Global Liquid Bioinsecticides Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

1.31 Billion

USD

4.78 Billion

2024

2032

USD

1.31 Billion

USD

4.78 Billion

2024

2032

| 2025 –2032 | |

| USD 1.31 Billion | |

| USD 4.78 Billion | |

|

|

|

|

Segmentação do mercado global de bioinseticidas líquidos, por tipo de organismo (Bacteria Thuringiensis, Beauveria Bassiana e Metarhizium Anisopliae), tipo (inseticidas naturais, patógenos e parasitas), tipo de cultura (oleaginosas e leguminosas, frutas e vegetais, grãos e cereais), aplicação (tratamento de sementes, tratamento do solo e pulverização foliar), insetos (insetos e ácaros, lagartas e insetos do solo) - Tendências do setor e previsão até 2032

Tamanho do mercado de bioinseticidas líquidos

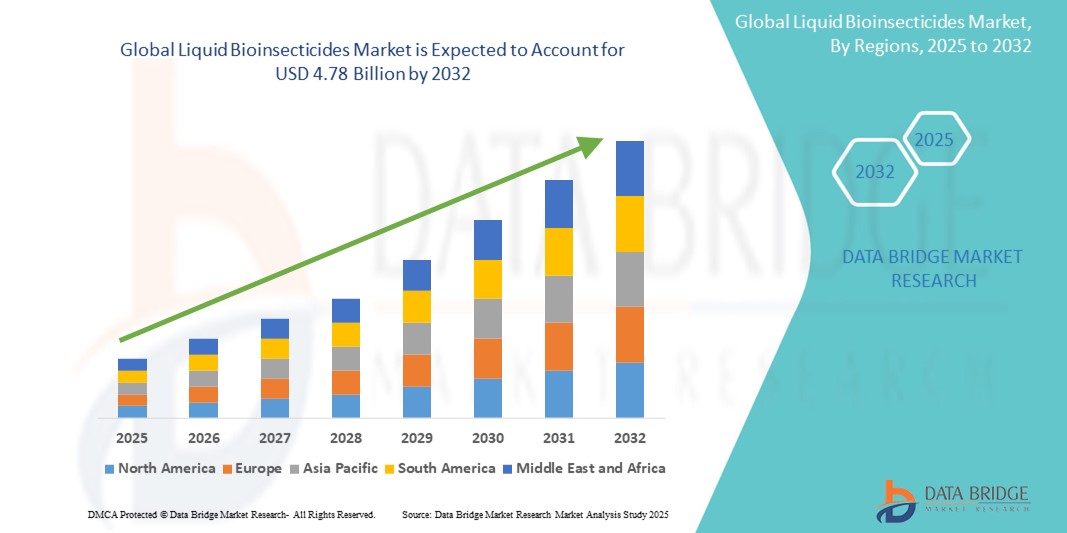

- O tamanho do mercado global de bioinseticidas líquidos foi avaliado em US$ 1,31 bilhão em 2024 e deve atingir US$ 4,78 bilhões até 2032 , com um CAGR de 17,50% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente mudança para práticas agrícolas orgânicas e sustentáveis, aliada à crescente preocupação com os impactos ambientais e à saúde dos pesticidas sintéticos. Essas preocupações estão levando os órgãos reguladores a impor restrições mais rígidas ao uso de pesticidas químicos, aumentando assim a demanda por alternativas ecologicamente corretas, como bioinseticidas líquidos.

- Além disso, o apoio governamental por meio de subsídios e campanhas de conscientização, juntamente com os avanços na formulação microbiana e tecnologias de distribuição, está acelerando a adoção de bioinseticidas líquidos em diversos tipos de culturas, contribuindo significativamente para a expansão do mercado.

Análise de Mercado de Bioinseticidas Líquidos

- Bioinseticidas líquidos são formulações de origem biológica — normalmente à base de bactérias, fungos ou extratos vegetais — que visam pragas específicas, preservando organismos benéficos. Esses produtos são aplicados como pulverizações foliares, tratamentos de sementes ou irrigação do solo para proporcionar o controle de pragas de forma sustentável e sem resíduos.

- A crescente demanda por bioinseticidas líquidos é impulsionada principalmente pela crescente ênfase global na produção de alimentos orgânicos, pelo apoio regulatório aos biopesticidas e pela crescente conscientização entre os agricultores sobre os benefícios de longo prazo das soluções sustentáveis de manejo de pragas.

- A América do Norte dominou o mercado de bioinseticidas líquidos com uma participação de 37,09% em 2024, devido à crescente mudança do consumidor para a produção de alimentos orgânicos e à crescente adoção de insumos agrícolas sustentáveis.

- Espera-se que a Ásia-Pacífico seja a região de crescimento mais rápido no mercado de bioinseticidas líquidos durante o período previsto, devido à expansão da agricultura orgânica, à conscientização crescente sobre os efeitos nocivos dos produtos químicos sintéticos e às políticas governamentais de apoio.

- O segmento de pulverização foliar dominou o mercado, com uma participação de mercado de 50,2% em 2024, devido ao seu mecanismo de contato direto, ação rápida e facilidade de aplicação em diversos tipos de culturas. A aplicação foliar permite o direcionamento preciso de pragas de insetos durante surtos e oferece resultados visíveis com frequência mínima de reaplicação, o que impulsiona a adoção tanto por pequenos produtores quanto por fazendas comerciais.

Escopo do Relatório e Segmentação do Mercado de Bioinseticidas Líquidos

|

Atributos |

Principais insights do mercado de bioinseticidas líquidos |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

Europa

Ásia-Pacífico

Oriente Médio e África

Ámérica do Sul

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de consumo de produção, análise de tendência de preço, cenário de mudança climática, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matéria-prima/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de bioinseticidas líquidos

“Crescente demanda por agricultura orgânica”

- Uma tendência significativa e crescente no mercado de bioinseticidas líquidos é a crescente demanda por práticas de agricultura orgânica, à medida que consumidores, reguladores e produtores buscam alternativas mais seguras e sustentáveis aos agroquímicos sintéticos.

- Por exemplo, empresas como a Certis Biologicals, a Koppert Biological Systems e a Marrone Bio Innovations estão a expandir os seus portefólios de bioinseticidas líquidos para satisfazer as necessidades dos produtores biológicos, oferecendo produtos listados pela OMRI e em conformidade com as normas biológicas internacionais.

- A mudança para a agricultura orgânica e regenerativa está sendo impulsionada pela crescente conscientização do consumidor sobre a segurança alimentar, a saúde ambiental e os impactos negativos dos resíduos de pesticidas químicos nos ecossistemas.

- As iniciativas e subsídios governamentais que promovem a agricultura orgânica, especialmente em regiões como a Europa, a América do Norte e a Ásia-Pacífico, estão a impulsionar ainda mais a adopção de bioinseticidas como ferramentas essenciais para a gestão integrada de pragas.

- A tendência também é apoiada pela crescente popularidade dos movimentos da fazenda à mesa, certificações de alimentos orgânicos e compromissos dos varejistas com o fornecimento sustentável, todos os quais estão aumentando a demanda por soluções de proteção de cultivos que estejam alinhadas com valores de rótulos limpos e ecologicamente corretos.

- As empresas estão investindo em pesquisas para desenvolver bioinseticidas líquidos mais eficazes e de amplo espectro, além de tecnologias de aplicação inovadoras, permitindo que os agricultores obtenham controle confiável de pragas, mantendo a certificação orgânica e o acesso ao mercado.

Dinâmica do mercado de bioinseticidas líquidos

Motorista

“Crescente Resistência a Pesticidas Químicos”

- A crescente resistência das pragas aos pesticidas químicos convencionais é um importante impulsionador do mercado de bioinseticidas líquidos, à medida que os produtores buscam soluções alternativas para controlar a evolução das populações de pragas e manter a produtividade das colheitas.

- Por exemplo, empresas como a Bayer Crop Science, a Syngenta Biologicals e a Valent BioSciences estão a desenvolver e a promover bioinseticidas líquidos baseados em bactérias, fungos e extratos vegetais naturais que oferecem novos modos de ação e reduzem o risco de desenvolvimento de resistência.

- O uso generalizado de inseticidas químicos levou ao surgimento de espécies de pragas resistentes, levando as agências reguladoras a restringir ou proibir certos ingredientes ativos e incentivando a adoção de alternativas biológicas

- Os bioinseticidas líquidos proporcionam controle direcionado com impacto mínimo sobre insetos benéficos e organismos não-alvo, tornando-os componentes valiosos de programas de manejo integrado de pragas

- O mercado também se beneficia dos avanços na ciência da formulação, que melhoram a estabilidade, a vida útil e a eficácia dos bioinseticidas líquidos, favorecendo sua adoção mais ampla em diferentes culturas e condições climáticas. À medida que o manejo da resistência se torna uma prioridade para produtores e reguladores, espera-se que a demanda por soluções inovadoras em bioinseticidas continue aumentando.

Restrição/Desafio

“Altos custos de produção”

- Os altos custos de produção continuam sendo um desafio significativo no mercado de bioinseticidas líquidos, afetando a competitividade de preços e a adoção em larga escala, especialmente em regiões sensíveis a custos

- Por exemplo, a fabricação de bioinseticidas líquidos geralmente envolve processos complexos de fermentação, controle de qualidade rigoroso e requisitos de armazenamento especializados, o que pode aumentar os custos para produtores como a Marrone Bio Innovations e a Certis Biologicals.

- A necessidade de logística de cadeia fria, prazo de validade mais curto em comparação com alternativas químicas e conformidade regulatória aumentam ainda mais as despesas operacionais, tornando difícil para alguns produtores justificar a mudança, apesar dos benefícios ambientais

- Aumentar a escala da produção, mantendo a eficácia e a consistência do produto, é outro obstáculo, especialmente para fabricantes de pequeno e médio porte. As empresas estão respondendo investindo em otimização de processos, economias de escala e parcerias com fabricantes terceirizados para reduzir custos e expandir o alcance do mercado.

- Superar este desafio exigirá inovação contínua nas tecnologias de produção, redes de distribuição melhoradas e maior educação sobre o valor a longo prazo e os benefícios de sustentabilidade dos bioinseticidas líquidos, tanto para os produtores como para o ambiente.

Escopo de mercado de bioinseticidas líquidos

O mercado é segmentado com base no tipo de organismo, tipo, tipo de cultura, aplicação e insetos.

- Por tipo de organismo

Com base no tipo de organismo, o mercado de bioinseticidas líquidos é segmentado em Bacillus thuringiensis, Beauveria bassiana e Metarhizium anisopliae. O segmento de Bacillus thuringiensis foi responsável pela maior participação de mercado em 2024, devido à sua eficácia comprovada contra um amplo espectro de larvas de insetos e à sua aceitação de longa data na agricultura orgânica e convencional. É amplamente utilizado por seu perfil de segurança, não toxicidade para humanos e animais e sua capacidade de ser integrado a programas de manejo integrado de pragas (MIP). Sua compatibilidade com outros insumos biológicos e químicos fortalece ainda mais sua posição dominante em diversos sistemas de cultivo.

Espera-se que o segmento de Metarhizium anisopliae apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado por seu uso crescente no controle de insetos do solo e pelo aumento de ensaios clínicos que demonstram sua eficácia contra pragas de difícil manejo, como cupins e besouros. Seu modo de ação único, que envolve infecção fúngica e colonização interna de insetos hospedeiros, o torna altamente atraente em práticas agrícolas sustentáveis que buscam alternativas livres de produtos químicos.

- Por tipo

Com base no tipo, o mercado é segmentado em inseticidas naturais, patógenos e parasitas. O segmento de inseticidas naturais deteve a maior participação de mercado em 2024, impulsionado pela crescente demanda dos consumidores por insumos agrícolas livres de produtos químicos e por regulamentações mais rigorosas sobre resíduos de pesticidas sintéticos. Os inseticidas naturais são favorecidos por seu perfil ambientalmente benigno e rápida biodegradabilidade, o que se alinha bem com as metas de crescimento e sustentabilidade do setor de agricultura orgânica.

Prevê-se que o segmento de patógenos apresente o maior CAGR entre 2025 e 2032, devido ao aumento da pesquisa e da implantação de soluções microbianas que ofereçam controle direcionado de pragas. Patógenos, especialmente fungos e bactérias entomopatogênicos, estão ganhando força devido à sua especificidade, impacto mínimo em áreas não alvo e capacidade de se estabelecer em diversas condições ambientais, o que aumenta seu potencial de supressão de pragas a longo prazo.

- Por tipo de cultura

Com base no tipo de cultura, o mercado é segmentado em oleaginosas e leguminosas, frutas e hortaliças, e grãos e cereais. O segmento de frutas e hortaliças dominou o mercado em 2024, devido ao alto valor dessas culturas e à sua vulnerabilidade a ataques de pragas durante todo o período de cultivo. Os agricultores desse segmento preferem cada vez mais bioinseticidas líquidos devido aos seus curtos intervalos pré-colheita, resíduos mínimos e conformidade com os padrões internacionais de exportação.

Espera-se que o segmento de oleaginosas e leguminosas registre o crescimento mais rápido durante o período previsto, impulsionado por iniciativas governamentais que promovem a adoção de bioinsumos no cultivo de leguminosas e pela crescente conscientização dos agricultores sobre a saúde do solo e a segurança dos polinizadores. A capacidade dos bioinseticidas de oferecer tanto a supressão de pragas quanto o enriquecimento microbiano do solo agrega ainda mais valor aos sistemas de cultivo baseados em oleaginosas.

- Por aplicação

Com base na aplicação, o mercado é segmentado em tratamento de sementes, tratamento de solo e pulverização foliar. O segmento de pulverização foliar deteve a maior participação na receita, com 50,2% em 2024, devido ao seu mecanismo de contato direto, ação rápida e facilidade de aplicação em diversos tipos de culturas. A aplicação foliar permite o direcionamento preciso de pragas de insetos durante surtos e oferece resultados visíveis com frequência mínima de reaplicação, o que impulsiona a adoção tanto por pequenos produtores quanto por fazendas comerciais.

O segmento de tratamento de sementes deverá crescer a um ritmo acelerado entre 2025 e 2032, à medida que a proteção precoce contra pragas ganha importância na agricultura de precisão e nas estratégias de manejo integrado de pragas. O tratamento de sementes com bioinseticidas oferece controle a longo prazo desde os estágios iniciais de crescimento, reduzindo a necessidade de aplicações repetidas em campo e contribuindo para a redução de custos de insumos e a melhoria da produtividade.

- Por Insetos

Com base nas pragas-alvo, o mercado é segmentado em insetos e ácaros, lagartas e insetos de solo. O segmento de lagartas dominou o mercado em 2024 devido à infestação generalizada de larvas de lepidópteros nas principais culturas alimentares, particularmente em regiões tropicais e subtropicais. Bioinseticidas líquidos direcionados a lagartas, especialmente aqueles à base de Bacillus thuringiensis, são amplamente adotados devido à sua alta especificidade e mínima persistência ambiental.

Espera-se que o segmento de insetos do solo apresente a taxa composta de crescimento anual (CAGR) mais rápida entre 2025 e 2032, impulsionado pelos crescentes desafios no manejo de pragas da zona radicular com produtos químicos tradicionais. A ênfase crescente na saúde do solo, aliada aos avanços em tecnologias de formulação que aumentam a capacidade de sobrevivência microbiana na rizosfera, está impulsionando a adoção acelerada de bioinseticidas para o controle de insetos subterrâneos.

Análise regional do mercado de bioinseticidas líquidos

- A América do Norte dominou o mercado de bioinseticidas líquidos com a maior participação na receita de 37,09% em 2024, impulsionada pela crescente mudança do consumidor em direção à produção de alimentos orgânicos e pela crescente adoção de insumos agrícolas sustentáveis.

- A região demonstra uma forte preferência por soluções de controlo de pragas amigas do ambiente, apoiadas por regulamentações rigorosas sobre pesticidas e pela crescente consciencialização relativamente aos efeitos nocivos dos produtos químicos sintéticos.

- O investimento robusto em pesquisa e o apoio governamental favorável aos programas de proteção biológica de cultivos contribuem ainda mais para a expansão do mercado tanto de culturas em linha quanto de culturas especiais.

Visão do mercado de bioinseticidas líquidos dos EUA

O mercado de bioinseticidas líquidos dos EUA conquistou a maior fatia da receita em 2024 na América do Norte, impulsionado pela rápida expansão da agricultura orgânica e pelo aumento do escrutínio regulatório sobre produtos químicos para proteção de cultivos. Os agricultores estão adotando cada vez mais bioinseticidas microbianos e fúngicos para atender à crescente demanda dos consumidores por alimentos seguros e cultivados de forma sustentável. A presença de grandes empresas de biocontrole, juntamente com programas de apoio do USDA e da EPA, continua a impulsionar o crescimento do mercado em diversos tipos de cultivos.

Visão geral do mercado de bioinseticidas líquidos na Europa

O mercado europeu de bioinseticidas líquidos deverá crescer a uma CAGR substancial ao longo do período previsto, impulsionado principalmente pelas rigorosas regulamentações da UE sobre pesticidas e pelo crescente foco em sistemas agrícolas ecológicos. A crescente popularidade do manejo integrado de pragas (MIP), aliada à crescente conscientização dos consumidores sobre segurança alimentar e sustentabilidade, está fomentando a adoção de produtos biológicos para o controle de insetos. A região está vivenciando um crescimento significativo nos setores de horticultura, vinhedos e cultivo protegido, onde a conformidade regulatória e os requisitos de exportação estão impulsionando a substituição de inseticidas químicos por bioinseticidas.

Visão geral do mercado de bioinseticidas líquidos no Reino Unido

Prevê-se que o mercado de bioinseticidas líquidos do Reino Unido cresça a um CAGR considerável durante o período previsto, impulsionado por mudanças políticas em direção à agricultura sustentável e pela crescente demanda por produtos alimentícios livres de produtos químicos. O forte setor varejista de orgânicos do país e a preocupação pública com a perda de biodiversidade estão incentivando os agricultores a integrar bioinseticidas em suas estratégias de proteção de cultivos, especialmente em frutas, vegetais e leguminosas.

Visão do mercado de bioinseticidas líquidos na Alemanha

Espera-se que o mercado alemão de bioinseticidas líquidos se expanda a um CAGR considerável durante o período previsto, impulsionado pela liderança do país na agricultura orgânica e seu foco em insumos agrícolas ecologicamente corretos. O rigoroso arcabouço regulatório alemão e a abordagem inovadora em biotecnologia agrícola estão incentivando a adoção de bioinseticidas líquidos em sistemas agrícolas convencionais e orgânicos.

Visão do mercado de bioinseticidas líquidos da Ásia-Pacífico

O mercado de bioinseticidas líquidos da Ásia-Pacífico deverá crescer com a CAGR mais rápida durante o período previsto de 2025 a 2032, impulsionado pela expansão da agricultura orgânica, pela conscientização sobre os efeitos nocivos dos produtos químicos sintéticos e por políticas governamentais de apoio. A crescente demanda por alimentos na região, juntamente com iniciativas que promovem a agricultura sustentável e livre de resíduos, está impulsionando a adoção de soluções biológicas de controle de pragas. À medida que a Ásia-Pacífico emerge como um polo de alta demanda e alta oferta de insumos agrícolas de base biológica, o aumento dos investimentos e da capacidade de produção doméstica está ampliando o alcance do mercado para pequenas e grandes propriedades rurais.

Visão do mercado de bioinseticidas líquidos na Índia

O mercado indiano de bioinseticidas líquidos está ganhando força devido à crescente conscientização dos agricultores sobre a saúde do solo, a segurança ambiental e os benefícios econômicos dos insumos de origem biológica. Programas governamentais, como a Missão Nacional para a Agricultura Sustentável, e subsídios para biopesticidas estão acelerando sua adoção, principalmente no cultivo de frutas, vegetais e leguminosas.

Visão do mercado de bioinseticidas líquidos da China

O mercado chinês de bioinseticidas líquidos foi responsável pela maior fatia da receita de mercado na região Ásia-Pacífico em 2024, devido à redução do uso de pesticidas sintéticos, impulsionada por políticas públicas, e à crescente ênfase em práticas agrícolas sustentáveis. A forte base industrial nacional da China, a expansão de terras agrícolas certificadas como orgânicas e a crescente preferência do consumidor por produtos com rótulos limpos estão contribuindo significativamente para o crescimento do mercado em segmentos-chave de cultivo.

Participação no mercado de bioinseticidas líquidos

A indústria de bioinseticidas líquidos é liderada principalmente por empresas bem estabelecidas, incluindo:

- BASF (Alemanha)

- Bayer AG (Alemanha)

- BIOBEST GROUP NV (Bélgica)

- Certis USA LLC (EUA)

- Novozymes (Dinamarca)

- Marrone Bio Innovations (EUA)

- Syngenta (Suíça)

- Nufarm (Austrália)

- Som Phytopharma India Ltd. (Índia)

- Valent BioSciences LLC (EUA)

- BioWorks Inc. (EUA)

- Camson Biotechnologies Ltd (Índia)

- Andermatt Biocontrol AG (Suíça)

- Kan Biosys Pvt. Ltd. (Índia)

- Futureco Bioscience SA (Espanha)

- Kilpest India Ltd (Índia)

- BioSafe Systems, LLC. (EUA)

- Vestaron Corporation (EUA)

- SDS Biotech KK (Japão)

Últimos desenvolvimentos no mercado global de bioinseticidas líquidos

- Em abril de 2024, a Syngenta firmou uma colaboração estratégica com a Lavie Bio, de Israel, com foco na exploração e desenvolvimento de biopesticidas inovadores. Essa parceria visa acelerar a criação de produtos biológicos, uma necessidade crítica no setor agrícola. Aproveitando a infraestrutura de biologia computacional fornecida pela Evogene, a Lavie Bio busca identificar cepas microbianas que atendam às necessidades de proteção de cultivos, aumentando significativamente seu alcance de mercado e suas capacidades por meio da extensa rede da Syngenta.

- Em novembro de 2023, a FMC lançou o Ethos Elite LFR, um novo produto de proteção de cultivos pré-misturado com inseticida/biofungicida, com lançamento previsto para o mercado dos EUA em 2024. Esta formulação combina a eficácia comprovada do inseticida piretroide bifentrina com duas cepas biológicas patenteadas da FMC — Bacillus velezensis cepa RTI301 e Bacillus subtilis cepa RTI477 — proporcionando controle de amplo espectro contra doenças do início da temporada e pragas transmitidas pelo solo.

- Em fevereiro de 2023, a Vestaron, produtora líder de bioinseticidas à base de peptídeos, lançou o Spear RC, um novo membro da sua linha Spear. Este inseticida inovador foi desenvolvido para combater pragas lepidópteras, como a lagarta-do-algodoeiro, a lagarta-medideira-da-soja e a lagarta-do-cartucho, em culturas como algodão, soja e arroz. Testes de campo demonstraram que o Spear® RC oferece desempenho de controle de pragas comparável ao de inseticidas químicos convencionais.

- Em março de 2022, a Marrone Bio Innovations Inc. e a Bioceres Crop Solutions Corp. anunciaram um acordo definitivo para a fusão, em uma transação totalmente acionária, com o objetivo de criar uma empresa líder global em soluções agrícolas sustentáveis. Essa fusão combina a expertise da Bioceres em produtos de bionutrição e tratamento de sementes com as inovações da Marrone Bio em proteção biológica de cultivos. Juntas, elas aprimorarão suas capacidades no desenvolvimento e na comercialização de produtos agrícolas ecologicamente corretos para apoiar práticas agrícolas sustentáveis em todo o mundo.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.