Global Pharmaceutical Packaging Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

118.43 Billion

USD

206.52 Billion

2024

2032

USD

118.43 Billion

USD

206.52 Billion

2024

2032

| 2025 –2032 | |

| USD 118.43 Billion | |

| USD 206.52 Billion | |

|

|

|

|

Mercado global de embalagens farmacêuticas, por produto (embalagem primária, embalagem secundária e terciária), material (plásticos e polímeros, papel e cartão, vidro, metais e outros), modo de administração de medicamentos (embalagem para administração oral de medicamentos, embalagem para administração parentérica de medicamentos, tópico Embalagem para administração de medicamentos, embalagem para administração de medicamentos por inalação, embalagem para administração de medicamentos por via nasal, embalagem para administração de medicamentos por via ocular, embalagem para administração de outros medicamentos), utilizador final (empresas de fabrico de produtos farmacêuticos, empresas de embalagens por contrato, farmácias e outros) - Tendências e previsões do sector até 2031.

Análise e Insights do Mercado de Embalagens Farmacêuticas

A externalização dos serviços de embalagem por contrato tornou-se crucial para as empresas farmacêuticas, permitindo-lhes concentrar-se em competências essenciais e, ao mesmo tempo, cumprir padrões exigentes. A Prespack oferece parcerias multidimensionais, aliviando os fabricantes de produtos medicinais ou dispositivos médicos de muitos processos. Esta tendência reflete o crescente setor de outsourcing farmacêutico, contribuindo, em última análise, para a expansão do mercado de embalagens farmacêuticas.

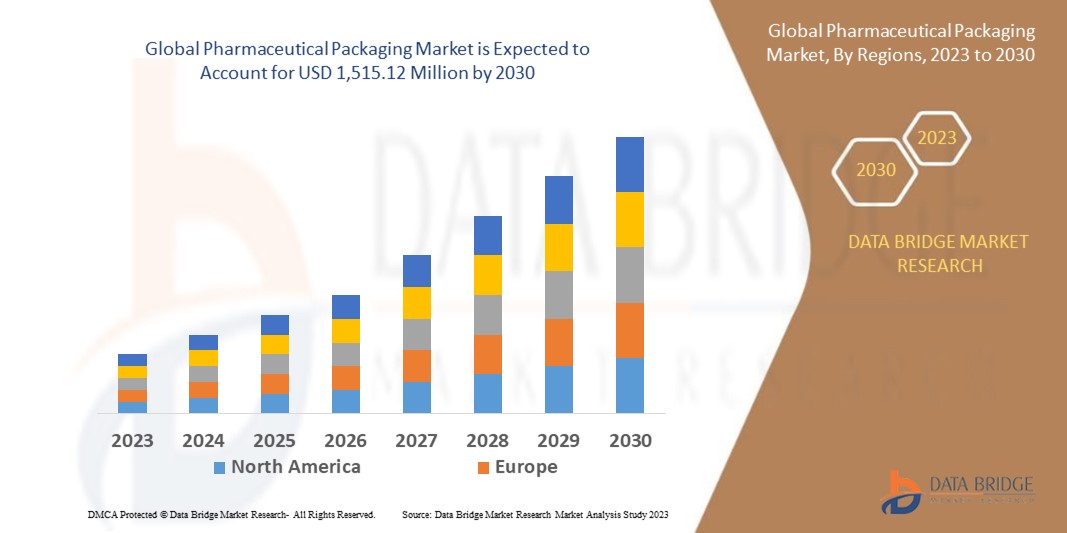

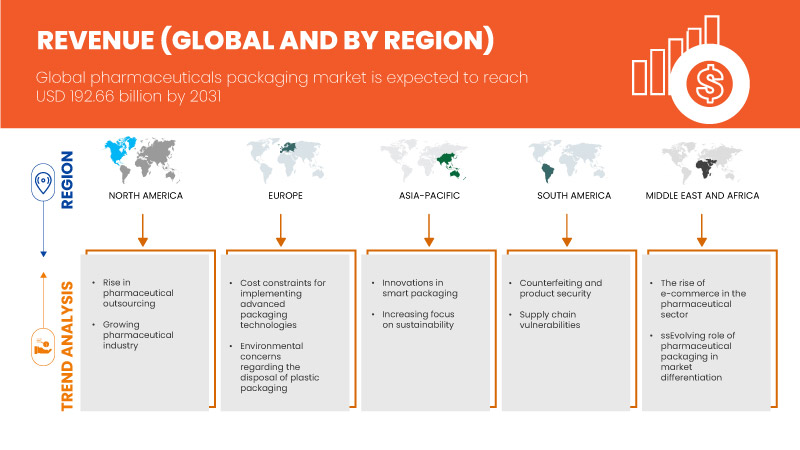

A Data Bridge Market Research analisa que o mercado global de embalagens farmacêuticas deverá atingir os 192,66 mil milhões de dólares até 2031, face aos 111,52 mil milhões de dólares em 2023, crescendo a um CAGR de 7,2% no período previsto de 2024 a 2031 .

|

Métrica de Reporte |

Detalhes |

|

Período de previsão |

2024 a 2031 |

|

Ano base |

2023 |

|

Anos históricos |

2022 (Personalizável para 2016–2021) |

|

Unidades quantitativas |

Receita em biliões de dólares americanos |

|

Segmentos abrangidos |

Produto (embalagem primária, embalagem secundária e terciária), material (plásticos e polímeros, papel e cartão, vidro, metais e outros), modo de administração de medicamentos (embalagem para administração oral de medicamentos, embalagem para administração parentérica de medicamentos, embalagem para administração tópica de medicamentos, embalagem para administração inalatória de medicamentos). Embalagem de entrega, embalagem de entrega de medicamentos nasais, embalagem de entrega de medicamentos oculares, embalagem de entrega de outros medicamentos), utilizador final (empresas de fabrico farmacêutico, empresas de embalagem convencionados, farmácias e outros) |

|

Países abrangidos |

EUA, Canadá, México, Alemanha, Reino Unido, França, Itália, Holanda, Espanha, Rússia, Suíça, Turquia, Bélgica, Resto da Europa, China, Japão, Índia, Coreia do Sul, Austrália, Singapura, Indonésia, Tailândia, Malásia , Filipinas , Resto da Ásia-Pacífico, Brasil, Argentina, Resto da América do Sul, África do Sul, Emirados Árabes Unidos, Arábia Saudita, Egito, Israel, Resto do Médio Oriente e África |

|

Atores do mercado abrangidos |

WestRock Company, Amcor plc, BD, AptarGroup, Inc., West Pharmaceutical Services, Inc., Berry Global, Inc., CCL Industries, Gerresheimer AG, Schott AG, UFlex Limited, SGD Pharma, EPL Limited, Drug Plastics Group, Comar, e Daikyo Seiko Co., Ltd., entre outros |

Definição de Mercado

A embalagem farmacêutica envolve o processo de acondicionamento de medicamentos e outros produtos farmacêuticos em materiais de embalagem que garantem a sua proteção, identificação e divulgação de informação. Estes materiais incluem plásticos, vidro, alumínio , papel e cartão, cada um escolhido pelas suas propriedades e aplicações específicas. Estes materiais são cuidadosamente selecionados com base na sua compatibilidade com o produto farmacêutico, na sua capacidade de proteção contra fatores externos e nos requisitos regulamentares.

Dinâmica do mercado global de embalagens farmacêuticas

Esta secção trata da compreensão dos impulsionadores, oportunidades, restrições e desafios do mercado. Tudo isto é discutido em detalhe abaixo:

Motoristas

- Crescente outsourcing farmacêutico

As empresas farmacêuticas estão cada vez mais a optar por externalizar os processos de fabrico para embaladores contratados especializados. Esta mudança estratégica permite que estas empresas se concentrem nas suas principais competências, como a investigação, o desenvolvimento e o marketing, deixando as complexidades da embalagem para os especialistas. Os embaladores contratados oferecem uma variedade de serviços, incluindo o design de embalagens, a seleção de materiais e a garantia de conformidade com os rigorosos requisitos regulamentares. Isto é particularmente vantajoso para as empresas farmacêuticas que procuram soluções de embalagem inovadoras e personalizadas para os seus produtos.

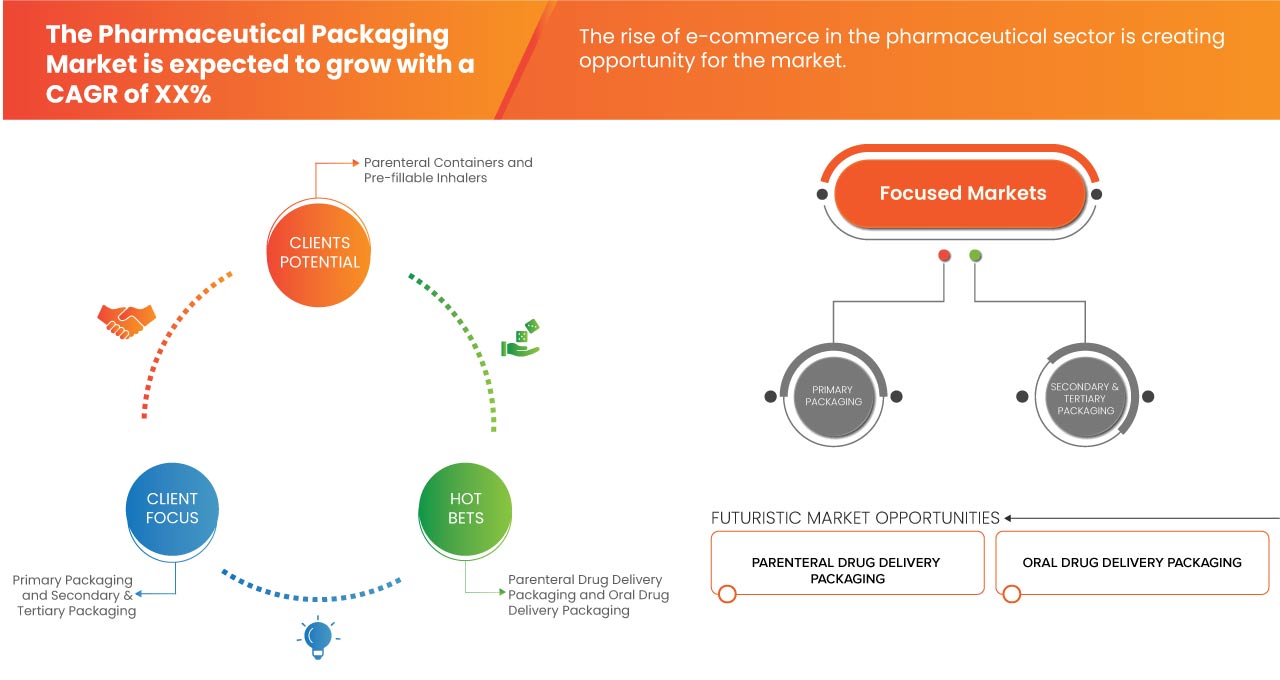

- Papel Evolutivo da Embalagem Farmacêutica na Diferenciação de Mercado

A embalagem evoluiu para além da sua função tradicional de apenas conter produtos farmacêuticos; é hoje um elemento chave na diferenciação destes produtos no mercado. Esta mudança é motivada pela cada vez maior concorrência na indústria farmacêutica, onde as empresas estão a utilizar a embalagem como uma ferramenta para diferenciar os seus produtos dos concorrentes. A embalagem serve como uma plataforma visual e informativa que comunica detalhes vitais sobre o produto, incluindo a sua qualidade, segurança e eficácia. Além disso, a embalagem atua como um meio de marketing, ajudando a atrair os consumidores e a influenciar as suas decisões de compra. Em resposta a esta tendência, verificou-se um aumento de soluções de embalagem inovadoras. Por exemplo, as embalagens inteligentes incorporam características digitais como etiquetas RFID ou códigos QR, permitindo aos consumidores aceder a informações adicionais sobre o produto ou rastrear a autenticidade.

A utilização de materiais ecológicos nas embalagens está a ganhar força, refletindo a crescente consciência ambiental dos consumidores. Estas abordagens inovadoras não só diferenciam os produtos, como também contribuem para práticas sustentáveis, melhorando ainda mais a reputação da marca.

O foco na diferenciação de produtos através da embalagem está a impulsionar avanços significativos no setor das embalagens farmacêuticas, promovendo um ambiente de mercado propício à inovação e melhoria contínuas.

Oportunidade

- Inovações em embalagens inteligentes

As inovações em embalagens inteligentes, como as etiquetas sensíveis à temperatura e o rastreio RFID, estão a revolucionar o mercado global de embalagens farmacêuticas. Estes avanços oferecem uma infinidade de benefícios, começando por uma maior visibilidade em toda a cadeia de abastecimento. As etiquetas sensíveis à temperatura, por exemplo, proporcionam uma monitorização em tempo real, garantindo que os medicamentos são armazenados e transportados em condições ideais. Esta capacidade é particularmente crucial para os produtos farmacêuticos, uma vez que manter a temperatura correta é essencial para preservar a sua eficácia e segurança. Além disso, o rastreio RFID permite que as empresas rastreiem unidades individuais de produtos, garantindo a autenticidade e evitando adulterações. Este nível de rastreabilidade não só ajuda na conformidade com as normas regulamentares, como também aumenta a confiança do consumidor. Além disso, as embalagens inteligentes facilitam processos de recolha eficientes, uma vez que as empresas podem identificar e recuperar rapidamente os produtos afetados.

Restrição s/ Desafios

- Falsificação e Segurança de Produtos

A contrafação no setor farmacêutico representa um desafio multifacetado, apesar dos avanços nas tecnologias de embalagem. A proliferação de medicamentos falsificados não só põe em risco a saúde dos doentes como também corrói a confiança nos produtos farmacêuticos e na indústria. Estas atividades ilícitas envolvem frequentemente táticas sofisticadas, incluindo a replicação de embalagens e rótulos para imitar produtos genuínos. À medida que os falsificadores evoluem continuamente os seus métodos para evitar a detecção, as empresas farmacêuticas devem manter-se vigilantes e adaptar as suas estratégias de embalagem para se manterem à frente destas ameaças. Esta batalha contínua contra os medicamentos falsificados sublinha a importância crítica de soluções de embalagem inovadoras e de esforços colaborativos dentro da indústria e das entidades reguladoras para garantir a segurança e a integridade dos produtos farmacêuticos.

- Restrições de custos para a implementação de tecnologias avançadas de embalagem

O desenvolvimento e a implementação de tecnologias de embalagem avançadas, como a embalagem inteligente e as medidas antifalsificação, exigem frequentemente investimentos substanciais em investigação, desenvolvimento e infraestruturas tecnológicas. Para as empresas mais pequenas e com recursos limitados, estes custos podem ser proibitivos, impedindo-as de adotar soluções de embalagem inovadoras. Como resultado, estas empresas podem estar em desvantagem em comparação com os concorrentes de maior dimensão que podem investir em tecnologias de embalagem avançadas. Esta restrição dificulta o crescimento global e o potencial de inovação do mercado de embalagens farmacêuticas, limitando a disponibilidade de soluções de embalagem avançadas e dificultando potencialmente a competitividade do mercado.

Desenvolvimentos recentes

- Em setembro de 2023, a WestRock Company WRK e a Smurfit Kappa Group Plc SMFKY concordaram em fundir-se e criar a Smurfit WestRock, que deverá ser uma das maiores empresas de papel e embalagens do mundo, com um valor de cerca de 20 mil milhões de dólares .

- Em julho de 2023, a Constantia Flexibles anunciou a sua mais recente solução de embalagem farmacêutica, a película de conformação a frio REGULA CIRC, uma tecnologia de ponta que define um novo padrão de sustentabilidade em embalagens blister. Concebido com a circularidade em mente, o REGULA CIRC está em conformidade com a regulamentação e legislação futura, oferecendo uma solução de barreira total que cumpre os mais elevados padrões de embalagem sustentável

- Em junho de 2022, a Berlin Packaging, um dos maiores fornecedores de embalagens híbridas do mundo, anunciou a aquisição do Andler Packaging Group, um distribuidor de valor acrescentado de recipientes e tampas de plástico, vidro e metal.

- Em dezembro de 2021, a Comar, fornecedor líder de dispositivos e conjuntos médicos personalizados e soluções de embalagens especiais, anunciou hoje que adquiriu a Omega Packaging, fabricante de produtos moldados por injeção e sopro que servem os mercados farmacêutico, nutracêutico, nutrição desportiva e cuidados com a pele.

- Em abril de 2022, a Amcor, líder no design e produção de soluções de embalagens éticas, revelou recentemente a adição de um novo laminado High Shield, mais ecológico, à sua gama de embalagens farmacêuticas

Âmbito do mercado global de embalagens farmacêuticas

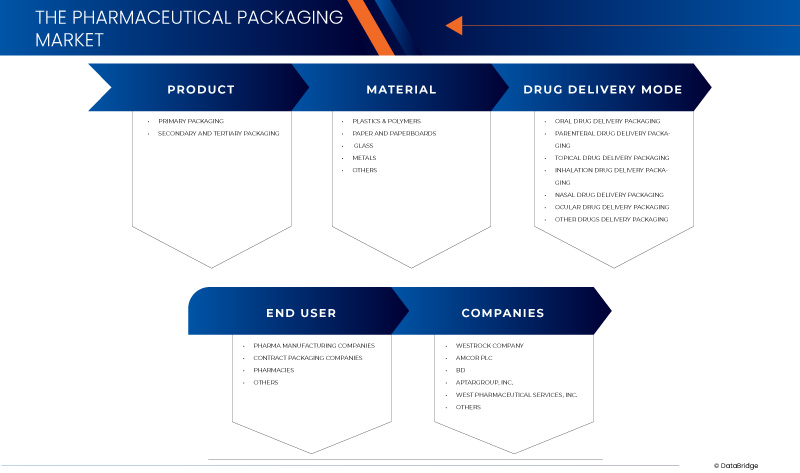

O mercado global de embalagens farmacêuticas está segmentado em quatro segmentos notáveis com base no produto, material, modo de administração do medicamento e utilizador final. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e as diferenças nos seus mercados-alvo.

Produto

- Embalagem primária

- Embalagem Secundária e Terciária

Com base no produto, o mercado está segmentado em embalagens primárias e embalagens secundárias e terciárias.

Material

- Plásticos e Polímeros

- Papel e cartão

- Copo

- Metais

- Outros

Com base no material, o mercado está segmentado em plásticos e polímeros, papel e cartão, vidro, metais e outros.

Modo de administração de medicamentos

- Embalagem para administração oral de medicamentos

- Embalagem para administração de medicamentos parenterais

- Embalagem para administração de medicamentos tópicos

- Embalagem para administração de medicamentos para inalação

- Embalagem para administração nasal de medicamentos

- Embalagem para administração de medicamentos oculares

- Outras embalagens para entrega de medicamentos

Com base no modo de administração de medicamentos, o mercado está segmentado em embalagens para administração oral de medicamentos, embalagens para administração parentérica de medicamentos, embalagens para administração tópica de medicamentos, embalagens para administração inalatória de medicamentos, embalagens para administração nasal de medicamentos, embalagens para administração ocular de medicamentos e outras embalagens para administração de medicamentos.

Utilizador final

- Empresas de fabrico de produtos farmacêuticos

- Empresas de embalagens contratadas

- Farmácias

- Outros

Com base no utilizador final, o mercado está segmentado em empresas de fabrico de produtos farmacêuticos, empresas de embalagem por contrato, farmácias e outras.

Análise regional/perspetivas do mercado global de embalagens farmacêuticas

O mercado global de embalagens farmacêuticas está categorizado em quatro segmentos notáveis com base no produto, material, modo de administração do medicamento e utilizador final.

Os países abrangidos neste relatório de mercado são os EUA, Canadá, México, Alemanha, Reino Unido, França, Itália, Países Baixos, Espanha, Rússia, Suíça, Turquia, Bélgica, resto da Europa, China, Japão, Índia, Coreia do Sul, Austrália , Singapura , Indonésia, Tailândia, Malásia, Filipinas, resto da Ásia-Pacífico, Brasil, Argentina, resto da América do Sul, África do Sul, Emirados Árabes Unidos, Arábia Saudita, Egito, Israel e resto do Médio Oriente e África.

Espera-se que a América do Norte domine o mercado global de embalagens farmacêuticas devido à sua infraestrutura de cuidados de saúde avançada, estrutura regulamentar robusta e investimento significativo em investigação e desenvolvimento. Espera-se que os EUA dominem a América do Norte devido à sua infraestrutura de cuidados de saúde avançada, à grande indústria farmacêutica e à elevada procura por soluções de embalagem inovadoras. Espera-se que a China domine a região Ásia-Pacífico devido à sua indústria farmacêutica em rápida expansão, à grande base de consumidores e aos investimentos crescentes em infraestruturas de saúde e tecnologias de embalagem. Espera-se que a Alemanha domine a região da Europa devido ao seu robusto setor de fabrico farmacêutico, forte ambiente regulamentar e ênfase em normas de embalagem de alta qualidade.

A secção de países do relatório também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado nacional que impactam as tendências atuais e futuras do mercado. Pontos de dados como novas vendas, vendas de reposição, demografia do país, atos regulamentares e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade de marcas globais e os seus desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais e o impacto dos canais de vendas são considerados ao fornecer uma análise de previsão dos dados do país.

Análise do panorama competitivo e da quota de mercado global de embalagens farmacêuticas

O panorama competitivo do mercado global de embalagens farmacêuticas fornece detalhes dos concorrentes. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em I&D, novas iniciativas de mercado, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos, aprovações de produtos, amplitude e amplitude do produto, domínio da aplicação e tipo de produto curva da linha de vida. Os pontos de dados fornecidos acima estão apenas relacionados com o foco da empresa no mercado.

Alguns dos principais participantes do mercado que operam no mercado são a WestRock Company, Amcor plc, BD, AptarGroup, Inc., West Pharmaceutical Services, Inc., Berry Global, Inc., CCL Industries, Gerresheimer AG, Schott AG, UFlex Limited, SGD Pharma, EPL Limited, Drug Plastics Group, Comar e Daikyo Seiko Co., Ltd., entre outras.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.