Mercado global de bebidas à base de leite, por produto (leite de origem animal e leite de origem vegetal), sabor (com sabor e sem sabor/simples), natureza (biológico e convencional), canal de distribuição (retalhista com base em loja e retalhista sem loja) - Tendências e previsões do setor até 2030.

Análise e dimensão do mercado de bebidas à base de leite

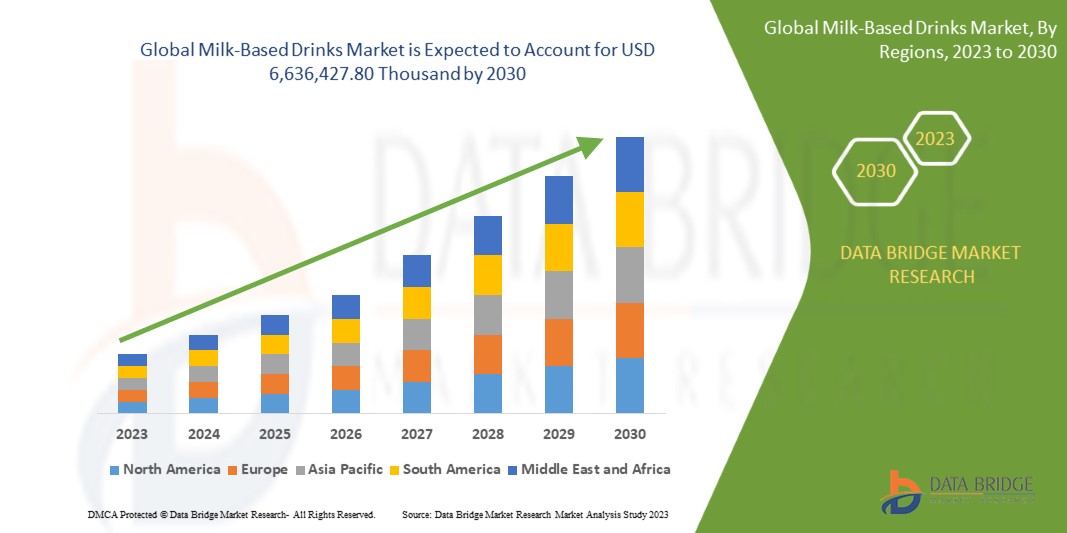

O mercado global de bebidas à base de leite deverá crescer significativamente no período previsto de 2023 a 2030. A Data Bridge Market Research analisa que o mercado está a crescer com um CAGR de 4,4% no período previsto de 2023 a 2030 e deverá atingir os 6.636.427,80 mil dólares até 2030. O principal fator que impulsiona o crescimento do mercado é a crescente consciencialização dos consumidores em relação à saúde e ao bem-estar e a crescente popularidade da conveniência e dos estilos de vida acelerados.

O relatório do mercado global de bebidas à base de leite fornece detalhes sobre a quota de mercado, novos desenvolvimentos e o impacto dos participantes do mercado nacional e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações de mercado, aprovações de produtos , decisões estratégicas, lançamentos de produtos, expansões geográficas e inovações tecnológicas no mercado. Para compreender a análise e o cenário de mercado, contacte-nos para obter um briefing de analista. A nossa equipa irá ajudá-lo a criar uma solução de impacto na receita para atingir a sua meta desejada.

|

Métrica de Reporte |

Detalhes |

|

Período de previsão |

2023 a 2030 |

|

Ano base |

2022 |

|

Anos históricos |

2021 (Personalizável para 2015 - 2020) |

|

Unidades quantitativas |

Receita em USD mil |

|

Segmentos abrangidos |

Produto (leite de origem animal e leite de origem vegetal), sabor (com sabor e sem sabor/natural), natureza (biológico e convencional), canal de distribuição (retalhista com base em loja e retalhista sem loja) |

|

Países abrangidos |

EUA, Canadá, México, Alemanha, Itália, Reino Unido, Espanha, França, Bélgica, Holanda, Suíça, Rússia, Turquia e Resto da Europa, Índia, China, Japão, Austrália e Nova Zelândia, Coreia do Sul, Singapura, Tailândia, Indonésia , Malásia, Filipinas, Resto da Ásia-Pacífico, Brasil, Argentina, Resto da América do Sul, Emirados Árabes Unidos, Arábia Saudita, África do Sul, Egito, Israel e Resto do Médio Oriente e África |

|

Atores do mercado abrangidos |

Califia Farms, LLC, MOOALA BRANDS, LLC., Chobani, LLC., Simple FOODS Co., Ltd., TURM-Sahne GmbH, Sanatório, Arla Foods amba, RUDE HEALTH, Danone SA, Nestlé, THE HERSHEY COMPANY, Oatly Inc, YEO HIAP SENG LTD, Valsoia SpA e GCMMF, entre outros |

Definição de Mercado

O mercado das bebidas à base de leite refere-se ao segmento da indústria focado na produção, distribuição e consumo de bebidas derivadas principalmente do leite. Este mercado abrange uma vasta gama de produtos, incluindo leite de vaca, alternativas ao leite de origem vegetal, batidos aromatizados e bebidas especiais de café e chá. É influenciada pelas preferências dos consumidores pelo sabor, pela consciência de saúde e pelas escolhas alimentares, com as empresas a competir para inovar e satisfazer as crescentes exigências dos consumidores.

Dinâmica do mercado global de bebidas à base de leite

Motoristas

- A crescente popularidade da conveniência e dos estilos de vida acelerados

Nos últimos anos, uma mudança notável nas preferências dos consumidores em relação à conveniência e ao consumo em movimento estimulou o crescimento de vários setores, incluindo o mercado global de bebidas à base de leite. Esta tendência é uma resposta ao estilo de vida moderno e acelerado, em que os consumidores procuram opções nutritivas e ricas em proteínas que possam ser consumidas convenientemente a qualquer hora. As bebidas à base de leite oferecem uma solução ao combinar os benefícios nutricionais das proteínas, cálcio e vitaminas com a conveniência das bebidas portáteis e pré-embaladas. A urbanização, agendas mais ocupadas, deslocações mais longas e maiores exigências de trabalho levaram a uma mudança significativa no comportamento do consumidor. Como resultado, os consumidores procuram cada vez mais produtos que se adaptem ao seu ritmo de vida acelerado, fazendo da conveniência uma prioridade. Além disso, a escassez de tempo levou os consumidores a procurar soluções rápidas e fáceis para as suas necessidades nutricionais. Os padrões tradicionais de refeições evoluíram, com os snacks e o consumo em viagem a tornarem-se mais comuns.

No mundo acelerado de hoje, os tradicionais pequenos-almoços sentados são frequentemente substituídos por opções para levar. As bebidas à base de leite, especialmente as fortificadas com nutrientes, são comercializadas como um substituto rápido e nutritivo do pequeno-almoço. Oferecem uma opção de refeição equilibrada para pessoas com pressa para o trabalho ou para a escola.

O crescimento do comércio eletrónico permitiu que os consumidores encomendassem bebidas à base de leite online, aumentando ainda mais a conveniência. Os serviços de subscrição entregam estes produtos à porta dos consumidores em intervalos regulares, poupando tempo e esforço nas compras de supermercado

As bebidas à base de leite são geralmente enriquecidas com outros nutrientes essenciais, vitaminas e minerais, o que as torna uma opção completa de snack ou substituição de refeições para levar.

O mercado global de bebidas à base de leite está a registar um crescimento robusto devido à crescente prevalência de estilos de vida práticos e rápidos. As bebidas à base de leite surgiram como uma solução conveniente e nutritiva, uma vez que os consumidores dão prioridade a opções portáteis e ricas em nutrientes que se adaptem às suas agendas ocupadas. Espera-se que o consumo crescente de bebidas à base de leite impulsione o crescimento do mercado a nível global.

- Aumentar a Consciencialização do Consumidor em Relação à Saúde e Bem-Estar

Nos últimos anos, tem-se assistido a uma mudança significativa nas preferências dos consumidores em direção a estilos de vida mais saudáveis e à consciencialização nutricional. Esta mudança estimulou uma tendência crescente no consumo de dietas ricas em proteínas, o que, posteriormente, impulsionou o crescimento do mercado. A proteína é um componente essencial das bebidas à base de leite e está alinhada com as dietas focadas na proteína preferidas por muitos consumidores preocupados com a saúde.

As bebidas à base de leite ricas em proteínas, muitas vezes comercializadas como opções de recuperação muscular ou substituição de refeições, servem indivíduos que procuram aumentar a sua ingestão de proteínas por vários motivos de saúde e fitness. O crescente foco na saúde e no bem-estar levou os consumidores a procurar opções alimentares que apoiem os seus objetivos de fitness e bem-estar geral. A proteína é um macronutriente essencial que desempenha um papel crucial na reparação muscular, na manutenção e nas funções corporais em geral. As pessoas estão a incorporar dietas ricas em proteínas nas suas rotinas diárias à medida que se tornam mais proativas na gestão da sua saúde. As bebidas à base de leite estão a adaptar-se a vários estilos de vida, como o vegetarianismo, o flexitarianismo e as dietas cetogénicas. As marcas estão a oferecer alternativas como o leite de amêndoa , o leite de soja e opções sem lactose para satisfazer estas preferências alimentares.

Existe uma crescente consciencialização entre os consumidores sobre o valor nutricional das bebidas que consomem, incluindo as bebidas à base de leite. Muitos consumidores vêem o leite como uma fonte de nutrientes essenciais, como o cálcio, a vitamina D , as proteínas e diversas vitaminas e minerais. Esta consciencialização impulsiona a procura por bebidas à base de leite como uma opção conveniente e nutritiva.

Há uma maior ênfase na manutenção da saúde e do bem-estar ao longo da vida, à medida que a população global envelhece. As bebidas à base de leite enriquecidas com nutrientes importantes para o envelhecimento, como a vitamina B12 e o cálcio, podem atrair este público.

O crescente foco dos consumidores na saúde e no bem-estar, juntamente com a conveniência e diversidade oferecidas por estas bebidas, levou à sua ampla adoção. Para capitalizar estas tendências de saúde e bem-estar, os fabricantes e os profissionais de marketing de bebidas à base de leite precisam de alinhar as suas ofertas de produtos, estratégias de marketing e mensagens com as preferências cada vez mais preocupadas com a saúde dos consumidores. Assim, espera-se que a tendência crescente de dietas saudáveis e ricas em proteínas impulsione o crescimento do mercado.

Oportunidade

- A crescente preferência por escolhas alimentares veganas e baseadas em vegetais

Tem-se assistido a uma mudança notável nas preferências alimentares em direção a alternativas baseadas em plantas, à medida que os consumidores se tornam cada vez mais preocupados com a saúde e o ambiente. Esta mudança está a criar um ambiente favorável ao crescimento do mercado, uma vez que estes produtos atendem às necessidades e preferências desta base de consumidores em evolução.

A crescente procura por dietas veganas e baseadas em vegetais está a estimular a inovação no segmento das bebidas à base de leite. Os fabricantes estão a desenvolver uma vasta gama de fontes de proteína de origem vegetal, como a proteína de ervilha , a proteína de soja e a proteína de arroz , para satisfazer as diferentes preferências dos consumidores. O mercado está a assistir ao surgimento de bebidas especializadas à base de leite, dirigidas a segmentos específicos de consumidores, como atletas, entusiastas do fitness e indivíduos com restrições alimentares. As opções baseadas em plantas estão a ganhar popularidade entre estes segmentos devido aos seus benefícios nutricionais.

Os fabricantes estão a responder às mudanças nas preferências dos consumidores inovando e diversificando as suas ofertas de produtos, expandindo a sua presença no retalho e educando os consumidores sobre os benefícios da nutrição à base de plantas. O mercado global de bebidas à base de leite está bem posicionado para prosperar e contribuir para o panorama em evolução da indústria alimentar e das bebidas, à medida que a tendência para dietas baseadas em vegetais continua a crescer. Espera-se que a crescente procura por dietas veganas e baseadas em vegetais ofereça oportunidades significativas de crescimento do mercado.

Restrições/Desafios

- Regras e regulamentos rigorosos sobre bebidas à base de leite

Regras e regulamentos rigorosos sobre as bebidas à base de leite podem apresentar desafios significativos ao crescimento do mercado, impactando vários aspetos da produção, rotulagem, comercialização e distribuição.

Muitos países têm regulamentos rigorosos que regem a composição e a rotulagem das bebidas à base de leite. Estas regras exigem frequentemente listas de ingredientes precisas e abrangentes, informações nutricionais e declarações de alergénios. Garantir a conformidade pode ser complicado, especialmente quando se formulam bebidas à base de leite com sabores adicionados, fortificações ou ingredientes alternativos, como componentes sem lactose.

Devem ser cumpridos padrões de qualidade rigorosos para garantir a segurança das bebidas à base de leite. Isto inclui critérios microbiológicos e químicos, limites de contaminantes e requisitos específicos para a pasteurização ou tratamento térmico. A conformidade com estas normas pode ser dispendiosa, pois pode exigir investimentos em medidas de controlo de qualidade e instalações de ensaio.

Os regulamentos exigem frequentemente práticas rigorosas de segurança e higiene nas instalações de processamento de leite. A manutenção destes padrões exige investimentos contínuos em infraestruturas, equipamentos, formação de funcionários e protocolos de higienização. O não cumprimento destes requisitos pode resultar em multas dispendiosas ou recalls de produtos.

Cada vez mais, as regulamentações ambientais estão a ter impacto na indústria de bebidas à base de leite. As regulamentações relacionadas com materiais de embalagem, eliminação de resíduos e emissões de carbono podem exigir alterações nos processos de produção e nas estratégias de fornecimento.

Concluindo, as regras e regulamentos rigorosos no mercado global de bebidas à base de leite criam desafios complexos de conformidade que podem afetar a formulação do produto, o controlo de qualidade, a rotulagem, o marketing e o comércio internacional. As empresas que operam neste setor devem investir em conhecimentos jurídicos e regulamentares. Estes esforços de conformidade podem aumentar os custos operacionais e afetar as estratégias de mercado, tornando a conformidade regulamentar um desafio significativo neste setor.

- Aumento da intolerância à lactose e das alergias aos produtos lácteos

O aumento da intolerância à lactose e das alergias aos produtos lácteos representa uma restrição significativa ao crescimento do mercado. Estas condições estão a tornar-se cada vez mais prevalentes e podem atuar como restrições de várias formas.

Os consumidores estão a tornar-se mais cautelosos com o consumo de produtos lácteos à medida que cresce a consciencialização sobre a intolerância à lactose e as alergias aos produtos lácteos. Muitas pessoas com estas condições apresentam desconforto digestivo, reações alérgicas ou outros problemas de saúde ao consumir produtos lácteos. Isto levou a um declínio na procura de bebidas tradicionais à base de leite.

Os indivíduos intolerantes à lactose e alérgicos aos produtos lácteos procuram alternativas aos produtos lácteos, como o leite de amêndoa, o leite de soja e o leite de aveia , que não desencadeiam reações adversas. Esta mudança nas preferências dos consumidores impulsionou o crescimento da indústria do leite vegetal, desviando quota de mercado das bebidas tradicionais à base de leite.

Os fabricantes de bebidas à base de leite devem investir no desenvolvimento de alternativas sem lactose ou sem produtos lácteos para satisfazer os consumidores intolerantes à lactose e alérgicos aos produtos lácteos. Criar produtos que imitem o sabor e a textura dos produtos lácteos, mantendo um rótulo limpo, pode ser desafiante e dispendioso, dificultando a expansão do mercado.

Existem regulamentos rigorosos de rotulagem para proteger os consumidores com alergias. Os fabricantes devem rotular os seus produtos com precisão, e os riscos de contaminação cruzada são uma preocupação. O cumprimento destes requisitos regulamentares pode aumentar a complexidade e o custo da produção, afetando potencialmente os preços e a competitividade.

Aumentar a consciencialização sobre a intolerância à lactose e as alergias aos produtos lácteos é um processo contínuo. Os fabricantes podem ter de investir em campanhas educativas para informar os consumidores sobre as suas opções sem lactose ou sem produtos lácteos, o que pode ser dispendioso e demorado.

Concluindo, a crescente incidência de intolerância à lactose e de alergias aos produtos lácteos é uma restrição significativa no mercado global de bebidas à base de leite. As empresas devem adaptar-se desenvolvendo alternativas adequadas, cumprindo os regulamentos de rotulagem e educando os consumidores para prosperarem neste cenário em mudança.

Desenvolvimentos recentes

- Em agosto de 2023, a Chobani, LLC, uma empresa de alimentos e bebidas de última geração conhecida pelo iogurte grego , lançou o Chobani Oatmilk Pumpkin Spice, uma bebida de aveia rica e cremosa com sabor a especiarias de abóbora, feita com os benefícios da aveia integral. A mais recente adição ao canteiro de abóboras da marca é vegan, uma boa fonte de cálcio e perfeita para os fãs de especiarias de abóbora que procuram bebidas de outono que não comprometam a qualidade ou o sabor.

- Em janeiro de 2023, a Oatly Inc, a maior e original empresa de bebidas de aveia do mundo, e a Ya YA Foods Corporation, fabricante líder por contrato de uma vasta gama de produtos alimentares e bebidas assépticas, anunciaram uma parceria híbrida estratégica de longo prazo na América do Norte. In this hybrid partnership, Oatly will continue to produce its proprietary oat base at both the Ogden, UT, and Fort Worth, TX facilities, which will then be transferred to Ya YA Foods to be co-packed into Oatly products on-site at each localização.

- Em novembro de 2021, a Arla Foods amba revelou a sua nova estratégia a cinco anos, enfatizando o seu forte compromisso com a produção sustentável de produtos lácteos e a expansão responsável do negócio. Nos próximos cinco anos, a empresa está preparada para aumentar os seus investimentos em mais de 40%, ultrapassando os 4 mil milhões de euros. Estes investimentos serão direcionados para iniciativas de sustentabilidade, digitalização, adoção de tecnologias de produção inovadoras e desenvolvimento de produtos. Além disso, a empresa planeia aumentar os seus dividendos para mais de 1 bilião de euros, demonstrando a sua dedicação em apoiar os seus proprietários agricultores enquanto estes embarcam na sua jornada de sustentabilidade.

- Em setembro de 2021, a Valsoia SpA assinou um acordo com a Green Pro International BV, que detém 100% das ações da Swedish Green Food Company AB, para a aquisição de 100% do capital social da empresa sueca, especializada na importação e distribuição de produtos 100% vegetais em o território europeu.

- Em março de 2021, a Hershey India Pvt Ltd, parte da THE HERSHEY COMPANY, desenvolveu o Sofit Plus, uma bebida fortificada com proteína vegetal exclusivamente para a sua iniciativa social ‘Nourishing Minds’. Concebida para satisfazer as necessidades nutricionais de crianças carenciadas, a bebida foi desenvolvida pela Hershey Índia em colaboração com o IIT-Bombaim, o Hospital Sion e a ONG Annamrita.

Âmbito do mercado global de bebidas à base de leite

O mercado global de bebidas à base de leite está segmentado em quatro segmentos notáveis com base no produto, sabor, natureza e canal de distribuição. O crescimento entre estes segmentos irá ajudá-lo a analisar os principais segmentos de crescimento nos setores e fornecerá aos utilizadores uma visão geral valiosa do mercado e informações de mercado para tomar decisões estratégicas para identificar as principais aplicações de mercado.

Produto

- Leite de origem animal

- Leite vegetal

Com base no produto, o mercado está segmentado em leite de origem animal e leite de origem vegetal.

Sabor

- Saborizado

- Sem sabor/simples

Com base no sabor, o mercado está segmentado em saborizados e sem sabor/simples.

Natureza

- Orgânico

- Convencional

Com base na natureza, o mercado está segmentado em biológico e convencional.

Canal de Distribuição

- Retalhista baseado em loja

- Retalhista sem loja

Com base no canal de distribuição, o mercado está segmentado em retalhistas com loja e retalhistas sem loja.

Análise regional/perspetivas do mercado global de bebidas à base de leite

O mercado global de bebidas à base de leite está segmentado em quatro segmentos notáveis com base no produto, sabor, natureza e canal de distribuição.

Os países abrangidos pelo relatório do mercado global de bebidas à base de leite são os EUA, Canadá, México, Alemanha, Itália, Reino Unido, Espanha, França, Bélgica, Países Baixos, Suíça, Rússia, Turquia e Resto da Europa, Índia, China, Japão, Austrália e Nova Zelândia, Coreia do Sul, Singapura, Tailândia, Indonésia, Malásia, Filipinas, Resto da Ásia-Pacífico, Brasil, Argentina, Resto da América do Sul, Emirados Árabes Unidos, Arábia Saudita, África do Sul, Egito, Israel e Resto do Médio Oriente e África.

Espera-se que a Ásia-Pacífico domine o mercado global de bebidas à base de leite devido à presença de uma grande base de produção e consumo na região. Espera-se que a Índia domine a região Ásia-Pacífico em termos de quota de mercado e receitas de mercado devido à inovação contínua de produtos e ao surgimento de sabores distintos e exóticos. Espera-se que os EUA dominem a região da América do Norte devido à crescente popularidade da conveniência e do estilo de vida acelerado. Espera-se que a Alemanha domine a região da Europa devido à crescente consciencialização dos consumidores em relação à saúde e ao bem-estar.

A secção de países do relatório também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado que impactam as tendências atuais e futuras do mercado. Análises da cadeia de valor a montante e a jusante, tendências técnicas, análise das cinco forças de Porter e estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e disponibilidade de marcas globais e os seus desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, o impacto das tarifas domésticas e das rotas comerciais são considerados ao fornecer uma análise de previsão dos dados do país.

Análise do cenário competitivo e da quota de mercado global de bebidas lácteas

O panorama competitivo do mercado global de bebidas à base de leite fornece detalhes por concorrentes. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos, pipelines de testes de produto, aprovações de produto, patentes, largura do produto e amplitude, domínio da aplicação e curva de vida da tecnologia. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas em relação ao mercado.

Alguns dos participantes proeminentes que operam no mercado global de bebidas à base de leite são a Califia Farms, LLC, MOOALA BRANDS, LLC., Chobani, LLC., Simple FOODS Co., Ltd., TURM-Sahne GmbH, Sanitarium, Arla Foods amba , RUDE HEALTH, Danone SA, Nestlé, THE HERSHEY COMPANY, Oatly Inc, YEO HIAP SENG LTD, Valsoia SpA e GCMMF, entre outras.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING POPULARITY OF CONVENIENCE AND FAST-PACED LIFESTYLES

5.1.2 INCREASING CONSUMER CONSCIOUSNESS REGARDING HEALTH AND WELL-BEING

5.1.3 ONGOING PRODUCT INNOVATION AND THE EMERGENCE OF DISTINCTIVE AND EXOTIC FLAVORS

5.2 RESTRAINTS

5.2.1 RISING LACTOSE INTOLERANCE AND DAIRY ALLERGIES

5.2.2 SUPPLY CHAIN DISRUPTIONS DUE TO VARIOUS FACTORS

5.3 OPPORTUNITIES

5.3.1 INCREASING FAVORABILITY OF VEGAN AND PLANT-BASED DIETARY CHOICES

5.4 CHALLENGE

5.4.1 STRINGENT RULES AND REGULATIONS

6 GLOBAL MILK-BASED DRINKS MARKET BY GEOGRAPHY

6.1 OVERVIEW

6.2 ASIA PACIFIC

6.3 NORTH AMERICA

6.4 EUROPE

6.5 SOUTH AMERICA

6.6 MIDDLE EAST & AFRICA

7 GLOBAL MILK-BASED DRINKS MARKET: COMPANY LANDSCAPE

7.1 COMPANY SHARE ANALYSIS: GLOBAL

7.2 COMPANY SHARE ANALYSIS: EUROPE

7.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

7.4 COMPANY SHARE ANALYSIS: NORTH AMERICA

7.5 PARTNERSHIPS AND ACQUISITION

7.6 BUSINESS EXPANSION

7.7 NEW PRODUCT LAUNCH

8 SWOT ANALYSIS

9 COMPANY PROFILES

9.1 OATLY INC

9.1.1 COMPANY SNAPSHOT

9.1.2 REVENUE ANALYSIS

9.1.3 COMPANY SHARE ANALYSIS

9.1.4 PRODUCT PORTFOLIO

9.1.5 RECENT DEVELOPMENT

9.2 DANONE S.A.

9.2.1 COMPANY SNAPSHOT

9.2.2 REVENUE ANALYSIS

9.2.3 COMPANY SHARE ANALYSIS

9.2.4 PRODUCT PORTFOLIO

9.2.5 RECENT DEVELOPMENTS

9.3 ARLA FOODS AMBA

9.3.1 COMPANY SNAPSHOT

9.3.2 COMPANY SHARE ANALYSIS

9.3.3 PRODUCT PORTFOLIO

9.3.4 RECENT DEVELOPMENT

9.4 NESTLÉ

9.4.1 COMPANY SNAPSHOT

9.4.2 REVENUE ANALYSIS

9.4.3 COMPANY SHARE ANALYSIS

9.4.4 PRODUCT PORTFOLIO

9.4.5 RECENT DEVELOPMENTS

9.5 GCMMF

9.5.1 COMPANY SNAPSHOT

9.5.2 COMPANY SHARE ANALYSIS

9.5.3 PRODUCT PORTFOLIO

9.5.4 RECENT DEVELOPMENTS

9.6 CALIFIA FARMS, LLC

9.6.1 COMPANY SNAPSHOT

9.6.2 PRODUCT PORTFOLIO

9.6.3 RECENT DEVELOPMENTS

9.7 CHOBANI, LLC

9.7.1 COMPANY SNAPSHOT

9.7.2 PRODUCT PORTFOLIO

9.7.3 RECENT DEVELOPMENTS

9.8 MOOALA BRANDS, LLC.

9.8.1 COMPANY SNAPSHOT

9.8.2 PRODUCT PORTFOLIO

9.8.3 RECENT DEVELOPMENTS

9.9 RUDE HEALTH

9.9.1 COMPANY SNAPSHOT

9.9.2 PRODUCT PORTFOLIO

9.9.3 RECENT DEVELOPMENTS

9.1 SANITARIUM

9.10.1 COMPANY SNAPSHOT

9.10.2 PRODUCT PORTFOLIO

9.10.3 RECENT DEVELOPMENTS

9.11 SIMPLE FOODS CO., LTD.

9.11.1 COMPANY SNAPSHOT

9.11.2 PRODUCT PORTFOLIO

9.11.3 RECENT DEVELOPMENTS

9.12 THE HERSHEY COMPANY

9.12.1 COMPANY SNAPSHOT

9.12.2 REVENUE ANALYSIS

9.12.3 PRODUCT PORTFOLIO

9.12.4 RECENT DEVELOPMENT

9.13 TURM-SAHNE GMBH

9.13.1 COMPANY SNAPSHOT

9.13.2 PRODUCT PORTFOLIO

9.13.3 RECENT DEVELOPMENTS

9.14 VALSOIA S.P.A.

9.14.1 COMPANY SNAPSHOT

9.14.2 REVENUE ANALYSIS

9.14.3 PRODUCT PORTFOLIO

9.14.4 RECENT DEVELOPMENT

9.15 YEO HIAP SENG LTD

9.15.1 COMPANY SNAPSHOT

9.15.2 REVENUE ANALYSIS

9.15.3 PRODUCT PORTFOLIO

9.15.4 RECENT DEVELOPMENTS

10 QUESTIONNAIRE

11 RELATED REPORTS

Lista de Tabela

TABLE 1 GLOBAL MILK-BASED DRINKS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 2 GLOBAL MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 3 GLOBAL PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 GLOBAL MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 5 GLOBAL FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 GLOBAL MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 7 GLOBAL MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 8 GLOBAL STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 9 GLOBAL NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 10 GLOBAL ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC MILK-BASED DRINKS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 21 INDIA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 22 INDIA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 INDIA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 24 INDIA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 25 INDIA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 26 INDIA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 27 INDIA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 28 INDIA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 29 INDIA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 30 CHINA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 31 CHINA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 CHINA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 33 CHINA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 CHINA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 35 CHINA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 36 CHINA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 CHINA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 CHINA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 JAPAN MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 40 JAPAN PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 41 JAPAN MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 42 JAPAN FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 JAPAN MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 44 JAPAN MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 45 JAPAN STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 JAPAN NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 47 JAPAN ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 AUSTRALIA & NEW ZEALAND MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 49 AUSTRALIA & NEW ZEALAND PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 50 AUSTRALIA & NEW ZEALAND MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 51 AUSTRALIA & NEW ZEALAND FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 AUSTRALIA & NEW ZEALAND MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 53 AUSTRALIA & NEW ZEALAND MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 54 AUSTRALIA & NEW ZEALAND STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 AUSTRALIA & NEW ZEALAND NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 AUSTRALIA & NEW ZEALAND ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 SOUTH KOREA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 58 SOUTH KOREA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 SOUTH KOREA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 60 SOUTH KOREA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 SOUTH KOREA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 62 SOUTH KOREA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 63 SOUTH KOREA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 SOUTH KOREA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 SOUTH KOREA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 SINGAPORE MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 67 SINGAPORE PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 68 SINGAPORE MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 69 SINGAPORE FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 SINGAPORE MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 71 SINGAPORE MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 72 SINGAPORE STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 73 SINGAPORE NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 SINGAPORE ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 75 THAILAND MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 76 THAILAND PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 77 THAILAND MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 78 THAILAND FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 79 THAILAND MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 80 THAILAND MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 81 THAILAND STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 THAILAND NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 THAILAND ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 84 INDONESIA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 85 INDONESIA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 86 INDONESIA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 87 INDONESIA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 88 INDONESIA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 89 INDONESIA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 90 INDONESIA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 91 INDONESIA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 92 INDONESIA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 93 MALAYSIA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 94 MALAYSIA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 95 MALAYSIA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 96 MALAYSIA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 97 MALAYSIA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 98 MALAYSIA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 99 MALAYSIA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 100 MALAYSIA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 101 MALAYSIA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 102 PHILIPPINES MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 103 PHILIPPINES PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 104 PHILIPPINES MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 105 PHILIPPINES FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 106 PHILIPPINES MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 107 PHILIPPINES MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 108 PHILIPPINES STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 109 PHILIPPINES NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 110 PHILIPPINES ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 111 REST OF ASIA-PACIFIC MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 112 NORTH AMERICA MILK-BASED DRINKS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 113 NORTH AMERICA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 114 NORTH AMERICA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 115 NORTH AMERICA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 116 NORTH AMERICA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 117 NORTH AMERICA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 118 NORTH AMERICA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 119 NORTH AMERICA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 120 NORTH AMERICA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 121 NORTH AMERICA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 122 U.S. MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 123 U.S. PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 124 U.S. MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 125 U.S. FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 126 U.S. MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 127 U.S. MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 128 U.S. STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 129 U.S. NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 130 U.S. ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 131 CANADA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 132 CANADA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 133 CANADA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 134 CANADA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 135 CANADA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 136 CANADA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 137 CANADA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 138 CANADA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 139 CANADA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 140 MEXICO MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 141 MEXICO PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 142 MEXICO MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 143 MEXICO FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 144 MEXICO MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 145 MEXICO MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 146 MEXICO STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 147 MEXICO NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 148 MEXICO ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 149 EUROPE MILK-BASED DRINKS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 150 EUROPE MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 151 EUROPE PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 152 EUROPE MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 153 EUROPE FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 154 EUROPE MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 155 EUROPE MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 156 EUROPE STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 157 EUROPE NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 158 EUROPE ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 159 GERMANY MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 160 GERMANY PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 161 GERMANY MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 162 GERMANY FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 163 GERMANY MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 164 GERMANY MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 165 GERMANY STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 166 GERMANY NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 167 GERMANY ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 168 ITALY MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 169 ITALY PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 170 ITALY MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 171 ITALY FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 172 ITALY MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 173 ITALY MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 174 ITALY STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 175 ITALY NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 176 ITALY ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 177 U.K. MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 178 U.K. PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 179 U.K. MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 180 U.K. FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 181 U.K. MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 182 U.K. MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 183 U.K. STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 184 U.K. NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 185 U.K. ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 186 SPAIN MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 187 SPAIN PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 188 SPAIN MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 189 SPAIN FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 190 SPAIN MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 191 SPAIN MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 192 SPAIN STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 193 SPAIN NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 194 SPAIN ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 195 FRANCE MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 196 FRANCE PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 197 FRANCE MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 198 FRANCE FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 199 FRANCE MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 200 FRANCE MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 201 FRANCE STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 202 FRANCE NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 203 FRANCE ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 204 BELGIUM MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 205 BELGIUM PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 206 BELGIUM MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 207 BELGIUM FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 208 BELGIUM MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 209 BELGIUM MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 210 BELGIUM STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 211 BELGIUM NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 212 BELGIUM ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 213 NETHERLANDS MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 214 NETHERLANDS PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 215 NETHERLANDS MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 216 NETHERLANDS FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 217 NETHERLANDS MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 218 NETHERLANDS MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 219 NETHERLANDS STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 220 NETHERLANDS NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 221 NETHERLANDS ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 222 SWITZERLAND MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 223 SWITZERLAND PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 224 SWITZERLAND MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 225 SWITZERLAND FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 226 SWITZERLAND MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 227 SWITZERLAND MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 228 SWITZERLAND STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 229 SWITZERLAND NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 230 SWITZERLAND ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 231 RUSSIA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 232 RUSSIA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 233 RUSSIA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 234 RUSSIA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 235 RUSSIA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 236 RUSSIA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 237 RUSSIA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 238 RUSSIA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 239 RUSSIA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 240 TURKEY MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 241 TURKEY PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 242 TURKEY MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 243 TURKEY FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 244 TURKEY MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 245 TURKEY MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 246 TURKEY STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 247 TURKEY NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 248 TURKEY ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 249 REST OF EUROPE MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 250 SOUTH AMERICA MILK-BASED DRINKS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 251 SOUTH AMERICA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 252 SOUTH AMERICA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 253 SOUTH AMERICA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 254 SOUTH AMERICA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 255 SOUTH AMERICA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 256 SOUTH AMERICA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 257 SOUTH AMERICA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 258 SOUTH AMERICA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 259 SOUTH AMERICA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 260 BRAZIL MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 261 BRAZIL PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 262 BRAZIL MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 263 BRAZIL FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 264 BRAZIL MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 265 BRAZIL MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 266 BRAZIL STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 267 BRAZIL NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 268 BRAZIL ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 269 ARGENTINA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 270 ARGENTINA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 271 ARGENTINA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 272 ARGENTINA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 273 ARGENTINA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 274 ARGENTINA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 275 ARGENTINA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 276 ARGENTINA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 277 ARGENTINA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 278 REST OF SOUTH AMERICA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 279 MIDDLE EAST AND AFRICA MILK-BASED DRINKS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 280 MIDDLE EAST AND AFRICA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 281 MIDDLE EAST AND AFRICA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 282 MIDDLE EAST AND AFRICA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 283 MIDDLE EAST AND AFRICA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 284 MIDDLE EAST AND AFRICA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 285 MIDDLE EAST AND AFRICA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 286 MIDDLE EAST AND AFRICA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 287 MIDDLE EAST AND AFRICA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 288 MIDDLE EAST AND AFRICA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 289 UNITED ARAB EMIRATES MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 290 UNITED ARAB EMIRATES PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 291 UNITED ARAB EMIRATES MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 292 UNITED ARAB EMIRATES FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 293 UNITED ARAB EMIRATES MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 294 UNITED ARAB EMIRATES MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 295 UNITED ARAB EMIRATES STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 296 UNITED ARAB EMIRATES NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 297 UNITED ARAB EMIRATES ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 298 SAUDI ARABIA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 299 SAUDI ARABIA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 300 SAUDI ARABIA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 301 SAUDI ARABIA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 302 SAUDI ARABIA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 303 SAUDI ARABIA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 304 SAUDI ARABIA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 305 SAUDI ARABIA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 306 SAUDI ARABIA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 307 SOUTH AFRICA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 308 SOUTH AFRICA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 309 SOUTH AFRICA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 310 SOUTH AFRICA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 311 SOUTH AFRICA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 312 SOUTH AFRICA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 313 SOUTH AFRICA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 314 SOUTH AFRICA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 315 SOUTH AFRICA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 316 EGYPT MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 317 EGYPT PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 318 EGYPT MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 319 EGYPT FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 320 EGYPT MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 321 EGYPT MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 322 EGYPT STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 323 EGYPT NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 324 EGYPT ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 325 ISRAEL MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 326 ISRAEL PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 327 ISRAEL MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 328 ISRAEL FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 329 ISRAEL MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 330 ISRAEL MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 331 ISRAEL STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 332 ISRAEL NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 333 ISRAEL ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 334 REST OF MIDDLE EAST AND AFRICA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

Lista de Figura

FIGURE 1 GLOBAL MILK-BASED DRINKS MARKET: SEGMENTATION

FIGURE 2 GLOBAL MILK-BASED DRINKS MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL MILK-BASED DRINKS MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL MILK-BASED DRINKS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL MILK-BASED DRINKS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL MILK-BASED DRINKS MARKET: MULTIVARIATE MODELLING

FIGURE 7 GLOBAL MILK-BASED DRINKS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 GLOBAL MILK-BASED DRINKS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 GLOBAL MILK-BASED DRINKS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 GLOBAL MILK-BASED DRINKS MARKET: SEGMENTATION

FIGURE 11 GROWING CONSUMER AWARENESS AND FOCUS ON HEALTH AND WELLNESS IS EXPECTED TO DRIVE THE GROWTH OF THE GLOBAL MILK-BASED DRINKS MARKET IN THE FORECAST PERIOD

FIGURE 12 THE ANIMAL-BASED MILK SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE OF THE GLOBAL MILK-BASED DRINKS MARKET IN 2023 AND 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL MILK-BASED DRINKS MARKET

FIGURE 14 GLOBAL MILK-BASED DRINKS MARKET: SNAPSHOT ( 2022)

FIGURE 15 ASIA-PACIFIC MILK-BASED DRINKS MARKET: SNAPSHOT (2022)

FIGURE 16 NORTH AMERICA MILK-BASED DRINKS MARKET: SNAPSHOT (2022)

FIGURE 17 EUROPE MILK-BASED DRINKS MARKET: SNAPSHOT (2022)

FIGURE 18 SOUTH AMERICA MILK-BASED DRINKS MARKET: SNAPSHOT (2022)

FIGURE 19 MIDDLE EAST AND AFRICA MILK-BASED DRINKS MARKET: SNAPSHOT (2022)

FIGURE 20 GLOBAL MILK-BASED DRINKS MARKET: COMPANY SHARE 2022 (%)

FIGURE 21 EUROPE MILK-BASED DRINKS MARKET: COMPANY SHARE 2022 (%)

FIGURE 22 ASIA-PACIFC MILK-BASED DRINKS MARKET: COMPANY SHARE 2022 (%)

FIGURE 23 NORTH AMERICA MILK-BASED DRINKS MARKET: COMPANY SHARE 2022 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.