Kenya Uganda Tanzania And Rwanda Potato Processing Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

553.15 Million

USD

720.84 Million

2023

2034

USD

553.15 Million

USD

720.84 Million

2023

2034

| 2024 –2034 | |

| USD 553.15 Million | |

| USD 720.84 Million | |

|

|

|

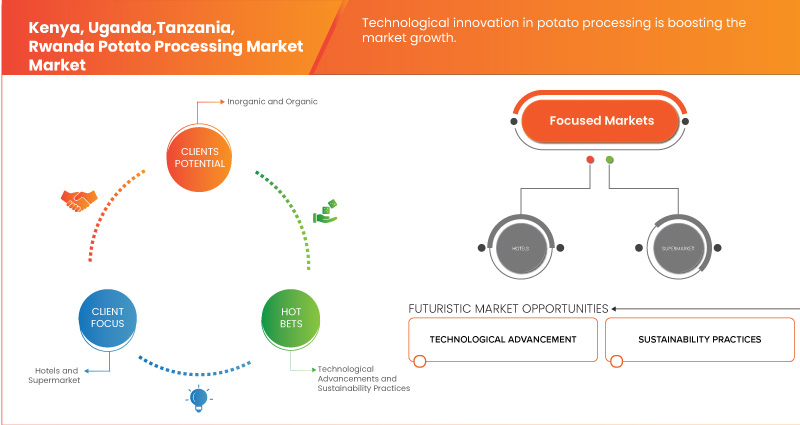

Kenya, Uganda, Tanzania, and Rwanda Potato Processing Market, By Category (Inorganic and Organic), Product Type (Frozen, Ambient, and Dehydrated), Shape (Dices, Round, Tater Drums, Shreds, and Others), Packaging (Pouches, Cardboard Boxes, Cans and Others), By Application (Ready-To-Cook & Prepared Meals, Snacks and Bakery Industry, Baby Food (Bottled), Dough Mixtures, Soups and Jams, and Others), End User (Food Service Sector and Retail/Household) – Industry Trends and Forecast to 2034.

Potato Processing Market Analysis

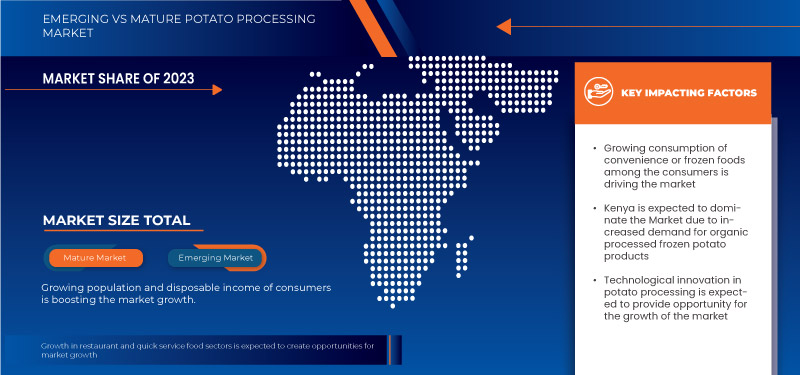

Growing consumption of conveniene or frozen foods among the consumers and growing popularity of restaurant and quick service food sectors is driving the market growth.Technological innovation in potato processing and increasing demand for organic processed frozen potato products provodes opportunities in the market.Moreover, availability of a diverse range of products driving market growth.

Potato Processing Market Size

The Kenya, Uganda, Tanzania, and Rwanda potato processing market is expected to reach USD 720.84 million by 2034 from USD 553.15 million in 2023, growing with a substantial CAGR of 2.5% in the forecast period of 2024 to 2034.

Potato Processing Market Trends

“Growing Consumption of Convenience or Frozen Foods among the Consumers”

There is an increasing trend in the demand for convenience or frozen foods. Numerous factors have contributed to the rise in demand for frozen or convenient potato products. First of all, as a result of busier lifestyles, people now need quick and simple meal options. The products made from frozen potatoes provide a fast and easy solution. Additionally, frozen potato products have a longer shelf life than fresh potato products, which makes them a sensible choice for customers who want to stock up on essentials.

Moreover, because frozen potato products are adaptable and can be used in a variety of dishes, from sides to main courses, both home cooks and food service providers favor them. Furthermore, the cost of frozen potato products is frequently lower than that of fresh potatoes, which is another important consideration for people trying to cut costs on groceries. Overall, the rising demand for frozen potato products is being driven by a combination of convenience, usefulness, versatility, and affordability.

Report Scope and Potato Processing Market Segmentation

|

Attributes |

Potato Processing Key Market Insights |

|

Segmentation |

|

|

Países abrangidos |

Quénia, Uganda, Ruanda, Tanzânia |

|

Principais participantes do mercado |

Tropical Heat. (Quénia), Norda Industries Limited (Quénia), Leson Company Ltd (Tanzânia), Butcher (Quénia), Wedgehut Foods Ltd (Quénia) e Hollanda FairFoods LTD (Ruanda) |

|

Oportunidades de Mercado |

|

|

Conjuntos de informações de dados de valor acrescentado |

Para além dos insights sobre os cenários de mercado, tais como o valor de mercado, a taxa de crescimento, a segmentação, a cobertura geográfica e os principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research incluem também análises aprofundadas de especialistas, análises de preços, análises de quota de marca, inquérito ao consumidor, análise demográfica, análise da cadeia de abastecimento, análise da cadeia de valor, visão geral das matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e enquadramento regulamentar. |

Definição do Mercado de Processamento de Batata

O processamento da batata envolve uma infinidade de técnicas para obter os produtos finais desejados. Este processo é normalmente realizado em fábricas especializadas no processamento de batata, equipadas com diversas ferramentas e equipamentos. As etapas típicas envolvidas na produção de batatas fritas, chips, flocos e amido incluem a limpeza, descascamento, lavagem, fatiamento e escaldamento de batatas frescas. Os produtos de batata processados são utilizados pelas famílias, cadeias de fast food e restaurantes porque já estão parcialmente preparados, o que reduz o tempo necessário para preparar pratos como batatas fritas, sopas, saladas e batatas fritas de batata. A batata processada é utilizada numa variedade de aplicações por muitas indústrias de utilizadores finais, incluindo a indústria de snacks, a indústria de alimentos prontos a cozinhar, a indústria de panificação e a indústria de serviços alimentares, entre outras.

Dinâmica do mercado de transformação de batata

Motoristas

- Consumo crescente de alimentos de conveniência ou congelados entre os consumidores

Existe uma tendência crescente na procura de alimentos prontos ou congelados. Vários factores contribuíram para o aumento da procura de produtos de batata congelados ou práticos. Em primeiro lugar, como resultado de estilos de vida mais agitados, as pessoas precisam agora de opções de refeições rápidas e simples. Os produtos feitos com batatas congeladas oferecem uma solução rápida e fácil. Além disso, os produtos de batata congelada têm uma vida útil mais longa do que os produtos de batata fresca, o que os torna uma escolha sensata para os clientes que desejam armazenar produtos essenciais. e podem ser utilizados numa variedade de pratos, desde acompanhamentos para pratos principais, tanto os cozinheiros domésticos como os prestadores de serviços de alimentação os preferem. Além disso, o custo dos produtos de batata congelada é frequentemente inferior ao das batatas frescas, o que é outra consideração importante para as pessoas que tentam reduzir os custos com as compras. No geral, a crescente procura de produtos de batata congelada está a ser impulsionada por uma combinação de conveniência, utilidade, versatilidade e preço acessível.

Por exemplo,

- Em 2021, de acordo com um artigo publicado no Researchgate, nos últimos 50 anos, os consumidores africanos têm comprado cada vez mais alimentos processados. Esta tendência acelerou nas últimas décadas devido ao aumento da oferta do sector da transformação, com as Pequenas e Médias Empresas (PME) e as grandes empresas privadas a fazerem investimentos significativos. Os alimentos embalados, industrializados, ultraprocessados e as bebidas açucaradas (SSBs) constituem agora uma proporção crescente dos alimentos processados consumidos

A crescente procura por produtos de batata congelados e práticos é motivada pela necessidade de opções de refeições rápidas, fáceis e versáteis no meio de estilos de vida mais agitados. A vida útil prolongada, o preço acessível e a adaptabilidade das batatas congeladas contribuem ainda mais para a sua crescente popularidade.

- Crescimento dos setores da restauração e fast food

A expansão do mercado de transformação de batata do Quénia, Uganda, Tanzânia e Ruanda foi significativamente impulsionada pela expansão dos sectores da restauração e dos serviços alimentares rápidos. A procura por alimentos feitos de batata tem aumentado à medida que mais pessoas em todo o mundo procuram opções de refeições rápidas, saborosas e acessíveis. Os restaurantes de fast food e outros prestadores de serviços alimentares escolhem frequentemente as batatas porque são um ingrediente versátil e acessível. Para fazer face a esta procura crescente, as empresas de transformação de batata têm vindo a expandir as suas operações, abrindo novos espaços para os agricultores, processadores e outros intervenientes na indústria alimentar da África Oriental.

A expansão dos setores da restauração e da alimentação de serviço rápido teve um impacto significativo no mercado de processamento de batata. A procura por produtos à base de batata, como batatas fritas, hash browns e puré de batata, aumentou à medida que os restaurantes de fast food e outros prestadores de serviços alimentares continuam a alargar os seus menus e a oferecer mais opções. Além disso, o crescimento do fast-casual dining deu mais oportunidades ao setor de processamento de batata, uma vez que oferece melhor comida a um preço ligeiramente mais elevado do que o fast food tradicional. Devido a esta tendência, os restaurantes fast-casual de luxo servem cada vez mais produtos especiais de batata, como batatas fritas gourmet e outros produtos especiais de batata. No geral, espera-se que a expansão dos setores da restauração e dos serviços rápidos continue a impulsionar a procura por produtos utilizados no processamento de batata, abrindo um novo âmbito de negócio para os envolvidos no setor nos próximos anos.

Por exemplo,

- De acordo com um relatório da Glovo, o mercado de serviços alimentares no Quénia registou um crescimento significativo, com um aumento de 160% nas encomendas de comida local em comparação com 2021, reflectindo uma preferência crescente por encomendar comida em kibandas e lojas de comida de rua locais.

Portanto, o mercado de processamento de batata foi significativamente impactado pela expansão dos setores de restauração e serviços rápidos. O setor cresceu como resultado da crescente procura por opções de refeições rápidas, saborosas e acessíveis, abrindo novas oportunidades de negócio para produtores, processadores e outros participantes na cadeia de abastecimento alimentar. Além disso, os produtos novos e criativos podem agora ser criados pelas empresas de processamento de batata graças aos avanços na tecnologia de processamento, o que aumentou a procura. A contínua expansão dos setores de fast food e restauração, juntamente com as constantes inovações no processamento de batata, são um bom presságio para o crescimento futuro do mercado de processamento de batata.

Oportunidades

- Inovação tecnológica no processamento de batata

A inovação tecnológica representa uma oportunidade significativa para o mercado de processamento de batata no Quénia, Ruanda e Tanzânia, oferecendo um potencial transformador para a produtividade, eficiência e crescimento do mercado. À medida que a indústria da batata nestas regiões evolui, as tecnologias avançadas podem enfrentar os desafios existentes e abrir novos caminhos para o desenvolvimento. Um dos principais benefícios da inovação tecnológica é a eficiência de processamento melhorada. Os equipamentos de processamento modernos, como descascadores, fatiadores e fritadeiras de alto desempenho, podem melhorar significativamente a velocidade e a qualidade do processamento da batata. As tecnologias de automação, incluindo sistemas robotizados para classificação e embalagem, reduzem o trabalho manual e aumentam a capacidade de produção. Estes avanços permitem aos processadores satisfazer a crescente procura de produtos de batata, mantendo a qualidade consistente e reduzindo os custos operacionais. Por exemplo, os sistemas automatizados podem lidar com grandes volumes de batatas com precisão, garantindo uniformidade em produtos processados, como batatas fritas e batatas fritas, e minimizando o desperdício.

Os avanços tecnológicos também desempenham um papel crucial na sustentabilidade. Equipamentos de processamento energeticamente eficientes e tecnologias de redução de resíduos contribuem para operações mais ecológicas. Por exemplo, as inovações nos sistemas de recuperação de energia e nas tecnologias de reciclagem de água podem reduzir significativamente a pegada ambiental do processamento de batata. Estas práticas sustentáveis não só estão alinhadas com as tendências de produção mais ecológica, como também atraem consumidores cada vez mais conscientes do ambiente. Ao adoptar estas tecnologias, os transformadores no Quénia, Ruanda e Tanzânia podem aumentar a sua competitividade no mercado e atrair compradores internacionais que dão prioridade à sustentabilidade.

Por exemplo,

- De acordo com um blogue publicado no Potato Business, os processadores modernos de batata utilizam dados de máquinas inteligentes para melhorar o rendimento da produção e garantir uma qualidade consistente do produto. Os sensores colocados em pontos críticos, como antes da embalagem ou após a congelação, recolhem dados continuamente para monitorizar os parâmetros do processo. Estes dados são partilhados em toda a linha de produção, permitindo uma integração perfeita e um melhor controlo de todo o processo

Desta forma, os mercados de processamento de batata são significativamente impactados pelos avanços tecnológicos porque permitem aos fabricantes operar de forma mais eficaz, poupar dinheiro e aproveitar novas oportunidades. O desenvolvimento da automação, da robótica e das tecnologias digitais permitiu que o processamento da batata fosse mais eficiente, reduzisse a utilização de energia e melhorasse a qualidade do produto.

- Aumento da procura de produtos biológicos processados de batata congelada

A crescente preferência dos consumidores por alimentos biológicos e naturais aumentou significativamente a procura de produtos de batata biológica congelada nos últimos anos em países africanos como o Quénia, o Ruanda e outros. Os produtos feitos a partir de batatas biológicas congeladas são feitos a partir de batatas que foram cultivadas sem o uso de fertilizantes artificiais, pesticidas ou OGM. Em comparação com os produtos tradicionais de batata congelada, estes produtos apresentam uma série de vantagens, tais como um menor risco de exposição química, melhor sustentabilidade ambiental e maior valor nutricional. Os consumidores podem sentir-se confiantes na qualidade e segurança dos produtos que estão a comprar porque o processo de certificação biológica garante que o processo de produção cumpre normas rigorosas. A procura por produtos de batata congelada biológica deverá aumentar à medida que os consumidores continuam a procurar opções alimentares mais saudáveis e biológicas. Isto apresentará aos produtores oportunidades para diversificar as suas linhas de produtos e aproveitar este mercado em expansão.

Muitos produtores estão agora a oferecer uma grande variedade de opções biológicas para satisfazer a crescente procura deste segmento de mercado por produtos biológicos de batata congelada. Estes produtos consistem em batatas congeladas em vários formatos, como tater tots biológicos, hash browns e batatas fritas. Para ir ao encontro de um maior leque de preferências dos consumidores, alguns fabricantes foram mais longe e ofereceram opções sem OGM e sem glúten. Para satisfazer as exigências dos consumidores ambientalmente conscientes, muitos fabricantes estão também a implementar técnicas de produção sustentáveis, como a utilização de fontes de energia renováveis e a redução de desperdícios.

Por exemplo,

- No Quénia, regista-se um aumento notável da procura de produtos de batata biológica, impulsionado pela crescente consciencialização sobre a alimentação saudável. Esta mudança é evidente no surgimento de mercados e restaurantes biológicos, como o Bridges Organic Restaurant, em Nairobi. A responsável de vendas e marketing, Suzanne Gathitu, salienta que o restaurante obtém as suas batatas exclusivamente de agricultores biológicos certificados, garantindo que o produto é livre de pesticidas, químicos e OGM. Esta crescente procura por opções biológicas reflete uma tendência mais ampla para estilos de vida mais saudáveis e para a necessidade de alimentos seguros e livres de químicos.

Assim, a crescente procura dos consumidores por alimentos biológicos e naturais está a impulsionar significativamente o mercado de produtos biológicos de batata congelada em países africanos como o Quénia e o Ruanda. Estes produtos oferecem vantagens como menor exposição química, melhor sustentabilidade ambiental e maior valor nutricional. À medida que as preferências dos consumidores favorecem cada vez mais opções biológicas e mais saudáveis, os produtores estão a diversificar as suas ofertas para incluir várias formas de batatas biológicas congeladas e incorporar práticas sustentáveis. Esta tendência não só vai ao encontro da crescente procura, como também apresenta oportunidades de expansão de mercado e inovação no setor dos alimentos biológicos.

Restrições/Desafios

- Aumento dos problemas de saúde associados ao maior consumo de snacks de batata processada

A batata é um vegetal de raiz incrivelmente versátil, consumido numa variedade de pratos em todo o mundo. No entanto, as batatas processadas são normalmente categorizadas como alimentos ricos em gordura e sódio. Os níveis elevados de acrilamida estão presentes nos snacks de batata processados devido à utilização de altas temperaturas no processamento e na fritura das batatas, o que as torna menos saudáveis para a saúde humana. O elevado índice glicémico torna-os inadequados para doentes diabéticos, pois aumentam imediatamente os níveis de açúcar no sangue.

Os efeitos secundários associados à saúde devido a estes snacks de batata processada estão listados abaixo:

- O consumo excessivo de snacks de batata processada pode aumentar a pressão arterial

- As batatas fritas podem aumentar as hipóteses de doenças cardíacas

- Snacks de batata podem aumentar o risco de AVC

- Pode causar um aumento de peso intenso

- IG elevado faz com que o nível de açúcar no sangue aumente

- Maior ingestão de snacks de batata processada eleva os níveis de triglicéridos e de colesterol total

Desta forma, os efeitos secundários como o aumento de peso e a obesidade estão a aumentar de dia para dia devido ao aumento do consumo de batatas fritas e snacks, o que pode restringir o crescimento do mercado.

Por exemplo,

- Em 2024, de acordo com um artigo publicado no The New Times, um estudo recente do Centro Biomédico do Ruanda (RBC) revela um aumento da obesidade entre os ruandeses. A prevalência de indivíduos com excesso de peso aumentou de 14 por cento em 2013 para 18,6 por cento em 2022. O estudo, que entrevistou 5.676 pessoas em todas as províncias, destacou que a taxa de mulheres com excesso de peso aumentou significativamente de 19 por cento para 26 por cento, enquanto os homens com excesso de peso registaram um modesto aumento de 9 por cento para 11,5 por cento

Assim, a elevada ingestão de snacks de batata processada pode aumentar os níveis de colesterol, o que pode resultar em riscos cardíacos. Portanto, a crescente consciencialização sobre os efeitos secundários dos snacks de batata processada entre os consumidores pode restringir o crescimento do mercado.

- Preocupações ambientais desfavoráveis

O cultivo de batata no Quénia, Ruanda e Tanzânia enfrenta desafios ambientais significativos que limitam o crescimento do mercado de processamento de batata nestas regiões. Estas preocupações ecológicas impactam não só as práticas agrícolas, mas também toda a cadeia de fornecimento de batata, afectando a dinâmica do mercado de produtos de batata transformados.

Um grande problema ambiental é o uso excessivo de fertilizantes químicos e pesticidas. Num esforço para aumentar a produtividade e combater pragas e doenças, muitos produtores de batata dependem fortemente destes produtos químicos. No entanto, o uso excessivo leva à degradação do solo, à redução da fertilidade do solo e à contaminação das fontes de água. Esta pressão ambiental pode resultar em batatas de qualidade inferior e num aumento dos custos de produção, afectando, em última análise, a consistência e o preço das matérias-primas disponíveis para processamento. À medida que o mercado dos produtos de batata processada cresce, a sustentabilidade do cultivo da batata torna-se cada vez mais crítica. A viabilidade a longo prazo da produção de batata é ameaçada pela degradação do solo, o que pode reduzir o rendimento e a qualidade das culturas, impactando assim o fornecimento de batata crua para processamento.

Por exemplo,

- Em 2017, de acordo com um artigo publicado no site do Grupo do Banco Mundial na Tanzânia, a escassez de água estava a ter cada vez mais impacto nas práticas agrícolas, incluindo o cultivo de batata. Apesar da abundância de lagos e rios de água doce no país, o rápido crescimento populacional e a expansão económica reduziram significativamente a água doce renovável per capita de mais de 3.000 m³ para cerca de 1.600 m³. Este declínio levou a um grave stress hídrico, particularmente evidente no Rio Grande Ruaha, que agora se mantém seco durante vários meses todos os anos. A causa principal é a expansão da irrigação informal a montante, que, embora proporcione benefícios económicos aos agricultores individuais, tem contribuído para uma utilização insustentável da água.

Assim, as flutuações climáticas e as exigências específicas de temperatura das batatas têm sido uma razão para a diminuição da produção de batata em toda a região, o que está a afectar o mercado, criando assim uma restrição significativa no crescimento do mercado na região africana.

Este relatório de mercado fornece detalhes de novos desenvolvimentos recentes, regulamentos comerciais, análise de importação e exportação, análise de produção, otimização da cadeia de valor, quota de mercado, impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações do mercado, análise estratégica do crescimento do mercado, tamanho do mercado, crescimento do mercado das categorias, nichos de aplicação e dominância, aprovações de produtos, lançamentos de produtos, expansões geográficas, inovações tecnológicas no mercado. Para mais informações sobre o mercado, contacte a Data Bridge Market Research para obter um briefing de analista.

Impacto e cenário atual do mercado de escassez de matéria-prima e atrasos no envio

A Data Bridge Market Research oferece uma análise de alto nível do mercado e fornece informações tendo em conta o impacto e o ambiente atual do mercado de escassez de matérias-primas e atrasos nas remessas. Isto traduz-se em avaliar possibilidades estratégicas, criar planos de ação eficazes e auxiliar as empresas na tomada de decisões importantes.

Além do relatório padrão, também oferecemos uma análise aprofundada do nível de aquisição, desde atrasos previstos de expedição, mapeamento de distribuidores por região, análise de commodities, análise de produção, tendências de mapeamento de preços, sourcing, análise de desempenho de categoria, soluções avançadas de gestão de risco da cadeia de abastecimento.

Impacto esperado da desaceleração económica nos preços e na disponibilidade dos produtos

Quando a atividade económica abranda, as indústrias começam a sofrer. Os efeitos previstos da crise económica nos preços e na acessibilidade dos produtos são tidos em conta nos relatórios de informação de mercado e nos serviços de informações fornecidos pelo DBMR. Com isto, os nossos clientes conseguem geralmente manter-se um passo à frente dos seus concorrentes, projetar as suas vendas e receitas e estimar as suas despesas com lucros e perdas.

Âmbito do mercado de processamento de batata

O mercado está segmentado em seis segmentos notáveis com base na categoria, tipo de produto, formato, embalagem, aplicação e utilizador final. O crescimento entre estes segmentos irá ajudá-lo a analisar segmentos de baixo crescimento nos setores e fornecerá aos utilizadores uma visão geral e informações valiosas do mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Categoria

- Inorgânico

- Orgânico

Tipo de produto

- Congelado

- Congelado, Por tipo de produto

- Batatas fritas congeladas

- Congelado, Por tipo de produto

- Batatas fritas com baixo teor de gordura

- Batata Doce Frita

- Outros

- Batatas fritas congeladas, por tipo

- Batatas fritas cortadas a direito

- Batatas fritas cortadas em rodelas

- Batatas fritas onduladas

- Outros

- Batatas fritas congeladas

- Especialidades de batata

- Especialidades de batata, por Cut Specialties

- Cunhas

- Fatias

- Batatas assadas

- Outros

- Especialidades de batata, por Mash Specialties

- Puré Simples

- Croquetes de batata

- Noisettes

- Duquesas

- Outros

- Especialidades de batata, por Shredded Specialties

- Batatas fritas

- Batata Rosti

- Bolinhos de batata

- Outros

- Especialidades de batata, por Cut Specialties

- Ambiente

- Ambiente, Por tipo de produto

- Batatas fritas

- Flocos

- Outros

- Ambiente, Por tipo de produto

- Congelado, Por tipo de produto

- Desidratado, por tipo de produto

- Desidratado, por tipo de produto

- Grânulos de batata

- Amido

- Desidratado, por tipo de produto

- Outros

Forma

- Dados

- Redondo

- Tambores de batata

- Fragmentos

- Outros

Embalagem

- Bolsas

- Caixas de cartão

- Latas

- Outros

Aplicação

- Refeições prontas a cozinhar e preparadas

- Indústria de Snacks e Panificação

- Comida para Bebé (Engarrafada)

- Misturas para massa

- Sopas e Geleias

- Outros

Utilizador final

- Setor dos serviços de alimentação

- Setor dos serviços de alimentação, por utilizador final

- Restaurante

- Restaurante, Por Tipo

- Restaurante de cadeia

- Restaurante Independente

- Restaurante, Por Categoria de Serviço

- Restaurantes de serviço rápido

- Restaurantes com serviço completo

- Restaurante, Por Tipo

- Hotel

- Café

- Bares e Discotecas

- Restauração

- Outros

- Restaurante

- Setor dos serviços de alimentação, por utilizador final

Análise regional do mercado de transformação de batata

O mercado é analisado e são fornecidos insights e tendências sobre o tamanho do mercado por categoria, tipo de produto, formato, embalagem, aplicação e utilizador final, conforme referenciado acima.

Os países abrangidos pelo mercado são o Quénia, a Tanzânia, o Ruanda e o Uganda.

Espera-se que o Quénia domine o mercado de processamento de batata devido à sua infraestrutura bem estabelecida, tecnologia de processamento avançada e maiores níveis de investimento no setor em comparação com outros países da África Oriental, o que deverá impulsionar ainda mais o crescimento do mercado .

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of regional brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Potato Processing Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, regional presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Potato Processing Market Leaders Operating in the Market Are:

- Tropical Heat.(Kenya)

- Norda Industries Limited (Kenya)

- Leson Company Ltd (Tanzania)

- Butcher (Kenya)

- Wedgehut Foods Ltd (Kenya)

- Hollanda FairFoods LTD (Rwanda)

Latest Developments in Potato Processing Market

- In April 2022, Tropical Heat. has launched new product lines, including healthy snacks and breakfast cereals. The upcoming range features innovative items such as rice cakes made with brown rice and flavored chocolate rice cakes, which offer a low-calorie alternative to traditional snacks. These products aimed to bridge the gap between health and taste, catering to consumers seeking nutritious yet flavorful options. Additionally, Tropical Heat is expanding its market presence, now operating in 25 countries, with plans to reach 30 soon

- In August 2022, Butcher. (Sereni Fries) has launched new product: frozen chips. The product includes three cuts—matchstick, medium, and standard—and offers convenience, quality, and reduced preparation time. This expansion has helped the company to increase their production capacity to 40 tons per day and tap into the retail and export markets. This launch has also created 15 new jobs, growing the workforce from 48 to 63 employees

- Em 2022,Talhante. (Sereni Fries) apresentou a sua Iniciativa da Boa Batata no evento realizado entre 30 de maio e 2 de junho, no 11º Congresso Mundial da Batata em Dublin, T. Este programa formou pequenos agricultores quenianos em Boas Práticas Agrícolas e Práticas Agrícolas Climáticas Inteligentes para superar desafios como os métodos agrícolas tradicionais e a informação inadequada. Esta iniciativa teve como objectivo aumentar a produtividade das culturas, reduzir as perdas pós-colheita e melhorar os padrões de vida dos agricultores através da agricultura contratual. Foca-se também na erradicação da pobreza, na criação de emprego e na melhoria da segurança alimentar, beneficiando significativamente as mulheres e os jovens.

- Em setembro de 2022, a Wedgehut Foods Ltd. especializou-se em acrescentar valor a variedades de batata como a Markies, Shangi, Arizona e Destiny. No âmbito do programa Mavuno Zaidi com a Syngenta e a IDH, a empresa planeou apoiar 100.000 agricultores com financiamento. Estão também a colaborar com a AgricoPSA para promover a cadeia de valor da batata do Quénia

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PRICE INDEX

4.2 PRODUCTION CAPACITY OVERVIEW (KILO TONS)

4.3 SUPPLY CHAIN OF KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET

4.3.1 RAW MATERIAL PROCUREMENT

4.3.2 PROCESSING

4.3.3 MARKETING AND DISTRIBUTION

4.3.4 END USERS

4.4 BRAND OUTLOOK

4.5 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.6 IMPACT OF ECONOMIC SLOWDOWN ON THE MARKET

4.6.1 OVERVIEW

4.6.2 CONCLUSION

4.7 IMPORT AND EXPORT

4.8 MARKET SHARE OF POTATO PROCESSED PRODUCTS AMONG POTATO BASED SNACKS, 2023, (%)

4.9 TECHNOLOGICAL INNOVATION

4.1 OVERVIEW ON POTATO COLD STORAGE

4.10.1 FOOD-GRADE POTATO STORAGE

4.10.2 PROCESSING-GRADE POTATO STORAGE

4.10.3 STORAGE AND UTILIZATION CAPACITY

4.10.4 UTILIZATION

4.11 FACTORS AFFECTING BUYING DECISION

4.11.1 LARGE PRODUCT RANGE

4.11.2 COMPANY AUTHENTICITY

4.11.3 INCOME

4.12 INDUSTRY TRENDS AND FUTURE PERSPECTIVE OF KENYA, UGANDA, RWANDA, AND TANZANIA POTATO PROCESSING MARKET

4.12.1 INDUSTRY TRENDS

4.12.2 FUTURE TRENDS

4.13 PRODUCTION CAPACITY ANALYSIS ON POTATO PROCESSORS

4.13.1 PRODUCTION CAPACITY ANALYSIS ON POTATO PROCESSORS, BY PRODUCT TYPE, 2022-2024, (TONS)

4.13.2 PRODUCTION CAPACITY ANALYSIS ON POTATO PROCESSORS, BY APPLICATION, 2022-2024, (TONS)

4.13.3 PRODUCTION CAPACITY ANALYSIS ON POTATO INDUSTRY, BY GRADE, 2022-2024, (TONS)

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING CONSUMPTION OF CONVENIENCE OR FROZEN FOODS AMONG THE CONSUMERS

6.1.2 GROWTH OF RESTAURANT AND QUICK SERVICE FOOD SECTORS

6.1.3 GROWING POPULATION AND DISPOSABLE INCOME OF CONSUMERS

6.1.4 AVAILABILITY OF A DIVERSE RANGE OF PRODUCTS

6.2 RESTRAINTS

6.2.1 INCREASING HEALTH PROBLEMS ASSOCIATED WITH THE HIGHER CONSUMPTION OF PROCESSED POTATO SNACKS

6.2.2 UNFAVORABLE ENVIRONMENTAL CONCERNS

6.3 OPPORTUNITIES

6.3.1 TECHNOLOGICAL INNOVATION IN POTATO PROCESSING

6.3.2 INCREASING DEMAND FOR ORGANIC PROCESSED FROZEN POTATO PRODUCTS

6.4 CHALLENGES

6.4.1 HIGH COST ASSOCIATED WITH POTATO CHIPS MACHINES

6.4.2 FLUCTUATION IN PRICES OF RAW MATERIALS

7 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY CATEGORY

7.1 OVERVIEW

7.2 INORGANIC

7.3 ORGANIC

8 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 FROZEN

8.3 AMBIENT

8.4 DEHYDRATED

9 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY SHAPE

9.1 OVERVIEW

9.2 DICES

9.3 ROUND

9.4 TATER DRUMS

9.5 SHREDS

9.6 OTHERS

10 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY PACKAGING

10.1 OVERVIEW

10.2 POUCHES

10.3 CARDBOARD BOXES

10.4 CAN

10.5 OTHERS

11 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 READY-TO-COOK & PREPARED MEALS

11.3 SNACKS AND BAKERY INDUSTRY

11.4 BABY FOOD (BOTTLED)

11.5 DOUGH MIXTURES

11.6 SOUPS AND JAMS

11.7 OTHERS

12 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY END-USER

12.1 OVERVIEW

12.2 FOOD SERVICE SECTOR

12.3 RETAIL/HOUSEHOLD

13 KENYA, UGANDA, TANZANIA AND, RWANDA POTATO PROCESSING MARKET, BY COUNTRY

13.1 OVERVIEW

13.1.1 KENYA

13.1.2 RWANDA

13.1.3 UGANDA

13.1.4 TANZANIA

14 KENYA, UGANDA, TANZANIA AND RWANDA POTATO PROCESSING MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: KENYA, UGANDA, TANZANIA, AND RWANDA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 TROPICAL HEAT.

16.1.1 COMPANY SNAPSHOT

16.1.2 PRODUCT PORTFOLIO

16.1.3 RECENT DEVELOPMENTS

16.2 NORDA INDUSTRIES LIMITED

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 RECENT DEVELOPMENTS

16.3 LESON COMPANY LTD

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 RECENT DEVELOPMENTS

16.4 BUTCHER. (SERENI FRIES)

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT DEVELOPMENTS

16.5 WEDGEHUT FOODS LTD.

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENTS

16.6 HOLLANDA FAIRFOODS LTD

16.6.1 COMPANY SNAPSHOT

16.6.2 1.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tabela

TABLE 1 AVERAGE IMPORT OF POTATO CRISPS AND FROZEN READY-CUT POTATO CHIPS, 2020-21, (HS CODE:- 200410) (TONS)

TABLE 2 REGULATORY COVERAGE

TABLE 3 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY CATEGORY, 2022-2034 (USD THOUSAND)

TABLE 4 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY CATEGORY, 2022-2034 (TONS)

TABLE 5 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, AVERAGE SELLING PRICE, BY CATEGORY, (USD/KG)

TABLE 6 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 7 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 8 KENYA, UGANDA, TANZANIA, AND RWANDA FROZEN IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 9 KENYA, UGANDA, TANZANIA, AND RWANDA FROZEN IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 10 KENYA, UGANDA, TANZANIA, AND RWANDA FROZEN FRENCH FRIES IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 11 KENYA, UGANDA, TANZANIA, AND RWANDA FROZEN FRENCH FRIES IN POTATO PROCESSING MARKET, BY TYPE, 2022-2034 (USD THOUSAND)

TABLE 12 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY CUT SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 13 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY MASH SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 14 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY SHREDDED SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 15 KENYA, UGANDA, TANZANIA, AND RWANDA AMBIENT IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 16 KENYA, UGANDA, TANZANIA AND RWANDA AMBIENT IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 17 KENYA, UGANDA, TANZANIA AND RWANDA DEHYDRATED IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 18 KENYA, UGANDA, TANZANIA AND RWANDA DEHYDRATED IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 19 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY SHAPE, 2022-2034 (USD THOUSAND)

TABLE 20 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY PACKAGING, 2022-2034 (USD THOUSAND)

TABLE 21 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY APPLICATION, 2022-2034 (USD THOUSAND)

TABLE 22 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY END-USER, 2022-2034 (USD THOUSAND)

TABLE 23 KENYA, UGANDA, TANZANIA AND RWANDA FOOD SERVICE SECTOR IN POTATO PROCESSING MARKET, BY END-USER, 2022-2034 (USD THOUSAND)

TABLE 24 KENYA, UGANDA, TANZANIA AND RWANDA RESTAURANT IN POTATO PROCESSING MARKET, BY TYPE, 2022-2034 (USD THOUSAND)

TABLE 25 KENYA, UGANDA, TANZANIA AND RWANDA RESTAURANT IN POTATO PROCESSING MARKET, BY SERVICE CATEGORY, 2022-2034 (USD THOUSAND)

TABLE 26 KENYA, UGANDA, TANZANIA AND RWANDA POTATO PROCESSING MARKET, BY COUNTRY, 2022-2034 (USD THOUSAND)

TABLE 27 KENYA, UGANDA, TANZANIA AND RWANDA POTATO PROCESSING MARKET, BY COUNTRY, 2022-2034 (TONS)

TABLE 28 KENYA POTATO PROCESSING MARKET, BY CATEGORY, 2022-2034 (USD THOUSAND)

TABLE 29 KENYA POTATO PROCESSING MARKET, BY CATEGORY, 2022-2034 (TONS)

TABLE 30 KENYA POTATO PROCESSING MARKET, AVERAGE SELLING PRICE, BY CATEGORY, (USD/KG)

TABLE 31 KENYA POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 32 KENYA POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 33 KENYA FROZEN IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 34 KENYA FROZEN IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 35 KENYA FROZEN FRENCH FRIES IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 36 KENYA FROZEN FRENCH FRIES IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 37 KENYA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY CUT SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 38 KENYA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY MASH SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 39 KENYA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY SHREDDED SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 40 KENYA AMBIENT IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 41 KENYA AMBIENT IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 42 KENYA DEHYDRATED IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 43 KENYA DEHYDRATED IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 44 KENYA POTATO PROCESSING MARKET, BY SHAPE, 2022-2034 (USD THOUSAND)

TABLE 45 KENYA POTATO PROCESSING MARKET, BY PACKAGING, 2022-2034 (USD THOUSAND)

TABLE 46 KENYA POTATO PROCESSING MARKET, BY APPLICATION, 2022-2034 (USD THOUSAND)

TABLE 47 KENYA POTATO PROCESSING MARKET, BY END-USER, 2022-2034 (USD THOUSAND)

TABLE 48 KENYA FOOD SERVICE SECTOR IN POTATO PROCESSING MARKET, BY END-USER, 2022-2034 (USD THOUSAND)

TABLE 49 KENYA RESTAURANT IN POTATO PROCESSING MARKET, BY TYPE, 2022-2034 (USD THOUSAND)

TABLE 50 KENYA RESTAURANT IN POTATO PROCESSING MARKET, BY SERVICE CATEGORY, 2022-2034 (USD THOUSAND)

TABLE 51 RWANDA POTATO PROCESSING MARKET, BY CATEGORY, 2022-2034 (USD THOUSAND)

TABLE 52 RWANDA POTATO PROCESSING MARKET, BY CATEGORY, 2022-2034 (TONS)

TABLE 53 RWANDA POTATO PROCESSING MARKET, AVERAGE SELLING PRICE, BY CATEGORY, (USD/KG)

TABLE 54 RWANDA POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 55 RWANDA POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 56 RWANDA FROZEN IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 57 RWANDA FROZEN IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 58 RWANDA FROZEN FRENCH FRIES IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 59 RWANDA FROZEN FRENCH FRIES IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 60 RWANDA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY CUT SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 61 RWANDA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY MASH SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 62 RWANDA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY SHREDDED SPECIALTIES 2022-2034 (USD THOUSAND)

TABLE 63 RWANDA AMBIENT IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 64 RWANDA AMBIENT IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 65 RWANDA DEHYDRATED IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 66 RWANDA DEHYDRATED IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 67 RWANDA POTATO PROCESSING MARKET, BY SHAPE, 2022-2034 (USD THOUSAND)

TABLE 68 RWANDA POTATO PROCESSING MARKET, BY PACKAGING, 2022-2034 (USD THOUSAND)

TABLE 69 RWANDA POTATO PROCESSING MARKET, BY APPLICATION, 2022-2034 (USD THOUSAND)

TABLE 70 RWANDA POTATO PROCESSING MARKET, BY END-USER, 2022-2034 (USD THOUSAND)

TABLE 71 RWANDA FOOD SERVICE SECTOR IN POTATO PROCESSING MARKET, BY END-USER, 2022-2034 (USD THOUSAND)

TABLE 72 RWANDA RESTAURANT IN POTATO PROCESSING MARKET, BY TYPE, 2022-2034 (USD THOUSAND)

TABLE 73 RWANDA RESTAURANT IN POTATO PROCESSING MARKET, BY SERVICE CATEGORY, 2022-2034 (USD THOUSAND)

TABLE 74 UGANDA POTATO PROCESSING MARKET, BY CATEGORY, 2022-2034 (USD THOUSAND)

TABLE 75 UGANDA POTATO PROCESSING MARKET, BY CATEGORY, 2022-2034 (TONS)

TABLE 76 RWANDA POTATO PROCESSING MARKET, AVERAGE SELLING PRICE, BY CATEGORY, (USD/KG)

TABLE 77 UGANDA POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 78 UGANDA POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 79 UGANDA FROZEN IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 80 UGANDA FROZEN IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 81 UGANDA FROZEN FRENCH FRIES IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 82 UGANDA FROZEN FRENCH FRIES IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 83 UGANDA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY CUT SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 84 UGANDA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY MASH SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 85 UGANDA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY SHREDDED SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 86 UGANDA AMBIENT IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 87 UGANDA AMBIENT IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 88 UGANDA DEHYDRATED IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 89 UGANDA DEHYDRATED IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 90 UGANDA POTATO PROCESSING MARKET, BY SHAPE, 2022-2034 (USD THOUSAND)

TABLE 91 UGANDA POTATO PROCESSING MARKET, BY PACKAGING, 2022-2034 (USD THOUSAND)

TABLE 92 UGANDA POTATO PROCESSING MARKET, BY APPLICATION, 2022-2034 (USD THOUSAND)

TABLE 93 UGANDA POTATO PROCESSING MARKET, BY END-USER, 2022-2034 (USD THOUSAND)

TABLE 94 UGANDA FOOD SERVICE SECTOR IN POTATO PROCESSING MARKET, BY END-USER, 2022-2034 (USD THOUSAND)

TABLE 95 UGANDA RESTAURANT IN POTATO PROCESSING MARKET, BY TYPE, 2022-2034 (USD THOUSAND)

TABLE 96 UGANDA RESTAURANT IN POTATO PROCESSING MARKET, BY SERVICE CATEGORY, 2022-2034 (USD THOUSAND)

TABLE 97 TANZANIA POTATO PROCESSING MARKET, BY CATEGORY, 2022-2034 (USD THOUSAND)

TABLE 98 TANZANIA POTATO PROCESSING MARKET, BY CATEGORY, 2022-2034 (TONS)

TABLE 99 TANZANIA POTATO PROCESSING MARKET,AVERAGE SELLING PRICE, BY CATEGORY, 2022-2034 (USD/TONS)

TABLE 100 TANZANIA POTATO PROCESSING MARKET, AVERAGE SELLING PRICE, BY CATEGORY, (USD/KG)

TABLE 101 TANZANIA POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 102 TANZANIA POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 103 TANZANIA FROZEN IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 104 TANZANIA FROZEN IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 105 TANZANIA FROZEN FRENCH FRIES IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 106 TANZANIA FROZEN FRENCH FRIES IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 107 TANZANIA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY CUT SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 108 TANZANIA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, MASH SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 109 TANZANIA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY SHREDDED SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 110 TANZANIA AMBIENT IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 111 TANZANIA AMBIENT IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 112 TANZANIA DEHYDRATED IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 113 TANZANIA DEHYDRATED IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 114 TANZANIA POTATO PROCESSING MARKET, BY SHAPE, 2022-2034 (USD THOUSAND)

TABLE 115 TANZANIA POTATO PROCESSING MARKET, BY PACKAGING, 2022-2034 (USD THOUSAND)

TABLE 116 TANZANIA POTATO PROCESSING MARKET, BY APPLICATION, 2022-2034 (USD THOUSAND)

TABLE 117 TANZANIA POTATO PROCESSING MARKET, BY END-USER, 2022-2034 (USD THOUSAND)

TABLE 118 TANZANIA FOOD SERVICE SECTOR IN POTATO PROCESSING MARKET, BY END-USER, 2022-2034 (USD THOUSAND)

TABLE 119 TANZANIA RESTAURANT IN POTATO PROCESSING MARKET, BY TYPE, 2022-2034 (USD THOUSAND)

TABLE 120 TANZANIA RESTAURANT IN POTATO PROCESSING MARKET, BY SERVICE CATEGORY, 2022-2034 (USD THOUSAND)

Lista de Figura

FIGURE 1 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET

FIGURE 2 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: DATA TRIANGULATION

FIGURE 3 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: DROC ANALYSIS

FIGURE 4 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: COUNTRY MARKET ANALYSIS

FIGURE 5 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: MULTIVARIATE MODELLING

FIGURE 7 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: DBMR MARKET POSITION GRID

FIGURE 9 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: SEGMENTATION

FIGURE 12 GROWING CONSUMPTION OF CONVENIENCE OR FROZEN FOODS AMONG THE CONSUMERS IS EXPECTED TO DRIVE THE KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET IN THE FORECAST PERIOD

FIGURE 13 THE INORGANIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE KENYA, UGANDA, TANZANIA AND RWANDA POTATO PROCESSING MARKET IN 2024 AND 2034

FIGURE 14 KENYA, UGANDA, TANZANIA AND RWANDA POTATO PROCESSING MARKET, 2024-2034, AVERAGE SELLING PRICE (USD/KG)

FIGURE 15 SUPPLY CHAIN OF KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET

FIGURE 17 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: CATEGORY, 2023

FIGURE 18 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: PRODUCT TYPE, 2023

FIGURE 19 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: SHAPE, 2023

FIGURE 20 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: PACKAGING, 2023

FIGURE 21 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: APPLICATION, 2023

FIGURE 22 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: END-USER, 2023

FIGURE 23 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET -COMPANY SHARE 2023 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.