Global Liquid Biopsy Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

2.69 Billion

USD

9.34 Billion

2024

2032

USD

2.69 Billion

USD

9.34 Billion

2024

2032

| 2025 –2032 | |

| USD 2.69 Billion | |

| USD 9.34 Billion | |

|

|

|

|

Mercado global de biópsia líquida, por produto (instrumentos, consumíveis e acessórios, e serviços e software), tipo de biomarcador (células tumorais circulantes (CTCS), ADN livre de células circulantes (CFDNA), RNA livre de células, vesículas extracelulares, exossomas e Outros), Tipo de amostra (com base em amostra de sangue, com base em amostra de urina, com base em amostra de saliva e outros fluidos de tecido, com base em amostra de fezes e outros), tipo analítico (molecular, proteómica e histologia/imagiologia), tipo de aplicação (aplicações de cancro e aplicações não oncológicas), aplicação clínica (rastreio de rotina, avaliação do doente, seleção da terapêutica, monitorização do tratamento, monitorização da recidiva e outras), tecnologia (análise paralela multigénica e análise de gene único), utilizador final (hospitais, Laboratórios de Referência, Centros de Diagnóstico, Centros de Investigação e Institutos Académicos, e Outros), Canal de Distribuição (Concurso Directo, Distribuidor Terceiro, e Outros) – Tendências do Sector e Previsão para 2031.

Análise e tamanho do mercado de biópsia líquida

No mercado da biópsia líquida, a monitorização da doença residual mínima (DRM) representa uma aplicação significativa. Isto envolve a utilização de técnicas de biópsia líquida para detetar e analisar células cancerígenas residuais ou ADN na corrente sanguínea pós-tratamento. Esta abordagem não invasiva oferece uma ferramenta valiosa para avaliar a eficácia do tratamento e prever a probabilidade de recorrência do cancro. O desenvolvimento contínuo de tecnologias de biópsia líquida e a sua integração na prática clínica impulsiona ainda mais o crescimento e a adoção de soluções de biópsia líquida para monitorização de DRM no mercado.

Em novembro de 2023, a Illumina Inc. anunciou o TruSight Oncology 500 ctDNA v2, uma iteração avançada do seu ensaio de biópsia líquida concebido para um perfil genómico abrangente em oncologia. Esta versão atualizada promete uma maior sensibilidade e especificidade na deteção de mutações associadas ao cancro no ADN tumoral circulante.

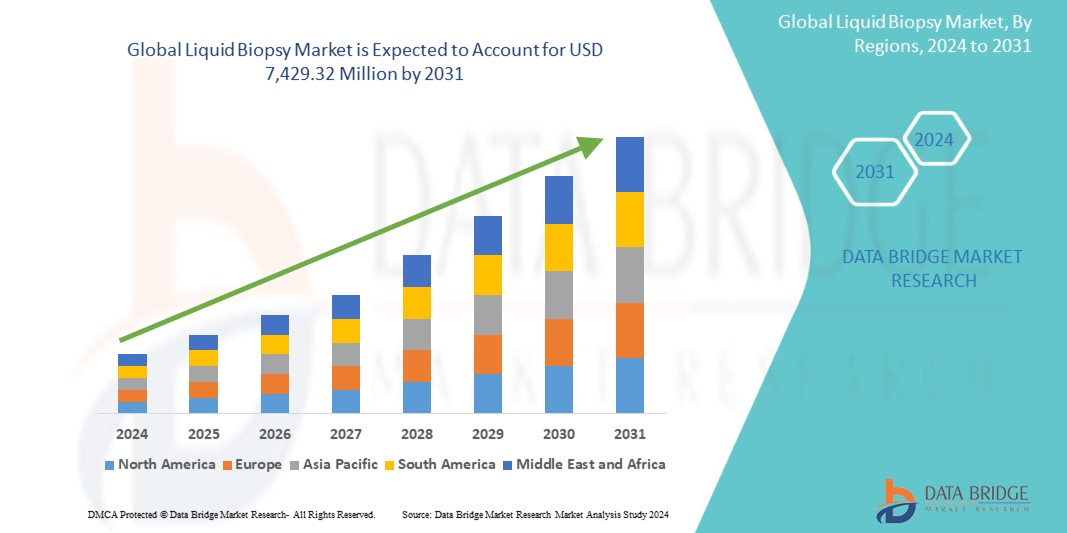

O tamanho global do mercado de biópsia líquida foi avaliado em 2,31 mil milhões de dólares em 2023 e deverá atingir os 8 mil milhões de dólares até 2031, com um CAGR de 16,8% durante o período de previsão de 2024 a 2031. Para além dos insights sobre cenários de mercado, como o valor do mercado, a taxa de crescimento, a segmentação, a cobertura geográfica e os grandes players, os relatórios de mercado com curadoria da Data Bridge Market Research incluem também análises especializadas aprofundadas, epidemiologia dos pacientes, análise de pipeline, análise de preços e estrutura regulatória.

Âmbito do relatório e segmentação de mercado

|

Métrica de reporte |

Detalhes |

|

Período de previsão |

2024-2031 |

|

Ano base |

2023 |

|

Anos históricos |

2022 (personalizável para 2016-2021) |

|

Unidades Quantitativas |

Receita em biliões de dólares, volumes em unidades, preços em dólares |

|

Segmentos cobertos |

Produto (instrumentos, consumíveis e acessórios, e serviços e software), tipo de biomarcador ( células tumorais circulantes (CTCs), DNA livre de células circulantes (CFDNA), RNA livre de células, vesículas extracelulares, exossomas e outros), tipo de amostra ( Com base numa amostra de sangue, com base numa amostra de urina, com base numa amostra de saliva e outros fluidos de tecido, amostragem com base em fezes e outros), tipo analítico (molecular, proteómica e histologia/imagem), tipo de aplicação (aplicações de cancro e aplicações não oncológicas), Aplicação clínica (rastreio de rotina, avaliação do doente, seleção de terapêutica, monitorização de tratamento, monitorização de recidiva e outros), tecnologia (análise paralela multigénica e análise de gene único), utilizador final (hospitais, laboratórios de referência, centros de diagnóstico, Centros de Investigação e Institutos Académicos e Outros), Canal de Distribuição (Concurso Directo, Distribuidor Terceirizado e Outros) |

|

Países abrangidos |

EUA, Canadá e México na América do Norte, Alemanha, França, Reino Unido, Holanda, Suíça, Bélgica, Rússia, Itália, Espanha, Turquia, Resto da Europa na Europa, China, Japão, Índia, Coreia do Sul, Singapura, Malásia , Austrália, Tailândia, Indonésia, Filipinas, Resto da Ásia-Pacífico (APAC) na Ásia-Pacífico (APAC), Arábia Saudita, Emirados Árabes Unidos, África do Sul, Egito, Israel, Resto do Médio Oriente e África (MEA) como parte do Médio Oriente e África (MEA), Brasil, Argentina e Resto da América do Sul como parte da América do Sul |

|

Participantes do mercado abrangidos |

(EUA), Bio-Rad Laboratories, Inc. (EUA), Exact Sciences Corporation (EUA), Menarini Silicon Biosystems (Itália), Epic Sciences (EUA), NeoGenomics Laboratories (EUA), mdxhealth (Bélgica), F. Hoffmann- La Roche Ltd (Suíça), QIAGEN (Holanda), Oncocyte Corporation (EUA), Johnson & Johnson Services, Inc. (EUA), Guardant Health (EUA), Laboratory Corporation of America Holdings (EUA), ANGLE plc (Reino Unido) , Natera, Inc. |

|

Oportunidades de mercado |

|

Definição de Mercado

A biópsia líquida é uma técnica médica que transforma o diagnóstico através da análise de biomoléculas como o ADN, ARN e proteínas em fluidos corporais como o sangue. Ao contrário das biópsias tradicionais invasivas, é não invasivo, oferecendo informações de diagnóstico vitais sobre condições como o cancro sem cirurgia. Embora ainda em evolução, as biópsias líquidas revelam-se imensamente promissoras na melhoria da detecção e gestão do cancro, marcando um salto significativo na inovação médica.

Dinâmica do mercado de biópsia líquida

Motoristas

- Aumento da integração de IA aumenta a precisão dos dados celulares extraídos de amostras de biópsia líquida

A Inteligência Artificial (IA) está a transformar a tecnologia de biópsia líquida, melhorando a sua precisão, eficiência e capacidades preditivas. Através de algoritmos avançados e aprendizagem automática, a IA pode analisar grandes quantidades de dados genéticos, proteómicos e celulares extraídos de amostras de biópsia líquida. Isto permite a deteção precoce de doenças como o cancro, oferecendo informações personalizadas sobre o tratamento e monitorizando a progressão da doença. As plataformas de biópsia líquida orientadas por IA agilizam os diagnósticos, tornando-os mais acessíveis e económicos, impulsionando assim o crescimento do mercado. Com a sua capacidade de descobrir insights acionáveis a partir de dados biológicos complexos, a IA está a catalisar a expansão das aplicações de biópsia líquida na área da saúde, levando a melhores resultados para os doentes e impulsionando o mercado.

Em novembro de 2020, a NeoGenomics, Inc. lançou um serviço móvel de flebotomia para testes de biópsia líquida, aproveitando diagnósticos melhorados por IA, como o InvisionFirst e o NeoLAB. Esta iniciativa está alinhada com a tendência crescente de tecnologias de biópsia líquida baseadas em IA, alargando a acessibilidade aos doentes através da recolha conveniente de amostras nos seus locais. Em parceria com empresas de flebotomia para uma ampla cobertura, a NeoGenomics otimiza a eficiência das suas soluções de biópsia líquida alimentadas por IA, impulsionando a adoção pelo mercado e melhorando o acesso dos doentes a diagnósticos avançados.

- O aumento dos gastos em saúde promove a adoção de tecnologias de biópsia líquida

Com um maior investimento em infraestruturas e recursos de saúde, há uma maior ênfase em ferramentas de diagnóstico avançadas, como as biópsias líquidas. Estas tecnologias oferecem métodos não invasivos e eficientes para a deteção, monitorização e planeamento de tratamento personalizado do cancro. À medida que os sistemas de saúde se esforçam por melhorar os resultados dos doentes, os benefícios das biópsias líquidas em termos de detecção precoce, avaliação da eficácia do tratamento e invasividade mínima tornam-nas uma opção atractiva. Consequentemente, o aumento dos gastos em saúde atua como um catalisador para a ampla adoção e crescimento do mercado de biópsia líquida.

Oportunidades

- Crescente procura por técnicas de biópsia líquida não invasivas devido ao seu impacto no diagnóstico do cancro

Na última década, os métodos invasivos tradicionais deram lugar a técnicas não invasivas, como a biópsia líquida. Esta abordagem envolve o isolamento de componentes derivados de tumores, como células tumorais circulantes e ADN, a partir de fluidos corporais para análise genómica e proteómica. Consequentemente, o mercado está a testemunhar um crescimento substancial à medida que os prestadores de cuidados de saúde confiam cada vez mais nestes métodos avançados e menos intrusivos para uma detecção mais precisa do cancro e estratégias de tratamento personalizadas.

- Avanços crescentes na medicina de precisão devido à biópsia líquida

Os avanços neste campo permitem a deteção e monitorização não invasiva de doenças através da análise de biomarcadores circulantes, como o ADN tumoral circulante (ctDNA), as células tumorais circulantes (CTCs) e os exossomas. Esta abordagem facilita o diagnóstico precoce, a seleção do tratamento e a monitorização da resposta ao tratamento, melhorando os resultados dos doentes. Com a sua capacidade de fornecer informações em tempo real sobre a progressão da doença e a eficácia terapêutica, a biópsia líquida tem um imenso potencial para a medicina personalizada, impulsionando o crescimento do mercado da biópsia líquida à medida que se torna uma ferramenta indispensável na oncologia e muito mais.

Restrições/Desafios

- O elevado custo dos testes de biópsia líquida limita a sua adoção entre os doentes

Os testes de biópsia líquida envolvem frequentemente tecnologias avançadas e equipamento especializado, contribuindo para a sua natureza dispendiosa. Além disso, factores como as taxas de processamento laboratorial e a necessidade de pessoal qualificado elevam ainda mais o custo global. Como resultado, os doentes podem encontrar barreiras financeiras, especialmente em regiões com acesso limitado a recursos de cuidados de saúde ou com cobertura de seguro inadequada. O fosso de acessibilidade dificulta a adoção generalizada de testes de biópsia líquida, apesar dos seus potenciais benefícios em termos de deteção precoce do cancro e tratamento personalizado.

- A escassez de profissionais qualificados limita a escalabilidade das técnicas de biópsia líquida

A biópsia líquida, um método não invasivo para a deteção de biomarcadores em fluidos corporais como o sangue, requer formação e experiência especializada para uma análise e interpretação precisas dos resultados. A escassez de profissionais qualificados capazes de realizar estes intrincados testes limita a adoção generalizada e a escalabilidade das técnicas de biópsia líquida, restringindo assim o crescimento do mercado. Este estrangulamento impede a utilização eficiente da biópsia líquida como ferramenta de diagnóstico em oncologia e noutras áreas, dificultando o seu potencial impacto nos resultados de saúde.

Este relatório de mercado fornece detalhes dos novos desenvolvimentos recentes, regulamentos comerciais, análise de importação-exportação, análise de produção, otimização da cadeia de valor, quota de mercado, impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações do mercado, análise estratégica do crescimento do mercado, tamanho do mercado, crescimento do mercado da categoria, nichos de aplicação e domínio, aprovações de produtos, lançamentos de produtos, expansões geográficas, inovações tecnológicas no mercado. Para mais informações sobre o mercado, contacte a Data Bridge Market Research para obter um resumo do analista, a nossa equipa irá ajudá-lo a tomar uma decisão de mercado informada para alcançar o crescimento do mercado.

Desenvolvimentos recentes

- Em janeiro de 2022, foram anunciados os vencedores do programa Biotech Grants da QIAGEN, demonstrando a dedicação da empresa em promover parcerias com empresas de biotecnologia e farmacêuticas. Apoiando estas empresas, a QIAGEN pretende reforçar o seu sucesso no mercado, contribuindo para a sua estratégia de crescimento de receitas

- Em janeiro de 2022, a Exact Sciences Corporation expandiu o seu portefólio de diagnóstico de cancro ao adquirir a Prevention Genetics, um laboratório de testes genéticos. Este movimento estratégico permite que a Exact Sciences se aventure em testes de cancro hereditário, complementando as suas ofertas existentes e melhorando a sua posição no mercado de diagnóstico.

- Em julho de 2021, a Biocept Inc. garantiu uma patente sul-coreana para a sua tecnologia Primer-Switch, um marco significativo para o fornecedor de serviços de diagnóstico molecular. Esta tecnologia, baseada em PCR em tempo real e métodos associados, permite a deteção de mutações no ADN tumoral circulante, auxiliando na identificação de biomarcadores de cancro raros e fortalecendo a posição da Biocept na área do diagnóstico do cancro

Âmbito do mercado de biópsia líquida

O mercado está segmentado com base no produto, tipo de biomarcador, tipo de amostra, tipo analítico, tipo de aplicação, aplicação clínica, tecnologia, utilizador final e canal de distribuição. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e a diferença nos seus mercados-alvo.

Produto

- Instrumentos

- Consumíveis e Acessórios

- Serviços e Software

Tipo de biomarcador

- Células Tumorais Circulantes (CTCc)

- DNA livre de células circulantes (CFDNA)

- RNA livre de células

- Vesículas Extracelulares

- Exossomos

- Outros

Tipo de amostra

- Baseado em amostra de sangue

- Baseado em amostra de urina

- Saliva e outros fluidos teciduais com base em amostras

- Baseado em amostra fecal

- Outros

Tipo Analítico

- Molecular

- Proteómica

- Histologia/Imagem

Tipo de aplicação

- Aplicações contra o cancro

- Aplicações não oncológicas

Aplicação Clínica

- Triagem de rotina

- Avaliação do doente

- Seleção de Terapia

- Monitorização do Tratamento

- Monitorização de recorrência

- Outros

Tecnologia

- Análise Multi-Gene-Paralela

- Análise de gene único

Utilizador final

- Hospitais

- Laboratórios de Referência

- Centros de diagnóstico

- Centros de investigação e institutos académicos

- Outros

Canal de Distribuição

- Concurso Direto

- Distribuidor Terceirizado

- Outros

Análise/perspetivas regionais do mercado de biópsia líquida

O mercado está categorizado em nove segmentos notáveis com base no produto, tipo de biomarcador, tipo de amostra, tipo analítico, tipo de aplicação, aplicação clínica, tecnologia, utilizador final e canal de distribuição.

Os países abrangidos neste relatório de mercado EUA, Canadá, México, Alemanha, Reino Unido, França, Rússia, Itália, Espanha, Turquia, Polónia, Bélgica, Países Baixos, Suíça, Dinamarca, Suécia, Noruega, Finlândia, resto da Europa, China, Japão , Índia, Austrália, Coreia do Sul, Nova Zelândia, Singapura, Tailândia, Filipinas, Malásia, Indonésia, Vietname, Taiwan, resto da Ásia-Pacífico, Brasil, Argentina, resto da América do Sul, Arábia Saudita, Emirados Árabes Unidos, África do Sul, Egipto, Qatar, Kuwait, Omã, Bahrein e resto do Médio Oriente e África.

Na América do Norte, espera-se que os EUA dominem o mercado devido à elevada prevalência de condições crónicas no país e uma população geriátrica considerável cria uma procura significativa por sistemas de chamada de enfermagem para apoiar os cuidados aos doentes. Além disso, o aumento das despesas com cuidados de saúde nos EUA sublinha um investimento crescente em infra-estruturas e tecnologia de cuidados de saúde, incluindo sistemas de chamada de enfermeiros. Estes factores posicionam colectivamente os EUA como líder na promoção do crescimento do mercado e da inovação na região, reflectindo o seu compromisso em melhorar os resultados dos doentes e a prestação de cuidados de saúde.

Na Europa, a Alemanha domina o mercado devido à forte presença de players importantes como a F. Hoffmann-La Roche Ltd, a QIAGEN e a Sysmex Inostics Inc. Este domínio é atribuído à robusta infraestrutura de investigação e desenvolvimento da Alemanha, à força de trabalho altamente qualificada e ao apoio políticas governamentais que promovam a inovação. A localização geográfica estratégica do país na Europa facilita também a colaboração e o acesso aos mercados em todo o continente. Consequentemente, a Alemanha serve como um centro de investigação de ponta, avanços tecnológicos e liderança de mercado nas indústrias de biotecnologia e ciências da vida em toda a Europa.

Na Ásia-Pacífico, a China domina o mercado devido à sua capacidade de satisfazer a procura crescente, especialmente dos mercados emergentes. Aproveitando as suas capacidades de produção e preços competitivos, as empresas chinesas conquistaram uma quota de mercado significativa na região. Além disso, o foco estratégico da China na expansão da sua presença nos mercados emergentes contribuiu para a sua posição de liderança. Esta tendência sublinha a emergência da China como um interveniente-chave no mercado global de biópsias líquidas, impulsionada tanto pelas suas capacidades de produção como pela crescente procura de mercados dinâmicos em toda a Ásia-Pacífico.

A secção do país do relatório também fornece fatores individuais de impacto no mercado e alterações na regulamentação do mercado interno que impactam as tendências atuais e futuras do mercado. Pontos de dados como a análise da cadeia de valor a jusante e a montante, tendências técnicas e análise das cinco forças de Porter, estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, são considerados a presença e disponibilidade de marcas globais e os desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, o impacto das tarifas nacionais e das rotas comerciais, ao mesmo tempo que se fornece uma análise de previsão dos dados do país.

Base instalada de crescimento da infraestrutura de saúde e penetração de novas tecnologias

O mercado também fornece análises de mercado detalhadas para o crescimento de cada país em despesas de saúde para equipamentos de capital, base instalada de diferentes tipos de produtos para o mercado, impacto da tecnologia utilizando curvas de linha de vida e mudanças nos cenários regulamentares de saúde e o seu impacto no mercado. Os dados estão disponíveis para o período histórico 2016-2021.

Análise do panorama competitivo e do mercado da biópsia líquida

O cenário competitivo do mercado fornece detalhes dos concorrentes. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos, aprovações de produtos, largura e amplitude do produto, domínio de aplicação e tipo de produto curva da linha de vida. Os dados fornecidos acima estão apenas relacionados com o foco da empresa no mercado.

Alguns dos principais players que operam no mercado são:

- Thermo Fisher Scientific Inc.

- (EUA)

- BIOCEPT, INC.

- (EUA)

- Corporação de Ciências Exatas (EUA)

- Menarini Silicon Biosystems (Itália)

- Ciências Épicas (EUA)

- Laboratórios de NeoGenómica (EUA)

- mdxhealth (Bélgica)

- F. Hoffmann-La Roche Ltd (Suíça)

- QIAGEN (Holanda)

- Oncocy Corporation (EUA)

- (EUA)

- (EUA)

- Guardant Health (EUA)

- Laboratory Corporation of America Holdings (EUA)

- ANGLE plc (Reino Unido)

- (EUA)

- (EUA)

- STRECK (EUA)

- Previsão (EUA)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.