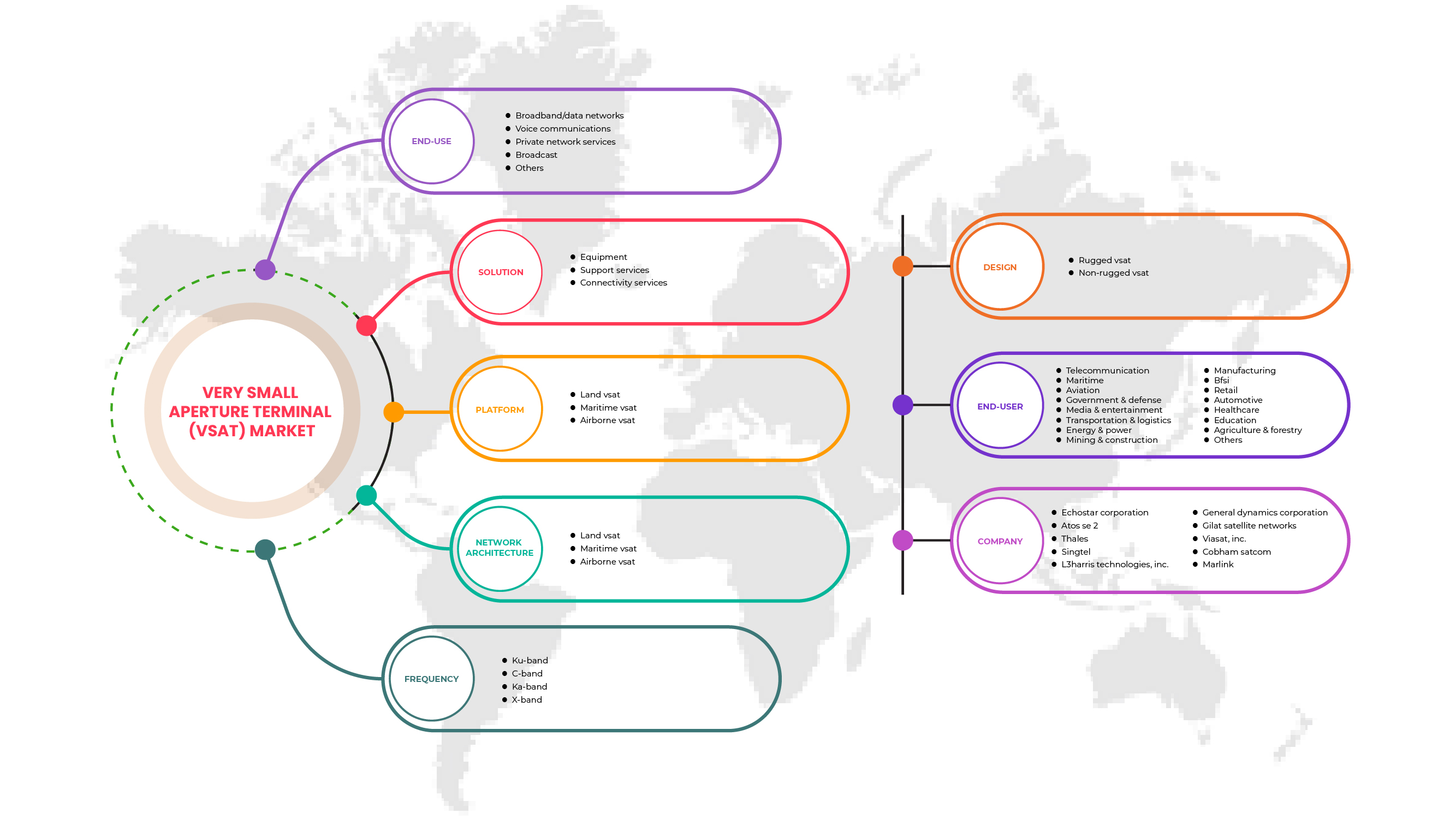

Mercado global de terminais de abertura muito pequena (VSAT), por solução (equipamento, serviços de suporte, serviços de conectividade), plataforma (VSAT terrestre, VSAT marítimo, VSAT aéreo), frequência (banda Ku, banda C, banda Ka, banda X). e Entretenimento, Transportes e Logística, Energia e Eletricidade, Mineração e Construção, Manufatura, BFSI, Retalho, Automóvel, Transportes e Logística, Saúde, Educação, Agricultura e Silvicultura e Outros), Utilização Final (Banda Larga/Rede de Dados, Comunicação de Voz, Serviço de Rede Privada, Broadcast e outros) – Tendências e previsões do setor até 2029.

Análise e dimensão do mercado de terminais de abertura muito pequena (VSAT)

O enorme crescimento da capacidade dos satélites resultou numa queda significativa dos preços, tornando os terminais de abertura muito pequena (VSATs) uma solução viável para muitos setores e regiões pela primeira vez. Além disso, tem-se verificado uma crescente adoção da tecnologia VSAT em setores como o marítimo, petróleo e gás, aviação, entre outros. Estes sistemas também fornecem a conectividade necessária entre utilizadores de aplicações médicas, bases de dados, vídeos e telefones em locais remotos e permitem a comunicação com locais remotos e móveis.

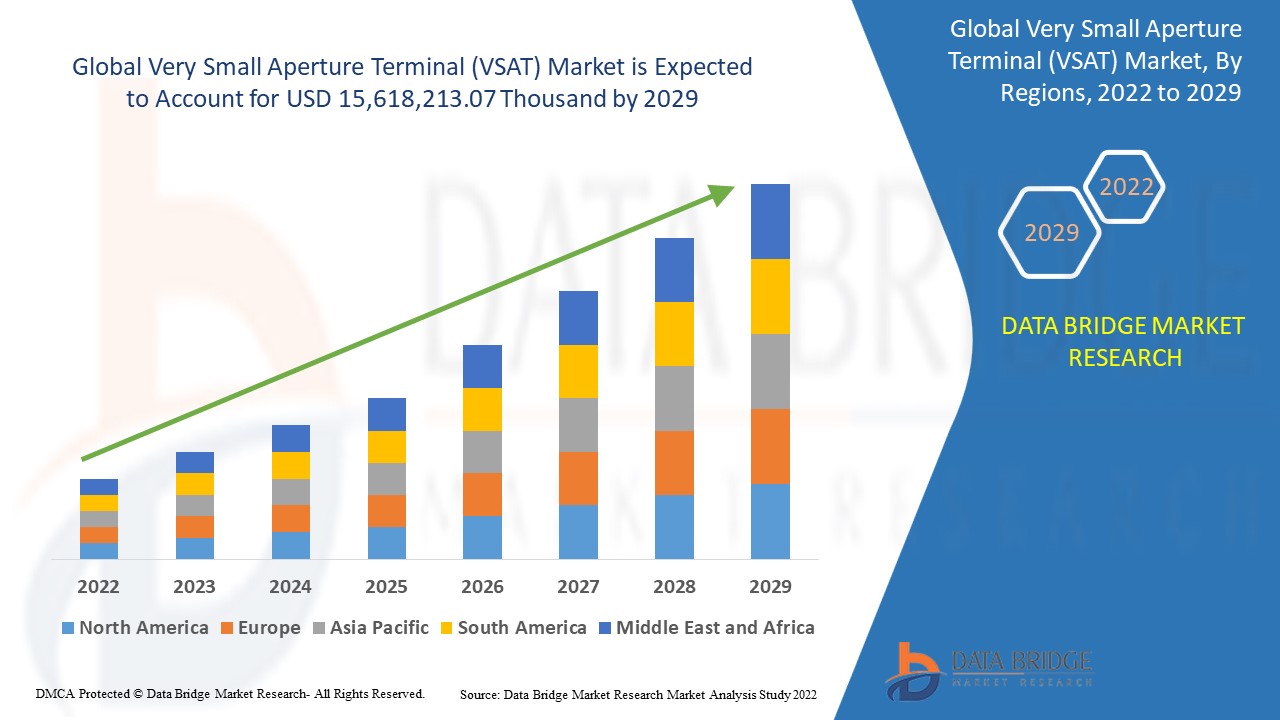

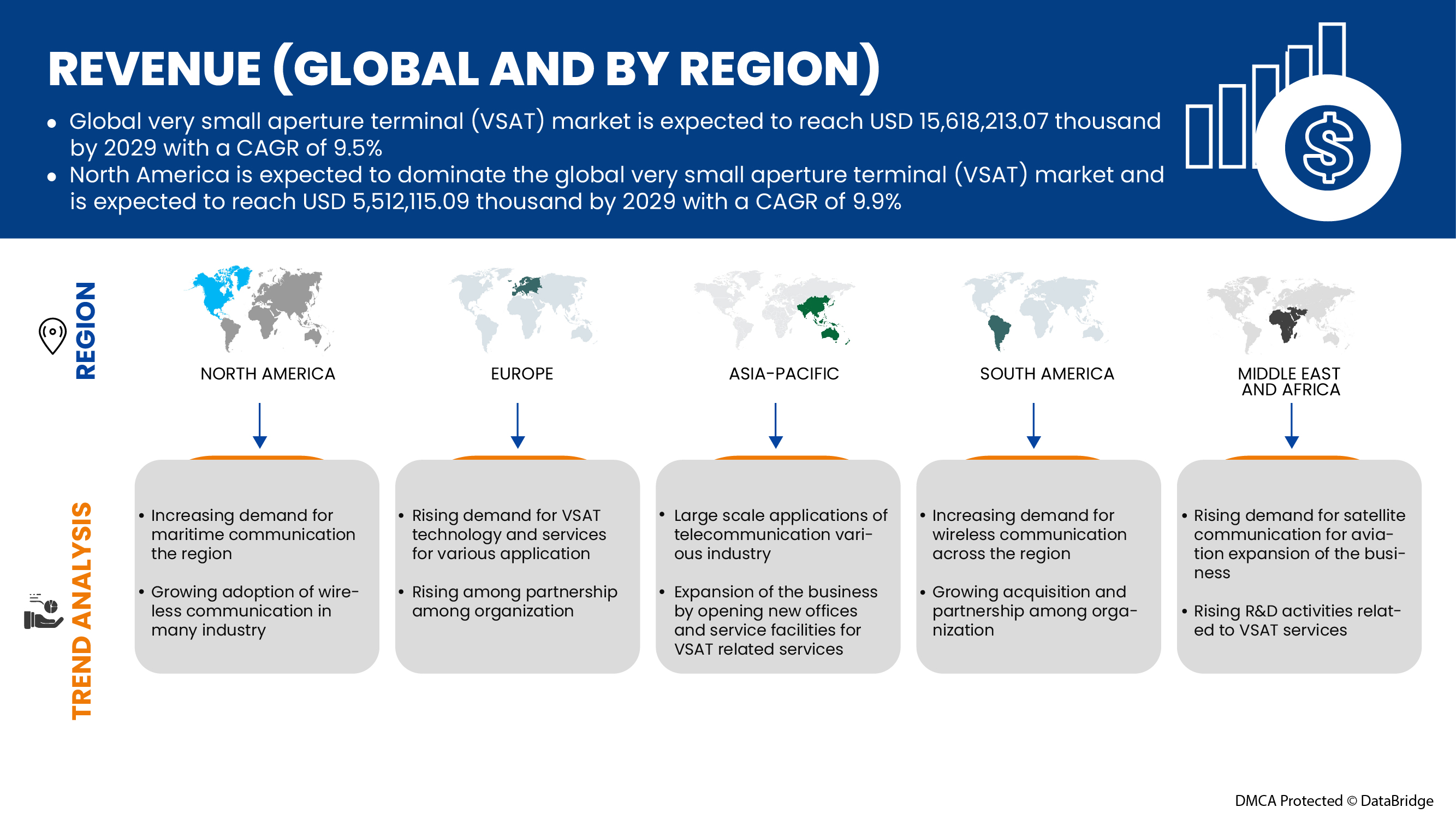

A Data Bridge Market Research analisa que o mercado de terminais de abertura muito pequena (VSAT) deverá atingir o valor de 15.618.213,07 mil dólares até 2029, com um CAGR de 9,5% durante o período previsto. O relatório do mercado de terminais de abertura muito pequena (VSAT) também abrange análises de preços, análises de patentes e avanços tecnológicos em profundidade.

|

Métrica de Reporte |

Detalhes |

|

Período de previsão |

2022 a 2029 |

|

Ano base |

2021 |

|

Anos históricos |

2020 (Personalizável para 2019-2014) |

|

Unidades quantitativas |

Receita em USD mil, preço em USD |

|

Segmentos abrangidos |

Por solução (equipamento, serviços de suporte, serviços de conectividade), plataforma (VSAT terrestre, VSAT marítimo, VSAT aéreo), frequência (banda Ku, banda C, banda Ka, banda X), arquitetura de rede (topologia em estrela, malha Topologia, Topologia Híbrida, Ligações Ponto a Ponto), Design (VSAT Robusto e VSAT Não Robusto), Vertical (Telecomunicações, Marítimo, Aviação, Governo e Defesa, Media e Entretenimento, Transportes e Logística, Energia e Energia, Mineração e Construção, Fabrico , BFSI, Retalho, Automóvel, Transportes e Logística, Saúde, Educação, Agricultura e Silvicultura e Outros), Utilização Final (Banda Larga/Rede de Dados, Comunicação por Voz, Serviço de Rede Privada, Transmissão e Outros) |

|

Países abrangidos |

EUA, Canadá e México, Alemanha, França, Reino Unido, Holanda, Suíça, Bélgica, Rússia, Itália, Espanha, Turquia, Suécia, Resto da Europa, China, Japão, Índia, Coreia do Sul, Singapura, Malásia, Austrália e Nova Zelândia. Tailândia, Indonésia, Filipinas, Resto da Ásia-Pacífico, Arábia Saudita, Emirados Árabes Unidos, África do Sul, Egito, Israel, Resto do Médio Oriente e África, Brasil, Argentina e Resto da América do Sul. |

|

Atores do mercado abrangidos |

Singtel, Vizocom Company, x2nSat, C-COM Satellite Systems Inc, Marlink, Thuraya Telecommunications Company, Speedcast, NSSLGlobal, ST Engineering, Atos SE 2, Iridium Communications Inc., EchoStar Corporation, Orbit Communications Systems Ltd., Ultra, Nisshinbo Holdings Inc ., General Dynamics Corporation, Honeywell International Inc., Cobham Satcom, Thales, GILAT SATELLITE NETWORKS, L3Harris Technologies, Inc., Viasat, Inc., KVH Industries, Inc., CPI International Inc., Global Invacom |

Definição de Mercado

Um sistema de comunicação por satélite bidirecional é designado por VSAT, ou Terminal de Abertura Muito Pequena. A antena parabólica deste sistema tem normalmente menos de 3,8 metros de diâmetro. A eficácia de um sistema VSAT pode ser negativamente afetada pelo clima. Além disso, existem três topologias para redes VSAT que são normalmente utilizadas: estrela, malha ou híbrida. Portanto, os sistemas VSAT fornecem a conectividade necessária entre utilizadores de aplicações médicas, bases de dados, vídeos e telefones em locais remotos e permitem a comunicação com locais remotos e móveis.

Dinâmica do mercado global de terminais de abertura muito pequena (VSAT)

Esta secção trata da compreensão dos impulsionadores, vantagens, oportunidades, restrições e desafios do mercado. Tudo isto é discutido em detalhe abaixo:

Motoristas

- Crescente procura por comunicação segura para aplicações IoT marítimas

A tecnologia VSAT tornou-se um grande negócio para a indústria marítima. São utilizados para comunicações bidirecionais via satélite para internet, dados e telefonia, normalmente em áreas rurais e ambientes hostis. Nos últimos anos, tem-se assistido a uma mudança progressiva na ecosfera da IoT marítima. Esta ecosfera é servida por várias peças eletrónicas standard, que são o hardware integrado com vários softwares. Os serviços de IoT por satélite permitem que as empresas acedam aos dados dos ativos da forma mais acessível. Portanto, os navios no mar estão remotos, as embarcações e outras entidades discretas estão a adotar os sistemas digitais como parte de redes maiores de IoT. A utilização de dispositivos IoT e sistemas de sensores em embarcações/frotas ajuda a ganhar vantagem competitiva, pois ao permitir estas tecnologias, as empresas conseguem aproveitar todo o potencial dos dados para operações e tomadas de decisão mais eficazes.

- Aumento da adoção da tecnologia VSAT na indústria de petróleo e gás

Atualmente, o setor do petróleo e gás está a sofrer uma grande mudança devido às diversas inovações digitais. Existem várias exigências, como a segurança, a exploração de novas áreas petrolíferas e o aumento da visibilidade entre a plataforma e a sede, tudo isto mantendo os custos operacionais sob controlo. Por conseguinte, os operadores de plataformas estão constantemente a ser pressionados a tomar decisões mais rápidas e a executar as operações de forma mais eficiente. Além disso, a indústria do petróleo e do gás opera em ambientes remotos onshore e offshore, onde a utilização de comunicações terrestres não é prática nem fiável. Por este motivo, muitas empresas começaram a implementar a tecnologia VSAT para que os operadores das plataformas possam tomar decisões rápidas e mais informadas, o que reduzirá os custos operacionais, aumentará a produtividade e proporcionará condições de trabalho mais seguras para a tripulação, independentemente da localização.

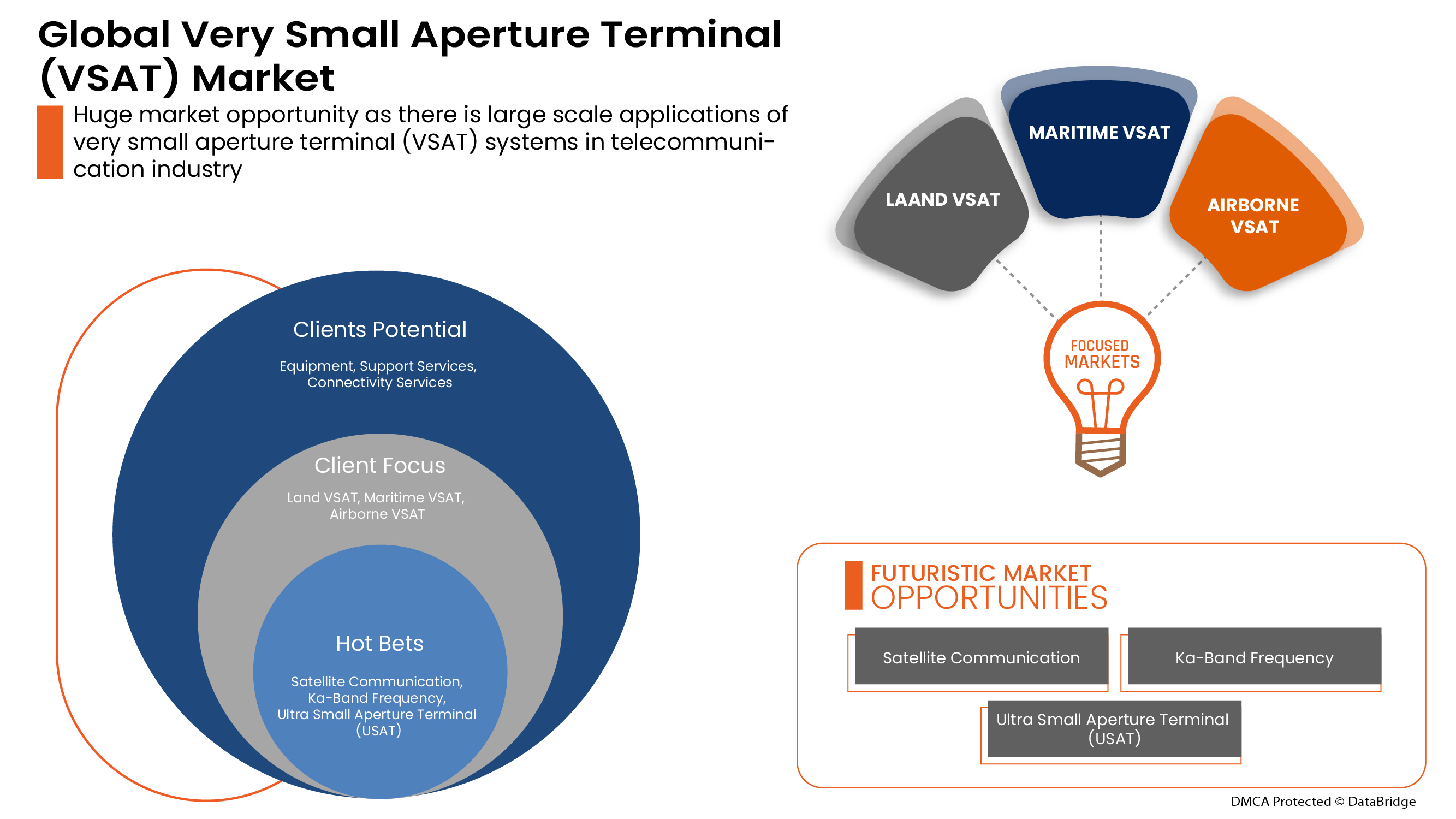

Oportunidades

- Aumento das parcerias estratégicas e aquisições entre diversas organizações

Coordenar e investir em projetos é essencial para alcançar melhorias sustentadas no setor dos terminais de abertura muito pequena (VSAT). Devido a isto, o governo e outras organizações privadas estão a esforçar-se através de parcerias e aquisições, acelerando assim o crescimento das indústrias. Isto ajuda a aumentar a consciencialização e o lucro da organização e, assim, cria espaço para uma nova invenção no setor. Além disso, através de parcerias, a empresa pode investir mais em tecnologias avançadas para fornecer serviços e soluções de terminais de abertura muito pequena (VSAT) mais seguros e fiáveis. Além disso, isto ajuda ambas as empresas a serem reconhecidas no mercado competitivo, gerando assim lucro até certo ponto.

Restrições/Desafios

- Preocupações crescentes com a cibersegurança e violações de dados

Os problemas de cibercrime/hacking e cibersegurança aumentaram em 600% durante a pandemia em todos os setores. As falhas na segurança de rede ou de software são fraquezas exploradas pelos hackers para executar ações não autorizadas dentro de um sistema.

De acordo com o recente relatório publicado Maritime Cybersecurity Survey pela Safety at Sea e BIMCO, nos 12 meses anteriores a fevereiro de 2020, 31% das organizações foram vítimas de ataques cibernéticos, o que representa um aumento de 9% em relação a 2019. De de acordo com outro relatório publicado por Robert Rizika, chefe de operações norte-americanas na Naval Dome, informou que os ataques cibernéticos à tecnologia operacional (OT) da indústria marítima aumentaram 900%, de 50% em 2017 para 120% e 310% nos anos de 2018 e 2019, respetivamente.

- Problemas relacionados com a fiabilidade da rede de terminais de abertura muito pequena (VSAT) durante o mau tempo

O clima espacial interfere com a comunicação rádio entre a Terra e os satélites porque pode causar perturbações na ionosfera que refletem, refractam ou absorvem as ondas de rádio. Considerando que os sinais de satélite têm de percorrer grandes distâncias no ar, os serviços de internet por satélite para utilizadores rurais podem ser vulneráveis a condições meteorológicas severas. Embora o vento raramente afete os sinais de rádio, pode oscilar, vibrar ou até mesmo deslocar equipamentos como antenas parabólicas. A latência e a redução de intensidade são dois fatores específicos que afetam a capacidade dos satélites enviarem sinais. A chuva e a humidade atmosférica são as principais causas do desvanecimento da chuva, o que pode enfraquecer ou degradar o sinal do satélite a frequências mais elevadas nas bandas Ku e Ka.

Impacto pós-COVID-19 no mercado global de terminais de abertura muito pequena (VSAT)

A COVID-19 criou um impacto negativo no mercado de terminais de abertura muito pequena (VSAT) devido às regulamentações de bloqueio e ao encerramento das instalações de fabrico.

A pandemia da COVID-19 impactou o mercado dos terminais de abertura muito pequena (VSAT) de forma negativa. No entanto, o aumento da procura por sistemas globais de segurança marítima em todo o mundo ajudou o mercado a crescer após a pandemia. Além disso, o crescimento foi elevado após a abertura do mercado devido à COVID-19, e prevê-se que haja um crescimento considerável no sector devido à crescente proliferação de comunicações baseadas em satélite nos sectores militar e de defesa.

Os fornecedores de soluções estão a tomar várias decisões estratégicas para recuperar após a COVID-19. Os participantes estão a conduzir diversas atividades de investigação e desenvolvimento para melhorar a tecnologia envolvida no terminal de abertura muito pequena (VSAT). Com isto, as empresas levarão tecnologias avançadas para o mercado. Além disso, as iniciativas governamentais para a utilização da tecnologia de automação levaram ao crescimento do mercado

Desenvolvimentos recentes

- Em junho de 2022, a Cobham Satcom estabeleceu uma parceria com a Mangata Networks. O principal objectivo por detrás desta parceria foi o de reforçar os sistemas de rastreamento por satélite e as infra-estruturas terrestres. No âmbito desta parceria, a Cobham Satcom concordou em implementar várias antenas de gateway Cobham Satcom 4.0M TRACKER a nível global. Com isto, ambas as empresas ganharam reputação entre os seus clientes e expandiram a sua presença no mercado.

- Em dezembro de 2021, a Orbit Communications Systems Ltd. adquiriu a Euclid Systems Engineering, uma empresa especializada no desenvolvimento de posicionadores e sistemas de rastreio inteligentes e leves para as indústrias de defesa. O motivo por detrás desta aquisição foi o de fortalecer as capacidades SATCOM marítimas e aéreas da empresa com a ajuda da Euclid Systems Engineering. Este desenvolvimento ajudará a empresa a expandir o seu portfólio de produtos e a sua presença global no mercado.

Âmbito do mercado global de terminais de abertura muito pequena (VSAT)

O mercado global de terminais de abertura muito pequena (VSAT) está segmentado com base na solução, plataforma, frequência, arquitetura de rede, design, vertical e utilização final. O crescimento entre estes segmentos irá ajudá-lo a analisar segmentos de baixo crescimento nos setores e fornecerá aos utilizadores uma visão geral e informações valiosas do mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Solução

- Equipamento

- Serviços de suporte

- Serviços de conectividade

Com base na solução, o mercado global de terminais de abertura muito pequena (VSAT) está segmentado em equipamentos, serviços de suporte e serviços de conectividade.

Plataforma

- VSAT terrestre

- VSAT marítimo

- VSAT aerotransportado

Com base na plataforma, o mercado global de terminais de abertura muito pequena (VSAT) foi segmentado em VSAT terrestre, VSAT marítimo e VSAT aéreo.

Frequência

- Banda Ku

- Banda C

- Banda Ka

- Banda X

Com base na frequência, o mercado global de terminais de abertura muito pequena (VSAT) foi segmentado em banda Ku, banda C, banda Ka e banda X.

Arquitetura de rede

- Topologia em estrela

- Topologia de malha

- Topologia Híbrida

- Links ponto a ponto

Com base na arquitetura de rede, o mercado global de terminais de abertura muito pequena (VSAT) foi segmentado em topologia estrela, topologia em malha, topologia híbrida e ligações ponto a ponto.

Estilo

- VSAT robusto

- VSAT não robusto

Com base no design, o mercado global de terminais de abertura muito pequena (VSAT) está segmentado em VSAT robusto e VSAT não robusto.

Vertical

- Telecomunicação

- Marítimo

- Aviação

- Governo e Defesa

- Media e Entretenimento

- Transporte e Logística

- Energia e Poder

- Mineração e Construção

- Fabricação

- BFSI

- Retalho

- Automotivo

- Transporte e Logística

- Assistência médica

- Educação

- Agricultura e Silvicultura

- Outros

Com base na vertical, o mercado global de terminais de abertura muito pequena (VSAT) está segmentado em telecomunicações, marítimo, aviação, governo e defesa, media e entretenimento, transporte e logística, energia e energia, mineração e construção, manufatura, BFSI, retalho , automóvel, transportes e logística, saúde, educação, agricultura e silvicultura, outros.

Uso final

- Rede de banda larga/dados

- Comunicação de voz

- Serviço de rede privada

- Transmissão

- Outros

Com base na utilização final, o mercado global de terminais de abertura muito pequena (VSAT) está segmentado em rede de banda larga/dados, comunicação de voz, serviço de rede privada, transmissão e outros.

Análise/Insights regionais do mercado global de terminais de abertura muito pequena (VSAT)

O mercado global de terminais de abertura muito pequena (VSAT) é analisado e são fornecidos insights e tendências sobre o tamanho do mercado por país, tipo de material, processo de fabrico e indústria de utilização final, conforme referenciado acima.

The countries covered in the very small aperture terminal (VSAT) market report are U.S., Canada and Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Sweden, Rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia & New Zealand, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa, Brazil, Argentina and Rest of South America.

North America dominates the very small aperture terminal (VSAT) market owing to rapid adoption of satellite communication technology and increasing research and development activities for reducing antenna size. U.S. dominates in the North America region owing to rising utilization of VSAT in government & defence applications. China dominates in the Asia-Pacific region as it is the world’s biggest manufacturing hub for technological products. Germany dominates in Europe region owing to growing demand for secure communication for maritime and airborne IoT applications.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Very Small Aperture Terminal (VSAT) Market Share Analysis

Global very small aperture terminal (VSAT) market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to very small aperture terminal (VSAT) market.

Some of the major players operating in the global very small aperture terminal (VSAT) market are Singtel, Vizocom Company, x2nSat, C-COM Satellite Systems Inc, Marlink , Thuraya Telecommunications Company, Speedcast, NSSLGlobal, ST Engineering, Atos SE 2, Iridium Communications Inc., EchoStar Corporation, Orbit Communications Systems Ltd., Ultra, Nisshinbo Holdings Inc., General Dynamics Corporation, Honeywell International Inc., Cobham Satcom, Thales, GILAT SATELLITE NETWORKS, L3Harris Technologies, Inc., Viasat, Inc., KVH Industries, Inc., CPI International Inc., Global Invacom among others.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 SOLUTION TIMELINE CURVE

2.1 MARKET CHALLENGE MATRIX

2.11 MARKET PLATFORM COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES MODEL

4.2 TECHNOLOGY ANALYSIS

4.3 USE CASES

4.3.1 RELIABLE VSAT CONNECTIVITY IMPROVES OPERATIONAL STABILITY FOR SUN ENTERPRISES

4.3.2 CUSTOMER WINS MAJOR OIL AND GAS CONTRACT USING WINEGARD'S SECRET WEAPON

4.3.3 VIZOCOM'S SATELLITE SOLUTION PROVIDES THE DEPARTMENT OF DEFENSE EDUCATION ACTIVITY (DODEA) WITH INTERNET CONNECTIVITY TO PUERTO RICO AFTER HURRICANE MARIA IN 2017

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR SECURE COMMUNICATION FOR MARITIME IOT APPLICATIONS

5.1.2 INCREASED ADOPTION OF VSAT TECHNOLOGY IN THE OIL AND GAS INDUSTRY

5.1.3 PROLIFERATION OF SATELLITE-BASED COMMUNICATION IN THE MILITARY AND DEFENSE SECTOR

5.2 RESTRAINTS

5.2.1 RISING CYBER SECURITY CONCERNS AND DATA BREACHES

5.2.2 ISSUES RELATED TO DATA LATENCY IN VSAT TECHNOLOGY

5.3 OPPORTUNITIES

5.3.1 SURGE IN DEMAND FOR GLOBAL MARITIME DISTRESS SAFETY SYSTEM

5.3.2 INCREASING STRATEGIC PARTNERSHIP AND ACQUISITION AMONG VARIOUS ORGANIZATIONS

5.3.3 ADVENT OF VSAT SERVICE PROVIDERS IN VARIOUS ENTERPRISE SECTORS

5.4 CHALLENGES

5.4.1 HIGHER HARDWARE AND INSTALLATION COSTS OF VSAT SYSTEMS

5.4.2 ISSUES RELATED TO RELIABILITY OF VSAT NETWORK DURING BAD WEATHER

5.4.3 HIGHER CHANCES OF INTERFERENCE IN VERY SMALL APERTURE TERMINAL (VSAT) NETWORKS

6 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION

6.1 OVERVIEW

6.2 EQUIPMENT

6.2.1 OUT-DOOR UNITS

6.2.1.1 ANTENNAS

6.2.1.2 RF FREQUENCY CONVERTERS

6.2.1.3 AMPLIFIERS

6.2.1.4 DIPLEXERS

6.2.1.5 OTHERS

6.2.2 IN-DOOR UNITS

6.2.2.1 SATELLITE MODEM

6.2.2.2 SATELLITE ROUTER

6.2.3 MOUNTS

6.2.4 ANTENNA CONTROL UNITS

6.2.5 OTHERS

6.2.6 SUPPORT SERVICES

6.2.6.1 PROFESSIONAL SERVICES

6.2.6.1.1 MAINTENANCE & SUPPORT SERVICES

6.2.6.1.2 ENGINEERING & CONSULTATION

6.2.6.1.3 TRAINING

6.2.6.2 MANAGED SERVICES

6.2.6.2.1 INSTALLATION & SETUP

6.2.6.2.2 NETWORK DESIGN & OPTIMIZATION

6.2.6.2.3 NETWORK OPERATIONS

6.3 CONNECTIVITY SERVICES

7 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY PLATFORM

7.1 OVERVIEW

7.2 LAND VSAT

7.2.1 FIXED

7.2.1.1 EARTH STATION

7.2.1.2 COMMERCIAL BUILDINGS

7.2.1.3 COMMAND & CONTROL CENTERS

7.2.2 ON-THE-MOVE

7.2.2.1 COMMERCIAL VEHICLES

7.2.2.2 MILITARY VEHICLES

7.2.2.3 TRAINS

7.2.2.4 EMERGENCY VEHICLES

7.2.2.5 UNMANNED GROUND VEHICLES

7.2.3 PORTABLE/MANPACKS

7.3 MARITIME VSAT

7.3.1 COMMERCIAL SHIP

7.3.2 MILITARY SHIP

7.3.3 UNMANNED MARINE SHIP

7.4 AIRBORNE VSAT

7.4.1 COMMERCIAL AIRCRAFT

7.4.2 MILITARY AIRCRAFT

7.4.3 UNMANNED MARINE SHIP

8 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY NETWORK ARCHITECTURE

8.1 OVERVIEW

8.2 STAR TOPOLOGY

8.3 MESH TOPOLOGY

8.4 HYBRID TOPOLOGY

8.5 POINT-TO-POINT LINKS

9 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY FREQUENCY

9.1 OVERVIEW

9.2 KU-BAND

9.3 C-BAND

9.4 KA-BAND

9.5 X-BAND

10 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY DESIGN

10.1 OVERVIEW

10.2 RUGGED VSAT

10.3 NON- RUGGED VSAT

11 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY VERTICAL

11.1 OVERVIEW

11.2 TELECOMMUNICATION

11.2.1 EQUIPMENT

11.2.2 SUPPORT SERVICES

11.2.3 CONNECTIVITY SERVICES

11.3 MARITIME

11.3.1 EQUIPMENT

11.3.2 SUPPORT SERVICES

11.3.3 CONNECTIVITY SERVICES

11.4 AVIATION

11.4.1 EQUIPMENT

11.4.2 SUPPORT SERVICES

11.4.3 CONNECTIVITY SERVICES

11.5 GOVERNMENT & DEFENSE

11.5.1 EQUIPMENT

11.5.2 SUPPORT SERVICES

11.5.3 CONNECTIVITY SERVICES

11.6 MEDIA & ENTERTAINMENT

11.6.1 EQUIPMENT

11.6.2 SUPPORT SERVICES

11.6.3 CONNECTIVITY SERVICES

11.7 TRANSPORTATION & LOGISTICS

11.7.1 EQUIPMENT

11.7.2 SUPPORT SERVICES

11.7.3 CONNECTIVITY SERVICES

11.8 ENERGY & POWER

11.9 MINING & CONSTRUCTION

11.9.1 EQUIPMENT

11.9.2 SUPPORT SERVICES

11.9.3 CONNECTIVITY SERVICES

11.1 MANUFACTURING

11.10.1 EQUIPMENT

11.10.2 SUPPORT SERVICES

11.10.3 CONNECTIVITY SERVICES

11.11 BFSI

11.12 RETAIL

11.12.1 EQUIPMENT

11.12.2 SUPPORT SERVICES

11.12.3 CONNECTIVITY SERVICES

11.13 AUTOMOTIVE

11.13.1 EQUIPMENT

11.13.2 SUPPORT SERVICES

11.13.3 CONNECTIVITY SERVICES

11.14 HEALTHCARE

11.15 EDUCATION

11.16 AGRICULTURE & FORESTRY

11.16.1 EQUIPMENT

11.16.2 SUPPORT SERVICES

11.16.3 CONNECTIVITY SERVICES

11.17 OTHERS

12 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY END-USE

12.1 OVERVIEW

12.2 BROADBAND/DATA NETWORKS

12.3 VOICE COMMUNICATIONS

12.4 PRIVATE NETWORK SERVICES

12.5 BROADCAST

12.6 OTHERS

13 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION

13.1 OVERVIEW

13.2 NORTH AMERICA

13.2.1 U.S.

13.2.2 CANADA

13.2.3 MEXICO

13.3 ASIA-PACIFIC

13.3.1 CHINA

13.3.2 JAPAN

13.3.3 SOUTH KOREA

13.3.4 INDIA

13.3.5 AUSTRALIA & NEW ZEALAND

13.3.6 INDONESIA

13.3.7 THAILAND

13.3.8 SINGAPORE

13.3.9 MALAYSIA

13.3.10 PHILIPPINES

13.3.11 REST OF ASIA-PACIFIC

13.4 EUROPE

13.4.1 GERMANY

13.4.2 U.K.

13.4.3 FRANCE

13.4.4 SPAIN

13.4.5 ITALY

13.4.6 RUSSIA

13.4.7 NETHERLANDS

13.4.8 SWITZERLAND

13.4.9 SWEDEN

13.4.10 BELGIUM

13.4.11 TURKEY

13.4.12 REST OF EUROPE

13.5 SOUTH AMERICA

13.5.1 BRAZIL

13.5.2 ARGENTINA

13.5.3 REST OF SOUTH AMERICA

13.6 MIDDLE EAST & AFRICA

13.6.1 SAUDI ARABIA

13.6.2 U.A.E.

13.6.3 SOUTH AFRICA

13.6.4 ISRAEL

13.6.5 EGYPT

13.6.6 REST OF MIDDLE EAST & AFRICA

14 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.2 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14.3 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANLYSIS

16 COMPAMY PROFILE

16.1 ECHOSTAR CORPORATION

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 ATOS SE

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCTS PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 THALES

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 SINGTEL

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 L3HARRIS TECHNOLOGIES, INC

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 GENERAL DYNAMICS CORPORATION

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENTS

16.7 GILAT SATELLITE NETWORKS

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 C-COM SATELLITE SYSTEMS INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 COBHAM SATCOM

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 CPI INTERNATIONAL INC.

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 GLOBAL INVACOM

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 SERVICES PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 HONEYWELL INTERNATIONAL INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 IRIDIUM COMMUNICATIONS INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 SERVICE PORTFOLIO

16.13.4 RECENT DEVELOPMENT

16.14 KVH INDUSTRIES, INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 SOLUTION PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 MARLINK

16.15.1 COMPANY SNAPSHOT

16.15.2 SOLUTION PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 NISSHINBO HOLDINGS INC.

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 NSSL GLOBAL

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 ORBIT COMMUNICATIONS SYSTEMS LTD.

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 SPEEDCAST

16.19.1 COMPANY SNAPSHOT

16.19.2 SOLUTION PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 ST ENGINEERING

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT DEVELOPMENT

16.21 THURAYA TELECOMMUNICATIONS COMPANY

16.21.1 COMPANY SNAPSHOT

16.21.2 SERVICE PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 ULTRA

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCT PORTFOLIO

16.22.4 RECENT DEVELOPMENTS

16.23 VIASAT, INC.

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENTS

16.24 VIZOCOM COMPANY

16.24.1 COMPANY SNAPSHOT

16.24.2 SOLUTION PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 X2NSAT

16.25.1 COMPANY SNAPSHOT

16.25.2 SERVICE PORTFOLIO

16.25.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tabela

TABLE 1 CYBER-ATTACKS ON VESSELS/MARITIME INDUSTRY

TABLE 2 TYPICAL HARDWARE AND INSTALLATION COSTS

TABLE 3 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 4 GLOBAL EQUIPMENT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 5 GLOBAL EQUIPMENT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 6 GLOBAL OUT-DOOR UNITS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 7 GLOBAL IN-DOOR UNITS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 GLOBAL SUPPORT SERVICES IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 GLOBAL SUPPORT SERVICES IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 10 GLOBAL PROFESSIONAL SERVICES IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 11 GLOBAL MANAGED SERVICES IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 12 GLOBAL CONNECTIVITY SERVICES IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY PLATFORM, 2020-2029 (USD THOUSAND)

TABLE 14 GLOBAL LAND VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 GLOBAL LAND VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 16 GLOBAL FIXED IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 17 GLOBAL ON-THE-MOVE IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 18 GLOBAL MARITIME VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 GLOBAL MARITIME VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 20 GLOBAL AIRBORNE VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 GLOBAL AIRBORNE VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 22 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY NETWORK ARCHITECTURE, 2020-2029 (USD THOUSAND)

TABLE 23 GLOBAL STAR TOPOLOGY IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 GLOBAL MESH TOPOLOGY IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 GLOBAL HYBRID TOPOLOGY IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 GLOBAL POINT-TO-POINT LINKS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY FREQUENCY, 2020-2029 (USD THOUSAND)

TABLE 28 GLOBAL KU-BAND IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 GLOBAL C-BAND IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 GLOBAL KA-BAND IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 GLOBAL X-BAND IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY DESIGN, 2020-2029 (USD THOUSAND)

TABLE 33 GLOBAL RUGGED VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 GLOBAL NON- RUGGED VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 36 GLOBAL TELECOMMUNICATION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 GLOBAL TELECOMMUNICATION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 38 GLOBAL MARITIME IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 GLOBAL MARITIME IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 40 GLOBAL AVIATION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 41 GLOBAL AVIATION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 42 GLOBAL GOVERNMENT & DEFENSE IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 43 GLOBAL GOVERNMENT & DEFENSE IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 44 GLOBAL MEDIA & ENTERTAINMENT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 45 GLOBAL MEDIA & ENTERTAINMENT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 46 GLOBAL TRANSPORTATION & LOGISTICS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 47 GLOBAL TRANSPORTATION & LOGISTICS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 48 GLOBAL ENERGY & POWER IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 49 GLOBAL MINING & CONSTRUCTION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 50 GLOBAL MINING & CONSTRUCTION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 51 GLOBAL MANUFACTURING IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 52 GLOBAL MANUFACTURING IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 53 GLOBAL BFSI IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 54 GLOBAL RETAIL IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 55 GLOBAL RETAIL IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 56 GLOBAL AUTOMOTIVE IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 57 GLOBAL AUTOMOTIVE IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 58 GLOBAL HEALTHCARE IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 59 GLOBAL EDUCATION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 60 GLOBAL AGRICULTURE & FORESTRY IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 61 GLOBAL AGRICULTURE & FORESTRY IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 62 GLOBAL OTHERS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 63 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 64 GLOBAL BROADBAND/DATA NETWORKS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 65 GLOBAL VOICE COMMUNICATIONS NETWORKS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 66 GLOBAL PRIVATE NETWORK SERVICES NETWORKS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 67 GLOBAL BROADCAST IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 68 GLOBAL OTHERS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 69 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 70 NORTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 71 ASIA-PACIFIC VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 72 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 73 SOUTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 74 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

Lista de Figura

FIGURE 1 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: SEGMENTATION

FIGURE 2 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: MARKET PLATFORM COVERAGE GRID

FIGURE 10 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS EXPECTED TO DOMINATE WHEREAS ASIA-PACIFIC IS THE FASTEST-GROWING REGION IN THE GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET IN THE FORECAST PERIOD

FIGURE 12 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR GLOBAL VERY SMALL APERTURE TERMINAL MANUFACTURERS IN THE FORECAST PERIOD

FIGURE 13 PROLIFERATION OF SATELLITE-BASED COMMUNICATION IN THE MILITARY AND DEFENSE SECTOR IS EXPECTED TO DRIVE THE GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET IN THE FORECAST PERIOD 2022 TO 2029

FIGURE 14 EQUIPMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET IN 2022 & 2029

FIGURE 15 IMPACT OF VARIOUS SATELLITE TECHNOLOGY TRENDS AND INNOVATIONS IN 2022

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET

FIGURE 17 REGIONAL MARKET SHARE IN SERVICE ENTERPRISE FOR THE YEAR 2016

FIGURE 18 GLOBAL SHIPPING LOSSES BY THE NUMBER OF VESSELS OVER THE YEARS

FIGURE 19 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, SOLUTION, 2021

FIGURE 20 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, PLATFORM, 2021 (USD THOUSAND)

FIGURE 21 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, NETWORK ARCHITECTURE, 2021 (USD THOUSAND)

FIGURE 22 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, FREQUENCY, 2021 (USD THOUSAND)

FIGURE 23 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, DESIGN, 2021 (USD THOUSAND)

FIGURE 24 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, VERTICAL, 2021

FIGURE 25 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, END-USE, 2021 (USD THOUSAND)

FIGURE 26 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: SNAPSHOT (2021)

FIGURE 27 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021)

FIGURE 28 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 30 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY SOLUTION (2022-2029)

FIGURE 31 NORTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: SNAPSHOT (2021)

FIGURE 32 NORTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021)

FIGURE 33 NORTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 34 NORTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 35 NORTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY SOLUTION (2022-2029)

FIGURE 36 ASIA-PACIFIC VERY SMALL APERTURE TERMINAL (VSAT) MARKET: SNAPSHOT (2021)

FIGURE 37 ASIA-PACIFIC VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021)

FIGURE 38 ASIA-PACIFIC VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 39 ASIA-PACIFIC VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 40 ASIA-PACIFIC VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY SOLUTION (2022-2029)

FIGURE 41 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: SNAPSHOT (2021)

FIGURE 42 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021)

FIGURE 43 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 44 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 45 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY SOLUTION (2022-2029)

FIGURE 46 SOUTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: SNAPSHOT (2021)

FIGURE 47 SOUTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021)

FIGURE 48 SOUTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 49 SOUTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 50 SOUTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY SOLUTION (2022-2029)

FIGURE 51 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: SNAPSHOT (2021)

FIGURE 52 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021)

FIGURE 53 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 54 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 55 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY SOLUTION (2022-2029)

FIGURE 56 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: COMPANY SHARE 2021 (%)

FIGURE 57 NORTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: COMPANY SHARE 2021 (%)

FIGURE 58 ASIA-PACIFIC VERY SMALL APERTURE TERMINAL (VSAT) MARKET: COMPANY SHARE 2021 (%)

FIGURE 59 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: COMPANY SHARE 2021 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.