Global Bariatric Medical Devices Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

1,921.19 Million

USD

3,256.86 Million

2024

2032

USD

1,921.19 Million

USD

3,256.86 Million

2024

2032

| 2025 –2032 | |

| USD 1,921.19 Million | |

| USD 3,256.86 Million | |

|

|

|

|

Segmentação do mercado global de dispositivos médicos bariátricos, por tipo (dispositivos cirúrgicos e dispositivos não cirúrgicos), tecnologia (dispositivos de cirurgia bariátrica laparoscópica, dispositivos de cirurgia bariátrica assistida por robótica e dispositivos de cirurgia bariátrica endoscópica), material do dispositivo (materiais biocompatíveis, metais, polímeros, e outros materiais), Aplicação (Gestão da obesidade, cirurgia para perda de peso (WLS) e suplementos para perda de peso), Utilizador final (hospitais, centros bariátricos especializados, centros de cirurgia ambulatória (ASCs) e ambientes de cuidados domiciliário) – Tendências e previsões do setor até 2032

Análise de mercado de dispositivos médicos bariátricos

A prevalência global da obesidade está a aumentar constantemente, com mais de 650 milhões de adultos em todo o mundo classificados como obesos, representando aproximadamente 13% da população adulta. Nos Estados Unidos, cerca de 42% dos adultos são considerados obesos, o que faz com que esta seja uma preocupação significativa de saúde pública. Da mesma forma, na Europa, mais de 30% da população adulta é afectada pela obesidade, realçando o seu impacto generalizado. Entretanto, na região da Ásia-Pacífico, países como a China e a Índia estão a assistir a um aumento das taxas de obesidade, impulsionado pela rápida urbanização, pelos estilos de vida sedentários e pelas mudanças no sentido de dietas ricas em calorias. Esta crescente epidemia de obesidade está a alimentar a procura de dispositivos médicos bariátricos, à medida que mais indivíduos procuram intervenções eficazes para o controlo do peso e para problemas de saúde relacionados com a obesidade. A tendência enfatiza a necessidade urgente de soluções inovadoras e eficientes no mercado global de cuidados de saúde, impulsionando ainda mais os avanços na tecnologia médica bariátrica.

Tamanho do mercado de dispositivos médicos bariátricos

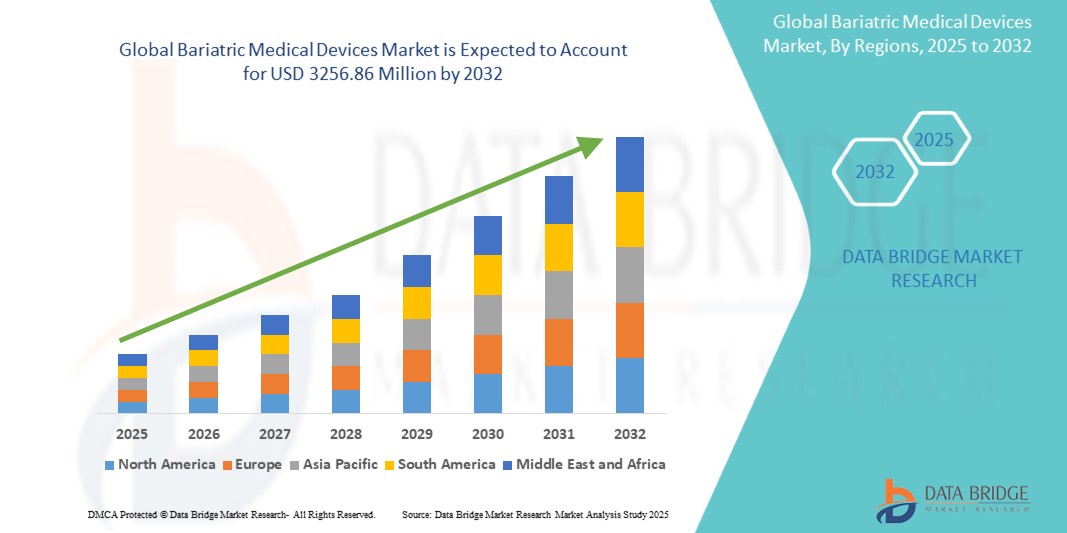

O tamanho do mercado global de dispositivos médicos bariátricos foi avaliado em 1.921,19 milhões de dólares em 2024 e está projetado para atingir os 3.256,86 milhões de dólares até 2032, com um CAGR de 6,80% durante o período previsto de 2025 a 2032 . Além dos insights sobre os cenários de mercado, tais como o valor de mercado, a taxa de crescimento, a segmentação, a cobertura geográfica e os principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research incluem também análises aprofundadas de especialistas, epidemiologia dos doentes, análise de pipeline , análise de preços e enquadramento regulamentar.

Tendências do mercado de dispositivos médicos bariátricos

“Mudança para soluções não invasivas”

A mudança para soluções não invasivas no mercado dos dispositivos médicos bariátricos está a tornar-se mais notória à medida que os pacientes optam cada vez mais por procedimentos que envolvem menos riscos e tempos de recuperação mais rápidos. Os procedimentos endoscópicos e os balões gástricos estão a ganhar popularidade devido à sua natureza minimamente invasiva, oferecendo resultados eficazes de perda de peso sem necessidade de incisões cirúrgicas. Estes métodos são vistos como alternativas atraentes às cirurgias bariátricas tradicionais, como o bypass gástrico ou a gastrectomia vertical, que envolvem operações mais complexas e períodos de recuperação mais longos. As opções não cirúrgicas estão geralmente associadas a menores taxas de complicações, menos internamentos hospitalares e um retorno mais rápido às atividades normais. Esta tendência reflete uma preferência crescente por tratamentos que priorizam a conveniência e a segurança, principalmente para os doentes hesitantes em submeter-se a procedimentos mais invasivos. À medida que a consciencialização sobre estas opções se espalha, mais pessoas estão a escolher tratamentos não invasivos para controlar a obesidade de forma eficaz.

Âmbito do Relatório e Segmentação do Mercado de Dispositivos Médicos Bariátricos

|

Atributos |

Principais insights do mercado de dispositivos médicos bariátricos |

|

Segmentos abrangidos |

|

|

Países abrangidos |

EUA, Canadá, México, Alemanha, França, Reino Unido, Holanda, Suíça, Bélgica, Rússia, Itália, Espanha, Turquia, Resto da Europa, China, Japão, Índia, Coreia do Sul, Singapura, Malásia, Austrália, Tailândia, Indonésia , Filipinas , Resto da Ásia-Pacífico, Arábia Saudita, Emirados Árabes Unidos, África do Sul, Egito, Israel, Resto do Médio Oriente e África, Brasil, Argentina, Resto da América do Sul |

|

Principais participantes do mercado |

Johnson & Johnson Services, Inc. (EUA), Medtronic (Irlanda), Cook Medical (EUA), Boston Scientific (EUA), Hoya Corporation (Japão), Apollo Endosurgery (EUA), B. Braun SE (Alemanha), EndoGastric Solutions (EUA), Stryker Corporation (EUA), Intuitive Surgical (EUA), Neogastric, LLC (EUA), Teleflex Incorporated (EUA), BaroSense Inc. (EUA), Zimmer Biomet (EUA), AbbVie Inc. (EUA), Cook Medical (EUA), Medi-Globe GmbH (Alemanha), entre outros. |

|

Oportunidades de Mercado |

|

|

Conjuntos de informações de dados de valor acrescentado |

Para além dos insights sobre os cenários de mercado, tais como o valor de mercado, a taxa de crescimento, a segmentação, a cobertura geográfica e os principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research incluem também análises aprofundadas de especialistas, epidemiologia dos doentes, análise de pipeline, análise de preços, e quadro regulamentar. |

Definição de mercado de dispositivos médicos bariátricos

Os dispositivos médicos bariátricos são ferramentas especializadas concebidas para auxiliar no tratamento e gestão da obesidade. Estes dispositivos auxiliam na perda de peso através de intervenções cirúrgicas ou não cirúrgicas. Os dispositivos bariátricos incluem opções como bandas gástricas, balões e dispositivos de gastrectomia vertical , que ajudam a reduzir a capacidade do estômago, a limitar a ingestão de alimentos ou a alterar a digestão. Estes dispositivos podem ser implantados cirurgicamente ou utilizados em tratamentos não invasivos, como procedimentos endoscópicos. Visam reduzir os riscos para a saúde associados à obesidade, como a diabetes, a hipertensão e as doenças cardiovasculares. Os dispositivos médicos bariátricos são cada vez mais utilizados como parte de programas abrangentes de controlo de peso para melhorar os resultados dos doentes e apoiar os objetivos de perda de peso a longo prazo.

Dinâmica do mercado de dispositivos médicos bariátricos

Motoristas

- Aumento das taxas de obesidade

A crescente prevalência da obesidade, especialmente em regiões como a América do Norte, a Europa e partes da Ásia-Pacífico, está a aumentar significativamente a procura de dispositivos médicos bariátricos. Nestas regiões, as taxas de obesidade estão a aumentar devido a factores de estilo de vida, como a má alimentação, a falta de actividade física e a crescente urbanização. À medida que os riscos para a saúde relacionados com a obesidade, incluindo diabetes, hipertensão e doenças cardiovasculares, aumentam, as pessoas procuram soluções eficazes para perder peso. As cirurgias bariátricas, como o bypass gástrico e a gastrectomia vertical, bem como as opções não cirúrgicas, como os balões gástricos e os dispositivos endoscópicos, estão a tornar-se mais comuns. Esta mudança está a levar a um aumento da utilização de dispositivos bariátricos avançados que oferecem perda de peso a longo prazo e melhor qualidade de vida. Além disso, a crescente aceitação dos tratamentos bariátricos e a expansão da infraestrutura de saúde nos mercados emergentes estão a contribuir para a expansão do mercado a nível global. Por exemplo, em Março de 2024, de acordo com um artigo publicado pela OMS, mais de mil milhões de pessoas no mundo vivem com obesidade, e as taxas de obesidade nos adultos mais do que duplicaram. Além disso, 43% dos adultos tinham excesso de peso em 2022. Espera-se que esta prevalência crescente impulsione a procura de dispositivos médicos bariátricos, à medida que mais indivíduos procuram soluções para gerir os riscos para a saúde relacionados com a obesidade, impulsionando o crescimento do mercado de tratamentos para a perda de peso.

- Avanços tecnológicos nos tratamentos bariátricos

Os avanços tecnológicos nos tratamentos bariátricos estão a revolucionar o campo, melhorando as opções de perda de peso cirúrgicas e não cirúrgicas. Os procedimentos minimamente invasivos, como as cirurgias laparoscópicas e assistidas por robótica, estão a ganhar força porque exigem incisões mais pequenas, reduzem o tempo de recuperação e apresentam menores riscos de complicações em comparação com a cirurgia tradicional. Estas inovações permitem uma recuperação mais rápida do paciente e uma maior precisão cirúrgica, o que impulsiona a sua adoção cada vez maior. Além disso, as soluções não cirúrgicas, como os balões gástricos e os dispositivos endoscópicos, estão a expandir as opções de tratamento para indivíduos que preferem alternativas menos invasivas. Estes dispositivos são mais fáceis de administrar, envolvem um tempo de inatividade mínimo e apresentam resultados eficazes na perda de peso, o que os torna uma escolha atrativa para os pacientes. Como resultado, o mercado de dispositivos médicos bariátricos está a ter uma maior procura, impulsionada por melhores resultados para os pacientes e um maior acesso a tecnologias avançadas. Esta tendência reflete uma mudança em direção a soluções de perda de peso mais eficientes e mais amigáveis para os pacientes em todo o mundo. Em janeiro de 2024, de acordo com um artigo publicado pelo NCBI, a cirurgia robótica, com a sua visualização avançada e a utilização de instrumentos especializados, está a revolucionar as intervenções médicas. Espera-se que este campo em evolução impulsione o crescimento dos dispositivos médicos bariátricos, uma vez que estas tecnologias oferecem precisão, invasividade mínima e tempos de recuperação mais rápidos, tornando-as cada vez mais populares em cirurgias para perda de peso e outros procedimentos médicos.

Oportunidades

- Aumento da sensibilização e educação

À medida que aumenta a consciencialização sobre a obesidade e os riscos para a saúde a ela associados, mais pessoas procuram intervenções médicas para o controlo do peso. As campanhas de saúde pública, juntamente com os esforços dos profissionais de saúde para educar o público, estão a desempenhar um papel significativo na sensibilização para os perigos da obesidade. Estas iniciativas enfatizam a importância da intervenção precoce e os benefícios dos tratamentos bariátricos. O crescente reconhecimento das complicações de saúde a longo prazo relacionadas com a obesidade, como as doenças cardíacas, a diabetes e a apneia do sono, levou a uma aceitação mais ampla dos procedimentos bariátricos. Como resultado, mais doentes estão a considerar soluções médicas, como a cirurgia bariátrica e tratamentos não invasivos para a perda de peso. A crescente consciencialização está a fomentar uma maior base de doentes, proporcionando uma oportunidade para os fabricantes de dispositivos médicos bariátricos satisfazerem esta procura crescente e expandirem o seu alcance de mercado. Esta tendência não só ajuda a reduzir os riscos para a saúde relacionados com a obesidade, como também apoia o desenvolvimento contínuo de soluções inovadoras para a perda de peso. Em agosto de 2024, de acordo com um artigo publicado pelo Royal College of Surgeons of England, aproximadamente 5.000 pessoas do Reino Unido viajam para o estrangeiro todos os anos para cirurgia bariátrica, principalmente para a Turquia, Europa de Leste ou Médio Oriente, o que é comparável aos 4.500 cirurgias bariátricas realizadas anualmente no NHS (2021–2022). Esta tendência destaca a crescente consciencialização sobre os procedimentos bariátricos, à medida que mais pessoas procuram soluções para a perda de peso, mesmo fora dos seus países de origem. O número crescente de pacientes que optam por cirurgias no estrangeiro representa uma oportunidade para o mercado de dispositivos médicos bariátricos, alargando o acesso às opções de tratamento e fomentando a procura global por soluções inovadoras para a perda de peso. Isto é um reflexo claro da crescente consciencialização e educação sobre a obesidade e o seu tratamento.

- Aumento do apoio governamental e dos seguros

Os governos de diversas regiões, especialmente da América do Norte e da Europa, reconhecem cada vez mais os benefícios de saúde a longo prazo ao abordarem precocemente a obesidade. Ao reconhecer a redução significativa dos custos dos cuidados de saúde e ao melhorar a saúde pública, estes governos estão a expandir a cobertura dos seguros para cirurgias bariátricas e dispositivos médicos. As políticas estão a evoluir para apoiar uma gama mais ampla de tratamentos para a perda de peso, incluindo balões gástricos, cirurgias assistidas por robótica e cirurgias bariátricas tradicionais. Esta mudança está a tornar estes tratamentos mais acessíveis a uma população maior de doentes, especialmente aqueles que antes enfrentavam custos diretos elevados. A expansão dos reembolsos de seguros está também a promover a adoção de tratamentos avançados, eficazes e económicos, uma vez que as seguradoras compreendem que estas soluções podem reduzir o encargo financeiro a longo prazo associado a complicações relacionadas com a obesidade, como a diabetes e as doenças cardíacas. Consequentemente, este apoio está a contribuir para o crescimento do mercado de dispositivos médicos bariátricos, tornando os tratamentos mais amplamente disponíveis e aceites.

Restrições/Desafios

- Elevado custo de cirurgias e dispositivos bariátricos

O elevado custo das cirurgias bariátricas e dos dispositivos médicos é uma barreira significativa à acessibilidade para muitos doentes. Procedimentos cirúrgicos como o bypass gástrico e a gastrectomia vertical envolvem frequentemente taxas hospitalares elevadas, incluindo anestesia, despesas com o bloco operatório e cuidados pós-operatórios. Os dispositivos médicos, como bandas gástricas ou balões, podem acrescentar custos adicionais. Estes desafios financeiros são especialmente pronunciados em regiões de baixo rendimento ou entre indivíduos sem seguro de saúde suficiente. Embora a cobertura de seguro para procedimentos bariátricos esteja a expandir-se em algumas regiões, a acessibilidade continua a ser um problema para muitas pessoas que não podem suportar as despesas diretas. A relação custo-benefício global destes tratamentos precisa de melhorar, particularmente em áreas carenciadas, para garantir que mais indivíduos possam aceder aos cuidados de que necessitam. Esta barreira financeira afecta a adopção generalizada de tratamentos bariátricos e pode limitar o crescimento do mercado em determinadas populações.

- Segurança do doente e complicações associadas aos procedimentos bariátricos

A segurança do doente e as complicações associadas aos procedimentos bariátricos representam um desafio significativo no mercado dos dispositivos médicos bariátricos. Embora as cirurgias bariátricas, como o bypass gástrico e a gastrectomia vertical, ofereçam soluções eficazes para a perda de peso, apresentam riscos inerentes, incluindo infeções, coágulos sanguíneos e problemas relacionados com a anestesia. Estas complicações podem desencorajar os doentes de optar por estes tratamentos. As opções não cirúrgicas, como os balões gástricos, embora menos invasivas, podem ainda levar a riscos como a perfuração gástrica, a migração do dispositivo ou a fuga. Além disso, podem surgir problemas a longo prazo, como deficiências nutricionais ou problemas gastrointestinais, exigindo intervenções médicas adicionais e cuidados de acompanhamento. Estas complicações requerem frequentemente cuidados pós-operatórios extensos, o que aumenta o custo global do tratamento e a complexidade. Gerir estes riscos e, ao mesmo tempo, garantir a segurança do doente é um desafio crítico para os profissionais de saúde, uma vez que a necessidade de monitorização e intervenção cuidadosas pode limitar a adoção generalizada e o sucesso dos procedimentos e dispositivos bariátricos.

Este relatório de mercado fornece detalhes de novos desenvolvimentos recentes, regulamentos comerciais, análise de importação e exportação, análise de produção, otimização da cadeia de valor, quota de mercado, impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações do mercado, análise estratégica do crescimento do mercado, tamanho do mercado, crescimento do mercado das categorias, nichos de aplicação e dominância, aprovações de produtos, lançamentos de produtos, expansões geográficas, inovações tecnológicas no mercado. Para mais informações sobre o mercado, contacte a Data Bridge Market Research para obter um briefing de analista.

Âmbito do mercado de dispositivos médicos bariátricos

O mercado é segmentado com base no tipo, tecnologia, material do dispositivo, aplicação e utilizador final. O crescimento entre estes segmentos irá ajudá-lo a analisar segmentos de baixo crescimento nos setores e fornecerá aos utilizadores uma visão geral e informações valiosas do mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Tipo

- Dispositivos Cirúrgicos

- Dispositivos não cirúrgicos

Tecnologia

- Dispositivos para cirurgia bariátrica laparoscópica

- Dispositivos de cirurgia bariátrica assistida por robótica

- Dispositivos para cirurgia bariátrica endoscópica

Material do dispositivo

- Materiais Biocompatíveis

- Metais

- Polímeros

- Outros materiais

Aplicação

- Gestão da obesidade

- Cirurgia para perda de peso (WLS)

- Suplementos para perda de peso

Utilizador final

- Hospitais

- Centros Bariátricos Especializados

- Centros Cirúrgicos de Ambulatório (ASCs)

- Configurações de cuidados domiciliários

Análise regional do mercado de dispositivos médicos bariátricos

O mercado é analisado e são fornecidos insights e tendências sobre o tamanho do mercado por país, tipo, tecnologia, material do dispositivo, aplicação e utilizador final, conforme referenciado acima.

Os países abrangidos pelo mercado são os EUA, Canadá, México, Alemanha, França, Reino Unido, Holanda, Suíça, Bélgica, Rússia, Itália, Espanha, Turquia, resto da Europa, China, Japão, Índia, Coreia do Sul, Singapura, Malásia , Austrália, Tailândia, Indonésia, Filipinas, resto da Ásia-Pacífico, Arábia Saudita, Emirados Árabes Unidos, África do Sul, Egito, Israel, resto do Médio Oriente e África, Brasil, Argentina e resto da América do Sul.

Espera-se que a América do Norte domine o mercado devido às elevadas taxas de obesidade, às infraestruturas de saúde avançadas e à forte procura por tratamentos inovadores para a perda de peso, bem como políticas de reembolso favoráveis para as cirurgias bariátricas.

Prevê-se que a região da Ásia-Pacífico seja a que mais cresce devido ao aumento das taxas de obesidade, à crescente urbanização, às mudanças nos estilos de vida e à crescente consciencialização sobre os cuidados de saúde em países como a China e a Índia, para além da alargamento do acesso a tratamentos e tecnologias médicas avançadas.

A secção do relatório sobre os países também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado nacional que impactam as tendências atuais e futuras do mercado. Pontos de dados como a análise da cadeia de valor a montante e a jusante, tendências técnicas e análise das cinco forças de Porter, estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade de marcas globais e os seus desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, ao impacto de tarifas domésticas e rotas comerciais são considerados ao fornecer uma análise de previsão dos dados do país.

Participação no mercado de dispositivos médicos bariátricos

O cenário competitivo do mercado fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença global, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa , lançamento do produto, amplitude e abrangência do produto, aplicação domínio. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas em relação ao mercado.

Os líderes de mercado de dispositivos médicos bariátricos que operam no mercado são:

- Johnson & Johnson Services, Inc. (EUA)

- Medtronic (Irlanda)

- Cook Medical (EUA)

- Boston Scientific (EUA)

- Hoya Corporation (Japão)

- Apollo Endosurgery (EUA)

- B. Braun SE (Alemanha)

- Soluções EndoGastric (EUA)

- Stryker Corporation (EUA)

- Intuitive Surgical (EUA)

- Neogastric, LLC (EUA)

- Teleflex Incorporated (EUA)

- BaroSense Inc. (EUA)

- Zimmer Biomet (EUA)

- AbbVie Inc. (EUA)

- Cook Medical (EUA)

- Medi-Globe GmbH (Alemanha)

Últimos desenvolvimentos no mercado de dispositivos médicos bariátricos

- Em outubro de 2024, a Johnson & Johnson MedTech lançou o ECHELON ENDOPATH™ Staple Line Reinforcement (SLR), um dispositivo concebido para aumentar a resistência da linha de agrafes e minimizar as complicações durante as cirurgias bariátricas, torácicas e gerais. Esta inovação ajudará a empresa a expandir a sua oferta de produtos no mercado de dispositivos cirúrgicos e a reforçar a sua posição nos segmentos bariátrico e cirúrgico mais amplo, melhorando os resultados dos doentes e aumentando a adoção entre os prestadores de cuidados de saúde.

- Em julho de 2024, os produtos da EziSurg ganharam reconhecimento internacional, surgindo em mercados como França, Itália, Médio Oriente e Estados Unidos, destacando o forte desempenho das marcas chinesas de dispositivos médicos a nível global. Esta ampla presença no mercado ajudará a empresa a expandir a sua notoriedade de marca, a impulsionar o crescimento das vendas internacionais e a reforçar a sua posição competitiva na indústria global de dispositivos médicos.

- Em abril de 2024, a Allurion Technologies, Inc. anunciou o lançamento comercial nos EUA do seu Virtual Care Suite (VCS), uma ferramenta abrangente concebida para apoiar o tratamento da obesidade. Esta mudança ajudará a empresa a reforçar a sua presença no espaço da saúde digital, oferecendo aos doentes e aos prestadores de cuidados de saúde uma solução integrada e contínua que melhora a experiência do doente e a eficácia do tratamento, impulsionando assim a adoção e expandindo a sua quota de mercado no crescente setor de cuidados à obesidade.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.