Global Eclinical Solutions Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

9.36 Billion

USD

25.79 Billion

2024

2032

USD

9.36 Billion

USD

25.79 Billion

2024

2032

| 2025 –2032 | |

| USD 9.36 Billion | |

| USD 25.79 Billion | |

|

|

|

|

Segmentação do mercado global de soluções e-clínicas, por produto ( sistemas de captura eletrônica de dados e gerenciamento de dados de ensaios clínicos, sistemas de gerenciamento de ensaios clínicos , plataformas de análise clínica, registros médicos de coordenação de cuidados (CCMR), gerenciamento de fornecimento de ensaios e randomização, plataformas de integração de dados clínicos, soluções eletrônicas de avaliação de resultados clínicos, soluções de segurança, sistemas de arquivos mestres de ensaios eletrônicos , soluções de gerenciamento de informações regulatórias e outros), modo de entrega (soluções hospedadas na Web (sob demanda), soluções corporativas licenciadas (no local) e soluções baseadas em nuvem (SAAS)), fase de ensaio clínico (fase I, fase II, fase III e fase IV), tamanho da organização (pequena, média e grande), dispositivo do usuário (desktop, tablet, dispositivo PDA portátil, smartphone e outros), usuário final (empresas farmacêuticas e biofarmacêuticas , organizações de pesquisa contratadas, empresas de serviços de consultoria, fabricantes de dispositivos médicos, hospitais e institutos de pesquisa acadêmica) - tendências do setor e previsão até 2032

Tamanho do mercado de soluções clínicas eletrônicas

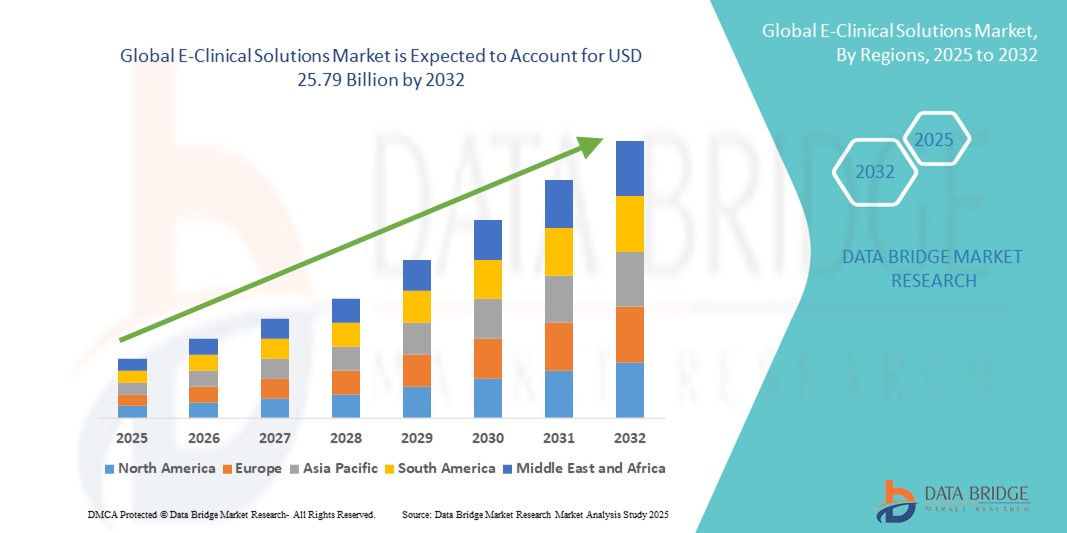

- O tamanho do mercado global de soluções clínicas eletrônicas foi avaliado em US$ 9,36 bilhões em 2024 e deve atingir US$ 25,79 bilhões até 2032 , com um CAGR de 13,50% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente adoção de tecnologias digitais e pelo progresso tecnológico em sistemas de pesquisa clínica e de saúde, levando a um melhor gerenciamento de dados, eficiência de testes e tomada de decisões em tempo real em empresas farmacêuticas e de biotecnologia.

- Além disso, a crescente demanda por plataformas seguras, fáceis de usar e integradas para ensaios clínicos está consolidando as Soluções Clínicas Eletrônicas como a escolha preferencial para coleta, monitoramento e análise de dados. Esses fatores convergentes estão acelerando a adoção das Soluções Clínicas Eletrônicas, impulsionando significativamente o crescimento do setor.

Análise de Mercado de Soluções Clínicas Eletrônicas

- Soluções clínicas eletrônicas, abrangendo plataformas digitais como CTMS, EDC, eCOA e RTSM, estão se tornando cada vez mais essenciais em ensaios clínicos devido ao seu papel na gestão de dados, eficiência operacional e conformidade regulatória. A expansão do mercado é impulsionada pela urgência em otimizar ensaios complexos e oferecer suporte a modelos de ensaios descentralizados e virtuais.

- A crescente demanda por soluções clínicas eletrônicas é alimentada principalmente por fatores como o número crescente de ensaios clínicos globais, o aumento dos investimentos em P&D por empresas farmacêuticas e de biotecnologia, a mudança para sistemas baseados em nuvem/habilitados para dispositivos móveis e a necessidade de acelerar os cronogramas de desenvolvimento de medicamentos por meio da automação e integração de dados.

- A América do Norte dominou o mercado de soluções e-Clinical, com a maior participação na receita, de 49,38% em 2024, apoiada por uma infraestrutura de saúde robusta, indústrias farmacêuticas e de biotecnologia bem estabelecidas e estruturas regulatórias favoráveis que incentivam a adoção digital. Esse domínio é particularmente impulsionado pela adoção avançada nos EUA, que detinham aproximadamente 41,4% do mercado global em 2024.

- Espera-se que a região Ásia-Pacífico registre forte crescimento no mercado de soluções e-Clinical, com um CAGR projetado de 11,8%, devido ao aumento da terceirização de ensaios clínicos, à expansão da infraestrutura de saúde e P&D e ao aumento da atividade de ensaios em países como China, Índia, Japão e Coreia do Sul.

- O segmento de Grandes Empresas dominou o mercado de soluções e-Clinical com 63,4% de participação de mercado em 2024, refletindo seu amplo investimento em pesquisa e desenvolvimento, operações globais de ensaios clínicos e a necessidade crítica de plataformas totalmente integradas para gerenciar a conformidade regulatória, fluxos de trabalho complexos e coordenação de estudos em vários países.

Escopo do relatório e segmentação do mercado de soluções clínicas eletrônicas

|

Atributos |

Insights importantes do mercado de soluções clínicas eletrônicas |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

Europa

Ásia-Pacífico

Oriente Médio e África

Ámérica do Sul

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências de mercado de soluções clínicas eletrônicas

Maior conveniência por meio de plataformas clínicas eletrônicas integradas

- Uma tendência significativa e crescente no mercado global de soluções clínicas eletrônicas é o aprofundamento da integração de sistemas de gestão de ensaios clínicos, captura eletrônica de dados (EDC) e sistemas de gestão de ensaios clínicos (CTMS) em plataformas digitais unificadas. Essa convergência está aprimorando significativamente a eficiência operacional, a qualidade dos dados e a tomada de decisões em todo o ecossistema de pesquisa clínica.

- Por exemplo, plataformas e-Clinical modernas integram perfeitamente o EDC com funcionalidades de gerenciamento de ensaios clínicos, permitindo que patrocinadores e organizações de pesquisa contratadas (CROs) monitorem o progresso dos ensaios em tempo real, gerenciem o recrutamento de pacientes e garantam a conformidade regulatória por meio de uma única interface. Da mesma forma, soluções avançadas agora incorporam randomização e gerenciamento de suprimentos para ensaios clínicos (RTSM), reduzindo atrasos e melhorando a coordenação geral dos ensaios clínicos.

- A integração de soluções e-Clinical permite ainda mais a automação da entrada de dados, a validação avançada de dados e a geração de relatórios em tempo real. Por exemplo, as plataformas estão incorporando cada vez mais recursos de desenho adaptativo de ensaios clínicos e sistemas automatizados de resolução de consultas, minimizando assim a intervenção manual e aumentando a precisão no tratamento de dados de pacientes. Além disso, recursos avançados de análise e modelagem preditiva permitem que os gestores de ensaios clínicos prevejam as taxas de recrutamento de pacientes e identifiquem potenciais gargalos com antecedência.

- A integração perfeita de plataformas E-Clinical com prontuários eletrônicos de saúde (PEs), sistemas de informação laboratorial (LIS) e outros ecossistemas digitais de saúde facilita o acesso centralizado a diversas fontes de dados clínicos. Por meio de uma única plataforma unificada, os pesquisadores podem gerenciar prontuários de pacientes, relatórios de eventos adversos, documentação de ensaios clínicos e submissões regulatórias, criando um processo de ensaio clínico simplificado e em conformidade.

- Essa tendência em direção a ecossistemas e-clínicos mais inteligentes, interconectados e fáceis de usar está remodelando fundamentalmente as expectativas para a gestão de ensaios clínicos. Consequentemente, empresas como Medidata, Oracle Health Sciences e Veeva Systems estão desenvolvendo soluções e-clínicas de última geração com interoperabilidade aprimorada, modelos de implantação baseados em nuvem e acessibilidade móvel para oferecer suporte a ensaios clínicos globais e descentralizados.

- A demanda por soluções e-Clinical que oferecem funcionalidade integrada está crescendo rapidamente nos setores farmacêutico, de biotecnologia e de dispositivos médicos, à medida que as partes interessadas priorizam cada vez mais a eficiência operacional, a conformidade regulatória e o tempo de colocação no mercado acelerado para novas terapias.

Dinâmica do mercado de soluções clínicas eletrônicas

Motorista

Crescente necessidade de gestão eficiente de ensaios clínicos e crescente adoção de soluções digitais

- A crescente complexidade e o custo dos ensaios clínicos, aliados ao crescente número de candidatos a medicamentos e produtos biológicos em desenvolvimento, estão gerando uma demanda significativa por Soluções Clínicas Eletrônicas avançadas. Essas plataformas permitem o gerenciamento eficiente de dados, o engajamento contínuo dos pacientes e a conformidade regulatória em locais de ensaio geograficamente diversos.

- Por exemplo, em junho de 2024, a Medidata (Dassault Systèmes) introduziu melhorias em sua plataforma de Ensaios Clínicos Descentralizados (DCT) baseada em IA, com o objetivo de aprimorar o recrutamento de pacientes e o monitoramento dos ensaios em tempo real. Esses avanços tecnológicos estão acelerando a adoção de plataformas e-Clinical nos setores farmacêutico e de biotecnologia.

- À medida que patrocinadores e CROs se esforçam para reduzir os prazos dos ensaios clínicos e aprimorar a tomada de decisões, soluções como captura eletrônica de dados (EDC), sistemas de gerenciamento de ensaios clínicos (CTMS), eCOA e ferramentas de monitoramento remoto estão se tornando indispensáveis. Esses sistemas oferecem automação, precisão de dados e insights em tempo real, garantindo assim a eficiência operacional.

- Além disso, a crescente mudança em direção a ensaios centrados no paciente e a expansão de modelos de ensaios híbridos e descentralizados estão tornando as plataformas e-Clinical uma parte integrante do ecossistema de pesquisa clínica, permitindo melhor retenção e adesão do paciente.

- A integração de análises avançadas, computação em nuvem e interfaces baseadas em dispositivos móveis aumenta ainda mais a proposta de valor das Soluções Clínicas Eletrônicas, tornando-as essenciais para atender à crescente demanda por processos de desenvolvimento de medicamentos mais rápidos, seguros e eficientes.

Restrição/Desafio

Preocupações com a segurança de dados, complexidades de integração e altos custos de implementação

- Preocupações com vulnerabilidades de privacidade e segurança de dados representam uma grande restrição para o mercado de Soluções Clínicas Eletrônicas. Como esses sistemas lidam com dados sensíveis de pacientes e ensaios clínicos, eles permanecem suscetíveis a ameaças à segurança cibernética, acesso não autorizado e potenciais violações, gerando preocupações entre patrocinadores, CROs e autoridades regulatórias.

- Por exemplo, incidentes de alto perfil de ataques cibernéticos a organizações de saúde e de investigação clínica aumentaram a consciencialização sobre os riscos da adopção de plataformas digitais baseadas na nuvem sem salvaguardas robustas.

- Abordar essas preocupações por meio de criptografia avançada, autenticação multifator, conformidade com GDPR/HIPAA e auditorias regulares do sistema é essencial para manter a confiança do usuário. Fornecedores como Oracle Health Sciences e Veeva Systems enfatizam seus recursos de proteção de dados para tranquilizar as partes interessadas.

- Além disso, os desafios de integração do alinhamento das e-Clinical Solutions com os sistemas legados existentes e os diversos fluxos de trabalho de gerenciamento de testes muitas vezes atrasam a adoção, especialmente entre CROs de médio e pequeno porte.

- Os altos custos iniciais de implementação, incluindo licenciamento, personalização e treinamento de pessoal, continuam sendo outra barreira à adoção, especialmente em regiões em desenvolvimento ou para patrocinadores de testes com orçamento limitado. Embora os modelos de assinatura baseados em SaaS estejam reduzindo as despesas iniciais, plataformas avançadas com IA, análise e recursos de interoperabilidade ainda exigem um preço premium.

- Superar essas barreiras por meio de soluções modulares acessíveis, melhores padrões de interoperabilidade e estruturas de segurança cibernética mais fortes será vital para alcançar a adoção global sustentada de soluções clínicas eletrônicas.

Escopo de mercado de soluções clínicas eletrônicas

O mercado é segmentado com base no produto, modo de entrega, fase do ensaio clínico, tamanho da organização, dispositivo do usuário e usuário final.

- Por produto

Com base no produto, o mercado de soluções e-Clinical é segmentado em sistemas de captura eletrônica de dados e gerenciamento de dados de ensaios clínicos, sistemas de gerenciamento de ensaios clínicos, plataformas de análise clínica, registros médicos de coordenação de cuidados (CCMR), randomização e gerenciamento de suprimentos para ensaios, plataformas de integração de dados clínicos, soluções eletrônicas de avaliação de resultados clínicos, soluções de segurança, sistemas eletrônicos de arquivos mestres de ensaios, soluções de gerenciamento de informações regulatórias e outros. O segmento de sistemas de gerenciamento de dados dominou o mercado com a maior participação na receita de 28,6% em 2024, devido ao seu papel central na coleta, limpeza e gerenciamento eficiente de dados de ensaios clínicos. Esses sistemas são cruciais para manter a integridade dos dados, a conformidade regulatória e a precisão dos relatórios, tornando-os indispensáveis em ensaios clínicos de pequena e grande escala. O aumento do volume de dados de ensaios em estudos multicêntricos e globais está aumentando a demanda por um gerenciamento robusto de dados. A integração com registros eletrônicos de saúde (EHR) e outras plataformas de ensaios fortalece ainda mais sua adoção. Recursos avançados de análise e monitoramento em tempo real também tornam os sistemas de gerenciamento de dados a espinha dorsal de operações clínicas eficientes.

Espera-se que o segmento de plataformas de análise clínica testemunhe o CAGR mais rápido, de 22,1%, de 2025 a 2032, impulsionado pela crescente adoção de análises baseadas em IA, aprendizado de máquina e modelagem preditiva em pesquisas clínicas. Essas plataformas permitem que as partes interessadas extraiam insights acionáveis de conjuntos de dados complexos de ensaios clínicos, otimizem o recrutamento de pacientes e melhorem os resultados dos ensaios clínicos em tempo real. As soluções de análise também oferecem suporte ao monitoramento baseado em risco, identificam desvios de protocolo e aprimoram a conformidade regulatória. A capacidade de integrar diversas fontes de dados, incluindo eCOA, dispositivos vestíveis e sistemas laboratoriais, impulsiona seu crescimento. Ferramentas e painéis de visualização avançados ajudam os gerentes de ensaios clínicos a tomar decisões informadas rapidamente. O foco crescente em ensaios clínicos adaptativos e de medicina de precisão acelera ainda mais a adoção de Plataformas de Análise Clínica.

- Por modo de entrega

Com base no modo de entrega, o mercado de soluções e-Clinical é segmentado em soluções hospedadas na web (sob demanda), soluções corporativas licenciadas (no local) e soluções baseadas em nuvem (software como serviço/SAAS). O segmento de Soluções Hospedadas na Web (Sob Demanda) detinha a maior participação de mercado, 41,3% em 2024, devido à sua escalabilidade, custo-benefício e facilidade de implantação. Essas soluções permitem que os usuários acessem dados de ensaios clínicos e ferramentas de gerenciamento remotamente, sem a necessidade de infraestrutura de TI complexa, beneficiando particularmente organizações de pesquisa de pequeno e médio porte. A facilidade de integração com os sistemas de TI existentes e os requisitos mínimos de manutenção fortalecem ainda mais a adoção. A flexibilidade para dimensionar recursos com base nas necessidades dos ensaios clínicos também impulsiona a preferência por esse segmento. O acesso centralizado aos dados e os recursos de monitoramento em tempo real aumentam a eficiência operacional.

O segmento de Soluções em Nuvem (SaaS) deverá crescer à taxa composta de crescimento anual (CAGR) mais rápida, de 21,4%, entre 2025 e 2032, impulsionado pela crescente prevalência de modelos de ensaios clínicos descentralizados e híbridos. As plataformas em nuvem oferecem acesso seguro e em tempo real aos dados dos ensaios em diversos locais e países, permitindo uma melhor colaboração entre patrocinadores, CROs e centros clínicos. Fluxos de trabalho automatizados, padronização de dados e recursos de conformidade regulatória oferecem suporte a operações de ensaios eficientes. A adoção da nuvem também reduz os custos de infraestrutura de TI e acelera os cronogramas de implantação. A integração de análises avançadas e acesso móvel em plataformas em nuvem fortalece a supervisão operacional. O crescente incentivo regulatório para soluções digitais de gestão de ensaios acelera ainda mais o crescimento do mercado.

- Por fase de ensaio clínico

Com base na fase do ensaio clínico, o mercado de soluções e-Clinical é segmentado em Fase I, Fase II, Fase III e Fase IV. O segmento de Fase III foi responsável pela maior participação na receita, 46,7% em 2024, impulsionado por protocolos de ensaio complexos, grandes populações de pacientes e rigorosos requisitos regulatórios em estudos em estágio avançado. Os ensaios de Fase III geram dados substanciais, necessitando de soluções e-Clinical avançadas para gerenciamento eficiente de dados, monitoramento de pacientes e conformidade regulatória. A integração de sistemas de gerenciamento de ensaios, plataformas analíticas e ferramentas e-COA aumenta a precisão operacional. Os patrocinadores dependem fortemente dos sistemas de Fase III para garantir a conclusão oportuna dos estudos e minimizar atrasos. O foco crescente em ensaios multicêntricos globais reforça o domínio do segmento.

Espera-se que o segmento de Fase II cresça à mais rápida taxa composta de crescimento anual (CAGR) de 19,6% entre 2025 e 2032, impulsionado pelo crescente número de ensaios clínicos de médio prazo em oncologia, terapias direcionadas e medicina de precisão. Os estudos de Fase II exigem designs adaptativos, monitoramento detalhado do paciente e integração perfeita de dados de diversas fontes. As soluções e-Clinical simplificam esses processos, fornecendo insights em tempo real e melhorando a eficiência dos ensaios clínicos. Ferramentas aprimoradas de engajamento do paciente e a integração com dispositivos vestíveis aceleram a adoção. A ênfase regulatória na segurança do paciente e na precisão dos dados também contribui para o crescimento. A necessidade de tomada de decisão rápida em ensaios clínicos de médio prazo alimenta ainda mais a demanda por plataformas e-Clinical sofisticadas.

- Por tamanho da organização

Com base no porte da organização, o mercado de soluções e-Clinical é segmentado em pequenas e médias empresas (PMEs) e grandes empresas. O segmento de Grandes Empresas dominou, com uma participação de mercado de 63,4% em 2024, refletindo seu amplo investimento em P&D, operações globais de ensaios clínicos e a necessidade de plataformas totalmente integradas para gerenciar a conformidade regulatória, estudos multinacionais e fluxos de trabalho complexos. Grandes empresas utilizam soluções e-Clinical para reduzir erros operacionais, agilizar a coleta de dados e garantir processos padronizados em todos os ensaios clínicos. O monitoramento e a análise centralizados apoiam a tomada de decisões em escala. A integração com o prontuário eletrônico de saúde (EHR) e outros sistemas hospitalares aumenta a eficiência. A alta adoção de soluções habilitadas para nuvem e hospedadas na web consolida ainda mais seu domínio.

Espera-se que o segmento de PMEs registre o CAGR mais rápido, de 20,2%, entre 2025 e 2032, impulsionado pela crescente adoção de soluções e-Clinical escaláveis, acessíveis e baseadas em nuvem. As PMEs se beneficiam de fluxos de trabalho automatizados, acesso remoto e custos reduzidos de infraestrutura, permitindo-lhes conduzir ensaios clínicos eficientes com recursos limitados. A rápida implantação de plataformas SaaS acelera a adoção. Essas soluções permitem a conformidade regulatória sem altos investimentos em TI. A necessidade de competir com grandes empresas em cronogramas de desenvolvimento de medicamentos impulsiona ainda mais o crescimento do mercado. A integração com ferramentas móveis e analíticas aumenta a eficiência operacional para organizações menores.

- Por dispositivo do usuário

Com base no dispositivo do usuário, o mercado de soluções e-Clinical é segmentado em desktops, tablets, PDAs portáteis, smartphones e outros. O segmento de desktops deteve a maior participação, 37,9% em 2024, visto que os desktops continuam sendo a principal ferramenta para gerentes de ensaios clínicos, analistas de dados e coordenadores clínicos realizarem entradas de dados complexas, análises e relatórios regulatórios. Seu robusto poder computacional, interfaces de tela ampla e ambiente seguro os tornam ideais para o gerenciamento de dados confidenciais de ensaios clínicos. Os desktops também suportam integração com múltiplas plataformas de ensaios clínicos e sistemas de prontuário eletrônico (EHR). Confiabilidade e estabilidade são essenciais para lidar com operações de ensaios clínicos em larga escala e em vários locais.

O segmento de smartphones deverá crescer à taxa composta de crescimento anual (CAGR) mais rápida, de 23,5%, entre 2025 e 2032, impulsionado pela adoção de soluções eCOA compatíveis com dispositivos móveis, aplicativos de engajamento de pacientes e ferramentas de monitoramento remoto. Os smartphones fornecem atualizações de ensaios clínicos em tempo real, melhoram a adesão dos pacientes e permitem que médicos, monitores e patrocinadores acessem os dados a qualquer hora e em qualquer lugar. A acessibilidade móvel aprimora modelos de ensaios clínicos descentralizados e híbridos. A integração com plataformas em nuvem e dispositivos vestíveis permite a coleta contínua de dados. A crescente necessidade de gerenciamento flexível e centrado no paciente acelera a adoção de soluções baseadas em smartphones. Os smartphones também reduzem atrasos na geração de relatórios e monitoramento de dados, aumentando a eficiência operacional.

- Por usuário final

Com base no usuário final, o mercado de soluções e-Clinical é segmentado em empresas farmacêuticas e biofarmacêuticas, organizações de pesquisa contratadas (CROs), empresas de serviços de consultoria, fabricantes de dispositivos médicos, hospitais e institutos de pesquisa acadêmica. O segmento de empresas farmacêuticas e biofarmacêuticas dominou, com uma participação de mercado de 51,8% em 2024, impulsionado pela adoção de plataformas e-Clinical para gerenciar ensaios clínicos complexos e multicêntricos, garantir a conformidade regulatória e acelerar os cronogramas de desenvolvimento de medicamentos. Grandes empresas farmacêuticas contam com essas soluções para gerenciamento integrado de ensaios clínicos, acesso a dados em tempo real e fluxos de trabalho padronizados para reduzir erros e aumentar a eficiência.

Espera-se que o segmento de CROs apresente o CAGR mais rápido, de 21,9%, entre 2025 e 2032, impulsionado pela tendência crescente de terceirização de operações de ensaios clínicos e pela necessidade de uma gestão de ensaios eficiente e com boa relação custo-benefício. As CROs utilizam plataformas e-Clinical para gerenciar ensaios clínicos de múltiplos clientes, otimizar fluxos de trabalho, otimizar recursos e garantir relatórios precisos em estudos globais. O acesso em tempo real aos dados, o monitoramento centralizado e a colaboração aprimorada entre as partes interessadas aumentam a eficiência dos ensaios clínicos. A crescente adoção de ensaios clínicos descentralizados e modelos híbridos acelera o crescimento. O segmento também se beneficia de inovações tecnológicas, como análises baseadas em IA e soluções de monitoramento móvel.

Análise regional do mercado de soluções clínicas eletrônicas

- A América do Norte dominou o mercado de soluções clínicas eletrônicas com a maior participação de receita de 49,38% em 2024, apoiada por uma infraestrutura de saúde robusta, indústrias farmacêuticas e de biotecnologia bem estabelecidas e estruturas regulatórias favoráveis que incentivam a adoção digital.

- Este domínio é particularmente impulsionado pela adoção avançada nos EUA , alimentada pela implementação crescente de sistemas de captura eletrônica de dados, plataformas de gerenciamento de ensaios clínicos e soluções baseadas em análise.

- A ênfase da região na conformidade regulatória, segurança do paciente e eficiência operacional continua a impulsionar a adoção generalizada de plataformas e-Clinical em hospitais, CROs e institutos de pesquisa

Visão do mercado de soluções clínicas eletrônicas dos EUA

O mercado de soluções clínicas eletrônicas dos EUA conquistou a maior fatia da receita na América do Norte, impulsionado pela alta adoção de soluções digitais para ensaios clínicos, pelo aumento da terceirização das operações de ensaios e pelo forte investimento em infraestrutura de pesquisa clínica. Tecnologias avançadas, como plataformas baseadas em nuvem, ferramentas de avaliação eletrônica de resultados clínicos (eCOA) e sistemas integrados de gestão de ensaios clínicos, estão permitindo um recrutamento mais rápido de pacientes, uma gestão eficiente de dados e maior transparência nos ensaios clínicos. O foco crescente em ensaios clínicos descentralizados e híbridos impulsiona ainda mais a adoção de soluções clínicas eletrônicas abrangentes em empresas farmacêuticas e de biotecnologia.

Visão do mercado de soluções clínicas eletrônicas na Europa

O mercado europeu de soluções clínicas eletrônicas deverá crescer a um CAGR substancial ao longo do período previsto, impulsionado principalmente pela crescente terceirização de operações de ensaios clínicos, pelo suporte regulatório para tecnologias de saúde digital e pela adoção de sistemas avançados de gestão de ensaios. Países como Alemanha, França e Reino Unido estão testemunhando um crescimento significativo devido aos fortes ecossistemas de P&D farmacêutico, à crescente complexidade dos ensaios e à necessidade de soluções integradas de gestão de ensaios em tempo real. As partes interessadas europeias estão aproveitando plataformas clínicas eletrônicas baseadas em nuvem, orientadas por análises e compatíveis com dispositivos móveis para aumentar a eficiência operacional e garantir a conformidade em estudos multicêntricos.

Visão do mercado de soluções clínicas eletrônicas do Reino Unido

O mercado de soluções clínicas eletrônicas do Reino Unido deverá crescer a uma CAGR considerável durante o período previsto, impulsionado pela sólida infraestrutura de pesquisa clínica do país e pela crescente adoção de plataformas digitais de ensaios clínicos. Patrocinadores e CROs estão investindo em soluções clínicas eletrônicas integradas para otimizar o monitoramento de pacientes, gerenciar os dados dos ensaios clínicos centralmente e acelerar os processos de desenvolvimento de medicamentos. Além disso, o aumento de modelos de ensaios clínicos descentralizados e híbridos está incentivando a adoção de sistemas baseados em nuvem e acessíveis por dispositivos móveis, apoiando a tomada de decisões em tempo real e a supervisão eficiente dos ensaios clínicos.

Visão do mercado de soluções clínicas eletrônicas na Alemanha

Espera-se que o mercado alemão de soluções clínicas eletrônicas se expanda a um CAGR considerável durante o período previsto, impulsionado pela crescente atividade de ensaios clínicos, altos padrões regulatórios e crescente adoção de plataformas digitais avançadas. Os fortes setores farmacêutico e de biotecnologia da Alemanha, aliados ao seu foco em inovação e integridade de dados, promovem o uso de soluções clínicas eletrônicas abrangentes, incluindo captura eletrônica de dados, sistemas de gestão de ensaios clínicos e plataformas analíticas integradas. A região está testemunhando um crescimento robusto em institutos de pesquisa acadêmica, CROs e organizações farmacêuticas.

Visão do mercado de soluções clínicas eletrônicas da Ásia-Pacífico

O mercado de soluções e-clínicas da Ásia-Pacífico deverá crescer a uma forte taxa composta de crescimento anual (CAGR) de 11,8% durante o período previsto, impulsionado pela crescente terceirização de ensaios clínicos, pela expansão da infraestrutura de saúde e P&D e pelo aumento da atividade de ensaios clínicos em países como China, Índia, Japão e Coreia do Sul. A região testemunha uma demanda crescente por sistemas de gerenciamento de ensaios clínicos baseados em nuvem, plataformas de análise e soluções e-clínicas compatíveis com dispositivos móveis para dar suporte a estudos descentralizados, otimizar o recrutamento de pacientes e aprimorar a coleta de dados. Os crescentes investimentos de empresas farmacêuticas e de biotecnologia na APAC estão impulsionando ainda mais a adoção de tecnologias e-clínicas avançadas.

Visão do mercado de soluções clínicas eletrônicas do Japão

O mercado japonês de soluções clínicas eletrônicas está ganhando força devido à infraestrutura avançada de saúde do país, aos padrões de pesquisa clínica de alta qualidade e ao uso crescente de soluções de ensaios clínicos baseadas em tecnologia. Patrocinadores e CROs estão utilizando plataformas integradas de gerenciamento de ensaios clínicos, ferramentas de eCOA e sistemas baseados em nuvem para aprimorar o monitoramento de pacientes, aumentar a eficiência dos ensaios clínicos e garantir a conformidade regulatória. O foco crescente em medicina de precisão e estudos clínicos complexos está acelerando ainda mais o crescimento do mercado.

Visão do mercado de soluções clínicas eletrônicas da China

O mercado chinês de soluções clínicas eletrônicas foi responsável pela maior fatia da receita de mercado na Ásia-Pacífico em 2024, devido à expansão das atividades de ensaios clínicos do país, ao robusto investimento em P&D farmacêutico e ao crescente apoio regulatório às tecnologias de saúde digital. A China está testemunhando a rápida adoção de sistemas eletrônicos de captura de dados, soluções de gerenciamento de ensaios clínicos e plataformas de análise em tempo real para apoiar ensaios multicêntricos, melhorar o recrutamento de pacientes e agilizar as operações de ensaios. Iniciativas governamentais que promovem a digitalização na área da saúde e das ciências biológicas fortalecem ainda mais a expansão do mercado na região.

Participação de mercado de soluções clínicas eletrônicas

O setor de soluções clínicas eletrônicas é liderado principalmente por empresas bem estabelecidas, incluindo:

- Oracle (EUA)

- Signant Health (EUA)

- MaxisIT (EUA)

- Parexel International Corporation (EUA)

- Dassault Systèmes (França)

- Clario (EUA)

- Mednet (EUA)

- OpenClinica, LLC (EUA)

- 4G Clinical (EUA)

- Veeva Systems (EUA)

- Saama Technologies, LLC (EUA)

- Anju (EUA)

- Castor (Holanda)

- Medrio, Inc. (EUA)

- ArisGlobal (EUA)

- Merative (EUA)

- Advarra (EUA)

- eClinical Solutions, LLC (EUA)

- Y-Prime LLC (EUA)

- RealTime Software Solutions LLC (EUA)

- Quretec (Estônia)

- Gerente de Pesquisa (Holanda)

- Datatrack Int. (Holanda)

- IQVIA Inc. (EUA)

Últimos desenvolvimentos no mercado global de soluções clínicas eletrônicas

- Em dezembro de 2021, a Oracle Corporation anunciou a aquisição da Cerner Corporation, fornecedora líder de sistemas de prontuários eletrônicos de saúde (PEP), por aproximadamente US$ 28,3 bilhões em dinheiro. Essa iniciativa estratégica teve como objetivo fortalecer a presença da Oracle no setor de saúde e acelerar a transformação digital em ambientes clínicos.

- Em julho de 2025, a eClinicalWorks, uma importante provedora de EHR ambulatorial em nuvem, tornou-se participante ativa do Ecossistema de Tecnologia em Saúde Digital dos Centros de Serviços Medicare e Medicaid (CMS). Esta iniciativa, anunciada por altos funcionários da saúde na Casa Branca, concentra-se em promover o compartilhamento integrado de dados de saúde e estabelecer novos padrões de interoperabilidade para o setor.

- Em agosto de 2023, a OceanMD, uma plataforma baseada em nuvem que oferece soluções de engajamento de pacientes e fluxo de trabalho clínico, assinou um contrato de US$ 38,5 milhões com a Autoridade Provincial de Serviços de Saúde da Colúmbia Britânica. O acordo visava fornecer serviços digitais, como encaminhamentos eletrônicos, consultas eletrônicas e pedidos eletrônicos, aprimorando a prestação de serviços de saúde em toda a província.

- Em março de 2025, entrou em vigor o Regulamento (UE) 2025/327 da União Europeia, que cria o Espaço Europeu de Dados de Saúde. Este regulamento visa proporcionar aos cidadãos da UE um melhor controlo sobre os seus dados pessoais de saúde e reforçar a interoperabilidade dos registos eletrónicos de saúde entre os Estados-Membros.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.