Global Exploration And Production Software Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

8.82 Billion

USD

23.78 Billion

2024

2032

USD

8.82 Billion

USD

23.78 Billion

2024

2032

| 2025 –2032 | |

| USD 8.82 Billion | |

| USD 23.78 Billion | |

|

|

|

|

Global Exploration and Production Software Market Segmentation, By Deployment Type (On-Premise Software and Cloud-Based Software), Operation Type (On-Shore and Off-Shore), Software Type (Risk Management Mapping, Seismic Amplitude Analysis, Portfolio Aggregation, Performance Tracking, Navigation System, Resource Valuation, Reservoir Characterization, Reservoir Simulation, Drilling, and Production) – Industry Trends and Forecast to 2032

Exploration and Production Software Market Analysis

The exploration and production (E&P) software market is witnessing significant growth, driven by advancements in technology and increasing digitalization across the oil and gas industry. E&P software solutions facilitate efficient exploration, reservoir management, and production processes by leveraging advanced tools such as seismic analysis, reservoir simulation, and real-time data monitoring. These technologies enable companies to optimize resource utilization, reduce operational risks, and enhance decision-making capabilities. The market's expansion is supported by the growing demand for hydrocarbons and the rising exploration of unconventional resources such as shale gas and tight oil. With increasing global energy demands, companies are investing heavily in advanced software to improve operational efficiency and streamline workflows. Technological innovations, such as artificial intelligence (AI), machine learning (ML), and cloud-based solutions, are transforming the industry by offering predictive analytics, enhanced data integration, and cost-effective scalability. Regions such as North America and the Middle East dominate the market, owing to robust oil and gas activities and early adoption of digital technologies. As environmental concerns rise, E&P software also plays a critical role in minimizing environmental impact through improved resource management and reduced exploration waste.

Exploration and Production Software Market Size

The global exploration and production software market size was valued at USD 8.82 billion in 2024 and is projected to reach USD 23.78 billion by 2032, with a CAGR of 13.20% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Exploration and Production Software Market Trends

“Increasing Adoption of Artificial Intelligence (AI) and Machine Learning (ML)”

One notable trend in the exploration and production (E&P) software market is the increasing adoption of artificial intelligence (AI) and machine learning (ML) technologies to optimize operations and decision-making. These advanced tools analyze vast amounts of seismic, geological, and operational data to provide actionable insights, enhancing reservoir characterization, drilling accuracy, and production efficiency. For instance, SLB (formerly Schlumberger) has integrated AI-driven analytics into its software to predict drilling outcomes and minimize risks in complex environments. In addition, AI-powered algorithms enable real-time monitoring and predictive maintenance, reducing equipment downtime and operational costs. This trend aligns with the industry’s focus on digital transformation, driven by the need for efficient resource utilization amid growing energy demands and volatile market conditions. By improving accuracy and streamlining processes, AI and ML are revolutionizing E&P workflows, making them indispensable in the quest for sustainable and cost-effective hydrocarbon production.

Report Scope and Exploration and Production Software Market Segmentation

|

Attributes |

Exploration and Production Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

SLB (U.S.), Getech Group plc (U.K.), Halliburton (U.S.), Baker Hughes Company (U.S.), S&P Global (U.S.), Emerson Electric Co (U.S.), Computer Modelling Group Ltd (Canada), KONGSBERG (Norway), General Electric Company (U.S.), Pason Systems Corp (Canada), Aspen Technology Inc (U.S.), ETL SOLUTIONS (U.K.), Ikon Science (U.K.), GEPlan (Italy), Interactive Network Technologies, Inc. (U.S.), Peloton (Canada), PE Limited (U.K.), Rock Flow Dynamics (U.S.), Petrolink (U.K.), eDrilling (Norway), TDE Group Limited (Austria), and Etech International (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Exploration and Production Software Market Definition

Exploration and Production (E&P) software refers to specialized digital tools and applications designed to support the oil and gas industry in the exploration, development, and extraction of hydrocarbons. These software solutions assist in a wide range of activities, including seismic data interpretation, reservoir modeling, drilling optimization, production monitoring, and risk management.

Exploration and Production Software Market Dynamics

Drivers

- Growing Investment in the Oil and Gas Sector

Growing investment in the oil and gas sector is a significant driver for the exploration and production (E&P) software market, as companies seek to maximize the efficiency and profitability of their operations. As oil prices rise and energy demand increases globally, more capital is being directed toward exploration and production projects, particularly in challenging environments such as deepwater and unconventional resource extraction. For instance, in recent years, major players such as ExxonMobil and Shell have significantly increased their investments in digital technologies, including E&P software, to improve subsurface mapping, optimize well placement, and reduce operational risks. These investments aim to boost production and enhance cost-efficiency through data-driven decision-making and real-time monitoring. As more companies prioritize digital transformation to stay competitive, the demand for advanced E&P software solutions continues to grow, making investment in the oil and gas sector a key driver of market expansion.

- Increasing Exploration of Unconventional Gas Resources

The increasing exploration of unconventional gas resources, such as shale gas, tight gas, and coalbed methane, is a major driver for the exploration and production (E&P) software market. These unconventional resources often require advanced technologies and sophisticated techniques for accurate subsurface characterization and efficient extraction. As exploration moves into more complex and challenging geological formations, E&P software solutions play a crucial role in optimizing drilling processes, managing reservoir performance, and reducing operational risks. For instance, companies such as Chevron and BP are leveraging advanced E&P software to navigate the complexities of shale gas drilling, enhancing real-time data analysis and predictive modeling to improve well productivity. As demand for natural gas increases, driven by its cleaner energy profile compared to coal, the exploration of these unconventional resources accelerates, further driving the need for innovative E&P software solutions to support efficient and sustainable gas production.

Opportunities

- Increasing Digitalization in the Oil, Gas, and Energy Sectors

Increasing digitalization in the oil, gas, and energy sectors presents a significant market opportunity for the exploration and production (E&P) software market. As companies in these industries adopt digital technologies such as artificial intelligence (AI), machine learning (ML), big data analytics, and the Internet of Things (IoT), there is a growing demand for software that can efficiently manage and analyze large volumes of data in real-time. For instance, companies such as Schlumberger and Halliburton are integrating AI and machine learning into their E&P software solutions to enhance decision-making, improve drilling accuracy, and optimize reservoir management. This shift towards digitalization improves operational efficiency and reduces costs and supports the transition toward more sustainable energy production. The increasing need for automated systems, predictive maintenance, and real-time monitoring creates a strong demand for innovative E&P software, positioning digitalization as a key driver of market growth and an opportunity for companies offering advanced software solutions.

- Growing Number of Initiatives by Governments

The growing number of initiatives by governments to support the oil and gas industry’s digital transformation and ensure energy security is creating a significant market opportunity for the exploration and production (E&P) software market. Governments are increasingly recognizing the need to modernize energy infrastructure, enhance resource management, and reduce environmental impacts through digital technologies. For instance, the U.S. Department of Energy has been funding projects that focus on the integration of AI and big data in energy exploration and production, providing a boost to E&P software adoption. Similarly, the European Union’s push for a green transition encourages the oil and gas sector to adopt innovative solutions for better efficiency and environmental compliance. These government initiatives, coupled with regulatory incentives, create a favorable environment for the adoption of advanced E&P software solutions that enhance production optimization, improve resource management, and ensure sustainability in the sector.

Restraints/Challenges

- High Implementation Costs

High implementation costs are a significant challenge in the exploration and production (E&P) software market, as these solutions often involve substantial upfront investments. The costs include the purchase of licenses and the need for specialized hardware and the integration of the software with existing legacy systems. For instance, when oil and gas companies adopt advanced E&P software such as Schlumberger’s Petrel or Halliburton’s Landmark, the expenses go beyond the software itself, with additional costs for training staff to operate the new system, customizing the software to fit specific needs, and possibly upgrading infrastructure. These complexities can be prohibitively expensive, especially for smaller companies or those operating in emerging markets with limited budgets. Such high costs can make it difficult for these organizations to justify the investment, leading them to either delay adoption or continue relying on outdated, less efficient systems. Consequently, the market faces slower growth as smaller players, who might benefit from these technologies, struggle to compete with larger firms that can more easily absorb these expenses.

- Cybersecurity Risks

Cybersecurity risks are a major challenge in the exploration and production (E&P) software market, as these solutions become increasingly interconnected with other systems, both internally and externally. The integration of E&P software with other enterprise tools, cloud platforms, and real-time data systems increases the potential for cyber-attacks, making sensitive data such as geological surveys, exploration insights, and production metrics more vulnerable. For instance, a cyber-attack on an E&P company’s software could compromise critical data, leading to financial losses and operational disruptions, potentially delaying exploration projects and production activities. In 2020, a cyberattack on a major oil company highlighted the potential dangers, where hackers gained access to sensitive operational data, leading to major security and financial concerns. As a result, the demand for robust security protocols, encryption methods, and frequent software updates has become a key factor in the adoption and continued use of these systems. However, the need for continuous cybersecurity monitoring and the cost of implementing such measures add another layer of complexity, making it more challenging for companies especially those with limited resources to adopt E&P software solutions. This cybersecurity challenge, if left unaddressed, can inhibit the growth and adoption of E&P software, particularly in an industry already facing significant operational and financial pressures.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Exploration and Production Software Market Scope

The market is segmented on the basis of deployment type, operation type, and software type. The growth amongst these segments will help you analyse meagre growth segments in the industries, and provide the users. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Deployment Type

- On-Premise Software

- Cloud-Based Software

Operation Type

- On-Shore

- Off-Shore

Software Type

- Risk Management Mapping

- Seismic Amplitude Analysis

- Portfolio Aggregation

- Performance Tracking

- Navigation System

- Resource Valuation

- Reservoir Characterization

- Reservoir Simulation

- Drilling

- Production

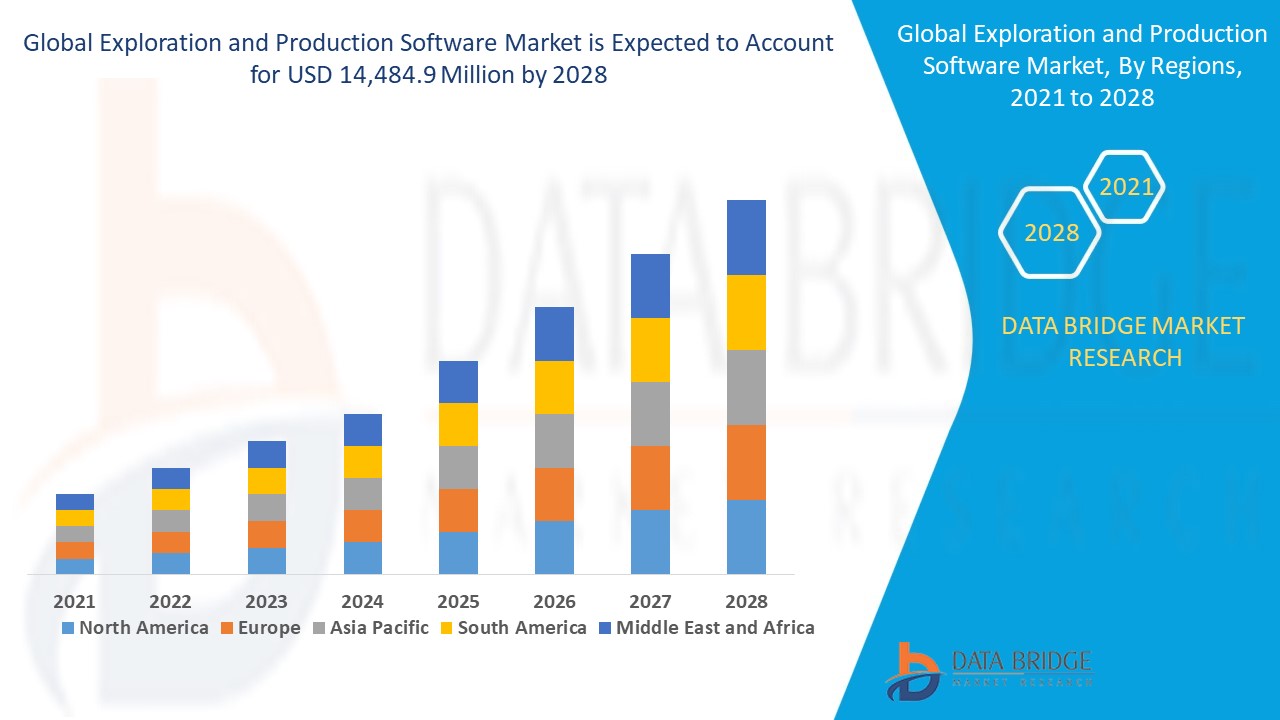

Exploration and Production Software Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, deployment type, operation type, and software type. The growth amongst these segments will help you analyse meagre growth segments in the industries, and provide the users as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America is dominating the exploration and production (E&P) software market, driven by several key factors. The region's growing demand for liquid hydrocarbons and significant investments in the oil and gas sector are bolstered by the increasing exploration of unconventional gas resources. In addition, the rapid digitalization of the oil, gas, and energy industries, combined with technological advancements in E&P processes, has spurred widespread adoption of E&P software. This extensive use of advanced software solutions enhances operational efficiency and decision-making, cementing North America’s leadership in this market.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Exploration and Production Software Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Exploration and Production Software Market Leaders Operating in the Market Are:

- SLB (U.S.)

- Getech Group plc (U.K.)

- Halliburton (U.S.)

- Baker Hughes Company (U.S.)

- S&P Global (U.S.)

- Emerson Electric Co (U.S.)

- Computer Modelling Group Ltd (Canada)

- KONGSBERG (Norway)

- General Electric Company (U.S.)

- Pason Systems Corp (Canada)

- Aspen Technology Inc (U.S.)

- ETL SOLUTIONS (U.K.)

- Ikon Science (U.K.)

- GEPlan (Italy)

- Interactive Network Technologies, Inc. (U.S.)

- Peloton (Canada)

- PE Limited (U.K.)

- Rock Flow Dynamics (U.S.)

- Petrolink (U.K.)

- eDrilling (Norway)

- TDE Group Limited (Austria)

- Etech International (U.S.)

Latest Developments in Exploration and Production Software Market

- In November 2023, DUG revolutionized the energy sector by introducing seismic services, advanced software, and high-performance computing technologies. These innovations reduce project turnaround times, minimize subsurface characterization risks, and enhance decision-making processes in well placement, reservoir management, and exploration

- In June 2023, Halliburton Company launched the EarthStar X near-bit resistivity service, featuring an advanced mapping sensor. This technology detects geological changes in real time, allowing rapid trajectory adjustments to maximize asset value

- In May 2023, KONGSBERG and TGS announced a partnership to develop integrated data solutions tailored for the offshore wind industry, focusing on improving operational efficiency and promoting sustainability

- In May 2023, Halliburton adopted the Landmark DecisionSpace Geosciences software suite as its standard geoscience toolkit and selected OpenWorks as its corporate database for subsurface data interpretation

- In February 2023, Schlumberger completed the acquisition of Gyrodata, a leader in wellbore positioning technology, integrating its solutions into SLB’s Well Construction business to enhance innovative drilling capabilities

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.