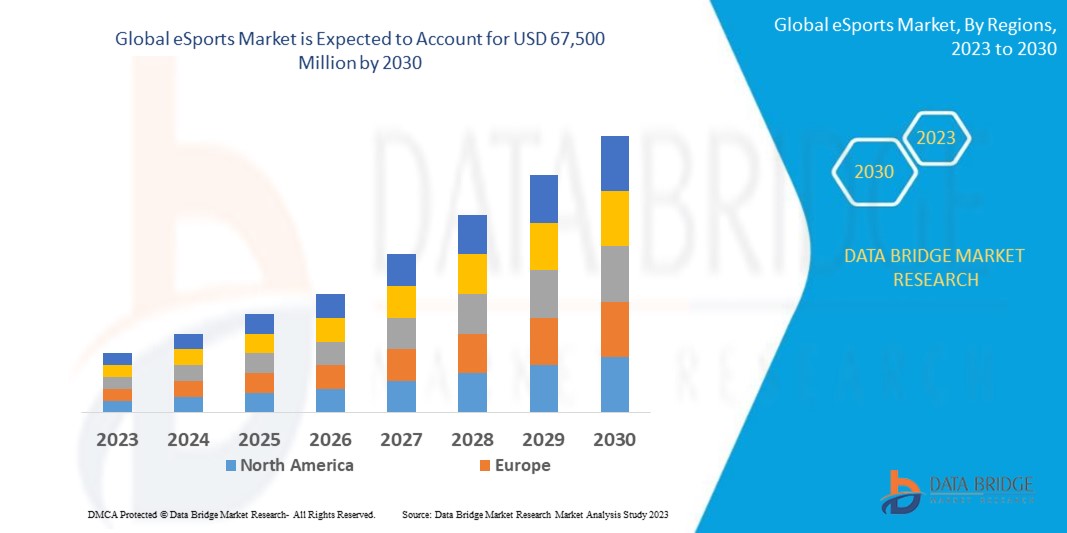

Global Esports Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

11,450.00 Million

USD

67,500.00 Million

2022

2030

USD

11,450.00 Million

USD

67,500.00 Million

2022

2030

| 2023 –2030 | |

| USD 11,450.00 Million | |

| USD 67,500.00 Million | |

|

|

|

|

Mercado global de eSports, por fontes de receita (patrocínios e anúncios diretos, direitos de media, taxas de editoras, bilhetes e merchandise, digital e streaming), jogos (tiro na primeira/terceira pessoa (FPS/TPS), arena de batalha multijogador online (MOBA), Estratégia em Tempo Real (RTS), Jogos de Luta, Simulações Desportivas, Jogador Vs. Jogador (PvP) e Outros), E-Platform (Telemóveis e Tablets, eSports Baseados em Consolas, eSports Baseados em PC) - Tendências da Indústria e Previsão para 2031 .

Análise e dimensão do mercado de eSports

O mercado global de eSports continua a crescer, impulsionado por uma confluência de fatores. Um dos principais impulsionadores é a crescente acessibilidade da internet de alta velocidade e a proliferação de smartphones e dispositivos de jogos, que democratizaram a participação em jogos em todo o mundo. Além disso, o surgimento de plataformas de streaming como o Twitch e o YouTube Gaming facilitou a ampla disseminação de conteúdos de desportos eletrónicos, fomentando uma comunidade vibrante e atraindo um público diversificado. No entanto, no meio deste crescimento, surgiram desafios como obstáculos regulamentares e preocupações com a saúde e o bem-estar dos jogadores.

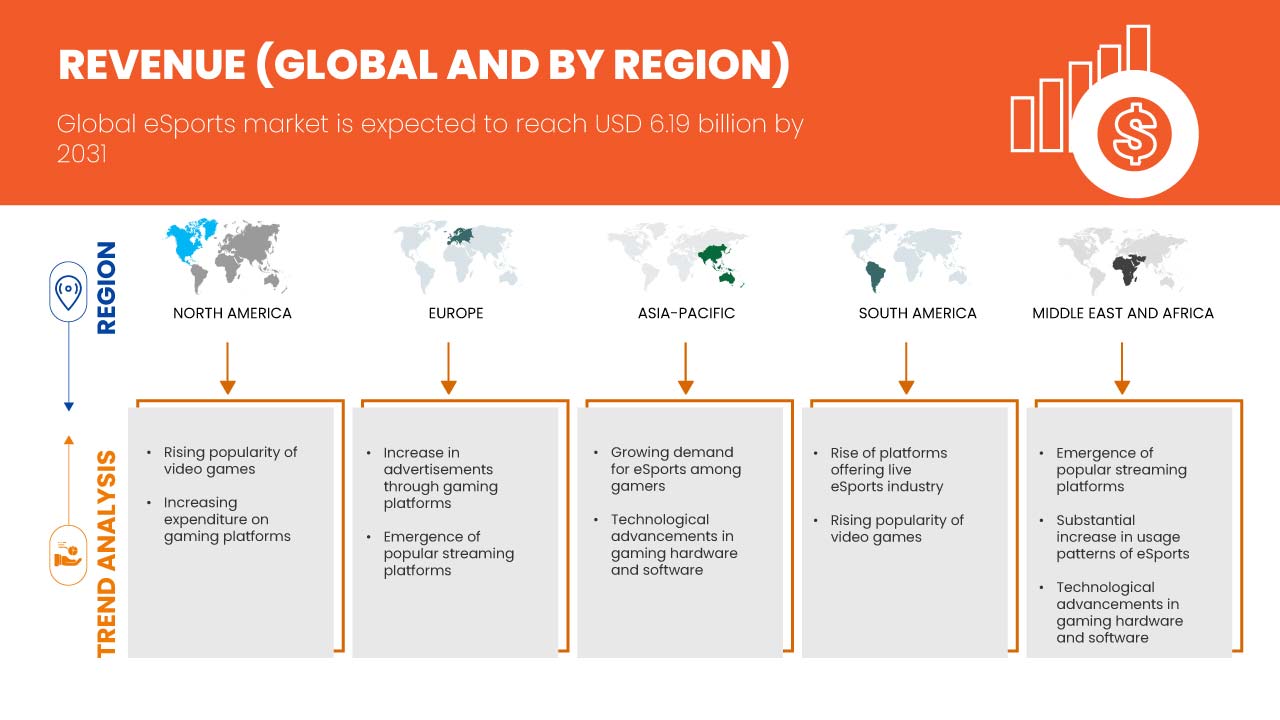

A Data Bridge Market Research analisa que o mercado global de eSports deverá atingir os 6,19 mil milhões de dólares até 2031, face aos 1,58 mil milhões de dólares em 2023, crescendo com um CAGR de 18,8% durante o período previsto de 2024 a 2031 .

|

Métrica de Reporte |

Detalhes |

|

Período de previsão |

2024 a 2031 |

|

Ano base |

2023 |

|

Anos históricos |

2022 (Personalizável para 2016-2021) |

|

Unidades quantitativas |

Receita em biliões de dólares americanos |

|

Segmentos abrangidos |

Fontes de receita (patrocínios e anúncios diretos, direitos de media, taxas de editoras, bilhetes e merchandise, digital e streaming), jogos (tiro na primeira/terceira pessoa (FPS/TPS), arena de batalha multijogador online (MOBA), estratégia em tempo real (RTS ), Jogos de Luta, Simulações Desportivas, Jogador Vs. Jogador (PvP) e Outros), E-Platform (Telemóveis e Tablets, eSports Baseados em Consolas, eSports Baseados em PC) |

|

Países abrangidos |

EUA, Canadá, México, Alemanha, França, Itália, Reino Unido, Holanda, Bélgica, Espanha, Suíça, Rússia, Turquia, Resto da Europa, China, Japão, Coreia do Sul, Índia, Austrália, Singapura, Tailândia, Malásia, Indonésia , Filipinas , Resto da Ásia-Pacífico, Brasil, Argentina, Resto da América do Sul, Arábia Saudita, África do Sul, Emirados Árabes Unidos, Egito, Israel e Resto do Médio Oriente e África |

|

Atores do mercado abrangidos |

FaZe Holdings Inc., X1 Entertainment Group, ESL FACEIT GROUP, CLOUD9, Activision Blizzard, Gfinity, NODWINGAMING, G ESports Holding GmbH., Team Liquid, Challonge, LLC, Battlefy, Inc., Play Versus, Inc., JOGOS ÓPTICOS, ESports Battle e ESports Tower LLC. entre outros |

Definição de Mercado

eSports, abreviatura de desportos eletrónicos, refere-se a jogos de vídeo competitivos organizados num ambiente profissional ou semiprofissional. Os jogadores ou equipas competem entre si em vários videojogos, geralmente em formatos multijogador, com torneios e ligas organizados a nível local, nacional e internacional. Os eSports têm ganho uma popularidade significativa nos últimos anos, com jogadores profissionais, equipas e organizações a competir por prémios em dinheiro, patrocínios e reconhecimento. Os jogos normalmente jogados nos eSports incluem títulos populares como League of Legends, Counter-Strike: Global Offensive, Dota 2, Overwatch e muitos outros numa variedade de géneros, como jogos de tiro na primeira pessoa, estratégia em tempo real e arena de batalha multijogador online.

Dinâmica do mercado global de eSports

Motoristas

- Crescente popularidade dos videojogos

A crescente popularidade dos videojogos serve como um importante impulsionador do mercado global de eSports, impulsionando o seu rápido crescimento e expandindo o seu alcance a novos públicos em todo o mundo. À medida que os videojogos continuam a evoluir e a atrair um leque diversificado de jogadores, o potencial dos jogos competitivos como forma de entretenimento tem aumentado. Com os avanços na tecnologia, especialmente na conectividade à internet e nas plataformas de jogos, os jogadores podem ligar-se e competir facilmente com outros jogadores de todo o mundo. A crescente popularidade dos videojogos não só atrai novos participantes e espectadores para os eventos de eSports, como também cultiva um ecossistema vibrante de criadores de conteúdos, influenciadores e plataformas de envolvimento da comunidade. Consequentemente, os eSports beneficiam desta relação simbiótica com a indústria do jogo em geral, experimentando um aumento de audiência, acordos de patrocínio e oportunidades de investimento.

- Avanços tecnológicos em hardware e software de jogos

A inovação e a melhoria contínuas na tecnologia de jogos levaram a experiências de jogo melhoradas, que impactam diretamente a competitividade e o apelo dos eSports. Em primeiro lugar, os avanços no hardware de jogos, como unidades de processamento gráfico (GPUs), unidades centrais de processamento (CPUs) e periféricos como ratos e teclados de alto desempenho para jogos, permitem aos jogadores atingir níveis mais elevados de precisão, capacidade de resposta e imersão durante o jogo. Estas melhorias tecnológicas não só melhoram a habilidade dos jogadores, como também contribuem para o espetáculo geral e a emoção dos eventos de eSports, atraindo públicos e patrocinadores de maior dimensão.

Além disso, os avanços no software de jogos, incluindo os motores de jogo e as técnicas de renderização gráfica, revolucionaram a forma como as competições de eSports são organizadas e experienciadas. Os motores de jogo permitem aos programadores criar ambientes visualmente impressionantes e imersivos, melhorando a experiência do espectador e confundindo a linha entre a realidade virtual e a física. Além disso, sistemas de matchmaking online robustos e modos dedicados de eSports dentro dos jogos facilitam uma jogabilidade justa e competitiva, permitindo que jogadores de todo o mundo compitam entre si sem problemas.

Oportunidades

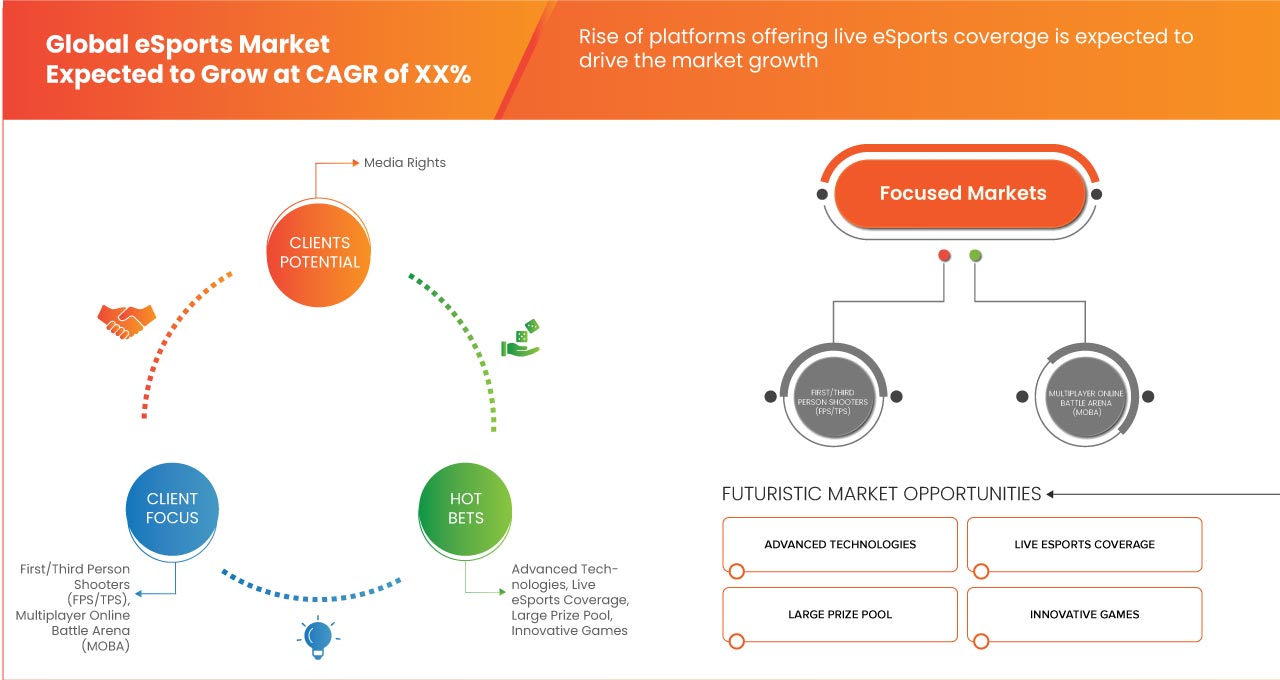

- Ascensão de plataformas que oferecem cobertura de eSports ao vivo

O setor dos eSports tem apresentado um crescimento tremendo ao longo dos anos, tanto em termos de audiência como de receitas. O aumento da audiência é o que mais contribuiu para o crescimento das receitas – e não é apenas porque estes espectadores estão a gerar receitas. Percebendo o potencial de alcançar um público grande e envolvido, as marcas estão a investir no marketing de eSports, tanto direta como indiretamente. Com o crescimento exponencial da indústria de eSports, houve um aumento correspondente nas plataformas que oferecem cobertura ao vivo de eventos de eSports. Estas plataformas variam desde sites de streaming dedicados aos eSports até aos canais de media tradicionais e tornaram-se participantes importantes na disseminação de conteúdos de eSports para um público global. Isto representa uma oportunidade significativa para reunir e analisar dados de visualização, métricas de envolvimento e dados demográficos do público em várias plataformas.

O surgimento de plataformas que oferecem cobertura ao vivo de eSports representa uma mudança monumental na forma como o público consome conteúdos de jogos. Plataformas como o Twitch, YouTube Gaming e Facebook Gaming também democratizaram o acesso a eventos de eSports, permitindo aos fãs assistir aos seus jogos e jogadores favoritos em tempo real a partir de qualquer parte do mundo. Por exemplo, o Twitch surgiu como uma força dominante no panorama do streaming de eSports, ostentando milhões de utilizadores ativos e alojando uma grande variedade de conteúdos de jogos.

Restrição/Desafio

- Preocupações com a saúde e o vício dos eSports

As preocupações com a saúde e a dependência no mercado dos eSports são considerações significativas, dada a natureza imersiva dos jogos e a intensa competição envolvida. Sessões prolongadas de jogo podem levar a vários problemas de saúde física, como cansaço visual, lesões por esforço repetitivo (LER) e problemas músculo-esqueléticos devido a estar sentado durante muito tempo ou postura inadequada. Além disso, o jogo excessivo pode ter efeitos adversos na saúde mental, incluindo o aumento do stress, ansiedade e depressão, particularmente entre os jogadores profissionais que enfrentam uma pressão intensa para ter um bom desempenho.

Além disso, o vício do jogo, conhecido como distúrbio do jogo, é reconhecido como uma preocupação legítima pela Organização Mundial de Saúde (OMS). O vício do jogo pode levar ao isolamento social, negligência com a higiene pessoal, distúrbios do sono e comprometimento académico ou ocupacional. Também pode prejudicar as relações com familiares e amigos.

Desenvolvimentos recentes

- Em outubro de 2022, de acordo com um artigo da ResearchGate GmbH., o reino dos eSports apresenta um caminho promissor para os anunciantes, com os jogadores a perceberem geralmente os anúncios nos videojogos de forma positiva. serve como força motriz para o mercado global.

- Em junho de 2021, de acordo com um artigo da Biblioteca Nacional de Medicina, o aumento da publicidade na indústria do jogo serve como um impulsionador significativo para o mercado global de eSports. Os anunciantes reconhecem os eSports como uma grande oportunidade devido à receção positiva dos anúncios por parte dos jogadores, que os percebem favoravelmente se estes se misturarem perfeitamente com a experiência de jogo sem interromper o jogo. Esta abordagem reflete o conceito de "colocação de produto", em que as marcas são integradas no conteúdo de entretenimento. À medida que a publicidade nos jogos continua a evoluir, não só gera receitas, como também melhora a experiência global dos eSports, contribuindo para o crescimento contínuo e o sucesso comercial da indústria.

Âmbito do mercado global de eSports

O mercado global de eSports está dividido em três segmentos notáveis baseados em fluxos de receitas, jogos e plataforma eletrónica. O crescimento entre estes segmentos irá ajudá-lo a analisar os principais segmentos de crescimento nos setores e fornecerá aos utilizadores uma visão geral valiosa do mercado e informações de mercado para tomar decisões estratégicas para identificar as principais aplicações de mercado.

Fontes de Receita

- Patrocínios e Anúncios Diretos

- Direitos de comunicação social

- Taxas de editora

- Bilhetes e produtos

- Digital

- Transmissão

Com base nos fluxos de receitas, o mercado está segmentado em patrocínios e anúncios diretos, direitos de media, taxas de editoras, bilhetes e merchandise, digital e streaming.

Jogos

- Jogos de tiro na primeira/terceira pessoa (FPS/TPS)

- Arena de Batalha Multijogador Online (MOBA)

- Estratégia em Tempo Real (RTS)

- Jogos de Luta

- Simulações Desportivas

- Jogador Vs. Jogador (PVP)

- Outros

Com base nos jogos, o mercado está ainda segmentado em jogos de tiro na primeira/terceira pessoa (FPS/TPS), arena de batalha multijogador online (MOBA), estratégia em tempo real (RTS), jogos de luta, simulações desportivas, jogador contra jogador (PVP). ) e outros.

Plataforma eletrónica

- Telemóveis e Tablets

- eSports baseados em consolas

- Esports baseados em PC

Com base na plataforma eletrónica, o mercado está segmentado em dispositivos móveis e tablets, eSports baseados em consolas e eSports baseados em PC.

Análise/Insights Regionais do Mercado Global de eSports

O mercado global de eSports está segmentado com base em fluxos de receitas, jogos e plataforma eletrónica.

Os países abrangidos pelo relatório do mercado global de eSports são os EUA, Canadá, México, Alemanha, França, Itália, Reino Unido, Países Baixos, Bélgica, Espanha, Suíça, Rússia, Turquia, resto da Europa, China, Japão, Coreia do Sul, Índia, Austrália, Singapura, Tailândia, Malásia, Indonésia, Filipinas, resto da Ásia-Pacífico, Brasil, Argentina, resto da América do Sul, Arábia Saudita, África do Sul, Emirados Árabes Unidos, Egito, Israel e resto do Médio Oriente e África.

Prevê-se que a Ásia-Pacífico domine este mercado devido à rápida industrialização, ao aumento das actividades de construção e à elevada procura de tintas, revestimentos e adesivos, apoiada pelo crescente desenvolvimento das infra-estruturas e dos sectores transformadores da região. Espera-se que a China domine a Ásia-Pacífico devido ao aumento de anúncios em plataformas de jogos. Espera-se que os EUA dominem a América do Norte devido ao aumento da procura de videojogos. Espera-se que a Alemanha domine a Europa devido ao número crescente de plataformas de streaming.

A secção de países do relatório também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado que impactam as tendências atuais e futuras do mercado. A análise dos pontos de dados a montante e a jusante da cadeia de valor, a análise das tendências técnicas das cinco forças de Porter e os estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e disponibilidade de marcas da América do Norte e os seus desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, o impacto das tarifas domésticas e das rotas comerciais são considerados ao fornecer uma análise de previsão dos dados do país .

Análise do cenário competitivo e da quota de mercado global de eSports

O panorama competitivo do mercado global de eSports fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos, pipelines de testes de produto, aprovações de produto, patentes, largura e amplitude do produto, domínio da aplicação, curva de vida da tecnologia. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas no mercado global de tensioativos.

Alguns dos participantes proeminentes que operam no mercado global de eSports são a FaZe Holdings Inc., X1 Entertainment Group, ESL FACEIT GROUP, CLOUD9, Activision Blizzard, Gfinity PLC., NODWINGAMING, G ESports Holding GmbH., Team Liquid, Challonge, LLC, Battlefy , Inc., Play Versus, Inc., OPTIC GAMING, ESports Battle e ESports Tower LLC. entre outros.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING POPULARITY OF VIDEO GAMES

5.1.2 TECHNOLOGICAL ADVANCEMENTS IN GAMING HARDWARE AND SOFTWARE

5.1.3 EMERGENCE OF POPULAR STREAMING PLATFORMS

5.1.4 INCREASE IN ADVERTISEMENTS THROUGH GAMING PLATFORMS

5.2 RESTRAINTS

5.2.1 HEALTH AND ADDICTION CONCERNS IN ESPORTS

5.2.2 LACK OF STANDARDIZATION IN THE ESPORTS INDUSTRY

5.3 OPPORTUNITIES

5.3.1 RISE OF PLATFORMS OFFERING LIVE ESPORTS COVERAGE

5.3.2 INCREASING NUMBER OF EVENTS WITH LARGE PRIZE POOL

5.4 CHALLENGES

5.4.1 INTELLECTUAL PROPERTY RIGHTS ISSUES

5.4.2 SUSTAINABILITY, DATA PRIVACY AND INTEGRITY CONCERNS

6 GLOBAL ESPORTS MARKET, BY REVENUE STREAMS

6.1 OVERVIEW

6.2 SPONSORSHIPS AND DIRECT ADVERTISEMENTS ESPORTS

6.3 MEDIA RIGHTS

6.4 PUBLISHER FEES

6.5 TICKETS AND MERCHANDISE

6.6 DIGITAL

6.7 STREAMING

7 GLOBAL ESPORTS MARKET, BY GAMES

7.1 OVERVIEW

7.2 FIRST/THIRD PERSON SHOOTERS (FPS/TPS)

7.3 MULTIPLAYER ONLINE BATTLE ARENA (MOBA)

7.4 REAL TIME STRATEGY (RTS)

7.5 FIGHTING GAMES

7.6 SPORTS SIMULATIONS

7.7 PLAYER VS. PLAYER (PVP)

7.8 OTHERS

8 GLOBAL ESPORTS MARKET, BY E-PLATFORM

8.1 OVERVIEW

8.2 MOBILE AND TABLETS

8.3 CONSOLES-BASED ESPORTS

8.4 PC-BASED ESPORTS

9 GLOBAL ESPORTS MARKET, BY REGION

9.1 OVERVIEW

9.2 ASIA-PACIFIC

9.2.1 CHINA

9.2.2 SOUTH KOREA

9.2.3 JAPAN

9.2.4 INDIA

9.2.5 AUSTRALIA

9.2.6 INDONESIA

9.2.7 MALAYSIA

9.2.8 PHILIPPINES

9.2.9 SINGAPORE

9.2.10 THAILAND

9.2.11 REST OF ASIA-PACIFIC

9.3 NORTH AMERICA

9.3.1 U.S.

9.3.2 CANADA

9.3.3 MEXICO

9.4 EUROPE

9.4.1 GERMANY

9.4.2 U.K.

9.4.3 SPAIN

9.4.4 FRANCE

9.4.5 RUSSIA

9.4.6 ITALY

9.4.7 NETHERLANDS

9.4.8 TURKEY

9.4.9 BELGIUM

9.4.10 SWITZERLAND

9.4.11 REST OF EUROPE

9.5 MIDDLE EAST AND AFRICA

9.5.1 SAUDI ARABIA

9.5.2 U.A.E.

9.5.3 EGYPT

9.5.4 SOUTH AFRICA

9.5.5 ISRAEL

9.5.6 REST OF MIDDLE EAST AND AFRICA

9.6 SOUTH AMERICA

9.6.1 BRAZIL

9.6.2 ARGENTINA

9.6.3 REST OF SOUTH AMERICA

10 GLOBAL ESPORTS MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: GLOBAL

10.2 COMPANY SHARE ANALYSIS: EUROPE

10.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

10.4 COMPANY SHARE ANALYSIS: NORTH AMERICA

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 ACTIVISION BLIZZARD

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT UPDATES

12.2 ESL FACEIT GROUP

12.2.1 COMPANY SNAPSHOT

12.2.2 COMPANY SHARE ANALYSIS

12.2.3 BRAND PORTFOLIO

12.2.4 RECENT DEVELOPMENTS

12.3 TEAM LIQUID

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 BRAND PORTFOLIO

12.3.4 RECENT DEVELOPMENTS

12.4 PLAY VERSUS, INC.

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENT

12.5 FAZE HOLDINGS INC.

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 SERVICE PORTFOLIO

12.5.5 RECENT DEVELOPMENTS

12.6 BATTLEFLY, INC.

12.6.1 COMPANY SNAPSHOT

12.6.2 BRAND PORTFOLIO

12.6.3 RECENT DEVELOPMENTS

12.7 CHALLONGE, LLC

12.7.1 COMPANY SNAPSHOT

12.7.2 BRAND PORTFOLIO

12.7.3 RECENT DEVELOPMENTS

12.8 CLOUD9

12.8.1 COMPANY SNAPSHOT

12.8.2 BRAND PORTFOLIO

12.8.3 RECENT DEVELOPMENTS

12.9 ESPORTS BATTLE

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENT

12.1 ESPORTS TOWER LLC.

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENT

12.11 G ESPORTS HOLDING GMBH.

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENT

12.12 GFINITY PLC.

12.12.1 COMPANY SNAPSHOT

12.12.2 REVENUE ANALYSIS

12.12.3 PRODUCT PORTFOLIO

12.12.4 RECENT UPDATES

12.13 NODWINGAMING

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT UPDATES

12.14 OPTIC GAMING

12.14.1 COMPANY SNAPSHOT

12.14.2 BRAND PORTFOLIO

12.14.3 RECENT DEVELOPMENTS

12.15 X1 ENTERTAINMENT GROUP

12.15.1 COMPANY SNAPSHOT

12.15.2 REVENUE ANALYSIS

12.15.3 BRAND PORTFOLIO

12.15.4 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

Lista de Tabela

TABLE 1 GLOBAL ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 2 GLOBAL SPONSORSHIPS AND DIRECT ADVERTISEMENTS IN ESPORTS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 3 GLOBAL MEDIA RIGHTS IN ESPORTS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 4 GLOBAL PUBLISHER FEES IN ESPORTS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 5 GLOBAL TICKETS AND MERCHANDISE IN ESPORTS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 6 GLOBAL DIGITAL IN ESPORTS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 7 GLOBAL STREAMING IN ESPORTS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 8 GLOBAL ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 9 GLOBAL FIRST/THIRD PERSON SHOOTERS (FPS/TPS) IN ESPORTS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 10 GLOBAL MULTIPLAYER ONLINE BATTLE ARENA (MOBA) IN ESPORTS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 11 GLOBAL REAL TIME STRATEGY (RTS) IN ESPORTS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 12 GLOBAL FIGHTING GAMES IN ESPORTS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 13 GLOBAL SPORTS STIMULATION IN ESPORTS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 14 GLOBAL PLAYER VS. PLAYER (PVP) IN ESPORTS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 15 GLOBAL OTHERS IN ESPORTS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 16 GLOBAL ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 17 GLOBAL MOBILE AND TABLETS IN ESPORTS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 18 GLOBAL CONSOLES-BASED ESPORTS IN ESPORTS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 19 GLOBAL PC-BASED ESPORTS IN ESPORTS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 20 GLOBAL ESPORTS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC ESPORTS MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 25 CHINA ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 26 CHINA ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 27 CHINA ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 28 SOUTH KOREA ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 29 SOUTH KOREA ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 30 SOUTH KOREA ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 31 JAPAN ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 32 JAPAN ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 33 JAPAN ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 34 INDIA ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 35 INDIA ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 36 INDIA ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 37 AUSTRALIA ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 38 AUSTRALIA ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 39 AUSTRALIA ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 40 INDONESIA ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 41 INDONESIA ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 42 INDONESIA ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 43 MALAYSIA ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 44 MALAYSIA ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 45 MALAYSIA ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 46 PHILIPPINES ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 47 PHILIPPINES ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 48 PHILIPPINES ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 49 SINGAPORE ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 50 SINGAPORE ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 51 SINGAPORE ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 52 THAILAND ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 53 THAILAND ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 54 THAILAND ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 55 REST OF ASIA-PACIFIC ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 56 NORTH AMERICA ESPORTS MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 57 NORTH AMERICA ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 58 NORTH AMERICA ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 59 NORTH AMERICA ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 60 U.S. ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 61 U.S. ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 62 U.S. ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 63 CANADA ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 64 CANADA ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 65 CANADA ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 66 MEXICO ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 67 MEXICO ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 68 MEXICO ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 69 EUROPE ESPORTS MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 70 EUROPE ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 71 EUROPE ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 72 EUROPE ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 73 GERMANY ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 74 GERMANY ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 75 GERMANY ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 76 U.K. ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 77 U.K. ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 78 U.K. ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 79 SPAIN ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 80 SPAIN ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 81 SPAIN ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 82 FRANCE ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 83 FRANCE ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 84 FRANCE ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 85 RUSSIA ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 86 RUSSIA ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 87 RUSSIA ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 88 ITALY ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 89 ITALY ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 90 ITALY ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 91 NETHERLANDS ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 92 NETHERLANDS ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 93 NETHERLANDS ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 94 TURKEY ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 95 TURKEY ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 96 TURKEY ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 97 BELGIUM ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 98 BELGIUM ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 99 BELGIUM ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 100 SWITZERLAND ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 101 SWITZERLAND ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 102 SWITZERLAND ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 103 REST OF EUROPE ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 104 MIDDLE EAST AND AFRICA ESPORTS MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 105 MIDDLE EAST AND AFRICA ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 106 MIDDLE EAST AND AFRICA ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 107 MIDDLE EAST AND AFRICA ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 108 SAUDI ARABIA ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 109 SAUDI ARABIA ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 110 SAUDI ARABIA ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 111 U.A.E. ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 112 U.A.E. ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 113 U.A.E. ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 114 EGYPT ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 115 EGYPT ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 116 EGYPT ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 117 SOUTH AFRICA ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 118 SOUTH AFRICA ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 119 SOUTH AFRICA ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 120 ISRAEL ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 121 ISRAEL ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 122 ISRAEL ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 123 REST OF MIDDLE EAST AND AFRICA ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 124 SOUTH AMERICA ESPORTS MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 125 SOUTH AMERICA ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 126 SOUTH AMERICA ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 127 SOUTH AMERICA ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 128 BRAZIL ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 129 BRAZIL ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 130 BRAZIL ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 131 ARGENTINA ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 132 ARGENTINA ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 133 ARGENTINA ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 134 REST OF SOUTH AMERICA ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

Lista de Figura

FIGURE 1 GLOBAL ESPORTS MARKET

FIGURE 2 GLOBAL ESPORTS MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL ESPORTS MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL ESPORTS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL ESPORTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL ESPORTS MARKET: MULTIVARIATE MODELLING

FIGURE 7 GLOBAL ESPORTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 GLOBAL ESPORTS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 GLOBAL ESPORTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 GLOBAL ESPORTS MARKET: SEGMENTATION

FIGURE 11 RISING POPULARITY OF VIDEO GAME IS EXPECTED TO DRIVE THE GLOBAL ESPORTS MARKET IN THE FORECAST PERIOD

FIGURE 12 THE SPONSORSHIPS AND DIRECT ADVERTISEMMENTS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL ESPORTS MARKET IN 2024 AND 2031

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE MARKET

FIGURE 14 GLOBAL ESPORTS MARKET: BY REVENUE STREAMS, 2023

FIGURE 15 GLOBAL ESPORTS MARKET: BY GAMES, 2023

FIGURE 16 GLOBAL ESPORTS MARKET: BY E-PLATFORM, 2023

FIGURE 17 GLOBAL ESPORTS MARKET: SNAPSHOT (2023)

FIGURE 18 ASIA-PACIFIC ESPORTS MARKET: SNAPSHOT (2023)

FIGURE 19 NORTH AMERICA ESPORTS MARKET: SNAPSHOT (2023)

FIGURE 20 EUROPE ESPORTS MARKET: SNAPSHOT (2023)

FIGURE 21 MIDLE EAST AND AFRICA ESPORTS MARKET: SNAPSHOT (2023)

FIGURE 22 SOUTH AMERICA ESPORTS MARKET: SNAPSHOT (2023)

FIGURE 23 GLOBAL ESPORTS MARKET: COMPANY SHARE 2023 (%)

FIGURE 24 EUROPE ESPORTS MARKET: COMPANY SHARE 2023 (%)

FIGURE 25 ASIA-PACIFC ESPORTS MARKET: COMPANY SHARE 2023 (%)

FIGURE 26 NORTH AMERICA ESPORTS MARKET: COMPANY SHARE 2023 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.