Japan Tax It Software Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

2.58 Billion

USD

4.66 Billion

2024

2032

USD

2.58 Billion

USD

4.66 Billion

2024

2032

| 2025 –2032 | |

| USD 2.58 Billion | |

| USD 4.66 Billion | |

|

|

|

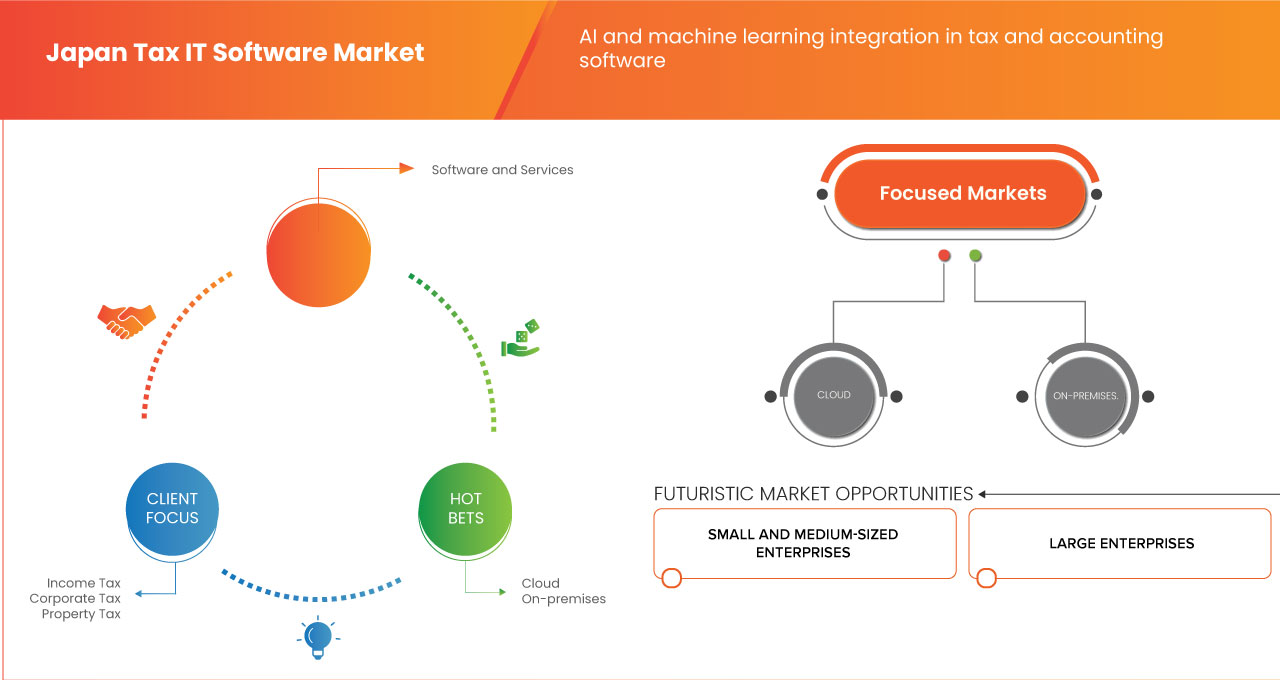

Segmentação do mercado de software de TI para impostos do Japão, por oferta (software e serviços), tipo de imposto (imposto sobre o rendimento, imposto sobre as empresas, imposto sobre o património e outros), modo de implementação (nova nuvem e local), tamanho da organização (pequena e média Empresas e Grandes Empresas), Modelo de Receita (Compra Única e Baseado em Subscrição) Indústria (Bancos, Serviços Financeiros e Seguros (BFSI), TI e Telecomunicações, Manufatura, Retalho e Bens de Consumo, Saúde, Energia e Serviços Públicos, Media e Entretenimento , e outros) - Tendências e previsões da indústria até 2032

Análise e dimensão do mercado de software de TI para impostos no Japão

O mercado de software fiscal de TI do Japão está a crescer, impulsionado pela crescente procura de conformidade com as regulamentações fiscais em evolução e iniciativas de digitalização do governo, como o e-Tax. As empresas estão a adotar soluções automatizadas para reduzir erros e aumentar a eficiência operacional na declaração de impostos. A integração de IA e análise em tempo real é uma tendência significativa, permitindo atualizações dinâmicas e insights personalizados. Os principais participantes estão a concentrar-se em interfaces fáceis de utilizar e em cibersegurança robusta para satisfazer as diversas necessidades comerciais. Os desafios incluem os elevados custos de implementação para as pequenas empresas e a resistência à transformação digital. As oportunidades estão na expansão de soluções baseadas na cloud e no serviço ao crescente setor das PME. A concorrência está a intensificar-se com os fornecedores nacionais e internacionais a visarem o mercado.

A Data Bridge Market Research analisa que o mercado de software de TI fiscal do Japão deverá atingir um valor de 4,66 mil milhões de dólares até 2032, face aos 2,58 mil milhões de dólares em 2024, crescendo a um CAGR de 7,7% durante o período previsto de 2025 a 2032.

Âmbito do Relatório e Segmentação de Mercado de Software de TI Fiscal

|

Atributos |

Principais insights de mercado do sistema de limpeza de sensores |

|

Segmentos abrangidos |

|

|

Principais participantes do mercado |

SAP (Alemanha), ADP, Inc. (EUA), freee KK (Japão), Money Forward, Inc. (Japão), PCA Corporation (EUA), QUICKBOOKS (INTUIT INC.) (EUA), SAGE GROUP PLC (Reino Unido ) , TKC Corporation (Japão) e Wolters Kluwer NV (Holanda) |

|

Oportunidades de Mercado |

|

|

Conjuntos de informações de dados de valor acrescentado |

Para além dos insights sobre os cenários de mercado, tais como o valor de mercado, a taxa de crescimento, a segmentação, a cobertura geográfica e os principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research incluem também análises aprofundadas de especialistas, epidemiologia dos doentes, análise de pipeline, análise de preços, e quadro regulamentar. |

Definição de Mercado

O mercado de software de TI fiscal do Japão abrange uma variedade de soluções de software concebidas para agilizar e automatizar processos relacionados com impostos para particulares, empresas e profissionais fiscais. Este mercado inclui aplicações de software que suportam a preparação, apresentação, conformidade e relatórios fiscais de acordo com as regulamentações fiscais específicas do Japão. As principais funcionalidades envolvem frequentemente a análise de dados em tempo real, capacidades de arquivo eletrónico, planeamento fiscal e atualizações regulamentares, o que ajuda os utilizadores a cumprir os requisitos fiscais locais e internacionais. À medida que a procura por transformação digital aumenta, estas soluções integram cada vez mais tecnologias como a computação em nuvem, a inteligência artificial e a segurança de dados, permitindo uma maior eficiência e precisão na gestão fiscal.

Dinâmica do mercado de software de TI para impostos no Japão

Motoristas

- Procura crescente entre as pequenas e médias empresas do Japão

O setor das pequenas e médias empresas (PME) no Japão tem vindo a expandir-se rapidamente, resultando numa procura crescente por soluções eficientes e económicas, especialmente em matéria fiscal e contabilidade. À medida que as empresas crescem, a necessidade de otimizar as operações financeiras e garantir a conformidade com as alterações na legislação torna-se mais crítica. Neste contexto, o software de contabilidade e fiscalidade baseado na nuvem oferece uma alternativa perfeita para as PME que procuram melhorar a gestão financeira e, ao mesmo tempo, manter os custos sob controlo.

- A integração de IA e aprendizagem automática em software de contabilidade e fiscalidade

A integração da tecnologia de Inteligência Artificial (IA) e Machine Learning (AM) no software de contabilidade e fiscalidade está a transformar o panorama da gestão financeira para as empresas. À medida que as empresas enfrentam situações financeiras cada vez mais complicadas, a utilização de IA para análise preditiva, otimização fiscal e deteção de fraudes proporciona uma vantagem competitiva significativa. Estas tecnologias permitem que as empresas automatizem operações demoradas e forneçam maior precisão, resultando numa maior eficiência operacional.

Oportunidades

- Expansão dos serviços na nuvem para empresas

A rápida expansão dos serviços de cloud criou novas oportunidades para as pequenas e médias empresas (PME) no Japão. À medida que o país avança para a transformação digital , o software de contabilidade e fiscalidade baseado na nuvem está a ganhar popularidade. Estas soluções oferecem uma forma económica, escalável e fácil de utilizar para as organizações gerirem as suas operações financeiras sem a necessidade de investimentos significativos em infraestruturas.

- Iniciativas governamentais para promover o software de conformidade digital

Os governos de todo o mundo, incluindo o Japão, estão a apoiar ativamente a utilização de software de conformidade digital nas empresas para melhorar a produtividade, eliminar erros e garantir a conformidade regulamentar. Com o advento das atividades de transformação digital, os governos estão a criar programas e leis que incentivam as empresas a utilizar tecnologia moderna, como software de contabilidade e fiscalidade, para simplificar as suas operações e satisfazer as crescentes necessidades de conformidade regulamentar.

Restrições/Desafios

- Custos elevados e restrições de investimento inicial

Embora os modernos softwares de contabilidade e fiscalidade apresentem muitas vantagens, os elevados custos de obtenção, implementação e manutenção destes sistemas podem ser um obstáculo substancial, especialmente para as pequenas e médias empresas (PME). À medida que as organizações procuram otimizar as suas operações financeiras e manter-se competitivas, o investimento inicial necessário para este software pode desencorajar muitas, especialmente quando estão incluídas taxas extra de personalização e integração.

- Preocupações com a cibersegurança e a privacidade de dados

À medida que as empresas digitalizam as suas operações financeiras, as preocupações com a cibersegurança tornaram-se um grande impedimento à utilização de softwares modernos de contabilidade e fiscalidade. As empresas enfrentam riscos mais elevados de violações de dados, ataques cibernéticos e violações de privacidade à medida que dependem cada vez mais de plataformas digitais para gerir dados financeiros confidenciais. Estes problemas impedem frequentemente as empresas de adotarem completamente os sistemas de gestão financeira digital.

Desenvolvimentos recentes

- Em outubro de 2024, a ADP adquiriu a Workforce Software, fornecedora líder de soluções de gestão de força de trabalho para empresas globais. Esta aquisição expande as ofertas da ADP, melhorando as capacidades globais de gestão da força de trabalho e impulsionando a inovação futura para satisfazer as necessidades empresariais em evolução

- Em outubro de 2024, a TKC Co., Ltd. lançou o TKC-Phone SE3, um smartphone seguro concebido para os gabinetes de contabilidade fiscal. Este dispositivo ajuda as empresas a cumprir os requisitos de confidencialidade e supervisão da Lei do Contabilista Fiscal. Conta com restrições de aplicações, proteção de dados e gestão de dispositivos, garantindo privacidade para a equipa e uma comunicação segura. O lançamento nacional está previsto para dezembro de 2024

Âmbito do mercado de software de TI para impostos no Japão

O mercado de software de TI fiscal do Japão está segmentado em seis segmentos notáveis com base na oferta, tipo de imposto, modo de implementação, tamanho da organização, modelo de receita e setor. O crescimento entre estes segmentos irá ajudá-lo a analisar segmentos de baixo crescimento nos setores e fornecerá aos utilizadores uma visão geral e informações valiosas do mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Oferta

- Software

- Serviços

Tipo de imposto

- Imposto de Renda

- Imposto sobre as empresas

- Imposto sobre a propriedade

- Outros

Modo de Implantação

- Nova Nuvem

- No local

Tamanho da organização

- Pequenas e Médias Empresas

- Grandes Empresas

Modelo de Receita

- Compra única

- Baseado em assinatura

Indústria

- Bancário

- Serviços Financeiros e Seguros BFSI

- Informática e Telecomunicações

- Fabricação

- Retalho e bens de consumo

- Assistência médica

- Energia e serviços públicos

- Media e Entretenimento

- Outros

Análise do cenário competitivo e da quota de mercado do software de TI fiscal do Japão

O panorama competitivo do mercado de software de TI fiscal do Japão fornece detalhes dos concorrentes. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento de produto, amplitude e abrangência do produto, domínio da aplicação . Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas relacionadas com o mercado de software de TI fiscal do Japão.

- SAP (Alemanha)

- ADP, Inc. (EUA)

- freee KK (Japão)

- Money Forward, Inc. (Japão)

- PCA Corporation (EUA)

- QUICKBOOKS (INTUIT INC.) (EUA)

- SAGE GROUP PLC (Reino Unido)

- TKC Corporation (Japão)

- Wolters Kluwer NV (Holanda)

- Yayoi Co., Ltd. (Japão)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF JAPAN TAX IT SOFTWARE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 OFFERING TIMELINE CURVE

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.1.1 INDUSTRY ANALYSIS

4.1.2 CURRENT MARKET LANDSCAPE

4.1.3 FUTURISTIC SCENARIO

4.1.3.1 TECHNOLOGY TRENDS

4.1.4 COMPETITIVE LANDSCAPE

4.1.5 FUTURE OUTLOOK

4.2 PENETRATION AND GROWTH PROSPECT MAPPING

4.3 MARKET OPPORTUNITIES

4.4 TECHNOLOGY ANALYSIS

4.5 COMPANY COMPARATIVE ANALYSIS

5 REGULATORY STANDARDS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND AMONG JAPAN’S SMALL AND MEDIUM-SIZED BUSINESSES

6.1.2 AI AND MACHINE LEARNING INTEGRATION IN TAX AND ACCOUNTING SOFTWARE

6.1.3 BUSINESSES AIM TO SIMPLIFY FREQUENT ACCOUNTING OPERATIONS TO REDUCE MANUAL ERRORS

6.1.4 RISING DEMAND FOR REAL-TIME FINANCIAL INSIGHTS

6.2 RESTRAINTS

6.2.1 HIGH COSTS AND INITIAL INVESTMENT RESTRICTIONS FOR THE USE OF ADVANCED TAX AND ACCOUNTING SOFTWARE

6.2.2 CYBERSECURITY AND DATA PRIVACY CONCERNS HINDER ADOPTION OF TAX AND ACCOUNTING SOFTWARE

6.3 OPPORTUNITIES

6.3.1 EXPANSION OF CLOUD SERVICES FOR BUSINESS

6.3.2 GOVERNMENT INITIATIVES TO PROMOTE DIGITAL COMPLIANCE SOFTWARE ADOPTION ACROSS BUSINESSES

6.4 CHALLENGES

6.4.1 FREQUENT TAX UPDATES CREATE CHALLENGES FOR SOFTWARE

6.4.2 CHALLENGES OF INTEGRATING LEGACY SYSTEMS FOR BUSINESSES IN JAPAN

7 JAPAN TAX IT SOFTWARE MARKET, BY OFFERING

7.1 OVERVIEW

7.2 SOFTWARE

7.3 SERVICES

7.3.1 SERVICES, BY TYPE

7.4 TRAINING AND CONSULTING

7.5 SUPPORT

8 JAPAN TAX IT SOFTWARE MARKET, BY TAX TYPE

8.1 OVERVIEW

8.2 INCOME TAX

8.3 CORPORATE TAX

8.4 PROPERTY TAX

8.5 OTHERS

9 JAPAN TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE

9.1 OVERVIEW

9.2 CLOUD

9.3 ON-PREMISES

10 JAPAN TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE

10.1 OVERVIEW

10.2 LARGE ENTERPRISES

10.3 SMALL AND MEDIUM-SIZED ENTERPRISES

11 JAPAN TAX IT SOFTWARE MARKET, BY REVENUE MODEL

11.1 OVERVIEW

11.2 SUBSCRIPTION BASED

11.3 ONE-TIME PURCHASE

12 JAPAN TAX IT SOFTWARE MARKET, BY INDUSTRY

12.1 OVERVIEW

12.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

12.3 IT AND TELECOMMUNICATIONS

12.4 MANUFACTURING

12.5 RETAIL AND CONSUMER GOODS

12.6 HEALTHCARE

12.7 MEDIA AND ENTERTAINMENT

12.8 ENERGY AND UTILITIES

12.9 OTHERS

13 JAPAN TAX IT SOFTWARE MARKET

13.1 COMPANY SHARE ANALYSIS: JAPAN

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 ADP,INC

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 YAYOI CO., LTD.

15.2.1 COMPANY SNAPSHOT

15.2.2 PRODUCT PORTFOLIO

15.2.3 RECENT DEVELOPMENT

15.3 TKC CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 SAGE GROUP PLC

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 MONEY FORWARD, INC

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 FREEE KK

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 INTUIT INC

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 PCA CORPORATION

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 SAP SE

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 WOLTERS KLUWER N.V.

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tabela

TABLE 1 AWI TAX CONSULTING TAX SOFTWARE PRICE (IN USD)

TABLE 2 TECHNOLOGY MATRIX

TABLE 3 COMPARATIVE ANALYSIS

TABLE 4 REGULATIONS AND STANDARDS FOR JAPAN TAX AND ACCOUNTING SOFTWARE MARKET

TABLE 5 JAPAN TAX IT SOFTWARE MARKET, BY OFFERING 2018-2032 (USD THOUSAND)

TABLE 6 JAPAN SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE 2018-2032 (USD THOUSAND)

TABLE 7 JAPAN TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 JAPAN TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 9 JAPAN TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2022-2032 (USD THOUSAND)

TABLE 10 JAPAN TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 11 JAPAN TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

Lista de Figura

FIGURE 1 JAPAN TAX IT SOFTWARE MARKET: SEGMENTATION

FIGURE 2 JAPAN TAX IT SOFTWARE MARKET: DATA TRIANGULATION

FIGURE 3 JAPAN TAX IT SOFTWARE MARKET: DROC ANALYSIS

FIGURE 4 JAPAN TAX IT SOFTWARE MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 JAPAN TAX IT SOFTWARE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 JAPAN TAX IT SOFTWARE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 JAPAN TAX IT SOFTWARE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 JAPAN TAX IT SOFTWARE MARKET: MULTIVARIATE MODELING

FIGURE 9 JAPAN TAX IT SOFTWARE MARKET: PRODUCT TIMELINE CURVE

FIGURE 10 JAPAN TAX IT SOFTWARE MARKET: SEGMENTATION

FIGURE 11 TWO SEGMENTS COMPRISE THE JAPAN TAX IT SOFTWARE MARKET, BY PRODUCT (2024)

FIGURE 12 JAPAN TAX IT SOFTWARE MARKET, BY MARKET REVENUE, PRODUCT & VENDOR PENETRATION MATRIX

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 GROWING DEMAND AMONG JAPAN’S SMALL AND MEDIUM-SIZED BUSINESS IS EXPECTED TO DRIVE THE JAPAN TAX IT SOFTWARE MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 15 SOFTWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE JAPAN TAX IT SOFTWARE MARKET IN 2025 & 2032

FIGURE 16 JAPAN’S METHODS OF PREPARING TAXES

FIGURE 17 TRENDS IN THE TOTAL SALES OF THE MANUFACTURING INDUSTRY (IN USD BILLION)

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE JAPAN TAX IT SOFTWARE MARKET

FIGURE 19 JAPAN TAX IT SOFTWARE MARKET: BY OFFERING, 2024

FIGURE 20 JAPAN TAX IT SOFTWARE MARKET: BY TAX TYPE, 2024

FIGURE 21 JAPAN TAX IT SOFTWARE MARKET: BY DEPLOYMENT MODE, 2024

FIGURE 22 JAPAN TAX IT SOFTWARE MARKET: BY ORGANIZATION SIZE, 2024

FIGURE 23 JAPAN TAX IT SOFTWARE MARKET: BY ORGANIZATION SIZE, 2024

FIGURE 24 JAPAN TAX IT SOFTWARE MARKET: BY INDUSTRY, 2024

FIGURE 25 JAPAN TAX IT SOFTWARE MARKET: COMPANY SHARE 2024 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.