Global Goat Milk Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

10.74 Billion

USD

16.11 Billion

2024

2032

USD

10.74 Billion

USD

16.11 Billion

2024

2032

| 2025 –2032 | |

| USD 10.74 Billion | |

| USD 16.11 Billion | |

|

|

|

|

Mercado global de leite de cabra, por produto (leite integral, leite UHT semidesnatado e desnatado, leite semidesnatado e leite integral UHT), sabor (original/clássico e aromatizado), teor de gordura (regular, com baixo teor de gordura e sem gordura), tipo de embalagem (garrafa, embalagem tetrapack, sachê/bolsa, lata e outros), canal de distribuição (varejistas com sede em loja e varejistas sem loja), usuário final (doméstico/varejo e indústria de serviços alimentícios) - tendências do setor e previsão até 2032.

Tamanho do mercado de leite de cabra

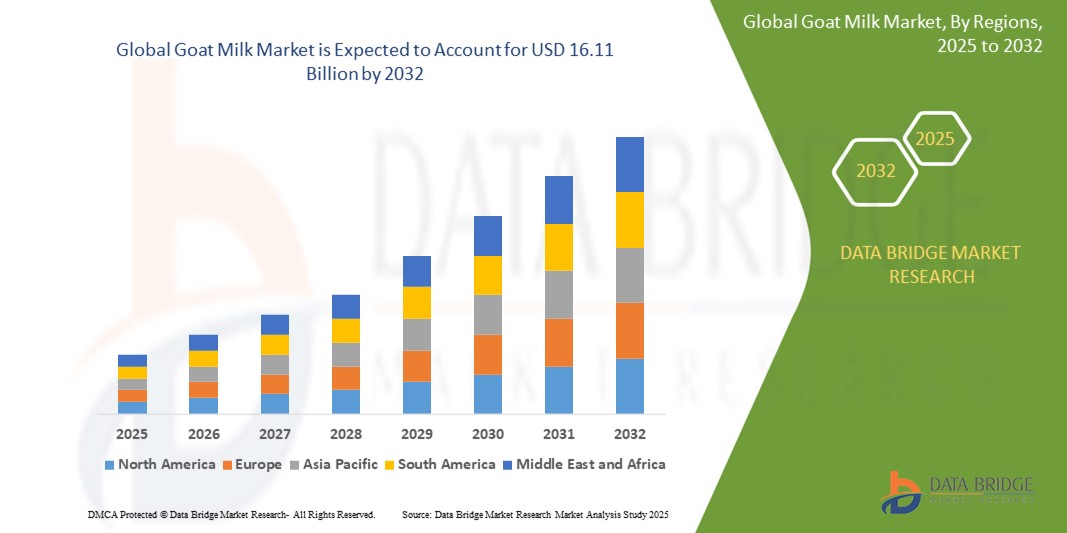

- O tamanho do mercado global de leite de cabra foi avaliado em US$ 10,74 bilhões em 2024 e deve atingir US$ 16,11 bilhões até 2032 , com um CAGR de 5,2% durante o período previsto.

- O crescimento do mercado é impulsionado principalmente pela crescente conscientização do consumidor sobre os benefícios à saúde associados ao leite de cabra, como maior digestibilidade e conteúdo nutricional em comparação ao leite de vaca, juntamente com a crescente demanda por produtos lácteos naturais e orgânicos.

- As crescentes preferências por alternativas lácteas sem lactose e hipoalergênicas, juntamente com a expansão das aplicações na indústria de serviços alimentícios, estão impulsionando ainda mais a adoção de produtos de leite de cabra, aumentando significativamente a expansão do mercado.

Análise do Mercado de Leite de Cabra

- O leite de cabra e seus derivados, como queijo, iogurte e leite em pó, estão ganhando popularidade como alternativas nutritivas e digeríveis aos laticínios tradicionais, especialmente para consumidores intolerantes à lactose e aqueles que buscam opções alimentares sustentáveis.

- A crescente demanda por leite de cabra é alimentada pela crescente conscientização sobre saúde, aumento da prevalência de intolerância à lactose e uma mudança em direção a produtos lácteos premium e especiais nos setores doméstico e de serviços alimentícios.

- A região Ásia-Pacífico dominou o mercado de leite de cabra com a maior participação na receita de 42,5% em 2024, impulsionada pela forte aceitação cultural dos produtos de leite de cabra, pela produção leiteira em larga escala e pela crescente demanda do consumidor por alternativas saudáveis aos laticínios, principalmente em países como China e Índia.

- Espera-se que a América do Norte seja a região de crescimento mais rápido durante o período previsto, devido à crescente conscientização sobre saúde, à crescente adoção de produtos orgânicos e naturais e à crescente demanda por fórmulas infantis à base de leite de cabra e alimentos especiais.

- O segmento de leite integral dominou a maior fatia de receita de mercado de 43,42% em 2024, impulsionado por seu alto valor nutricional e pela preferência generalizada do consumidor por produtos lácteos integrais não processados, especialmente no consumo doméstico.

Escopo do Relatório e Segmentação do Mercado de Leite de Cabra

|

Atributos |

Principais insights do mercado de leite de cabra |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

Europa

Ásia-Pacífico

Oriente Médio e África

Ámérica do Sul

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de leite de cabra

“Aumento da integração de inovações focadas na saúde e análises do consumidor”

- O mercado global de leite de cabra está vivenciando uma tendência notável de integração de inovações focadas na saúde e análises do consumidor para atender às preferências alimentares em evolução

- Esses avanços permitem que os fabricantes obtenham insights mais profundos sobre os padrões de compra do consumidor, as demandas nutricionais e as preferências do produto, facilitando o desenvolvimento de produtos de leite de cabra personalizados.

- Inovações voltadas para a saúde, como leite de cabra fortificado com probióticos, vitaminas ou minerais adicionados, atendem à crescente demanda por alimentos funcionais que auxiliam na digestão e na imunidade.

- Por exemplo, as empresas estão aproveitando a análise de dados do consumidor para criar variantes de leite de cabra com sabor, como chocolate ou misturas de frutas, visando grupos demográficos mais jovens e expandindo o alcance do mercado.

- Esta tendência aumenta o apelo dos produtos de leite de cabra, tornando-os mais atraentes para consumidores, famílias e indústrias de serviços alimentícios preocupados com a saúde.

- A análise pode avaliar os comportamentos do consumidor, como preferências por opções orgânicas ou com baixo teor de gordura, permitindo que os produtores otimizem as ofertas de produtos e as estratégias de marketing.

Dinâmica do Mercado de Leite de Cabra

Motorista

“Crescente demanda por alternativas lácteas ricas em nutrientes e favoráveis à lactose”

- A crescente demanda do consumidor por alternativas lácteas ricas em nutrientes e sem lactose, impulsionada pela crescente intolerância à lactose e pela conscientização sobre a saúde, é um fator-chave para o mercado global de leite de cabra

- Os produtos de leite de cabra, conhecidos por seu menor teor de lactose e fácil digestibilidade em comparação ao leite de vaca, oferecem características como perfis nutricionais aprimorados, incluindo altos níveis de cálcio, proteínas e vitaminas.

- Iniciativas governamentais em regiões como a Ásia-Pacífico, promovendo a diversificação dos laticínios e a saúde nutricional, estão contribuindo para a ampla adoção do leite de cabra

- A expansão do comércio eletrônico e os avanços na tecnologia de embalagens, como tetrapacks e garrafas, estão possibilitando ainda mais o crescimento do mercado, melhorando a acessibilidade e a vida útil dos produtos.

- Os fabricantes estão cada vez mais oferecendo produtos de leite de cabra, como leite integral, UHT semidesnatado e variantes com sabor, como opções padrão ou premium para atender às expectativas do consumidor e aumentar o valor do produto

Restrição/Desafio

“Altos custos de produção e limitações na cadeia de suprimentos”

- O alto custo da produção de leite de cabra, incluindo mão de obra, alimentação e processamento, representa uma barreira significativa à adoção pelo mercado, especialmente em mercados emergentes onde a sensibilidade aos custos é alta.

- Estabelecer cadeias de abastecimento eficientes para leite de cabra, especialmente para leite UHT semidesnatado e desnatado, pode ser complexo e dispendioso devido à escala de produção limitada em comparação com o leite de vaca.

- Além disso, preocupações com interrupções na cadeia de suprimentos e disponibilidade de produtos representam grandes desafios. O número limitado de fazendas leiteiras de cabras em larga escala, especialmente em regiões fora da Ásia-Pacífico, restringe o fornecimento consistente para atender à crescente demanda.

- As variações regulatórias entre países em relação às certificações orgânicas, padrões de qualidade e requisitos de rotulagem complicam ainda mais as operações dos produtores e distribuidores globais

- Esses fatores podem dissuadir potenciais compradores e limitar a expansão do mercado, especialmente em regiões como a América do Norte, onde o crescimento rápido é limitado por desafios de oferta e custo.

Âmbito do mercado de leite de cabra

O mercado é segmentado com base no produto, sabor, teor de gordura, tipo de embalagem, canal de distribuição e usuário final.

- Por produto

Com base no produto, o mercado global de leite de cabra é segmentado em leite integral, leite UHT semidesnatado e desnatado, leite semidesnatado e leite UHT integral. O segmento de leite integral dominou a maior fatia de mercado, com 43,42% da receita em 2024, impulsionado por seu alto valor nutricional e pela ampla preferência do consumidor por laticínios integrais e não processados, principalmente no consumo doméstico.

Espera-se que o segmento de leite UHT semidesnatado e desnatado apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado por sua maior vida útil, conveniência e alinhamento com tendências de saúde. Consumidores que buscam alternativas lácteas com menor teor de gordura e a adequação do processamento UHT para o comércio internacional impulsionam ainda mais a adoção.

- Por Sabor

Com base no sabor, o mercado global de leite de cabra é segmentado em original/clássico e aromatizado. O segmento original/clássico dominou o mercado, com uma participação de receita de 86,03% em 2024, devido ao seu sabor autêntico, ampla aceitação pelo consumidor e versatilidade em aplicações culinárias em todas as regiões.

Prevê-se que o segmento de produtos com sabor apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente demanda de consumidores mais jovens e por aqueles que buscam variedade. Sabores como chocolate, baunilha e misturas de frutas atraem crianças e consumidores não tradicionais de leite de cabra, apoiados por um marketing inovador e formatos prontos para beber.

- Por teor de gordura

Com base no teor de gordura, o mercado global de leite de cabra é segmentado em regular, com baixo teor de gordura e sem gordura. O segmento regular representou a maior fatia da receita de mercado, 50,63% em 2024, devido ao seu sabor rico e perfil nutricional, que atrai consumidores que priorizam produtos naturais e minimamente processados.

Espera-se que o segmento com baixo teor de gordura testemunhe um crescimento significativo entre 2025 e 2032, impulsionado pela crescente conscientização sobre saúde e pela demanda por opções de laticínios favoráveis ao controle de peso. O leite de cabra com baixo teor de gordura atende às preferências alimentares, reduzindo a ingestão calórica e mantendo os benefícios nutricionais.

- Por tipo de embalagem

Com base no tipo de embalagem, o mercado global de leite de cabra é segmentado em garrafas, embalagens tetrapack, sachês/bolsas, latas e outros. O segmento de garrafas deteve a maior fatia de mercado, com aproximadamente 40% de receita em 2024, devido à sua praticidade, reciclabilidade e ampla utilização nos setores de varejo e food service. Inovações em embalagens sustentáveis reforçam ainda mais sua posição dominante.

O segmento de embalagens tetrapack deverá apresentar a maior taxa de crescimento entre 2025 e 2032, impulsionado por seu design leve, maior prazo de validade e adequação a produtos UHT. A crescente demanda por embalagens portáteis e ecológicas em regiões urbanizadas impulsiona seu crescimento.

- Por canal de distribuição

Com base no canal de distribuição, o mercado global de leite de cabra é segmentado em varejistas com e sem lojas físicas. O segmento de varejistas com lojas físicas dominou o mercado, com uma participação de receita de aproximadamente 70% em 2024, impulsionado pela preferência do consumidor por compras em supermercados, hipermercados e lojas especializadas, que oferecem uma ampla gama de produtos à base de leite de cabra.

Espera-se que o segmento de varejo não lojista testemunhe um rápido crescimento entre 2025 e 2032, impulsionado pela crescente popularidade das plataformas de e-commerce e das compras de supermercado online. A conveniência da entrega em domicílio e a capacidade de alcançar consumidores em áreas remotas impulsionam a adoção, principalmente após a COVID-19.

- Por usuário final

Com base no consumidor final, o mercado global de leite de cabra é segmentado em domicílio/varejo e indústria de serviços alimentícios. O segmento de domicílio/varejo deteve a maior participação de mercado na receita, com 77,07% em 2024, impulsionado pela alta demanda do consumidor por leite de cabra como alternativa nutritiva ao leite de vaca, especialmente entre pessoas com intolerância à lactose e preocupadas com a saúde.

Prevê-se que o segmento de serviços alimentícios apresente um crescimento robusto entre 2025 e 2032, impulsionado pela crescente incorporação de produtos lácteos de cabra em cafés, restaurantes e padarias. A demanda por laticínios premium e especiais em aplicações culinárias aumenta sua adoção neste setor.

Análise regional do mercado de leite de cabra

- A região Ásia-Pacífico dominou o mercado de leite de cabra com a maior participação na receita de 42,5% em 2024, impulsionada pela forte aceitação cultural dos produtos de leite de cabra, pela produção leiteira em larga escala e pela crescente demanda do consumidor por alternativas saudáveis aos laticínios, principalmente em países como China e Índia.

- Os consumidores priorizam o leite de cabra por suas vantagens para a saúde, incluindo digestão mais fácil, menor alergenicidade em comparação ao leite de vaca e adequação para indivíduos intolerantes à lactose, especialmente em regiões com preferências alimentares diversas.

- O crescimento é apoiado por avanços nas tecnologias de processamento, como o processamento UHT (temperatura ultra-alta), e pela crescente adoção nos setores doméstico, varejista e de serviços alimentícios, com foco em variantes com sabor e baixo teor de gordura.

Visão geral do mercado de leite de cabra dos EUA

Espera-se que o mercado de leite de cabra nos EUA testemunhe um crescimento significativo, impulsionado pela crescente conscientização dos consumidores sobre os benefícios do leite de cabra para a saúde e pela crescente demanda por alternativas naturais e orgânicas aos laticínios. A tendência por produtos lácteos premium e especiais, aliada à crescente disponibilidade nos principais canais de varejo, impulsiona a expansão do mercado. A adoção do leite de cabra pelo setor de food service em cafés e restaurantes complementa as vendas no varejo, criando um ecossistema de mercado robusto.

Visão geral do mercado de leite de cabra na Europa

Espera-se que o mercado europeu de leite de cabra testemunhe um crescimento significativo, impulsionado pela crescente demanda por laticínios alternativos e pelo forte foco na agricultura sustentável. Os consumidores buscam o leite de cabra por seu perfil nutricional e por seu uso em produtos especiais, como queijos e iogurtes. O crescimento é expressivo tanto no varejo quanto no setor de serviços alimentícios, com países como França e Espanha apresentando uma adesão significativa devido às tradições culinárias e às tendências voltadas à saúde.

Visão geral do mercado de leite de cabra no Reino Unido

Espera-se que o mercado de leite de cabra do Reino Unido testemunhe um rápido crescimento, impulsionado pelo crescente interesse do consumidor por alternativas de laticínios com foco na saúde e escolhas alimentares sustentáveis. A crescente conscientização sobre os benefícios do leite de cabra para a intolerância à lactose e a saúde da pele incentiva a adoção. A evolução das tendências alimentares e a expansão dos produtos à base de leite de cabra em supermercados e plataformas online impulsionam ainda mais o crescimento do mercado.

Visão geral do mercado de leite de cabra na Alemanha

Espera-se que a Alemanha testemunhe um forte crescimento no mercado de leite de cabra, atribuído à sua avançada indústria de laticínios e ao grande foco do consumidor em saúde e bem-estar. Os consumidores alemães preferem produtos de leite de cabra com baixo teor de gordura e certificações orgânicas, que se alinham com as metas de sustentabilidade. A integração do leite de cabra em produtos lácteos premium e a crescente disponibilidade nos canais de varejo sustentam o crescimento sustentado do mercado.

Visão do mercado de leite de cabra na Ásia-Pacífico

A região Ásia-Pacífico domina o mercado global de leite de cabra, impulsionada pelo consumo e produção em larga escala em países como China, Índia e Paquistão. O aumento da renda disponível e a crescente conscientização sobre os benefícios do leite de cabra para a saúde, incluindo seu papel na nutrição infantil e na saúde digestiva, impulsionam a demanda. Iniciativas governamentais que promovem a diversificação de laticínios e a segurança nutricional incentivam ainda mais o uso de produtos derivados do leite de cabra.

Visão geral do mercado de leite de cabra no Japão

Espera-se que o mercado de leite de cabra no Japão testemunhe um crescimento significativo devido à forte preferência do consumidor por produtos lácteos de alta qualidade e com foco na saúde. A presença de grandes fabricantes de alimentos e bebidas e a integração do leite de cabra em alimentos e bebidas funcionais aceleram a penetração no mercado. O crescente interesse por produtos de leite de cabra premium e orgânico também contribui para o crescimento.

Visão geral do mercado de leite de cabra na China

A China detém a maior fatia do mercado de leite de cabra da Ásia-Pacífico, impulsionada pela rápida urbanização, pela crescente conscientização sobre saúde e pela crescente demanda por alternativas nutritivas ao leite. A crescente classe média do país e o foco em nutrição infantil e alimentos funcionais impulsionam a adoção do leite de cabra. A forte capacidade de produção nacional e os preços competitivos aumentam a acessibilidade ao mercado.

Participação no mercado de leite de cabra

A indústria do leite de cabra é liderada principalmente por empresas bem estabelecidas, incluindo:

- Ansnutria Dairy Corporation Ltd. (China)

- Grupo Emmi (Suíça)

- Cooperativa de Cabras Leiteiras (Nova Zelândia)

- Holle baby food AG (Suíça)

- Granarolo SpA (Itália)

- Bubs Australia Limited (Austrália)

- CapriLac (Austrália)

- Castle Dairy sa (Bélgica)

- DEFEEM SDN. BHD. (Malásia)

- Delamere Dairy (Reino Unido)

- Fazenda Leite Fresco Sdn. Bhd. (Malásia)

- Hay Dairies Pte Ltd. (Singapura)

- LACTALIS (França)

- Orient EuroPharma CO. Ltd. (Taiwan)

- UK Farm SDN BHD (Malásia)

Quais são os desenvolvimentos recentes no mercado global de leite de cabra?

- Em outubro de 2023, o ICAR – Instituto Central de Pesquisa em Caprinos (CIRG) e a Heifer India formalizaram uma parceria estratégica para transformar o cenário da caprinocultura indiana. Assinado em 6 de outubro no campus Makhdoom do CIRG em Mathura, o memorando de entendimento concentra-se em pesquisa pioneira, treinamento avançado e práticas sustentáveis para impulsionar pequenos produtores e fortalecer a cadeia de valor do leite de cabra. A colaboração visa aumentar a produtividade, aprimorar as práticas de criação e saúde e garantir a sustentabilidade a longo prazo por meio do empoderamento comunitário e da integração com o setor privado. Esta iniciativa apoia a crescente demanda por derivados do leite de cabra na Índia e no mundo.

- Em julho de 2023, a Ausnutria Dairy Corporation Ltd. anunciou que sua Fórmula Infantil à Base de Leite de Cabra Kabrita havia concluído com sucesso a revisão nutricional e de segurança da FDA dos EUA, tornando-se a primeira fórmula infantil europeia à base de leite de cabra a receber tal autorização. Este marco permite à Kabrita expandir sua presença no mercado americano, oferecendo uma alternativa à lactose e de fácil digestão às fórmulas à base de leite de vaca. Desenvolvido para bebês de 0 a 12 meses, a fórmula contém beta-caseína A2 e uma proporção de soro de leite/caseína semelhante à do leite materno, contribuindo para um crescimento saudável e conforto digestivo.

- Em junho de 2023, a Vilvah lançou sua Máscara Capilar de Leite de Cabra, um tratamento 3 em 1 de condicionamento profundo desenvolvido para nutrir, fortalecer e modelar os cabelos com leite de cabra e ceramidas de origem vegetal. Esta fórmula inovadora ajuda a reparar a barreira capilar, reduzir a quebra e reter a hidratação, tornando-a ideal para cabelos secos, danificados ou cacheados. Enriquecida com algas marinhas marrons e xilitilglicosídeo, a máscara realça o brilho, controla o frizz e contribui para a saúde do couro cabeludo. Pode ser usada como condicionador com enxágue, máscara leave-in ou creme modelador com proteção térmica, atendendo à crescente demanda por cuidados capilares naturais e sustentáveis.

- Em novembro de 2022, a Redwood Hill Farm & Creamery Inc. e a Jackson-Mitchell Inc. fundiram-se para formar a Darey Brands Inc., unindo dois pioneiros em laticínios especiais sob uma única marca. A nova entidade combina os iogurtes e kefirs de leite de cabra da Redwood Hill com o leite e a manteiga de cabra Meyenberg® da Jackson-Mitchell, criando um portfólio robusto de laticínios de cabra, vaca e vegetais. Apoiada pela controladora Emmi Group, a Darey Brands está posicionada para um crescimento acelerado em diversas categorias, com foco em laticínios sustentáveis e saudáveis, que atendam às preferências em constante evolução dos consumidores.

- Em junho de 2022, a Canada Royal Milk (CRM) firmou uma parceria estratégica com a Ontario Goat Dairy Cooperative (ODGC) e a Producteurs de lait de chèvre du Québec (PLCQ), garantindo acesso a leite de cabra de mais de 120 fazendas em Ontário e Quebec. Essa colaboração permite que a CRM forneça consistentemente leite de cabra de alta qualidade para sua unidade em Kingston, Ontário, apoiando a produção de produtos lácteos em pó, incluindo fórmulas infantis. A iniciativa marca um passo significativo na expansão da CRM no mercado norte-americano de laticínios de cabra, oferecendo maior estabilidade aos produtores e abrindo novos caminhos para inovação e exportação.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL GOAT MILK MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET END USER COVERAGE GRID

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PROMOTIONAL ACTIVITIES

4.2 FACTORS INFLUENCING PURCHASING DECISION OF CUSTOMER

5 REGULATION COVERAGE

5.1 REGULATORY MONITORING AND ADAPTATION

5.2 THIRD-PARTY TESTING AND CERTIFICATION

5.3 SUSTAINABILITY INITIATIVES

5.4 DOCUMENTATION AND TRANSPARENCY

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PREVALENCE OF LACTOSE INTOLERANCE

6.1.2 ADVANCEMENT IN GOAT MILK-BASED INFANT FORMULA

6.1.3 SURGE IN DEMAND FOR GOAT MILK

6.1.4 ADVANTAGES OF GOAT MILK OVER COW MILK

6.2 RESTRAINTS

6.2.1 HIGH PRODUCTION COSTS OF GOAT MILK

6.2.2 STRICT REGULATORY REQUIREMENTS FOR PRODUCTION, PROCESSING, AND MARKETING

6.3 OPPORTUNITIES

6.3.1 HIGH PREVALENCE OF LIFESTYLE DISORDERS

6.3.2 INCREASING AVAILABILITY OF DIVERSIFIED GOAT MILK PRODUCTS

6.3.3 RISKS ASSOCIATED WITH THE CONSUMPTION OF COW MILK

6.4 CHALLENGES

6.4.1 LIMITED SUPPLY IN THE MARKET

6.4.2 INCREASING COMPETITION FROM PLANT BASED ALTERNATIVES

7 GLOBAL GOAT MILK MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 WHOLE MILK

7.3 UHT SEMI SKIMMED & SKIMMED MILK

7.4 SEMI SKIMMED MILK

7.5 UHT WHOLE MILK

8 GLOBAL GOAT MILK MARKET, BY PACKAGING TYPE

8.1 OVERVIEW

8.2 BOTTLE

8.2.1 PLASTIC

8.2.2 GLASS

8.3 TETRA PAK

8.4 SACHET/POUCH

8.5 TIN

8.6 OTHERS

9 GLOBAL GOAT MILK MARKET, BY FLAVOUR

9.1 OVERVIEW

9.2 ORIGINAL/CLASSIC

9.3 FLAVOURED

9.3.1 CHOCOLATE

9.3.2 OTHERS

10 GLOBAL GOAT MILK MARKET, BY FAT CONTENT

10.1 OVERVIEW

10.2 REGULAR

10.3 LOW FAT

10.4 FAT FREE

11 GLOBAL GOAT MILK MARKET, BY END USER

11.1 OVERVIEW

11.2 HOUSEHOLD/RETAIL

11.3 FOOD SERVICE INDUSTRY

12 GLOBAL GOAT MILK MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 STORE BASED RETAILERS

12.2.1 SUPERMARKETS/HYPERMARKETS

12.2.2 CONVENIENCE STORES

12.2.3 GROCERY RETAILERS

12.2.4 OTHERS

12.3 NON-STORE RETAILERS

12.3.1 ONLINE RETAILERS

12.3.2 COMPANY WEBSITES

13 GLOBAL GOAT MILK MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 MEXICO

13.1.2 U.S.

13.1.3 CANADA

13.2 EUROPE

13.2.1 FRANCE

13.2.2 SPAIN

13.2.3 NETHERLANDS

13.2.4 ITALY

13.2.5 GERMANY

13.2.6 BELGIUM

13.2.7 SWITZERLAND

13.2.8 U.K.

13.2.9 RUSSIA

13.2.10 TURKEY

13.2.11 REST OF EUROPE

13.3 ASIA-PACIFIC

13.3.1 INDIA

13.3.2 CHINA

13.3.3 INDONESIA

13.3.4 AUSTRALIA

13.3.5 MALAYSIA

13.3.6 THAILAND

13.3.7 PHILIPPINES

13.3.8 SINGAPORE

13.3.9 SOUTH KOREA

13.3.10 JAPAN

13.3.11 REST OF ASIA-PACIFIC

13.4 MIDDLE EAST AND AFRICA

13.4.1 SOUTH AFRICA

13.4.2 SAUDI ARABIA

13.4.3 U.A.E

13.4.4 KUWAIT

13.4.5 REST OF MIDDLE EAST AFRICA

13.5 SOUTH AMERICA

13.5.1 BRAZIL

13.5.2 ARGENTINA

13.5.3 REST OF SOUTH AMERICA

14 GLOBAL GOAT MILK MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 AUSNUTRIA DAIRY CORPORATION LTD.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 EMMI GROUP

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 DAIRY GOAT CO-OPERATIVE (N.Z.) LTD

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 HOLLE BABY FOOD AG

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 GRANAROLO S.P.A

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 BUBS AUSTRALIA LIMITED.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 CAPRILAC

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 CASTLE DAIRY S.A.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 DEFEEM SDN. BHD.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 DELAMERE DAIRY

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 FARM FRESH MILK SDN. BHD.

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 GOOD GOAT MILK CO.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 HAY DAIRIES PTE LTD.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 LACTALIS

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 ORIENT EUROPHARMA CO., LTD.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 UK FARM SDN BHD

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tabela

TABLE 1 REGULATIONS ACROSS VARIOUS REGIONS AND COUNTRIES

TABLE 2 GLOBAL GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 3 GLOBAL WHOLE MILK IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 4 GLOBAL UHT SEMI SKIMMED & SKIMMED MILK IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 5 GLOBAL SEMI SKIMMED MILK IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 6 GLOBAL UHT WHOLE MILK IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION

TABLE 7 GLOBAL GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 8 GLOBAL BOTTLE IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 9 GLOBAL BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 10 GLOBAL TETRA PAK IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 11 GLOBAL SACHET/POUCH IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 12 GLOBAL TIN IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 13 GLOBAL OTHERS IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 14 GLOBAL GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 15 GLOBAL ORIGINAL/CLASSIC IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 16 GLOBAL FLAVOURED IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 17 GLOBAL FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 18 GLOBAL GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 19 GLOBAL REGULAR IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 20 GLOBAL LOW FAT IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 21 GLOBAL FAT FREE IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 22 GLOBAL GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 23 GLOBAL HOUSEHOLD/RETAIL IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 24 GLOBAL FOOD SERVICE INDUSTRY IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 25 GLOBAL GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 26 GLOBAL STORE BASED RETAILERS IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 27 GLOBAL STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 28 GLOBAL NON-STORE RETAILERS IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 29 GLOBAL NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 30 GLOBAL GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 31 NORTH AMERICA GOAT MILK MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 32 NORTH AMERICA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 33 NORTH AMERICA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 34 NORTH AMERICA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 35 NORTH AMERICA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 36 NORTH AMERICA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 37 NORTH AMERICA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 38 NORTH AMERICA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 39 NORTH AMERICA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 40 NORTH AMERICA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 41 NORTH AMERICA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 42 MEXICO GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 43 MEXICO GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 44 MEXICO FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 45 MEXICO GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 46 MEXICO GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 47 MEXICO BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 48 MEXICO GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 49 MEXICO STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 50 MEXICO NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 51 MEXICO GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 52 U.S. GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 53 U.S. GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 54 U.S. FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 55 U.S. GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 56 U.S. GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 57 U.S. BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 58 U.S. GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 59 U.S. STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 60 U.S. NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 61 U.S. GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 62 CANADA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 63 CANADA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 64 CANADA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 65 CANADA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 66 CANADA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 67 CANADA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 68 CANADA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 69 CANADA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 70 CANADA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 71 CANADA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 72 EUROPE GOAT MILK MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 73 EUROPE GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 74 EUROPE GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 75 EUROPE FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 76 EUROPE GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 77 EUROPE GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 78 EUROPE BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 79 EUROPE GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 80 EUROPE STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 81 EUROPE NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 82 EUROPE GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 83 FRANCE GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 84 FRANCE GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 85 FRANCE FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 86 FRANCE GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 87 FRANCE GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 88 FRANCE BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 89 FRANCE GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 90 FRANCE STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 91 FRANCE NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 92 FRANCE GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 93 SPAIN GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 94 SPAIN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 95 SPAIN FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 96 SPAIN GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 97 SPAIN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 98 SPAIN BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 99 SPAIN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 100 SPAIN STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 101 SPAIN NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 102 SPAIN GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 103 NETHERLANDS GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 104 NETHERLANDS GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 105 NETHERLANDS FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 106 NETHERLANDS GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 107 NETHERLANDS GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 108 NETHERLANDS BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 109 NETHERLANDS GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 110 NETHERLANDS STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 111 NETHERLANDS NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 112 NETHERLANDS GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 113 ITALY GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 114 ITALY GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 115 ITALY FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 116 ITALY GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 117 ITALY GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 118 ITALY BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 119 ITALY GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 120 ITALY STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 121 ITALY NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 122 ITALY GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 123 GERMANY GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 124 GERMANY GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 125 GERMANY FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 126 GERMANY GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 127 GERMANY GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 128 GERMANY BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 129 GERMANY GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 130 GERMANY STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 131 GERMANY NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 132 GERMANY GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 133 BELGIUM GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 134 BELGIUM GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 135 BELGIUM FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 136 BELGIUM GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 137 BELGIUM GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 138 BELGIUM BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 139 BELGIUM GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 140 BELGIUM STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 141 BELGIUM NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 142 BELGIUM GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 143 SWITZERLAND GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 144 SWITZERLAND GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 145 SWITZERLAND FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 146 SWITZERLAND GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 147 SWITZERLAND GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 148 SWITZERLAND BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 149 SWITZERLAND GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 150 SWITZERLAND STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 151 SWITZERLAND NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 152 SWITZERLAND GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 153 U.K. GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 154 U.K. GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 155 U.K. FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 156 U.K. GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 157 U.K. GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 158 U.K. BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 159 U.K. GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 160 U.K. STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 161 U.K. NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 162 U.K. GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 163 RUSSIA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 164 RUSSIA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 165 RUSSIA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 166 RUSSIA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 167 RUSSIA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 168 RUSSIA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 169 RUSSIA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 170 RUSSIA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 171 RUSSIA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 172 RUSSIA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 173 TURKEY GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 174 TURKEY GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 175 TURKEY FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 176 TURKEY GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 177 TURKEY GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 178 TURKEY BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 179 TURKEY GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 180 TURKEY STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 181 TURKEY NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 182 TURKEY GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 183 REST OF EUROPE GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 184 ASIA-PACIFIC GOAT MILK MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 185 ASIA-PACIFIC GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 186 ASIA-PACIFIC GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 187 ASIA-PACIFIC FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 188 ASIA-PACIFIC GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 189 ASIA-PACIFIC GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 190 ASIA-PACIFIC BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 191 ASIA-PACIFIC GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 192 ASIA-PACIFIC STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 193 ASIA-PACIFIC NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 194 ASIA-PACIFIC GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 195 INDIA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 196 INDIA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 197 INDIA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 198 INDIA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 199 INDIA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 200 INDIA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 201 INDIA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 202 INDIA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 203 INDIA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 204 INDIA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 205 CHINA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 206 CHINA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 207 CHINA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 208 CHINA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 209 CHINA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 210 CHINA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 211 CHINA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 212 CHINA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 213 CHINA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 214 CHINA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 215 INDONESIA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 216 INDONESIA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 217 INDONESIA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 218 INDONESIA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 219 INDONESIA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 220 INDONESIA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 221 INDONESIA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 222 INDONESIA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 223 INDONESIA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 224 INDONESIA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 225 AUSTRALIA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 226 AUSTRALIA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 227 AUSTRALIA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 228 AUSTRALIA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 229 AUSTRALIA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 230 AUSTRALIA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 231 AUSTRALIA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 232 AUSTRALIA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 233 AUSTRALIA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 234 AUSTRALIA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 235 MALAYSIA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 236 MALAYSIA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 237 MALAYSIA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 238 MALAYSIA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 239 MALAYSIA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 240 MALAYSIA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 241 MALAYSIA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 242 MALAYSIA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 243 MALAYSIA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 244 MALAYSIA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 245 THAILAND GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 246 THAILAND GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 247 THAILAND FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 248 THAILAND GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 249 THAILAND GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 250 THAILAND BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 251 THAILAND GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 252 THAILAND STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 253 THAILAND NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 254 THAILAND GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 255 PHILIPPINES GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 256 PHILIPPINES GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 257 PHILIPPINES FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 258 PHILIPPINES GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 259 PHILIPPINES GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 260 PHILIPPINES BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 261 PHILIPPINES GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 262 PHILIPPINES STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 263 PHILIPPINES NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 264 PHILIPPINES GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 265 SINGAPORE GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 266 SINGAPORE GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 267 SINGAPORE FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 268 SINGAPORE GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 269 SINGAPORE GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 270 SINGAPORE BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 271 SINGAPORE GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 272 SINGAPORE STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 273 SINGAPORE NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 274 SINGAPORE GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 275 SOUTH KOREA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 276 SOUTH KOREA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 277 SOUTH KOREA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 278 SOUTH KOREA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 279 SOUTH KOREA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 280 SOUTH KOREA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 281 SOUTH KOREA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 282 SOUTH KOREA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 283 SOUTH KOREA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 284 SOUTH KOREA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 285 JAPAN GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 286 JAPAN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 287 JAPAN FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 288 JAPAN GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 289 JAPAN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 290 JAPAN BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 291 JAPAN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 292 JAPAN STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 293 JAPAN NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 294 JAPAN GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 295 REST OF ASIA-PACIFIC GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 296 MIDDLE EAST AND AFRICA GOAT MILK MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 297 MIDDLE EAST AND AFRICA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 298 MIDDLE EAST AND AFRICA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 299 MIDDLE EAST AND AFRICA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 300 MIDDLE EAST AND AFRICA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 301 MIDDLE EAST AND AFRICA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 302 MIDDLE EAST AND AFRICA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 303 MIDDLE EAST AND AFRICA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 304 MIDDLE EAST AND AFRICA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 305 MIDDLE EAST AND AFRICA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 306 MIDDLE EAST AND AFRICA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 307 SOUTH AFRICA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 308 SOUTH AFRICA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 309 SOUTH AFRICA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 310 SOUTH AFRICA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 311 SOUTH AFRICA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 312 SOUTH AFRICA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 313 SOUTH AFRICA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 314 SOUTH AFRICA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 315 SOUTH AFRICA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 316 SOUTH AFRICA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 317 SAUDI ARABIA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 318 SAUDI ARABIA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 319 SAUDI ARABIA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 320 SAUDI ARABIA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 321 SAUDI ARABIA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 322 SAUDI ARABIA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 323 SAUDI ARABIA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 324 SAUDI ARABIA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 325 SAUDI ARABIA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 326 SAUDI ARABIA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 327 U.A.E GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 328 U.A.E GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 329 U.A.E FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 330 U.A.E GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 331 U.A.E GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 332 U.A.E BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 333 U.A.E GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 334 U.A.E STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 335 U.A.E NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 336 U.A.E GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 337 KUWAIT GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 338 KUWAIT GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 339 KUWAIT FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 340 KUWAIT GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 341 KUWAIT GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 342 KUWAIT BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 343 KUWAIT GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 344 KUWAIT STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 345 KUWAIT NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 346 KUWAIT GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 347 REST OF MIDDLE EAST AFRICA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 348 SOUTH AMERICA GOAT MILK MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 349 SOUTH AMERICA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 350 SOUTH AMERICA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 351 SOUTH AMERICA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 352 SOUTH AMERICA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 353 SOUTH AMERICA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 354 SOUTH AMERICA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 355 SOUTH AMERICA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 356 SOUTH AMERICA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 357 SOUTH AMERICA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 358 SOUTH AMERICA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 359 BRAZIL GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 360 BRAZIL GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 361 BRAZIL FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 362 BRAZIL GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 363 BRAZIL GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 364 BRAZIL BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 365 BRAZIL GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 366 BRAZIL STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 367 BRAZIL NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 368 BRAZIL GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 369 ARGENTINA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 370 ARGENTINA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 371 ARGENTINA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 372 ARGENTINA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 373 ARGENTINA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 374 ARGENTINA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 375 ARGENTINA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 376 ARGENTINA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 377 ARGENTINA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 378 ARGENTINA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 379 REST OF SOUTH AMERICA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

Lista de Figura

FIGURE 1 GLOBAL GOAT MILK MARKET: SEGMENTATION

FIGURE 2 GLOBAL GOAT MILK MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL GOAT MILK MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL GOAT MILK MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL GOAT MILK MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL GOAT MILK MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL GOAT MILK MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 GLOBAL GOAT MILK MARKET: DBMR MARKET POSITION GRID

FIGURE 9 GLOBAL GOAT MILK MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 GLOBAL GOAT MILK MARKET: SEGMENTATION

FIGURE 11 TWO SEGMENTS COMPRISE GLOBAL GOAT MILK MARKET

FIGURE 12 GLOBAL GOAT MILK MARKET EXECUTIVE SUMMARY

FIGURE 13 GLOBAL GOAT MILK MARKET STRATEGIC DECISIONS

FIGURE 14 INCREASING PREVALENCE OF LACTOSE INTOLERANCE IS DRIVING THE GROWTH OF THE GLOBAL GOAT MILK MARKET FROM 2024 TO 2031

FIGURE 15 THE PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL GOAT MILK MARKET IN 2024 AND 2031

FIGURE 16 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE GLOBAL GOAT MILK MARKET AND EUROPE IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 17 EUROPE IS THE FASTEST-GROWING REGION FOR GOAT MILK MARKET MANUFACTURERS IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 18 DROC ANALYSIS

FIGURE 19 GLOBAL GOAT MILK MARKET: BY PRODUCT, 2023

FIGURE 20 GLOBAL GOAT MILK MARKET: BY PACKAGING TYPE, 2023

FIGURE 21 GLOBAL GOAT MILK MARKET: BY FLAVOUR, 2023

FIGURE 22 GLOBAL GOAT MILK MARKET: BY FAT CONTENT, 2023

FIGURE 23 GLOBAL GOAT MILK MARKET: BY END USER, 2023

FIGURE 24 GLOBAL GOAT MILK MARKET: BY DISTRIBUTION CHANNEL, 2023

FIGURE 25 GLOBAL GOAT MILK MARKET: SNAPSHOT (2023)

FIGURE 26 GLOBAL GOAT MILK MARKET: COMPANY SHARE 2023 (%)

FIGURE 27 NORTH AMERICA GOAT MILK MARKET: COMPANY SHARE 2023 (%)

FIGURE 28 EUROPE GOAT MILK MARKET: COMPANY SHARE 2023 (%)

FIGURE 29 ASIA-PACIFIC GOAT MILK MARKET: COMPANY SHARE 2023 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.