Mercado global de solventes, por categoria (solventes oxigenados, solventes hidrocarbonetos, solventes halogenados, outros), fonte (convencional, de base biológica), aplicação (tintas e revestimentos, produtos farmacêuticos, adesivos, tintas de impressão , cuidados pessoais, fabrico de polímeros, produtos químicos agrícolas, Limpeza de metais, outros) - Tendências e previsões do setor até 2030.

Análise e dimensão do mercado de solventes

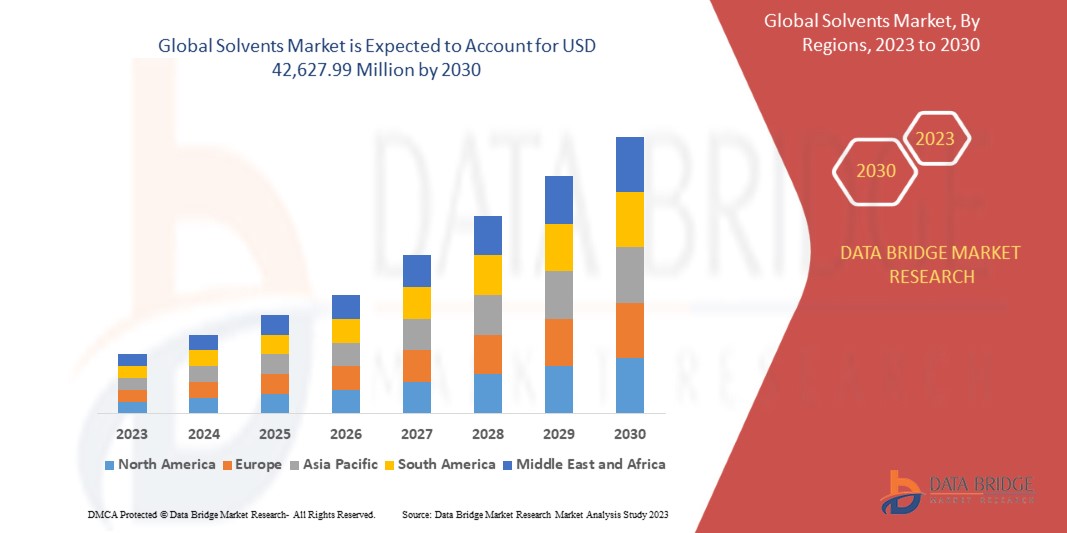

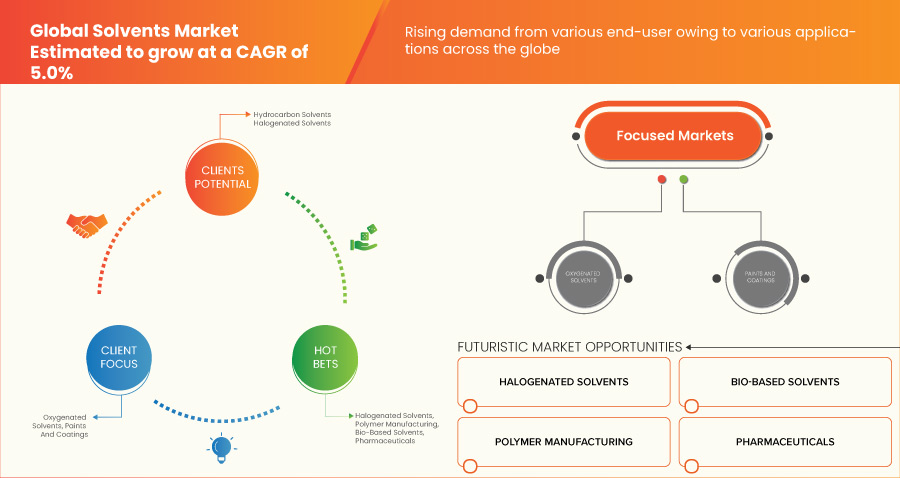

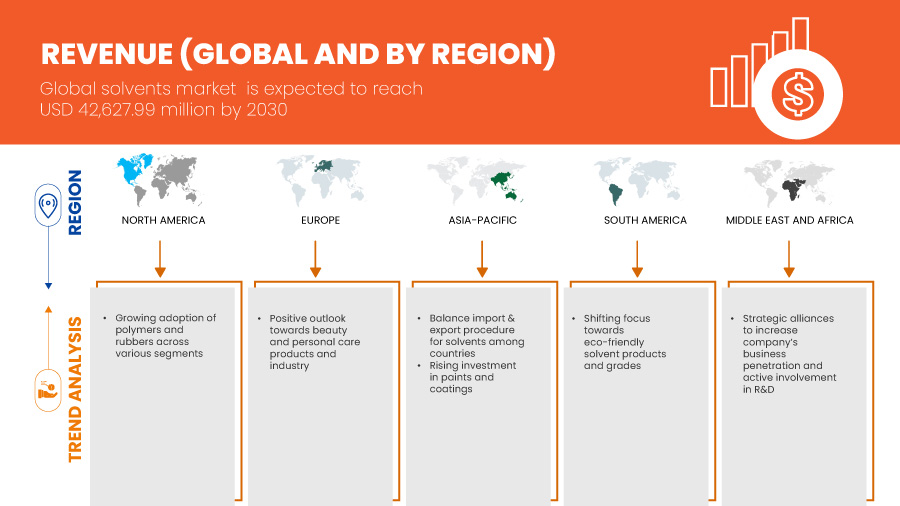

O mercado global de solventes deverá crescer significativamente no período previsto de 2023 a 2030. A Data Bridge Market Research analisa que o mercado está a crescer com um CAGR de 5,0% no período previsto de 2023 a 2030 e deverá atingir os US$ 42.627,99 milhões. até 2030. O principal fator que impulsiona o crescimento do mercado de solventes é a crescente utilização de tintas de impressão para diferentes aplicações industriais e a perspetiva positiva em relação à indústria de produtos de beleza e de cuidados pessoais.

Os solventes são fluidos sintéticos fluorados de baixo peso molecular. Não são tóxicos nem inflamáveis no seu estado natural. Um solvente pode ser utilizado a temperaturas severas que variam de 80°C a 200°C. A sua estrutura molecular pode ser linear, ramificada ou uma combinação de ambas, dependendo da aplicação. Os solventes possuem diversas propriedades, tais como resistência à temperatura, lubricidade, resistência ao desgaste e volatilidade dos fluidos.

O relatório do mercado global de solventes fornece detalhes sobre a quota de mercado, novos desenvolvimentos e o impacto dos participantes do mercado nacional e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações do mercado, aprovações de produtos, decisões estratégicas, lançamentos de produtos, expansões geográficas, e inovações tecnológicas no mercado. Para compreender a análise e o cenário de mercado, contacte-nos para obter um briefing de analista. A nossa equipa irá ajudá-lo a criar uma solução de impacto na receita para atingir a sua meta desejada.

|

Métrica de Reporte |

Detalhes |

|

Período de previsão |

2023 a 2030 |

|

Ano base |

2022 |

|

Anos históricos |

2021 (Personalizável para 2015 - 2020) |

|

Unidades quantitativas |

Receita em milhões de dólares americanos, volumes em quilotoneladas |

|

Segmentos abrangidos |

Categoria (Solventes Oxigenados, Solventes de Hidrocarbonetos, Solventes Halogenados, Outros), Fonte (Convencional, Biobaseado), Aplicação ( Tintas e Revestimentos , Produtos Farmacêuticos, Adesivos, Tintas de Impressão, Cuidado Pessoal, Fabrico de Polímeros, Produtos Químicos Agrícolas, Limpeza de Metais, Outros) |

|

Países abrangidos |

EUA, Canadá, México, Brasil, Argentina, Resto da América do Sul, Alemanha, França, Itália, Holanda, Reino Unido, Rússia, Espanha, Turquia, Suíça, Bélgica, Resto da Europa, China, Índia, Japão, Coreia do Sul , Singapura, Tailândia, Indonésia, Malásia, Filipinas, Austrália e Nova Zelândia, Resto da Ásia-Pacífico, África do Sul, Arábia Saudita, Egito, Emirados Árabes Unidos, Israel, Resto do Médio Oriente e África |

|

Atores do mercado abrangidos |

Arkema (França), INVISTA (uma subsidiária da Koch Industries, Inc.) (EUA), Ashland (EUA), Bharat Petroleum Corporation Limited (Índia), Huntsman International LLC (EUA), Solvay (Bélgica), ADM (EUA), Shell Global (Holanda), BP plc (Reino Unido), Eastman Chemical Company (EUA), INEOS GROUP HOLDINGS SA (Reino Unido), BASF SE (Alemanha), Celanese Corporation (EUA), Cargill, Incorporated (EUA), Reliance Industries Limited ( Índia), Honeywell International Inc. (EUA), LyondellBasell Industries Holding BV (Holanda), Exxon Mobil Corporation (EUA), Monument Chemical (EUA), Dow (EUA), Olin Corporation (EUA), entre outras. |

Definição de Mercado

Os solventes são normalmente substâncias líquidas com capacidade de dissolver ou distribuir uma vasta gama de compostos, incluindo substâncias sólidas, líquidas e gasosas. São amplamente utilizados numa variedade de indústrias, incluindo produtos químicos, farmacêuticos, tintas e revestimentos, adesivos, produtos de limpeza e muitos mais. O mercado de solventes inclui uma variedade de tipos de solventes, tais como hidrocarbonetos , solventes oxigenados, solventes halogenados e outros solventes especializados.

Dinâmica do mercado global de solventes

MOTORISTAS

- Crescente procura de solventes na indústria de tintas e revestimentos

Os solventes desempenham um papel importante como transportadores de revestimentos de superfície, como tintas, vernizes e adesivos. Os produtos químicos usados em tintas e revestimentos dependem de solventes, pois eles podem dissolver e dispersar componentes empregados nas formulações dos revestimentos. Garante ainda a qualidade do produto final obtido e o desempenho ideal. Os solventes atuam como componentes essenciais nas formulações de tintas e revestimentos na indústria da construção, uma vez que podem dissolver pigmentos, aditivos e aglutinantes para formar revestimentos de alto desempenho. São utilizados vários tipos de solventes dependendo dos requisitos dos revestimentos, como o tempo de secagem, a qualidade do filme e a compatibilidade com outros componentes. A seleção de solventes, como solventes de hidrocarbonetos, cetonas , ésteres, álcoois e éteres de glicol, depende de fatores como a capacidade de solvatação, polaridade e compatibilidade com outros componentes da formulação. O benzeno , o tolueno e os xilenos são solventes de hidrocarbonetos aromáticos utilizados em tintas à base de esmalte, enquanto as tintas à base de laca necessitam de solventes mais fortes para uma secagem mais rápida.

Por exemplo,

- Em abril de 2022, de acordo com os dados de construção da Biltrax, até 2022, o setor da construção indiano deverá crescer a uma taxa de crescimento anual composta (CAGR) de 15,7%, atingindo um valor de 738,5 dólares biliões. A expansão do setor da construção criará oportunidades para os fabricantes e fornecedores de solventes à escala global

- Em março de 2022, de acordo com o GROUPE BERKEM, o Groupe Berkem, um player líder em produtos químicos de origem biológica, anunciou o lançamento da sua linha de resinas alquídicas 100% de origem biológica dirigida ao mercado de tintas de construção. Este desenvolvimento inovador envolve a transformação de produtos existentes em soluções sustentáveis, utilizando óleos de origem biológica, subprodutos da química orgânica e um solvente 100% de origem biológica. Isto contribui para o mercado global de solventes ao fornecer soluções ecológicas na indústria de tintas para a construção.

Para além das tintas e revestimentos, os solventes encontram aplicações em adesivos para materiais de ligação. Os adesivos são de diferentes tipos, como policloropreno, poliuretano , acrilato e adesivos à base de silicone. Além disso, os solventes são utilizados em agentes de limpeza e desengordurantes, removedores de tinta e vernizes. À medida que o sector da construção e automóvel cresce em todo o mundo devido à urbanização, ao desenvolvimento de infra-estruturas, ao aumento das actividades de construção e à crescente procura de automóveis. O crescimento da indústria da construção e automóvel aumenta ainda mais a procura de tintas, revestimentos e adesivos e, consequentemente, a procura de solventes.

- Aumento da utilização de tintas de impressão para diferentes aplicações industriais

Os solventes desempenham um papel crucial na indústria gráfica, uma vez que oferecem solvência às tintas para dissolver pigmentos e veículos, como veículos de glicol solúveis em água, numa solução. Isto é feito para que a tinta possa ser facilmente aplicada no papel ou em qualquer outro substrato. As tintas de impressão necessitam de solventes através dos quais seja possível obter uma distribuição adequada da cor e da consistência. Os solventes com elevado poder de solvência podem produzir impressões vibrantes e duradouras. Os solventes com uma gama de ebulição estreita evaporam rapidamente após a aplicação da tinta, o que proporciona uma secagem eficaz e adequada da tinta nos substratos aplicados.

Por exemplo,

- Em março de 2022, de acordo com a Gardner Business Media, Inc., a Sun Chemical lançou as tintas à base de solvente SunSpectro SolvaWash, concebidas para aumentar as taxas de reciclagem de garrafas PET. Estas tintas de rotogravura e flexoimpressíveis laváveis/destintáveis são desenvolvidas especificamente para a impressão inversa de mangas retráteis PET cristalizáveis. As tintas à base de solventes SolvaWash da Sun Chemical irão apoiar o mercado global de solventes, permitindo maiores taxas de reciclagem para garrafas PET.

- Em julho de 2021, de acordo com o Fint Group, a Flint Group Packaging Inks lançou uma nova linha de tintas e revestimentos à base de solventes, chamada ONECode, concebida especificamente para os conversores de embalagens flexíveis europeus. Inclui seis novas marcas, que disponibilizam sistemas de tintas para impressão flexográfica (VertixCode), impressão em rotogravura (MatrixCode), tintas de dupla finalidade (HelixCode), soluções sustentáveis (ZenCode), vernizes e primários de sobreimpressão (NexisCode) e aditivos ( AdmixCode). Isto beneficiará o mercado global de solventes ao simplificar o processo de impressão para os conversores europeus de embalagens flexíveis.

A aplicação de solventes em tintas de impressão é amplamente realizada em diferentes aplicações, tais como impressão, embalagem, impressão de garrafas e impressão de plástico, entre outras. A indústria de embalagens desempenha um papel significativo no aumento da procura de solventes de tinta para aplicações de impressão. Houve um aumento da procura de embalagens flexíveis devido à sua natureza personalizável, baixo custo e propriedades leves. Estas embalagens flexíveis são utilizadas em vários setores, desde os bens de consumo à saúde, aumentando assim a procura de solventes durante o período previsto. Espera-se também que o crescimento da indústria alimentar e das bebidas aumente a procura de embalagens, o que impulsionará ainda mais a procura de tintas de impressão. Os solventes de tinta ajudam a atingir a qualidade de impressão e a durabilidade necessárias para os materiais de embalagem utilizados no setor alimentar e das bebidas. No futuro, a procura de tintas de impressão de alta qualidade aumentará para diferentes aplicações numa vasta gama de setores, tais como soluções de embalagem para alimentos e bebidas, bens de consumo e aplicações na área da saúde, impulsionando assim o mercado global de solventes.

- Perspetiva positiva em relação à indústria de produtos de beleza e cuidados pessoais

O setor dos produtos de beleza e de higiene pessoal está a crescer a um ritmo significativo devido a fatores como a crescente consciencialização sobre os cuidados pessoais e a procura de produtos de beleza e bem-estar. Além disso, a evolução das tendências de beleza e a mudança nas preferências dos consumidores devido à presença das redes sociais contribuem para o crescimento do setor da beleza e dos cuidados pessoais.

Por exemplo,

- De acordo com a The Cosmetic, Toiletry, and Perfumery Association, o mercado europeu de cosméticos atingiu um valor de 92,66 milhões de dólares a preço de venda a retalho (RSP) em 2022. Isto proporciona um impulso ao mercado global de solventes, indicando a contínua expansão e força da indústria cosmética na Europa

- De acordo com a Cosmetics Europe, a Europa é um mercado líder em cosméticos e produtos de higiene pessoal, com um valor estimado de vendas a retalho de 92,66 mil milhões de dólares em 2022. Entre os países europeus, a Alemanha tem o maior tamanho de mercado, avaliado em 15,06 mil milhões de dólares

Os solventes são utilizados principalmente para dissolver ingredientes ativos que são hidrófobos e são utilizados em formulações de cosméticos e cuidados com a pele. Os solventes melhoram a estabilidade, a textura e a absorção dos produtos de beleza e de higiene pessoal. Solventes como o butilenoglicol, propilenoglicol , álcool isopropílico e álcool etílico são amplamente utilizados em produtos para o cuidado da pele, cosméticos, cuidados capilares e fragrâncias. Os solventes atuam também como humectantes, emolientes e controladores de viscosidade. Ajudam na hidratação e humectação da pele, melhorando a textura e estabilizando as formulações. Além disso, os fabricantes também estão focados em fabricar solventes que tenham um maior desempenho, melhor compatibilidade com diferentes ingredientes e perfis de segurança. Desta forma, prevê-se que a procura de solventes cresça no período previsto, à medida que o setor da beleza e dos cuidados pessoais continua a expandir-se, impulsionando ainda mais o mercado global de solventes.

OPORTUNIDADES

- Mudar o foco dos fabricantes para solventes ecológicos

Nos últimos anos, tem-se assistido a uma mudança significativa de utilizadores finais para solventes ecológicos, também chamados de biossolventes ou solventes verdes. A maioria destes solventes é derivada do processamento de culturas agrícolas. Uma vez que os solventes derivados de produtos petroquímicos contribuem para as emissões de compostos orgânicos voláteis, têm efeitos secundários graves no ambiente. Estes solventes não são cancerígenos nem corrosivos, o que os torna seguros para manuseamento e reduz os riscos para os trabalhadores.

Por exemplo,

- Em novembro de 2021, de acordo com a Woodcote Media Limited, a Celtic Renewables, uma inovadora em tecnologia limpa, anunciou uma parceria com a Caldic para lançar a primeira unidade química sustentável da Escócia em Grangemouth. A tecnologia patenteada de baixo carbono da Celtic Renewables permite a conversão de material biológico indesejado em produtos químicos renováveis, biocombustíveis e outros produtos valiosos. Este desenvolvimento irá apoiar os clientes da Caldic na sua jornada de sustentabilidade, fornecendo-lhes biossolventes de alta qualidade com uma pegada de carbono significativamente mais baixa

- Em fevereiro de 2023, de acordo com a LUMITOS AG, a Clariter e a TotalEnergies Fluids lançaram os primeiros solventes ultrapuros sustentáveis feitos a partir de resíduos plásticos. Esta tecnologia inovadora, que resultou de uma colaboração de 18 meses, combina o inovador processo de reciclagem da Clariter com a tecnologia de hidrodesaromatização da TotalEnergies Fluids. Os solventes resultantes cumprem os mais elevados padrões de pureza exigidos por indústrias exigentes, como a farmacêutica e a cosmética.

O lactato de etilo é um dos solventes verdes derivados do processamento do milho e apresenta vantagens como a biodegradabilidade quando comparado com os solventes convencionais. São também utilizados em aplicações como decapantes de tintas e remoção de gorduras, óleos, adesivos e combustíveis sólidos de diversas superfícies metálicas. Existem mais esforços contínuos de investigação e desenvolvimento por parte dos fabricantes para melhorar o desempenho e a variedade de solventes ecológicos.

- Imenso potencial no sector das energias renováveis

Com o aumento da procura por fontes de energia mais limpas e sustentáveis, o setor das energias renováveis tem vindo a registar um crescimento significativo nos últimos anos. Os sistemas de painéis solares e turbinas eólicas, componentes essenciais da geração de energia renovável, requerem semicondutores para uma conversão e controlo de energia eficazes.

Por exemplo,

- Em abril de 2023, de acordo com a Cision US Inc., a Lowe's fez um avanço recente nas energias renováveis ao anunciar a instalação de painéis solares em telhados de 174 das suas lojas e centros de distribuição nos EUA. Espera-se que os painéis solares, uma vez concluídos, forneçam aproximadamente 90% do uso de energia em cada local. A Lowe's estabeleceu uma parceria com a DSD Renewables, a Greenskies Clean Focus e a Infiniti Energy para gerir estas instalações na Califórnia, Illinois e Nova Jersey.

- Em dezembro de 2022, de acordo com a HT Digital Streams Ltd, a Jindal Stainless estabeleceu uma parceria com a ReNew Power, a maior empresa de energia renovável da Índia, para estabelecer um projeto de energia renovável de 300 MW. Este projeto empregará uma combinação de tecnologias solar e eólica e estima-se que gere 700 milhões de unidades de eletricidade anualmente.

Os solventes e as combinações de solventes são amplamente utilizados na indústria de semicondutores para diversos fins, como a limpeza de equipamentos, a secagem de wafers e a deposição ou remoção de substratos. Os solventes de grau semicondutor têm um papel importante no fabrico de semicondutores. São concebidos para a indústria de semicondutores e indústrias eletrónicas, que exigem um baixo nível de impurezas. O álcool isopropílico e a acetona estão entre os solventes de limpeza mais populares na indústria de semicondutores. Os fabricantes de solventes podem, portanto, investir em atividades de investigação e desenvolvimento para o desenvolvimento de novos solventes, incluindo solventes ecológicos que satisfaçam os requisitos do fabrico de semicondutores. Tais medidas ajudarão na expansão dos sistemas de energia renovável em todo o mundo, oferecendo assim uma vasta gama de oportunidades para o crescimento do mercado global de solventes.

RESTRIÇÕES/DESAFIOS

- Preocupações com a saúde e segurança relacionadas com o uso de solventes

Os solventes são utilizados para diversas aplicações para dissolver ou diluir componentes. Os solventes utilizados em produtos de construção, como tintas, decapantes e diluentes, representam potenciais riscos para a saúde dos indivíduos a eles expostos. Solventes como o diclorometano, o tolueno e o acetato de etilo influenciam a saúde humana de diferentes formas, como o contacto com a pele, a ingestão, a inalação e o contacto com os olhos. Durante a aplicação destes produtos ocorre a respiração, o que provoca efeitos secundários como dores de cabeça, náuseas e irritação nos olhos, pele, pulmões e pele. Além disso, as exposições prolongadas a estes solventes resultam em problemas de saúde, como dermatites, e danos em partes do corpo, como os olhos, os rins, os pulmões, o sistema nervoso e a pele. Doses elevadas de solventes podem mesmo levar à inconsciência e à morte, especialmente no caso de exposição ocupacional.

Por exemplo,

- Em maio de 2023, de acordo com o HealthNews, um estudo publicado sugere uma possível ligação entre o solvente químico tetracloroetileno (TCE) e a doença de Parkinson. A investigação reviu vários estudos que examinaram os efeitos da exposição prolongada ao TCE, que já foi amplamente utilizado em setores como a saúde, a limpeza a seco e a indústria transformadora. O estudo encontrou evidências de que a exposição ao TCE pode causar neuroinflamação, perda de neurónios dopaminérgicos e alterações nas proteínas cerebrais associadas à doença de Parkinson.

Tais preocupações com a saúde e a segurança relacionadas com os solventes levarão à redução da procura de produtos que contenham solventes. Estes setores, como as tintas, os revestimentos e os adesivos, também podem enfrentar desafios significativos, restringindo assim o crescimento do mercado global de solventes.

- Problemas no transporte e armazenamento de solventes

Os solventes são utilizados em vários setores, como produtos farmacêuticos, tintas, agroquímicos e muitos outros. A maioria dos solventes é inflamável e requer um manuseamento e armazenamento cuidadosos. Se não forem geridos adequadamente, podem levar a consequências graves, incluindo acidentes de trabalho, danos materiais e poluição ambiental. Devido a estes riscos, há necessidade de regulamentos de segurança que sejam implementados no transporte e armazenamento de solventes. Os solventes libertam também gases que podem causar problemas de saúde e riscos aos trabalhadores. O armazenamento e o transporte inadequados de solventes podem ter efeitos graves no ambiente. Os solventes, se derramados, podem contaminar o solo e as fontes de água, o que representa uma ameaça adicional para os ecossistemas e pode causar danos à vida selvagem.

Existem várias regulamentações, como a rotulagem adequada, as condições de armazenamento, a segregação, a ventilação e a identificação no que diz respeito ao armazenamento e transporte de solventes. Se tais regulamentos forem ignorados, podem causar muitos danos no local onde ocorre o derrame de solventes. O transporte de produtos químicos, como os solventes, traz consigo diferentes riscos e desafios. Se os solventes forem rotulados incorretamente, os produtos químicos errados poderão ser transportados e armazenados. Além disso, factores como práticas de armazenamento inadequadas, trabalhadores exaustos, mau funcionamento de equipamentos e catástrofes naturais ou provocadas pelo homem podem contribuir para acidentes de transporte que podem ter efeitos prejudiciais. Os desafios no transporte e armazenamento de solventes têm um impacto direto nos fabricantes de solventes. Os incidentes resultantes de transporte ou armazenamento inadequados podem perturbar a cadeia de abastecimento, levando a atrasos, perda de confiança dos clientes e potenciais perdas financeiras, desafiando assim o crescimento do mercado global de solventes no período previsto.

Desenvolvimento recente

- Em junho de 2023, a Bharat Petroleum Corporation Limited (BPCL) foi reconhecida nos prestigiados FIPI Oil & Gas Awards 2022 ao garantir cinco cobiçados prémios. Os prémios foram entregues por Shri. Hardeep Singh Puri, Excelentíssimo Ministro do Petróleo e Gás Natural e Habitação e Desenvolvimento Urbano, Governo da Índia, numa grande cerimónia realizada recentemente

- Em agosto de 2022, a Eastman foi nomeada na lista da Forbes dos Melhores Empregadores do Estado de 2022. Este prestigiado prémio é atribuído pela Forbes e pela Statista Inc., o portal de estatísticas líder mundial e fornecedor de classificação do setor. Isto ajudará a empresa a crescer como marca e em reconhecimento

Âmbito do mercado global de solventes

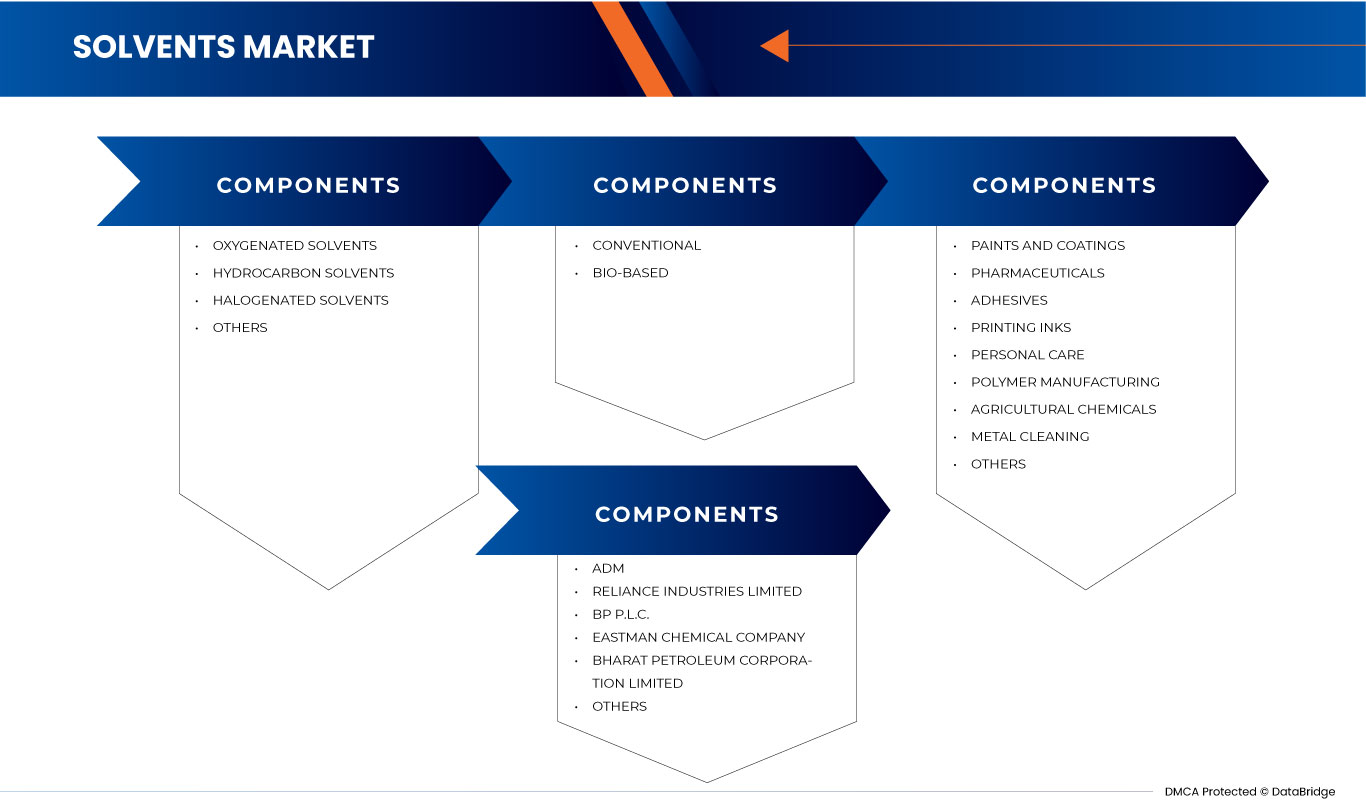

O mercado de solventes está categorizado com base na categoria, fonte e aplicação. O crescimento entre estes segmentos irá ajudá-lo a analisar os principais segmentos de crescimento nos setores e fornecerá aos utilizadores uma visão geral valiosa do mercado e informações de mercado para tomar decisões estratégicas para identificar as principais aplicações de mercado.

Categoria

- Solventes Oxigenados

- Solventes de hidrocarbonetos

- Solventes Halogenados

- Outros

Com base na categoria, o mercado está segmentado em solventes oxigenados, solventes hidrocarbonetos, solventes halogenados e outros.

Fonte

- Convencional

- Baseado na biologia

Com base na origem, o mercado está segmentado em convencional e de base biológica.

Aplicação

- Tintas e Revestimentos

- Produtos farmacêuticos

- Adesivos

- Tintas de impressão

- Cuidados pessoais

- Fabricação de polímeros

- Produtos químicos agrícolas

- Limpeza de metais

- Outros

Com base na aplicação, o mercado está segmentado em tintas e revestimentos, produtos farmacêuticos, adesivos, tintas de impressão, cuidados pessoais , fabrico de polímeros, produtos químicos agrícolas, limpeza de metais, outros.

Análise/Insights Regionais do Mercado Global de Solventes

O mercado de solventes está segmentado com base na categoria, fonte e aplicação.

Os países no mercado de solventes são os EUA, Canadá, México, Brasil, Argentina, resto da América do Sul, Alemanha, França, Itália, Holanda, Reino Unido, Rússia, Espanha, Turquia, Suíça, Bélgica, resto da Europa, China, Índia, Japão, Coreia do Sul, Singapura, Tailândia, Indonésia, Malásia, Filipinas, Austrália e Nova Zelândia, Resto da Ásia-Pacífico, África do Sul, Arábia Saudita, Egito, Emirados Árabes Unidos, Israel, Resto do Médio Oriente e África .

A Ásia-Pacífico está a dominar o mercado global de solventes em termos de quota de mercado e receitas de mercado. A China está a dominar devido à crescente procura de solventes na indústria de tintas e revestimentos. Além disso, a crescente utilização de tintas de impressão em diferentes aplicações industriais também contribui para o crescimento do mercado. Os EUA dominam o mercado devido à crescente utilização de tintas de impressão em diferentes aplicações industriais. A Alemanha está a dominar devido à crescente consciencialização sobre os cuidados pessoais e à procura de produtos de beleza e bem-estar. Além disso, as tendências de beleza em evolução e as mudanças nas preferências dos consumidores também contribuem para o crescimento do mercado.

A secção de países do relatório também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado que impactam as tendências atuais e futuras do mercado. A análise dos pontos de dados a montante e a jusante da cadeia de valor, a análise das tendências técnicas das cinco forças de Porter e os estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e disponibilidade de marcas globais e os desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, o impacto das tarifas nacionais e das rotas comerciais são considerados ao fornecer uma análise de previsão dos dados do país.

Análise do cenário competitivo e da quota de mercado global de solventes

O cenário competitivo do mercado global de solventes fornece detalhes por concorrentes. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos, pipelines de testes de produto, aprovações de produto, patentes, largura e amplitude do produto, domínio da aplicação, curva de vida da tecnologia. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas no mercado global de solventes.

Alguns dos participantes proeminentes que operam no mercado global de solventes são a Arkema (França), a INVISTA (uma subsidiária da Koch Industries, Inc.) (EUA), a Ashland (EUA), a Bharat Petroleum Corporation Limited (Índia), a Huntsman International LLC (EUA ), Solvay (Bélgica), ADM (EUA), Shell Global (Holanda), BP plc (Reino Unido), Eastman Chemical Company (EUA), INEOS GROUP HOLDINGS SA (Reino Unido), BASF SE (Alemanha), Celanese Corporation ( EUA) , Cargill, Incorporated (EUA), Reliance Industries Limited (Índia), Honeywell International Inc. (EUA), LyondellBasell Industries Holding BV (Holanda), Exxon Mobil Corporation (EUA), Monument Chemical (EUA), Dow (EUA) , Olin Corporation (EUA) entre outros.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE FORCES:

4.2.1 THE THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT’S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 PRODUCTION ANALYSIS

4.4.1 PRODUCTION ANALYSIS

4.5 SUPPLY CHAIN ANALYSIS

4.5.1 OVERVIEW

4.5.2 LOGISTIC COST SCENARIO

4.5.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.6 VENDOR SELECTION CRITERIA

4.7 LIST OF KEY BUYERS

4.8 RAW MATERIAL COVERAGE

4.9 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR SOLVENTS IN THE PAINTS AND COATINGS INDUSTRY

6.1.2 RISING USAGE OF PRINTING INKS FOR DIFFERENT INDUSTRIAL APPLICATIONS

6.1.3 POSITIVE OUTLOOK TOWARD BEAUTY & PERSONAL CARE PRODUCTS INDUSTRY

6.1.4 GROWING ADOPTION OF POLYMERS AND RUBBERS ACROSS VARIOUS SEGMENTS

6.1.5 POSITIVE OUTLOOK TOWARD THE AGROCHEMICALS INDUSTRY

6.1.6 INCREASING SPENDING IN THE PHARMACEUTICAL SECTOR

6.2 RESTRAINTS

6.2.1 HEALTH AND SAFETY CONCERNS RELATED TO THE USAGE OF SOLVENTS

6.2.2 TECHNICAL COMPLEXITIES IN SOLVENT RECOVERY AND REUSE

6.3 OPPORTUNITIES

6.3.1 SHIFTING THE FOCUS OF MANUFACTURERS TOWARD ECO-FRIENDLY SOLVENTS

6.3.2 IMMENSE POTENTIAL IN THE RENEWABLE ENERGY SECTOR

6.4 CHALLENGES

6.4.1 ISSUES IN TRANSPORTATION AND STORAGE OF SOLVENTS

6.4.2 STRINGENT RULES AND REGULATIONS

7 GLOBAL SOLVENTS MARKET, BY REGION

7.1 OVERVIEW

7.2 ASIA-PACIFIC

7.2.1 CHINA

7.2.2 INDIA

7.2.3 JAPAN

7.2.4 SOUTH KOREA

7.2.5 SINGAPORE

7.2.6 THAILAND

7.2.7 INDONESIA

7.2.8 MALAYSIA

7.2.9 PHILIPPINES

7.2.10 AUSTRALIA & NEW ZEALAND

7.2.11 REST OF ASIA-PACIFIC

7.3 NORTH AMERICA

7.3.1 U.S.

7.3.2 CANADA

7.3.3 MEXICO

7.4 EUROPE

7.4.1 GERMANY

7.4.2 FRANCE

7.4.3 ITALY

7.4.4 NETHERLANDS

7.4.5 U.K.

7.4.6 RUSSIA

7.4.7 SPAIN

7.4.8 TURKEY

7.4.9 SWITZERLAND

7.4.10 BELGIUM

7.4.11 REST OF EUROPE

7.5 MIDDLE EAST AND AFRICA

7.5.1 SOUTH AFRICA

7.5.2 SAUDI ARABIA

7.5.3 EGYPT

7.5.4 UNITED ARAB EMIRATES

7.5.5 ISRAEL

7.5.6 REST OF MIDDLE EAST AND AFRICA

7.6 SOUTH AMERICA

7.6.1 BRAZIL

7.6.2 ARGENTINA

7.6.3 REST OF SOUTH AMERICA

8 GLOBAL SOLVENTS MARKET: COMPANY LANDSCAPE

8.1 COMPANY SHARE ANALYSIS: GLOBAL

8.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

8.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

8.4 COMPANY SHARE ANALYSIS: EUROPE

8.5 PRODUCT LAUNCH

8.6 AGREEMENT

8.7 ACQUISITION

8.8 AWARD

9 SWOT ANALYSIS

10 COMPANY PROFILE

10.1 ADM

10.1.1 COMPANY SNAPSHOT

10.1.2 COMPANY SHARE ANALYSIS

10.1.3 PRODUCT PORTFOLIO

10.1.4 REVENUE ANALYSIS

10.1.5 RECENT DEVELOPMENTS

10.2 RELIANCE INDUSTRIES LIMITED

10.2.1 COMPANY SNAPSHOT

10.2.2 REVENUE ANALYSIS

10.2.3 COMPANY SHARE ANALYSIS

10.2.4 PRODUCT PORTFOLIO

10.2.5 RECENT DEVELOPMENTS

10.3 BP P.L.C.

10.3.1 COMPANY SNAPSHOT

10.3.2 REVENUE ANALYSIS

10.3.3 COMPANY SHARE ANALYSIS

10.3.4 PRODUCT PORTFOLIO

10.3.5 RECENT DEVELOPMENTS

10.4 EASTMAN CHEMICAL COMPANY (2022)

10.4.1 COMPANY SNAPSHOT

10.4.2 REVENUE ANALYSIS

10.4.3 COMPANY SHARE ANALYSIS

10.4.4 PRODUCT PORTFOLIO

10.4.5 RECENT UPDATES

10.5 BHARAT PETROLEUM CORPORATION LIMITED (2022)

10.5.1 COMPANY SNAPSHOT

10.5.2 REVENUE ANALYSIS

10.5.3 COMPANY SHARE ANALYSIS

10.5.4 PRODUCT PORTFOLIO

10.5.5 RECENT DEVELOPMENT

10.6 OLIN CORPORATION

10.6.1 COMPANY SNAPSHOT

10.6.2 REVENUE ANALYSIS

10.6.3 PRODUCT PORTFOLIO

10.6.4 RECENT DEVELOPMENTS

10.7 ARKEMA (2022)

10.7.1 COMPANY SNAPSHOT

10.7.2 REVENUE ANALYSIS

10.7.3 PRODUCT PORTFOLIO

10.7.4 RECENT DEVELOPMENT

10.8 ASHLAND.(2022)

10.8.1 COMPANY SNAPSHOT

10.8.2 REVENUE ANALYSIS

10.8.3 PRODUCT PORTFOLIO

10.8.4 RECENT UPDATE

10.9 BASF SE

10.9.1 COMPANY SNAPSHOT

10.9.2 REVENUE ANALYSIS

10.9.3 PRODUCT PORTFOLIO

10.9.4 RECENT UPDATE

10.1 CARGILL, INCORPORATED

10.10.1 COMPANY SNAPSHOT

10.10.2 REVENUE ANALYSIS

10.10.3 PRODUCT PORTFOLIO

10.10.4 RECENT DEVELOPMENT

10.11 CELANESE CORPORATON(2022)

10.11.1 COMPANY SNAPSHOT

10.11.2 REVENUE ANALYSIS

10.11.3 PRODUCT PORTFOLIO

10.11.4 RECENT UPDATE

10.12 DOW

10.12.1 COMPANY SNAPSHOT

10.12.2 REVENUE ANALYSIS

10.12.3 PRODUCT PORTFOLIO

10.12.4 RECENT DEVELOPMENTS

10.13 EXXON MOBIL CORPORATION(2022)

10.13.1 COMPANY SNAPSHOT

10.13.2 REVENUE ANALYSIS

10.13.3 PRODUCT PORTFOLIO

10.13.4 RECENT UPDATES

10.14 HONEYWELL INTERNATIONAL INC. (2022)

10.14.1 COMPANY SNAPSHOT

10.14.2 REVENUE ANALYSIS

10.14.3 PRODUCT PORTFOLIO

10.14.4 RECENT DEVELOPMENTS

10.15 HUNTSMAN INTERNATIONAL LLC (2022)

10.15.1 COMPANY SNAPSHOT

10.15.2 REVENUE ANALYSIS

10.15.3 PRODUCT PORTFOLIO

10.15.4 RECENT DEVELOPMENT

10.16 INEOS GROUP HOLDINGS S.A. (2022)

10.16.1 COMPANY SNAPSHOT

10.16.2 REVENUE ANALYSIS

10.16.3 PRODUCT PORTFOLIO

10.16.4 RECENT DEVELOPMENT

10.17 INVISTA (A SUBSIDRIARY OF KOCH INDUSTRIES, INC.)

10.17.1 COMPANY SNAPSHOT

10.17.2 PRODUCT PORTFOLIO

10.17.3 RECENT DEVELOPMENTS

10.18 LYONDELLBASELL INDUSTRIES HOLDING B.V. (2022)

10.18.1 COMPANY SNAPSHOT

10.18.2 REVENUE ANALYSIS

10.18.3 PRODUCT PORTFOLIO

10.18.4 RECENT UPDATE

10.19 MONUMENT CHEMICAL

10.19.1 COMPANY SNAPSHOT

10.19.2 PRODUCT PORTFOLIO

10.19.3 RECENT DEVELOPMENTS

10.2 SHELL GLOBAL (2022)

10.20.1 COMPANY SNAPSHOT

10.20.2 REVENUE ANALYSIS

10.20.3 PRODUCT PORTFOLIO

10.20.4 RECENT UPDATES

10.21 SOLVAY (2022)

10.21.1 COMPANY SNAPSHOT

10.21.2 REVENUE ANALYSIS

10.21.3 PRODUCT PORTFOLIO

10.21.4 RECENT DEVELOPMENTS

11 QUESTIONNAIRE

12 RELATED REPORTS

Lista de Tabela

TABLE 1 REGULATORY COVERAGE

TABLE 2 GLOBAL SOLVENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 GLOBAL SOLVENTS MARKET, BY REGION, 2021-2030 (KILO TONS)

TABLE 4 GLOBAL SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 5 GLOBAL SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 6 GLOBAL OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 7 GLOBAL ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 GLOBAL GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 GLOBAL KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 10 GLOBAL ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 GLOBAL GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 GLOBAL ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 13 GLOBAL HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 14 GLOBAL AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 GLOBAL XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 16 GLOBAL HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 17 GLOBAL SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 18 GLOBAL SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 19 GLOBAL SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 20 GLOBAL SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 21 ASIA-PACIFIC SOLVENTS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 22 ASIA-PACIFIC SOLVENTS MARKET, BY COUNTRY, 2021-2030 (KILO TONS)

TABLE 23 ASIA-PACIFIC SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 24 ASIA-PACIFIC SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 25 ASIA-PACIFIC OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 26 ASIA-PACIFIC ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 ASIA-PACIFIC GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 ASIA-PACIFIC KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 ASIA-PACIFIC ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 30 ASIA-PACIFIC GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 ASIA-PACIFIC ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 ASIA-PACIFIC HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 33 ASIA-PACIFIC AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 ASIA-PACIFIC XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 ASIA-PACIFIC HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 36 ASIA-PACIFIC SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 37 ASIA-PACIFIC SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 38 ASIA-PACIFIC SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 39 ASIA-PACIFIC SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 40 CHINA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 41 CHINA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 42 CHINA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 43 CHINA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 CHINA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 CHINA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 CHINA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 CHINA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 CHINA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 CHINA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 50 CHINA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 CHINA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 CHINA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 53 CHINA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 54 CHINA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 55 CHINA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 56 CHINA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 57 INDIA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 58 INDIA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 59 INDIA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 60 INDIA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 INDIA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 62 INDIA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 63 INDIA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 INDIA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 INDIA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 INDIA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 67 INDIA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 INDIA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 69 INDIA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 70 INDIA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 71 INDIA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 72 INDIA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 73 INDIA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 74 JAPAN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 75 JAPAN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 76 JAPAN OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 77 JAPAN ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 JAPAN GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 79 JAPAN KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 JAPAN ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 81 JAPAN GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 JAPAN ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 83 JAPAN HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 84 JAPAN AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 85 JAPAN XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 JAPAN HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 87 JAPAN SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 88 JAPAN SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 89 JAPAN SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 90 JAPAN SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 91 SOUTH KOREA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 92 SOUTH KOREA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 93 SOUTH KOREA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 94 SOUTH KOREA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 95 SOUTH KOREA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 96 SOUTH KOREA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 SOUTH KOREA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 SOUTH KOREA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 SOUTH KOREA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 SOUTH KOREA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 101 SOUTH KOREA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 102 SOUTH KOREA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 103 SOUTH KOREA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 104 SOUTH KOREA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 105 SOUTH KOREA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 106 SOUTH KOREA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 107 SOUTH KOREA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 108 SINGAPORE SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 109 SINGAPORE SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 110 SINGAPORE OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 111 SINGAPORE ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 112 SINGAPORE GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 113 SINGAPORE KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 114 SINGAPORE ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 115 SINGAPORE GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 116 SINGAPORE ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 117 SINGAPORE HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 118 SINGAPORE AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 119 SINGAPORE XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 120 SINGAPORE HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 121 SINGAPORE SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 122 SINGAPORE SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 123 SINGAPORE SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 124 SINGAPORE SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 125 THAILAND SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 126 THAILAND SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 127 THAILAND OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 128 THAILAND ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 129 THAILAND GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 130 THAILAND KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 131 THAILAND ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 132 THAILAND GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 133 THAILAND ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 134 THAILAND HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 135 THAILAND AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 136 THAILAND XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 137 THAILAND HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 138 THAILAND SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 139 THAILAND SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 140 THAILAND SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 141 THAILAND SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 142 INDONESIA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 143 INDONESIA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 144 INDONESIA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 145 INDONESIA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 146 INDONESIA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 147 INDONESIA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 148 INDONESIA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 149 INDONESIA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 150 INDONESIA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 151 INDONESIA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 152 INDONESIA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 153 INDONESIA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 154 INDONESIA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 155 INDONESIA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 156 INDONESIA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 157 INDONESIA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 158 INDONESIA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 159 MALAYSIA SOLVENTS MARKET

TABLE 160 MALAYSIA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 161 MALAYSIA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 162 MALAYSIA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 163 MALAYSIA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 164 MALAYSIA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 165 MALAYSIA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 166 MALAYSIA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 167 MALAYSIA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 168 MALAYSIA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 169 MALAYSIA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 170 MALAYSIA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 171 MALAYSIA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 172 MALAYSIA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 173 MALAYSIA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 174 MALAYSIA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 175 MALAYSIA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 176 MALAYSIA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 177 PHILIPPINES SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 178 PHILIPPINES SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 179 PHILIPPINES OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 180 PHILIPPINES ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 181 PHILIPPINES GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 182 PHILIPPINES KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 183 PHILIPPINES ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 184 PHILIPPINES GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 185 PHILIPPINES ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 186 PHILIPPINES HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 187 PHILIPPINES AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 188 PHILIPPINES XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 189 PHILIPPINES HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 190 PHILIPPINES SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 191 PHILIPPINES SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 192 PHILIPPINES SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 193 PHILIPPINES SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 194 AUSTRALIA & NEW ZEALAND SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 195 AUSTRALIA & NEW ZEALAND SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 196 AUSTRALIA & NEW ZEALAND OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 197 AUSTRALIA & NEW ZEALAND ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 198 AUSTRALIA & NEW ZEALAND GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 199 AUSTRALIA & NEW ZEALAND KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 200 AUSTRALIA & NEW ZEALAND ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 201 AUSTRALIA & NEW ZEALAND GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 202 AUSTRALIA & NEW ZEALAND ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 203 AUSTRALIA & NEW ZEALAND HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 204 AUSTRALIA & NEW ZEALAND AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 205 AUSTRALIA & NEW ZEALAND XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 206 AUSTRALIA & NEW ZEALAND HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 207 AUSTRALIA & NEW ZEALAND SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 208 AUSTRALIA & NEW ZEALAND SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 209 AUSTRALIA & NEW ZEALAND SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 210 AUSTRALIA & NEW ZEALAND SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 211 REST OF ASIA-PACIFIC SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 212 REST OF ASIA-PACIFIC SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 213 NORTH AMERICA SOLVENTS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 214 NORTH AMERICA SOLVENTS MARKET, BY COUNTRY, 2021-2030 (KILO TONS)

TABLE 215 NORTH AMERICA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 216 NORTH AMERICA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 217 NORTH AMERICA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 218 NORTH AMERICA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 219 NORTH AMERICA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 220 NORTH AMERICA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 221 NORTH AMERICA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 222 NORTH AMERICA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 223 ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 224 NORTH AMERICA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 225 NORTH AMERICA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 226 NORTH AMERICA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 227 NORTH AMERICA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 228 NORTH AMERICA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 229 NORTH AMERICA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 230 NORTH AMERICA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 231 NORTH AMERICA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 232 U.S. SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 233 U.S. SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 234 U.S. OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 235 U.S. ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 236 U.S. GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 237 U.S. KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 238 U.S. ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 239 U.S. GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 240 U.S. ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 241 U.S. HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 242 U.S. AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 243 U.S. XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 244 U.S. HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 245 U.S. SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 246 U.S. SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 247 U.S. SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 248 U.S. SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 249 CANADA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 250 CANADA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 251 CANADA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 252 CANADA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 253 CANADA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 254 CANADA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 255 CANADA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 256 CANADA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 257 CANADA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 258 CANADA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 259 CANADA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 260 CANADA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 261 CANADA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 262 CANADA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 263 CANADA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 264 CANADA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 265 CANADA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 266 MEXICO SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 267 MEXICO SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 268 MEXICO OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 269 MEXICO ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 270 MEXICO GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 271 MEXICO KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 272 MEXICO ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 273 MEXICO GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 274 MEXICO ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 275 MEXICO HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 276 MEXICO AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 277 MEXICO XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 278 MEXICO HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 279 MEXICO SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 280 MEXICO SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 281 MEXICO SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 282 MEXICO SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 283 EUROPE SOLVENTS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 284 EUROPE SOLVENTS MARKET, BY COUNTRY, 2021-2030 (KILO TONS)

TABLE 285 EUROPE SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 286 EUROPE SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 287 EUROPE OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 288 EUROPE ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 289 EUROPE GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 290 EUROPE KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 291 EUROPE ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 292 EUROPE GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 293 EUROPE ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 294 EUROPE HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 295 EUROPE AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 296 EUROPE XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 297 EUROPE HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 298 EUROPE SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 299 EUROPE SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 300 EUROPE SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 301 EUROPE SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 302 GERMANY SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 303 GERMANY SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 304 GERMANY OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 305 GERMANY ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 306 GERMANY GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 307 GERMANY KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 308 GERMANY ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 309 GERMANY GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 310 GERMANY ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 311 GERMANY HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 312 GERMANY AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 313 GERMANY XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 314 GERMANY HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 315 GERMANY SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 316 GERMANY SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 317 GERMANY SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 318 GERMANY SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 319 FRANCE SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 320 FRANCE SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 321 FRANCE OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 322 FRANCE ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 323 FRANCE GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 324 FRANCE KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 325 FRANCE ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 326 FRANCE GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 327 FRANCE ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 328 FRANCE HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 329 FRANCE AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 330 FRANCE XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 331 FRANCE HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 332 FRANCE SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 333 FRANCE SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 334 FRANCE SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 335 FRANCE SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 336 ITALY SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 337 ITALY SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 338 ITALY OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 339 ITALY ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 340 ITALY GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 341 ITALY KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 342 ITALY ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 343 ITALY GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 344 ITALY ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 345 ITALY HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 346 ITALY AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 347 ITALY XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 348 ITALY HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 349 ITALY SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 350 ITALY SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 351 ITALY SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 352 ITALY SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 353 NETHERLANDS SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 354 NETHERLANDS SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 355 NETHERLANDS OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 356 NETHERLANDS ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 357 NETHERLANDS GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 358 NETHERLANDS KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 359 NETHERLANDS ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 360 NETHERLANDS GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 361 NETHERLANDS ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 362 NETHERLANDS HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 363 NETHERLANDS AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 364 NETHERLANDS XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 365 NETHERLANDS HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 366 NETHERLANDS SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 367 NETHERLANDS SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 368 NETHERLANDS SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 369 NETHERLANDS SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 370 U.K. SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 371 U.K. SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 372 U.K. OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 373 U.K. ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 374 U.K. GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 375 U.K. KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 376 U.K. ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 377 U.K. GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 378 U.K. ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 379 U.K. HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 380 U.K. AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 381 U.K. XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 382 U.K. HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 383 U.K. SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 384 U.K. SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 385 U.K. SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 386 U.K. SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 387 RUSSIA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 388 RUSSIA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 389 RUSSIA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 390 RUSSIA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 391 RUSSIA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 392 RUSSIA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 393 RUSSIA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 394 RUSSIA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 395 RUSSIA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 396 RUSSIA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 397 RUSSIA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 398 RUSSIA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 399 RUSSIA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 400 RUSSIA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 401 RUSSIA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 402 RUSSIA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 403 RUSSIA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 404 SPAIN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 405 SPAIN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 406 SPAIN OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 407 SPAIN ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 408 SPAIN GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 409 SPAIN KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 410 SPAIN ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 411 SPAIN GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 412 SPAIN ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 413 SPAIN HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 414 SPAIN AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 415 SPAIN XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 416 SPAIN HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 417 SPAIN SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 418 SPAIN SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 419 SPAIN SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 420 SPAIN SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 421 TURKEY SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 422 TURKEY SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 423 TURKEY OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 424 TURKEY ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 425 TURKEY GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 426 TURKEY KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 427 TURKEY ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 428 TURKEY GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 429 TURKEY ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 430 TURKEY HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 431 TURKEY AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 432 TURKEY XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 433 TURKEY HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 434 TURKEY SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 435 TURKEY SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 436 TURKEY SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 437 TURKEY SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 438 SWITZERLAND SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 439 SWITZERLAND SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 440 SWITZERLAND OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 441 SWITZERLAND ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 442 SWITZERLAND GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 443 SWITZERLAND KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 444 SWITZERLAND ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 445 SWITZERLAND GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 446 SWITZERLAND ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 447 SWITZERLAND HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 448 SWITZERLAND AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 449 SWITZERLAND XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 450 SWITZERLAND HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 451 SWITZERLAND SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 452 SWITZERLAND SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 453 SWITZERLAND SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 454 SWITZERLAND SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 455 BELGIUM SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 456 BELGIUM SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 457 BELGIUM OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 458 BELGIUM ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 459 BELGIUM GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 460 BELGIUM KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 461 BELGIUM ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 462 BELGIUM GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 463 BELGIUM ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 464 BELGIUM HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 465 BELGIUM AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 466 BELGIUM XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 467 BELGIUM HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 468 BELGIUM SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 469 BELGIUM SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 470 BELGIUM SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 471 BELGIUM SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 472 REST OF EUROPE SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 473 REST OF EUROPE SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 474 MIDDLE EAST AND AFRICA SOLVENTS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 475 MIDDLE EAST AND AFRICA SOLVENTS MARKET, BY COUNTRY, 2021-2030 (KILO TONS)

TABLE 476 MIDDLE EAST AND AFRICA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 477 MIDDLE EAST AND AFRICA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 478 MIDDLE EAST AND AFRICA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 479 MIDDLE EAST AND AFRICA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 480 MIDDLE EAST AND AFRICA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 481 MIDDLE EAST AND AFRICA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 482 MIDDLE EAST AND AFRICA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 483 MIDDLE EAST AND AFRICA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 484 MIDDLE EAST AND AFRICA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 485 MIDDLE EAST AND AFRICA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 486 MIDDLE EAST AND AFRICA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 487 MIDDLE EAST AND AFRICA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 488 MIDDLE EAST AND AFRICA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 489 MIDDLE EAST AND AFRICA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 490 MIDDLE EAST AND AFRICA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 491 MIDDLE EAST AND AFRICA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 492 MIDDLE EAST AND AFRICA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 493 SOUTH AFRICA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 494 SOUTH AFRICA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 495 SOUTH AFRICA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 496 SOUTH AFRICA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 497 SOUTH AFRICA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 498 SOUTH AFRICA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 499 SOUTH AFRICA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 500 SOUTH AFRICA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 501 SOUTH AFRICA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 502 SOUTH AFRICA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 503 SOUTH AFRICA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 504 SOUTH AFRICA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 505 SOUTH AFRICA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 506 SOUTH AFRICA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 507 SOUTH AFRICA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 508 SOUTH AFRICA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 509 SOUTH AFRICA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 510 SAUDI ARABIA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 511 SAUDI ARABIA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)