Global Polylysine Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

951.08 Million

USD

1,459.61 Million

2024

2032

USD

951.08 Million

USD

1,459.61 Million

2024

2032

| 2025 –2032 | |

| USD 951.08 Million | |

| USD 1,459.61 Million | |

|

|

|

|

Segmentação do mercado global de polilisina, por forma (pó e líquido), fonte (natural e sintética), função (agente antimicrobiano, conservante, agente de administração de medicamentos e antioxidante), aplicação (alimentos e bebidas, produtos farmacêuticos, cuidados pessoais e cosméticos, suplementos alimentares e outros) - Tendências do setor e previsão até 2032

Tamanho do mercado de polilisina

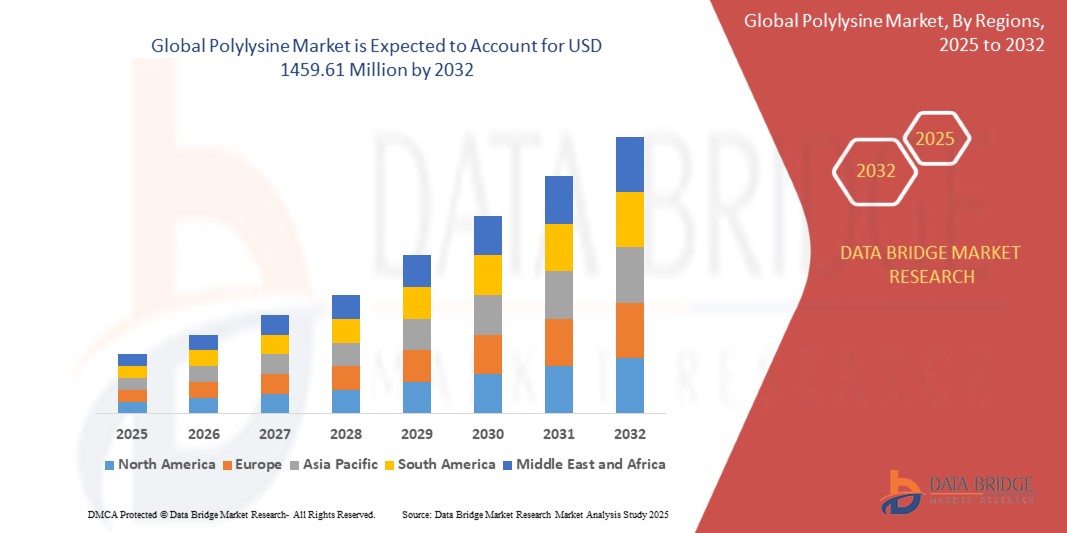

- O tamanho do mercado global de polilisina foi avaliado em US$ 951,08 milhões em 2024 e deve atingir US$ 1.459,61 milhões até 2032 , com um CAGR de 5,5% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente demanda por conservantes naturais e de base biológica na indústria de alimentos e bebidas, à medida que os fabricantes abandonam os aditivos sintéticos para atender aos requisitos de rótulos limpos e regulatórios.

- Além disso, a expansão das aplicações da polilisina em produtos farmacêuticos, cuidados pessoais e suplementos alimentares, aliada às suas propriedades antimicrobianas e biocompatíveis, está consolidando-a como um ingrediente versátil em diversos setores. Esses fatores convergentes estão acelerando a adoção, impulsionando significativamente o crescimento do mercado de polilisina.

Análise de Mercado de Polilisina

- A polilisina é um biopolímero de origem natural amplamente utilizado como agente antimicrobiano e conservante em alimentos, produtos farmacêuticos, suplementos alimentares e produtos de higiene pessoal. Sua forte capacidade de inibir o crescimento bacteriano e prolongar a vida útil do produto o torna um valioso ingrediente de rótulo limpo em diversos setores.

- A crescente demanda por polilisina é alimentada principalmente pela crescente mudança em direção a conservantes naturais, pelo aumento das restrições regulatórias sobre aditivos sintéticos e pela crescente preferência do consumidor por soluções seguras, de base biológica e sustentáveis em aplicações de alimentos e saúde.

- A Ásia-Pacífico dominou o mercado de polilisina com uma participação de 45,5% em 2024, devido à crescente demanda por conservantes naturais no setor de alimentos e bebidas, à forte atividade de fabricação farmacêutica e à liderança da região na produção de ingredientes baseados em fermentação.

- Espera-se que a Europa seja a região de crescimento mais rápido no mercado de polilisina durante o período previsto devido às rigorosas regulamentações de segurança alimentar, à alta demanda por conservantes naturais e ao aumento dos investimentos em P&D em polímeros biocompatíveis.

- O segmento natural dominou o mercado, com uma participação de mercado de 63,2% em 2024, devido à crescente preferência do consumidor por conservantes de rótulo limpo e de origem biológica. A polilisina de origem natural, normalmente produzida por fermentação microbiana, é amplamente aceita em aplicações alimentícias e farmacêuticas devido à sua segurança e às aprovações regulatórias. A crescente conscientização sobre os efeitos nocivos dos aditivos sintéticos está incentivando os fabricantes de alimentos a adotar conservantes naturais, como a polilisina. O forte alinhamento da polilisina natural com as tendências de sustentabilidade e a rotulagem de produtos orgânicos reforça ainda mais sua dominância no mercado.

Escopo do relatório e segmentação do mercado de polilisina

|

Atributos |

Principais insights do mercado de polilisina |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

Europa

Ásia-Pacífico

Oriente Médio e África

Ámérica do Sul

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de consumo de produção, análise de tendência de preço, cenário de mudança climática, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matéria-prima/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de polilisina

Expansão das aplicações da polilisina na indústria farmacêutica

- A indústria farmacêutica está integrando cada vez mais a polilisina devido às suas propriedades antimicrobianas e biodegradáveis, tornando-a um aditivo valioso em formulações e sistemas de administração de medicamentos. Sua origem natural e perfil de segurança a distinguem como uma opção atraente para inovação farmacêutica focada em soluções de rótulo limpo e amigáveis ao paciente.

- Por exemplo, a Nagase & Co. Ltd., produtora líder de ε-polilisina, vem expandindo ativamente suas aplicações em áreas biomédicas, alavancando a eficiência antimicrobiana do composto. Isso encontrou relevância em cremes tópicos, agentes cicatrizantes e sistemas de liberação de fármacos, reforçando seu papel em aplicações farmacêuticas modernas.

- A polilisina está ganhando força em formulações de liberação controlada de fármacos devido à sua capacidade de formar complexos estáveis com diferentes níveis de pH, permitindo a administração regulada e sustentada de agentes farmacêuticos. Isso é particularmente vantajoso em formulações onde a liberação gradual e direcionada do fármaco aumenta a eficácia do tratamento.

- O uso de polilisina em combinação com outros biopolímeros naturais, como a quitosana, está incentivando o desenvolvimento de compósitos de base biológica em aplicações farmacêuticas. Essas combinações são frequentemente utilizadas em tecnologias de encapsulamento para a entrega de compostos sensíveis, como peptídeos e vacinas, oferecendo maior estabilidade e eficiência.

- Pesquisas em andamento destacam o potencial da polilisina na medicina regenerativa, onde auxilia na adesão celular e em estruturas de engenharia de tecidos. Tais aplicações criam novas oportunidades para a polilisina além da preservação tradicional de alimentos, posicionando-a como um material essencial no desenvolvimento farmacêutico avançado.

- A crescente mudança para excipientes naturais e de rótulo limpo na produção farmacêutica reforça a relevância da polilisina. À medida que agências reguladoras e consumidores enfatizam a segurança e a sustentabilidade, as empresas estão utilizando a polilisina como alternativa a excipientes sintéticos ou menos sustentáveis ambientalmente em inovações farmacêuticas.

Dinâmica do Mercado de Polilisina

Motorista

Crescente demanda por conservantes naturais

- A crescente preferência do consumidor por conservantes alimentares naturais e seguros é um dos principais impulsionadores da adoção da polilisina em todos os setores. Sua atividade antimicrobiana de amplo espectro, aliada à sua origem natural baseada em fermentação, atrai tanto autoridades regulatórias quanto consumidores preocupados com a saúde.

- Por exemplo, a Chisso Corporation tem sido um ator fundamental no fornecimento de ε-polilisina para aplicações de preservação de alimentos, firmando parcerias com produtores globais de alimentos para incorporá-la em refeições prontas para consumo, molhos e assados. Esses avanços estão impulsionando uma adoção mais ampla em todas as regiões, à medida que as empresas buscam alternativas naturais.

- O aumento de produtos alimentícios com rótulos limpos está aumentando significativamente a demanda por conservantes naturais, como a polilisina. As marcas estão cada vez mais destacando métodos de preservação com ingredientes naturais para atender à demanda do consumidor por transparência, confiabilidade e segurança.

- Além disso, as crescentes preocupações com a resistência a antibióticos e a exposição química a conservantes sintéticos estão pressionando ainda mais as empresas alimentícias e farmacêuticas a adotar a polilisina. A forte eficácia antimicrobiana do produto contribui para o prolongamento da vida útil, ao mesmo tempo em que atende às expectativas de saúde e regulatórias.

- A crescente importância dos padrões globais de segurança alimentar está incentivando grandes fabricantes a optar por conservantes naturais consistentes e eficazes. A Polylysine, com seu histórico comprovado nos mercados asiáticos, está se expandindo continuamente para as indústrias norte-americana e europeia, impulsionada pela demanda por soluções de preservação mais seguras e inovadoras.

Restrição/Desafio

Aumento do uso de conservantes sintéticos

- Apesar das vantagens da polilisina, a ampla disponibilidade e o baixo custo dos conservantes sintéticos representam um desafio significativo para sua adoção. As opções sintéticas continuam sendo a escolha dominante para fabricantes de grande porte que buscam eficiência de custos e garantias de desempenho consolidadas.

- Por exemplo, o benzoato de sódio e o sorbato de potássio continuam a dominar o mercado global de conservantes de alimentos, com empresas como a Archer Daniels Midland (ADM) e a Cargill investindo na produção e distribuição dessas soluções sintéticas. Sua relação custo-benefício cria uma forte concorrência para alternativas à base de polilisina.

- O conhecimento limitado da polilisina entre os principais fabricantes e consumidores restringe ainda mais sua adoção. Muitas empresas permanecem hesitantes devido à familiaridade estabelecida com produtos sintéticos e à aceitação mais lenta de novas formulações, especialmente em mercados onde as aprovações regulatórias são rigorosas ou pouco claras.

- Além disso, os custos de produção associados aos conservantes derivados da fermentação permanecem mais altos, o que pode limitar a competitividade dos preços da polilisina. Essa diferença de preço restringe a escalabilidade para fabricantes de pequeno e médio porte em mercados sensíveis a custos.

- A ausência de regulamentações globais padronizadas sobre conservantes naturais gera incerteza na introdução da polilisina em novos mercados. Embora seja aprovada em diversas regiões, como o Japão, a expansão consistente para outros territórios enfrenta obstáculos que atrasam a adoção global e limitam o uso generalizado.

Escopo de mercado da polilisina

O mercado é segmentado com base na forma, origem, função e aplicação.

• Por Formulário

Com base na forma, o mercado de polilisina é segmentado em pó e líquido. O segmento de pó dominou a maior fatia de mercado em 2024, devido à sua longa vida útil, facilidade de armazenamento e alta estabilidade em diversas aplicações. A polilisina em pó é amplamente utilizada na indústria de alimentos e bebidas, pois garante uma mistura uniforme com outros ingredientes, mantendo a eficácia antimicrobiana. Sua relação custo-benefício e capacidade de ser transportada por longas distâncias sem degradação fortaleceram ainda mais sua posição dominante nas cadeias de suprimentos globais. Além disso, a polilisina em pó é preferida por fabricantes farmacêuticos e de cosméticos devido à sua compatibilidade com formulações secas.

Prevê-se que o segmento de líquidos testemunhe o crescimento mais rápido entre 2025 e 2032, impulsionado pelo seu uso crescente em formulações prontas para uso em processamento de alimentos e aplicações cosméticas. A polilisina líquida proporciona maior facilidade de aplicação durante os processos de produção, oferecendo solubilidade direta em soluções sem a necessidade de etapas adicionais de processamento. Os fabricantes estão favorecendo formulações líquidas para revestimentos antimicrobianos personalizados, bebidas e produtos de cuidados pessoais, onde a dispersibilidade instantânea é uma vantagem fundamental. A crescente demanda por ingredientes de rótulo limpo e minimamente processados está impulsionando ainda mais a adoção da polilisina líquida.

• Por fonte

Com base na origem, o mercado de polilisina é segmentado em natural e sintético. O segmento natural deteve a maior participação na receita, 63,2% em 2024, impulsionado pela crescente preferência do consumidor por conservantes de rótulo limpo e de origem biológica. A polilisina de origem natural, normalmente produzida por fermentação microbiana, é amplamente aceita em aplicações alimentícias e farmacêuticas devido à sua segurança e aprovações regulatórias. A crescente conscientização sobre os efeitos nocivos dos aditivos sintéticos está incentivando os fabricantes de alimentos a adotar conservantes naturais, como a polilisina. O forte alinhamento da polilisina natural com as tendências de sustentabilidade e a rotulagem de produtos orgânicos reforça ainda mais seu domínio no mercado.

Espera-se que o segmento sintético apresente o CAGR mais rápido entre 2025 e 2032, à medida que a pesquisa e o desenvolvimento em biotecnologia e ciência de polímeros avançam. A polilisina sintética oferece aos fabricantes maior controle sobre a estrutura molecular e as propriedades funcionais, tornando-a adequada para usos farmacêuticos e industriais especializados. Seu potencial em sistemas de liberação de fármacos e aplicações biomédicas, onde modificações moleculares específicas são necessárias, está impulsionando a demanda. Além disso, as fontes sintéticas são cada vez mais vistas como uma solução escalável para atender à crescente demanda global, especialmente onde os processos de fermentação natural enfrentam limitações de produção.

• Por Função

Com base na função, o mercado de polilisina é segmentado em agente antimicrobiano, conservante, agente de liberação de fármacos e antioxidante. O segmento de agentes antimicrobianos dominou o mercado em 2024, atribuído ao amplo uso da polilisina para estender a vida útil e prevenir a deterioração microbiana em alimentos e bebidas. Sua atividade de amplo espectro contra bactérias e fungos a torna altamente valiosa nas categorias de alimentos embalados e prontos para consumo. A crescente demanda por soluções antimicrobianas naturais na tendência de rótulos limpos está fortalecendo ainda mais sua adoção nas indústrias de processamento de alimentos em todo o mundo. Além disso, o reconhecimento da polilisina como segura por agências reguladoras globais reforça seu papel de liderança no mercado.

O segmento de agentes de liberação de fármacos deverá apresentar o crescimento mais rápido entre 2025 e 2032, impulsionado pelo crescente interesse em polímeros biocompatíveis e biodegradáveis na pesquisa farmacêutica. A estrutura catiônica exclusiva da polilisina aumenta a absorção celular e melhora a eficiência do encapsulamento de fármacos, tornando-a altamente adequada para terapias avançadas, como liberação gênica e nanomedicina. O crescente investimento em tecnologias de liberação direcionada de fármacos e medicina de precisão está impulsionando a rápida adoção da polilisina na pesquisa clínica. Sua capacidade de minimizar efeitos colaterais e melhorar a eficácia terapêutica a posiciona como um facilitador fundamental em sistemas de liberação de fármacos de última geração.

• Por aplicação

Com base na aplicação, o mercado de polilisina é segmentado em alimentos e bebidas, produtos farmacêuticos, cuidados pessoais e cosméticos, suplementos alimentares e outros. O segmento de alimentos e bebidas dominou a maior fatia de mercado em 2024, impulsionado pela crescente demanda global por conservantes naturais e agentes antimicrobianos seguros em produtos alimentícios embalados. A polilisina é amplamente utilizada em carnes, laticínios, panificação e itens prontos para consumo para estender a vida útil sem alterar o sabor ou a qualidade. A crescente conscientização do consumidor sobre a segurança alimentar e a pressão regulatória para reduzir conservantes sintéticos fortaleceram ainda mais a aplicação da polilisina neste setor. Sua comprovada capacidade de reduzir perdas por deterioração proporciona aos fabricantes de alimentos benefícios significativos em termos de custo, consolidando sua posição dominante.

Espera-se que o segmento farmacêutico testemunhe o crescimento mais rápido entre 2025 e 2032, impulsionado pelo uso crescente da polilisina em formulações e sistemas de liberação de medicamentos. Sua biocompatibilidade e biodegradabilidade a tornam altamente atrativa para formulações de liberação controlada, terapia gênica e carreadores de fármacos à base de nanopartículas. A crescente demanda por tecnologias de liberação de fármacos mais seguras e eficazes está impulsionando a adoção em pipelines de P&D farmacêutico. Além disso, as colaborações entre empresas de biotecnologia e farmacêuticas estão acelerando a inovação, abrindo caminho para uma aplicação mais ampla da polilisina em terapias avançadas.

Análise regional do mercado de polilisina

- A Ásia-Pacífico dominou o mercado de polilisina com a maior participação na receita de 45,5% em 2024, impulsionada pela crescente demanda por conservantes naturais no setor de alimentos e bebidas, forte atividade de fabricação farmacêutica e liderança da região na produção de ingredientes baseados em fermentação

- A infraestrutura de produção econômica da região, o mercado de suplementos alimentares em expansão e a crescente adoção de soluções de rótulo limpo estão acelerando o consumo de polilisina em vários setores

- A rápida industrialização, as iniciativas governamentais favoráveis à promoção de ingredientes de base biológica e a presença de exportadores de alimentos em larga escala estão apoiando ainda mais o uso generalizado de polilisina na região.

Visão do mercado de polilisina da China

A China detinha a maior fatia do mercado de polilisina na Ásia-Pacífico em 2024, apoiada por seu domínio na produção de fermentação em larga escala e ampla aplicação na conservação de alimentos. O país se beneficia de investimentos robustos em biotecnologia e forte capacidade de exportação de ingredientes alimentícios. A crescente demanda por agentes antimicrobianos seguros e naturais em alimentos processados e produtos farmacêuticos está impulsionando a expansão, com aprovações regulatórias fortalecendo a adoção doméstica.

Visão do mercado de polilisina da Índia

A Índia está testemunhando o crescimento mais rápido na região Ásia-Pacífico, impulsionado por crescentes investimentos em processamento de alimentos, suplementos alimentares e fabricação de produtos farmacêuticos. Iniciativas governamentais de apoio para impulsionar a capacidade biotecnológica e reduzir a dependência de aditivos sintéticos estão aumentando a demanda por polilisina. O comportamento cada vez mais consciente do consumidor em relação à saúde e uma crescente base de exportação de alimentos funcionais e nutracêuticos estão contribuindo ainda mais para a rápida expansão do mercado.

Visão geral do mercado de polilisina na América do Norte

A América do Norte manteve uma posição forte no mercado global de polilisina em 2024, impulsionada pela crescente demanda por agentes antimicrobianos naturais em alimentos embalados, produtos farmacêuticos e produtos de higiene pessoal. A preferência do consumidor por ingredientes seguros e de rótulo limpo, aliada a redes avançadas de fabricação e distribuição, está impulsionando a adoção. Fortes pipelines de inovação em biotecnologia e produtos farmacêuticos reforçam ainda mais a importância da região no mercado global.

Visão do mercado de polilisina dos EUA

Os EUA representaram a maior fatia do mercado de polilisina na América do Norte em 2024, impulsionados por sua crescente indústria de alimentos processados, investimentos significativos em pesquisa de biopolímeros e crescente demanda por nutracêuticos. A aprovação regulatória da polilisina como aditivo alimentar seguro, aliada à alta adoção em suplementos alimentares e cuidados pessoais, está impulsionando o crescimento do mercado. A presença de empresas líderes em biotecnologia e a forte demanda do consumidor por soluções naturais consolidam o domínio dos EUA na região.

Visão geral do mercado de polilisina na Europa

Espera-se que o mercado europeu de polilisina cresça à taxa composta de crescimento anual (CAGR) mais rápida entre 2025 e 2032, impulsionado por rigorosas regulamentações de segurança alimentar, alta demanda por conservantes naturais e crescentes investimentos em P&D em polímeros biocompatíveis. A ênfase da região em ingredientes sustentáveis e formulações avançadas em produtos farmacêuticos e cuidados pessoais está fomentando a adoção. O aumento das parcerias entre produtores de alimentos, empresas de biotecnologia e instituições de pesquisa também está reforçando o papel da polilisina no desenvolvimento de produtos com rótulos limpos.

Visão geral do mercado de polilisina na Alemanha

O mercado de polilisina da Alemanha é impulsionado por sua liderança em biotecnologia e inovação farmacêutica. A forte demanda do setor de alimentos e bebidas por agentes antimicrobianos naturais, aliada a uma sólida base de pesquisa para aplicações em biopolímeros, está acelerando o crescimento. O alinhamento regulatório do país com a sustentabilidade e a preferência por aditivos de base biológica de alta qualidade posicionam ainda mais a Alemanha como um mercado-chave na Europa.

Visão geral do mercado de polilisina do Reino Unido

O mercado do Reino Unido se beneficia de sua forte indústria de ciências biológicas e do crescente foco em segurança alimentar e inovação em rótulos limpos. Os esforços pós-Brexit para localizar cadeias de suprimentos estão incentivando a adoção de conservantes naturais, enquanto a crescente P&D em sistemas de administração de medicamentos e alimentos funcionais fortalece as aplicações da polilisina. A colaboração entre universidades, empresas de biotecnologia e fabricantes de alimentos apoia a inovação em soluções baseadas em polilisina.

Participação de mercado da polilisina

A indústria de polilisina é liderada principalmente por empresas bem estabelecidas, incluindo:

- Chisso Corporation (Japão)

- Okuna Chemical Industries Co., Ltd. (Japão)

- SunBio Co., Ltd. (Japão)

- JNC Corporation (Japão)

- Nanquim Shine King Biotech Co., Ltd. (China)

- Chengdu Jinkai Biologia Engineering Co., Ltd. (China)

- Zhengzhou Bainafo Bioengenharia Co., Ltd. (China)

- Produtos Biológicos Yiming Co., Ltd. (China)

- Siveele Biotech Corporation (Japão)

- Lion King Biotechnology Inc. (Taiwan)

- Ajinomoto Co., Inc. (Japão)

- Evonik Industries AG (Alemanha)

- BASF SE (Alemanha)

- Kyowa Hakko Bio Co., Ltd. (Japão)

Últimos desenvolvimentos no mercado global de polilisina

- Em janeiro de 2024, a JNC Corporation anunciou o comissionamento de uma nova unidade de produção no Japão, dedicada à expansão da produção de polilisina. Este desenvolvimento reflete a estratégia da empresa de fortalecer sua posição como fornecedora global de ingredientes à base de fermentação. Espera-se que a unidade melhore significativamente a escalabilidade da produção e garanta uma cadeia de suprimentos estável, atendendo à crescente demanda global nos setores alimentício, farmacêutico e de biotecnologia. Ao aumentar a capacidade, a JNC atende às atuais exigências do mercado e também se posiciona para capturar oportunidades emergentes nos segmentos de rótulos limpos e conservantes naturais.

- Em março de 2024, a Ajinomoto Co., Inc. lançou uma nova linha de conservantes alimentares à base de polilisina, reforçando seu compromisso com a inovação em aditivos naturais. A nova linha de produtos atende à crescente preferência do consumidor por ingredientes seguros, naturais e transparentes em alimentos processados. A sólida rede de distribuição global da Ajinomoto apoiará o sucesso comercial deste lançamento, ajudando os fabricantes de alimentos a reduzir a dependência de conservantes sintéticos. O lançamento também reflete a estratégia de sustentabilidade de longo prazo da empresa, já que a polilisina oferece segurança e funcionalidade ao estender a vida útil, ao mesmo tempo em que atende às aprovações regulatórias para alegações de rótulo limpo.

- Em agosto de 2023, a Thomas Scientific adquiriu a Quintana Supply, expandindo sua presença nacional e fortalecendo sua presença nos mercados de tecnologia avançada e industrial. Esta aquisição aprimora a capacidade de distribuição da Thomas Scientific, especialmente em produtos para salas limpas e ambientes controlados, essenciais para aplicações farmacêuticas e de bioprocessamento. A integração das operações da Quintana permite que a empresa amplie seu atendimento ao cliente e a eficiência da cadeia de suprimentos, proporcionando maior acessibilidade a materiais essenciais de laboratório e produção em todos os EUA.

- Em 2023, a Evonik Industries investiu na expansão de sua capacidade de produção de polilisina líquida na Europa, destacando seu foco estratégico em soluções sustentáveis e de base biológica. O investimento ocorre em um momento em que a demanda por polilisina em produtos farmacêuticos, cuidados pessoais e cosméticos está crescendo rapidamente devido a regulamentações mais rigorosas e à preferência do consumidor por ingredientes naturais. Ao expandir a produção, a Evonik fortalece a resiliência de sua cadeia de suprimentos regional e se posiciona como um player fundamental no atendimento às necessidades das indústrias europeias, impulsionadas pela sustentabilidade. Essa iniciativa também reforça a visão mais ampla da empresa de reduzir a dependência de conservantes sintéticos e, ao mesmo tempo, conquistar participação de mercado em biopolímeros de alto valor.

- Em abril de 2022, a Merck KGaA (por meio de sua unidade de ciências biológicas nos EUA/Canadá, MilliporeSigma) adquiriu a plataforma MAST® (Tecnologia de Amostragem Automatizada Modular) da Lonza, reforçando sua liderança em bioprocessamento digital. A aquisição integrou um sistema avançado de amostragem automatizada ao ecossistema BioContinuumTM da Merck, permitindo o monitoramento em tempo real dos bioprocessos. Isso reduziu significativamente os prazos de desenvolvimento de processos, diminuiu a necessidade de mão de obra manual e melhorou a eficiência da produção em operações biofarmacêuticas de larga escala. Ao incorporar a plataforma MAST®, a Merck aprimorou sua capacidade de fornecer produtos biológicos de alta qualidade e com boa relação custo-benefício, fortalecendo, em última análise, a competitividade no mercado de bioprocessamento em rápida evolução.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.