Global Low Power Busbar Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

7.71 Billion

USD

12.74 Billion

2024

2032

USD

7.71 Billion

USD

12.74 Billion

2024

2032

| 2025 –2032 | |

| USD 7.71 Billion | |

| USD 12.74 Billion | |

|

|

|

|

Segmentação do mercado global de barramentos de baixa potência, por condutor (alumínio e cobre), peso (menos de 1 kg e mais de 1 kg), formato (chanfro e retângulo), isolamento (revestimento de energia epóxi, Teonix, Tedler, Mylar , Nomex , Kapton e outros), comprimento (inferior a 1 m, 1 m a 2 m, 2 m a 3 m e superior a 3 m), tipo de barramento (barramentos de condutor único, barramentos de condutor múltiplo, barramentos flexíveis e barramentos laminados) , Utilizador final (industrial, residencial, serviços públicos e comercial) – Tendências e previsões do setor até 2032

Análise de mercado de barramentos de baixa potência

O mercado de barramentos de baixa potência está a assistir a avanços significativos impulsionados pela adoção de sistemas de barramentos modulares e pela integração de tecnologias inteligentes de gestão de energia. Os sistemas modulares oferecem flexibilidade no design, instalação e expansão, sendo ideais para aplicações compactas de distribuição de energia. Além disso, as inovações em materiais isolantes, como os revestimentos de resina epóxi, aumentam a durabilidade, a resistência ao calor e a segurança.

A utilização de sistemas de monitorização habilitados para IoT em barramentos permite a recolha de dados em tempo real, garantindo uma melhor gestão de energia e manutenção preditiva. Por exemplo, os barramentos inteligentes equipados com sensores ajudam a detetar sobrecargas ou flutuações de temperatura, minimizando o tempo de inatividade e melhorando a fiabilidade em ambientes industriais e residenciais.

O crescimento deste mercado é impulsionado pelo aumento dos investimentos em infraestruturas de energia renovável, onde os barramentos de baixa potência são essenciais para uma distribuição eficiente de energia. Além disso, a procura por soluções de eficiência energética em data centers e edifícios comerciais está a estimular a adoção. As economias emergentes na Ásia-Pacífico e em África estão a contribuir significativamente para a expansão do mercado devido à rápida urbanização e industrialização.

Tamanho do mercado de barramentos de baixa potência

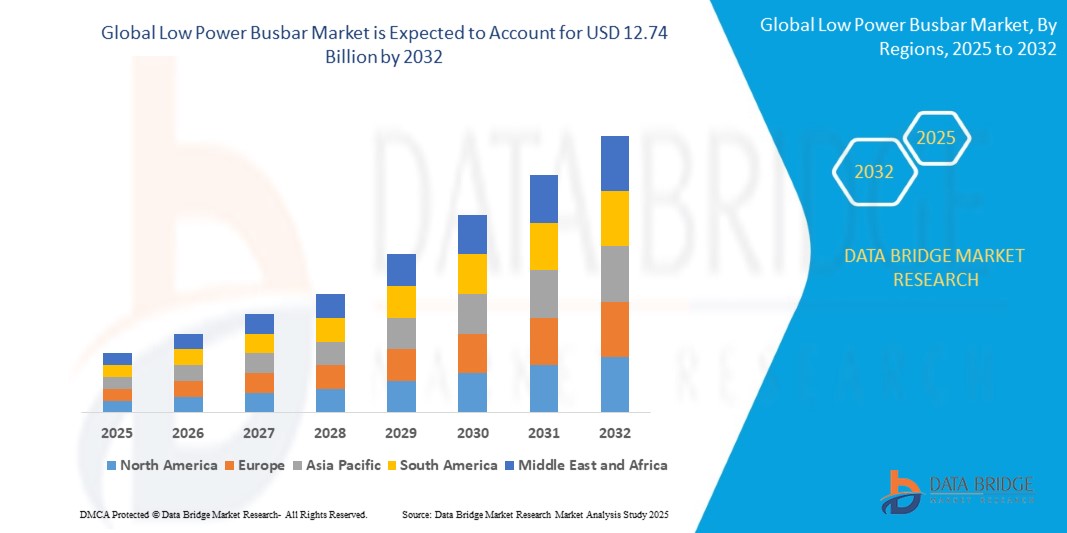

O tamanho do mercado global de barramentos de baixa potência foi avaliado em 7,71 mil milhões de dólares em 2024 e está projetado para atingir 12,74 mil milhões de dólares até 2032, com um CAGR de 6,51% durante o período previsto de 2025 a 2032. Além dos insights sobre cenários de mercado, tais como como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, produção e capacidade da empresa representada geograficamente, layouts de rede de distribuidores e parceiros, análise detalhada e atualizada das tendências de preços e análise do défice da cadeia de abastecimento e da procura.

Tendências do mercado de barramentos de baixa potência

“Integração de Barramentos em Empreendimentos de Cidades Inteligentes e Verdes”

A adoção de barramentos em projetos de cidades inteligentes e verdes é uma tendência significativa que impulsiona o crescimento do mercado de barramentos de baixa potência. Os barramentos, conhecidos pela sua eficiência e design compacto, estão cada vez mais a substituir os sistemas de cablagem tradicionais em infraestruturas urbanas. Esta mudança é motivada pela necessidade de soluções de distribuição de energia sustentáveis e eficientes em ambientes urbanos modernos. Por exemplo, a implementação de barramentos modulares no sistema de iluminação pública inteligente de Barcelona levou à redução do consumo de energia, destacando a eficácia dos barramentos na melhoria da eficiência energética em ambientes urbanos.

Âmbito do Relatório e Segmentação do Mercado de Barras de Baixa Potência

|

Atributos |

Informações importantes sobre o mercado de barramentos de baixa potência |

|

Segmentos abrangidos |

|

|

Países abrangidos |

EUA, Canadá e México na América do Norte, Alemanha, França, Reino Unido, Holanda, Suíça, Bélgica, Rússia, Itália, Espanha, Turquia, Resto da Europa na Europa, China, Japão, Índia, Coreia do Sul, Singapura, Malásia , Austrália, Tailândia, Indonésia, Filipinas, Resto da Ásia-Pacífico (APAC) na Ásia-Pacífico (APAC), Arábia Saudita, Emirados Árabes Unidos, África do Sul, Egito, Israel, Resto do Médio Oriente e África (MEA) como parte do Médio Oriente e África (MEA), Brasil, Argentina e Resto da América do Sul como parte da América do Sul |

|

Principais participantes do mercado |

ABB (Suíça), Siemens (Alemanha), Schneider Electric (França), Eaton (Irlanda), General Electric (EUA), Legrand (França), Mersen Corporate Services SAS (França), EMS Industrial & Service Company (EUA), Oriental Copper Co., Ltd. (Tailândia), Rittal GmbH & Co. KG (Alemanha), CHINT Group. (Camboja), Promet AG. (Suíça), Methode Electronics (EUA), Sun.King Technology Group Limited (China), Rogers Corporation. (EUA), Amphenol (EUA), Watteredge LLC (EUA), Emerson Electric Co. (EUA), Busbar Systems Belgium (Bélgica) |

|

Oportunidades de Mercado |

|

|

Conjuntos de informações de dados de valor acrescentado |

Para além dos insights sobre os cenários de mercado, tais como o valor de mercado, a taxa de crescimento, a segmentação, a cobertura geográfica e os principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research incluem também análises aprofundadas de especialistas, produção e análise de empresas representadas geograficamente. capacidade, layouts de rede de distribuidores e parceiros, análise detalhada e atualizada das tendências de preços e análise do défice da cadeia de abastecimento e da procura. |

Definição de mercado de barramentos de baixa potência

Um barramento de baixa potência é um sistema condutor elétrico concebido para distribuir eficientemente energia elétrica por uma rede, normalmente em ambientes que requerem menor tensão e capacidade de corrente, como edifícios residenciais, pequenos escritórios ou aplicações industriais específicas. Estes barramentos são compactos, económicos e fornecem uma solução simplificada para a distribuição de energia, reduzindo a complexidade da cablagem e as perdas de energia. Utilizam frequentemente materiais como cobre ou alumínio e são envolvidos em materiais isolantes para maior segurança. Os principais benefícios incluem a facilidade de instalação, escalabilidade e maior eficiência energética. Os barramentos de baixa potência são cada vez mais populares em aplicações que enfatizam a conservação de energia e a distribuição eficiente de carga.

Dinâmica do mercado de barramentos de baixa potência

Motoristas

- Integração da Energia Renovável na Transmissão Elétrica Eficiente

A crescente adoção de fontes de energia renováveis, como a energia solar e eólica, está a aumentar a procura por soluções de transmissão elétrica eficientes, impulsionando o mercado de barramentos de baixa potência. Os barramentos desempenham um papel vital na integração de energia limpa nas redes elétricas, garantindo uma distribuição de energia eficaz com uma perda mínima de energia. Por exemplo, as explorações solares de países como os EUA e a Índia estão a utilizar cada vez mais barramentos de baixa potência para ligar painéis fotovoltaicos a inversores e redes elétricas, aumentando a eficiência energética. À medida que os governos de todo o mundo investem em projetos de energia renovável para atingir metas de sustentabilidade, a fiabilidade, a escalabilidade e os recursos de poupança de energia dos barramentos posicionam-nos como um componente essencial nos sistemas de energia modernos.

- Urbanização e Desenvolvimento de Infraestruturas para Distribuição de Energia

A rápida urbanização aumenta significativamente a procura por sistemas de distribuição de energia fiáveis, impulsionando o crescimento do mercado de barramentos de baixa potência. Os centros urbanos em expansão exigem infraestruturas elétricas eficientes para suportar empreendimentos residenciais, comerciais e industriais. Os barramentos, conhecidos pelo seu design compacto e alta fiabilidade, desempenham um papel fundamental para garantir o fluxo ininterrupto de energia. Por exemplo, os projetos de cidades inteligentes, como a “Missão 100 Cidades Inteligentes” da Índia e as iniciativas de desenvolvimento urbano da China dão prioridade aos sistemas avançados de distribuição de energia, onde os barramentos são essenciais. Além disso, a construção de edifícios altos modernos e parques industriais incorpora frequentemente barramentos para soluções elétricas fiáveis e com economia de espaço, atendendo às crescentes necessidades energéticas das cidades em expansão.

Oportunidades

- Crescimento do Setor das Telecomunicações e Data Centers

A rápida expansão do setor das telecomunicações e dos data centers criou uma oportunidade significativa para o mercado dos barramentos de baixa potência. Estas instalações exigem sistemas de distribuição de energia fiáveis e com eficiência energética para gerir elevadas cargas de dados e garantir um funcionamento ininterrupto. Por exemplo, o aumento dos investimentos em data centers por parte de gigantes tecnológicos como a Google e a Microsoft realça a crescente necessidade de infraestruturas elétricas escaláveis. Os barramentos, conhecidos pelo seu design compacto e baixa perda de energia, são essenciais para satisfazer estas exigências. À medida que as redes de telecomunicações se expandem para suportar 5G e IoT, a dependência de soluções avançadas de distribuição de energia reforça ainda mais a adoção de barramentos, impulsionando o crescimento do mercado neste setor.

- Aumento da industrialização para sistemas elétricos eficientes

A crescente industrialização em todo o mundo está a criar oportunidades significativas para o mercado de barramentos de baixa potência. As indústrias exigem cada vez mais sistemas elétricos eficientes e fiáveis para alimentar as suas operações, e os barramentos proporcionam uma solução robusta para a distribuição de energia simplificada. Por exemplo, nas fábricas e nas instalações de processamento, os barramentos permitem o fluxo ininterrupto de eletricidade, reduzindo o tempo de inatividade e aumentando a produtividade. Países como a Índia e o Vietname estão a assistir a um rápido crescimento industrial, levando ao aumento da procura de infra-estruturas eléctricas avançadas. Além disso, a tendência para soluções sustentáveis e energeticamente eficientes em instalações industriais apoia ainda mais a adoção de barramentos de baixa potência, impulsionando a inovação e a expansão do mercado.

Restrições/Desafios

- Limitação de espaço complica distribuição de energia

As restrições de espaço prejudicam significativamente o mercado dos barramentos de baixa potência, complicando a instalação e a distribuição de energia. Em ambientes com espaço físico limitado, os sistemas de barramentos tradicionais tornam-se desafiantes para serem integrados de forma eficaz. Este problema é particularmente grave em instalações industriais compactas, infraestruturas urbanas de alta densidade e centros de dados onde a otimização do espaço é fundamental. A incapacidade de instalar e adaptar perfeitamente os barramentos a espaços confinados interrompe o fluxo de energia, reduzindo a eficiência e a fiabilidade do sistema. Além disso, limita a capacidade do mercado de servir diversos setores com diferentes requisitos espaciais. Estas restrições não só impedem a adoção generalizada, como também sufocam a inovação, limitando o potencial de crescimento do mercado.

- Custos iniciais elevados para instalação dos sistemas

Os elevados custos iniciais associados à instalação de sistemas de barramentos de baixa potência representam um desafio significativo ao crescimento do mercado. As despesas envolvidas na compra de materiais, no projeto de sistemas personalizados e na execução da instalação podem ser proibitivas, principalmente para pequenas e médias empresas ou projetos com orçamento limitado. Este encargo financeiro leva muitas vezes à hesitação na adoção de sistemas de barramentos, especialmente em regiões ou indústrias com capital limitado para atualizações de infraestruturas. Como resultado, a integração de barramentos de baixa potência em vários setores, incluindo a indústria transformadora, edifícios comerciais e energia renovável, é retardada. Este obstáculo financeiro dificulta a expansão geral do mercado de barramentos de baixa potência, limitando o seu potencial de adoção e crescimento mais amplos em todos os setores.

Este relatório de mercado fornece detalhes de novos desenvolvimentos recentes, regulamentos comerciais, análise de importação e exportação, análise de produção, otimização da cadeia de valor, quota de mercado, impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações do mercado, análise estratégica do crescimento do mercado, tamanho do mercado, crescimento do mercado das categorias, nichos de aplicação e dominância, aprovações de produtos, lançamentos de produtos, expansões geográficas, inovações tecnológicas no mercado. Para mais informações sobre o mercado, contacte a Data Bridge Market Research para obter um briefing de analista.

Escopo de mercado de barramento de baixa potência

O mercado está segmentado com base no condutor, peso, forma, isolamento, comprimento, tipo de barramento e utilizador final. O crescimento entre estes segmentos irá ajudá-lo a analisar segmentos de baixo crescimento nos setores e fornecerá aos utilizadores uma visão geral e informações valiosas do mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Condutor r

- Alumínio

- Cobre

- Piche Eletrolítico Resistente

- Livre de oxigénio

Peso Sábio

- Menos de 1 Kg

- Mais de 1 Kg

Forma Sábia

- Chanfro

- Retângulo

Isolamento

- Revestimento de energia epóxi

- Teonix

- Tedler

- Mylar

- Nomex

- Captão

- Outros

Comprimento

- Menos de 1m

- 1m a 2m

- 2 M a 3 M

- Mais de 3 M

Tipo de barramento

- Barramentos de condutor único

- Barramentos de condutores múltiplos

- Barras de autocarros flexíveis

- Barras de autocarro laminadas

Utilizador final

- Industrial

- Química e Petróleo

- Alimentos e Bebidas

- Metal e Mineração

- Fabricação

- residencial

- Utilitários

- Comercial

- Hotéis

- Hospitais

- Acadêmicos

Análise regional do mercado de barramentos de baixa potência

O mercado é analisado e são fornecidos insights e tendências sobre o tamanho do mercado por condutor, peso, forma, isolamento, comprimento, tipo de barramento e utilizador final, como referenciado acima.

Os países abrangidos no relatório de mercado são os EUA, Canadá, México na América do Norte, Alemanha, Suécia, Polónia, Dinamarca, Itália, Reino Unido, França, Espanha, Países Baixos, Bélgica, Suíça, Turquia, Rússia, Resto da Europa na Europa , Japão , China, Índia, Coreia do Sul, Nova Zelândia, Vietname, Austrália, Singapura, Malásia, Tailândia, Indonésia, Filipinas, Resto da Ásia-Pacífico (APAC) na Ásia-Pacífico (APAC), Brasil, Argentina, Resto da América do Sul como uma parte da América do Sul, Emirados Árabes Unidos, Arábia Saudita, Omã, Qatar, Kuwait, África do Sul, Resto do Médio Oriente e África (MEA) como parte do Médio Oriente e África (MEA).

Prevê-se que a região Ásia-Pacífico domine o mercado global de barramentos de baixa potência, detendo a maior quota de mercado, impulsionada pelo aumento dos investimentos nas economias emergentes do setor. A China lidera o mercado de barramentos da região, e a Índia deverá testemunhar o maior crescimento devido aos crescentes investimentos, solidificando a sua posição no dinâmico panorama do mercado.

Espera-se que a América do Norte surja como a região de crescimento mais rápido no mercado global de barramentos de baixa potência, impulsionada pela presença de grandes corporações. Os EUA lideram na América do Norte e estão preparados para um rápido crescimento, seguidos de perto pelo Canadá, refletindo uma trajetória promissora para a expansão do mercado na região.

A secção de países do relatório também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado que impactam as tendências atuais e futuras do mercado. Pontos de dados como a análise da cadeia de valor a montante e a jusante, tendências técnicas e análise das cinco forças de Porter, estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade de marcas globais e os seus desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, ao impacto de tarifas domésticas e rotas comerciais são considerados ao fornecer uma análise de previsão dos dados do país.

Participação no mercado de barramentos de baixa potência

O cenário competitivo do mercado fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença global, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa , lançamento do produto, amplitude e abrangência do produto, aplicação domínio. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas em relação ao mercado.

Os líderes de mercado de barramentos de baixa potência que operam no mercado são:

- ABB (Suíça)

- Siemens (Alemanha)

- Schneider Electric (França)

- Eaton (Irlanda)

- General Electric (EUA)

- Legrand (França)

- Mersen Corporate Services SAS (França)

- Empresa Industrial e de Serviços EMS (EUA)

- Oriental Copper Co., Ltd. (Tailândia)

- Rittal GmbH & Co. KG (Alemanha)

- Grupo CHINT. (Camboja)

- Promet AG.(Suíça)

- Methode Electronics (EUA)

- Grupo de Tecnologia Sun.King Limited (China)

- Rogers Corporation. (NÓS)

- Amphenol (EUA),

- Watteredge LLC (EUA)

- Emerson Electric Co. (EUA)

- Busbar Systems Bélgica (Bélgica)

Últimos desenvolvimentos no mercado dos barramentos de baixa potência

- Em abril de 2024, a Referro Systems, um reconhecido distribuidor de produtos da Rockwell Automation, expandiu as suas ofertas lançando barramentos de cobre flexíveis Cu-Flex na África do Sul. Estas barras de distribuição são concebidas para proporcionar flexibilidade, durabilidade e fiabilidade para sistemas elétricos, atendendo a aplicações industriais que exigem soluções de distribuição de energia eficientes e adaptáveis.

- Em janeiro de 2023, numa iniciativa para reforçar a infraestrutura energética rural do país, o governo dos EUA comprometeu 2,7 mil milhões de dólares. Este investimento estratégico visa aumentar a segurança da rede, modernizar a infra-estrutura obsoleta e melhorar a eficiência dos sistemas eléctricos rurais. Espera-se que estas atualizações promovam um crescimento significativo no setor da distribuição de energia em todo o país

- Em setembro de 2021, a Vertiv Holdings Company, fornecedora global de soluções de infraestrutura digital, adquiriu a E&I Engineering Ireland e a sua afiliada nos Emirados Árabes Unidos, a Powerbar Gulf, por 1,8 mil milhões de dólares, com um potencial earn-out adicional de 200 milhões de dólares. Esta aquisição visa impulsionar o portefólio de sistemas de barramento da Vertiv e solidificar a sua posição no mercado de sistemas de energia crítica

- Em fevereiro de 2021, a Siemens implementou um terminal de autocarros avançado com tecnologia de barramento troncalizado, otimizando as estações de carregamento para autocarros elétricos. Esta implementação expandiu o portefólio de negócios da Siemens, aumentando a receita e o lucro. A incorporação de soluções eficientes de distribuição de energia realçou o compromisso da Siemens com o avanço da infraestrutura de transporte sustentável

- Em novembro de 2020, a General Electric lançou o disjuntor miniatura (MCB) ElfaPlus, com acessórios abrangentes, como barramentos. Esta adição ao portefólio de produtos expandiu as ofertas comerciais da GE, contribuindo para o aumento da rentabilidade. O ElfaPlus MCB com barramentos integrados reforçou o compromisso da GE com a inovação e diversificação no mercado de componentes elétricos

- Em outubro de 2020, a Schneider Electric recebeu o reconhecimento entre as 10 principais inovações globais do Cool Earth Forum (ICEF) pelo seu inovador conjunto de manobra SM AirSeT. Apresentando tecnologia de média tensão digital e um barramento integrado, esta inovação não só demonstra a administração ambiental, como também melhora a receita e a posição da Schneider Electric no setor

- Em agosto de 2020, a Schneider Electric concluiu com sucesso a aquisição do negócio de Elétrica e Automação da Larsen & Toubro, reforçando a sua posição no setor de baixa tensão e automação industrial. Este movimento estratégico expandiu o portefólio de negócios da Schneider Electric, contribuindo para o aumento das receitas e da rentabilidade através de uma gama diversificada de ofertas

- Em julho de 2020, a Schneider Electric recebeu o Prémio de Eficiência Energética Industrial pelo seu inovador quadro elétrico SM AirSeT. Esta tecnologia de média tensão integrada digitalmente e amiga do ambiente apresenta um barramento gerador de lucro, contribuindo para o aumento da receita. O prémio reconhece o compromisso da Schneider Electric com soluções sustentáveis e os avanços tecnológicos no setor energético

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.