Global Transfection Reagents And Equipment Market

Tamanho do mercado em biliões de dólares

CAGR :

%

| 1 –0 | |

|

|

|

|

Mercado Global de Reagentes e Equipamentos de Transfecção, Por Produtos (Reagentes e Kits e Instrumentos), Estágio (Investigação, Fases Pré-clínica, Clínica e Comercial), Tipo (Reagente e Equipamento de Transfecção Transitória, Reagente de Transfecção Estável e Equipamento), Métodos (Não- métodos virais e métodos virais), tipos de moléculas (DNA plasmidial, RNA interferente pequeno (siRNA), proteínas, oligonucleótidos de DNA, complexos de ribonucleoproteínas (RNPs) e outros), organismo (células de mamíferos, plantas, fungos , vírus e bactérias) , Aplicação (Aplicação In Vitro, Aplicação In Vivo, Bioprodução e Outros), Utilizador Final (Biofarmacêutica, CROs, (CMOs/CDMOs), Academia, Hospitais, Laboratórios Clínicos e Outros), Canal de Distribuição (Licitação Direta , Vendas no Retalho e Outros), Tendências da Indústria e Previsão para 2030

Análise e insights de mercado de reagentes e equipamentos de transfecção

A transfecção envolve a introdução de ácido nucleico nas células eucarióticas por métodos virais e não virais. O método de transfecção pode superar o desafio de transferir a membrana carregada negativamente. Produtos químicos como o fosfato de cálcio e o dietilaminoetil (DEAE)-dextrano ou reagente catiónico à base de lípidos reagem com a camada exterior de ADN. Neutraliza a carga negativa global, transmite a quantidade positiva à molécula e, portanto, permite a entrega do ADN. Métodos físicos como a eletroporação criam poros minúsculos na membrana celular através da aplicação de voltagem elétrica, permitindo a entrada do ADN diretamente no citoplasma. O DEAE-dextrano é utilizado para transfecção transitória; no entanto, a lipofecção pode atingir uma transfecção estável e, por isso, pode ser utilizada para a expressão proteica a longo prazo. A transfecção mediada por fosfato de cálcio também pode ser utilizada para a transfecção estável. O método de transfecção viral atinge uma elevada eficiência e é utilizado em diversas fases do desenvolvimento de produtos farmacêuticos.

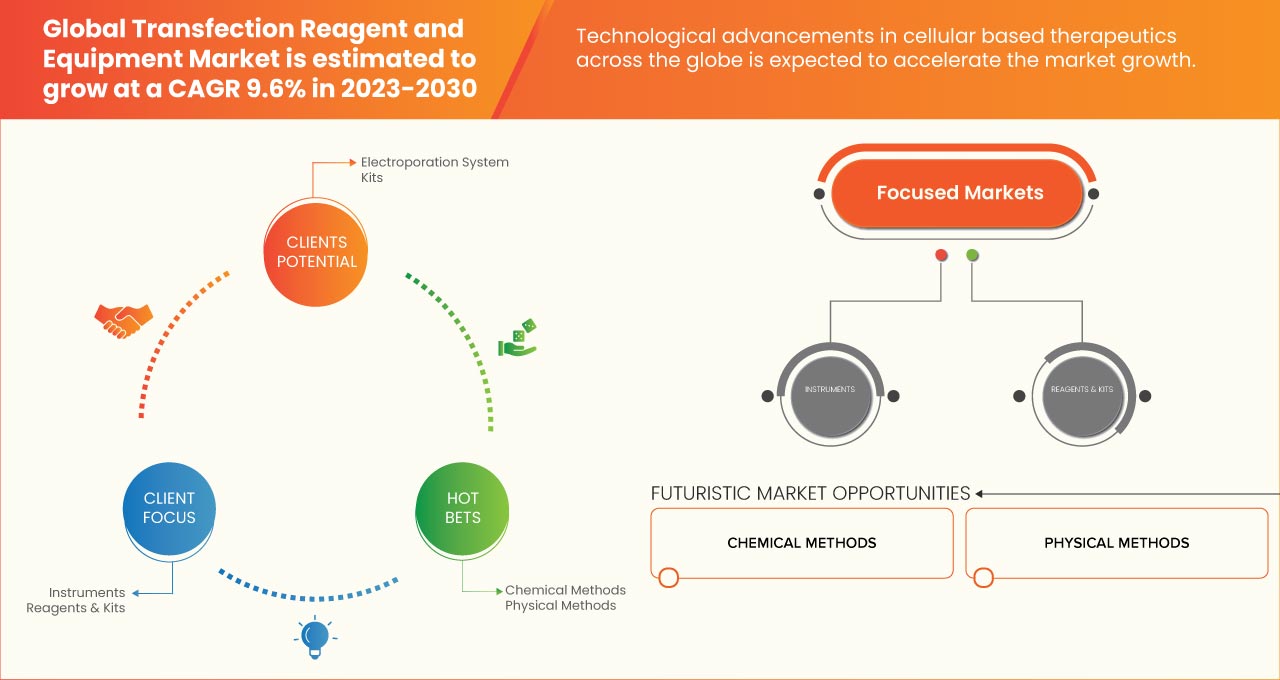

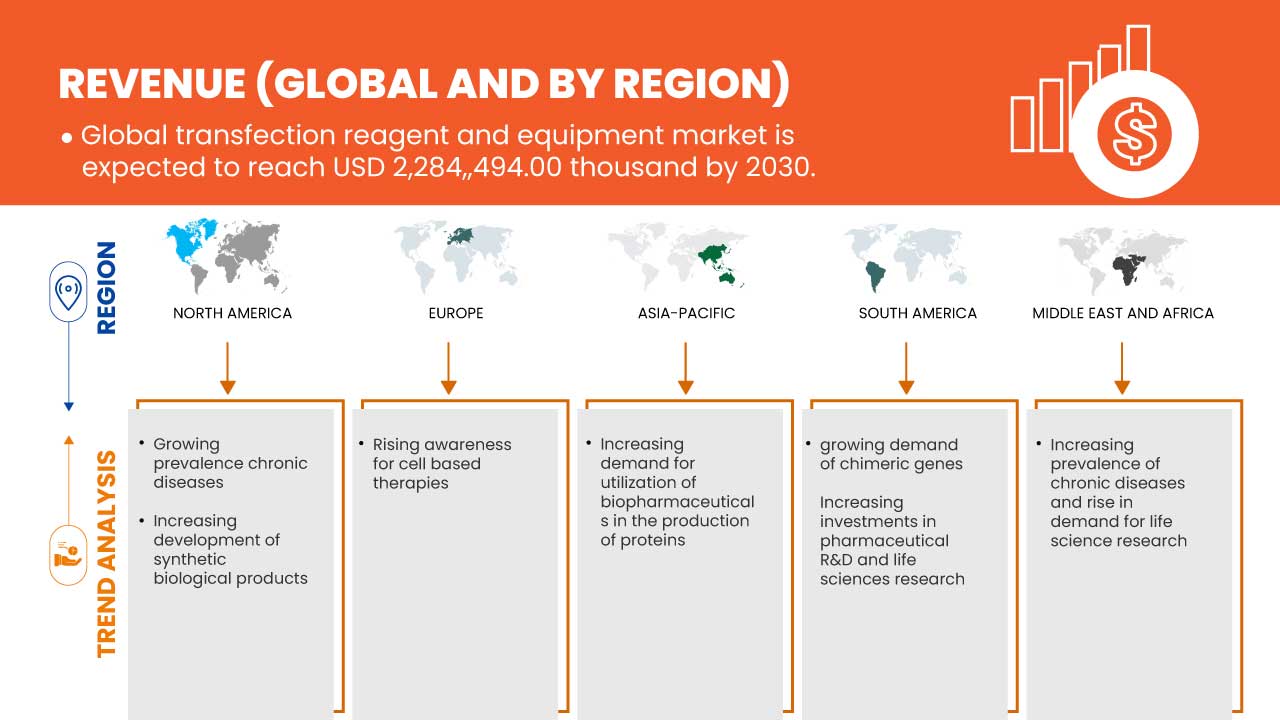

O método de transfecção é utilizado para diversas aplicações que envolvem a agricultura para a proteção das culturas e aumento do rendimento, para a produção de produtos de biologia sintética para realçar sabores e fragrâncias e para melhorar proteínas unicelulares, entre outras. A procura de transfecção aumentou tanto nos países desenvolvidos como nos países em desenvolvimento, e a razão por detrás disto é a ocorrência crescente de doenças crónicas. O mercado da transfecção está a crescer devido à crescente procura de genes quiméricos e à utilização de biofármacos na produção de proteínas. O mercado crescerá no período de previsão devido à exploração dos mercados emergentes, às iniciativas estratégicas dos participantes do mercado e ao aumento do apoio governamental.

Espera-se que o elevado custo dos instrumentos, a eficácia seletiva do reagente de transfeção e os danos celulares induzidos pelos métodos de transfeção restrinjam o crescimento global do mercado de reagentes e equipamentos de transfeção.

O mercado está a crescer devido a diversas iniciativas estratégicas adotadas pelos players do mercado que envolvem aquisição, colaboração e parceria.

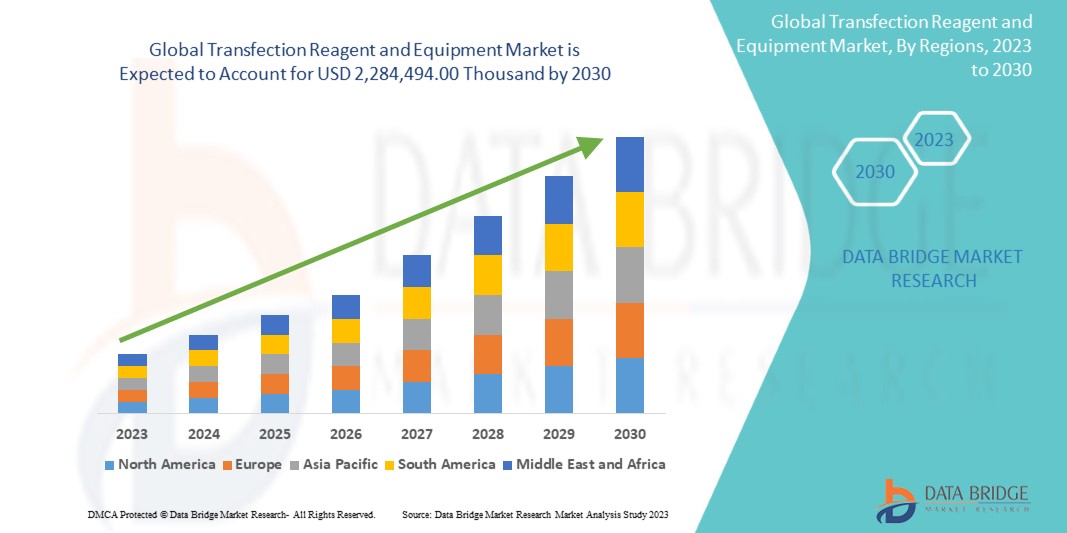

A Data Bridge Market Research analisa que o mercado global de reagentes e equipamentos de transfecção deverá atingir o valor de 2.284.494,00 mil dólares até 2030, com um CAGR de 9,6% no período de previsão.

|

Métrica de reporte |

Detalhes |

|

Período de previsão |

2023 a 2030 |

|

Ano base |

2022 |

|

Anos históricos |

2021 (personalizável para 2020-2016) |

|

Unidades Quantitativas |

Receita em milhares, volumes em unidades, preços em dólares americanos |

|

Segmentos cobertos |

Por produtos (reagentes e kits e instrumentos), estádio (investigação, fase pré-clínica, clínica e comercial), tipo (reagente e equipamento de transfecção transitória, reagente de transfecção estável e equipamento), métodos (métodos não virais e métodos virais) , Tipos de molécula (DNA plasmidial, RNA interferente pequeno (siRNA), proteínas, oligonucleótidos de DNA, complexos de ribonucleoproteínas (RNPs) e outros), organismo (células de mamíferos, plantas, fungos, vírus e bactérias), aplicação (aplicação in vitro, Aplicação In Vivo, Bioprodução e Outros), Utilizador Final (Biofarmacêutica, CROs, (CMOs/CDMOs), Academia, Hospitais, Laboratórios Clínicos e Outros), Canal de Distribuição (Licitação Direta, Vendas a Retalho e Outros). |

|

Países abrangidos |

EUA, Canadá, México, Alemanha, França, Itália, Reino Unido, Espanha, Suíça, Rússia, Holanda, Bélgica, Turquia e resto da Europa, China, Japão, Índia, Austrália, Coreia do Sul, Singapura, Tailândia, Malásia, Filipinas , Indonésia e Resto da Ásia-Pacífico, Brasil, Argentina, Resto da América do Sul, África do Sul, Arábia Saudita, Emirados Árabes Unidos, Israel, Egito e Resto do Médio Oriente e África. |

|

Participantes do mercado abrangidos |

Mirus Bio LLC., Promega Corporation, Polyplus Transfection, Bio-Rad Laboratories, Inc., Merck KGaA, Lonza, MaxCyte, Inc., Altogen Biosystems, SBS Genetech, FUJIFILM Irvine Scientific (uma subsidiária da FUJIFILM Holdings Corporation), Avanti Polar Lipids (uma subsidiária da Croda International Plc), PerkinElmer chemagen Technologie GmbH (uma subsidiária da PerkinElmer Inc.), Cytiva, Geno Technology Inc., EUA, R&D Systems, Inc., Takara Bio Inc., Thermofisher Scientific Inc., Roche Molecular Systems (uma subsidiária da F. Hoffmann-La Roche Ltd), QIAGEN, OriGene Technologies, Inc., Applied Biological Materials Inc. (abm), Beckman Coulter, Inc. , SignaGen Laboratories, Impossible Foods Inc., Genlantis Inc., Ginkgo Bioworks , Verve Therapeutics, Inc., Conagen, Inc., Poseida Therapeutics, Inc., e Twist Bioscience, entre outros. |

Definição de mercado

The transfection method is used to introduce RNA, DNA or protein products in cells to alter the phenotype and genotype of the organism. The transfection method involves the new gene transfer or transferring a gene construct such as Clustered regularly interspaced short palindromic repeats (CRISPR) for genome editing purposes. Transfection has wide applications in the field of immunotherapy, gene therapy, and cell therapy, among others. Transfection involves both non-viral and viral-mediated transfection. The chemical and physical methods can achieve non–viral transfection. The most common chemical method used for transfection is calcium phosphate transfection, and liposome transfection, among others. Viral transfection yields high transfection efficiencies, and various types of physical methods employed for transfection include microinjection, biolistic particle delivery, and electroporation, among which electroporation provides high transfection efficiency. Transfection is of two types either it can be transient or stable transfection. For short-term gene expression studies such as gene knock-out studies, small-scale production transient transfection method is preferred; however, long-term research studies and large-scale protein production stable transfection methods are widely adopted.

Global Transfection Reagent and Equipment Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- RISE IN THE PREVALENCE OF CHRONIC DISEASES

The prevalence of chronic diseases is increasing worldwide, leading to the demand for effective and accurate treatment. Transfection is used to deliver targeted modified genes to treat several genetic diseases. The transfection method is also used for the delivery of the CRISPR gene, which can enhance adaptive immunity and prevent an individual from different diseases.

The increasing cases of chronic diseases such as COVID-19 and other infectious diseases have led to the discovery of effective gene therapy products which can replace the defective gene with the correct gene. The transfection method is widely used for gene therapy, among others. As the demand for effective and accurate treatment is increasing worldwide, the demand for gene therapy and transfection method is also increasing. Moreover, several undergoing researches proving gene therapy to have the potential for chronic disease treatment are also increasing its demand among physicians and patients. This thus signifies that the rise in chronic disease prevalence is acting as a driver for the global transfection Reagent and equipment market growth.

- DEVELOPMENT OF SYNTHETIC BIOLOGY PRODUCTS

Synthetic biology is a new era of biology that incorporates the engineering principle into biology. Synthetic biology involves the chemical synthesis of DNA by combining the knowledge of genomics to reassemble the DNA genomes. The synthetic biology that sequences into the new genes involves genetic engineering, which incorporates the transfection method, among others. As the demand for synthetic biology products is increasing worldwide, the use of transfection products is also increasing.

The demand for synthetic biology products is increasing due to the increasing demand for effective and innovative products. The manufacturing of synthetic products enhances the demand for transfection products, as gene transfer can be accompanied by the transfection method, among others. Thus, this signifies that synthetic product development drives the global transfection Reagent and equipment market growth.

Restraint

- CELL DAMAGE INDUCED BY TRANSFECTION PROCEDURE

Some transfection methods have been reported to cause cell damage, reducing the reproducibility of the overall method. Among the several kinds of transfection procedures, electroporation has been reported to cause maximum cell damage as per the increase in voltage. This cell damage lowers the efficiency rate and impacts the ongoing project.

One of the most common side effects of the transfection procedure is cell damage which lowers the cells metabolic events and leads to cell death. This damaged cell can enhance the media toxicity and hence produces inappropriate results. Thus, this suggests that cell damage induced by the transfection procedure acts as a restraint for the global transfection Reagent and equipment market growth.

Opportunity

- EXPLORATION OF EMERGING MARKET

The transfection products have been shown as promising tools for the genetic engineering and proteomic industry. The top market for transfection products is in Europe and North America. By looking at the positive outcomes of these products, many market players are penetrating their roots in growing economies involving China and India, among others. The emerging market allows these market players to combat the loss that arises from the well-established market.

As emerging markets allow the market players to overcome the economic downturn specified to particular established markets, investment and exploration of emerging markets allow the market players to engage in the development and manufacturing of transfection products to attain lucrative growth. Thus, this signifies that exploring emerging markets is an opportunity to grow the global transfection Reagent and equipment market.

Challenge

- LONG APPROVAL PROCEDURE

The long approval procedure for transfection Reagent and instruments is a hindering agent for the growth of the transfection market. Transfection products are subjected to extensive regulations and have to monitor every time. The transfection products are widely used for the insertion of desired gene molecules in a particular cell line to obtain proteins and other biological compounds. This process is thus investigated and approved by the long and strict regulatory procedures. The long process required to get a positive result from every conducted clinical trial led to more time consumption and the investment of lots of money by market players.

The transfection Reagent are mostly subjected to 21CFR parts 210 and 211 U.S. FDA guidelines, according to which the manufacturers had to assure that the reagent manufactured meets the safety, packaging and processing characteristics proposed by the regulatory agencies. The owner or manufacturer has to submit licenses under section 351 of the PHS (Public Health Services) Act, which is quite a tedious procedure. Thus, this signifies that long approval procedures challenge the global transfection Reagent and equipment market growth.

Recent Developments

- In August 2021, Mirus Bio expanded the TransIT VirusGen platform for Good Manufacturing Practice (GMP) viral vector production to support cell and gene therapy development, process operations, and commercial production. The extension, referred to as TransIT VirusGen GMP Transfection Reagent, is designed to improve the packaging and delivery of vector DNA to suspension and adherent HEK 293 cell types to improve the production of recombinant adeno-associated viruses and lentiviral vectors.

- In April 2021, BOC Sciences announced the launch of two in vivo RNA transfection kits, namely siRNA in vivo transfection kits and mRNA in vivo transfection kits, suitable for in vivo transfection of siRNA and mRNA, respectively.

Global Transfection Reagent and Equipment Market Scope

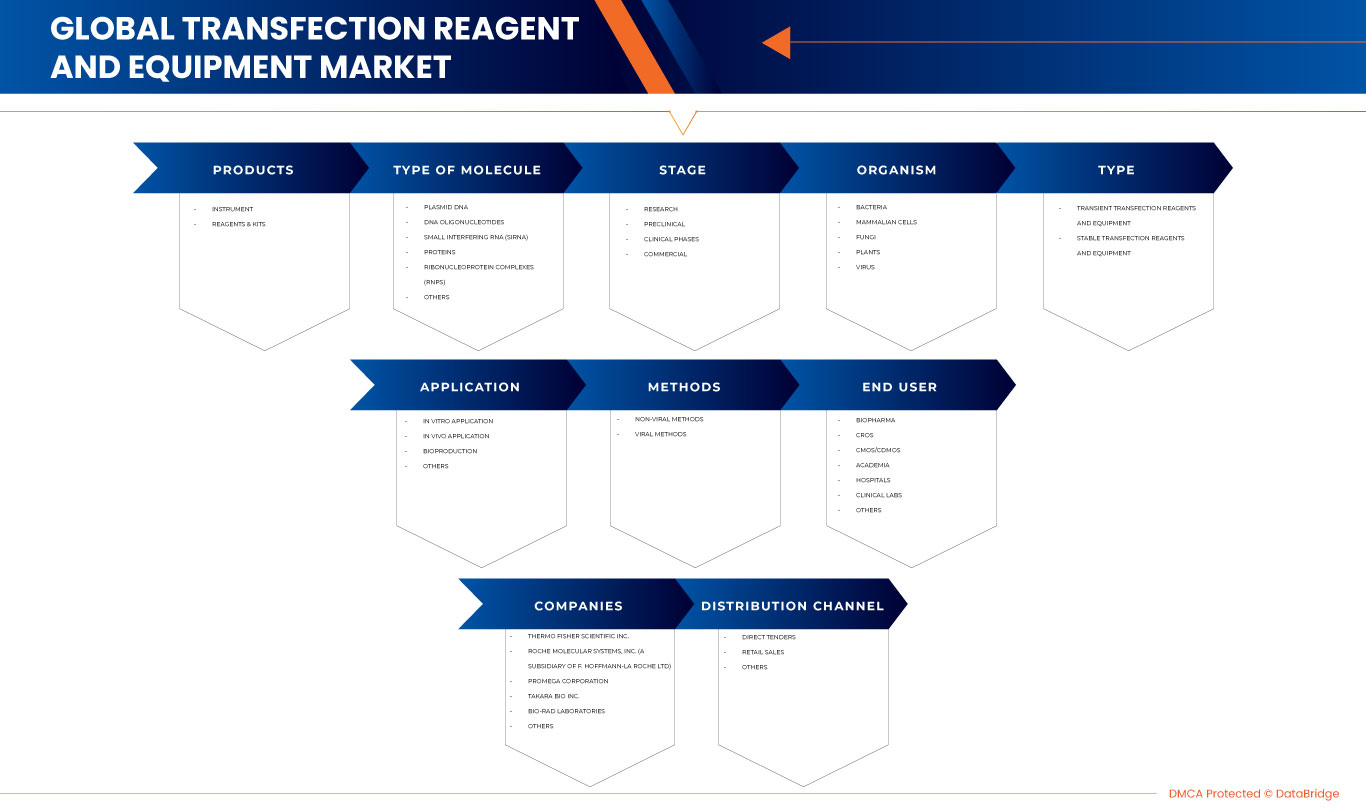

Global transfection Reagent and equipment market is segmented into nine notable segments such as products, stage, methods, type, types of molecule, application, end user, organism, and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

PRODUCTS

- INSTRUMENTS

- REAGENT & KITS

On the basis of products, the global transfection reagent and equipment market is segmented into instruments and reagent & kits.

STAGE

- RESEARCH

- PRECLINICAL

- CLINICAL PHASES

- COMMERCIAL

On the basis of stage, the global transfection reagent and equipment market is segmented into research, preclinical, clinical phases and commercial.

TYPE

- TRANSIENT TRANSFECTION REAGENT AND EQUIPMENT

- STABLE TRANSFECTION REAGENT AND EQUIPMENT

On the basis of type, the global transfection reagent and equipment market is segmented into transient transfection reagent and equipment and stable transfection reagent and equipment.

METHODS

- NON-VIRAL METHODS

- VIRAL METHODS

On the basis of methods, the global transfection reagent and equipment market is segmented into non-viral methods and viral methods.

TYPES OF MOLECULE

- PLASMID DNA

- DNA OLIGONUCLEOTIDES

- SMALL INTERFERING RNA (SIRNA)

- PROTEINS

- RIBONUCLEOPROTEIN COMPLEXES (RNPS)

- OTHERS

On the basis of types of molecule, the global transfection reagent and equipment market is segmented into plasmid DNA, DNA oligonucleotides, small interfering RNA (siRNA), proteins, ribonucleoprotein complexes (RNPs) and others.

ORGANISM

- BACTERIA

- MAMMALIAN CELLS

- FUNGI

- PLANTS

- VIRUS

On the basis of organism, the global transfection reagent and equipment market is segmented into bacteria, mammalian cells, fungi, plants and virus.

APPLICATION

- BY TYPE

- IN VITRO APPLICATION

- IN VIVO APPLICATION

- BIOPRODUCTION

- OTHERS

- BY INDUSTRY

- AGRICULTURE

- SYNTHETIC BIOLOGY

- OTHERS

On the basis of application, the global transfection reagent and equipment market is segmented by type into in vitro application, in vivo application, bioproduction, others and by industry into agriculture, synthetic biology, others.

END USER

- BIOPHARMA

- CROS

- CMOS/CDMOS

- ACADEMIA

- HOSPITALS

- CLINICAL LABS

- OTHERS

On the basis of end user, the global transfection reagent and equipment market is segmented into biopharma, CROs, CMOs/ CDMOs, academia, hospitals, clinical labs and others.

DISTRIBUTION CHANNEL

- DIRECT TENDER

- RETAIL SALES

- OTHERS

On the basis of distribution channel, the global transfection Reagent and equipment market is segmented into direct tender, retail sales and others.

Global Transfection Reagent and Equipment Market Regional Analysis/Insights

The global transfection reagent and equipment market is categorized into many notable segments such as geography, products, stages, methods, type, types of molecule, application, end user, organism, and distribution channel.

The countries covered in this market report are U.S., Canada, Mexico, Germany, France, Italy, U.K., Spain, Switzerland, Russia, Netherlands, Belgium, Turkey, and Rest of Europe, China, Japan, India, Australia, South Korea, Singapore, Thailand, Malaysia, Philippines, Indonesia, and Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, South Africa, Saudi Arabia, UAE, Israel, Egypt, and Rest of the Middle East and Africa.

In 2023, the North America region is dominating due to the presence of key market players in the largest consumer market with high GDP. U.S is expected to grow due to rise in the prevalence of chronic and rare diseases leading to increase in the use of transfection reagent and equipment.

A América do Norte está a dominar o mercado devido ao aumento do investimento em cuidados de saúde que deverá impulsionar o crescimento do mercado. Os EUA dominam a região da América do Norte devido à forte presença de atores importantes. A Alemanha domina a região da Europa devido à crescente procura por parte dos mercados emergentes e à expansão. A China domina a região Ásia-Pacífico devido à crescente inclinação dos clientes para processos tecnológicos avançados.

A secção do país do relatório também fornece fatores individuais de impacto no mercado e alterações na regulamentação do mercado interno que impactam as tendências atuais e futuras do mercado. Dados como novas vendas, vendas de reposição, demografia do país, atos regulamentares e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, são considerados a presença e disponibilidade de marcas globais e os desafios enfrentados devido à concorrência grande ou escassa de marcas locais e nacionais, e o impacto dos canais de vendas, ao mesmo tempo que se fornece uma análise de previsão dos dados do país .

Cenário competitivo e análise global da quota de mercado de reagentes e equipamentos de transfecção

O panorama competitivo do mercado global de reagentes e equipamentos de transfecção fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em I&D, novas iniciativas de mercado, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos, aprovações de produtos, largura e fôlego do produto, domínio de aplicação, tipo de produto linha de vida curva. Os dados acima fornecidos estão apenas relacionados com o foco da empresa no mercado global de reagentes e equipamentos de transfecção.

Alguns dos principais players que operam neste mercado são a Mirus Bio LLC., Promega Corporation, Polyplus Transfection, Bio-Rad Laboratories, Inc., Merck KGaA, Lonza, MaxCyte, Inc., Altogen Biosystems, SBS Genetech, FUJIFILM Irvine Scientific (A Subsidiária da FUJIFILM Holdings Corporation), Avanti Polar Lipids (uma subsidiária da Croda International Plc), PerkinElmer chemagen Technologie GmbH (uma subsidiária da PerkinElmer Inc.), Cytiva, Geno Technology Inc., EUA, R&D Systems, Inc., Takara Bio Inc. ., Thermofisher Scientific Inc., Roche Molecular Systems, Inc. (uma subsidiária da F. Hoffmann-La Roche Ltd), QIAGEN, OriGene Technologies, Inc., Applied Biological Materials Inc. Subsidiária da Danaher), Amyris, Codexis, Autolus, SignaGen Laboratories, Impossible Foods Inc., Genlantis Inc., Ginkgo Bioworks, Verve Therapeutics, Inc., Conagen, Inc., Poseida Therapeutics, Inc., e Twist Bioscience, entre outras.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TRANSIENT TRANSFECTION OF TRANSFECTION LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

5 INDUSTRY INSIGHTS:

6 GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET, REGULATIONS

6.1 EUROPEAN UNION REGULATORY SCENARIO

6.2 U.S. REGULATORY SCENARIO

6.3 JAPAN REGULATORY SCENARIO

6.4 CHINA REGULATORY SCENARIO

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISE IN THE PREVALENCE OF CHRONIC DISEASES

7.1.2 DEVELOPMENT OF SYNTHETIC BIOLOGY PRODUCTS

7.1.3 GROWING DEMAND FOR CHIMERIC GENES

7.1.4 LARGE-SCALE TRANSFECTIONS USED IN CLINICAL RESEARCH

7.1.5 UTILIZATION OF BIOPHARMACEUTICALS IN THE PRODUCTION OF PROTEINS

7.2 RESTRAINTS

7.2.1 HIGH COST OF TRANSFECTION PRODUCTS

7.2.2 SELECTIVE EFFECTIVENESS OF TRANSFECTION REAGENTS

7.2.3 CELL DAMAGE INDUCED BY TRANSFECTION PROCEDURE

7.3 OPPORTUNITIES

7.3.1 EXPLORATION OF EMERGING MARKET

7.3.2 STRATEGIC INITIATIVES BY MARKET PLAYERS

7.3.3 SURGING LEVEL OF INVESTMENT

7.4 CHALLENGES

7.4.1 LONG APPROVAL PROCEDURE

7.4.2 LACK OF SAFETY LEVEL LAB FOR VIRUS-ASSOCIATED TRANSFECTION

7.4.3 LACK OF TRAINED PROFESSIONALS

8 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY PRODUCTS

8.1 OVERVIEW

8.2 REAGENTS & KITS

8.3 INSTRUMENTS

9 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY STAGE

9.1 OVERVIEW

9.2 RESEARCH

9.3 PRECLINICAL

9.4 CLINICAL PHASES

9.5 COMMERCIAL

10 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY TYPE

10.1 OVERVIEW

10.2 TRANSIENT TRANSFECTION REAGENTS AND EQUIPMENT

10.3 STABLE TRANSECTION REAGENTS AND EQUIPMENT

11 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY METHODS

11.1 OVERVIEW

11.2 NON-VIRAL METHODS

11.3 VIRAL METHODS

12 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY TYPES OF MOLECULE

12.1 OVERVIEW

12.2 PLASMID DNA

12.3 SMALL INTERFERING RNA (SIRNA)

12.4 PROTEINS

12.5 DNA OLIGONUCLEOTIDES

12.6 RIBONUCLEOPROTEIN COMPLEXES (RNPS)

12.7 OTHERS

13 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY ORGANISM

13.1 OVERVIEW

13.2 MAMMALIAN CELLS

13.3 PLANTS

13.4 FUNGI

13.5 VIRUS

13.6 BACTERIA

14 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY APPLICATION

14.1 OVERVIEW

14.2 IN VITRO APPLICATION

14.2.1 IN VIVO APPLICATION

14.2.2 BIOPRODUCTION

14.2.3 OTHERS

14.2.4 SYNTHETIC BIOLOGY

14.2.5 AGRICULTURE

14.2.6 OTHERS

15 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY END USER

15.1 OVERVIEW

15.2 BIOPHARMA

15.3 CROS

15.4 CMOS/CDMOS

15.5 ACADEMIA

15.6 HOSPITALS

15.7 CLINICAL LABS

15.8 OTHERS

16 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 DIRECT TENDER

16.3 RETAIL SALES

16.4 OTHERS

17 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION

17.1 OVERVIEW

17.2 NORTH AMERICA

17.2.1 U.S.

17.2.2 CANADA

17.2.3 MEXICO

17.3 EUROPE

17.3.1 GERMANY

17.3.2 U.K.

17.3.3 FRANCE

17.3.4 ITALY

17.3.5 RUSSIA

17.3.6 SPAIN

17.3.7 TURKEY

17.3.8 NETHERLANDS

17.3.9 BELGIUM

17.3.10 SWITZERLAND

17.3.11 REST OF EUROPE

17.4 ASIA-PACIFIC

17.4.1 CHINA

17.4.2 JAPAN

17.4.3 INDIA

17.4.4 AUSTRALIA

17.4.5 SOUTH KOREA

17.4.6 SINGAPORE

17.4.7 THAILAND

17.4.8 MALAYSIA

17.4.9 INDONESIA

17.4.10 PHILIPPINES

17.4.11 REST OF ASIA-PACIFIC

17.5 SOUTH AMERICA

17.5.1 BRAZIL

17.5.2 ARGENTINA

17.5.3 REST OF SOUTH AMERICA

17.6 MIDDLE EAST AND AFRICA

17.6.1 SOUTH AFRICA

17.6.2 SAUDI ARABIA

17.6.3 U.A.E.

17.6.4 EGYPT

17.6.5 ISRAEL

17.6.6 REST OF MIDDLE EAST AND AFRICA

18 GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET, COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: GLOBAL

18.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

18.3 COMPANY SHARE ANALYSIS: EUROPE

18.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

19 SWOT ANALYSIS

20 COMPANY PROFILE

20.1 THERMO FISHER SCIENTIFIC INC.

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 COMPANY SHARE ANALYSIS

20.1.4 PRODUCT PORTFOLIO

20.1.5 RECENT DEVELOPMENT

20.2 ROCHE MOLECULAR SYSTEMS, INC. (A SUBSIDIARY OF F. HOFFMANN-LA ROCHE LTD)

20.2.1 COMPANY SNAPSHOT

20.2.2 REVENUE ANALYSIS

20.2.3 COMPANY SHARE ANALYSIS

20.2.4 PRODUCT PORTFOLIO

20.2.5 RECENT DEVELOPMENT

20.3 PROMEGA CORPORATION

20.3.1 COMPANY SNAPSHOT

20.3.2 COMPANY SHARE ANALYSIS

20.3.3 PRODUCT PORTFOLIO

20.3.4 RECENT DEVELOPMENT

20.4 TAKARA BIO INC.

20.4.1 COMPANY SNAPSHOT

20.4.2 REVENUE ANALYSIS

20.4.3 COMPANY SHARE ANALYSIS

20.4.4 PRODUCT PORTFOLIO

20.4.5 RECENT DEVELOPMENT

20.5 BIO-RAD LABORATORIES, INC.

20.5.1 COMPANY SNAPSHOT

20.5.2 REVENUE ANANLYSIS

20.5.3 COMPANY SHARE ANALYSIS

20.5.4 PRODUCT PORTFOLIO

20.5.5 RECENT DEVELOPMENT

20.6 ALTOGEN BIOSYSTEMS

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 RECENT DEVELOPMENT

20.7 APPLIED BIOLOGICAL MATERIALS INC. (ABM)

20.7.1 COMPANY SNAPSHOT

20.7.2 PRODUCT PORTFOLIO

20.7.3 RECENT DEVELOPMENT

20.8 AVANTI POLAR LIPIDS (A SUBSIDIARY OF CRODA INTERNATIONAL PLC)

20.8.1 COMPANY SNAPSHOT

20.8.2 REVENUE ANALYSIS

20.8.3 PRODUCT PORTFOLIO

20.8.4 RECENT DEVELOPMENT

20.9 BECKMAN COULTER, INC. (A SUBSIDIARY OF DANAHER)

20.9.1 COMPANY SNAPSHOT

20.9.2 PRODUCT PORTFOLIO

20.9.3 RECENT DEVELOPMENT

20.1 CYTIVA

20.10.1 COMPANY SNAPSHOT

20.10.2 PRODUCT PORTFOLIO

20.10.3 RECENT DEVELOPMENT

20.11 FUJIFILM IRVINE SCIENTIFIC (A SUBSIDIARY OF FUJIFILM HOLDINGS CORPORATION)

20.11.1 COMPANY SNAPSHOT

20.11.2 REVENUE ANANLYSIS

20.11.3 PRODUCT PORTFOLIO

20.11.4 RECENT DEVELOPMENT

20.12 GENLANTIS INC.

20.12.1 COMPANY SNAPSHOT

20.12.2 PRODUCT PORTFOLIO

20.12.3 RECENT DEVELOPMENT

20.13 GENO TECHNOLOGY INC., USA

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 RECENT DEVELOPMENT

20.14 GINKGO BIOWORKS

20.14.1 COMPANY SNAPSHOT

20.14.2 PRODUCT PORTFOLIO

20.14.3 RECENT DEVELOPMENTS

20.15 LONZA

20.15.1 COMPANY SNAPSHOT

20.15.2 REVENUE ANANLYSIS

20.15.3 PRODUCT PORTFOLIO

20.15.4 RECENT DEVELOPMENT

20.16 MAXCYTE, INC.

20.16.1 COMPANY SNAPSHOT

20.16.2 REVENUE ANALYSIS

20.16.3 PRODUCT PORTFOLIO

20.16.4 RECENT DEVELOPMENT

20.17 MERCK KGAA

20.17.1 COMPANY SNAPSHOT

20.17.2 REVENUE ANALYSIS

20.17.3 PRODUCT PORTFOLIO

20.17.4 RECENT DEVELOPMENT

20.18 MIRUS BIO LLC.

20.18.1 COMPANY SNAPSHOT

20.18.2 PRODUCT PORTFOLIO

20.18.3 RECENT DEVELOPMENT

20.19 ORIGENE TECHNOLOGIES, INC.

20.19.1 COMPANY SNAPSHOT

20.19.2 PRODUCT PORTFOLIO

20.19.3 RECENT DEVELOPMENT

20.2 PERKINELMER CHEMAGEN TECHNOLOGIE GMBH (A SUBSIDIARY OF PERKINELMER INC.)

20.20.1 COMPANY SNAPSHOT

20.20.2 REVENUE ANALYSIS

20.20.3 PRODUCT PORTFOLIO

20.20.4 RECENT DEVELOPMENT

20.21 POLYPLUS TRANSFECTION

20.21.1 COMPANY SNAPSHOT

20.21.2 PRODUCT PORTFOLIO

20.21.3 RECENT DEVELOPMENT

20.22 R&D SYSTEMS, INC.

20.22.1 COMPANY SNAPSHOT

20.22.2 PRODUCT PORTFOLIO

20.22.3 RECENT DEVELOPMENT

20.23 SBS GENETECH

20.23.1 COMPANY SNAPSHOT

20.23.2 PRODUCT PORTFOLIO

20.23.3 RECENT DEVELOPMENT

20.24 SIGNAGEN LABORATORIES

20.24.1 COMPANY SNAPSHOT

20.24.2 PRODUCT PORTFOLIO

20.24.3 RECENT DEVELOPMENT

21 QUESTIONNAIRE

22 RELATED REPORTS

Lista de Tabela

TABLE 1 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY PRODUCTS, 2021-2030 (USD THOUSAND)

TABLE 2 GLOBAL REAGENT AND KITS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 3 GLOBAL INSTRUMENTS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 4 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY STAGE, 2021-2030 (USD THOUSAND)

TABLE 5 GLOBAL RESEARCH IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 GLOBAL PRECLINICAL IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 GLOBAL CLINICAL PHASES IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 GLOBAL COMMERCIAL IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 10 GLOBAL TRANSIENT TRANSFECTION REAGENTS AND EQUIPMENT IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 GLOBAL STABLE TRANSFECTION REAGENTS AND EQUIPMENT IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET, BY METHODS, 2021-2030 (USD THOUSAND)

TABLE 13 GLOBAL NON-VIRAL METHODS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 GLOBAL VIRAL METHODS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY TYPES OF MOLECULE, 2021-2030 (USD THOUSAND)

TABLE 16 GLOBAL PLASMID DNA IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 GLOBAL SMALL INTERFERING RNA (SIRNA) IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 GLOBAL PROTEINS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 GLOBAL DNA OLIGONUCLEOTIDES IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 GLOBAL RIBONUCLEOPROTEIN COMPLEXES (RNPS) IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 GLOBAL OTHERS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY ORGANISM, 2021-2030 (USD THOUSAND)

TABLE 23 GLOBAL MAMMALIAN CELLS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 GLOBAL PLANTS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 GLOBAL FUNGI IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 GLOBAL VIRUS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 GLOBAL BACTERIA IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET , BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 29 GLOBAL IN VITRO APPLICATION IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 30 GLOBAL IN VIVO APPLICATION IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 31 GLOBAL BIOPRODUCTION IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 GLOBAL OTHERS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 33 GLOBAL APPLICATION IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY INDUSTRY, 2021-2030 (USD THOUSAND)

TABLE 34 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 35 GLOBAL BIOPHARMA IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 36 GLOBAL CROS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 37 GLOBAL CMOS/CDMOS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 38 GLOBAL ACADEMIA IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 39 GLOBAL HOSPITALS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 40 GLOBAL CLINICAL LABS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 41 GLOBAL OTHERS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 42 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 43 GLOBAL DIRECT TENDER IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 44 GLOBAL RETAIL SALES IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 45 GLOBAL OTHERS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

Lista de Figura

FIGURE 1 GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET: SEGMENTATION

FIGURE 2 GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET: MULTIVARIATE MODELLING

FIGURE 7 GLOBAL TRANSFECTION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET: SEGMENTATION

FIGURE 12 NORTH AMERICA IS EXPECTED TO DOMINATE AND ASIA-PACIFIC IS GROWING AT THE FASTEST PACE IN THE GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET IN THE FORECAST PERIOD OF 2022 TO 2030

FIGURE 13 INCREASING OCCURENCE OF CHRONIC DISEASES AND DEVELOPMENT OF SYNTHETIC BIOLOGY PRODUCTS IS DRIVING THE GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET IN THE FORECAST PERIOD OF 2022 TO 2030

FIGURE 14 THE TRANSIENT TRANSFECTION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET IN 2022 & 2030

FIGURE 15 NORTH AMERICA IS THE FASTEST GROWING MARKET IN THE GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET IN THE FORECAST PERIOD OF 2022 TO 2030

FIGURE 16 APPROVAL PROCESS FOR GENE THERAPY IN CHINA

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET

FIGURE 18 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY PRODUCTS, 2023

FIGURE 19 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY PRODUCTS, 2023-2030 (USD THOUSAND)

FIGURE 20 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY PRODUCTS, CAGR (2023-2030)

FIGURE 21 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY PRODUCTS, LIFELINE CURVE

FIGURE 22 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY STAGE, 2023

FIGURE 23 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY STAGE, 2023-2030 (USD THOUSAND)

FIGURE 24 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY STAGE, CAGR (2023-2030)

FIGURE 25 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY STAGE, LIFELINE CURVE

FIGURE 26 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY TYPE, 2023

FIGURE 27 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY TYPE, 2023-2030 (USD THOUSAND)

FIGURE 28 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 29 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY TYPE, LIFELINE CURVE

FIGURE 30 GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET: BY METHODS, 2022

FIGURE 31 GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET: BY METHODS, 2023-2030 (USD THOUSAND)

FIGURE 32 GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET: BY METHODS, CAGR (2023-2030)

FIGURE 33 GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET: BY METHODS, LIFELINE CURVE

FIGURE 34 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY TYPES OF MOLECULE, 2022

FIGURE 35 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY TYPES OF MOLECULE, 2023-2030 (USD THOUSAND)

FIGURE 36 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY TYPES OF MOLECULE, CAGR (2023-2030)

FIGURE 37 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY TYPES OF MOLECULE, LIFELINE CURVE

FIGURE 38 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY ORGANISM, 2022

FIGURE 39 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY ORGANISM, 2023-2030 (USD THOUSAND)

FIGURE 40 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY ORGANISM, CAGR (2023-2030)

FIGURE 41 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY ORGANISM, LIFELINE CURVE

FIGURE 42 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET BY APPLICATION, 2022

FIGURE 43 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET BY APPLICATION, 2023-2030 (USD THOUSAND)

FIGURE 44 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET BY APPLICATION, CAGR (2023-2030)

FIGURE 45 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET BY APPLICATION, LIFELINE CURVE

FIGURE 46 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY END USER, 2022

FIGURE 47 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET : BY END USER, 2023-2030 (USD THOUSAND)

FIGURE 48 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET : BY END USER, CAGR (2023-2030)

FIGURE 49 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET : BY END USER, LIFELINE CURVE

FIGURE 50 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 51 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD THOUSAND)

FIGURE 52 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 53 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 54 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: SNAPSHOT (2022)

FIGURE 55 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2022)

FIGURE 56 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 57 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2022 & 2030)

FIGURE 58 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY PRODUCTS (2023-2030)

FIGURE 59 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: SNAPSHOT (2022)

FIGURE 60 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2022)

FIGURE 61 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 62 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2022 & 2030)

FIGURE 63 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY PRODUCTS (2023-2030)

FIGURE 64 EUROPE TRANSFECTION REAGENT AND EQUIPMENT MARKET: SNAPSHOT (2022)

FIGURE 65 EUROPE TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2022)

FIGURE 66 EUROPE TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 67 EUROPE TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (202 & 2030)

FIGURE 68 EUROPE TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY PRODUCTS (2023-2030)

FIGURE 69 ASIA-PACIFIC TRANSFECTION REAGENT AND EQUIPMENT MARKET: SNAPSHOT (2022)

FIGURE 70 ASIA-PACIFIC TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2022)

FIGURE 71 ASIA-PACIFIC TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 72 ASIA-PACIFIC TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2022 & 2030)

FIGURE 73 ASIA-PACIFIC TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY PRODUCTS (2023-2030)

FIGURE 74 SOUTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: SNAPSHOT (2022)

FIGURE 75 SOUTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2022)

FIGURE 76 SOUTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 77 SOUTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2022 & 2030)

FIGURE 78 SOUTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY PRODUCTS (2023-2030)

FIGURE 79 MIDDLE EAST AND AFRICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: SNAPSHOT (2022)

FIGURE 80 MIDDLE EAST AND AFRICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2022)

FIGURE 81 MIDDLE EAST AND AFRICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 82 MIDDLE EAST AND AFRICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2022 & 2030)

FIGURE 83 MIDDLE EAST AND AFRICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY PRODUCTS (2023-2030)

FIGURE 84 GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET: COMPANY SHARE 2022 (%)

FIGURE 85 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: COMPANY SHARE 2022 (%)

FIGURE 86 EUROPE TRANSFECTION REAGENTS AND EQUIPMENT MARKET: COMPANY SHARE 2022 (%)

FIGURE 87 ASIA-PACIFIC TRANSFECTION REAGENTS AND EQUIPMENT MARKET: COMPANY SHARE 2022 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.