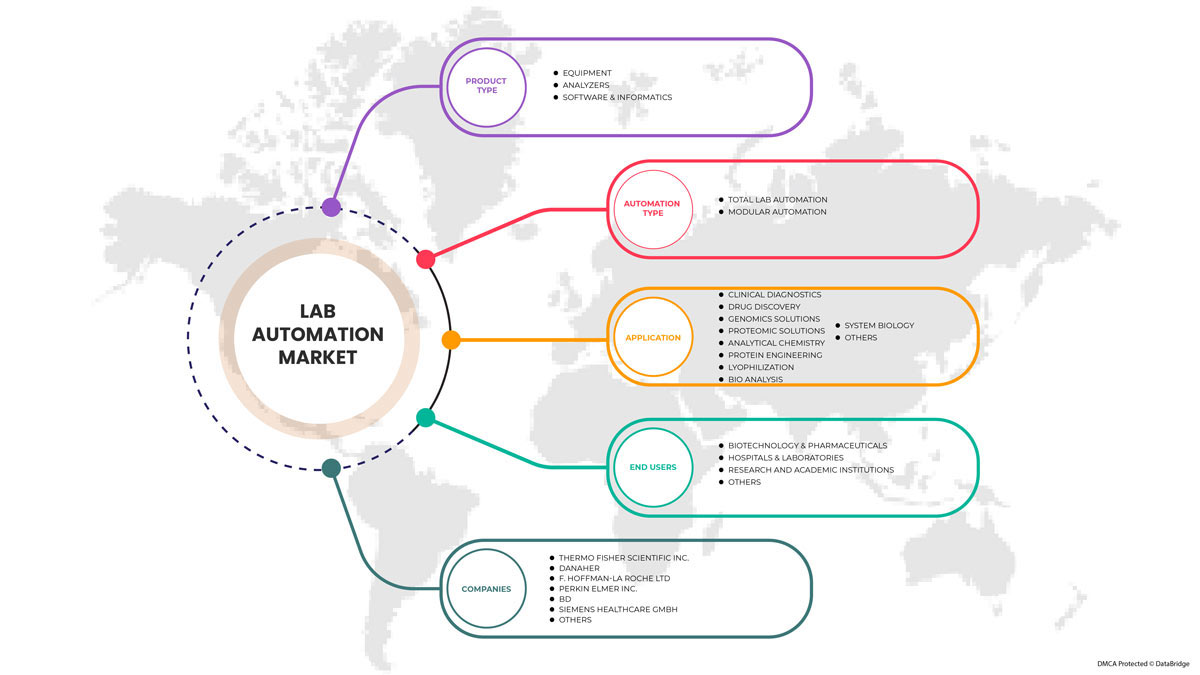

Mercado Global de Automação de Laboratórios, por Tipo de Produto (Equipamento, Software & Informática e Analisador), Tipo de Automação (Automação Modular e Automação Total de Laboratórios), Aplicação (Descoberta de Medicamentos, Diagnóstico Clínico, Soluções Genómicas , Soluções Proteómicas, Bio Análise, Engenharia de Proteínas, Liofilização , Biologia de Sistemas, Química Analítica e Outros), Utilizadores Finais (Biotecnologia e Produtos Farmacêuticos, Hospitais e Laboratórios, Instituições Académicas e de Investigação e Outros) - Tendências e Previsões do Setor para 2029.

Análise e insights de mercado de automação de laboratório

A procura pelo mercado de automação laboratorial está a aumentar devido ao avanço da tecnologia em todo o mundo. Para o setor da saúde são utilizados equipamentos e ferramentas de automação laboratorial. À medida que as despesas com cuidados de saúde têm aumentado devido a vários factores, as principais empresas farmacêuticas e de cuidados de saúde têm de automatizar os laboratórios para prestar serviços avançados de cuidados de saúde à porta de casa em menos tempo.

A crescente procura de cuidados de saúde no mercado é a principal causa da concorrência entre as principais empresas de saúde e farmacêuticas na melhoria da automação laboratorial em todo o mundo. O aumento da utilização de equipamentos, analisadores e software para o laboratório tem sido aproveitado. O foco dos players do mercado é fornecer variabilidade de ferramentas, equipamentos, máquinas e técnicas para apoiar o desenvolvimento e fabrico de infraestruturas laboratoriais automatizadas. Os intervenientes no mercado estão a propor mais investimento e financiamento para construir tecnologias e métodos avançados.

As despesas com cuidados de saúde aumentaram devido a vários factores, tais como o envelhecimento da população, a prevalência de doenças crónicas, o aumento dos preços dos medicamentos, os custos dos serviços de saúde e os custos administrativos, entre outros. Além disso, os hospitais, laboratórios privados, centros de investigação clínica e de diagnóstico estão a aumentar, aumentando a procura do mercado de automação laboratorial.

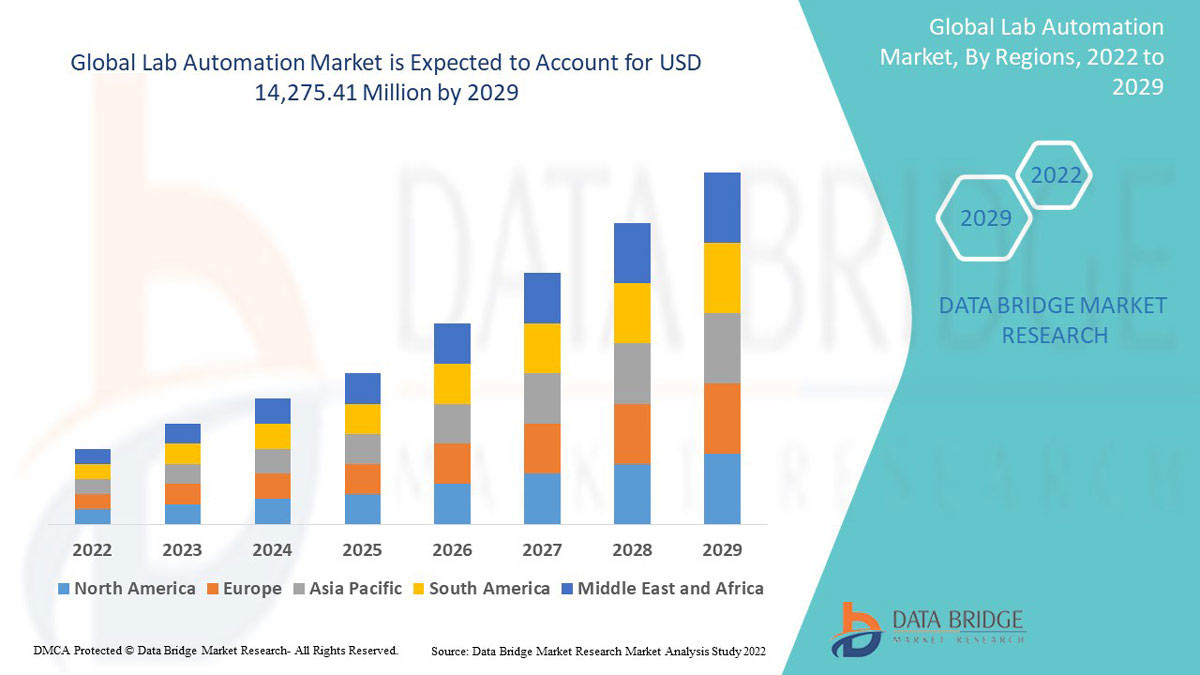

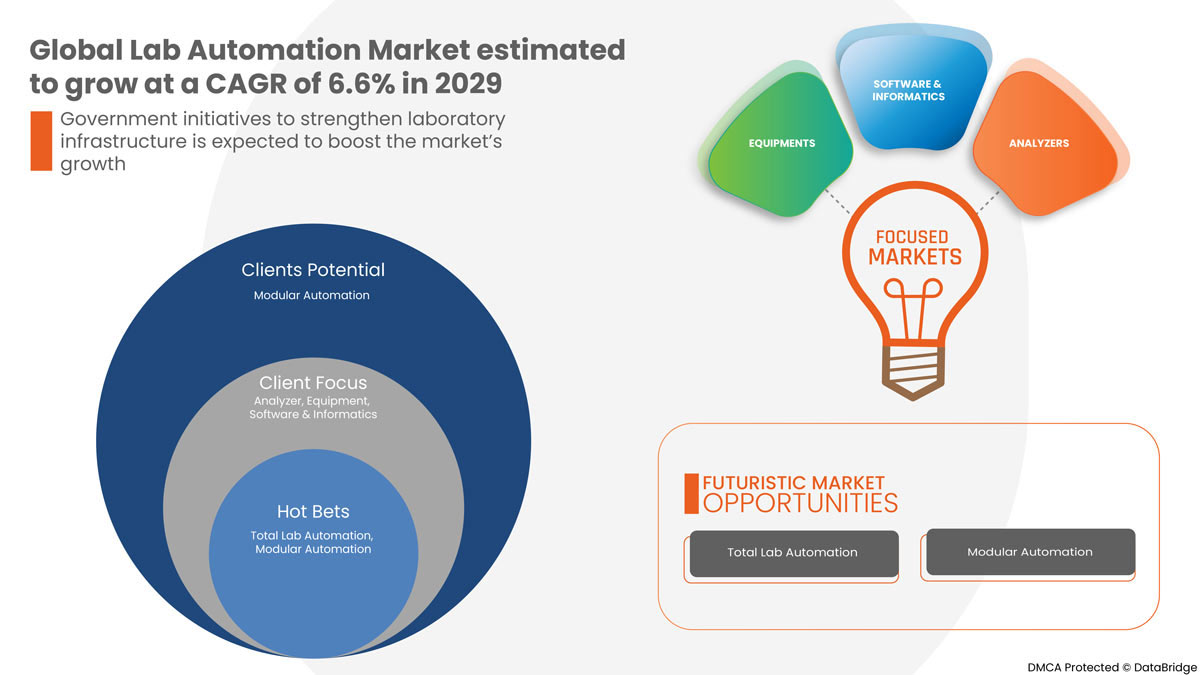

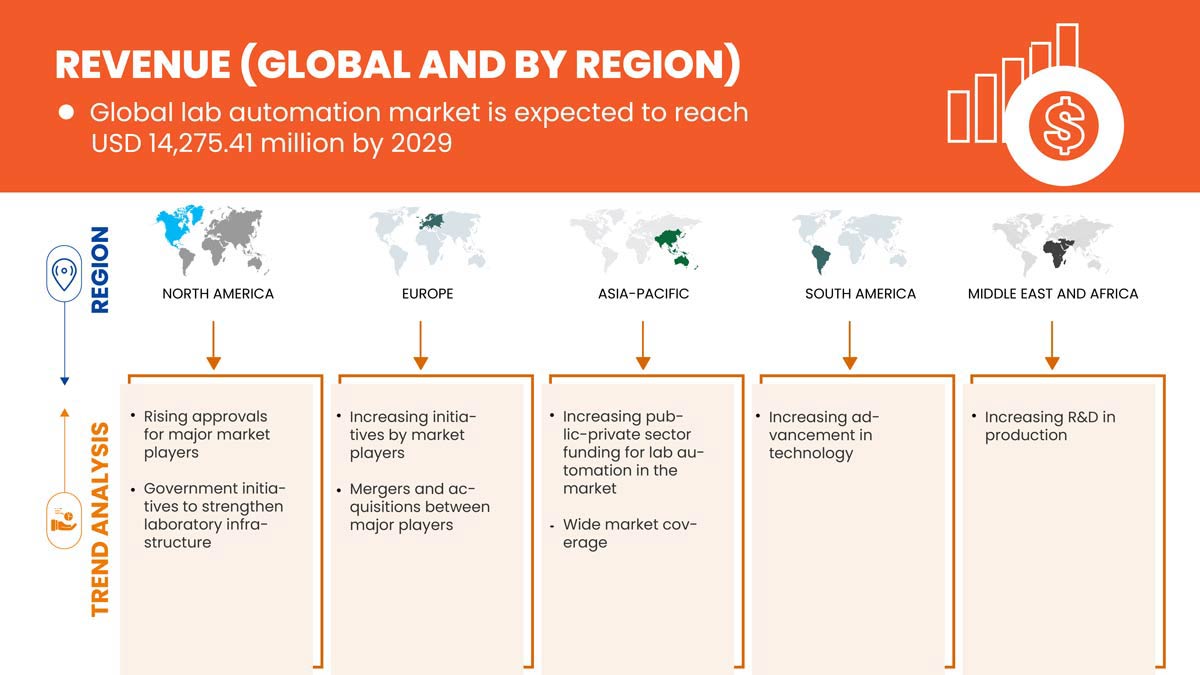

Espera-se que o mercado global de automação laboratorial ganhe crescimento de mercado no período de previsão de 2022 a 2029. A Data Bridge Market Research analisa que o mercado está a crescer com um CAGR de 6,6% no período de previsão de 2022 a 2029 e deverá atingir os 14.275,41 milhões de USD até 2029.

|

Métrica de reporte |

Detalhes |

|

Período de previsão |

2022 a 2029 |

|

Ano base |

2021 |

|

Anos históricos |

2020 (personalizável para 2019-2014) |

|

Unidades Quantitativas |

Receita em milhões de dólares |

|

Segmentos cobertos |

Por tipo de produto (equipamento, software e informática e analisador), tipo de automatização (automatização modular e automatização total do laboratório), aplicação (descoberta de fármacos, diagnóstico clínico, soluções genómicas, soluções proteómicas, bioanálise, engenharia de proteínas, liofilização, biologia de sistemas, analítico Química e Outros), Utilizadores Finais (Biotecnologia e Produtos Farmacêuticos, Hospitais e Laboratórios, Instituições Académicas e de Investigação e Outros) |

|

Países abrangidos |

EUA, Canadá, México, Alemanha, França, Reino Unido, Itália, Espanha, Holanda, Rússia, Bélgica, Suíça, Turquia, Resto da Europa, China, Japão, Índia, Coreia do Sul, Austrália, Singapura, Tailândia, Malásia, Indonésia , Filipinas , Resto da Ásia-Pacífico, Brasil, Argentina, Resto da América do Sul, África do Sul, Arábia Saudita, Emirados Árabes Unidos e Resto do Médio Oriente e África |

|

Participantes do mercado abrangidos |

QIAGEN, Siemens Healthcare, F. Hoffman Roche, Hamilton Company, Hudson Robotics, LabVantage Solutions Inc., Abbott, BD, BIOMERIEUX, Aurora Biomed Inc., Danaher, Tecan Trading AG, PerkinElmer Inc, Thermo Fisher Scientific, Agilent Technologies, Azenta US Inc, Eppendorf SE e Labware entre outros |

Definição de Mercado

A automatização laboratorial é a combinação de tecnologias automatizadas no laboratório para permitir processos novos e melhorados. É utilizado como estratégia para pesquisar, desenvolver, otimizar e capitalizar tecnologias em laboratório. É especialmente utilizado para automatizar processos laboratoriais que requerem uma intervenção humana mínima e eliminam os erros humanos. A automação laboratorial é utilizada com o objetivo de proporcionar testes e diagnósticos mais eficientes.

A automação laboratorial permite que os investigadores e técnicos produzam resultados de forma eficiente e eficaz em menos tempo, o que deverá impulsionar o mercado da automação laboratorial. Além disso, a rápida disseminação de doenças, juntamente com novas descobertas na área da saúde, aumentam a procura por diagnósticos e tratamentos, o que deverá alimentar o mercado da automação laboratorial. O elevado financiamento governamental e privado para investigação e descoberta e a presença de grandes intervenientes no mercado também contribuem para o crescimento do mercado.

Dinâmica global do mercado de automação laboratorial

Motoristas

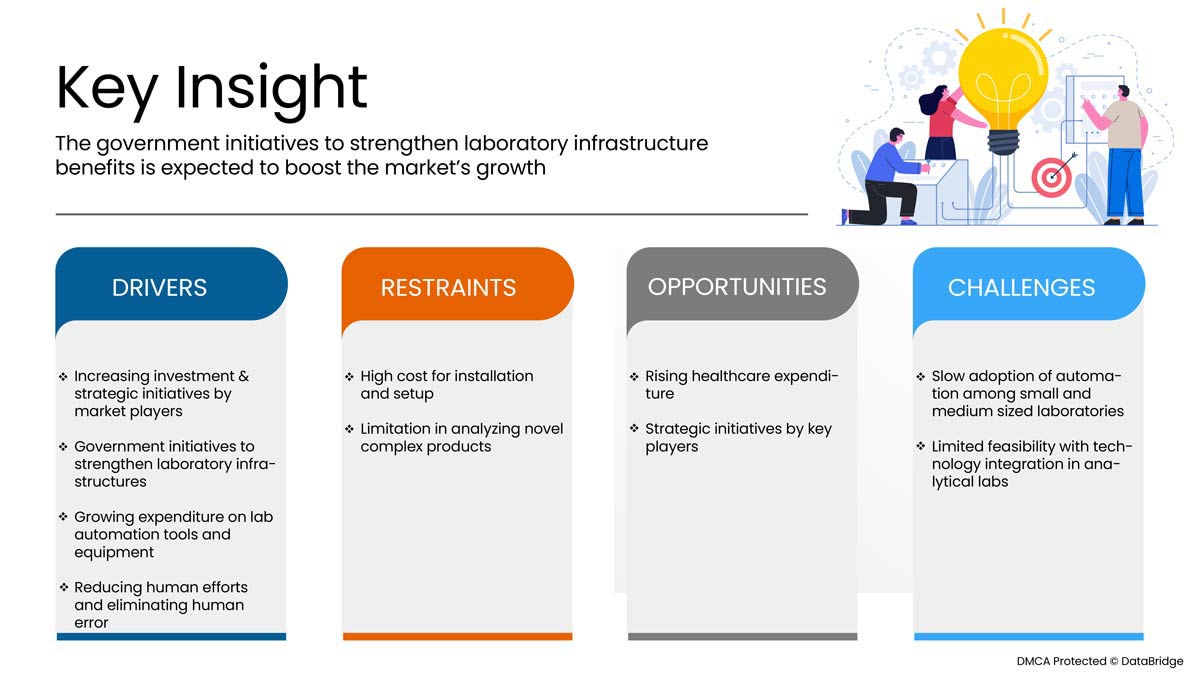

- Aumento dos investimentos e das iniciativas estratégicas por parte dos participantes do mercado

O mercado da automação laboratorial está a aumentar à medida que existe uma grande procura por serviços automatizados avançados e especializados que eliminam os erros humanos. O foco dos players do mercado e das empresas é fornecer uma variabilidade de ferramentas, equipamentos, máquinas e técnicas para apoiar o desenvolvimento e fabrico de infraestruturas laboratoriais automatizadas. O mercado da automação laboratorial está a aumentar à medida que existe uma elevada procura por serviços automatizados avançados e especializados que eliminam o erro humano. A fim de captar a quota de mercado global, os intervenientes no mercado estão a disponibilizar mais investimento e financiamento para construir tecnologias e métodos avançados. Estes participantes estão mais focados em reduzir os esforços manuais e o tempo prático para o processo tradicionalmente intensivo em mão-de-obra. Espera-se que isto impulsione o crescimento do mercado.

- Iniciativas governamentais para reforçar as infraestruturas laboratoriais

A fim de fortalecer ainda mais o sector da saúde e a infra-estrutura laboratorial, as organizações governamentais desempenham um papel significativo. O financiamento e a iniciativa do governo para expandir a automatização laboratorial ajudarão no crescimento do mercado e aumentarão os participantes no mercado. As colaborações e acordos governamentais com os principais intervenientes no mercado irão reforçar ainda mais a infraestrutura laboratorial.

- Despesas crescentes em ferramentas e equipamentos de automação laboratorial

Os gastos crescentes com ferramentas e equipamentos de automação laboratorial estão a aumentar. Isto deve-se principalmente ao rápido aumento da procura de exames laboratoriais por diversas razões, tais como o envelhecimento da população, o crescimento das doenças crónicas, a descoberta de biomarcadores novos e mais eficazes e o aumento das exigências gerais de saúde ou de diagnóstico.

- Reduzindo os esforços humanos e eliminando o erro humano

Existem várias formas tradicionais de reduzir os erros humanos, mas desenvolver um sistema para minimizar o risco de erro humano ajudará a garantir que não repete os mesmos erros. As instalações de fabrico estão focadas na construção de sistemas avançados, de forma a utilizar tecnologia de inteligência artificial para reconhecer e corrigir problemas antes que estes ocorram.

Oportunidades

-

Aumento das despesas com a saúde

As despesas com cuidados de saúde aumentaram devido a vários factores, tais como o envelhecimento da população, a prevalência de doenças crónicas, o aumento dos preços dos medicamentos, os custos dos serviços de saúde e os custos administrativos, entre outros. No entanto, 2020 foi o ponto de viragem em que as despesas foram as mais elevadas devido à pandemia da COVID-19. Verificou-se que em 2020, as despesas com saúde cresceram ao ritmo de crescimento mais rápido registado desde 2002 devido à pandemia .

-

Iniciativas estratégicas de atores-chave

Foram tomadas várias iniciativas pelas principais empresas farmacêuticas e de saúde para automatizar os laboratórios e prestar serviços de saúde avançados à porta de casa em menos tempo. A crescente procura de cuidados de saúde no mercado é a principal causa da concorrência entre as principais empresas farmacêuticas e de saúde na melhoria da automação laboratorial em todo o mundo. Assim, espera-se que as iniciativas estratégicas dos players do mercado funcionem como uma oportunidade para o crescimento do mercado da automação laboratorial.

-

Aumento do número de empresas farmacêuticas

A indústria farmacêutica registou um crescimento significativo nas últimas duas décadas. O aumento dos rendimentos disponíveis, o aumento do acesso a instalações de saúde, a crescente consciência das pessoas em relação aos cuidados de saúde e o aumento da penetração dos serviços médicos estão a fazer com que as empresas farmacêuticas aumentem em número para satisfazer a procura.

A pandemia da COVID-19 teve um grande impacto na indústria farmacêutica devido ao aumento da procura de serviços médicos e do fornecimento de medicamentos. As indústrias farmacêuticas têm crescido rapidamente em todo o mundo para satisfazer a elevada procura da humanidade e, por isso, o serviço deve ser prestado o mais rapidamente possível. Portanto, para obter um atendimento rápido e livre de erros em instalações de saúde avançadas em menos tempo, é necessária a automatização do laboratório. Assim, espera-se que o aumento do número de empresas farmacêuticas atue como uma oportunidade para o crescimento do mercado da automação laboratorial.

Restrições/Desafios

- Limitação na análise de novos produtos complexos

Existem vários fatores que contribuem para a complexidade dos novos produtos utilizados nos laboratórios automatizados. O envolvimento contínuo entre a equipa e os fabricantes de dispositivos no início do processo de desenvolvimento é muito necessário e torna-se obrigatório compreender para operar a peça ou a configuração geral. As limitações na deteção e análise de novos produtos complexos, como máquinas, ferramentas e equipamentos, estão a dificultar a instalação e o funcionamento de laboratórios automatizados no mercado.

- Custo elevado para instalação e configuração

A instalação e configuração da automação laboratorial são procedimentos muito mais trabalhosos e complexos. A criação de laboratórios automatizados requer muito tempo, esforço, planeamento, implementação e aprovações de vários departamentos governamentais. Além disso, o essencial para a implementação de um novo laboratório exige um investimento crítico em infraestruturas devido ao elevado custo das máquinas, ferramentas e equipamentos avançados.

- Atualização, manutenção e verificações periódicas

Operar laboratórios de forma eficiente é a principal preocupação após a configuração. A manutenção, atualização e verificações periódicas dos equipamentos são necessárias para o funcionamento. O gasto necessário para tal é um dos principais fatores de contenção dos players do mercado. Os titulares de laboratório são obrigados por regulamento ou controlo de qualidade a testar os seus produtos, independentemente das empresas fabricantes, a fim de operar sem problemas e evitar circunstâncias. Isto pode restringir o crescimento do mercado.

Impacto pós-COVID-19 no mercado global de automação laboratorial

A COVID-19 afetou positivamente o mercado da automação. Devido à pandemia, a saúde das pessoas foi afetada, o que fez com que ocorressem elevados testes de diagnóstico e a procura aumentasse. Os laboratórios privados, os hospitais e a investigação clínica aumentaram devido à pandemia. Assim, o COVID-19 aumentou positivamente o mercado da automação laboratorial.

Desenvolvimentos recentes

- Em junho de 2022, a BD anunciou que tinha concluído a aquisição da Straub Medical AG, uma empresa privada. Com esta aquisição, a empresa adicionou o valioso conhecimento e experiência da Straub Medical AG e expandiu o seu portfólio de produtos

- Em janeiro de 2022, a QIAGEN anunciou que iniciou novas colaborações com a Atlia Biosystems para fornecer soluções de testes pré-natais não invasivos.

Âmbito global do mercado de automação de laboratório

O mercado global de automação laboratorial está segmentado em tipo de produto, categoria de produto, sistemas automatizados, aplicação e utilizador final. O crescimento entre estes segmentos irá ajudá-lo a analisar os escassos segmentos de crescimento nas indústrias e a fornecer aos utilizadores uma valiosa visão geral do mercado e insights de mercado para tomar decisões estratégicas para identificar as principais aplicações do mercado.

Tipo de produto

- Equipamento

- Analisador

- Software e Informática

Com base no tipo de produto, o mercado global de automação laboratorial está segmentado em equipamentos, analisadores e software e informática.

Sistemas Automatizados

- Automação total do laboratório

- Automação Modular de Laboratório

Baseado em sistemas automatizados, o mercado global de automação laboratorial está segmentado em automação laboratorial total e automação laboratorial modular.

Aplicação

- Diagnóstico Clínico

- Descoberta de fármacos

- Soluções Genómicas

- Soluções Proteómicas

- Química Analítica

- Engenharia de Proteínas

- Liofilização

- Bioanálise

- Biologia Sistémica

- Outros

Com base na aplicação, o mercado global de automação laboratorial está segmentado em descoberta de medicamentos, diagnóstico clínico, soluções genómicas, soluções proteómicas, bioanálise, engenharia de proteínas, liofilização, biologia de sistemas, química analítica e outros.

Utilizador final

- Biotecnologia e produtos farmacêuticos

- Hospitais e laboratórios

- Institutos Académicos e de Investigação

- Outros

Com base no utilizador final, o mercado global de automação laboratorial está segmentado em biotecnologia e produtos farmacêuticos, hospitais e laboratórios, instituições académicas e de investigação e outros.

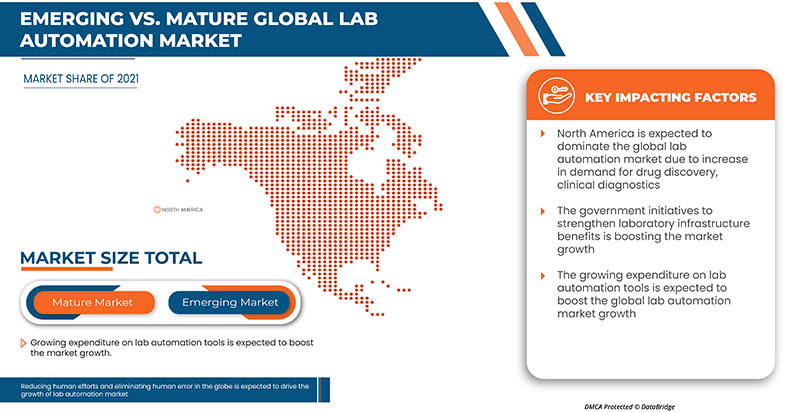

Análise/perspetivas regionais do mercado global de automação laboratorial

O mercado global de automação laboratorial é analisado e são fornecidos insights e tendências do tamanho do mercado por país, tipo de produto, sistemas automatizados, aplicação e utilizador final.

Os países abrangidos pelo mercado são os EUA, Canadá, México, Alemanha, França, Reino Unido, Itália, Espanha, Países Baixos, Rússia, Bélgica, Suíça, Turquia, Resto da Europa, China, Japão, Índia, Coreia do Sul, Austrália, Singapura , Tailândia, Malásia, Indonésia, Filipinas, Resto da Ásia-Pacífico, Brasil, Argentina, Resto da América do Sul, África do Sul, Arábia Saudita, Emirados Árabes Unidos e Resto do Médio Oriente e África.

Espera-se que a Ásia-Pacífico domine o mercado global de automação laboratorial devido a um número crescente de atividades de investigação. Espera-se que um aumento da procura de equipamentos, analisadores e software impulsione o crescimento do mercado no período de previsão.

A secção regional do relatório também fornece fatores individuais de impacto no mercado e alterações nas regulamentações do mercado que impactam as tendências atuais e futuras do mercado. Pontos de dados, como vendas de novos e de reposição, demografia do país, epidemiologia de doenças e tarifas de importação e exportação, são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, são considerados a presença e a disponibilidade das marcas da América Central e os desafios enfrentados devido à elevada concorrência das marcas locais e nacionais, e o impacto dos canais de vendas, ao mesmo tempo que se fornece uma análise de previsão dos dados do país.

Análise do cenário competitivo e da quota de mercado global de automação laboratorial

O panorama competitivo do mercado global de automação laboratorial fornece detalhes dos concorrentes. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença global, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa , lançamento de produto, largura e amplitude do produto e aplicação domínio. Os dados acima fornecidos estão apenas relacionados com o foco das empresas no mercado global de automação laboratorial.

Alguns dos principais players que operam no mercado global de automação laboratorial são a QIAGEN, Siemens Healthcare, F. Hoffman Roche, Hamilton Company, Hudson Robotics, LabVantage Solutions Inc., Abbott, BD, BIOMERIEUX, Aurora Biomed Inc., Danaher, Tecan Trading AG , PerkinElmer Inc, Thermo Fisher Scientific, Agilent Technologies, Azenta US Inc, Eppendorf SE e Labware, entre outros.

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Além disso, os modelos de dados incluem uma grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise da quota de mercado da empresa, padrões de medição, análise global vs. Solicite uma chamada de analista em caso de dúvidas adicionais.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL LAB AUTOMATION MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

5 REGULATION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING INVESTMENT & STRATEGIC INITIATIVES BY MARKET PLAYERS

6.1.2 GOVERNMENT INITIATIVES TO STRENGTHEN LABORATORY INFRASTRUCTURES

6.1.3 GROWING EXPENDITURE ON LAB AUTOMATION TOOLS AND EQUIPMENT

6.1.4 REDUCING HUMAN EFFORTS AND ELIMINATING HUMAN ERROR

6.2 RESTRAINTS

6.2.1 LIMITATION ANALYZING NOVEL COMPLEX PRODUCT

6.2.2 HIGH COST FOR INSTALLATION AND SETUP

6.2.3 UPGRADATION, MAINTENANCE, AND PERIODICAL CHECKUPS

6.3 OPPORTUNITIES

6.3.1 RISING HEALTHCARE EXPENDITURE

6.3.2 STRATEGIC INITIATIVES BY KEY PLAYERS

6.3.3 RISE IN THE NUMBER OF PHARMA COMPANIES

6.4 CHALLENGES

6.4.1 SLOW ADOPTION OF AUTOMATION AMONG SMALL AND MEDIUM SIZED LABORATORIES

6.4.2 LIMITED FEASIBILITY WITH TECHNOLOGY INTEGRATION IN ANALYTICAL LABS

7 GLOBAL LAB AUTOMATION MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 EQUIPMENT

7.2.1 AUTOMATED WORKSTATIONS

7.2.1.1 AUTOMATED LIQUID HANDLING SYSTEMS

7.2.1.2 AUTOMATED INTEGRATED WORKSTATIONS

7.2.1.3 PIPETTING SYSTEMS

7.2.1.4 MICROPLATE WASHERS

7.2.1.5 REAGENT DISPENSERS

7.2.2 MICROPLATE READERS

7.2.2.1 MULTI-MODE MICROPLATE READERS

7.2.2.2 SINGLE-MODE MICROPLATE READERS

7.2.2.3 AUTOMATED NUCLEIC ACID PURIFICATION SYSTEMS

7.2.2.4 AUTOMATED ELISA SYSTEMS

7.2.3 OFF-THE-SHELF AUTOMATED WORKCELLS

7.2.4 ROBOTIC SYSTEMS

7.2.4.1 ROBOTIC ARMS

7.2.4.2 TRACK ROBOTS

7.2.5 AUTOMATE STORAGE & RETRIEVALS (ASRS)

7.2.6 OTHERS

7.3 ANALYZER

7.3.1 BIO CHEMISTRY ANALYZERS

7.3.2 HAEMATOLOGY ANALYZERS

7.3.3 IMMUNO-BASED ANALYZERS

7.4 SOFTWARE & INFORMATICS

7.4.1 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS)

7.4.2 ELECTRONIC LABORATORY NOTEBOOK (ELN)

7.4.3 LABORATORY EXECUTION SYSTEMS (LES)

7.4.4 SCIENTIFIC DATA MANAGEMENT SYSTEMS (SDMS)

8 GLOBAL LAB AUTOMATION MARKET, BY AUTOMATION TYPE

8.1 OVERVIEW

8.2 TOTAL LAB AUTOMATION

8.3 MODULAR AUTOMATION

9 GLOBAL LAB AUTOMATION MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 CLINICAL DIAGNOSTICS

9.3 DRUG DISCOVERY

9.4 GENOMICS SOLUTIONS

9.5 PROTEOMIC SOLUTIONS

9.6 ANALYTICAL CHEMISTRY

9.7 PROTEIN ENGINEERING

9.8 BIO ANALYSIS

9.9 SYSTEM BIOLOGY

9.1 OTHERS

10 GLOBAL LAB AUTOMATION MARKET, BY END USER

10.1 OVERVIEW

10.2 BIOTECHNOLOGY & PHARMACEUTICALS

10.3 HOSPITALS & LABORATORIES

10.4 RESEARCH & ACADEMIC INSTITUTES

10.5 OTHERS

11 GLOBAL LAB AUTOMATION MARKET, BY REGION

11.1 OVERVIEW

11.2 NORTH AMERICA

11.2.1 U.S.

11.2.2 CANADA

11.2.3 MEXICO

11.3 EUROPE

11.3.1 GERMANY

11.3.2 FRANCE

11.3.3 U.K.

11.3.4 ITALY

11.3.5 RUSSIA

11.3.6 SPAIN

11.3.7 NETHERLANDS

11.3.8 SWITZERLAND

11.3.9 TURKEY

11.3.10 BELGIUM

11.3.11 REST OF EUROPE

11.4 ASIA-PACIFIC

11.4.1 CHINA

11.4.2 JAPAN

11.4.3 SOUTH KOREA

11.4.4 INDIA

11.4.5 AUSTRALIA

11.4.6 SINGAPORE

11.4.7 THAILAND

11.4.8 MALAYSIA

11.4.9 INDONESIA

11.4.10 PHILIPPINES

11.4.11 REST OF ASIA-PACIFIC

11.5 SOUTH AMERICA

11.5.1 BRAZIL

11.5.2 ARGENTINA

11.5.3 REST OF SOUTH AMERICA

11.6 MIDDLE EAST AND AFRICA

11.6.1 SOUTH AFRICA

11.6.2 SAUDI ARABIA

11.6.3 U.A.E.

11.6.4 REST OF MIDDLE EAST AND AFRICA

12 GLOBAL LAB AUTOMATION MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

12.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.3 COMPANY SHARE ANALYSIS: EUROPE

12.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 THERMO FISHER SCIENTIFIC INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 DANAHER

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 F. HOFFMANN- LA ROCHE LTD

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 PERKINELMER INC

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 BD

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ABBOTT

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 AGILENT TECHNOLOGIES

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 AURORA BIOMED INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 AZENTA US INC

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 BIOMERIEUX

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 EPPENDORF SE

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 HAMILTON COMPANY

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 HUDSON ROBOTICS

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 LABLYNX LIMS

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

14.15 LABVANTAGE SOLUTIONS INC.

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 LABWARE

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 QIAGEN

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENTS

14.18 SIEMENS HEALTHCARE GMBH

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENTS

14.19 TECAN TRADING AG

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tabela

TABLE 1 GLOBAL LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 GLOBAL EQUIPMENT IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 GLOBAL AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 4 GLOBAL MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 5 GLOBAL ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 GLOBAL ANALYZER IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 GLOBAL ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 8 GLOBAL SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 GLOBAL SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 10 GLOBAL LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 11 GLOBAL TOTAL LAB AUTOMATION IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 GLOBAL MODULAR AUTOMATION IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 GLOBAL LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 14 GLOBAL CLINICAL DIAGNOSTICS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 GLOBAL DRUG DISCOVERY IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 GLOBAL GENOMICS SOLUTIONS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 GLOBAL PROTEOMIC SOLUTIONS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 GLOBAL ANALYTICAL CHEMISTRY IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 GLOBAL PROTEIN ENGINEERING IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 GLOBAL BIO ANALYSIS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 GLOBAL SYSTEM BIOLOGY IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 GLOBAL OTHERS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 GLOBAL LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 24 GLOBAL BIOTECHNOLOGY & PHARMACEUTICALS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 GLOBAL HOSPITALS & LABORATORIES IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 GLOBAL RESEARCH & ACADEMIC INSTITUTES IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 GLOBAL OTHERS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 GLOBAL LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA LAB AUTOMATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 40 U.S. LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 41 U.S. EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 42 U.S. AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 43 U.S. MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 44 U.S. ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 45 U.S. ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 46 U.S. SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 47 U.S. LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 48 U.S. LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 U.S. LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 50 CANADA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 CANADA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 52 CANADA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 53 CANADA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 CANADA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 55 CANADA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 56 CANADA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 57 CANADA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 58 CANADA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 59 CANADA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 60 MEXICO LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 61 MEXICO EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 62 MEXICO AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 63 MEXICO MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 64 MEXICO ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 65 MEXICO ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 66 MEXICO SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 67 MEXICO LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 68 MEXICO LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 69 MEXICO LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 70 EUROPE LAB AUTOMATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 71 EUROPE LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 EUROPE EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 73 EUROPE AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 74 EUROPE MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 75 EUROPE ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 76 EUROPE ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 77 EUROPE SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 78 EUROPE LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 79 EUROPE LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 EUROPE LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 81 GERMANY LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 82 GERMANY EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 83 GERMANY AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 GERMANY MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 85 GERMANY ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 86 GERMANY ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 87 GERMANY SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 88 GERMANY LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 89 GERMANY LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 GERMANY LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 91 FRANCE LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 92 FRANCE EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 93 FRANCE AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 94 FRANCE MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 95 FRANCE ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 96 FRANCE ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 97 FRANCE SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 98 FRANCE LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 99 FRANCE LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 100 FRANCE LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 101 U.K. LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 102 U.K. EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 103 U.K. AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 104 U.K. MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 105 U.K. ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 106 U.K. ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 107 U.K. SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 108 U.K. LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 109 U.K. LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 U.K. LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 111 ITALY LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 112 ITALY EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 113 ITALY AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 114 ITALY MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 115 ITALY ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 116 ITALY ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 117 ITALY SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 118 ITALY LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 119 ITALY LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 120 ITALY LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 121 RUSSIA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 122 RUSSIA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 123 RUSSIA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 124 RUSSIA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 125 RUSSIA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 126 RUSSIA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 127 RUSSIA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 128 RUSSIA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 129 RUSSIA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 130 RUSSIA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 131 SPAIN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 132 SPAIN EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 133 SPAIN AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 134 SPAIN MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 135 SPAIN ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 136 SPAIN ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 137 SPAIN SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 138 SPAIN LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 139 SPAIN LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 140 SPAIN LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 141 NETHERLANDS LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 142 NETHERLANDS EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 143 NETHERLANDS AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 144 NETHERLANDS MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 145 NETHERLANDS ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 146 NETHERLANDS ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 147 NETHERLANDS SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 148 NETHERLANDS LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 149 NETHERLANDS LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 150 NETHERLANDS LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 151 SWITZERLAND LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 152 SWITZERLAND EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 153 SWITZERLAND AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 154 SWITZERLAND MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 155 SWITZERLAND ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 156 SWITZERLAND ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 157 SWITZERLAND SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 158 SWITZERLAND LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 159 SWITZERLAND LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 160 SWITZERLAND LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 161 TURKEY LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 162 TURKEY EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 163 TURKEY AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 164 TURKEY MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 165 TURKEY ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 166 TURKEY ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 167 TURKEY SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 168 TURKEY LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 169 TURKEY LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 170 TURKEY LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 171 BELGIUM LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 172 BELGIUM EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 173 BELGIUM AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 174 BELGIUM MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 175 BELGIUM ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 176 BELGIUM ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 177 BELGIUM SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 178 BELGIUM LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 179 BELGIUM LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 180 BELGIUM LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 181 REST OF EUROPE LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 182 ASIA-PACIFIC LAB AUTOMATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 183 ASIA-PACIFIC LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 184 ASIA-PACIFIC EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 185 ASIA-PACIFIC AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 186 ASIA-PACIFIC MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 187 ASIA-PACIFIC ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 188 ASIA-PACIFIC ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 189 ASIA-PACIFIC SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 190 ASIA-PACIFIC LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 191 ASIA-PACIFIC LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 192 ASIA-PACIFIC LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 193 CHINA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 194 CHINA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 195 CHINA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 196 CHINA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 197 CHINA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 198 CHINA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 199 CHINA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 200 CHINA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 201 CHINA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 202 CHINA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 203 JAPAN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 204 JAPAN EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 205 JAPAN AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 206 JAPAN MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 207 JAPAN ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 208 JAPAN ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 209 JAPAN SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 210 JAPAN LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 211 JAPAN LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 212 JAPAN LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 213 SOUTH KOREA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 214 SOUTH KOREA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 215 SOUTH KOREA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 216 SOUTH KOREA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 217 SOUTH KOREA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 218 SOUTH KOREA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 219 SOUTH KOREA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 220 SOUTH KOREA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 221 SOUTH KOREA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 222 SOUTH KOREA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 223 INDIA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 224 INDIA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 225 INDIA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 226 INDIA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 227 INDIA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 228 INDIA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 229 INDIA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 230 INDIA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 231 INDIA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 232 INDIA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 233 AUSTRALIA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 234 AUSTRALIA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 235 AUSTRALIA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 236 AUSTRALIA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 237 AUSTRALIA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 238 AUSTRALIA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 239 AUSTRALIA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 240 AUSTRALIA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 241 AUSTRALIA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 242 AUSTRALIA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 243 SINGAPORE LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 244 SINGAPORE EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 245 SINGAPORE AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 246 SINGAPORE MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 247 SINGAPORE ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 248 SINGAPORE ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 249 SINGAPORE SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 250 SINGAPORE LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 251 SINGAPORE LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 252 SINGAPORE LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 253 THAILAND LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 254 THAILAND EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 255 THAILAND AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 256 THAILAND MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 257 THAILAND ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 258 THAILAND ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 259 THAILAND SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 260 THAILAND LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 261 THAILAND LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 262 THAILAND LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 263 MALAYSIA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 264 MALAYSIA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 265 MALAYSIA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 266 MALAYSIA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 267 MALAYSIA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 268 MALAYSIA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 269 MALAYSIA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 270 MALAYSIA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 271 MALAYSIA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 272 MALAYSIA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 273 INDONESIA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 274 INDONESIA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 275 INDONESIA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 276 INDONESIA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 277 INDONESIA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 278 INDONESIA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 279 INDONESIA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 280 INDONESIA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 281 INDONESIA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 282 INDONESIA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 283 PHILIPPINES LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 284 PHILIPPINES EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 285 PHILIPPINES AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 286 PHILIPPINES MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 287 PHILIPPINES ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 288 PHILIPPINES ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 289 PHILIPPINES SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 290 PHILIPPINES LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 291 PHILIPPINES LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 292 PHILIPPINES LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 293 REST OF ASIA-PACIFIC LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 294 SOUTH AMERICA LAB AUTOMATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 295 SOUTH AMERICA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 296 SOUTH AMERICA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 297 SOUTH AMERICA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 298 SOUTH AMERICA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 299 SOUTH AMERICA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 300 SOUTH AMERICA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 301 SOUTH AMERICA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 302 SOUTH AMERICA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 303 SOUTH AMERICA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 304 SOUTH AMERICA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 305 BRAZIL LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 306 BRAZIL EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 307 BRAZIL AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 308 BRAZIL MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 309 BRAZIL ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 310 BRAZIL ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 311 BRAZIL SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 312 BRAZIL LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 313 BRAZIL LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 314 BRAZIL LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 315 ARGENTINA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 316 ARGENTINA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 317 ARGENTINA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 318 ARGENTINA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 319 ARGENTINA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 320 ARGENTINA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 321 ARGENTINA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 322 ARGENTINA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 323 ARGENTINA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 324 ARGENTINA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 325 REST OF SOUTH AMERICA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 326 MIDDLE EAST AND AFRICA LAB AUTOMATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 327 MIDDLE EAST AND AFRICA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 328 MIDDLE EAST AND AFRICA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 329 MIDDLE EAST AND AFRICA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 330 MIDDLE EAST AND AFRICA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 331 MIDDLE EAST AND AFRICA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 332 MIDDLE EAST AND AFRICA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 333 MIDDLE EAST AND AFRICA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 334 MIDDLE EAST AND AFRICA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 335 MIDDLE EAST AND AFRICA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 336 MIDDLE EAST AND AFRICA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 337 SOUTH AFRICA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 338 SOUTH AFRICA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 339 SOUTH AFRICA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 340 SOUTH AFRICA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 341 SOUTH AFRICA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 342 SOUTH AFRICA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 343 SOUTH AFRICA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 344 SOUTH AFRICA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 345 SOUTH AFRICA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 346 SOUTH AFRICA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 347 SAUDI ARABIA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 348 SAUDI ARABIA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 349 SAUDI ARABIA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 350 SAUDI ARABIA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 351 SAUDI ARABIA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 352 SAUDI ARABIA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 353 SAUDI ARABIA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 354 SAUDI ARABIA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 355 SAUDI ARABIA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 356 SAUDI ARABIA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 357 U.A.E. LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 358 U.A.E. EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 359 U.A.E. AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 360 U.A.E. MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 361 U.A.E. ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 362 U.A.E. ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 363 U.A.E. SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 364 U.A.E. LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 365 U.A.E. LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 366 U.A.E. LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 367 REST OF MIDDLE EAST AND AFRICA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

Lista de Figura

FIGURE 1 GLOBAL LAB AUTOMATION MARKET: SEGMENTATION

FIGURE 2 GLOBAL LAB AUTOMATION MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL LAB AUTOMATION MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL LAB AUTOMATION MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL LAB AUTOMATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL LAB AUTOMATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL LAB AUTOMATION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL LAB AUTOMATION MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 GLOBAL LAB AUTOMATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 GLOBAL LAB AUTOMATION MARKET: SEGMENTATION

FIGURE 11 GROWING EXPENDITURE ON LAB AUTOMATION TOOLS AND EQUIPMENT IS EXPECTED TO DRIVE THE GLOBAL LAB AUTOMATION MARKET GROWTH IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 EQUIPMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL LAB AUTOMATION MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE GLOBAL LAB AUTOMATION MARKET, AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 NORTH AMERICA IS THE FASTEST-GROWING MARKET FOR LAB AUTOMATION MARKET MANUFACTURERS IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL LAB AUTOMATION MARKET

FIGURE 16 GLOBAL LAB AUTOMATION MARKET: BY PRODUCT TYPE, 2021

FIGURE 17 GLOBAL LAB AUTOMATION MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 18 GLOBAL LAB AUTOMATION MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 19 GLOBAL LAB AUTOMATION MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 20 GLOBAL LAB AUTOMATION MARKET: BY AUTOMATION TYPE, 2021

FIGURE 21 GLOBAL LAB AUTOMATION MARKET: BY AUTOMATION TYPE, 2022-2029 (USD MILLION)

FIGURE 22 GLOBAL LAB AUTOMATION MARKET: BY AUTOMATION TYPE, CAGR (2022-2029)

FIGURE 23 GLOBAL LAB AUTOMATION MARKET: BY AUTOMATION TYPE, LIFELINE CURVE

FIGURE 24 GLOBAL LAB AUTOMATION MARKET: BY APPLICATION, 2021

FIGURE 25 GLOBAL LAB AUTOMATION MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 26 GLOBAL LAB AUTOMATION MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 27 GLOBAL LAB AUTOMATION MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 28 GLOBAL LAB AUTOMATION MARKET: BY END USER, 2021

FIGURE 29 GLOBAL LAB AUTOMATION MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 30 GLOBAL LAB AUTOMATION MARKET: BY END USER, CAGR (2022-2029)

FIGURE 31 GLOBAL LAB AUTOMATION MARKET: BY END USER, LIFELINE CURVE

FIGURE 32 GLOBAL LAB AUTOMATION MARKET: SNAPSHOT (2021)

FIGURE 33 GLOBAL LAB AUTOMATION MARKET: BY REGION (2021)

FIGURE 34 GLOBAL LAB AUTOMATION MARKET: BY REGION (2022 & 2029)

FIGURE 35 GLOBAL LAB AUTOMATION MARKET: BY REGION (2021 & 2029)

FIGURE 36 GLOBAL LAB AUTOMATION MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 37 NORTH AMERICA LAB AUTOMATION MARKET: SNAPSHOT (2021)

FIGURE 38 NORTH AMERICA LAB AUTOMATION MARKET: BY COUNTRY (2021)

FIGURE 39 NORTH AMERICA LAB AUTOMATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 40 NORTH AMERICA LAB AUTOMATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 41 NORTH AMERICA LAB AUTOMATION MARKET: PRODUCT TYPE (2022-2029)

FIGURE 42 EUROPE LAB AUTOMATION MARKET: SNAPSHOT (2021)

FIGURE 43 EUROPE LAB AUTOMATION MARKET: BY COUNTRY (2021)

FIGURE 44 EUROPE LAB AUTOMATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 45 EUROPE LAB AUTOMATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 46 EUROPE LAB AUTOMATION MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 47 ASIA-PACIFIC LAB AUTOMATION MARKET: SNAPSHOT (2021)

FIGURE 48 ASIA-PACIFIC LAB AUTOMATION MARKET: BY COUNTRY (2021)

FIGURE 49 ASIA-PACIFIC LAB AUTOMATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 50 ASIA-PACIFIC LAB AUTOMATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 51 ASIA-PACIFIC LAB AUTOMATION MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 52 SOUTH AMERICA LAB AUTOMATION MARKET: SNAPSHOT (2021)

FIGURE 53 SOUTH AMERICA LAB AUTOMATION MARKET: BY COUNTRY (2021)

FIGURE 54 SOUTH AMERICA LAB AUTOMATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 55 SOUTH AMERICA LAB AUTOMATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 56 SOUTH AMERICA LAB AUTOMATION MARKET: PRODUCT TYPE (2022-2029)

FIGURE 57 MIDDLE EAST AND AFRICA LAB AUTOMATION MARKET: SNAPSHOT (2021)

FIGURE 58 MIDDLE EAST AND AFRICA LAB AUTOMATION MARKET: BY COUNTRY (2021)

FIGURE 59 MIDDLE EAST AND AFRICA LAB AUTOMATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 60 MIDDLE EAST AND AFRICA LAB AUTOMATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 61 MIDDLE EAST AND AFRICA LAB AUTOMATION MARKET: PRODUCT TYPE (2022-2029)

FIGURE 62 GLOBAL LAB AUTOMATION MARKET: COMPANY SHARE 2021 (%)

FIGURE 63 NORTH AMERICA LAB AUTOMATION MARKET: COMPANY SHARE 2021 (%)

FIGURE 64 EUROPE LAB AUTOMATION MARKET: COMPANY SHARE 2021 (%)

FIGURE 65 ASIA-PACIFIC LAB AUTOMATION MARKET: COMPANY SHARE 2021 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.