Global Uv Absorbers Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

1.13 Billion

USD

1.84 Billion

2024

2032

USD

1.13 Billion

USD

1.84 Billion

2024

2032

| 2025 –2032 | |

| USD 1.13 Billion | |

| USD 1.84 Billion | |

|

|

|

|

Segmentação do mercado global de absorvedores de ultravioleta (UV), por produto (benzofenona, benzotriazol, triazina e outros), aplicação (plásticos, revestimentos, adesivos, cuidados pessoais, embalagens, filmes agrícolas e outros) - Tendências e previsões do setor até 2032

Tamanho do mercado de absorvedores ultravioleta (UV)

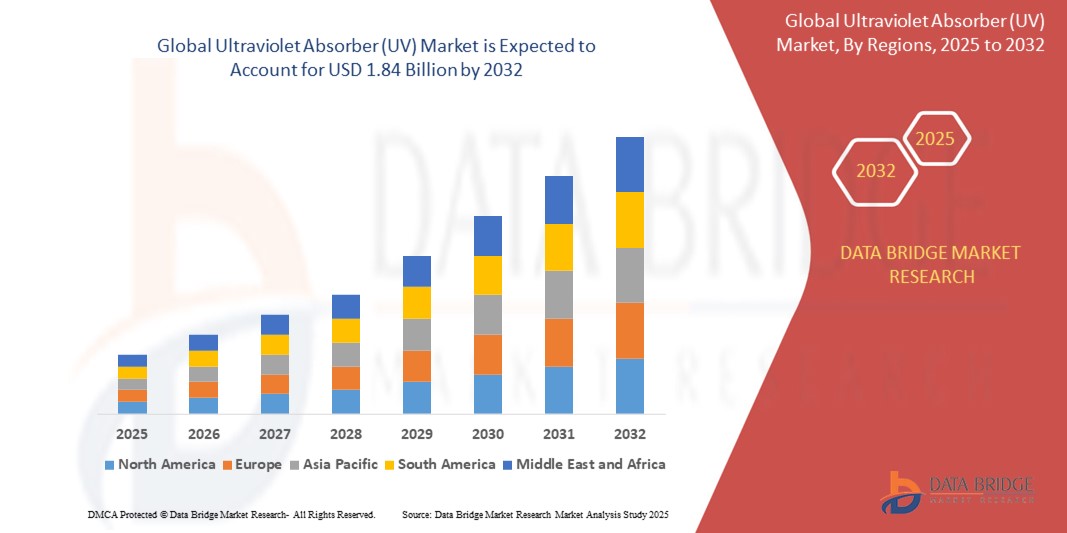

- O mercado global de absorvedores ultravioleta (UV) foi avaliado em US$ 1,13 bilhão em 2024 e deverá atingir US$ 1,84 bilhão até 2032 , com uma taxa de crescimento anual composta (CAGR) de 6,25% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela crescente conscientização sobre a degradação induzida por raios UV e pelas preocupações com a saúde. Absorvedores de ultravioleta são amplamente utilizados para melhorar a longevidade e o desempenho de produtos em aplicações externas, como componentes automotivos, materiais de construção e filmes agrícolas.

- Além disso, regulamentações ambientais rigorosas que incentivam o uso de estabilizadores UV na fabricação de bens industriais e de consumo estão impulsionando ainda mais a expansão do mercado.

Análise de mercado de absorvedores ultravioleta (UV)

- O mercado de absorvedores de ultravioleta está apresentando crescimento constante devido à crescente demanda nas indústrias de plásticos, revestimentos e cuidados pessoais, à medida que os consumidores buscam produtos mais duráveis e resistentes aos raios UV.

- Os fabricantes estão focando em aprimorar a eficiência dos absorvedores ultravioleta para atender às necessidades de aplicação em constante evolução, garantindo melhor proteção e maior vida útil do produto em diversos setores de uso final.

- A América do Norte dominou o mercado de absorvedores ultravioleta com a maior participação na receita em 2024, impulsionada pelo uso generalizado em plásticos e revestimentos, especialmente nos setores automotivo e da construção civil.

- A região Ásia-Pacífico deverá apresentar a maior taxa de crescimento no mercado global de absorvedores de ultravioleta (UV), impulsionada pela rápida industrialização, pela expansão dos setores de embalagens e construção e pelo aumento da demanda por plásticos e revestimentos com proteção UV em países como China, Japão e Índia.

- O segmento de benzotriazol dominou o mercado com a maior participação na receita em 2024, devido à sua superior eficiência de absorção ultravioleta e compatibilidade com uma ampla gama de sistemas poliméricos. Sua estabilidade térmica e eficácia na proteção de materiais contra a degradação induzida por UV o tornam a escolha preferida em diversas aplicações industriais, incluindo automotiva e de embalagens. Além disso, os compostos de benzotriazol oferecem proteção mais duradoura, reduzindo a frequência de manutenção e substituição de materiais.

Escopo do relatório e segmentação do mercado de absorvedores ultravioleta (UV)

|

Atributos |

Principais informações de mercado sobre absorvedores ultravioleta (UV) |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

Europa

Ásia-Pacífico

Oriente Médio e África

Ámérica do Sul

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de produção e consumo, análise de tendências de preços, cenário de mudanças climáticas, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de absorvedores ultravioleta (UV)

“Aumento da integração de absorvedores de raios UV em produtos sustentáveis e ecológicos”

- Os fabricantes estão incorporando cada vez mais absorvedores de raios UV em formulações sustentáveis e ecológicas para atender à crescente demanda dos consumidores por alternativas mais verdes.

- As regulamentações ambientais e as preocupações com a sustentabilidade estão incentivando o uso de soluções de absorção de UV de base biológica e não tóxicas em diversos setores.

- Aditivos UV ecológicos estão ganhando espaço em produtos de cuidados pessoais, especialmente em protetores solares com filtros seguros para recifes de coral, visando proteger os ecossistemas marinhos.

- Por exemplo, marcas como Thinksport e Blue Lizard agora oferecem linhas de protetores solares que não agridem os recifes de coral.

- Os fabricantes de embalagens estão integrando absorvedores de UV de fontes renováveis para apoiar práticas de economia circular e reduzir o impacto ambiental.

- Essa tendência não só ajuda a reduzir a pegada de carbono, como também melhora a reputação da marca e a confiança do consumidor em mercados ambientalmente conscientes.

Dinâmica do mercado de absorvedores ultravioleta (UV)

Motorista

“Demanda crescente das indústrias de embalagens e polímeros”

- O uso crescente de absorvedores de ultravioleta nas indústrias de embalagens e polímeros é um fator-chave para o crescimento, visto que esses setores exigem materiais que mantenham suas propriedades físicas e estéticas sob exposição aos raios UV.

- Os absorvedores de UV desempenham um papel vital na prevenção da descoloração, fragilidade e degradação estrutural em produtos à base de polímeros, garantindo durabilidade a longo prazo.

- Em embalagens de alimentos, cosméticos e produtos farmacêuticos, os absorvedores de UV ajudam a preservar a integridade do produto e prolongar sua vida útil, protegendo o conteúdo da radiação nociva.

- O aumento da produção de plásticos e a crescente demanda por aditivos de alto desempenho estão acelerando o uso de absorvedores de UV, especialmente em aplicações que exigem maior vida útil do produto.

- Por exemplo, os fabricantes de garrafas PET e chapas de policarbonato incorporam absorvedores de UV para melhorar a resistência aos raios UV, enquanto o comércio eletrônico e a logística global impulsionam a demanda por embalagens duráveis expostas a diferentes condições de luz.

Restrição/Desafio

“Preocupações ambientais e de saúde relacionadas à composição química”

- As preocupações ambientais e de saúde relacionadas aos absorvedores ultravioleta sintéticos representam um grande desafio, especialmente devido à sua natureza não biodegradável e persistência nos ecossistemas.

- Ingredientes como a benzofenona têm gerado preocupação devido à sua ligação com a disfunção endócrina e a toxicidade aquática, o que levou à atenção dos órgãos reguladores.

- A Europa e partes da América do Norte estão implementando regulamentações mais rigorosas sobre o uso de certos absorvedores de raios UV em produtos de consumo e cosméticos.

- Por exemplo, alguns ingredientes de protetores solares foram proibidos em áreas como o Havaí para evitar danos aos recifes de coral, o que levou a uma busca por alternativas mais seguras.

- Essa mudança obriga os fabricantes a investir na reformulação de produtos, aumentando os custos e complicando a conformidade, ao mesmo tempo que retarda a adoção pelo mercado em setores ecologicamente sensíveis.

Escopo do mercado de absorvedores ultravioleta (UV)

O mercado está segmentado com base no produto e na aplicação.

- Por produto

Com base no produto, o mercado de absorvedores de ultravioleta é segmentado em benzofenona, benzotriazol, triazina e outros. O segmento de benzotriazol dominou o mercado com a maior participação na receita em 2024, devido à sua eficiência superior de absorção de ultravioleta e compatibilidade com uma ampla gama de sistemas poliméricos. Sua estabilidade térmica e eficácia na proteção de materiais contra a degradação induzida por UV o tornam a escolha preferida em diversas aplicações industriais, incluindo automotiva e de embalagens. Além disso, os compostos de benzotriazol oferecem proteção mais duradoura, reduzindo a frequência de manutenção e substituição de materiais.

O segmento de triazinas deverá apresentar o crescimento mais rápido entre 2025 e 2032, impulsionado pelo seu excelente desempenho em aplicações resistentes a altas temperaturas e intempéries. A sua crescente adoção em revestimentos automotivos e filmes agrícolas deve-se à sua baixa volatilidade e proteção de longa duração. Além disso, a crescente demanda por materiais duráveis para uso externo está acelerando a transição para absorvedores de ultravioleta à base de triazinas.

- Por meio de aplicação

Com base na aplicação, o mercado de absorvedores de ultravioleta é segmentado em plásticos, revestimentos, adesivos, cuidados pessoais, embalagens, filmes agrícolas e outros. O segmento de plásticos detinha a maior participação na receita de mercado em 2024, impulsionado pelo crescente uso de estabilizadores UV em interiores automotivos, dispositivos eletrônicos e materiais de construção. Esses absorvedores aumentam a vida útil e melhoram a aparência dos produtos plásticos, prevenindo o desbotamento, a fragilidade e a degradação causados pela exposição prolongada ao sol. Com o uso extensivo de plásticos em aplicações externas e de consumo, a demanda por proteção UV eficaz continua a crescer.

O segmento de cuidados pessoais deverá apresentar o crescimento mais rápido entre 2025 e 2032, impulsionado pela crescente conscientização do consumidor sobre a proteção da pele e pelo uso cada vez maior de filtros UV em protetores solares, hidratantes e cosméticos. A demanda crescente por produtos multifuncionais de cuidados pessoais e a expansão da classe média em economias emergentes contribuem para esse rápido crescimento. A inovação contínua em tecnologias de filtros UV também apoia o desenvolvimento de formulações mais seguras e eficazes para o cuidado diário da pele.

Análise Regional do Mercado de Absorvedores de Ultravioleta (UV)

- A América do Norte dominou o mercado de absorvedores ultravioleta com a maior participação na receita em 2024, impulsionada pelo uso generalizado em plásticos e revestimentos, especialmente nos setores automotivo e da construção civil.

- A região beneficia de uma forte presença de importantes intervenientes do setor, de regulamentações rigorosas que promovem a proteção UV e da inovação tecnológica contínua em aditivos estabilizadores UV de alto desempenho.

- A demanda do consumidor por materiais duráveis e resistentes aos raios UV em aplicações finais, como embalagens e bens de consumo, continua impulsionando o crescimento nos EUA e no Canadá.

Análise do Mercado de Absorvedores de Ultravioleta nos EUA

O mercado de absorvedores de ultravioleta dos EUA detinha a maior participação de receita na América do Norte em 2024, impulsionado por suas indústrias de plásticos e polímeros bem estabelecidas. A crescente demanda por proteção UV em embalagens, revestimentos e eletrônicos contribui significativamente para a expansão do mercado. Além disso, o aumento dos investimentos em P&D por empresas químicas sediadas nos EUA em compostos avançados de absorção de UV alimenta a inovação e a versatilidade de aplicações.

Análise do Mercado Europeu de Absorvedores de Ultravioleta

O mercado europeu de absorvedores de ultravioleta deverá apresentar o crescimento mais rápido entre 2025 e 2032, impulsionado pela crescente conscientização sobre a degradação por UV e ciclos de vida sustentáveis dos produtos. Políticas ambientais rigorosas e a preferência do consumidor por revestimentos e plásticos de alto desempenho na Alemanha, França e Itália contribuem para a demanda. A ênfase da região em estabilizadores UV ecológicos e não tóxicos também está incentivando os fabricantes a desenvolver soluções mais sustentáveis.

Análise do Mercado de Absorvedores de Ultravioleta no Reino Unido

O mercado de absorvedores de ultravioleta do Reino Unido deverá apresentar o crescimento mais rápido entre 2025 e 2032, impulsionado pela expansão dos setores da construção civil e automotivo. A demanda por revestimentos de proteção UV em janelas, superfícies e peças automotivas continua a crescer em meio às variações climáticas. Inovações em plásticos leves e resistentes aos raios UV, utilizados em eletrônicos e embalagens, também estão impulsionando o mercado na região.

Análise do mercado de absorvedores ultravioleta na Alemanha

O mercado alemão de absorvedores de ultravioleta deverá apresentar o crescimento mais rápido entre 2025 e 2032, impulsionado por sua posição de liderança na indústria química e na ciência dos materiais. Absorvedores de UV de alto desempenho estão sendo adotados em revestimentos automotivos de ponta, painéis solares e componentes eletrônicos. O compromisso do país com a sustentabilidade ambiental também está acelerando a transição para estabilizadores de UV de próxima geração, menos tóxicos.

Análise do Mercado de Absorvedores de Ultravioleta na Ásia-Pacífico

O mercado de absorvedores ultravioleta da região Ásia-Pacífico deverá apresentar o crescimento mais rápido entre 2025 e 2032, impulsionado pela rápida industrialização, pelo aumento da renda disponível e pela crescente demanda por plásticos e revestimentos. Países-chave como China, Japão e Índia estão impulsionando a adoção dessa tecnologia em embalagens, produtos de higiene pessoal e filmes agrícolas. A capacidade de produção local e o apoio governamental à inovação na manufatura também contribuem para a expansão regional.

Análise do Mercado Japonês de Absorvedores de Ultravioleta

O mercado japonês de absorvedores de raios ultravioleta deverá apresentar o crescimento mais rápido entre 2025 e 2032, devido ao aumento do uso do produto em eletrônicos, componentes automotivos e itens de higiene pessoal. Como uma nação tecnologicamente avançada, o Japão prioriza a durabilidade e a segurança dos materiais, fomentando a demanda por absorvedores de UV em diversas aplicações de alta tecnologia. A inovação local em ciência de polímeros e estabilizadores UV ecologicamente seguros fortalece a posição do país no mercado global.

Análise do Mercado de Absorvedores de Ultravioleta na China

Em 2024, a China representou a maior fatia do mercado de absorvedores ultravioleta na região Ásia-Pacífico, impulsionada pela produção em larga escala de plásticos, materiais de embalagem e revestimentos. O rápido crescimento dos setores da construção civil, automotivo e de cuidados pessoais amplifica a demanda por proteção UV. A forte indústria química nacional e a produção com custos competitivos da China a posicionam ainda mais como um dos principais contribuintes para a oferta e o consumo globais de absorvedores UV.

Participação de mercado de absorvedores ultravioleta (UV)

O setor de absorvedores de ultravioleta (UV) é liderado principalmente por empresas consolidadas, incluindo:

- BASF SE (Alemanha)

- SONGWON (Coreia do Sul)

- Clariant (Suíça)

- Solvay (Bélgica)

- ADEKA CORPORATION (Japão)

- Addivant (EUA)

- 3V Sigma USA Inc (EUA)

- Everlight Chemical Industrial Co. (Taiwan)

- Milliken & Company (EUA)

- SABO SpA (Itália)

- Apexical, Inc. (EUA)

- Dalian Richfortune Chemicals Co., Ltd (China)

- CHEMIPRO KASEI KAISHA, LTD (Japão)

- Chitec Technology Co., Ltd. (Taiwan)

- Valtris Produtos Químicos Especiais (EUA)

- Lycus Ltd., LLC. (EUA)

- Everspring Chemical Co., Ltd. (Taiwan)

- Lambson (África do Sul)

- MPI Chemie BV (Países Baixos)

- Nanjing Union Rubber and Chemicals Co., Ltd. (China)

- Huntsman International LLC (EUA)

Novidades no mercado global de absorvedores ultravioleta (UV)

- Em novembro de 2022, a SABO SpA anunciou a aquisição estratégica do negócio de TAA e derivados da Evonik Industries AG, incluindo importantes unidades de produção em Marl, Alemanha, e Liaoyang, China. Essa aquisição é vital para garantir o fornecimento de matérias-primas essenciais para a fabricação de estabilizadores de luz de amina impedida (HALS). Com essa medida, a SABO visa assegurar um fornecimento estável de aditivos amplamente utilizados em componentes automotivos, filmes agrícolas, materiais de construção e bens de consumo.

- Em outubro de 2022, a Clariant lançou o AddWorks AGC 970, uma solução avançada de estabilizador de luz formulada especificamente para filmes agrícolas de polietileno. Essa inovação de ponta aumenta significativamente a vida útil do produto no setor de cobertura morta. Ao melhorar a durabilidade do filme contra a exposição aos raios UV e condições agressivas de agroquímicos, o AddWorks AGC 970 permite que os convertedores criem produtos mais resistentes, apoiando as práticas agrícolas e garantindo eficiência e sustentabilidade no manejo de culturas.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.