Global Dairy Alternative Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

27.11 Billion

USD

63.15 Billion

2024

2032

USD

27.11 Billion

USD

63.15 Billion

2024

2032

| 2025 –2032 | |

| USD 27.11 Billion | |

| USD 63.15 Billion | |

|

|

|

|

Segmentação do mercado global de alternativas lácteas, por tipo de produto (leite de soja, leite de amêndoa, leite de coco, leite de caju, leite de aveia, leite de arroz), tipo (inorgânico, orgânico), formulação (simples e adoçado, saborizado e sem açúcar, saborizado e adoçado, simples e sem açúcar), aplicação (alimentos, bebidas), valor nutricional (proteínas, vitaminas, carboidratos), canal de distribuição (supermercados/hipermercados, lojas online, especializadas) - tendências do setor e previsão para 2032

Tamanho do mercado de alternativas lácteas

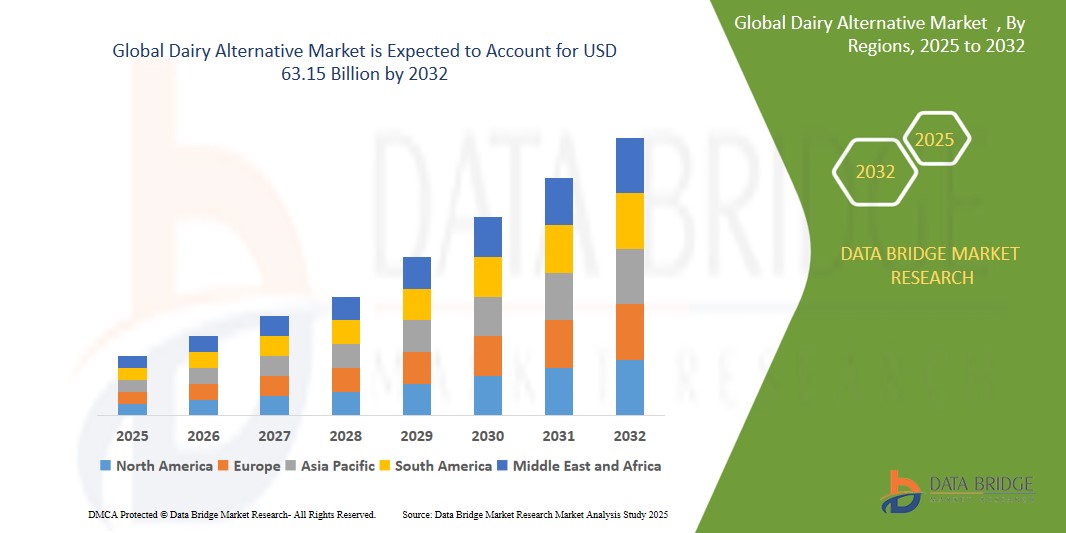

- O mercado global de alternativas lácteas foi avaliado em US$ 27,11 bilhões em 2024 e deve atingir US$ 63,15 bilhões até 2032

- Durante o período previsto de 2025 a 2032, o mercado deverá crescer a um CAGR de 11,20%, impulsionado principalmente pela adoção de inovações em ingredientes de origem vegetal para maior valor nutricional e sabor.

- Este crescimento é impulsionado por fatores como a crescente intolerância à lactose e a demanda por nutrição à base de plantas, além da crescente conscientização sobre saúde em todo o mundo.

Análise de Mercado de Alternativas Lácteas

- O mercado de alternativas aos laticínios é impulsionado pela crescente conscientização sobre saúde entre os consumidores, com uma demanda crescente por produtos de origem vegetal, sem lactose e sem laticínios para tratar problemas de saúde como colesterol, intolerância à lactose e obesidade.

- A crescente conscientização sobre a sustentabilidade ambiental e as considerações éticas na produção de alimentos também está impulsionando a mudança para alternativas à base de plantas. Os fabricantes estão inovando na oferta de produtos, com foco em sabor, textura e perfis nutricionais aprimorados, utilizando ingredientes diversos como aveia, amêndoas e soja.

- América do Norte, Europa e Ásia-Pacífico são as principais regiões para o mercado de alternativas lácteas, com a América do Norte e a Europa liderando a demanda por produtos de origem vegetal, enquanto a Ásia-Pacífico mostra um crescimento significativo devido à crescente conscientização sobre saúde e ao aumento da renda disponível.

Escopo do Relatório e Segmentação do Mercado de Alternativas Lácteas

|

Atributos |

Principais insights do mercado de alternativas lácteas |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

Europa

Ásia-Pacífico

Oriente Médio e África

Ámérica do Sul

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de consumo de produção, análise de tendência de preço, cenário de mudança climática, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matéria-prima/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências de mercado de alternativas lácteas

“Adoção de inovações em ingredientes de origem vegetal para maior valor nutricional e sabor”

- Uma tendência fundamental no mercado de alternativas lácteas é a rápida inovação em ingredientes de origem vegetal, com o objetivo de melhorar tanto o perfil nutricional quanto a experiência sensorial dos produtos sem laticínios.

- Novos ingredientes básicos, como grão-de-bico, linhaça, cânhamo e sementes de melancia, estão sendo explorados além da tradicional soja, amêndoa e aveia para oferecer melhor conteúdo de proteína, cremosidade e riqueza de micronutrientes.

- Técnicas de fermentação e processamento enzimático são cada vez mais empregadas para melhorar a digestibilidade, a textura e o sabor em alternativas lácteas, imitando o sabor e a sensação na boca dos laticínios convencionais.

- Por exemplo, um artigo de abril de 2025 do Guardian News & Media Limited afirma que o leite de aveia se tornou o leite vegetal mais popular do Reino Unido, respondendo por cerca de 40% do mercado em volume. Marcas como a Alpro, de propriedade da Danone, estão enfatizando o abastecimento local, utilizando aveia cultivada no Reino Unido e processada na fábrica de alta tecnologia Navara Oat Milling. Essa iniciativa sustenta a crescente demanda, com as vendas de leite de aveia em supermercados aumentando 7,2% no ano até fevereiro de 2025.

Dinâmica do mercado de alternativas lácteas

Motorista

“Aumento da intolerância à lactose e da procura por nutrição à base de plantas”

- A crescente prevalência de intolerância à lactose e alergias ao leite está aumentando significativamente a demanda por produtos lácteos alternativos. Os consumidores buscam opções à base de plantas que se alinhem às suas restrições alimentares e objetivos de saúde.

- Indivíduos preocupados com a saúde estão recorrendo a alternativas aos laticínios, como leite de amêndoa, leite de soja e leite de aveia, que são percebidos como escolhas mais saudáveis devido ao seu menor teor de gordura saturada e ausência de colesterol.

- A região da Ásia-Pacífico, em particular, está testemunhando um aumento na demanda por alternativas ao leite, impulsionada por um aumento acentuado nos casos relatados de alergias ao leite de vaca e intolerância à lactose. Os consumidores dessa região estão migrando para dietas veganas e adotando alternativas ao leite de vaca.

Por exemplo,

- Na Índia, estudos revelaram que 60% a 90% da população sofre de intolerância à lactose ou alergia a laticínios. Essa alta prevalência está aumentando significativamente a demanda por alternativas de laticínios à base de plantas no país.

- À medida que a conscientização sobre a intolerância à lactose e as restrições alimentares continua a aumentar, espera-se que o mercado de alternativas aos laticínios se expanda ainda mais, oferecendo aos consumidores uma variedade de opções que atendem às suas necessidades nutricionais e de saúde.

Oportunidade

“Promovendo Laticínios de Origem Vegetal com Ingredientes Funcionais e Novas Formulações”

- A integração de ingredientes funcionais, como probióticos, prebióticos e proteínas vegetais, está melhorando o perfil nutricional das alternativas lácteas, atendendo consumidores preocupados com a saúde e buscando benefícios adicionais à saúde.

- Inovações em tecnologias de fermentação estão permitindo o desenvolvimento de produtos lácteos de origem vegetal com sabor, textura e valor nutricional aprimorados, imitando de perto os laticínios tradicionais.

- Avanços na fermentação de precisão estão permitindo que as empresas produzam proteínas lácteas sem animais, levando à criação de alternativas lácteas sem lactose e ecologicamente corretas.

- A crescente demanda do consumidor por produtos sustentáveis e de rótulo limpo está levando os fabricantes a explorar novas formulações que atendam a essas preferências e, ao mesmo tempo, ofereçam sabor e funcionalidade.

Por exemplo,

- Em outubro de 2024, a empresa israelense DairyX desenvolveu cepas de levedura capazes de produzir proteínas de caseína por meio de fermentação de precisão, permitindo a produção de queijos cremosos e elásticos sem o uso de vacas. Essa inovação soluciona problemas de textura comumente associados a queijos vegetais e pode reduzir significativamente o impacto ambiental da indústria de laticínios.

- À medida que o mercado de laticínios de origem vegetal continua a evoluir, essas inovações apresentam oportunidades significativas para diversificação de produtos e expansão de mercado, alinhando-se às tendências mais amplas de saúde e bem-estar que influenciam as escolhas dos consumidores.

Restrição/Desafio

“Estruturas regulatórias para novos produtos veganos”

- A introdução de novos produtos alternativos aos laticínios geralmente envolve ingredientes inovadores à base de plantas que devem atender a aprovações regulatórias rigorosas, especialmente em mercados como a UE, os EUA e a Ásia.

- Esses processos regulatórios podem ser demorados e exigir ampla documentação, ensaios clínicos ou testes de segurança, o que atrasa o lançamento de produtos e dificulta a capacidade de resposta do mercado.

- As empresas devem investir pesadamente em conformidade, rotulagem e reformulação para atender aos padrões de segurança e rotulagem de alimentos em evolução, aumentando os custos operacionais e legais.

- Fabricantes menores enfrentam desafios desproporcionais ao navegar em ambientes regulatórios complexos, o que limita sua capacidade de escalar e inovar efetivamente.

Por exemplo,

De acordo com um blog publicado pela Eurofins, as regulamentações para produtos veganos enfatizam a conformidade com a rotulagem, a transparência dos ingredientes e as advertências sobre alérgenos. A publicação destaca a importância de aderir a padrões específicos para ingredientes de origem vegetal para garantir a segurança do produto e a confiança do consumidor, além de fornecer orientações para navegar pelos requisitos regulatórios no mercado vegano.

Escopo de mercado de alternativas lácteas

O mercado é segmentado com base no tipo de produto, tipo, formulação, aplicação, valor nutritivo e canal de distribuição.

|

Segmentação |

Sub-segmentação |

|

Por tipo de produto |

|

|

Por tipo |

|

|

Por Formulação |

|

|

Por aplicação |

|

|

Por Nutritivo |

|

|

Por canal de distribuição |

|

Análise regional do mercado de alternativas lácteas

“A América do Norte é a região dominante no mercado de alternativas lácteas”

-

A América do Norte domina o mercado global de alternativas lácteas, apoiada pela crescente demanda do consumidor por dietas à base de plantas, conscientização sobre intolerância à lactose e preocupações éticas relacionadas ao bem-estar animal e à sustentabilidade.

- Os EUA lideram o mercado regional devido à ampla adoção de produtos à base de aveia, amêndoa e soja, à forte presença de grandes marcas de laticínios de origem vegetal e à inovação contínua em sabores, texturas e conteúdo nutricional.

- Uma infraestrutura de varejo bem estabelecida, a crescente demanda por produtos de rótulo limpo e não transgênicos e o apoio de empresas de capital de risco para startups baseadas em plantas contribuem para uma liderança de mercado sustentada

“A Ásia-Pacífico deverá registar a maior taxa de crescimento”

-

Espera-se que a região da Ásia-Pacífico registre o crescimento mais rápido no mercado de alternativas lácteas, impulsionado pelo aumento das taxas de intolerância à lactose, urbanização e mudanças nas preferências alimentares.

- Países como a China, a Índia e o Japão são mercados-chave devido à expansão das populações de classe média, à crescente conscientização sobre a saúde e à crescente preferência por dietas baseadas em vegetais e com baixo teor de colesterol.

- A inovação do Japão em alternativas de laticínios à base de soja e a rápida adoção do leite de aveia e amêndoa pela China, tanto no varejo quanto nos canais de alimentação, estão acelerando a expansão do mercado.

- Na Índia, a crescente população vegana, a prevalência de alergias a laticínios e as inclinações religiosas em relação ao consumo de produtos à base de plantas estão impulsionando a demanda; startups locais e marcas internacionais estão cada vez mais lançando produtos sem laticínios específicos para cada região para atender a essas necessidades.

Participação no mercado de alternativas lácteas

O cenário competitivo do mercado fornece detalhes por concorrente. Os detalhes incluem visão geral da empresa, finanças da empresa, receita gerada, potencial de mercado, investimento em pesquisa e desenvolvimento, novas iniciativas de mercado, presença global, locais e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento de produto, abrangência e amplitude do produto e domínio da aplicação. Os pontos de dados fornecidos acima referem-se apenas ao foco das empresas em relação ao mercado.

Os principais líderes de mercado que operam no mercado são:

- Chobani, LLC (EUA)

- Danone SA (França)

- Hain Celestial (EUA)

- Daiya Foods (Canadá)

- Eden Foods (EUA)

- NUTRIOPS, SL (Espanha)

- Earth's Own (Canadá)

- SunOpta (Canadá)

- Melt Organic (EUA)

- Oatly AB (Suécia)

- Blue Diamond Growers (EUA)

- Ripple Foods (EUA)

- Vitasoy International Holdings Ltd (Hong Kong)

- Organic Valley (EUA)

Últimos desenvolvimentos no mercado global de alternativas lácteas

- Em junho de 2023, a Oatly Group AB (Suécia) lançou um cream cheese vegano que agora está disponível em todo o país nos EUA. Esta inovação em cream cheese à base de aveia está disponível em dois sabores: Simples e Cebolinha e Cebola.

- Em abril de 2021, a SunOpta adquiriu as marcas de bebidas vegetais Dream e WestSoy do The Hain Celestial Group, Inc., aprimorando seu portfólio de produtos e impulsionando ainda mais o crescimento no segmento de bebidas vegetais.

- Em novembro de 2021, a Blue Diamond lançou o Leite de Amêndoas Extra Cremoso Almond Breeze, elaborado com óleo de amêndoa derivado de amêndoas premium da Blue Diamond cultivadas na Califórnia, proporcionando uma textura mais rica e cremosa. O lançamento do produto teve como objetivo aumentar o apelo ao consumidor e expandir a base de clientes da empresa.

- Em fevereiro de 2025, a MALK Organics lançou dois novos produtos de rótulo limpo: leite de coco orgânico sem açúcar e leite de soja orgânico sem açúcar. Essas adições se alinham ao compromisso da marca de oferecer leites vegetais feitos com o mínimo de ingredientes, atendendo consumidores que buscam opções transparentes e mais saudáveis.

- A partir de 5 de março de 2025, a Dunkin' removeu as taxas adicionais para opções de leite vegetal, como leite de amêndoa e aveia, em todas as suas unidades nos EUA. Essa decisão, influenciada pelo feedback dos clientes e por esforços de advocacy, alinha a Dunkin' com outras grandes redes de café na busca por alternativas aos laticínios mais acessíveis aos consumidores.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.