Global Anti Friction Coating Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

712.23 Million

USD

1,308.56 Million

2025

2033

USD

712.23 Million

USD

1,308.56 Million

2025

2033

| 2026 –2033 | |

| USD 712.23 Million | |

| USD 1,308.56 Million | |

|

|

|

|

Segmentação do mercado global de revestimentos antifricção por produto (MOS2, PTFE, grafite, FEP, PFA e dissulfeto de tungstênio), natureza (à base de solvente e à base de água), aplicação (peças automotivas, itens de transmissão de potência, rolamentos, componentes de munição, componentes de válvulas e atuadores e outros) e uso final (automotivo, aeroespacial, naval, construção, saúde e outros) - Tendências e previsões do setor até 2033.

Tamanho do mercado de revestimentos antifricção

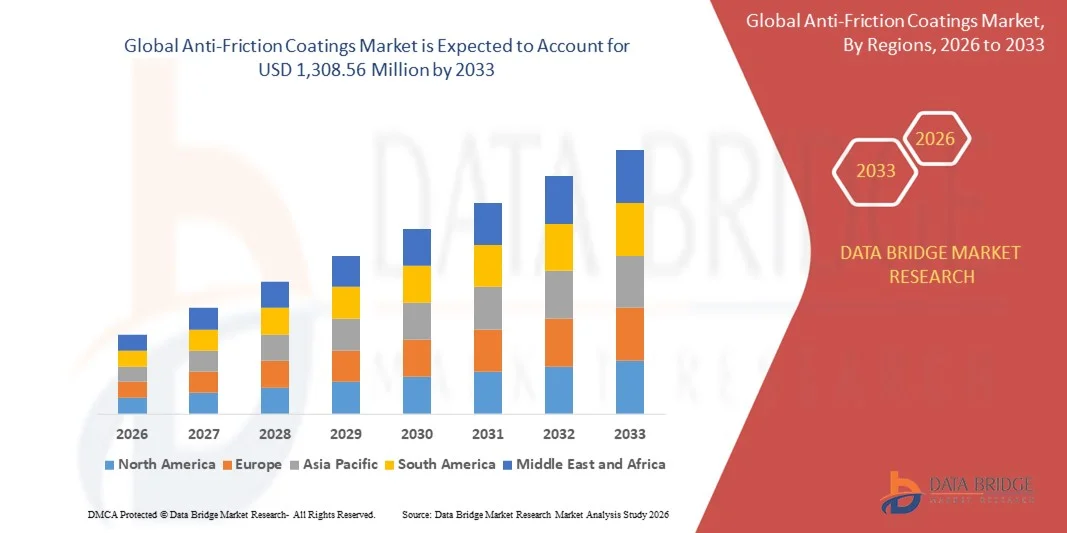

- O mercado global de revestimentos antifricção foi avaliado em US$ 712,23 milhões em 2025 e deverá atingir US$ 1.308,56 milhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 7,90% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela crescente demanda por revestimentos resistentes ao desgaste e energeticamente eficientes nos setores automotivo, aeroespacial e de máquinas industriais.

- A crescente adoção de tecnologias avançadas de engenharia de superfície para melhorar o desempenho dos equipamentos e reduzir os custos de manutenção está impulsionando ainda mais a expansão do mercado.

Análise do mercado de revestimentos antifricção

- O mercado está testemunhando inovações em formulações de revestimentos, incluindo lubrificantes secos, lubrificantes de película sólida e revestimentos compostos, para atender a diversas necessidades industriais.

- O aumento dos investimentos em pesquisa e desenvolvimento de revestimentos de alto desempenho e ecologicamente corretos está incentivando a adoção em diversas aplicações e regiões.

- A América do Norte dominou o mercado de revestimentos antifricção com a maior participação de receita, de 38,75% em 2025, impulsionada pela crescente demanda por máquinas com eficiência energética, componentes automotivos e soluções de automação industrial.

- A região Ásia-Pacífico deverá apresentar a maior taxa de crescimento no mercado global de revestimentos antifricção , impulsionada pela expansão da produção automotiva, pelo aumento da automação industrial e pela crescente demanda por componentes de máquinas duráveis e de baixa manutenção.

- O segmento de PTFE detinha a maior participação na receita de mercado em 2025, impulsionado por suas excelentes propriedades de baixo atrito, resistência química e ampla aplicabilidade em componentes automotivos, industriais e aeroespaciais. Os revestimentos de PTFE são preferidos para melhorar o desempenho, reduzir o desgaste e prolongar a vida útil de máquinas críticas.

Escopo do relatório e segmentação do mercado de revestimentos antifricção

|

Atributos |

Análises de mercado essenciais para revestimentos antifricção |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

Europa

Ásia-Pacífico

Oriente Médio e África

Ámérica do Sul

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de produção e consumo, análise de tendências de preços, cenário de mudanças climáticas, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de revestimentos antifricção

Adoção crescente de revestimentos antifricção em aplicações automotivas e industriais

- A crescente adoção de revestimentos antifricção está transformando máquinas e componentes automotivos, reduzindo o desgaste, aumentando a durabilidade e melhorando a eficiência energética. Esses revestimentos permitem uma vida útil mais longa dos equipamentos e custos de manutenção reduzidos, resultando em maior eficiência operacional e menor tempo de inatividade. Além disso, ajudam a minimizar a geração de calor, o que aumenta a segurança e a confiabilidade de máquinas de alta velocidade, fortalecendo ainda mais o desempenho operacional.

- A alta demanda por revestimentos de baixo atrito e alto desempenho em motores, sistemas de engrenagens e máquinas industriais está acelerando sua adoção em fábricas e oficinas automotivas. Esses revestimentos são particularmente eficazes na minimização das perdas por atrito, melhorando assim a eficiência de combustível e o desempenho mecânico. Além disso, contribuem para intervalos de manutenção mais longos e menor consumo de lubrificante, o que reduz o custo total de propriedade e aumenta a produtividade.

- A versatilidade e a facilidade de aplicação dos revestimentos antifricção modernos os tornam atraentes tanto para pequenos fabricantes quanto para grandes empresas industriais. As empresas se beneficiam da redução dos custos operacionais e do aumento da confiabilidade dos equipamentos, impulsionando a penetração geral no mercado. Além disso, os revestimentos são compatíveis com uma ampla gama de substratos e podem ser personalizados para aplicações industriais específicas, expandindo sua usabilidade e potencial de mercado.

- Por exemplo, em 2023, diversos fabricantes de componentes automotivos na Alemanha relataram redução do desgaste do motor e aumento da eficiência após a implementação de revestimentos antifricção avançados em componentes críticos, resultando em menos solicitações de garantia e maior satisfação do cliente. Melhorias semelhantes foram observadas em equipamentos industriais pesados na Ásia, onde máquinas revestidas apresentaram ciclos operacionais mais longos e menos quebras não programadas, aumentando a produtividade operacional geral.

- Embora os revestimentos antifricção estejam impulsionando a inovação em eficiência mecânica e conservação de energia, seu impacto depende da pesquisa contínua de materiais, da otimização do processo de aplicação e da conformidade com as regulamentações ambientais. Os fabricantes devem se concentrar em formulações ecologicamente corretas e soluções econômicas para aproveitar ao máximo a crescente demanda do mercado. A adoção contínua de tecnologias avançadas de revestimento também posiciona as empresas para obter uma vantagem competitiva por meio da melhoria da qualidade do produto e da confiabilidade do desempenho.

Dinâmica do mercado de revestimentos antifricção

Motorista

Aumento da demanda por eficiência energética e maior vida útil dos equipamentos.

- O crescente foco na redução do consumo de energia e no aumento da eficiência operacional está incentivando a adoção de revestimentos antifricção nos setores automotivo, aeroespacial e industrial. Esses revestimentos reduzem as perdas por atrito, o que se traduz em economia significativa de energia e custos operacionais mais baixos. Eles também prolongam o ciclo de vida de componentes críticos, proporcionando às empresas benefícios financeiros mensuráveis ao longo do tempo.

- Regulamentações governamentais que promovem a eficiência de combustível e a sustentabilidade ambiental estão acelerando ainda mais o crescimento do mercado. Empresas dos setores automotivo e industrial estão investindo cada vez mais em revestimentos avançados para atender aos padrões de emissões e aumentar a vida útil dos produtos. Além disso, incentivos regulatórios para práticas de fabricação sustentáveis estão encorajando as empresas a adotarem revestimentos ecológicos e de baixo atrito como parte de suas iniciativas de sustentabilidade.

- A expansão da automação industrial e de máquinas de alta velocidade também impulsiona a demanda, visto que os revestimentos antifricção melhoram o desempenho dos equipamentos sob condições de alta carga e temperatura. Os revestimentos permitem uma operação confiável em ambientes agressivos, reduzindo as taxas de falha e o tempo de inatividade. Essa tendência é particularmente proeminente em setores como o aeroespacial e o de manufatura pesada, onde a confiabilidade dos equipamentos impacta diretamente a produtividade e os custos operacionais.

- Por exemplo, em 2022, diversos fabricantes de equipamentos industriais dos EUA aplicaram revestimentos antifricção em caixas de engrenagens de alta velocidade, resultando em melhor desempenho, menor consumo de energia e maior vida útil dos componentes. Além disso, aplicações semelhantes em componentes de turbinas eólicas europeias demonstraram maior eficiência e menores necessidades de manutenção, ilustrando os benefícios transversais dos revestimentos para diversos setores.

- Embora a crescente conscientização e o apoio regulatório estejam impulsionando a expansão do mercado, a pesquisa e o desenvolvimento contínuos, a otimização de custos e a adoção de materiais ecologicamente corretos permanecem essenciais para o crescimento sustentável. As empresas que investem em tecnologias de revestimento de última geração estão em melhor posição para atender às demandas de mercado em constante evolução e capitalizar as oportunidades em aplicações industriais e automotivas emergentes.

Restrição/Desafio

Altos custos de materiais e complexidade de aplicação

- O alto custo de revestimentos antifricção avançados, como formulações cerâmicas e lubrificantes sólidos, limita a adoção por fabricantes de pequena escala e indústrias sensíveis a custos. Materiais especializados e requisitos de preparação de superfície aumentam as despesas operacionais e as barreiras de entrada. Além disso, a flutuação dos preços das matérias-primas para pós especiais pode impactar os custos gerais de fabricação, restringindo ainda mais os pequenos fabricantes.

- Em muitas regiões, a aplicação de revestimentos antifricção exige pessoal qualificado e controle preciso do processo. A falta de mão de obra treinada e de infraestrutura de aplicação avançada restringe a adoção em larga escala, principalmente em mercados emergentes. As empresas também podem enfrentar desafios para manter a qualidade consistente do revestimento em larga escala de produção, o que pode afetar a confiabilidade do desempenho e a confiança do cliente.

- Os desafios na cadeia de suprimentos de pós e aditivos para revestimentos especiais podem interromper os cronogramas de produção e aumentar os custos. A disponibilidade inconsistente de matérias-primas afeta a escalabilidade e a entrega pontual dos produtos revestidos aos clientes. Além disso, as restrições logísticas no transporte de materiais de revestimento sensíveis à temperatura ou perigosos podem levar a atrasos na produção e aumento dos riscos operacionais.

- Por exemplo, em 2023, diversos fornecedores de revestimentos industriais na Ásia enfrentaram atrasos e custos de produção mais elevados devido à escassez de pós lubrificantes avançados, afetando a produção geral do mercado e os prazos dos clientes. Desafios semelhantes foram relatados na América do Norte, onde a disponibilidade limitada de variantes de revestimento ecológicas retardou a adoção em projetos ambientalmente sensíveis.

- Embora as inovações tecnológicas continuem a aprimorar o desempenho dos revestimentos e a facilidade de aplicação, abordar os custos de capital, os requisitos de qualificação e as limitações da cadeia de suprimentos é crucial para uma adoção mais ampla e um crescimento sustentável do mercado. Empresas focadas em soluções de revestimento automatizadas e no fornecimento local de matéria-prima estão em melhor posição para superar essas barreiras e expandir sua presença no mercado.

Escopo do mercado de revestimentos antifricção

O mercado de revestimentos antifricção é segmentado com base no produto, natureza, aplicação e uso final.

- Por produto

Com base no produto, o mercado é segmentado em MOS2, PTFE, Grafite, FEP, PFA e Dissulfeto de Tungstênio. O segmento de PTFE detinha a maior participação na receita de mercado em 2025, impulsionado por suas excelentes propriedades de baixo atrito, resistência química e ampla aplicabilidade em componentes automotivos, industriais e aeroespaciais. Os revestimentos de PTFE são preferidos para melhorar o desempenho, reduzir o desgaste e prolongar a vida útil de máquinas críticas.

O segmento MOS2 deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado por sua capacidade superior de suportar cargas e estabilidade em altas temperaturas, tornando-o ideal para aplicações de alta exigência em motores automotivos, componentes de transmissão de potência e máquinas industriais. Os revestimentos MOS2 são particularmente populares por reduzirem o atrito em condições extremas, melhorarem a eficiência operacional e minimizarem os custos de manutenção.

- Por natureza

Com base na natureza, o mercado é segmentado em revestimentos à base de solvente e à base de água. O segmento à base de água detinha a maior participação em 2025, impulsionado pelo aumento das regulamentações ambientais e pela preferência por soluções de revestimento ecológicas. Os revestimentos à base de água oferecem emissões reduzidas de COVs (Compostos Orgânicos Voláteis), maior segurança no local de trabalho e conformidade com os padrões de sustentabilidade.

O segmento de revestimentos à base de solventes deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado por sua forte adesão, alto desempenho em condições extremas e adequação para aplicações industriais e automotivas críticas. Os revestimentos à base de solventes continuam sendo os preferidos onde durabilidade e extrema resistência operacional são necessárias.

- Por meio de aplicação

Com base na aplicação, o mercado é segmentado em peças automotivas, itens de transmissão de potência, rolamentos, componentes de munição, componentes de válvulas e atuadores, entre outros. O segmento de peças automotivas detinha a maior participação de mercado em 2025 devido à crescente demanda por componentes leves e de alto desempenho e aos rigorosos padrões de eficiência automotiva. Os revestimentos antifricção melhoram a eficiência de combustível, reduzem o desgaste e aumentam a confiabilidade dos sistemas automotivos.

O segmento de itens de transmissão de potência deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pelo aumento da automação industrial e pela demanda por caixas de engrenagens e máquinas de alta eficiência. Os revestimentos reduzem o atrito, melhoram a eficiência energética e minimizam o tempo de inatividade, tornando-os cruciais nas operações industriais modernas.

- Por uso final

Com base no uso final, o mercado é segmentado em automotivo, aeroespacial, naval, construção, saúde e outros. O segmento automotivo detinha a maior participação na receita em 2025, impulsionado pelo crescimento da produção de veículos, pela adoção de tecnologias de baixo consumo de combustível e pelo foco na redução dos custos de manutenção. Os revestimentos antifricção melhoram o desempenho do motor, a vida útil dos componentes e a eficiência geral do veículo.

O segmento aeroespacial deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente necessidade de componentes leves e de alto desempenho, capazes de suportar temperaturas e tensões extremas. Os revestimentos proporcionam lubrificação superior, resistência ao desgaste e eficiência energética, características essenciais para aplicações aeroespaciais.

Análise Regional do Mercado de Revestimentos Antifricção

- A América do Norte dominou o mercado de revestimentos antifricção com a maior participação de receita, de 38,75% em 2025, impulsionada pela crescente demanda por máquinas com eficiência energética, componentes automotivos e soluções de automação industrial.

- Fabricantes e usuários finais da região valorizam muito o desempenho, a durabilidade e os benefícios de economia de energia oferecidos pelos revestimentos antifricção avançados, que ajudam a reduzir os custos de manutenção e a aumentar a eficiência operacional.

- Essa ampla adoção é ainda mais sustentada por altos investimentos industriais, uma força de trabalho tecnologicamente qualificada e padrões regulatórios rigorosos que promovem processos de fabricação sustentáveis e eficientes, estabelecendo os revestimentos antifricção como uma solução preferencial em diversos setores.

Análise do Mercado de Revestimentos Antifricção nos EUA

O mercado de revestimentos antifricção dos EUA detinha a maior participação de receita na América do Norte em 2025, impulsionado pelo crescente foco na redução do consumo de energia e no aumento da vida útil dos equipamentos. Os setores automotivo, aeroespacial e industrial estão adotando ativamente revestimentos que melhoram o desempenho mecânico e reduzem o desgaste. O crescente investimento em máquinas de alta velocidade, sistemas de transmissão de potência e componentes de precisão, combinado com a ênfase regulatória na eficiência de combustível e na redução de emissões, impulsiona ainda mais o mercado. Além disso, inovações em formulações de revestimentos ecologicamente corretos e tecnologias avançadas de aplicação estão contribuindo significativamente para a expansão do mercado.

Análise do Mercado Europeu de Revestimentos Antifricção

O mercado europeu de revestimentos antifricção deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado principalmente por regulamentações ambientais e de eficiência rigorosas, juntamente com a modernização dos setores industrial e automotivo. A adoção de revestimentos em máquinas, rolamentos e componentes automotivos com maior eficiência energética está aumentando à medida que os fabricantes se esforçam para atingir metas de sustentabilidade. Consumidores e empresas industriais europeias também são atraídos pela maior vida útil dos equipamentos e pela redução dos custos operacionais proporcionadas por esses revestimentos. A região está testemunhando crescimento em aplicações automotivas, aeroespaciais e industriais, com revestimentos antifricção sendo incorporados tanto em novas instalações de produção quanto em projetos de modernização.

Análise do Mercado de Revestimentos Antifricção no Reino Unido

O mercado de revestimentos antifricção do Reino Unido deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente tendência de automação industrial e pela demanda por componentes de alto desempenho e baixa manutenção. A ênfase cada vez maior na eficiência energética e na conformidade ambiental está incentivando as empresas a adotarem revestimentos avançados para aplicações automotivas, aeroespaciais e de máquinas industriais. A infraestrutura de manufatura avançada do Reino Unido, combinada com sólidas capacidades de P&D, deverá continuar impulsionando o crescimento do mercado.

Análise do Mercado de Revestimentos Antifricção na Alemanha

O mercado alemão de revestimentos antifricção deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela adoção de engenharia de precisão e máquinas de alta tecnologia, juntamente com o foco em sustentabilidade e soluções energeticamente eficientes. A forte base industrial da Alemanha, particularmente nos setores automotivo e de manufatura, promove a integração de revestimentos antifricção avançados. O papel desses revestimentos na redução do desgaste, no prolongamento da vida útil dos componentes e na melhoria da eficiência energética está alinhado com as normas industriais e regulamentações ambientais locais, impulsionando uma adoção constante pelo mercado.

Análise do Mercado de Revestimentos Antifricção na Região Ásia-Pacífico

O mercado de revestimentos antifricção na região Ásia-Pacífico deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente industrialização, pela rápida produção automotiva e de máquinas e pelos avanços tecnológicos em países como China, Japão e Índia. A ênfase crescente da região em eficiência energética, componentes de baixa manutenção e práticas industriais sustentáveis está promovendo a adoção de revestimentos antifricção avançados. Além disso, a consolidação da região Ásia-Pacífico como um polo de fabricação de componentes automotivos e industriais está melhorando a acessibilidade e a disponibilidade, expandindo o mercado para uma base de clientes mais ampla.

Análise do Mercado Japonês de Revestimentos Antifricção

O mercado japonês de revestimentos antifricção deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela cultura de manufatura de alta tecnologia do país, pela demanda por máquinas de precisão e pela ênfase na eficiência energética. Os fabricantes japoneses estão adotando cada vez mais revestimentos para aplicações automotivas, aeroespaciais e industriais, visando reduzir o atrito, aumentar a vida útil dos componentes e diminuir os custos operacionais. Inovações em formulações ecológicas e técnicas avançadas de aplicação também estão impulsionando a adoção nos setores residencial e industrial.

Análise do Mercado de Revestimentos Antifricção na China

O mercado chinês de revestimentos antifricção representou a maior fatia de receita na região Ásia-Pacífico em 2025, impulsionado pela rápida industrialização do país, pela expansão da base de fabricação automotiva e de máquinas e pelo crescente foco em soluções de eficiência energética. Os revestimentos antifricção estão se tornando populares em peças automotivas, componentes de transmissão de potência e máquinas industriais, contribuindo para a redução da manutenção, a melhoria do desempenho mecânico e o alcance de metas de sustentabilidade. Incentivos governamentais para práticas de fabricação energeticamente eficientes e ecologicamente corretas, juntamente com a forte capacidade de produção nacional, são fatores-chave que impulsionam o mercado na China.

Participação de mercado de revestimentos antifricção

O setor de revestimentos antifricção é liderado principalmente por empresas consolidadas, incluindo:

- DuPont (EUA)

- Parker Hannifin Corp (EUA)

- CARL BECHEM GMBH (Alemanha)

- ASV Mutichemie Private Limited (Índia)

- Whitmore Manufacturing LLC (EUA)

- FUCHS LUBRITECH GmbH (Alemanha)

- Corporação Lubrizol (EUA)

- Lubrificação Klüber (Alemanha)

- Royal DSM NV (Países Baixos)

- Evonik Industries AG (Alemanha)

Novidades no mercado global de revestimentos antifricção

- Em maio de 2021, a DuPont lançou a graxa MOLYKOTE G-1079, um revestimento antifricção com redução de ruído, desenvolvido especificamente para aplicações de contato deslizante em atuadores, incluindo veículos elétricos de última geração. A nova formulação aprimora o desempenho tanto em movimentos rápidos com alta carga quanto em movimentos lentos com baixa carga, melhorando a eficiência operacional e a vida útil dos componentes. Essa inovação fortalece o portfólio de produtos da DuPont e espera-se que impulsione as vendas no mercado, atendendo à crescente demanda por lubrificantes avançados e de alto desempenho nos setores automotivo e industrial.

- Em abril de 2021, a Whitmore Manufacturing, LLC lançou o Lustor, um sistema escalável de armazenamento e distribuição de lubrificantes. A unidade compacta e durável prolonga a vida útil dos lubrificantes e se adapta a praticamente qualquer ambiente industrial, oferecendo maior eficiência e facilidade de uso. Esse desenvolvimento contribui para a otimização operacional de clientes industriais e fortalece a presença da Whitmore Manufacturing no mercado, impulsionando o crescimento da receita e a adoção de soluções avançadas de lubrificação.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.