Global Natural Fibers Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

60.42 Billion

USD

108.57 Billion

2024

2032

USD

60.42 Billion

USD

108.57 Billion

2024

2032

| 2025 –2032 | |

| USD 60.42 Billion | |

| USD 108.57 Billion | |

|

|

|

|

Segmentação do mercado global de fibras naturais, por fibras (algodão, lã, linho, seda, juta, cânhamo, sisal, kenaf e outras), canal de distribuição (fabricantes, distribuidores, atacadistas, varejistas e outros), aplicação (moda e vestuário, mobiliário e casa e industrial e técnico) - Tendências do setor e previsões até 2032

Tamanho do mercado de fibras naturais

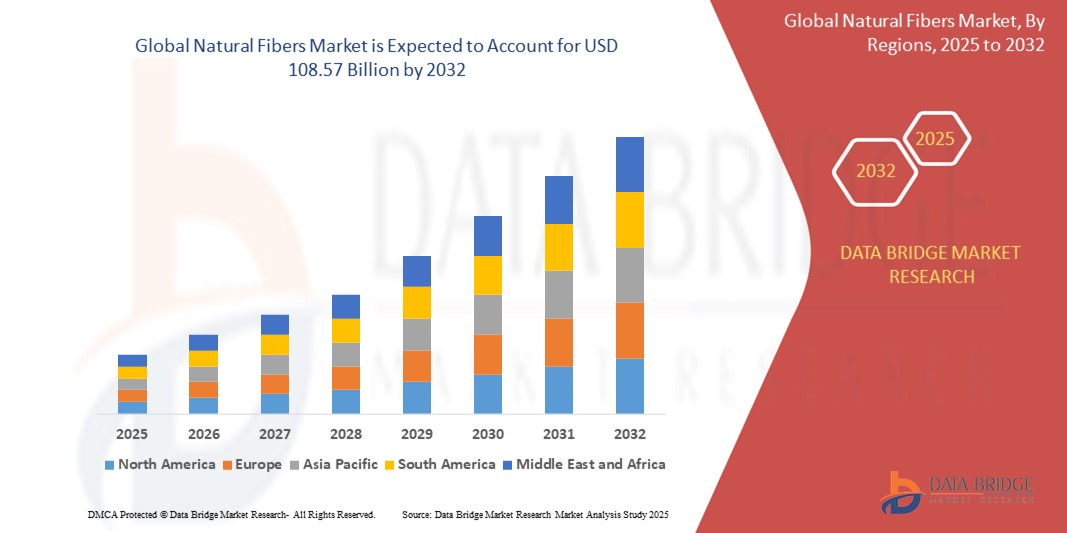

- O tamanho do mercado global de fibras naturais foi avaliado em US$ 60,42 bilhões em 2024 e deve atingir US$ 108,57 bilhões até 2032 , com um CAGR de 7,60% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente demanda por alternativas ecológicas e biodegradáveis às fibras sintéticas em setores como têxtil, automotivo, construção e embalagens.

- A crescente conscientização do consumidor em relação à sustentabilidade, juntamente com as pressões regulatórias para reduzir as pegadas de plástico e de carbono, está acelerando ainda mais a adoção de fibras naturais em economias desenvolvidas e emergentes.

Análise de Mercado de Fibras Naturais

- O mercado está testemunhando uma mudança em direção a materiais sustentáveis, como algodão, linho, juta, cânhamo, fibra de coco e sisal, que oferecem menor impacto ambiental e aplicações versáteis

- As indústrias estão cada vez mais integrando fibras naturais em compósitos e têxteis para atender aos padrões de certificação verde e atrair consumidores ambientalmente conscientes

- A Ásia-Pacífico dominou o mercado de fibras naturais com a maior participação na receita de 38,74% em 2024, impulsionada por uma forte presença de fontes de matéria-prima, baixos custos de mão de obra e crescente demanda das indústrias têxteis e de embalagens.

- Espera-se que a região da América do Norte testemunhe a maior taxa de crescimento no mercado global de fibras naturais, impulsionada pela crescente conscientização do consumidor em relação a materiais sustentáveis e biodegradáveis, juntamente com a crescente demanda por produtos ecológicos nos setores de moda, automotivo e construção.

- O segmento de algodão dominou o mercado, com a maior participação na receita, de 34,5% em 2024, impulsionado por seu amplo uso na indústria têxtil e de vestuário devido ao seu conforto, respirabilidade e alta aceitação pelo consumidor. A natureza biodegradável do algodão e a compatibilidade com práticas de agricultura orgânica também fortaleceram seu apelo em meio a crescentes preocupações com a sustentabilidade. Os fabricantes preferem cada vez mais o algodão orgânico para atender aos requisitos do selo ecológico e à demanda do consumidor por fornecimento ético.

Escopo do Relatório e Segmentação do Mercado de Fibras Naturais

|

Atributos |

Principais insights do mercado de fibras naturais |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

Europa

Ásia-Pacífico

Oriente Médio e África

Ámérica do Sul

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de consumo de produção, análise de tendência de preço, cenário de mudança climática, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matéria-prima/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de fibras naturais

“Crescente integração de fibras naturais em compósitos automotivos”

- Fibras naturais como juta, linho e kenaf são cada vez mais utilizadas em interiores de veículos, incluindo painéis de portas e painéis de instrumentos

- As montadoras preferem fibras naturais por seu peso leve, o que ajuda a melhorar a eficiência de combustível

- A pressão regulatória na Europa está a promover materiais de base biológica e recicláveis na produção automóvel

- Os compósitos de fibras naturais oferecem menor impacto ambiental em comparação aos materiais sintéticos tradicionais

- Os investimentos em materiais sustentáveis por parte dos fabricantes de equipamentos originais (OEMs) automotivos estão impulsionando a adoção de fibras naturais

- Por exemplo, a BMW usa fibra kenaf nos painéis das portas do seu carro elétrico i3 para reduzir o peso e aumentar a sustentabilidade

Dinâmica do Mercado de Fibras Naturais

Motorista

“Crescente demanda por materiais sustentáveis e biodegradáveis”

- As preocupações ambientais estão impulsionando uma mudança global em direção a materiais biodegradáveis e renováveis

- Os consumidores preferem cada vez mais alternativas ecológicas em têxteis, embalagens e mobiliário

- As proibições governamentais de plásticos e materiais não biodegradáveis estão apoiando a adoção de fibras naturais

- As fibras naturais reduzem a carga nos aterros sanitários e as emissões de carbono em comparação com as sintéticas

- As marcas estão incorporando fibras orgânicas para atingir metas de sustentabilidade e atrair compradores conscientes

- Por exemplo, a Levi's lançou coleções que utilizam cânhamo e algodão orgânico para apoiar as suas iniciativas climáticas positivas

Restrição/Desafio

“Problemas inconsistentes de qualidade e cadeia de suprimentos”

- As fibras naturais geralmente variam em textura, resistência e durabilidade devido à agricultura e às condições climáticas

- A disponibilidade sazonal leva a um fornecimento imprevisível, impactando aplicações em larga escala

- Uma infraestrutura de armazenamento e transporte deficiente pode levar à deterioração e degradação das fibras

- Os fabricantes lutam para padronizar a qualidade da fibra para aplicações de alto desempenho

- A volatilidade dos custos devido a rendimentos inconsistentes dificulta o planeamento e a aquisição a longo prazo

- Por exemplo, o setor da construção civil limitou a utilização de juta em compósitos estruturais devido à resistência à tração variável entre os lotes.

Escopo de mercado de fibras naturais

O mercado é segmentado com base em fibras, canal de distribuição e aplicação.

• Por Fibras

Com base nas fibras, o mercado de fibras naturais é segmentado em algodão, lã, linho, seda, juta, cânhamo, sisal, kenaf e outras. O segmento de algodão dominou o mercado, com a maior participação na receita, de 34,5% em 2024, impulsionado por seu amplo uso na indústria têxtil e de vestuário devido ao seu conforto, respirabilidade e alta aceitação pelo consumidor. A natureza biodegradável do algodão e a compatibilidade com práticas de agricultura orgânica também fortaleceram seu apelo em meio a crescentes preocupações com a sustentabilidade. Os fabricantes preferem cada vez mais o algodão orgânico para atender aos requisitos do selo ecológico e à demanda do consumidor por fornecimento ético.

Espera-se que o segmento do cânhamo apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado por seu rápido ciclo de cultivo, baixo impacto ambiental e uso emergente em aplicações têxteis e industriais. A resistência e a durabilidade do cânhamo, combinadas com sua necessidade mínima de pesticidas, estão atraindo interesse nos setores de moda, automotivo e construção, especialmente na Europa e na América do Norte.

• Por Canal de Distribuição

Com base no canal de distribuição, o mercado de fibras naturais é segmentado em fabricantes, distribuidores, atacadistas, varejistas e outros. O segmento de fabricantes deteve a maior fatia da receita de mercado em 2024, impulsionado pelo número crescente de empresas verticalmente integradas com foco em fornecimento sustentável e processamento interno para manter a qualidade e a rastreabilidade. O contato direto com os produtores de fibras também permite que os fabricantes reduzam custos e personalizem as características das fibras para atender aos requisitos do usuário final.

Espera-se que o segmento varejista apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pelo crescente interesse do consumidor por produtos ecológicos e pela expansão do varejo especializado e das plataformas de e-commerce. Os varejistas estão capitalizando a crescente demanda por roupas, decoração e produtos de estilo de vida sustentáveis, estocando alternativas à base de fibras naturais e promovendo seus benefícios ambientais por meio de branding e certificações.

• Por aplicação

Com base na aplicação, o mercado de fibras naturais é segmentado em moda e vestuário, mobiliário e casa, e industrial e técnico. O segmento de moda e vestuário conquistou a maior fatia de mercado em 2024, impulsionado pela crescente preferência do consumidor por tecidos respiráveis e que não agridem a pele e pelo aumento da demanda por moda sustentável. Fibras naturais como algodão, lã e seda estão sendo cada vez mais adotadas por marcas globais de moda que buscam reduzir sua pegada ambiental.

Espera-se que o segmento industrial e técnico apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pelo uso crescente de fibras como linho, kenaf e cânhamo em aplicações automotivas, de embalagens e de construção. Essas fibras estão sendo integradas a biocompósitos e materiais de isolamento, proporcionando soluções duráveis e leves, em conformidade com os padrões regulatórios e de sustentabilidade.

Análise regional do mercado de fibras naturais

- A Ásia-Pacífico dominou o mercado de fibras naturais com a maior participação na receita de 38,74% em 2024, impulsionada por uma forte presença de fontes de matéria-prima, baixos custos de mão de obra e crescente demanda das indústrias têxteis e de embalagens.

- Os países da região beneficiam de setores agrícolas de algodão e juta já estabelecidos, bem como de uma base industrial em rápido crescimento que utiliza cânhamo e kenaf para aplicações técnicas.

- Os incentivos governamentais que promovem o uso de materiais biodegradáveis e ecológicos estão acelerando ainda mais a adoção de fibras naturais em países como Índia, China e Bangladesh

Visão do mercado de fibras naturais da China

O mercado de fibras naturais da China foi responsável pela maior fatia da receita na região Ásia-Pacífico em 2024, impulsionado por sua forte base de produção em algodão, cânhamo e seda, bem como pela liderança do país na indústria têxtil global. A ampla capacidade da cadeia de suprimentos da China, aliada a iniciativas governamentais que promovem a agricultura sustentável e materiais biodegradáveis, está impulsionando o uso de fibras naturais em vestuário, mobiliário e aplicações industriais. Marcas e exportadoras nacionais estão cada vez mais incorporando materiais ecológicos para atender aos padrões regulatórios globais e às expectativas dos consumidores, especialmente dos mercados norte-americano e europeu.

Visão do mercado de fibras naturais do Japão

O mercado japonês de fibras naturais deverá crescer de forma constante durante o período previsto, impulsionado pela crescente preferência do consumidor por materiais naturais, de alta qualidade e ecologicamente corretos em artigos de moda e artigos para o lar. A longa tradição japonesa de uso de seda e algodão, aliada à inovação moderna em misturas e acabamentos têxteis, está incentivando a adoção de fibras naturais em vestuário premium e segmentos de estilo de vida. Além disso, a ênfase do país em arquitetura sustentável e embalagens verdes está fomentando a demanda por compósitos e materiais à base de fibras naturais em aplicações industriais de nicho.

Visão do mercado de fibras naturais na América do Norte

Espera-se que o mercado de fibras naturais da América do Norte apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente conscientização do consumidor em relação ao impacto ambiental, pela mudança para têxteis orgânicos e pela crescente demanda nos setores de móveis e embalagens. Grandes marcas nos EUA estão incorporando fibras naturais, como algodão e lã orgânicos, em suas linhas de produtos para atingir metas de sustentabilidade e atender ao segmento de consumidores ecoconscientes.

Visão do mercado de fibras naturais dos EUA

Espera-se que o mercado de fibras naturais dos EUA apresente a maior taxa de crescimento entre 2025 e 2032, devido ao crescente interesse em opções de estilo de vida sustentáveis, à expansão do cultivo de algodão orgânico e aos avanços tecnológicos no processamento de fibras. Os setores de moda, móveis e automotivo estão cada vez mais recorrendo às fibras naturais para aplicações que vão de estofados a biocompósitos. A presença de marcas líderes de vestuário e uma forte infraestrutura de varejo também contribuem para o crescimento do mercado, especialmente por meio de canais de varejo ecológico, tanto online quanto offline.

Visão do mercado de fibras naturais na Europa

A Europa deverá apresentar a maior taxa de crescimento entre 2025 e 2032, impulsionada por fortes regulamentações ambientais, pela preferência do consumidor por produtos sustentáveis e pela integração de fibras naturais em aplicações industriais. As políticas da União Europeia que apoiam práticas de economia circular estão incentivando o uso de linho, cânhamo e lã nos setores da moda, automotivo e construção. França, Alemanha e Reino Unido lideram a inovação e a adoção na região.

Visão do mercado de fibras naturais da Alemanha

A Alemanha deverá apresentar a maior taxa de crescimento entre 2025 e 2032, graças aos seus robustos setores têxtil e automotivo, que estão adotando ativamente fibras naturais como linho e cânhamo em interiores e componentes técnicos. A ênfase do país em uma vida ecologicamente consciente e na construção com eficiência energética também está criando um ambiente favorável ao uso de soluções de isolamento e embalagem biodegradáveis à base de fibras naturais.

Visão geral do mercado de fibras naturais do Reino Unido

Espera-se que o mercado de fibras naturais do Reino Unido apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente demanda por moda de origem ética, pelo apoio às metas governamentais de sustentabilidade e pela crescente popularidade de materiais naturais para decoração e mobiliário. A presença de redes de varejo responsáveis e marcas de moda que promovem "coleções verdes" está alimentando o interesse do consumidor, enquanto inovações em têxteis à base de plantas também estão atraindo investimentos em pesquisa e desenvolvimento.

Participação de mercado de fibras naturais

O setor de fibras naturais é liderado principalmente por empresas bem estabelecidas, incluindo:

- Vardhman Textiles Limited (Índia)

- Grasim Industries Limited (Índia)

- ANANDHI TEXSTYLES (Índia)

- Bcomp (Suíça)

- The Natural Fibre Company (Reino Unido)

- Procotex (Bélgica)

- FlexForm Technologies (EUA)

- Bast Fibre Technologies Inc. (Canadá)

- Lenzing AG (Áustria)

- Barnhardt Natural Fibers (EUA)

Últimos desenvolvimentos no mercado global de fibras naturais

- Em outubro de 2022, a Bast Fibre Technologies Inc. firmou um acordo de financiamento estratégico com o Ahlstrom Capital Group, por meio do qual a Ahlstrom adquiriu uma participação de 20% na Bast. Este investimento deverá acelerar a expansão das operações de produção de fibras da Bast, aprimorando sua capacidade de fabricação e reforçando sua posição no mercado de fibras naturais.

- Em fevereiro de 2022, a Bast Fibre Technologies Inc. concluiu a aquisição da Lumberton Cellulose da Georgia-Pacific, renomeando a unidade como BFT Lumberton. Espera-se que a mudança aumente a capacidade de produção anual da empresa para mais de 30.000 toneladas, consolidando-a como um importante polo de processamento de fibras naturais na América do Norte e fortalecendo a resiliência de sua cadeia de suprimentos.

- Em janeiro de 2022, a Reality Paskov sro fundiu-se com a Lenzing Biocel Paskov as, ambas sediadas na República Tcheca. Essa consolidação corporativa visa otimizar as operações e apoiar o crescimento futuro, permitindo que a Lenzing atenda melhor à crescente demanda por fibras naturais e sustentáveis nos mercados globais.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL NATURAL FIBERS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 MULTIVARIATE MODELLING

2.9 TYPE LIFELINE CURVE

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 IMPORT-EXPORT ANALYSIS

4.4 SUPPLY CHAIN ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING APPLICATION OF NATURAL FIBERS IN FASHION INDUSTRY

5.1.2 EXTENDED APPLICATION OF NATURAL FIBERS IN THE AUTOMOTIVE INDUSTRY

5.1.3 ADVANCEMENT IN THE APPLICATION OF NATURAL FIBERS IN THE PACKAGING INDUSTRY

5.1.4 TECHNOLOGICAL ADVANCEMENTS IN NATURAL FIBER PROCESSING

5.2 RESTRAINTS

5.2.1 REGIONAL CROP VARIABILITY

5.2.2 LIMITATIONS ASSOCIATED WITH NATURAL FIBERS

5.3 OPPORTUNITIES

5.3.1 RISING DEMAND FOR SILK

5.3.2 RISING SUSTAINABLE AGRICULTURE INITIATIVES

5.3.3 GROWING E-COMMERCE AND DIRECT-TO-CONSUMER MODELS

5.4 CHALLENGES

5.4.1 PRESENCE OF ALTERNATIVES SUCH AS SYNTHETIC POLYESTERS

5.4.2 INCREASING AWARENESS REGARDING VEGANISM CAN AFFECT THE ANIMAL DERIVED FIBERS

6 GLOBAL NATURAL FIBERS MARKET, BY FIBERS

6.1 OVERVIEW

6.2 COTTON

6.3 JUTE

6.4 FLAX

6.5 HEMP

6.6 WOOL

6.7 SILK

6.8 SISAL

6.9 KENAF

6.1 OTHERS

7 GLOBAL NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL

7.1 OVERVIEW

7.2 MANUFACTURERS

7.3 DISTRIBUTORS

7.4 WHOLESALERS

7.5 RETAILERS

7.6 OTHERS

8 GLOBAL NATURAL FIBERS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 INDUSTRIAL & TECHNICAL

8.2.1 AUTOMOTIVE TEXTILES

8.2.1.1 CHAIR CUSHIONS

8.2.1.2 HEADLINERS

8.2.1.3 CAR COVERS

8.2.1.4 OTHERS

8.2.2 SMART TEXTILES

8.2.3 ROPES AND NETTINGS

8.2.4 MEDICAL TEXTILES

8.2.5 SUN BLINDS

8.2.6 OTHERS

8.3 FURNISHING & HOME

8.3.1 BED LINEN

8.3.2 CARPETS

8.3.3 CURTAINS

8.3.4 UPHOLSTERY

8.3.5 OTHERS

8.4 FASHION & CLOTHING

8.4.1 SUITS

8.4.2 COAT

8.4.3 DRESSES

8.4.4 SHIRTS

8.4.5 OTHERS

9 GLOBAL NATURAL FIBERS MARKET, BY REGION

9.1 OVERVIEW

9.2 ASIA-PACIFIC

9.2.1 CHINA

9.2.2 INDIA

9.2.3 HONG KONG

9.2.4 AUSTRALIA

9.2.5 JAPAN

9.2.6 THAILAND

9.2.7 INDONESIA

9.2.8 SINGAPORE

9.2.9 MALAYSIA

9.2.10 TAIWAN

9.2.11 SOUTH KOREA

9.2.12 PHILIPPINES

9.2.13 REST OF ASIA-PACIFIC

9.3 NORTH AMERICA

9.3.1 U.S.

9.3.2 MEXICO

9.3.3 CANADA

9.4 EUROPE

9.4.1 GERMANY

9.4.2 ITALY

9.4.3 U.K.

9.4.4 FRANCE

9.4.5 SPAIN

9.4.6 RUSSIA

9.4.7 BELGIUM

9.4.8 NETHERLANDS

9.4.9 TURKEY

9.4.10 SWITZERLAND

9.4.11 REST OF EUROPE

9.5 SOUTH AMERICA

9.5.1 BRAZIL

9.5.2 ARGENTINA

9.5.3 REST OF SOUTH AMERICA

9.6 MIDDLE EAST AND AFRICA

9.6.1 SOUTH AFRICA

9.6.2 EGYPT

9.6.3 SAUDI ARABIA

9.6.4 U.A.E

9.6.5 ISRAEL

9.6.6 REST OF AFRICA

10 GLOBAL NATURAL FIBERS MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: GLOBAL

11 NORTH AMERICA NATURAL FIBERS MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 EUROPE NATURAL FIBERS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

13 ASIA-PACIFIC NATURAL FIBERS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 LENZING AG

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 GRASIM INDUSTRIES LIMITED

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 VARDHMAN TEXTILES LIMITED

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 BCOMP

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 BARNHARDT NATURAL FIBERS

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 ANANDHI TEXSTYLES

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 BAST FIBRE TECHNOLOGIES INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT (PRESS RELEASE)

15.8 FLEXFORM TECHNOLOGIES

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 PROCOTEX

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 THE NATURAL FIBRE COMPANY

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tabela

TABLE 1 IMPORT DATA OF WORLD AND TOP 10 COUNTRIES (2022) FOR " FLAX YARN "; HS CODE OF PRODUCT: 5306

TABLE 2 EXPORT DATA OF WORLD AND TOP 10 COUNTRIES (2022) FOR " FLAX YARN "; HS CODE OF PRODUCT: 5306

TABLE 3 GLOBAL NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 4 GLOBAL COTTON IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 5 GLOBAL JUTE IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 6 GLOBAL FLAX IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 7 GLOBAL HEMP IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 8 GLOBAL WOOL IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 9 GLOBAL SILK IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 10 GLOBAL SISAL IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 11 GLOBAL KENAF IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 12 GLOBAL OTHERS IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 13 GLOBAL NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 14 GLOBAL MANUFACTURERS IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 15 GLOBAL DISTRIBUTORS IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 16 GLOBAL WHOLESALERS IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 17 GLOBAL RETAILERS IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 18 GLOBAL OTHERS IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 19 GLOBAL NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 20 GLOBAL INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 21 GLOBAL INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 22 GLOBAL AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 23 GLOBAL FURNISHING & HOME IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 24 GLOBAL FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 25 GLOBAL FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 26 GLOBAL FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 27 GLOBAL NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 28 ASIA-PACIFIC NATURAL FIBERS MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 29 ASIA-PACIFIC NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 30 ASIA-PACIFIC NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 31 ASIA-PACIFIC NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 32 ASIA-PACIFIC INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 33 ASIA-PACIFIC AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 34 ASIA-PACIFIC FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 35 ASIA-PACIFIC FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 36 CHINA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 37 CHINA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 38 CHINA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 39 CHINA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 40 CHINA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 41 CHINA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 42 CHINA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 43 INDIA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 44 INDIA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 45 INDIA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 46 INDIA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 47 INDIA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 48 INDIA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 49 INDIA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 50 HONG KONG NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 51 HONG KONG NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 52 HONG KONG NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 53 HONG KONG INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 54 HONG KONG AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 55 HONG KONG FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 56 HONG KONG FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 57 AUSTRALIA AND NEW ZEALAND NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 58 AUSTRALIA AND NEW ZEALAND NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 59 AUSTRALIA AND NEW ZEALAND NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 60 AUSTRALIA AND NEW ZEALAND INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 61 AUSTRALIA AND NEW ZEALAND AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 62 AUSTRALIA AND NEW ZEALAND FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 63 AUSTRALIA AND NEW ZEALAND FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 64 JAPAN NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 65 JAPAN NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 66 JAPAN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 67 JAPAN INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 68 JAPAN AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 69 JAPAN FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 70 JAPAN FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 71 THAILAND NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 72 THAILAND NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 73 THAILAND NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 74 THAILAND INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 75 THAILAND AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 76 THAILAND FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 77 THAILAND FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 78 INDONESIA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 79 INDONESIA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 80 INDONESIA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 81 INDONESIA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 82 INDONESIA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 83 INDONESIA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 84 INDONESIA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 85 SINGAPORE NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 86 SINGAPORE NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 87 SINGAPORE NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 88 SINGAPORE INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 89 SINGAPORE AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 90 SINGAPORE FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 91 SINGAPORE FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 92 MALAYSIA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 93 MALAYSIA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 94 MALAYSIA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 95 MALAYSIA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 96 MALAYSIA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 97 MALAYSIA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 98 MALAYSIA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 99 TAIWAN NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 100 TAIWAN NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 101 TAIWAN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 102 TAIWAN INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 103 TAIWAN AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 104 TAIWAN FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 105 TAIWAN FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 106 SOUTH KOREA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 107 SOUTH KOREA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 108 SOUTH KOREA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 109 SOUTH KOREA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 110 SOUTH KOREA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 111 SOUTH KOREA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 112 SOUTH KOREA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 113 PHILIPPINES NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 114 PHILIPPINES NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 115 PHILIPPINES NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 116 PHILIPPINES INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 117 PHILIPPINES AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 118 PHILIPPINES FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 119 PHILIPPINES FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 120 REST OF ASIA-PACIFIC NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 121 NORTH AMERICA NATURAL FIBERS MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 122 NORTH AMERICA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 123 NORTH AMERICA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 124 NORTH AMERICA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 125 NORTH AMERICA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 126 NORTH AMERICA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 127 NORTH AMERICA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 128 NORTH AMERICA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 129 U.S. NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 130 U.S. NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 131 U.S. NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 132 U.S. INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 133 U.S. AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 134 U.S. FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 135 U.S. FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 136 MEXICO NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 137 MEXICO NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 138 MEXICO NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 139 MEXICO INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 140 MEXICO AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 141 MEXICO FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 142 MEXICO FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 143 CANADA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 144 CANADA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 145 CANADA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 146 CANADA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 147 CANADA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 148 CANADA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 149 CANADA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 150 EUROPE NATURAL FIBERS MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 151 EUROPE NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 152 EUROPE NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 153 EUROPE NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 154 EUROPE INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 155 EUROPE AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 156 EUROPE FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 157 EUROPE FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 158 GERMANY NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 159 GERMANY NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 160 GERMANY NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 161 GERMANY INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 162 GERMANY AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 163 GERMANY FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 164 GERMANY FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 165 ITALY NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 166 ITALY NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 167 ITALY NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 168 ITALY INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 169 ITALY AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 170 ITALY FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 171 ITALY FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 172 U.K. NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 173 U.K. NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 174 U.K. NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 175 U.K. INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 176 U.K. AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 177 U.K. FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 178 U.K. FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 179 FRANCE NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 180 FRANCE NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 181 FRANCE NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 182 FRANCE INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 183 FRANCE AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 184 FRANCE FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 185 FRANCE FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 186 SPAIN NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 187 SPAIN NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 188 SPAIN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 189 SPAIN INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 190 SPAIN AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 191 SPAIN FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 192 SPAIN FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 193 RUSSIA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 194 RUSSIA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 195 RUSSIA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 196 RUSSIA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 197 RUSSIA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 198 RUSSIA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 199 RUSSIA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 200 BELGIUM NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 201 BELGIUM NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 202 BELGIUM NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 203 BELGIUM INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 204 BELGIUM AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 205 BELGIUM FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 206 BELGIUM FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 207 NETHERLANDS NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 208 NETHERLANDS NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 209 NETHERLANDS NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 210 NETHERLANDS INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 211 NETHERLANDS AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 212 NETHERLANDS FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 213 NETHERLANDS FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 214 TURKEY NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 215 TURKEY NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 216 TURKEY NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 217 TURKEY INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 218 TURKEY AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 219 TURKEY FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 220 TURKEY FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 221 SWITZERLAND NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 222 SWITZERLAND NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 223 SWITZERLAND NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 224 SWITZERLAND INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 225 SWITZERLAND AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 226 SWITZERLAND FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 227 SWITZERLAND FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 228 REST OF EUROPE NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 229 SOUTH AMERICA NATURAL FIBERS MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 230 SOUTH AMERICA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 231 SOUTH AMERICA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 232 SOUTH AMERICA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 233 SOUTH AMERICA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 234 SOUTH AMERICA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 235 SOUTH AMERICA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 236 SOUTH AMERICA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 237 BRAZIL NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 238 BRAZIL NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 239 BRAZIL NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 240 BRAZIL INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 241 BRAZIL AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 242 BRAZIL FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 243 BRAZIL FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 244 ARGENTINA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 245 ARGENTINA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 246 ARGENTINA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 247 ARGENTINA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 248 ARGENTINA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 249 ARGENTINA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 250 ARGENTINA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 251 REST OF SOUTH AMERICA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 252 MIDDLE EAST AND AFRICA NATURAL FIBERS MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 253 MIDDLE EAST AND AFRICA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 254 MIDDLE EAST AND AFRICA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 255 MIDDLE EAST AND AFRICA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 256 MIDDLE EAST AND AFRICA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 257 MIDDLE EAST AND AFRICA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 258 MIDDLE EAST AND AFRICA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 259 MIDDLE EAST AND AFRICA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 260 SOUTH AFRICA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 261 SOUTH AFRICA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 262 SOUTH AFRICA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 263 SOUTH AFRICA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 264 SOUTH AFRICA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 265 SOUTH AFRICA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 266 SOUTH AFRICA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 267 EGYPT NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 268 EGYPT NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 269 EGYPT NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 270 EGYPT INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 271 EGYPT AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 272 EGYPT FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 273 EGYPT FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 274 SAUDI ARABIA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 275 SAUDI ARABIA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 276 SAUDI ARABIA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 277 SAUDI ARABIA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 278 SAUDI ARABIA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 279 SAUDI ARABIA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 280 SAUDI ARABIA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 281 U.A.E. NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 282 U.A.E. NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 283 U.A.E. NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 284 U.A.E. INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 285 U.A.E. AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 286 U.A.E. FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 287 U.A.E. FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 288 ISRAEL NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 289 ISRAEL NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 290 ISRAEL NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 291 ISRAEL INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 292 ISRAEL AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 293 ISRAEL FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 294 ISRAEL FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 295 REST OF MIDDLE EAST AND AFRICA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

Lista de Figura

FIGURE 1 GLOBAL NATURAL FIBERS MARKET: SEGMENTATION

FIGURE 2 GLOBAL NATURAL FIBERS MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL NATURAL FIBERS MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL NATURAL FIBERS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL NATURAL FIBERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL NATURAL FIBERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL NATURAL FIBERS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL NATURAL FIBERS MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 GLOBAL NATURAL FIBERS MARKET: SEGMENTATION

FIGURE 10 ASIA-PACIFIC REGION IS EXPECTED TO DOMINATE THE GLOBAL NATURAL FIBERS MARKET AND GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 11 EXTENDED APPLICATION OF NATURAL FIBERS IN AUTOMOTIVE INDUSTRY IS DRIVING THE GROWTH OF THE GLOBAL NATURAL FIBERS MARKET IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 12 COTTON SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL NATURAL FIBERS MARKET IN 2024 & 2031

FIGURE 13 ASIA-PACIFIC IS THE FASTEST-GROWING MARKET FOR NATURAL FIBERS MANUFACTURERS IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 14 SUPPLY CHAIN ANALYSIS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF GLOBAL NATURAL FIBERS MARKET

FIGURE 16 GLOBAL NATURAL FIBERS MARKET: BY FIBERS, 2023

FIGURE 17 GLOBAL NATURAL FIBERS MARKET: BY FIBERS, 2024-2031 (USD MILLION)

FIGURE 18 GLOBAL NATURAL FIBERS MARKET: BY FIBERS, CAGR (2024-2031)

FIGURE 19 GLOBAL NATURAL FIBERS MARKET: BY FIBERS, LIFELINE CURVE

FIGURE 20 GLOBAL NATURAL FIBERS MARKET: BY DISTRIBUTION CHANNEL, 2023

FIGURE 21 GLOBAL NATURAL FIBERS MARKET: BY DISTRIBUTION CHANNEL, 2024-2031 (USD MILLION)

FIGURE 22 GLOBAL NATURAL FIBERS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2024-2031)

FIGURE 23 GLOBAL NATURAL FIBERS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 24 GLOBAL NATURAL FIBERS MARKET: BY APPLICATION, 2023

FIGURE 25 GLOBAL NATURAL FIBERS MARKET: BY APPLICATION, 2024-2031 (USD MILLION)

FIGURE 26 GLOBAL NATURAL FIBERS MARKET: BY APPLICATION, CAGR (2024-2031)

FIGURE 27 GLOBAL NATURAL FIBERS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 28 GLOBAL NATURAL FIBERS MARKET: SNAPSHOT (2023)

FIGURE 29 GLOBAL NATURAL FIBERS MARKET: COMPANY SHARE 2023 (%)

FIGURE 30 NORTH AMERICA NATURAL FIBERS MARKET: COMPANY SHARE 2023 (%)

FIGURE 31 EUROPE NATURAL FIBERS MARKET: COMPANY SHARE 2023 (%)

FIGURE 32 AISA-PACIFIC NATURAL FIBERS MARKET: COMPANY SHARE 2023 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.