Global Virtual Client Computing Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

33.00 Billion

USD

70.74 Billion

2024

2032

USD

33.00 Billion

USD

70.74 Billion

2024

2032

| 2025 –2032 | |

| USD 33.00 Billion | |

| USD 70.74 Billion | |

|

|

|

|

Segmentação do mercado global de computação de cliente virtual, tipo de implantação (local e baseado em nuvem), usuário final (saúde, educação, TI e telecomunicações, BFSI (bancos, serviços financeiros e seguros) e manufatura), componente (software e hardware), tipo de virtualização (virtualização de desktop, virtualização de aplicativos e virtualização de dados), tipo de usuário (grandes empresas e pequenas e médias empresas (PMEs)), modo de acesso (acesso remoto e acesso local) - Tendências do setor e previsão até 2032.

Tamanho do mercado de computação de cliente virtual

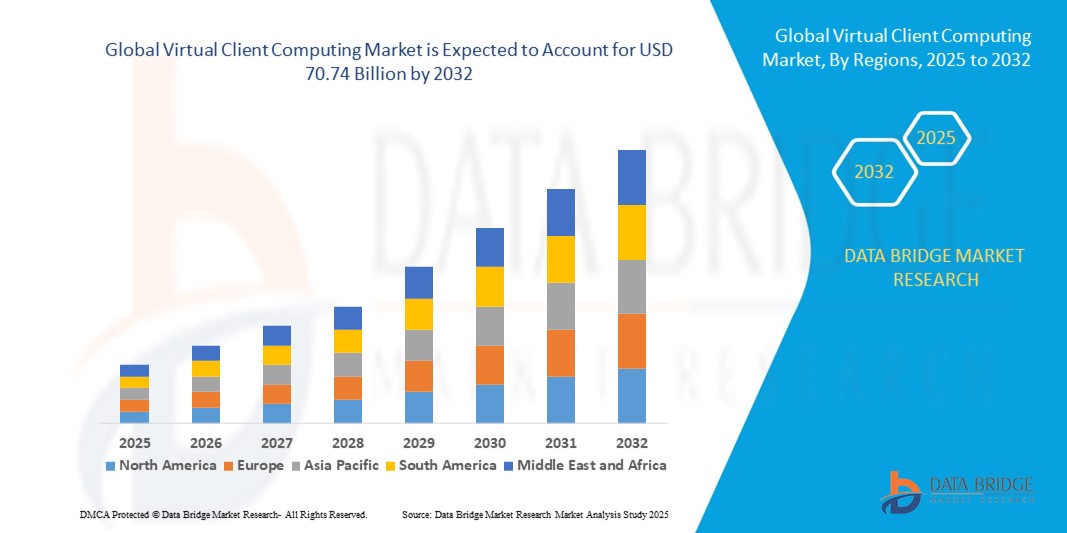

- O tamanho do mercado global de computação de cliente virtual foi avaliado em US$ 33,00 bilhões em 2024 e está projetado para atingir US$ 70,74 bilhões até 2032 , com um CAGR de 10,00% durante o período previsto de 2025 a 2032.

- Este crescimento é impulsionado pela crescente demanda por infraestruturas de TI seguras e centralizadas, soluções de trabalho remoto e tecnologias de virtualização econômicas em vários setores

- O mercado de computação para clientes virtuais está em constante crescimento, impulsionado pela crescente demanda por gerenciamento centralizado, segurança aprimorada e eficiência de custos em infraestrutura de TI. A computação para clientes virtuais permite que as organizações hospedem ambientes de desktop, aplicativos e dados em servidores centralizados, permitindo que os funcionários acessem seus ambientes de trabalho de qualquer dispositivo, em qualquer lugar.

Análise de Mercado de Computação de Cliente Virtual

- A computação de cliente virtual (VCC), que permite o gerenciamento centralizado e a implantação de ambientes de desktop em vários endpoints, é uma tecnologia crítica na infraestrutura de TI empresarial moderna, oferecendo segurança de dados aprimorada, dependência de hardware reduzida e gerenciamento simplificado por meio de virtualização e integração em nuvem.

- A crescente demanda por computação de cliente virtual é impulsionada principalmente pela ampla adoção de modelos de trabalho remoto e híbrido, preocupações crescentes com a segurança de dados e a necessidade de soluções de TI escaláveis e econômicas que ofereçam suporte à continuidade dos negócios e à mobilidade da força de trabalho.

- A América do Norte dominou o mercado de computação de cliente virtual (VCC) com a maior participação na receita de 41,5% em 2024, impulsionada pela rápida adoção de tecnologias de nuvem, transformação do local de trabalho digital e forte ênfase na segurança de dados

- Espera-se que a região da Ásia-Pacífico cresça a uma CAGR de 9,32% mais rápida entre 2025 e 2032, impulsionada pela rápida digitalização, expansão da infraestrutura de TI e crescente adoção de serviços em nuvem em mercados emergentes como China, Índia, Japão e Austrália.

- O segmento local dominou o mercado com a maior participação de receita de 58,6% em 2024, apoiado por empresas que exigem controle total, soberania de dados e conformidade com estruturas regulatórias rígidas.

Escopo do relatório e segmentação do mercado global de computação de cliente virtual

|

Atributos |

Insights do mercado global de computação de cliente virtual |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

Europa

Ásia-Pacífico

Oriente Médio e África

Ámérica do Sul

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de consumo de produção, análise de tendência de preço, cenário de mudança climática, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matéria-prima/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de computação de cliente virtual

Ascensão do trabalho remoto

- Uma tendência crucial que impulsiona o mercado de computação de cliente virtual (VCC) é a ampla adoção do trabalho remoto, que remodelou significativamente as operações organizacionais. Inicialmente acelerada pela pandemia de COVID-19, essa mudança continua sendo sustentada pelos avanços tecnológicos e pela evolução das expectativas dos funcionários em relação à flexibilidade no local de trabalho.

- Em resposta, as empresas implementaram rapidamente estratégias de trabalho remoto para garantir a continuidade dos negócios e proteger o bem-estar da força de trabalho, levando a um aumento na demanda por soluções de VCC.

- Essas tecnologias fornecem acesso seguro e consistente aos recursos corporativos de qualquer local e em múltiplos dispositivos, incluindo laptops, tablets e smartphones. Ao permitir a colaboração perfeita entre equipes distribuídas, o VCC aumenta a produtividade, a satisfação dos funcionários e a agilidade da força de trabalho.

- Além disso, permite que as organizações expandam seus esforços de recrutamento globalmente, sem a limitação geográfica. À medida que os modelos de trabalho remoto e híbrido se tornam a norma, as empresas investem cada vez mais em infraestrutura robusta de computação para clientes virtuais para apoiar a resiliência operacional de longo prazo, a segurança cibernética e os objetivos de transformação digital.

Dinâmica do mercado de computação de cliente virtual

Impulsione

a crescente demanda por soluções de trabalho remoto e gerenciamento centralizado de TI

- O aumento nos modelos de trabalho remoto e híbrido em empresas globalmente é um grande impulsionador para o mercado de computação de cliente virtual (VCC), à medida que as organizações buscam infraestruturas de TI seguras, escaláveis e facilmente gerenciáveis para dar suporte a forças de trabalho distribuídas.

- Por exemplo, em março de 2024, a Citrix (uma unidade de negócios do Cloud Software Group) introduziu recursos aprimorados em suas ofertas de DaaS, permitindo acesso remoto mais eficiente e monitoramento de desempenho aprimorado, com o objetivo de dar suporte às crescentes demandas de ambientes de trabalho híbridos.

- As soluções VCC permitem que as equipes de TI gerenciem centralmente desktops, aplicativos e ambientes de usuários, aumentando a segurança dos dados, reduzindo a dependência de hardware e otimizando os processos de atualização e solução de problemas.

- Além disso, a mudança para a infraestrutura de TI baseada em nuvem e a crescente adoção de tecnologias de virtualização estão reforçando a demanda por VCC, já que as empresas buscam reduzir os custos operacionais e melhorar a flexibilidade.

- A capacidade de proporcionar experiências de desktop consistentes em vários dispositivos e locais, garantindo a conformidade e a proteção de dados, torna o VCC uma solução atraente para setores como saúde, finanças e educação. À medida que as iniciativas de transformação digital se aceleram, o papel da computação de cliente virtual (VCC) na viabilização de operações remotas seguras e integradas continua a se expandir.

Restrição/Desafio

Implantação complexa e preocupações com privacidade de dados

- Apesar dos seus benefícios, a computação de cliente virtual enfrenta desafios relacionados a processos complexos de implantação e preocupações crescentes sobre a privacidade de dados, especialmente ao integrar-se com sistemas legados ou fazer a transição de ambientes de desktop tradicionais.

- Por exemplo, pequenas e médias empresas (PMEs) frequentemente enfrentam as demandas técnicas e financeiras da implementação de soluções completas de VDI ou DaaS, especialmente sem suporte de TI dedicado. Além disso, armazenar e gerenciar dados confidenciais em servidores centralizados ou ambientes de nuvem apresenta riscos de privacidade e conformidade, especialmente em setores regidos por regulamentações rigorosas, como saúde (HIPAA) ou finanças (GDPR, PCI DSS).

- Preocupações com violações de dados, acesso não autorizado e violações de conformidade podem impedir algumas organizações de adotar soluções VCC, especialmente em regiões com infraestrutura de segurança cibernética ou estruturas de proteção de dados limitadas.

- Lidar com essas preocupações requer criptografia robusta, protocolos de acesso seguros, auditorias de segurança regulares e conformidade com as leis regionais de dados. Fornecedores líderes, como VMware e Microsoft, enfatizam arquiteturas de confiança zero e gerenciamento seguro de endpoints para mitigar esses riscos.

- Além disso, o investimento inicial em infraestrutura e a necessidade de pessoal qualificado para gerenciar e manter sistemas VCC podem representar barreiras adicionais, especialmente para organizações com recursos limitados. Educar as empresas sobre o ROI a longo prazo e simplificar a implantação por meio de serviços gerenciados e opções hospedadas na nuvem será essencial para uma adoção mais ampla.

Escopo de mercado de computação de cliente virtual

O mercado é segmentado com base no tipo de implantação, usuário final, componente, tipo de virtualização, tipo de usuário e modo de acesso.

- Por tipo de implantação

Com base no tipo de implantação, o mercado de computação para clientes virtuais é segmentado em on-premises e baseado em nuvem. O segmento on-premises dominou o mercado, com a maior participação na receita, de 58,6% em 2024, apoiado por empresas que exigem controle total, soberania de dados e conformidade com estruturas regulatórias rigorosas. Grandes organizações em setores como bancos e governo frequentemente preferem a implantação on-premises para gerenciar dados confidenciais com segurança. Além disso, a integração de sistemas legados e as altas necessidades de personalização continuam a fortalecer o domínio das soluções de virtualização on-premises.

Espera-se que o segmento baseado em nuvem apresente o CAGR mais rápido entre 2025 e 2032, impulsionado pela rápida mudança para estratégias híbridas e multi-nuvem. A virtualização em nuvem oferece escalabilidade, eficiência de custos e flexibilidade, tornando-a atraente para PMEs e empresas em transformação digital. Com a crescente demanda por modelos baseados em assinatura e a redução dos custos de infraestrutura, espera-se que a implantação baseada em nuvem remodele o crescimento futuro do mercado de virtualização.

- Por usuário final

Com base no usuário final, o mercado de computação para clientes virtuais é segmentado em saúde, educação, TI e telecomunicações, BFSI e manufatura. O segmento de TI e telecomunicações foi responsável pela maior fatia da receita, de 34,7% em 2024, impulsionado pela dependência do setor na virtualização para otimizar data centers, reduzir custos operacionais e garantir o gerenciamento perfeito da carga de trabalho. A rápida adoção de redes 5G e aplicativos nativos em nuvem aumenta ainda mais a demanda por infraestrutura virtualizada em TI e telecomunicações.

Prevê-se que o setor da saúde testemunhe a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente adoção de registros eletrônicos de saúde (RES), telemedicina e requisitos de armazenamento seguro de dados. A virtualização permite que os provedores de saúde consolidem servidores, aprimorem a recuperação de desastres e garantam o gerenciamento de dados de pacientes em conformidade com a HIPAA. À medida que a saúde digital se expande, os provedores de saúde investem cada vez mais em sistemas virtualizados para aprimorar a eficiência, a escalabilidade e a segurança. Essa tendência posiciona a saúde como um forte impulsionador da futura expansão do mercado de virtualização.

- Por componente

Com base nos componentes, o mercado de computação de cliente virtual é segmentado em software e hardware. O segmento de software dominou o mercado, com uma participação de receita de 61,4% em 2024, já que as soluções de software constituem a espinha dorsal da virtualização, habilitando hipervisores, máquinas virtuais (VMs) e automação de cargas de trabalho. As empresas priorizam softwares de virtualização para otimização de cargas de trabalho, segurança e integração com a nuvem, com os fornecedores inovando continuamente para melhorar o desempenho e reduzir a complexidade.

O segmento de hardware deverá registrar o crescimento mais rápido entre 2025 e 2032, impulsionado pela necessidade de servidores, armazenamento e componentes de rede avançados para suportar ambientes altamente virtualizados. Inovações em hardware, incluindo virtualização de GPU e computação de alto desempenho, estão impulsionando ainda mais a adoção. Com a ascensão da computação de ponta e das cargas de trabalho de IA, a demanda por hardware projetado para infraestruturas virtualizadas está acelerando, especialmente em empresas de grande porte e data centers, posicionando o hardware como o componente de crescimento mais rápido do mercado.

- Por tipo de virtualização

Com base no tipo, o mercado de computação de cliente virtual é segmentado em virtualização de desktops, virtualização de aplicativos e virtualização de dados. A virtualização de desktops dominou, com a maior participação na receita, de 46,1% em 2024, apoiada por empresas que buscam gerenciamento centralizado, eficiência de custos e segurança aprimorada para forças de trabalho remotas. Soluções de infraestrutura de desktop virtual (VDI) tornaram-se essenciais à medida que as organizações expandiam os modelos de trabalho remoto e híbrido.

A virtualização de dados deverá apresentar o CAGR mais rápido entre 2025 e 2032, impulsionada pela crescente necessidade de acessar, integrar e analisar grandes volumes de dados sem replicação. Empresas de todos os setores estão utilizando a virtualização de dados para aprimorar análises em tempo real, otimizar a inteligência de negócios e agilizar a tomada de decisões. A virtualização de aplicativos continua a ter uma adoção constante, mas a rápida tendência da transformação digital está tornando a virtualização de dados uma prioridade para empresas que investem em IA, big data e soluções de integração de dados em tempo real.

- Por tipo de usuário

Com base no tipo de usuário, o mercado de computação para clientes virtuais é segmentado em grandes empresas e pequenas e médias empresas (PMEs). As grandes empresas dominaram, com uma participação de receita de 67,8% em 2024, impulsionadas por seus investimentos significativos em infraestrutura de TI, necessidade de escalabilidade e demanda por gerenciamento centralizado de ambientes virtuais. Essas organizações frequentemente implementam estratégias avançadas de virtualização para otimizar data centers, dar suporte a operações globais e garantir a conformidade com as normas de segurança.

Espera-se que o segmento de PMEs registre o crescimento mais rápido entre 2025 e 2032, impulsionado pela crescente conscientização sobre redução de custos, simplificação das operações de TI e melhoria na recuperação de desastres proporcionada pela virtualização. Soluções baseadas em nuvem e modelos de preços por assinatura tornam a virtualização cada vez mais acessível para PMEs. À medida que empresas menores adotam a transformação digital e o trabalho remoto, espera-se que a adoção da virtualização aumente significativamente, reduzindo a lacuna tecnológica entre PMEs e grandes empresas.

- Por modo de acesso

Com base no modo de acesso, o mercado de computação para clientes virtuais é segmentado em acesso remoto e acesso local. O segmento de acesso remoto dominou o mercado, com a maior participação na receita, de 59,2% em 2024, impulsionado pela adoção global de modelos de trabalho híbridos e pela demanda por acesso seguro a desktops e aplicativos virtuais de qualquer lugar. Empresas de todos os setores priorizam soluções de acesso remoto para garantir a produtividade da força de trabalho, a segurança dos dados e a flexibilidade.

A projeção é de que o acesso local apresente o crescimento mais rápido entre 2025 e 2032, apoiado por casos de uso específicos em fábricas, instituições de ensino e ambientes de TI localizados, onde alto desempenho e baixa latência são essenciais. Com a expansão da computação de ponta, a virtualização do acesso local desempenhará um papel fundamental para permitir o processamento de dados em tempo real e o gerenciamento de cargas de trabalho localizadas, especialmente em setores que exigem resposta instantânea e alta eficiência.

Análise regional do mercado de computação de cliente virtual

- A América do Norte dominou o mercado de computação de cliente virtual (VCC) com a maior participação na receita de 41,5% em 2024, impulsionada pela rápida adoção de tecnologias de nuvem, transformação do local de trabalho digital e forte ênfase na segurança de dados

- As empresas da região priorizam infraestrutura de desktop virtual (VDI) escalável e segura e soluções de desktop como serviço (DaaS) para oferecer suporte a modelos de trabalho híbridos e reduzir a complexidade de TI. Os EUA lideram o crescimento da região, beneficiando-se de robustos investimentos em TI e da adoção antecipada de soluções avançadas de computação de cliente virtual por setores como BFSI, saúde e governo.

- Altas rendas disponíveis, um ecossistema de nuvem maduro e uma presença significativa de fornecedores importantes de computação para clientes virtuais, como VMware, Citrix e Microsoft, impulsionam ainda mais o mercado. Além disso, a crescente demanda por acesso remoto e gerenciamento centralizado de TI impulsiona a adoção generalizada do VCC tanto em grandes empresas quanto em PMEs.

Visão do mercado de computação de cliente virtual dos EUA

Os EUA detêm a maior fatia da América do Norte, com 83% em 2024, impulsionados pela ampla adoção da nuvem e pela expansão da força de trabalho remota. As empresas do país implementam rapidamente plataformas VDI e DaaS para manter a produtividade e proteger dados confidenciais em meio ao aumento das ameaças cibernéticas. A proliferação de políticas de trabalho híbrido, aliada aos avanços em desktops virtuais com tecnologia de IA e estruturas de segurança de confiança zero, está acelerando o crescimento. Os principais provedores inovam continuamente para aprimorar a experiência do usuário e reduzir a sobrecarga de TI, tornando os EUA um mercado-chave para tecnologias de computação de cliente virtual.

Visão do mercado de computação de cliente virtual na Europa

Espera-se que o mercado europeu de computação para clientes virtuais cresça de forma constante, apoiado por rigorosas regulamentações de proteção de dados, como o GDPR, e por iniciativas crescentes de transformação digital nos setores público e privado. Países como o Reino Unido e a Alemanha são contribuintes notáveis, impulsionados por investimentos em infraestrutura de nuvem e soluções seguras de ambiente de trabalho virtual. A região se beneficia do foco em conformidade, soberania de dados e acesso remoto seguro, especialmente nos setores financeiro, de saúde e administração pública, que dependem cada vez mais do VCC para atender às demandas regulatórias e à eficiência operacional.

Visão do mercado de computação de cliente virtual do Reino Unido

O mercado de computação para clientes virtuais do Reino Unido deverá apresentar forte crescimento devido à crescente adoção do trabalho remoto e aos programas de modernização digital apoiados pelo governo. As organizações buscam aprimorar a segurança cibernética e a produtividade dos funcionários por meio de ambientes de desktop virtuais seguros. A infraestrutura avançada de TI do país e o crescente ecossistema de serviços em nuvem facilitam a implementação de VCC. A crescente adoção entre PMEs, juntamente com grandes empresas, sustenta um cenário de mercado dinâmico focado em implantações de nuvem híbrida e gerenciamento de TI com boa relação custo-benefício.

Visão do mercado de computação de cliente virtual na Alemanha

O mercado de computação para clientes virtuais da Alemanha é marcado por uma forte ênfase em segurança de dados, privacidade e conformidade regulatória, impulsionando a demanda por soluções de VCC locais e híbridas. Os setores industrial e de manufatura do país, juntamente com as instituições financeiras, são usuários-chave da tecnologia de VCC para manter a continuidade operacional e, ao mesmo tempo, proteger dados sensíveis. O foco da Alemanha em inovação e transformação digital também impulsiona a adoção, com a crescente integração da computação para clientes virtuais em fábricas inteligentes e iniciativas da Indústria 4.0.

Visão do mercado de computação de cliente virtual da Ásia-Pacífico

A região da Ásia-Pacífico deverá crescer a uma CAGR de 9,32% entre 2025 e 2032, impulsionada pela rápida digitalização, pela expansão da infraestrutura de TI e pela crescente adoção de serviços em nuvem em mercados emergentes como China, Índia, Japão e Austrália. A pressão dos governos por projetos de cidades inteligentes e locais de trabalho digitais acelera a adoção da computação para clientes virtuais. A crescente demanda por soluções de trabalho remoto seguras e flexíveis e por uma gestão de TI com boa relação custo-benefício impulsiona o crescimento, principalmente entre PMEs e organizações do setor público. A região também se beneficia de preços competitivos e da crescente conscientização sobre as vantagens do VCC.

Visão do mercado de computação de cliente virtual do Japão

O mercado de computação para clientes virtuais do Japão está crescendo de forma constante, apoiado pelo ecossistema de tecnologia avançada do país e pelo foco na produtividade da força de trabalho. As políticas de trabalho remoto e a necessidade de acesso seguro a aplicativos corporativos impulsionam a adoção da computação para clientes virtuais, especialmente nos setores de TI, manufatura e saúde. A integração com IA e automação aumenta a eficiência do desktop virtual, atendendo aos altos padrões japoneses de confiabilidade e segurança. O envelhecimento da força de trabalho também incentiva a adoção de tecnologias de desktop remoto fáceis de usar.

Visão do mercado de computação de cliente virtual da China

A China detém a maior fatia de mercado na região Ásia-Pacífico devido à rápida urbanização, à crescente adoção da nuvem e às iniciativas de transformação digital lideradas pelo governo. Empresas dos setores bancário, de e-commerce e educacional implementam cada vez mais a computação de cliente virtual (VCC) para permitir o trabalho remoto e aprimorar a segurança dos dados. O vasto ecossistema de TI do país e os provedores nacionais que oferecem soluções de VCC acessíveis contribuem para o crescimento robusto do mercado. O foco da China na construção de cidades inteligentes e serviços governamentais digitais acelera ainda mais a adoção da VCC nos setores público e privado.

Participação de mercado de computação de cliente virtual

Os líderes de mercado de computação de cliente virtual que operam no mercado são:

- VMware, Inc. (EUA)

- Citrix Systems, Inc. (EUA)

- Microsoft Corporation (EUA)

- Amazon Web Services (AWS) (EUA)

- Nutanix, Inc. (EUA)

- Google Cloud (EUA)

- Dell Technologies (EUA)

- IBM Corporation (EUA)

- Parallels, Inc. (EUA)

- HP Inc. (EUA)

- Ericom Software (EUA)

- Centrify Corporation (EUA)

- Tecnologia IGEL (Alemanha)

- Rackspace Technology (EUA)

- Fujitsu Limited (Japão)

Últimos desenvolvimentos no mercado global de computação de cliente virtual

- Em abril de 2023, a VMware, líder em virtualização e infraestrutura em nuvem, lançou a atualização do VMware Horizon 8 para aprimorar a entrega de aplicativos e desktops virtuais com desempenho, segurança e integração em nuvem aprimorados. Esta atualização se concentra no suporte a ambientes de trabalho híbridos, fornecendo acesso contínuo a desktops virtuais em todos os dispositivos, reforçando a posição da VMware como inovadora fundamental no setor de computação de cliente virtual.

- Em março de 2023, a Citrix Systems lançou o Citrix Workspace Premium, um novo nível de serviço que oferece análises e automação aprimoradas baseadas em IA para otimizar as experiências de desktop virtual e o gerenciamento de TI. Este desenvolvimento reforça o compromisso da Citrix em aprimorar a produtividade e a segurança dos usuários, simplificando as operações de TI em implantações complexas de VCC em empresas do mundo todo.

- Em fevereiro de 2023, a Microsoft expandiu seu serviço Windows 365 Cloud PC integrando recursos avançados de segurança de endpoint e otimização de desempenho com tecnologia de IA. Essas melhorias visam fornecer às organizações desktops virtuais seguros e escaláveis que suportam forças de trabalho híbridas, enfatizando o foco estratégico da Microsoft na computação de clientes baseada em nuvem.

- Em janeiro de 2023, a Amazon Web Services (AWS) anunciou o lançamento do Amazon WorkSpaces Web, um serviço de desktop virtual baseado em nuvem projetado para simplificar o acesso seguro a aplicativos internos por meio de navegadores sem a necessidade de VPNs. Essa inovação destaca o compromisso da AWS em fornecer soluções de VCC econômicas e fáceis de gerenciar para forças de trabalho remotas e distribuídas.

- Em janeiro de 2023, a Nutanix lançou o Nutanix Xi Frame V2, uma plataforma atualizada para entrega de desktops e aplicativos virtuais, com suporte aprimorado para multinuvem e ferramentas de gerenciamento simplificadas. Este lançamento fortalece a presença da Nutanix no mercado de VCC, permitindo que as empresas implantem espaços de trabalho virtuais de forma flexível em nuvens públicas e privadas.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.