Global Biopharmaceuticals Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

1.08 Billion

USD

1.72 Billion

2024

2032

USD

1.08 Billion

USD

1.72 Billion

2024

2032

| 2025 –2032 | |

| USD 1.08 Billion | |

| USD 1.72 Billion | |

|

|

|

|

Segmentação do mercado global de biofármacos, por tipo de produto ( anticorpos monoclonais , fatores de crescimento recombinantes, proteínas purificadas, proteínas recombinantes, hormônio recombinante, vacinas , imunomoduladores sintéticos e outros), serviço (testes de laboratório, testes personalizados/testes proprietários do cliente, compendiais e testes de laboratório multicompendiais), tipo de matéria-prima (excipientes de formulação, ingredientes farmacêuticos ativos (IFA) e suporte ao programa de qualificação de fornecedores com base em métodos compendiais (USP/EP/JP)), aplicação (oncologia, doenças inflamatórias e infecciosas , distúrbios autoimunes, distúrbios metabólicos, distúrbios hormonais, doenças cardiovasculares, doenças neurológicas e outros) - Tendências e previsões do setor até 2032

Tamanho do mercado de biofármacos

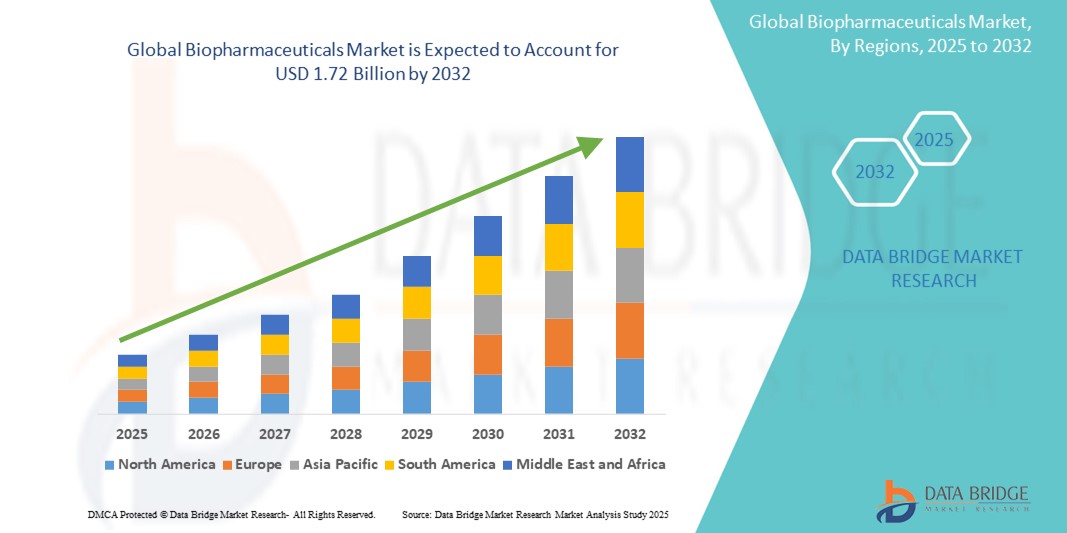

- O tamanho do mercado global de biofármacos foi avaliado em US$ 1,08 bilhão em 2024 e deve atingir US$ 1,72 bilhão até 2032 , com um CAGR de 6,00% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente adoção e progresso tecnológico na biotecnologia e na fabricação farmacêutica, levando ao aumento da digitalização na descoberta, desenvolvimento e produção de medicamentos.

- Além disso, a crescente demanda dos pacientes por tratamentos inovadores, direcionados e eficazes para doenças crônicas e condições médicas complexas está consolidando os biofármacos como a modalidade terapêutica moderna de escolha. Esses fatores convergentes estão acelerando a adoção de soluções biofarmacêuticas, impulsionando significativamente o crescimento do setor.

Análise de Mercado de Biofármacos

- Os biofármacos, que oferecem opções terapêuticas avançadas derivadas de fontes biológicas, são componentes cada vez mais vitais dos sistemas modernos de saúde e farmacêuticos, tanto em ambientes hospitalares quanto ambulatoriais, devido à sua especificidade aprimorada, potencial para modificação de doenças e integração perfeita com abordagens de medicina personalizada.

- A crescente demanda por biofármacos é alimentada principalmente pela crescente prevalência de doenças crônicas, avanços na biotecnologia e engenharia genética e uma preferência crescente por terapias direcionadas com perfis de eficácia e segurança aprimorados.

- A América do Norte domina o mercado de biofármacos com a maior participação de receita de 40,01% em 2025, caracterizada pela adoção precoce de tratamentos médicos avançados, altos gastos com saúde e uma forte presença de importantes participantes do setor.

- Espera-se que a Ásia-Pacífico seja a região de crescimento mais rápido no mercado de biofármacos, com um CAGR de 21,6% durante o período previsto, devido ao aumento do acesso e da conscientização sobre cuidados de saúde, ao aumento da renda disponível, permitindo maior acessibilidade a tratamentos avançados, e à crescente prevalência de doenças crônicas, juntamente com a expansão das capacidades de fabricação de biofármacos e do investimento em P&D.

- Espera-se que o segmento de anticorpos monoclonais domine o mercado de biofármacos com uma participação de mercado de 43,2% em 2025, impulsionado por sua eficácia comprovada no tratamento de uma ampla gama de doenças em diversas áreas terapêuticas.

Escopo do Relatório e Segmentação do Mercado de Biofármacos

|

Atributos |

Principais insights do mercado de biofármacos |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

Europa

Ásia-Pacífico

Oriente Médio e África

Ámérica do Sul

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de biofármacos

“Conveniência aprimorada por meio de IA e integração digital”

- Uma tendência significativa e crescente no mercado global de biofármacos é o aprofundamento da integração com inteligência artificial (IA) e plataformas de saúde digital. Essa fusão de tecnologias está aumentando significativamente a conveniência e o controle do usuário sobre seus regimes de tratamento e gestão da saúde.

- Por exemplo, sistemas de administração de medicamentos com tecnologia de IA podem integrar-se perfeitamente a dispositivos de monitoramento de pacientes, ajustando a dosagem com base em dados fisiológicos em tempo real. Da mesma forma, aplicativos digitais complementares podem ser controlados por comandos de voz, oferecendo aos pacientes uma maneira prática de gerenciar seus horários de medicação e acessar o suporte.

- A integração de IA em produtos biofarmacêuticos permite recursos como a previsão da resposta do paciente a terapias específicas para personalizar potencialmente os planos de tratamento e fornecer alertas mais inteligentes com base em dados de saúde

- A integração perfeita de dados biofarmacêuticos com assistentes digitais de saúde e plataformas de saúde mais amplas facilita o controle centralizado sobre vários aspectos do bem-estar do paciente. Por meio de uma única interface, os usuários podem gerenciar sua ingestão de medicamentos, níveis de atividade, informações dietéticas e comunicação com os profissionais de saúde, criando uma experiência de gestão de saúde unificada e proativa.

- Essa tendência em direção a sistemas de saúde mais inteligentes, intuitivos e interconectados está remodelando fundamentalmente as expectativas dos pacientes em relação ao gerenciamento de doenças. Consequentemente, empresas como a Amgen e a Novartis estão desenvolvendo soluções biofarmacêuticas habilitadas por IA, com recursos como recomendações de dosagem personalizadas com base em análises de IA e compatibilidade com controle de voz para aplicativos de suporte ao paciente.

- A demanda por biofármacos que ofereçam integração perfeita de IA e saúde digital está crescendo rapidamente nos setores de pacientes e provedores de saúde, à medida que os indivíduos priorizam cada vez mais a conveniência e a funcionalidade abrangente de saúde digital no gerenciamento de suas condições.

Dinâmica do Mercado de Biofármacos

Motorista

“ Necessidade crescente devido à crescente prevalência de doenças crônicas e à adoção de tratamentos avançados ”

- A crescente prevalência de doenças crônicas entre populações em todo o mundo, juntamente com a adoção acelerada de tratamentos médicos avançados e inovações biotecnológicas, é um fator significativo para o aumento da demanda por biofármacos.

- Por exemplo, em abril de 2024, a Amgen Inc. anunciou resultados positivos de um ensaio clínico de Fase III de seu novo medicamento biológico para uma condição autoimune específica, aguardando aprovação regulatória e lançamento no mercado. Espera-se que tais avanços por empresas importantes impulsionem o crescimento da indústria biofarmacêutica no período previsto.

- À medida que os pacientes e os prestadores de cuidados de saúde se tornam mais conscientes do potencial de tratamentos direcionados e eficazes para doenças complexas, os biofármacos oferecem mecanismos de ação avançados, eficácia melhorada e menos efeitos secundários em comparação com os medicamentos tradicionais de pequenas moléculas, proporcionando uma atualização convincente em relação às terapias convencionais.

- Além disso, a crescente popularidade das abordagens de medicina personalizada e o desejo por soluções de saúde interconectadas estão tornando os biofármacos um componente integral desses sistemas, oferecendo integração perfeita com ferramentas de diagnóstico e plataformas de monitoramento de pacientes.

- A conveniência das opções de autoadministração para alguns biofármacos, a capacidade de monitoramento remoto para pacientes em uso de medicamentos biológicos e o potencial de modificação da doença por meio de terapias inovadoras são fatores-chave que impulsionam a adoção de biofármacos em ambientes hospitalares e ambulatoriais. A tendência ao diagnóstico e à intervenção precoces e a crescente disponibilidade de novas opções biofarmacêuticas contribuem ainda mais para o crescimento do mercado.

Restrição/Desafio

“ Desafios de alto custo e acessibilidade dessas terapias avançadas ”

- Uma restrição no mercado global de biofármacos, que afeta uma região de rápido crescimento, gira em torno dos altos custos e desafios de acessibilidade dessas terapias avançadas, dificultando o acesso mais amplo dos pacientes

- Por exemplo, muitos produtos biofarmacêuticos inovadores, incluindo anticorpos monoclonais e terapias genéticas destinadas a doenças crónicas ou condições raras, têm preços significativos que são frequentemente proibitivos para um grande segmento da população indiana e até sobrecarregam os orçamentos de saúde das famílias de rendimento médio.

- Abordar estas questões de acessibilidade requer uma abordagem multifacetada que envolva iniciativas governamentais para negociar preços, promover o desenvolvimento e a adopção de biossimilares por fabricantes nacionais como a Biocon e a Cipla para oferecer alternativas mais rentáveis, e a expansão da cobertura do seguro de saúde para incluir estes tratamentos dispendiosos.

- Embora a procura por tratamentos inovadores seja elevada, a incapacidade de uma parcela significativa da população de os adquirir pode constituir uma barreira considerável à adopção generalizada de produtos biofarmacêuticos na Índia, o que pode abrandar a taxa de penetração do mercado, apesar do seu elevado potencial de crescimento global.

- A superação desta restrição através de preços estratégicos, produção local e mecanismos de financiamento de cuidados de saúde melhorados será crucial para a expansão sustentada e equitativa do mercado de biofármacos na Índia.

Escopo do mercado de biofármacos

O mercado é segmentado com base no tipo de produto, serviço, matéria-prima e aplicação.

- Por tipo de produto

Com base no tipo de produto, o mercado de biofármacos é segmentado em anticorpos monoclonais, fatores de crescimento recombinantes, proteínas purificadas, proteínas recombinantes, hormônios recombinantes, vacinas, imunomoduladores sintéticos e outros. O segmento de anticorpos monoclonais domina a maior fatia de mercado, com 43,2% em 2025, impulsionado por sua eficácia comprovada no tratamento de uma ampla gama de doenças e pela facilidade de desenvolvimento de terapias direcionadas. As empresas farmacêuticas frequentemente priorizam os anticorpos monoclonais por sua especificidade e potencial de alto impacto terapêutico. O mercado também observa forte demanda por esse segmento devido à sua aplicabilidade em diversas áreas terapêuticas e aos contínuos avanços na engenharia de anticorpos.

Prevê-se que o segmento de proteínas recombinantes apresente a taxa de crescimento mais rápida, de 21,7%, entre 2025 e 2032, impulsionado pela crescente adoção no tratamento de distúrbios metabólicos e deficiências hormonais, bem como por seu papel em diversas aplicações de pesquisa e diagnóstico. As proteínas recombinantes oferecem efeitos terapêuticos precisos e sua produção por meio de biotecnologia avançada proporciona escalabilidade e pureza. A expansão das aplicações na medicina personalizada e o desenvolvimento de novos tratamentos à base de proteínas também contribuem para sua crescente popularidade.

- Por serviço

Com base no serviço, o mercado de biofármacos é segmentado em testes laboratoriais, testes personalizados/testes proprietários do cliente, testes compendiais e testes laboratoriais multicompendiais. O segmento de testes laboratoriais deteve a maior fatia da receita de mercado em 2025, impulsionado pelo rigoroso controle de qualidade e pelos requisitos regulatórios associados ao desenvolvimento e à fabricação de biofármacos. Testes analíticos abrangentes são cruciais para garantir a segurança e a eficácia dos produtos biofarmacêuticos ao longo de seu ciclo de vida.

Espera-se que o segmento de testes personalizados/teste proprietário do cliente apresente o CAGR mais rápido entre 2025 e 2032, impulsionado pela crescente complexidade de novos biofármacos e pela necessidade de ensaios especializados, adaptados a candidatos e formulações específicas para medicamentos. À medida que a indústria inova com novas modalidades, espera-se que a demanda por serviços de testes exclusivos e proprietários para apoiar seu desenvolvimento e comercialização aumente significativamente.

- Por tipo de matéria-prima

Com base no tipo de matéria-prima, o mercado de biofármacos é segmentado em excipientes de formulação, ingredientes farmacêuticos ativos (IFA) e métodos compendiais (USP/EP/JP), com base no suporte ao programa de qualificação de fornecedores. O segmento de ingredientes farmacêuticos ativos (IFA) deteve a maior participação de mercado na receita em 2025, impulsionado pelo alto valor e pelo papel crítico dos componentes biologicamente ativos em formulações biofarmacêuticas. A demanda por IFAs potentes e de alta qualidade é fundamental para o crescimento do mercado biofarmacêutico.

Espera-se que o segmento de excipientes para formulações apresente o CAGR mais rápido entre 2025 e 2032, impulsionado pelo foco crescente em sistemas de liberação de fármacos, aprimoramento da estabilidade e desenvolvimento de novas formulações para melhorar a conveniência do paciente e a eficácia dos medicamentos. Excipientes avançados desempenham um papel crucial no sucesso da liberação e no desempenho de produtos biofarmacêuticos.

- Por aplicação

Com base na aplicação, o mercado de biofármacos é segmentado em oncologia, doenças inflamatórias e infecciosas, doenças autoimunes, doenças metabólicas, doenças hormonais, doenças cardiovasculares, doenças neurológicas e outras. O segmento de oncologia foi responsável pela maior fatia da receita de mercado em 2025, impulsionado pela alta prevalência de câncer globalmente e pelos avanços significativos em tratamentos biofarmacêuticos, como anticorpos monoclonais e terapias celulares para diversos tipos de câncer. A necessidade urgente de terapias eficazes contra o câncer continua a impulsionar o crescimento do mercado nesta área de aplicação.

Espera-se que o segmento de doenças neurológicas apresente o CAGR mais rápido entre 2025 e 2032, impulsionado pela crescente compreensão dos distúrbios neurológicos e pelo crescente desenvolvimento de novos biofármacos direcionados a essas condições complexas. As significativas necessidades médicas não atendidas em áreas como Alzheimer, Parkinson e esclerose múltipla estão impulsionando esforços substanciais de pesquisa e desenvolvimento e o consequente crescimento do mercado neste segmento de aplicação.

Análise regional do mercado de biofármacos

- A América do Norte domina o mercado de biofármacos com a maior participação na receita de 40,01% em 2024, impulsionada por uma crescente demanda por tratamentos e terapias médicas avançadas, bem como pela maior conscientização sobre produtos biológicos inovadores.

- Os prestadores de cuidados de saúde e os pacientes da região valorizam muito a eficácia, os melhores resultados e o potencial para a medicina personalizada oferecidos pelos produtos biofarmacêuticos em comparação com os medicamentos farmacêuticos tradicionais.

- Essa ampla adoção é ainda apoiada por altos gastos com saúde, um forte foco em pesquisa e desenvolvimento e a crescente preferência por tratamentos direcionados e modificadores de doenças, estabelecendo os biofármacos como uma solução preferida para uma ampla gama de condições médicas em ambientes hospitalares e ambulatoriais.

Visão do mercado biofarmacêutico dos EUA

O mercado de biofármacos dos EUA capturou a maior fatia de receita, de 74,2%, na América do Norte em 2025, impulsionado pela rápida adoção de terapias biológicas avançadas e pela crescente tendência da medicina personalizada. Os profissionais de saúde estão cada vez mais priorizando a melhoria dos resultados dos pacientes por meio de tratamentos biofarmacêuticos inovadores e direcionados. A crescente preferência por produtos biológicos e terapias genéticas, aliada a investimentos robustos em pesquisa e desenvolvimento e a vias regulatórias favoráveis, impulsiona ainda mais a indústria biofarmacêutica. Além disso, a crescente integração de diagnósticos avançados e análise de dados na área da saúde está contribuindo significativamente para a expansão do mercado.

Visão do mercado biofarmacêutico europeu

O mercado europeu de biofármacos deverá expandir-se a uma CAGR substancial ao longo do período previsto, impulsionado principalmente por regulamentações rigorosas em saúde e pela crescente necessidade de tratamentos eficazes para doenças crônicas e necessidades médicas não atendidas. O aumento do envelhecimento populacional, aliado à demanda por medicamentos inovadores e biossimilares, está fomentando a adoção de biofármacos. Os sistemas de saúde europeus também são atraídos pelo potencial de melhores resultados para os pacientes e pela relação custo-efetividade a longo prazo que essas terapias oferecem. A região está vivenciando um crescimento significativo em oncologia, imunologia e outras áreas terapêuticas, com biofármacos sendo incorporados tanto em regimes de tratamento de primeira linha quanto em regimes subsequentes.

Visão geral do mercado biofarmacêutico do Reino Unido

Prevê-se que o mercado de biofármacos do Reino Unido cresça a uma CAGR considerável durante o período previsto, impulsionado pela tendência crescente de adoção de inovações médicas avançadas e pelo desejo por maior eficácia e segurança no tratamento de doenças complexas. Além disso, as preocupações com o aumento da incidência de doenças crônicas e o potencial dos biofármacos para oferecer efeitos modificadores da doença estão incentivando tanto profissionais de saúde quanto pacientes a optarem por essas terapias avançadas. Espera-se que a adesão do Reino Unido à pesquisa médica de ponta, juntamente com sua indústria farmacêutica consolidada, continue a estimular o crescimento do mercado.

Visão do mercado biofarmacêutico na Alemanha

Espera-se que o mercado alemão de biofármacos se expanda a uma CAGR considerável durante o período previsto, impulsionado pela crescente conscientização sobre os benefícios das terapias biológicas e pela demanda por opções de tratamento tecnologicamente avançadas e focadas no paciente. A infraestrutura de saúde bem desenvolvida da Alemanha, aliada à sua forte ênfase em pesquisa e desenvolvimento farmacêutico, promove a adoção de biofármacos, especialmente em clínicas e hospitais especializados. A integração de biofármacos com abordagens de medicina personalizada também está se tornando cada vez mais prevalente, com forte preferência por terapias que demonstram benefícios clínicos significativos e melhor qualidade de vida.

Visão do mercado de biofármacos da Ásia-Pacífico

O mercado de biofármacos da Ásia-Pacífico deverá crescer à taxa composta de crescimento anual (CAGR) mais rápida, de 21,6%, em 2025, impulsionado pelo aumento do acesso à saúde, pelo aumento da renda disponível e pelos avanços tecnológicos em países como China, Japão e Índia. A crescente inclinação da região para tratamentos médicos modernos, apoiada por iniciativas governamentais que promovem a inovação farmacêutica e expandem a infraestrutura de saúde, está impulsionando a adoção de biofármacos. Além disso, à medida que a região da Ásia-Pacífico emerge como um importante polo de fabricação de produtos biofarmacêuticos e biossimilares, a acessibilidade e o preço acessível dessas terapias estão se expandindo para uma base de pacientes mais ampla.

Visão do mercado biofarmacêutico japonês

O mercado biofarmacêutico japonês está ganhando impulso devido à cultura de alta tecnologia do país, ao rápido envelhecimento da população e à demanda por soluções de saúde inovadoras e convenientes. O mercado japonês dá grande ênfase a tecnologias médicas avançadas, e a adoção de biofármacos é impulsionada pela crescente prevalência de doenças crônicas e pela necessidade de opções de tratamento mais eficazes. A integração de biofármacos com sistemas avançados de administração de medicamentos e plataformas digitais de saúde está impulsionando o crescimento. Além disso, o envelhecimento da população japonesa provavelmente estimulará a demanda por terapias que possam melhorar a qualidade de vida e controlar doenças relacionadas à idade.

Visão do mercado biofarmacêutico da Índia

Espera-se que o mercado biofarmacêutico indiano apresente a maior taxa composta de crescimento anual (CAGR), de 12,6%, devido ao aumento dos gastos com saúde, à crescente prevalência de doenças crônicas, ao crescente apoio governamental aos setores de biotecnologia e farmacêutico e a um aumento significativo na fabricação de biossimilares e vacinas. O mercado biofarmacêutico indiano se beneficia da crescente demanda por tratamentos de melhor qualidade, aliada ao aumento da renda, tornando as terapias avançadas mais acessíveis. Essa demanda é ainda mais amplificada pelas vantagens dos biofármacos em relação à medicina tradicional, incluindo potencialmente menos efeitos colaterais e maior eficácia no tratamento de doenças complexas.

Participação no mercado de biofármacos

A indústria biofarmacêutica é liderada principalmente por empresas bem estabelecidas, incluindo:

- Lilly (EUA)

- Johnson & Johnson Services, Inc. (EUA)

- Sanofi (França)

- Abbott (EUA)

- AstraZeneca (Reino Unido)

- F. Hoffmann-La Roche Ltd. (Suíça)

- BIOMÉRIEUX (França)

- Novartis AG (Suíça)

- Bristol-Myers Squibb Company (EUA)

- Novo Nordisk A/S (Dinamarca)

- Merck & Co., Inc. (EUA)

- GSK Plc (Reino Unido)

- Biogen (EUA)

- Bayer AG (Alemanha)

- Pfizer Inc. (EUA)

- Amgen (EUA)

- AbbVie Inc. (EUA)

Últimos desenvolvimentos no mercado global de biofármacos

- Em março de 2023, a Moderna anunciou a expansão de seu programa de vacinas de mRNA, projetado especificamente para tratar doenças infecciosas emergentes e terapias contra o câncer em ambientes com recursos limitados. Essa abordagem inovadora visa aprimorar a segurança sanitária global, oferecendo uma solução confiável e eficaz para a preparação para pandemias e oncologia. Esse avanço destaca o compromisso da Moderna com o desenvolvimento de tecnologias médicas de ponta que protejam populações vulneráveis, garantindo maior proteção e melhores resultados de saúde pública para instituições e suas comunidades.

- Em setembro de 2023 , a Moderna anunciou resultados clínicos positivos em suas franquias de câncer, doenças raras e doenças infecciosas em seu Dia Anual de P&D. A empresa enfatizou o sucesso de sua plataforma de mRNA em avançar programas de doenças respiratórias para dados positivos de Fase 3 e sua meta de lançar até 15 produtos em cinco anos, incluindo em oncologia e doenças infecciosas, indicando uma expansão significativa do pipeline.

- Em outubro de 2023 , a Gilead Sciences apresentou dados de última hora sobre seu pipeline de doenças hepáticas, incluindo resultados finais de um estudo fundamental de Fase 3 para bulevirtida na hepatite delta e resultados iniciais de um estudo de Fase 1a de uma nova vacina terapêutica experimental para hepatite B. A empresa também apresentou dados do mundo real sobre tratamentos para hepatite C, reforçando sua liderança em hepatite viral e doenças hepáticas.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.