Global Platform Based Payment Gateway Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

26.37 Billion

USD

33.93 Billion

2024

2032

USD

26.37 Billion

USD

33.93 Billion

2024

2032

| 2025 –2032 | |

| USD 26.37 Billion | |

| USD 33.93 Billion | |

|

|

|

|

Segmentação do mercado global de gateway de pagamento baseado em plataforma, por aplicação (micro e pequenas empresas, grandes empresas e empresas de média dimensão), utilizador final (BFSI, media e entretenimento, retalho e comércio eletrónico, viagens e hotelaria e outros) – tendências da indústria e previsão para 2032

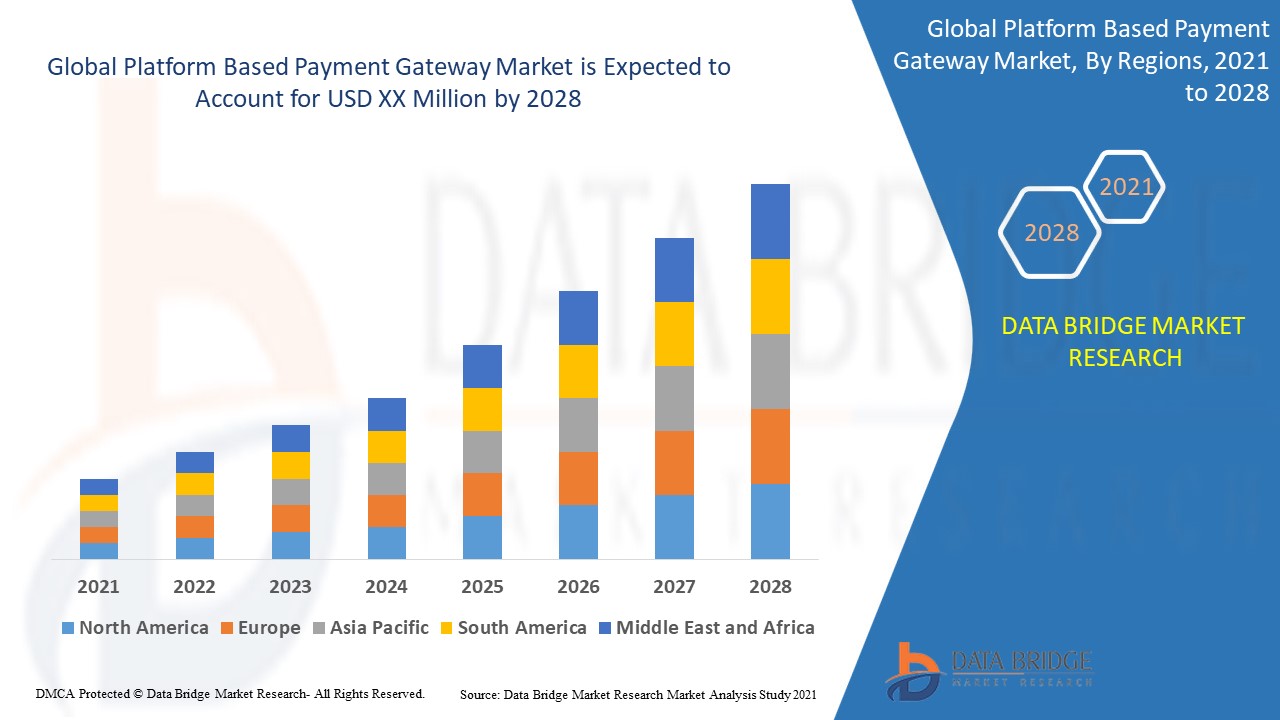

Análise de mercado de gateway de pagamento baseado em plataforma

O mercado de gateways de pagamento baseados em plataformas tem assistido a um crescimento significativo impulsionado pela crescente procura de soluções de pagamento seguras, eficientes e integradas em vários setores. Estas plataformas permitem às empresas processar transações online, oferecendo benefícios como rapidez, segurança e facilidade de integração com outros sistemas. Os avanços tecnológicos nos pagamentos móveis, blockchain e inteligência artificial estão a remodelar o mercado, a melhorar a experiência do utilizador e a melhorar a deteção de fraudes. Além disso, a crescente adoção do comércio eletrónico, dos serviços bancários online e das carteiras digitais está a alimentar a procura por soluções avançadas de gateways de pagamento. As empresas estão a investir em inovações como a autenticação biométrica, o suporte de várias moedas e os pagamentos contactless para aumentar a segurança e a conveniência para os clientes. Para além dos avanços tecnológicos, as alterações regulamentares e a crescente necessidade de soluções de pagamento internacionais aceleraram ainda mais o crescimento do mercado. A América do Norte continua a dominar o mercado, graças à robusta infraestrutura tecnológica e às elevadas taxas de adoção de soluções de pagamento digital. No entanto, prevê-se que a região da Ásia-Pacífico seja o mercado de crescimento mais rápido devido às iniciativas governamentais destinadas a melhorar os sistemas de pagamento digital e à rápida expansão dos negócios online. O futuro do mercado parece promissor, impulsionado por estes avanços e pela mudança contínua em direção aos ecossistemas de pagamento digital.

Tamanho do mercado de gateway de pagamento baseado em plataforma

O tamanho do mercado global de gateway de pagamento baseado em plataforma foi avaliado em 26,37 mil milhões de dólares em 2024 e está projetado para atingir 33,93 mil milhões de dólares até 2032, com um CAGR de 3,20% durante o período previsto de 2025 a 2032. Para além dos insights de mercado, como o valor de mercado, a taxa de crescimento, os segmentos de mercado, a cobertura geográfica, os participantes do mercado e o cenário de mercado, o relatório de mercado com curadoria da equipa de O Data Bridge inclui análise aprofundada de especialistas, análise de importação/exportação, análise de preços, análise de consumo de produção e análise Pilstle.

Tendências do mercado de gateway de pagamento baseado em plataforma

“Crescente adoção de soluções de pagamento móvel”

Uma tendência importante no mercado de gateways de pagamento baseados em plataformas é a crescente adoção de soluções de pagamento móvel. Com o crescente uso de smartphones e aplicações móveis , os consumidores procuram agora formas mais convenientes e seguras de fazer transações em qualquer lugar. Plataformas como o Apple Pay, Google Pay e Samsung Pay revolucionaram os pagamentos móveis ao permitir que os utilizadores concluam transações com apenas um toque no telefone. Esta mudança para pagamentos contactless e carteiras digitais é motivada pela procura de experiências de pagamento mais rápidas, seguras e integradas. Além disso, a integração de tecnologias de autenticação biométrica, como a impressão digital ou o reconhecimento facial, aumenta a segurança destas plataformas de pagamento móvel. À medida que os consumidores continuam a dar prioridade à conveniência e à segurança, as soluções de pagamento móvel estão a tornar-se um componente essencial dos serviços de gateway de pagamento, oferecendo oportunidades de mercado significativas para os fornecedores de pagamento. Esta tendência reflete a transformação digital em curso no setor dos serviços financeiros, atendendo às necessidades em evolução dos consumidores atentos à tecnologia.

Âmbito do Relatório e Segmentação do Mercado de Gateway de Pagamento Baseado em Plataforma

|

Atributos |

Principais insights de mercado sobre o gateway de pagamento baseado em plataforma |

|

Segmentos abrangidos |

|

|

Países abrangidos |

EUA, Canadá e México na América do Norte, Alemanha, França, Reino Unido, Holanda, Suíça, Bélgica, Rússia, Itália, Espanha, Turquia, Resto da Europa na Europa, China, Japão, Índia, Coreia do Sul, Singapura, Malásia, Austrália, Tailândia, Indonésia, Filipinas, Resto da Ásia-Pacífico (APAC) na Ásia-Pacífico (APAC), Arábia Saudita, Emirados Árabes Unidos, África do Sul, Egito, Israel, Resto do Médio Oriente e África (MEA) como parte do Médio Oriente e África (MEA), Brasil, Argentina e Resto da América do Sul como parte da América do Sul |

|

Principais participantes do mercado |

Alipay (China), Amazon Payments, Inc. (EUA), Wirecard (Alemanha), PESOPAY (Índia), PayU (Holanda), PayPal (EUA), PAYMILL (Alemanha), Fiuu (Espanha), Web Active Corporation (EUA), Worldpay LLC (Reino Unido), Stripe, Inc. (EUA), Klarna Bank AB (publ) (Suécia), Cashfree Payments India Private Limited (Índia), WebMoney (Rússia), 99bill ( China), MyGate (África do Sul), Servired (Espanha), Svea Bank (Suécia), Cardstream Limited (Reino Unido), Elavon (EUA), NAB Transact (Austrália), MercadoLibre SRL (Argentina) e CCBill (EUA) |

|

Oportunidades de Mercado |

|

|

Conjuntos de informações de dados de valor acrescentado |

Além de insights de mercado, tais como valor de mercado, taxa de crescimento, segmentos de mercado, cobertura geográfica, participantes do mercado e cenário de mercado, o relatório de mercado com curadoria da equipa de pesquisa de mercado da Data Bridge inclui análise aprofundada de especialistas, análise de importação/exportação, análise de preços, análise de consumo de produção e análise Pilstle. |

Definição de mercado de gateway de pagamento baseado em plataforma

Um gateway de pagamento baseado em plataforma é um serviço online que permite às empresas processar pagamentos de forma segura através de vários canais digitais, como websites, aplicações móveis e plataformas de comércio eletrónico . Atua como intermediário entre o comerciante e as instituições financeiras, transmitindo com segurança informações de pagamento para garantir transações bem-sucedidas. Estes gateways suportam vários métodos de pagamento, incluindo cartões de crédito, cartões de débito, carteiras digitais e transferências bancárias, além de oferecerem funcionalidades como deteção de fraudes, encriptação e suporte a várias moedas.

Dinâmica de mercado de gateway de pagamento baseado em plataforma

Motoristas

- Ascensão do comércio eletrónico e das compras online

O crescimento do comércio eletrónico e das compras online tornou-se um grande impulsionador do mercado de gateways de pagamento baseados em plataformas, à medida que mais consumidores e empresas adotam o retalho digital. Com plataformas como a Amazon, Alibaba e eBay a registarem um crescimento significativo, a procura por sistemas de processamento de pagamentos seguros, fiáveis e eficientes aumentou. À medida que as empresas migram cada vez mais para modelos online, exigem gateways de pagamento que possam lidar com grandes volumes de transações, fornecer suporte a várias moedas e garantir pagamentos rápidos e seguros. Por exemplo, o PayPal e o Stripe tornaram-se parte integrante das plataformas de comércio eletrónico, oferecendo experiências de pagamento integradas e capacidades de prevenção de fraudes. A necessidade de tais soluções de pagamento é ainda mais ampliada pelo crescimento do comércio móvel e pelo número crescente de transações online. Este crescimento no retalho online influencia diretamente o mercado, impulsionando a procura por soluções de gateway de pagamento avançadas, escaláveis e seguras. Consequentemente, o boom do comércio eletrónico serve como um importante impulsionador de mercado, impulsionando a inovação e a adoção no setor das gateways de pagamento.

- Aumento do uso de carteiras digitais

A crescente utilização de carteiras digitais é um importante impulsionador do crescimento no mercado de gateways de pagamento baseados em plataformas, uma vez que os consumidores procuram métodos mais convenientes e seguros para concluir transações. As carteiras digitais, como o PayPal, o Apple Pay e o Google Pay, revolucionaram os pagamentos online e móveis ao permitirem aos utilizadores armazenar as suas informações de pagamento e fazer compras com apenas um toque ou clique. Por exemplo, o Apple Pay permite aos consumidores pagar bens e serviços de forma rápida e segura, utilizando os seus smartphones, enquanto o Google Pay oferece funcionalidades integradas para pagamentos online e na loja. Como resultado, as empresas estão a adotar cada vez mais estas soluções de pagamento para satisfazer as expectativas dos clientes e melhorar a experiência do utilizador, aumentando a procura por gateways de pagamento integrados que suportem estas opções. Esta mudança para carteiras digitais melhora a conveniência e garante transações mais rápidas e seguras, impulsionando ainda mais o crescimento do mercado de gateways de pagamento.

Oportunidades

- Aumento dos avanços tecnológicos nas soluções de pagamento móvel

Os avanços tecnológicos nas soluções de pagamento móvel e nos pagamentos contactless representam uma oportunidade de mercado significativa para o mercado das gateways de pagamento baseadas em plataformas, uma vez que aumentam a eficiência, a segurança e a conveniência das transações. Inovações como o Apple Pay, Google Pay e Samsung Pay simplificaram o processo de pagamento, permitindo aos utilizadores concluir transações com um simples toque nos seus dispositivos móveis. Estas soluções contactless são mais rápidas e oferecem maior segurança através de tokenização e autenticação biométrica, o que as torna cada vez mais populares entre os consumidores. Além disso, o aumento dos pagamentos por código QR impulsionou ainda mais a acessibilidade dos sistemas de pagamento móvel, especialmente em regiões com grande penetração de smartphones. As empresas que adotam estas tecnologias podem oferecer experiências de pagamento seguras, sem atrito e integradas, atendendo à crescente procura por transações instantâneas e seguras. À medida que mais consumidores migram para os pagamentos digitais e móveis, esta tendência apresenta uma oportunidade substancial para os fornecedores de gateways de pagamento inovarem e conquistarem quota de mercado integrando estas soluções avançadas nas suas plataformas.

- Número crescente de iniciativas por parte dos governos

As iniciativas governamentais para promover os sistemas de pagamento digital estão a criar oportunidades de mercado significativas para o mercado de gateways de pagamento baseados em plataformas, especialmente nos mercados emergentes. Países como a Índia lançaram programas como o Digital India para incentivar as transações digitais e melhorar a inclusão financeira, aumentando o acesso aos serviços bancários e de pagamento. Por exemplo, o programa Pradhan Mantri Jan Dhan Yojana (PMJDY) na Índia permitiu que milhões de cidadãos sem conta bancária abrissem contas digitais, impulsionando diretamente a adoção de carteiras móveis e gateways de pagamento. Da mesma forma, a China avançou os seus ecossistemas Alipay e WeChat Pay com apoio governamental, tornando os pagamentos digitais acessíveis em todo o país. Estas iniciativas apoiadas pelo governo estão a ajudar a diminuir a exclusão digital e a impulsionar o crescimento da infraestrutura de pagamentos digitais. À medida que mais governos incentivam a utilização de pagamentos digitais para impulsionar a actividade económica e a inclusão financeira, a procura de gateways de pagamento baseados em plataformas continua a aumentar, apresentando uma grande oportunidade para os fornecedores de serviços de pagamento expandirem o seu alcance nestas regiões em desenvolvimento.

Restrições/Desafios

- Riscos de Segurança e Fraude

Os riscos de segurança e fraude estão entre os desafios mais urgentes para as gateways de pagamento baseadas em plataformas, uma vez que devem evoluir continuamente para proteger as informações confidenciais dos clientes contra ataques cibernéticos, violações de dados e esquemas de fraude cada vez mais sofisticados. Apesar da implementação de elevados níveis de encriptação, como o SSL (Secure Sockets Layer), e da adesão a normas rigorosas da indústria, como o PCI DSS (Payment Card Industry Data Security Standard), o risco de vulnerabilidades de segurança persiste. Por exemplo, as grandes violações de dados, como a violação da Equifax em 2017, expuseram dados pessoais e financeiros de milhões de consumidores, prejudicando significativamente a confiança dos consumidores e levando a acordos dispendiosos. No setor das gateways de pagamento, violações ou ataques fraudulentos semelhantes podem ter consequências de longo alcance, minando a confiança nos sistemas de pagamento digital. À medida que as técnicas de fraude se tornam mais avançadas, incluindo a utilização de ataques baseados em IA e esquemas de phishing, as gateways de pagamento são forçadas a atualizar continuamente os seus protocolos de segurança, o que pode ser dispendioso e consumir muitos recursos. A ameaça contínua de vulnerabilidades de segurança é um grande desafio para as empresas, uma vez que afeta os resultados financeiros devido a perdas relacionadas com fraudes e representa um risco a longo prazo para a reputação da marca e a lealdade do cliente. Por conseguinte, garantir medidas de segurança robustas e adaptar-se continuamente às ameaças emergentes é uma tarefa crítica para os gateways de pagamento manterem uma posição competitiva e fiável no mercado.

- Taxas e custos de transação

As taxas e os custos de transação representam um desafio significativo para as empresas que utilizam gateways de pagamento baseados em plataformas, uma vez que estas taxas podem variar em função de fatores como o método de pagamento, o volume de transações e a localização geográfica. Os fornecedores de gateways de pagamento cobram normalmente uma taxa por cada transação, que pode incluir uma taxa fixa mais uma percentagem do valor da transação. Por exemplo, gateways populares como o PayPal e o Stripe cobram cerca de 2,9% mais uma taxa fixa por cada transação, o que pode aumentar rapidamente, particularmente para empresas com elevados volumes de transações. Para as empresas de maior dimensão, estas taxas podem tornar-se uma despesa grande, afetando a sua rentabilidade. As empresas mais pequenas, em particular, podem ter dificuldades com estes custos, uma vez que têm menos margem para absorver taxas sem aumentar os preços ou reduzir os lucros. Além disso, as empresas envolvidas em transações internacionais enfrentam frequentemente taxas mais elevadas devido às taxas de conversão de moeda e às taxas internacionais. Isto pode ser um fardo significativo, particularmente para as empresas de comércio eletrónico que dependem das vendas globais. O efeito cumulativo das taxas de transação pode ter impacto nos resultados financeiros de uma empresa, obrigando muitas a procurar formas de otimizar os custos, seja negociando melhores taxas, adotando métodos de pagamento alternativos ou explorando outros gateways com taxas mais baixas. Por conseguinte, as taxas e os custos de transação continuam a ser um desafio persistente de mercado, especialmente para as empresas mais pequenas e para aquelas com operações em grande escala.

Este relatório de mercado fornece detalhes dos novos desenvolvimentos recentes, regulamentos comerciais, análise de importação e exportação, análise de produção, otimização da cadeia de valor, quota de mercado, impacto dos participantes do mercado nacional e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações do mercado, análise do crescimento estratégico do mercado, tamanho do mercado, crescimento do mercado de categorias, nichos de aplicação e dominância, aprovações de produtos, lançamentos de produtos, expansões geográficas, inovações tecnológicas no mercado. Para mais informações sobre o mercado, contacte a Data Bridge Market Research para obter um briefing de analista.

Âmbito de mercado do gateway de pagamento baseado em plataforma

O mercado é segmentado com base na aplicação e no utilizador final. O crescimento entre estes segmentos irá ajudá-lo a analisar segmentos de baixo crescimento nos setores e fornecer aos utilizadores. O crescimento entre estes segmentos irá ajudá-lo a analisar segmentos de baixo crescimento nos setores e fornecerá aos utilizadores uma visão geral e informações valiosas do mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Aplicação

- Micro e Pequenas Empresas

- Grandes Empresas

- Empresas de média dimensão

Utilizador final

- BFSI

- Media e Entretenimento

- Retalho e comércio eletrônico

- Viagens e hospitalidade

- Outros

Análise regional do mercado de gateway de pagamento baseado em plataforma

The market is analyzed and market size insights and trends are provided by country, application, and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries, and provide the users as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America dominates the platform-based payment gateway market and is expected to maintain its dominance due to continuous technological advancements. The widespread adoption of payment gateways across various industries, including e-commerce, retail, and financial services, fuels this growth. In addition, the increasing demand for secure, fast, and convenient payment methods drives further innovation in the region. As businesses continue to embrace digital transformation, the market in North America is poised for sustained expansion and success.

Asia Pacific is the fastest-growing market for payment gateways during the forecast period. This growth is primarily driven by various government initiatives aimed at improving internet payment infrastructure across the region. Countries are investing heavily in upgrading their digital payment systems to support the increasing demand for online transactions. As these advancements continue, the region is set to experience a surge in adoption, positioning it as a key player in the global payment gateway market.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Platform Based Payment Gateway Market Share

O cenário competitivo do mercado fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença global, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento de produtos, amplitude e abrangência do produto, domínio da aplicação. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas em relação ao mercado.

Os líderes de mercado de gateway de pagamento baseado em plataforma que operam no mercado são:

- Alipay (China)

- Amazon Payments, Inc. (EUA)

- Wirecard (Alemanha)

- PESOPAY (Índia)

- PayU (Holanda)

- PayPal (EUA)

- PAYMILL (Alemanha)

- Fiuu (Espanha)

- Web Active Corporation (EUA)

- Worldpay LLC (Reino Unido)

- Stripe, Inc. (EUA)

- Klarna Bank AB (publ) (Suécia)

- Cashfree Payments India Private Limited (Índia)

- WebMoney (Rússia)

- 99bill (China)

- MyGate (África do Sul)

- Servido (Espanha)

- Svea Bank (Suécia)

- Cardstream Limited (Reino Unido)

- Elavon (EUA)

- NAB Transact (Austrália)

- MercadoLibre SRL (Argentina)

- CCBill (EUA)

Últimos desenvolvimentos no mercado de gateway de pagamento baseado em plataforma

- Em fevereiro de 2024, a Adyen e a Billie estabeleceram uma parceria para apresentar o serviço Comprar agora, pagar depois a empresas de toda a Europa. A solução da Billie está totalmente integrada com a Adyen, permitindo que as lojas a ativem com apenas alguns cliques

- Em maio de 2022, a MasterCard colaborou com a CRED para oferecer aos titulares de cartões de crédito Mastercard uma forma fácil, segura e eficiente de fazer transações de alto valor utilizando a aplicação CRED em qualquer dispositivo móvel

- Em julho de 2021, a PayU, um fornecedor global de serviços de pagamento, uniu forças com a WooCommerce, uma plataforma de e-commerce personalizável, para fornecer aos comerciantes da WooCommerce uma infraestrutura de pagamento digital robusta e facilitar a digitalização completa dos seus processos de negócio.

- Em maio de 2021, a Stripe anunciou a sua parceria com a GrabPay, um fornecedor líder de soluções de pagamento, para oferecer às empresas na Malásia e em Singapura um método de pagamento online mais conveniente e gratificante através da carteira eletrónica da GrabPay.

- Em outubro de 2020, a Stripe, uma empresa de serviços financeiros, adquiriu a Paystack, uma empresa de processamento de pagamentos online que opera na Nigéria. A Paystack, que planeia expandir-se para a África do Sul, continua a operar de forma independente, ao mesmo tempo que integra os serviços da Stripe nas suas ofertas

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.