Global Veterinary Diagnostics Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

3.32 Billion

USD

6.40 Billion

2024

2032

USD

3.32 Billion

USD

6.40 Billion

2024

2032

| 2025 –2032 | |

| USD 3.32 Billion | |

| USD 6.40 Billion | |

|

|

|

|

Segmentação do mercado global de diagnóstico veterinário, por produto (instrumentos, reagentes, kits e consumíveis), tecnologia (imunodiagnóstico, bioquímica clínica, diagnóstico molecular, hematologia, urinálise e outros), tipo de animal (animais de companhia e animais de criação), tipo de doença (doenças infecciosas, doenças não infecciosas, doenças hereditárias, congênitas e adquiridas, doenças gerais e doenças estruturais e funcionais), espécie (bovino, camelídeo, canino e felino, caprino, equino, ovino, suíno, aviário e outros), usuário final (laboratórios de referência, hospitais e clínicas veterinárias, testes no local de atendimento/em casa, institutos de pesquisa e universidades) - Tendências do setor e previsão para 2032

Tamanho do mercado de diagnóstico veterinário

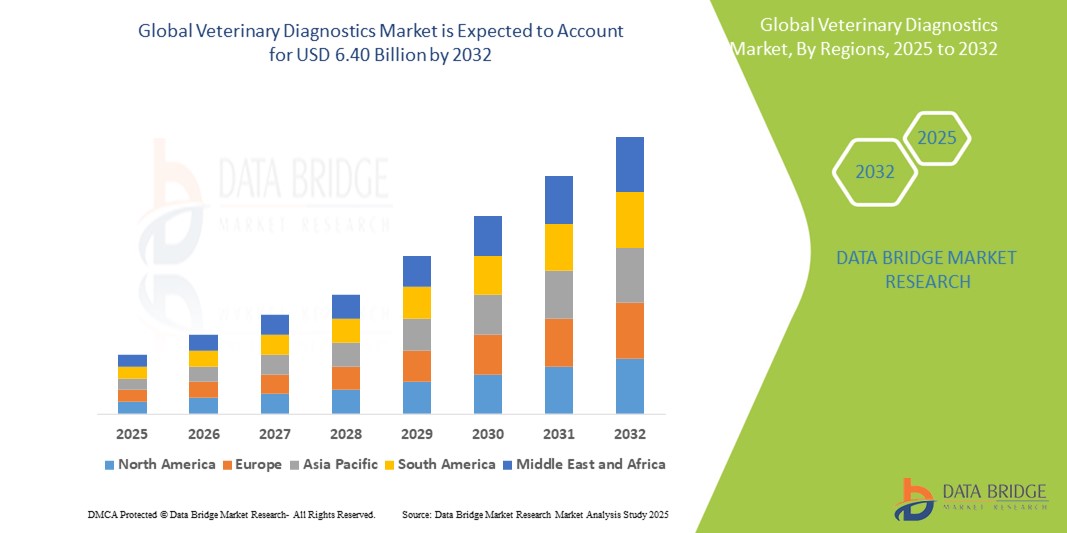

- O tamanho do mercado global de diagnóstico veterinário foi avaliado em US$ 3,32 bilhões em 2024 e deve atingir US$ 6,40 bilhões até 2032 , com um CAGR de 8,55% durante o período previsto.

- Este crescimento é impulsionado por fatores como a crescente prevalência de doenças animais, o aumento da posse de animais de estimação e a crescente demanda por produtos derivados do gado, juntamente com os avanços nas tecnologias de diagnóstico.

Análise de Mercado de Diagnóstico Veterinário

- Os diagnósticos veterinários são ferramentas essenciais usadas para detectar, monitorar e gerenciar doenças em animais, incluindo espécies de companhia e de gado, por meio de várias metodologias de teste, como imunodiagnóstico , diagnóstico molecular e bioquímica clínica.

- A demanda por diagnósticos veterinários é significativamente impulsionada pela crescente incidência de doenças zoonóticas, pela crescente adoção de animais de estimação e pelo aumento dos gastos com saúde animal.

- Espera-se que a América do Norte domine o mercado de diagnóstico veterinário com uma participação de mercado de 38,30%, devido à infraestrutura de saúde veterinária bem desenvolvida, às altas taxas de propriedade de animais de estimação e à presença de grandes empresas de diagnóstico.

- Espera-se que a Ásia-Pacífico seja a região de crescimento mais rápido no mercado de diagnóstico veterinário, com uma participação de mercado de 18,6%, durante o período previsto, devido ao aumento da população de gado, ao aumento da adoção de animais de estimação e à melhoria da infraestrutura de saúde animal.

- Espera-se que o segmento de animais de companhia domine o mercado com uma participação de mercado de 59,31% devido ao aumento da posse de animais de estimação, à conscientização crescente sobre a saúde dos animais de estimação e aos gastos crescentes com cuidados de saúde animal.

Escopo do Relatório e Segmentação do Mercado de Diagnóstico Veterinário

|

Atributos |

Principais Insights de Mercado de Diagnóstico Veterinário |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

Europa

Ásia-Pacífico

Oriente Médio e África

Ámérica do Sul

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de consumo de produção, análise de tendência de preço, cenário de mudança climática, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matéria-prima/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do Mercado de Diagnóstico Veterinário

“Integração de Tecnologias Avançadas de Diagnóstico e Testes no Ponto de Atendimento”

- Uma tendência proeminente no mercado de diagnóstico veterinário é a crescente adoção de tecnologias avançadas, como diagnóstico molecular, biossensores e dispositivos de teste no local de atendimento (POC) para detecção de doenças mais rápida e precisa.

- Essas inovações permitem o diagnóstico precoce, o monitoramento em tempo real e o tratamento eficiente de doenças animais, melhorando significativamente os resultados clínicos e reduzindo a propagação de doenças.

- Por exemplo, os dispositivos portáteis de teste POC permitem que os veterinários realizem diagnósticos rápidos no local, especialmente em ambientes remotos ou de fazenda, facilitando decisões imediatas de tratamento para gado e animais de companhia.

- Esta mudança em direção a ferramentas de diagnóstico avançadas e acessíveis está revolucionando os cuidados veterinários, melhorando as capacidades de gestão de doenças e alimentando a demanda global por soluções inovadoras de diagnóstico veterinário.

Dinâmica do Mercado de Diagnóstico Veterinário

Motorista

“Aumento da incidência de doenças zoonóticas e infecciosas em animais”

- A crescente prevalência de doenças zoonóticas e infecciosas, como brucelose, raiva, gripe aviária e tuberculose bovina, é um fator-chave para o mercado de diagnóstico veterinário.

- Estas doenças representam ameaças significativas à saúde animal e humana, necessitando de detecção precoce e monitorização contínua para prevenir surtos e garantir a segurança alimentar.

- Governos e organizações de saúde em todo o mundo estão enfatizando programas de vigilância e controle de doenças, levando a uma maior demanda por ferramentas de diagnóstico veterinário precisas e rápidas

Por exemplo,

- Segundo a Organização Mundial da Saúde (OMS), mais de 60% das doenças infecciosas conhecidas em humanos são zoonóticas e cerca de 75% das doenças infecciosas emergentes têm origem animal, destacando a importância de diagnósticos veterinários robustos.

- Como resultado da crescente incidência de doenças zoonóticas e infecciosas, a necessidade de diagnósticos veterinários avançados está a aumentar significativamente para garantir intervenções oportunas e proteger a saúde pública e animal.

Oportunidade

“Emergência da IA e do Big Data no Diagnóstico Veterinário”

- A integração da inteligência artificial (IA) e da análise de big data no diagnóstico veterinário oferece oportunidades significativas para melhorar a detecção de doenças, monitorar tendências de saúde animal e otimizar protocolos de tratamento.

- Plataformas de diagnóstico com tecnologia de IA podem analisar vastos conjuntos de dados de testes de laboratório, imagens e registros clínicos para identificar padrões, prever surtos de doenças e apoiar decisões veterinárias baseadas em evidências

- Além disso, os algoritmos de aprendizagem de máquina podem auxiliar na interpretação de resultados diagnósticos complexos, reduzindo erros e permitindo diagnósticos mais rápidos e precisos em animais de companhia e de criação.

Por exemplo,

- Em outubro de 2024, um relatório da Associação Médica Veterinária Americana (AVMA) destacou o uso crescente de ferramentas de diagnóstico habilitadas por IA em práticas veterinárias, que auxiliam no monitoramento em tempo real da saúde do gado e na detecção precoce de doenças como mastite, melhorando a produtividade e reduzindo perdas

- O uso de IA e big data em diagnósticos veterinários não só melhora os resultados clínicos, mas também contribui para cuidados veterinários de precisão, oferecendo gestão proativa da saúde, economia de custos e melhor bem-estar animal em todo o mundo.

Restrição/Desafio

“Alto custo de equipamentos e serviços de diagnóstico avançado”

- O alto custo associado a equipamentos avançados de diagnóstico veterinário e serviços de teste representa uma barreira significativa à expansão do mercado, especialmente em países de baixa e média renda

- Ferramentas de diagnóstico, como analisadores moleculares, sistemas de imagem e plataformas de testes automatizados, exigem investimentos substanciais, tornando-as menos acessíveis a pequenas clínicas, clínicas veterinárias rurais e criadores de gado independentes.

- Este desafio de custos não só restringe a adopção de tecnologias de diagnóstico de ponta, como também limita a disponibilidade de testes rápidos e precisos em áreas com poucos recursos.

Por exemplo,

- De acordo com um relatório de 2023 da Federação Europeia de Saúde Animal, os serviços de diagnóstico veterinário podem ser proibitivos em termos de custos para pequenos agricultores e donos de animais de estimação, resultando em testes atrasados ou evitados, o que afeta o controle de doenças e a eficácia do tratamento.

- Consequentemente, o peso financeiro associado à aquisição e manutenção de sistemas de diagnóstico sofisticados dificulta a penetração no mercado, criando disparidades na qualidade dos cuidados de saúde animal e abrandando o crescimento global do mercado.

Escopo de mercado de diagnóstico veterinário

O mercado é segmentado com base no produto, tecnologia, tipo de animal, tipo de doença, espécie, usuário final

|

Segmentação |

Sub-segmentação |

|

Por produto |

|

|

Por Tecnologia |

|

|

Por tipo de animal |

|

|

Por tipo de doença |

|

|

Por Espécie |

|

|

Por usuário final

|

|

Em 2025, prevê-se que os animais de companhia dominem o mercado com a maior participação no segmento de tipos de animais

Espera-se que o segmento de animais de companhia domine o mercado de diagnóstico veterinário, com a maior participação de 59,31% em 2025, devido ao aumento da posse de animais de estimação, à crescente conscientização sobre a saúde animal e aos crescentes gastos com saúde animal. Os avanços nas tecnologias de diagnóstico e a maior incidência de doenças crônicas e infecciosas em animais de estimação impulsionam ainda mais a demanda por diagnósticos oportunos e precisos.

Espera-se que os reagentes, kits e consumíveis representem a maior fatia do mercado de produtos durante o período previsto.

Em 2025, espera-se que o segmento de reagentes, kits e consumíveis domine o mercado, com a maior participação de mercado, de 53,2%, devido ao seu uso frequente em procedimentos diagnósticos e à demanda recorrente por testes de rotina. Seu papel crítico em diversas plataformas de diagnóstico, facilidade de uso e necessidades contínuas de reposição em ambientes clínicos e de campo contribuem ainda mais para seu domínio de mercado.

Análise regional do mercado de diagnóstico veterinário

“A América do Norte detém a maior fatia do mercado de diagnóstico veterinário”

- A América do Norte domina o mercado de diagnóstico veterinário com uma participação de mercado estimada em 38,30% , impulsionada por uma infraestrutura de saúde veterinária bem desenvolvida, altas taxas de propriedade de animais de estimação e a presença de grandes empresas de diagnóstico.

- Os EUA detêm uma quota de mercado de 60,5%, devido à crescente procura por serviços de diagnóstico avançados, à crescente consciencialização sobre a saúde animal e ao investimento significativo em investigação e desenvolvimento

- As políticas de reembolso favoráveis à saúde animal, o uso generalizado de animais de companhia e as iniciativas governamentais que apoiam o controle de doenças zoonóticas aumentam ainda mais o crescimento do mercado.

- Além disso, a rápida adoção de tecnologias inovadoras, como diagnósticos moleculares e testes no local de atendimento em práticas veterinárias, continua a impulsionar o mercado na América do Norte.

“A região Ásia-Pacífico deverá registrar o maior CAGR no mercado de diagnóstico veterinário”

- Espera-se que a região Ásia-Pacífico testemunhe a maior taxa de crescimento no mercado de diagnóstico veterinário, com uma participação de mercado de 18,6%, impulsionada pelo aumento da população pecuária, aumento da adoção de animais de estimação e melhoria da infraestrutura de saúde animal.

- Países como a China, a Índia e a Coreia do Sul são contribuintes importantes, devido ao crescente peso das doenças zoonóticas e ao maior foco na segurança alimentar e no bem-estar animal.

- A China lidera os investimentos em gestão da saúde animal, enquanto o Japão apresenta crescimento constante devido à sua forte base tecnológica e à crescente demanda por diagnósticos para animais de companhia.

- A Índia deverá registrar o maior CAGR da região devido à expansão do setor de cuidados veterinários, ao foco crescente do governo na prevenção de doenças e à crescente disponibilidade de ferramentas avançadas de diagnóstico em áreas rurais e urbanas.

Participação no mercado de diagnósticos veterinários

O cenário competitivo do mercado fornece detalhes por concorrente. Os detalhes incluem visão geral da empresa, finanças da empresa, receita gerada, potencial de mercado, investimento em pesquisa e desenvolvimento, novas iniciativas de mercado, presença global, locais e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento de produto, amplitude e abrangência do produto e domínio da aplicação. Os pontos de dados fornecidos acima referem-se apenas ao foco das empresas em relação ao mercado.

Os principais líderes de mercado que operam no mercado são:

- IDEXX (EUA)

- Zoetis Services LLC (EUA)

- Thermo Fisher Scientific Inc. (EUA)

- Virbac (França)

- Antech Diagnostics, Inc. (EUA)

- Neogen Corporation (EUA)

- Bio-Rad Laboratories, Inc. (EUA)

- Innovative Diagnostics SAS (França)

- Randox Laboratories Ltd. (Reino Unido)

- Eurofins Scientific (Luxemburgo)

- BioChek BV (Holanda)

- ThermoGenesis Holdings, Inc. (EUA)

- BIONOTE (Coreia do Sul)

- SKYLA CORPORATION (Taiwan)

- Diagnóstico Inovador (França)

- QIAGEN (Holanda)

- Zoetis Belgium SA (Bélgica)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

Últimos desenvolvimentos no mercado de diagnóstico veterinário

- Em maio de 2025, a Autoridade de Concorrência e Mercados (CMA) do Reino Unido iniciou uma investigação de 18 meses sobre o mercado de serviços veterinários, avaliado em £ 5 bilhões, com foco em preocupações com os altos preços dos medicamentos e a falta de transparência. As medidas preliminares incluem um site de comparação de preços e limites para as taxas de prescrição.

- Em março de 2025, pesquisadores desenvolveram um modelo de rede neural convolucional (CNN) usando um único sensor de unidade de medição inercial (IMU) para detectar sinais precoces de claudicação em cavalos. O sistema atingiu 90% de precisão em nível de sessão, oferecendo uma solução econômica e prática para o monitoramento da saúde equina.

- Março de 2025: Um novo sistema de diagnóstico multiagente, alimentado por IA, foi introduzido para a detecção de doenças em suínos. Utilizando a Geração Aumentada de Recuperação (RAG), o sistema oferece detecção oportuna e baseada em evidências de doenças e orientação clínica, aprimorando a tomada de decisões veterinárias no manejo da saúde suína.

- Em janeiro de 2024, a IDEXX Laboratories lançou o Analisador Celular In Vue Dx, um dispositivo pioneiro capaz de diagnosticar anormalidades citológicas comuns em amostras de sangue e ouvido. Essa inovação aumenta a precisão e a eficiência do diagnóstico em clínicas veterinárias.

- Em agosto de 2022, a PepiPets lançou um serviço de diagnóstico móvel, permitindo a realização de testes de diagnóstico em domicílio para animais de estimação. Este serviço visa aumentar a conveniência e minimizar o estresse tanto para os animais de estimação quanto para seus donos, eliminando a necessidade de consultas médicas.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.