Global Blood Gas And Electrolyte Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

2.94 Billion

USD

4.91 Billion

2024

2032

USD

2.94 Billion

USD

4.91 Billion

2024

2032

| 2025 –2032 | |

| USD 2.94 Billion | |

| USD 4.91 Billion | |

|

|

|

|

Global Blood Gas and Electrolyte Market Segmentation, By Product (Instruments and Consumables), Modality (Portable, Benchtop, and Laboratory), End-User (Hospitals & Clinics, Ambulatory Surgical Centers, Point-of-Care, Laboratory & Institute, and Others) – Industry Trends and Forecast to 2032

Blood Gas and Electrolyte Market Analysis

The blood gas and electrolyte market is experiencing significant growth due to the increasing demand for diagnostic solutions that aid in assessing a patient's acid-base balance, oxygenation, and overall metabolic status. These tests are critical in various clinical settings such as hospitals, diagnostic centers, and point-of-care environments, especially in critical care units, emergency departments, and intensive care units. Recent advancements in the market include the development of compact, portable blood gas analyzers that enable real-time, on-site testing with rapid results. The integration of advanced technologies such as biosensors, optical sensors, and data analytics has further enhanced the accuracy and efficiency of these devices. Innovations in non-invasive monitoring, such as optical blood sensors, are also gaining traction, providing continuous real-time analysis without the need for blood samples.

The market is also witnessing increased adoption due to rising healthcare expenditures, heightened patient awareness, and advancements in medical infrastructure, particularly in emerging regions such as Asia-Pacific. Government initiatives supporting research and development are further fueling the growth of this market, as they enable the introduction of more advanced and affordable diagnostic solutions. This evolving landscape is expected to continue driving demand for blood gas and electrolyte analysis solutions in the coming years.

Blood Gas and Electrolyte Market Size

The global blood gas and electrolyte market size was valued at USD 2.94 billion in 2024 and is projected to reach USD 4.91 billion by 2032, with a CAGR of 6.62% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Blood Gas and Electrolyte Market Trends

“Rising Demand for Precise and Rapid Diagnostic Tools”

The Blood Gas and Electrolyte Market is experiencing significant growth, driven by the rising demand for precise and rapid diagnostic tools in critical care settings. One key trend shaping the market is the shift toward point-of-care testing (POCT), where portable and compact analyzers enable healthcare providers to conduct blood gas and electrolyte tests directly at the patient's bedside, ensuring faster results and timely interventions. For instance, the development of handheld devices such as the i-Check handheld blood gas electrolyte from B&E BIO-TECHNOLOGY enhances patient care by providing quick diagnostics in emergency situations. This trend is particularly important in critical care units and intensive care units (ICUs), where rapid decision-making is essential. In addition, advancements in biosensor technology and non-invasive monitoring are further revolutionizing the market, allowing continuous and real-time monitoring of blood gases and electrolytes without the need for repeated blood sampling. These innovations are expected to drive the market, particularly in emerging regions with increasing healthcare investments.

Report Scope and Blood Gas and Electrolyte Market Segmentation

|

Attributes |

Blood Gas and Electrolyte Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Abbott (U.S.), OPTI Medical Systems (U.S.), Siemens Healthineers AG (Germany), F. Hoffmann-La Roche Ltd (Switzerland), Medica Corporation (U.S.), Radiometer Medical ApS (Denmark), Nova Biomedical (U.S.), Erba Mannheim (Germany), Sensa Core Medical Instrumentation Pvt. Ltd. (India), Instrumentation Laboratory Company (U.S.), Samsung Medison Co., Ltd. (South Korea), Accurex (India), Oracle (U.S.), Edan Instruments, Inc. (China), Bayer AG (Germany), and TECOM Analytical Systems (Germany) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Blood Gas and Electrolyte Market Definition

Blood gas and electrolyte analysis refers to a diagnostic process that measures the levels of gases, such as oxygen and carbon dioxide, as well as electrolytes such as sodium, potassium, chloride, and bicarbonate in the blood. These measurements help assess a patient's acid-base balance, oxygenation status, and metabolic function.

Blood Gas and Electrolyte Market Dynamics

Drivers

- Rising Incidence of Chronic Diseases

The rising incidence of chronic diseases, such as chronic respiratory diseases, kidney failure, and cardiovascular disorders, is significantly driving the demand for blood gas and electrolyte testing. According to the World Health Organization (WHO), chronic respiratory diseases are the third leading cause of death globally, affecting over 350 million people. In addition, the global prevalence of cardiovascular diseases (CVDs) continues to rise, with over 17.9 million deaths annually, as reported by the American Heart Association (AHA). These conditions often require continuous monitoring of blood gases and electrolytes to assess the patient's metabolic and respiratory status. In cases of chronic kidney disease (CKD), where renal function declines over time, electrolyte imbalances are common, necessitating regular blood tests to manage treatment effectively. As a result, the increasing prevalence of these chronic conditions is fueling the demand for advanced diagnostic solutions such as blood gas and electrolyte analyzers, positioning it as a key driver in the market's growth.

- Growing Aging Population

The aging global population is a significant driver of the blood gas and electrolyte market, as older individuals are more susceptible to health conditions that require continuous monitoring of blood gases and electrolytes. According to the United Nations, the number of people aged 60 and older is expected to reach 2.1 billion by 2050, up from 1 billion in 2020. With age, the risk of chronic conditions such as cardiovascular diseases, kidney dysfunction, and respiratory disorders increases, which often leads to electrolyte imbalances and respiratory issues that need constant monitoring. For instance, chronic kidney disease (CKD), which is more prevalent among the elderly, requires regular blood gas and electrolyte testing to track kidney function and manage complications. This demographic trend is driving the demand for advanced diagnostic solutions that can efficiently monitor and manage these health issues, making the aging population a key market driver in the blood gas and electrolyte industry.

Opportunities

- Increasing Technological Advancements

Advancements in technology, particularly the development of portable, point-of-care testing devices, have created a significant market opportunity in the blood gas and electrolyte market. Handheld blood gas analyzers, such as the i-Check device by B&E BIO-TECHNOLOGY, allow healthcare professionals to quickly assess a patient's blood gas levels and electrolytes at the bedside, providing immediate results without the need for laboratory analysis. These portable devices are especially valuable in critical care settings such as emergency rooms and intensive care units (ICUs), where rapid decision-making is essential for patient survival. With such technology, clinicians can make timely treatment adjustments, particularly in managing patients with conditions such as sepsis or respiratory failure, where fast and accurate results are crucial. As healthcare continues to prioritize efficiency and faster patient care, the growing adoption of portable, point-of-care diagnostic devices presents a significant market opportunity, further fueling the demand for blood gas and electrolyte testing solutions.

- Growing Global Healthcare Expenditures

Growing healthcare expenditures, particularly in emerging markets, present a significant opportunity for the blood gas and electrolyte market. As countries such as China, India, and Brazil invest heavily in healthcare infrastructure, there is a rising demand for advanced diagnostic tools, including blood gas and electrolyte analyzers. For instance, in India, healthcare spending is expected to reach USD 150 billion by 2025, driven by government initiatives and increased private sector investment in healthcare facilities. This influx of spending supports the adoption of advanced technologies, such as the Radiometer ABL90 FLEX blood gas analyzer, which enables hospitals and clinics to provide faster, more accurate diagnostics, especially in emergency and critical care settings. With improved patient care and clinical decision-making made possible by these diagnostic tools, healthcare providers are better equipped to manage complex conditions such as respiratory failure and electrolyte imbalances. As healthcare spending continues to rise, particularly in emerging markets, the growing demand for these diagnostic solutions represents a key market opportunity.

Restraints/Challenges

- High Cost of Blood Gas and Electrolytes

The high cost of blood gas analyzers and electrolyte testing equipment remains a significant market challenge, particularly for healthcare facilities in low- and middle-income countries (LMICs). These devices, often priced in the tens of thousands of dollars, can be prohibitively expensive for hospitals with limited budgets, which may struggle to afford initial purchases as well as the ongoing maintenance costs, such as reagents, calibration, and technician training. The financial barrier can delay or prevent the adoption of advanced diagnostic technology, resulting in suboptimal care and the inability to provide timely, accurate diagnoses for critical conditions such as respiratory distress or electrolyte imbalances. As a result, many facilities are forced to rely on less accurate or slower methods of diagnosis, which can lead to higher morbidity and mortality rates. This challenge is compounded by the economic realities of many countries, where healthcare spending is already stretched thin, thus limiting access to essential medical technologies and hindering overall healthcare improvement.

- Strict Regulatory Requirements

Regulatory hurdles pose a significant challenge in the blood gas and electrolyte analyzer market, as manufacturers must adhere to stringent regulations set by authorities such as the FDA, EMA, and regional health agencies. These regulatory bodies ensure that medical devices meet high safety, quality, and efficacy standards before they can be marketed, which often involves lengthy approval processes, extensive testing, and documentation. For instance, obtaining FDA approval for a new blood gas analyzer can take several years and incur high costs due to the required clinical trials and compliance with Good Manufacturing Practices (GMP). This delays the introduction of new, innovative products to the market and increases the cost of production, as manufacturers must invest significant resources in meeting these regulatory demands. As a result, smaller manufacturers with limited financial resources may find it difficult to compete, and even established companies may face significant delays in expanding their product lines. These regulatory challenges thus create barriers to entry, limit market competition, and contribute to higher prices, further hindering access to advanced diagnostic technologies, particularly in resource-constrained settings.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Blood Gas and Electrolyte Market Scope

The market is segmented on the basis of product, modality, and end-user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Instruments

- Brand

- I-STAT

- epoc

- GEM Premier (3500& 5000)

- ABL Flex (90 and 800)

- Cobas

- RAPID Series

- Others

- Brand

- Consumables

Modality

- Portable

- Benchtop

- Laboratory

End-User

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Point-of-Care

- Laboratory & Institute

- Others

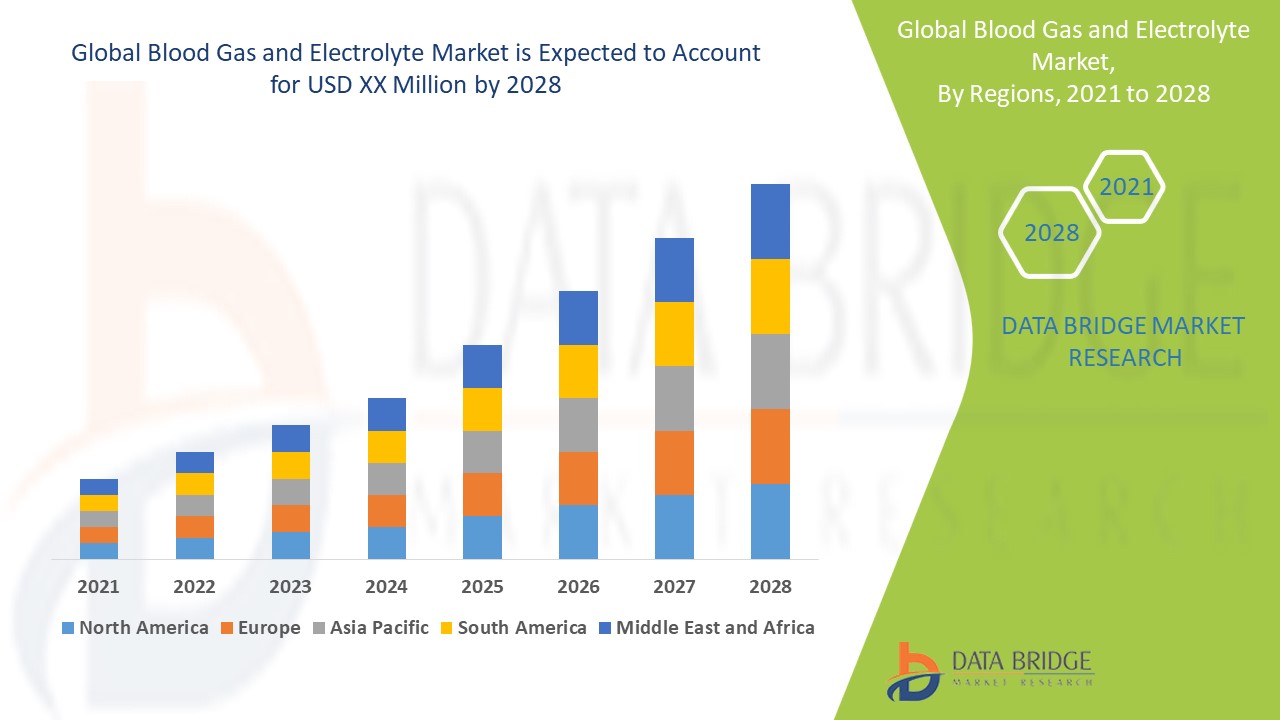

Blood Gas and Electrolyte Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, product, modality, and end-user as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the blood gas and electrolyte market, driven by several key factors. The region benefits from a high level of awareness among healthcare practitioners and patients, ensuring timely adoption of advanced diagnostic technologies. In addition, the well-established healthcare infrastructure provides robust support for efficient implementation and utilization of these solutions. Furthermore, increased government initiatives and funding for research and development activities in the medical field further strengthen North America’s dominance in this market.

Asia-Pacific is anticipated to experience highest growth in the blood gas and electrolyte market, fueled by various contributing factors. The region faces a high prevalence of unmet clinical needs, creating substantial opportunities for the adoption of advanced diagnostic and monitoring solutions. This growth is further supported by the rapid increase in healthcare expenditures, which enhances the availability of resources for improving medical infrastructure and services. In addition, rising levels of patient awareness about healthcare options and the importance of diagnostics are accelerating the demand for innovative technologies across the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Blood Gas and Electrolyte Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Blood Gas and Electrolyte Market Leaders Operating in the Market Are:

- Abbott (U.S.)

- OPTI Medical Systems (U.S.)

- Siemens Healthineers AG (Germany)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Medica Corporation (U.S.)

- Radiometer Medical ApS (Denmark)

- Nova Biomedical (U.S.)

- Erba Mannheim (Germany)

- Sensa Core Medical Instrumentation Pvt. Ltd. (India)

- Instrumentation Laboratory Company (U.S.)

- Samsung Medison Co., Ltd. (South Korea)

- Accurex (India)

- Oracle (U.S.)

- Edan Instruments, Inc. (China)

- Bayer AG (Germany)

- TECOM Analytical Systems (Germany)

Latest Developments in Blood Gas and Electrolyte Market

- In May 2024, Radiometer partnered with Etiometry to integrate Radiometer's acute care diagnostics with the Etiometry platform. This collaboration aims to enhance workflow and clinical decision-making in hospitals by improving critical care settings, particularly for blood gas analysis

- In March 2023, Transasia Medical Instruments demonstrated its commitment to social welfare by donating Erba analyzers, including hematology analyzers and E.C. 90 next-generation electrolyte analyzers featuring bio-sensor technology, to the Indian Red Cross Society’s Bel-Air Super Speciality Hospital in Wai, Satara district, Maharashtra

- In July 2022, Inspira Technologies OXY B.H.N. Ltd. unveiled the development of the HYLA blood sensor, a non-invasive optical blood sensor designed for real-time, continuous blood monitoring. It alerts physicians to immediate clinical changes without requiring blood samples, targeting the USD 2.5 billion Point-of-Care Testing and ABG analyzer market

- In June 2023, B&E BIO-TECHNOLOGY CO., LTD. launched the i-Check handheld blood gas electrolyte device, advancing point-of-care testing capabilities

- In September 2021, Sensa Core Medical Instrumentation introduced the ST-200CC Blood Gas Analyzer, a flagship device for clinics, hospitals, and diagnostic centers, distributed through its extensive network in India

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.