cuidados integrados. Programas governamentais que incentivam a expansão da infraestrutura laboratorial impulsionam a adoção pelo mercado. No geral, os laboratórios hospitalares se posicionam como o segmento de provedores de crescimento mais rápido.

- Por meio de aplicação

Com base na aplicação, o mercado de Serviços de Laboratório Clínico é segmentado em Serviços Relacionados à Descoberta de Fármacos, Serviços Relacionados ao Desenvolvimento de Fármacos, Serviços de Bioanálise e Química Laboratorial, Serviços de Testes Toxicológicos, Serviços Relacionados à Terapia Celular e Gênica, Serviços Relacionados a Ensaios Pré-clínicos e Clínicos e Outros Serviços de Laboratório Clínico. O segmento de Serviços Relacionados a Ensaios Pré-clínicos e Clínicos dominou a maior participação de mercado em receita, com 39,8% em 2025, devido ao crescente número de ensaios clínicos e estudos de pesquisa em oncologia, doenças infecciosas e distúrbios metabólicos. Organizações de pesquisa contratada (CROs) e empresas farmacêuticas estão colaborando com laboratórios regionais para apoiar o desenvolvimento de medicamentos. A expansão de centros de pesquisa clínica nos Emirados Árabes Unidos, Arábia Saudita e Egito impulsiona o volume de testes. A adoção de protocolos padronizados e instrumentação avançada garante dados precisos para conformidade regulatória. A integração de plataformas de bioinformática e gerenciamento de dados aumenta a eficiência da pesquisa. O crescimento de instituições acadêmicas e de pesquisa fornece demanda adicional. Os serviços pré-clínicos, incluindo toxicologia e farmacocinética, complementam as atividades de ensaios clínicos. O alto recrutamento de pacientes em estudos gera a necessidade de testes repetidos. Laboratórios que oferecem capacidade de realizar testes em múltiplos locais ganham preferência. A demanda por ensaios farmacogenômicos e moleculares impulsiona a expansão do segmento. A ênfase na conformidade regulatória garante a geração consistente de receita. No geral, o segmento permanece crucial para o suporte à pesquisa clínica e ao desenvolvimento de medicamentos.

O segmento de Serviços Relacionados ao Desenvolvimento de Medicamentos deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 17,3%, entre 2026 e 2033, impulsionado pela crescente terceirização de serviços analíticos, bioanalíticos e laboratoriais por empresas farmacêuticas e de biotecnologia. O aumento dos investimentos em novos projetos de desenvolvimento de medicamentos e a crescente atividade de ensaios clínicos em oncologia, imunologia e doenças raras alimentam a demanda. Plataformas de teste avançadas, fluxos de trabalho de alto rendimento e sistemas de qualidade padronizados permitem uma rápida adoção. A expansão de laboratórios regionais com parcerias com CROs acelera o crescimento. Os requisitos regulatórios para dados farmacocinéticos e de segurança precisos aumentam o potencial de mercado. A integração de serviços de testes pré-clínicos, bioanalíticos e clínicos facilita o suporte completo ao desenvolvimento de medicamentos. O foco crescente em medicina personalizada e diagnóstico molecular aumenta a demanda. Colaborações estratégicas entre empresas farmacêuticas e laboratórios locais otimizam a prestação de serviços. O treinamento e o desenvolvimento de pessoal de laboratório qualificado garantem testes precisos. O aumento dos incentivos governamentais para pesquisa e desenvolvimento impulsiona ainda mais a adoção. A crescente conscientização entre as partes interessadas da indústria farmacêutica sobre a geração de dados de qualidade garante um crescimento sustentado. O segmento está posicionado como a aplicação de crescimento mais rápido na região.

- Por tipo de serviço

Com base no tipo de serviço, o mercado de Serviços de Laboratório Clínico é segmentado em Serviços de Testes de Rotina, Serviços Específicos e Serviços de Anatomia Patológica. O segmento de Serviços de Testes de Rotina dominou a maior participação de mercado em receita, com 41,5% em 2025, impulsionado pelo alto volume de testes diagnósticos padrão, como hemogramas, painéis metabólicos e urinálises, realizados em hospitais e centros ambulatoriais. Os serviços de rotina são amplamente utilizados para exames preventivos de saúde, monitoramento de doenças crônicas e avaliações pré-operatórias. A adoção de analisadores automatizados e plataformas de alto rendimento garante tempos de resposta rápidos e resultados confiáveis. A expansão das instalações de saúde em áreas urbanas e semiurbanas suporta o alto volume de pacientes. A integração com o LIS (Sistema de Informação Laboratorial) e redes hospitalares melhora a emissão de relatórios e a eficiência do fluxo de trabalho. A cobertura de seguro para testes de rotina incentiva uma maior participação dos pacientes. Iniciativas governamentais de saúde preventiva promovem diagnósticos de rotina. Laboratórios independentes e hospitalares expandem ativamente suas capacidades de testes de rotina para atender à crescente demanda. Treinamento e medidas de controle de qualidade mantêm a precisão em altos volumes de testes. Parcerias com instituições de pesquisa ampliam a gama de serviços. A acessibilidade e o preço acessível reforçam a dominância no segmento de tipo de serviço.

O segmento de Serviços Esotéricos deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 18,1%, entre 2026 e 2033, impulsionado pela crescente demanda por testes moleculares, genéticos e imunológicos especializados. Técnicas avançadas, como sequenciamento de nova geração, ensaios baseados em PCR e análise de biomarcadores, são cada vez mais necessárias para a medicina de precisão e o diagnóstico de doenças raras. A expansão de laboratórios independentes e hospitalares com capacidade para realizar testes esotéricos acelera a adoção dessas técnicas. Empresas farmacêuticas dependem de serviços esotéricos para ensaios clínicos e suporte ao desenvolvimento de medicamentos. A crescente conscientização dos pacientes sobre testes genéticos e cuidados de saúde personalizados incentiva a adoção desses serviços. Iniciativas governamentais que promovem diagnósticos avançados contribuem para o crescimento. A integração com plataformas de pesquisa e bioinformática aprimora a precisão dos dados e a geração de relatórios. O treinamento de mão de obra qualificada garante a execução precisa de testes complexos. A maior colaboração entre laboratórios e instituições de pesquisa impulsiona as capacidades. A alta lucratividade e a baixa concorrência atraem novos participantes para o mercado. No geral, os Serviços Esotéricos representam o tipo de serviço de crescimento mais rápido no mercado de Serviços de Laboratório Clínico do Oriente Médio e da África.

Análise Regional do Mercado de Serviços de Laboratório Clínico no Oriente Médio e África

- Prevê-se que o mercado de serviços de laboratório clínico no Oriente Médio e África (MEA) cresça a uma taxa composta de crescimento anual (CAGR) substancial durante o período de previsão.

- Impulsionado principalmente por fortes iniciativas governamentais na área da saúde, investimentos em instalações de diagnóstico avançadas e a ampla adoção de tecnologias laboratoriais modernas em hospitais, clínicas e centros de diagnóstico especializados.

- A presença de importantes fornecedores regionais de serviços laboratoriais e a crescente conscientização dos pacientes sobre a importância de diagnósticos de qualidade estão contribuindo ainda mais para o crescimento do mercado em toda a região.

Análise do Mercado de Serviços de Laboratório Clínico na Arábia Saudita

O mercado de serviços de laboratório clínico da Arábia Saudita dominou o mercado de serviços de laboratório clínico do Oriente Médio e África (MEA), representando aproximadamente 39,8% da receita regional em 2025, impulsionado por sólidas iniciativas governamentais na área da saúde, investimentos significativos em instalações de diagnóstico avançadas e a ampla adoção de tecnologias laboratoriais modernas. Os principais provedores de serviços de laboratório do país e a crescente conscientização dos pacientes sobre a importância de diagnósticos de qualidade fortalecem ainda mais sua posição dominante no mercado.

Análise do Mercado de Serviços de Laboratório Clínico nos Emirados Árabes Unidos

O mercado de serviços de laboratório clínico dos Emirados Árabes Unidos deverá ser o de crescimento mais rápido na região, registrando uma taxa de crescimento anual composta (CAGR) estimada em 9,1% de 2026 a 2033, impulsionado pela rápida expansão da infraestrutura de saúde privada, pelo aumento das iniciativas governamentais para saúde preventiva, pelo crescimento do turismo médico e pela crescente adoção de tecnologias avançadas de diagnóstico e automação em laboratórios clínicos.

Participação de mercado dos serviços de laboratório clínico no Oriente Médio e na África

O setor de Serviços de Laboratório Clínico é liderado principalmente por empresas consolidadas, incluindo:

• LabCorp (EUA)

• Quest Diagnostics (EUA)

• Eurofins Scientific (Luxemburgo)

• Synlab (Alemanha)

• Cerba Healthcare (França)

• SRL Diagnostics (Índia)

• Unilabs (Suíça)

• Acibadem Labmed (Turquia)

• Dr. Lal PathLabs (Índia)

• NMC Healthcare Labs (Emirados Árabes Unidos)

• PathCare (África do Sul)

• BioReference Laboratories (EUA)

• Aspen Medical Laboratories (Austrália)

• Maccabi Healthcare Services Labs (Israel)

• Al Mokhtabar Labs (Egito)

• HealthHub Laboratories (Emirados Árabes Unidos)

Últimos desenvolvimentos no mercado de serviços de laboratório clínico no Oriente Médio e na África

- Em maio de 2025, a Laboratory Corporation of America (LabCorp) inaugurou um novo centro regional de diagnóstico em Chantilly, Virgínia, sua maior instalação até o momento, com uma equipe de mais de 200 profissionais e capacidade para processar mais de 26.000 amostras de pacientes diariamente, expandindo os serviços de histologia e citologia para aprimorar as capacidades de diagnóstico.

- Em fevereiro de 2025, a Myriad Genetics, Inc. firmou uma parceria com a INTERLINK Care Management e a CancerCARE for Life para expandir o acesso ao seu teste de câncer hereditário MyRisk with RiskScore para mais de um milhão de pessoas, aprimorando os serviços de triagem genética e previsão de risco de câncer.

- Em abril de 2025, a Scientist.com lançou o Clinical Labs Navigator™, uma plataforma de aquisição projetada para otimizar a contratação e a gestão de serviços para ensaios clínicos, aumentando a eficiência e a colaboração entre patrocinadores e fornecedores de laboratório.

- Em março de 2025, a IQVIA Laboratories lançou o pacote Site Lab Navigator, que inclui uma solução de requisição eletrônica que permite aos centros de pesquisa enviar solicitações de exames e gerenciar amostras digitalmente, reduzindo erros manuais e aprimorando os fluxos de trabalho dos laboratórios de ensaios clínicos.

- Em fevereiro de 2025, a SK pharmteco inaugurou um laboratório de análises modernizado, focado em Ingredientes Farmacêuticos Ativos de Alta Potência (HPAPIs), ampliando a capacidade de atendimento laboratorial para análises de substâncias farmacêuticas complexas.

- Em agosto de 2024, o LEAP Consulting Group lançou uma consultoria para auxiliar laboratórios clínicos no cumprimento das normas, incluindo orientações sobre as regulamentações da FDA para testes desenvolvidos em laboratório (LDTs), refletindo o foco do setor na preparação regulatória.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.