Ksa Cold Chain Logistics Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

4.33 Million

USD

13.81 Million

2024

2032

USD

4.33 Million

USD

13.81 Million

2024

2032

| 2025 –2032 | |

| USD 4.33 Million | |

| USD 13.81 Million | |

|

|

|

Mercado de logística de cadeia fria da Arábia Saudita, por tipo (armazenagem/stock, logística (rodoviária), logística (marítima), logística (ferroviária), logística (aérea), serviço e entrega de última milha), por tipo de mercadoria/ atributo crítico (alimentos, Produtos gerais (incluindo material médico), produtos perigosos (incluindo produtos químicos perigosos), tecnologia (congelação rápida, arrefecimento evaporativo, compressão de vapor, sistemas criogénicos, controlador lógico programável), por tipo de temperatura (ambiente, arrefecido , congelado), por carga útil Tamanho (grande, médio, pequeno, extrapequeno, pequeno), por operação (nacional, internacional/logística transfronteiriça), por tipo de cliente (B2B, B2C, comércio eletrónico e entrega de última milha), por modelo de negócio (ativos- Transportadoras Baseadas, Corretagem e Logística Terceirizada (3PL), Logística Terceirizada (4PL)), Distância (Mais de 500 Milhas, 201 Milhas a 500 Milhas, 101 Milhas–200 Milhas, 50 Milhas–100 Milhas, Menos de 50 Milhas ), País (KSA) - Tendências e previsões do sector até 2031.

Análise e dimensão do mercado de logística de cadeia fria da Arábia Saudita

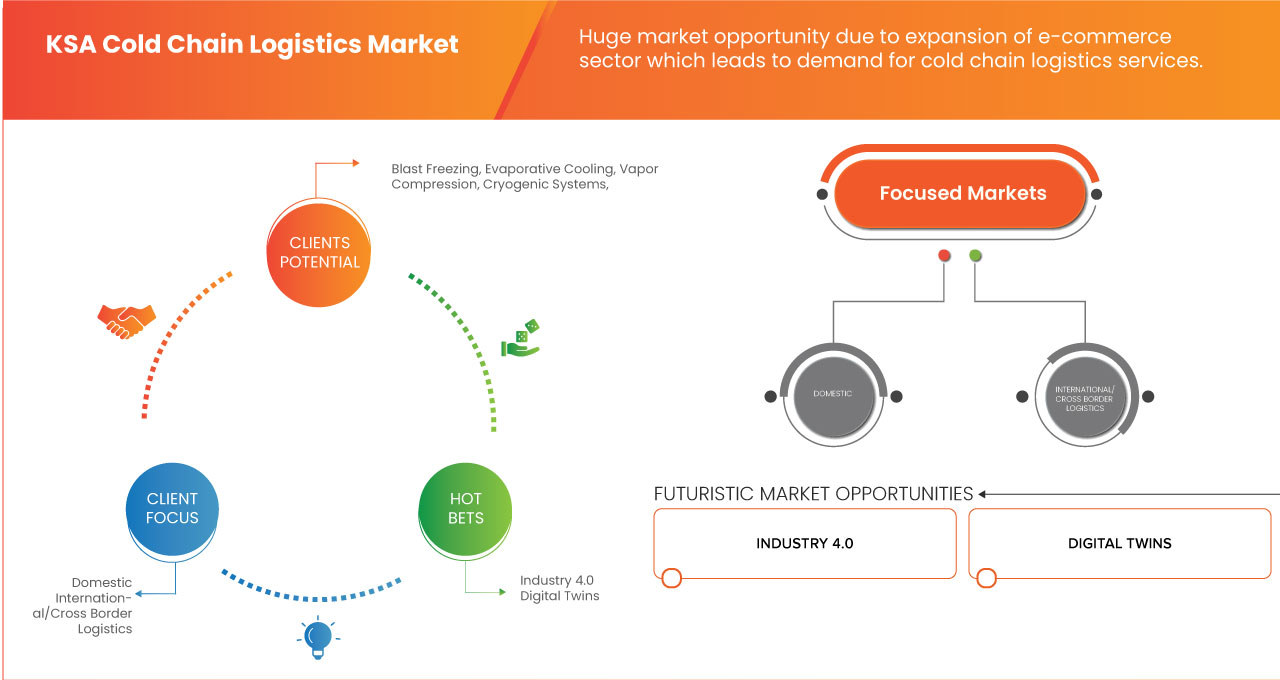

O aumento do consumo de alimentos, produtos farmacêuticos e outros produtos sensíveis à temperatura, as iniciativas governamentais e os investimentos em infraestruturas logísticas, a expansão do comércio eletrónico impulsionam o crescimento da logística da cadeia de frio e o transporte de produtos perecíveis exige medidas rigorosas de saúde e segurança são os fatores que estão a impulsionar o crescimento do mercado de logística de cadeia fria da Arábia Saudita. No entanto, espera-se que os elevados custos operacionais e a navegação nos padrões regulamentares em logística limitem o crescimento do mercado de logística de cadeia fria da Arábia Saudita. Além disso, a adoção de tecnologias como sistemas de armazenamento e recuperação automatizados, a localização estratégica da Arábia Saudita cria um centro comercial entre a Ásia, África e Europa, e a implementação da IoT e da IA para melhorar o rastreio e a eficiência é esperada como uma oportunidade para o crescimento do frio da Arábia Saudita. No entanto, a gestão da variabilidade da temperatura durante condições meteorológicas extremas é considerada um desafio para o crescimento do mercado de logística de cadeia fria da Arábia Saudita.

A Data Bridge Market Research analisa que o mercado de logística de cadeia fria da Arábia Saudita deverá atingir um valor de 11.947,06 milhões de dólares até 2031, face aos 3.848,92 milhões de 2023, crescendo a um CAGR de 15,6% durante o período previsto de 2024 a 2031.

|

Métrica de Reporte |

Detalhes |

|

Período de previsão |

2024 a 2031 |

|

Ano base |

2023 |

|

Anos históricos |

2022 (Personalizável para 2016-2021) |

|

Unidades quantitativas |

Receita em milhões de dólares americanos |

|

Segmentos abrangidos |

Tipo (Armazenagem/Stockagem, Logística (Rodoviária), Logística (Marítima), Logística (Ferroviária), Logística (Aérea), Serviço e Entrega de Última Milha), Tipo de Bens/Atributo Crítico (Géneros Alimentares, Bens Gerais (Incluindo Material Médico ), Mercadorias perigosas (incluindo produtos químicos perigosos)), tecnologia (congelação rápida, arrefecimento evaporativo, compressão de vapor, sistemas criogénicos, controlador lógico programável), tipo de temperatura (ambiente, arrefecido, congelado), tamanho da carga útil (grande, médio, pequeno, extragrande). Pequeno, Pequeno), Operação (Logística Nacional, Internacional/Transfronteiriça), Tipo de Cliente (B2B, B2C, E-Commerce e Entrega de Última Milhas), Modelo de Negócio (Transportadoras Baseadas em Ativos, Corretagem e Logística de Terceiros (3PL), Logística de Quarta Parte (4PL)), Distância (Mais de 500 Milhas, 201 Milhas a 500 Milhas, 101 Milhas–200 Milhas, 50 Milhas–100 Milhas, Menos de 50 Milhas) |

|

Países abrangidos |

Arábia Saudita |

|

Atores do mercado abrangidos |

AP Moller–Maersk, CGS, Mosanada Logistics Services (parte da Naghi & Sons.), Wared Logistics., NAQEL Company, Agility, IFFCO, Almajdouie Logistics, Advanced Storage Co, United Group, Four Winds, Jones International Transportation, SMSA Express Transportation Company Ltd., Transcorp, Tamer Logistics, Flow, Starlinks, Binzagr, Mubarrad, Etmam Logistics (subsidiária da Almarai), Aman Logistics e Logexa, entre outras |

Definição de Mercado

O mercado de logística de cadeia fria da Arábia Saudita abrange a gestão e o transporte abrangentes de produtos sensíveis à temperatura, incluindo alimentos perecíveis, bebidas, produtos farmacêuticos e produtos químicos, através de uma série de atividades de produção, armazenamento e distribuição refrigerados. Este mercado envolve infraestruturas especializadas, como armazéns frigoríficos, veículos com temperatura controlada e sistemas de monitorização avançados para garantir a integridade, a segurança e a qualidade dos produtos em toda a cadeia de abastecimento. O principal objetivo é manter a gama de temperaturas necessária desde o ponto de origem até ao destino final, aderindo a normas regulamentares rigorosas e aproveitando as tecnologias inovadoras para satisfazer a crescente procura de produtos frescos e seguros nos mercados nacional e internacional.

Dinâmica do mercado de logística de cadeia fria da Arábia Saudita

Esta secção trata da compreensão dos impulsionadores, vantagens, oportunidades, restrições e desafios do mercado. Tudo isto é discutido em detalhe abaixo:

Motoristas

- Aumento do consumo de alimentos, produtos farmacêuticos e outros produtos sensíveis à temperatura

O aumento do consumo de alimentos, produtos farmacêuticos e outros produtos sensíveis à temperatura aumentou a procura por uma logística de cadeia fria eficiente. Este setor garante que estes produtos perecíveis se mantêm dentro dos intervalos de temperatura exigidos durante toda a cadeia de abastecimento, desde a produção até à entrega, mantendo assim a sua qualidade e segurança. À medida que a necessidade destes produtos cresce, o papel da logística da cadeia fria na prevenção da deterioração e na garantia da conformidade com as normas de saúde e segurança torna-se ainda mais crucial.

- Iniciativas governamentais crescentes e investimentos em infraestruturas logísticas

As iniciativas e investimentos governamentais em infraestruturas logísticas são cruciais para o avanço do setor logístico da cadeia fria. Ao priorizar o desenvolvimento de instalações de armazenamento modernas, melhorar as redes de transporte e implementar sistemas de rastreio avançados, estes esforços visam melhorar a eficiência e a fiabilidade no manuseamento de produtos sensíveis à temperatura. Estes investimentos não só apoiam o crescimento de indústrias dependentes da logística da cadeia fria, como também promovem o desenvolvimento económico e a competitividade, garantindo o fluxo contínuo de mercadorias e reduzindo os custos operacionais.

Oportunidades

- Aumento da adoção de armazenamento e recuperação automatizados

A adoção de tecnologias como os sistemas de armazenamento e recuperação automatizados representa uma oportunidade significativa para o mercado da logística de cadeia fria. Estes sistemas aumentam a eficiência ao automatizar o armazenamento, a recuperação e o manuseamento de produtos sensíveis à temperatura, reduzindo o trabalho manual e minimizando o erro humano. Isto leva a uma gestão de stocks mais precisa e a tempos de processamento mais rápidos, melhorando a eficácia operacional global. Além disso, as tecnologias de automatização ajudam a otimizar a utilização do espaço em instalações de armazenamento refrigerado, o que pode levar a poupanças de custos e ao aumento da capacidade. Ao integrar tecnologias avançadas, as empresas podem melhorar os seus níveis de serviço e escalabilidade, posicionando-se para satisfazer a crescente procura de soluções logísticas com temperatura controlada.

- Aumento das atividades comerciais com outras regiões

O aumento das atividades comerciais com outras regiões, como a Ásia, África e Europa, representa uma oportunidade significativa para o mercado de logística de cadeia fria da Arábia Saudita. À medida que a Arábia Saudita expande as suas ligações comerciais globais, há uma procura crescente por soluções logísticas fiáveis e eficientes com temperatura controlada. Esta atividade comercial intensificada exige tecnologias de cadeia fria para gerir o crescente volume de produtos sensíveis à temperatura. A expansão do comércio gera a necessidade de infraestruturas melhoradas e de soluções inovadoras para garantir a entrega segura e eficiente de produtos perecíveis e sensíveis. Como resultado, o setor da logística de cadeia fria na Arábia Saudita irá provavelmente registar um crescimento substancial, estimulando investimentos em tecnologias modernas e melhorando o desempenho global da cadeia de abastecimento.

Restrições/Desafios

- Custos de investimento elevados

Os custos de investimento elevados são uma restrição significativa no setor da logística da cadeia fria. A manutenção da temperatura necessária para os produtos perecíveis implica investimentos substanciais em transporte refrigerado, instalações de armazenamento especializadas e sistemas de monitorização avançados. Além disso, a necessidade de fornecimento contínuo de energia e de manutenção rigorosa aumenta ainda mais os custos. Estas elevadas despesas operacionais podem sobrecarregar os orçamentos, principalmente para as empresas mais pequenas no mercado, e exigem estratégias de gestão eficientes para garantir a relação custo-benefício, mantendo a integridade e a qualidade dos produtos sensíveis à temperatura.

Desenvolvimentos recentes

- Em julho de 2024, o United Group continuou o seu compromisso com a excelência ética e a inovação ao integrar tecnologias avançadas de IA nas suas operações. Esta mudança estratégica automatizou tarefas repetitivas e aumentou a eficiência em vários departamentos, desde a introdução de dados até à gestão da cadeia de abastecimento. A implementação da IA não só simplifica os processos, como também capacita os colaboradores para se concentrarem em tarefas mais criativas e gratificantes. Este avanço está alinhado com a dedicação da empresa em manter-se à frente no setor e prestar serviços superiores, incluindo no setor da cadeia de frio, onde a gestão precisa e eficiente de produtos sensíveis à temperatura é crucial.

- Em janeiro de 2024, o United Group fez um avanço significativo na sua logística de cadeia fria ao implementar sistemas de controlo de temperatura de última geração nas suas operações de armazenagem e transporte. Esta atualização garantiu que os produtos sensíveis à temperatura, como os produtos farmacêuticos e os produtos perecíveis, fossem mantidos em condições ideais durante toda a viagem. A infraestrutura melhorada da cadeia de frio melhorou a capacidade da empresa de gerir o stock de forma mais eficiente, reduziu as taxas de deterioração e aumentou a satisfação do cliente ao garantir a entrega de produtos de alta qualidade. Este desenvolvimento salientou o compromisso do United Group com a excelência operacional e a sua dedicação em satisfazer as rigorosas exigências do setor da cadeia de frio

- Em março de 2024, a StarLink expandiu a sua parceria com a F5, uma empresa de serviços e segurança de aplicações multi-cloud. A colaboração alargou o seu alcance para incluir o Reino da Arábia Saudita (KSA) e o Bahrein. Esta expansão permitiu à StarLink oferecer o portefólio de soluções da F5 num espectro mais alargado, abrangendo a Arábia Saudita, Bahrein, Kuwait, Omã, Qatar, Jordânia e Líbano. Esta mudança estratégica capacitou as empresas no Médio Oriente ao fornecer serviços de aplicações e soluções de segurança melhorados. A parceria teve como objetivo satisfazer as necessidades em evolução dos clientes na região, contribuindo para o crescimento e eficácia de ambas as empresas no dinâmico campo dos serviços de cloud e segurança.

- Em março de 2023, a SMSA estabeleceu uma parceria estratégica com a China Mobile International Middle East durante a conferência LEAP, com o objetivo de promover soluções inteligentes de transformação digital e melhorar as tecnologias sauditas no setor da logística. Esta colaboração não só expandiu as capacidades da SMSA, como também a posicionou para oferecer serviços de correio avançados, beneficiando ao mesmo tempo da experiência e do alcance internacional da China Mobile International, contribuindo, em última análise, para o crescimento e a vantagem competitiva da SMSA no panorama da logística em evolução.

- Em novembro de 2023, a NAQEL Company atingiu um novo marco quando foi totalmente adquirida pela Saudi Post (SPL). Esta aquisição posicionou a NAQEL como um operador nacional, reforçando o papel da Arábia Saudita como porta de entrada logística para a Europa, Ásia e África. Alinhou também com as metas da Visão 2030, cujo objectivo é tornar o Reino num líder logístico regional. A aquisição aumentou as capacidades operacionais da NAQEL e expandiu o seu alcance de mercado

Âmbito do mercado de logística de cadeia fria da Arábia Saudita

O mercado de logística de cadeia fria da Arábia Saudita está dividido em nove segmentos notáveis que se baseiam no tipo, tipo de mercadoria/atributo crítico, tecnologia, tipo de temperatura, tamanho da carga útil, operação, tipo de cliente, modelo de negócio e distância.

Tipo

- Armazenagem/Armazenagem

- Logística (Estrada)

- Logística (Marítima)

- Logística (Ferroviária)

- Logística (Aéreo)

- Serviço e entrega de última milha

Com base no tipo, o mercado de logística de cadeia fria da Arábia Saudita está segmentado em armazenagem/stock, logística (rodoviária), logística (marítima), logística (ferroviária), logística (aérea) e serviço e entrega de última milha.

Tipo de bens/atributo crítico

- Alimentos

- Produtos gerais (incluindo material médico)

- Mercadorias perigosas (incluindo produtos químicos perigosos)

- Outros

Com base no tipo de mercadoria/atributo crítico, o mercado de logística de cadeia fria da Arábia Saudita está segmentado em alimentos, produtos gerais (incluindo material médico), produtos perigosos (incluindo produtos químicos perigosos) e outros.

Tecnologia

- Congelamento rápido

- Arrefecimento Evaporativo

- Compressão de vapor

- Sistemas Criogénicos

- Controlador Lógico Programável

- Outros

Com base na tecnologia, o mercado de logística de cadeia fria da Arábia Saudita está segmentado em congelação rápida, arrefecimento evaporativo, compressão de vapor, sistemas criogénicos, controlador lógico programável e outros.

Tipo de temperatura

- Ambiente

- Gelado

- Congelado

- Outros

Com base no tipo de temperatura, o mercado de logística de cadeia fria da Arábia Saudita está segmentado em temperatura ambiente, refrigerado, congelado e outros.

Tamanho da carga útil

- Grande

- Médio

- Pequeno

- Extrapequeno

- Pequena

Com base no tamanho da carga útil, o mercado de logística de cadeia fria da Arábia Saudita está segmentado em grande, médio, pequeno, extrapequeno e pequeno.

Operação

- Doméstico

- Logística Internacional/Transfronteiriça

Com base na operação, o mercado de logística de cadeia fria da Arábia Saudita está segmentado em logística nacional e internacional/transfronteiriça.

Tipo de cliente

- B2B

- B2C

- Comércio eletrónico

- Entrega de Últimas Milhas

Com base no tipo de cliente, o mercado de logística de cadeia fria da Arábia Saudita está segmentado em B2B, B2C, comércio eletrónico e entrega de última milha.

Modelo de negócio

- Transportadoras baseadas em ativos

- Corretagem e Logística de Terceiros (3PL)

- Logística de Quarta Parte (4PL)

- Outros

Com base no modelo de negócio, o mercado de logística de cadeia fria da Arábia Saudita está segmentado em transportadoras baseadas em ativos, corretagem e logística terceirizada (3PL), logística de quarta parte (4PL) e outros.

Distância

- Mais de 500 milhas

- 201 milhas para 500 milhas

- 101 milhas-200 milhas

- 50 milhas - 100 milhas

- Menos de 50 milhas

Com base na distância, o mercado de logística de cadeia fria da Arábia Saudita está segmentado em mais de 500 milhas, 201 milhas a 500 milhas, 101 milhas a 200 milhas, 50 milhas a 100 milhas e menos de 50 milhas.

Análise/Insights regionais do mercado de logística de cadeia fria da Arábia Saudita

O mercado da logística de cadeia fria é analisado e os insights e tendências sobre o tamanho do mercado são fornecidos pelo tipo, tipo de mercadoria/atributo crítico, tecnologia, tipo de temperatura, tamanho da carga útil, operação, tipo de cliente, modelo de negócio e distância, conforme acima referenciado.

A secção de países do relatório também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado que impactam as tendências atuais e futuras do mercado. Pontos de dados como a análise da cadeia de valor a montante e a jusante, tendências técnicas e análise das cinco forças de Porter, estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade de marcas globais e os seus desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, ao impacto de tarifas domésticas e rotas comerciais são considerados ao fornecer uma análise de previsão dos dados do país .

Análise do cenário competitivo e da quota de mercado da logística de cadeia fria da Arábia Saudita

O panorama competitivo do mercado de logística de cadeia fria da Arábia Saudita fornece detalhes dos concorrentes. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento de produto, amplitude e abrangência do produto, domínio da aplicação. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas no mercado global de automação industrial.

Alguns dos principais participantes que operam no mercado de logística de cadeia fria da Arábia Saudita são a AP Moller–Maersk, CGS, Mosanada Logistics Services (parte da Naghi & Sons.), Wared Logistics., NAQEL Company, Agility, IFFCO, Almajdouie Logistics, Advanced Storage Co. , United Group, Four Winds, Jones International Transportation, SMSA Express Transportation Company Ltd., Transcorp, Tamer Logistics, Flow, Starlinks, Binzagr, Mubarrad, Etmam Logistics (subsidiária da Almarai), Aman Logistics e Logexa, entre outras .

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.