Europe Trauma Fixation Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

4.24 Billion

USD

9.10 Billion

2024

2032

USD

4.24 Billion

USD

9.10 Billion

2024

2032

| 2025 –2032 | |

| USD 4.24 Billion | |

| USD 9.10 Billion | |

|

|

|

|

Segmentação do mercado de fixação de trauma na Europa, por tipo de produto (dispositivos de fixação interna e externa), material (implante metálico (aço, titânio e outros), fibra de carbono (termoplástico), implantes híbridos, bioabsorvíveis, enxertos e ortobiologia), aplicação (ombro e cotovelo, mão e punho, pélvico, quadril e fêmur, tíbia, craniomaxilofacial, joelho, pé e tornozelo, coluna vertebral e outros), usuário final (hospitais, centros cirúrgicos ambulatoriais, centros de trauma e outros), canal de distribuição (licitação direta, vendas no varejo e vendas online) - Tendências do setor e previsão até 2032

Tamanho do mercado de fixação de traumas na Europa

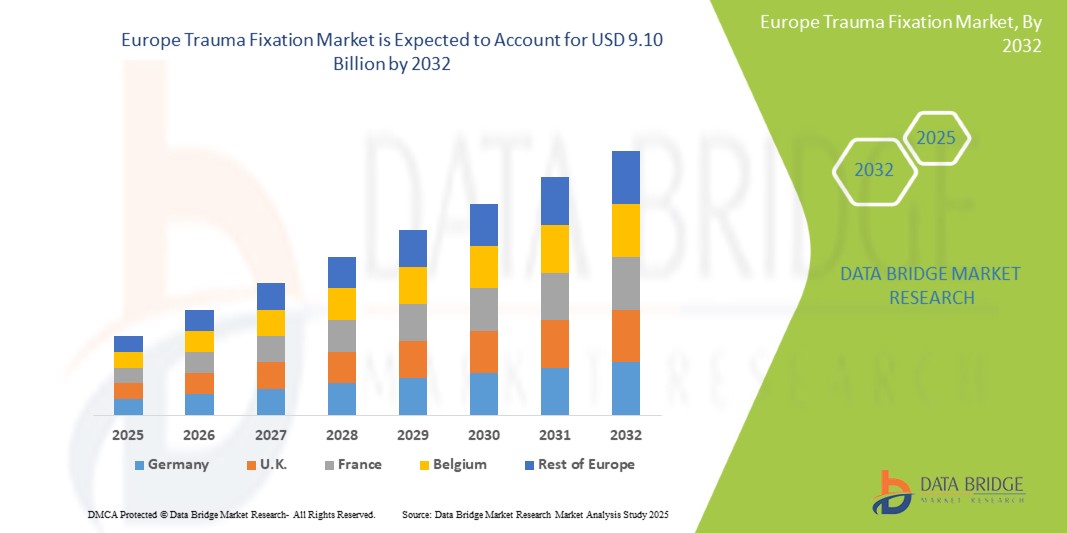

- O tamanho do mercado de fixação de traumas na Europa foi avaliado em US$ 4,24 bilhões em 2024 e deve atingir US$ 9,10 bilhões até 2032 , com um CAGR de 10,0% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente incidência de acidentes de trânsito e esportivos, pelo aumento da população geriátrica e pelos avanços tecnológicos contínuos em dispositivos de fixação de traumas.

- Além disso, a crescente demanda do consumidor e das instituições por soluções de fixação seguras, precisas e integradas, apoiadas pelo aumento da renda disponível, pelo apoio e reembolsos governamentais e pelo melhor acesso a instalações avançadas de saúde, está posicionando os dispositivos de fixação de traumas como o padrão moderno para o gerenciamento de fraturas em toda a Europa.

Análise do Mercado de Fixação de Traumas na Europa

- Dispositivos de fixação de trauma, incluindo sistemas de fixação interna e externa, são essenciais na cirurgia ortopédica para estabilizar e alinhar ossos fraturados, permitindo uma cura eficaz e uma recuperação mais rápida do paciente em lesões agudas e em ambientes de cuidados pós-operatórios.

- A crescente demanda por soluções de fixação de traumas é alimentada principalmente pelo aumento do tráfego rodoviário e de lesões relacionadas a esportes, pelo envelhecimento da população com maior risco de fraturas e pela adoção mais ampla de técnicas cirúrgicas minimamente invasivas e materiais avançados de implantes.

- A Alemanha dominou o mercado europeu de fixação de traumas com a maior participação na receita, 22,5% em 2024, caracterizada por sua infraestrutura avançada de saúde, altos volumes cirúrgicos, forte ambiente de reembolso e presença de grandes fabricantes de dispositivos médicos e centros especializados em traumas.

- Espera-se que a Polônia seja o país com crescimento mais rápido no mercado europeu de fixação de traumas durante o período previsto, devido à melhoria da infraestrutura hospitalar, ao aumento dos gastos governamentais com saúde, ao maior acesso a tratamentos ortopédicos avançados e à crescente adoção de tecnologias modernas de fixação.

- O segmento de dispositivos de fixação interna dominou o mercado europeu de fixação de traumas com uma participação de mercado de 65,5% em 2024, impulsionado pela preferência do cirurgião por pinos, placas e parafusos intramedulares para fraturas complexas, tempos de recuperação mais curtos e melhores resultados funcionais em comparação com muitas opções de fixação externa.

Escopo do Relatório e Segmentação do Mercado de Fixação de Trauma na Europa

|

Atributos |

Principais insights do mercado de fixação de traumas na Europa |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Europa

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de fixação de traumas na Europa

Mudança para soluções de fixação minimamente invasivas e específicas para cada paciente

- Uma tendência significativa e crescente no mercado europeu de fixação de traumas é a adoção de técnicas cirúrgicas minimamente invasivas combinadas com soluções de implantes específicas para cada paciente. Essa abordagem visa reduzir o tempo de recuperação, minimizar o trauma cirúrgico e melhorar os resultados para os pacientes.

- Por exemplo, empresas como a DePuy Synthes e a Stryker oferecem sistemas avançados de placas e pinos que podem ser inseridos por meio de incisões menores, reduzindo a perda de sangue e o risco de infecção. A Zimmer Biomet introduziu sistemas de fixação modulares adaptáveis às necessidades anatômicas individuais.

- Implantes específicos para cada paciente, frequentemente produzidos por impressão 3D, permitem ajuste personalizado e distribuição ideal da carga, melhorando a consolidação óssea e o conforto. Essa tendência está ganhando força em casos de fraturas complexas, nos quais os implantes prontos para uso podem não proporcionar os resultados ideais.

- A integração de ferramentas avançadas de imagem e planejamento cirúrgico assistido por computador permite que os cirurgiões planejem com precisão os procedimentos de fixação e selecionem ou projetem os dispositivos mais adequados para a anatomia de cada paciente.

- Hospitais na Alemanha, França e Reino Unido estão investindo cada vez mais em sistemas ortopédicos assistidos por robótica que combinam com essas inovações de fixação para melhorar a precisão e a reprodutibilidade cirúrgicas

- A crescente preferência por soluções de fixação menos invasivas e aprimoradas pela tecnologia está redefinindo os padrões ortopédicos na Europa, levando os fabricantes a expandir a P&D em biomateriais avançados, ferramentas guiadas de precisão e produção de implantes personalizados.

Dinâmica do mercado de fixação de traumas na Europa

Motorista

Aumento de casos de traumas por acidentes de trânsito e envelhecimento da população

- A crescente incidência de acidentes de trânsito, lesões esportivas e quedas entre a população idosa da Europa é um dos principais impulsionadores da demanda por fixação de traumas

- Por exemplo, dados do Eurostat mostram uma proporção crescente de cidadãos com mais de 65 anos, muitos dos quais são suscetíveis a fraturas por fragilidade que requerem fixação interna. Paralelamente, a densidade do tráfego urbano contribui para taxas de acidentes mais elevadas, sustentando a necessidade de soluções avançadas de gestão de fraturas.

- Dispositivos de fixação avançados, como placas de bloqueio, parafusos canulados e hastes intramedulares, oferecem mobilização mais rápida e melhor recuperação funcional, tornando-os escolhas preferenciais na prática ortopédica moderna.

- Políticas governamentais de apoio à saúde, estruturas de reembolso e investimentos em centros de trauma estão acelerando a adoção, especialmente na Europa Ocidental

- A presença de grandes fabricantes globais de produtos ortopédicos com fortes redes de distribuição na Europa apoia ainda mais a rápida disseminação da tecnologia e o treinamento para profissionais de saúde

Restrição/Desafio

Altos custos de implantes e vias regulatórias rigorosas

- O custo relativamente alto dos implantes avançados de fixação de trauma, particularmente aqueles feitos de ligas de titânio ou que incorporam materiais bioabsorvíveis, pode limitar a adoção em sistemas de saúde sensíveis a custos em partes do sul e leste da Europa.

- Por exemplo, os hospitais que operam com orçamentos limitados podem optar por implantes padrão de aço inoxidável em vez de opções premium, afetando potencialmente a penetração geral no mercado de dispositivos de última geração.

- Os rigorosos requisitos regulamentares do Regulamento de Dispositivos Médicos da UE (MDR) representam um desafio adicional, uma vez que a obtenção da certificação para novos produtos exige dados clínicos extensos, prazos prolongados e custos de conformidade significativos.

- Os fabricantes menores, em particular, enfrentam dificuldades na navegação dos processos de MDR, o que pode atrasar a inovação e a entrada no mercado

- Enfrentar esses desafios por meio da otimização de custos na fabricação de dispositivos, estratégias regulatórias simplificadas e parcerias com provedores de saúde será essencial para sustentar o crescimento do mercado em toda a região.

Escopo do mercado de fixação de traumas na Europa

O mercado é segmentado com base no tipo de produto, material, aplicação, usuário final e canal de distribuição

- Por tipo de produto

Com base no tipo de produto, o mercado europeu de fixação de traumas é segmentado em dispositivos de fixação interna e dispositivos de fixação externa. O segmento de dispositivos de fixação interna dominou o mercado, com a maior participação na receita, de 65,5% em 2024, impulsionado por sua estabilidade superior, capacidade de promover mobilização mais rápida do paciente e forte preferência dos cirurgiões pelo tratamento de fraturas complexas ou multifragmentárias.

Produtos como placas de bloqueio, parafusos canulados e hastes intramedulares são amplamente utilizados em cirurgia ortopédica devido aos seus resultados clínicos comprovados em longo prazo, taxas mínimas de complicações e risco reduzido de infecção em comparação com sistemas externos.

O segmento de dispositivos de fixação externa deverá testemunhar um crescimento notável durante o período previsto, apoiado por sua eficácia na estabilização temporária, tratamento de fraturas expostas e situações que exigem realinhamento ósseo gradual em casos de trauma de alta energia ou pacientes politraumatizados.

- Por Material

Com base no material, o mercado europeu de fixação de traumas é segmentado em implantes metálicos (aço, titânio e outros), fibra de carbono (termoplástico), implantes híbridos, bioabsorvíveis e enxertos e ortobiológicos. O segmento de implantes metálicos deteve a maior participação de mercado em 2024, visto que o aço e o titânio continuam sendo o padrão ouro para aplicações de suporte de carga, oferecendo excelente resistência, resistência à corrosão e biocompatibilidade.

Espera-se que o segmento de bioabsorvíveis registre o crescimento mais rápido durante o período previsto, impulsionado pela crescente demanda por implantes que se degradam naturalmente no corpo ao longo do tempo, eliminando a necessidade de cirurgias de remoção secundária e reduzindo os custos com saúde. Implantes de fibra de carbono e híbridos estão emergindo como categorias de nicho, mas promissoras, devido à sua estrutura leve, radiolucidez para imagens mais nítidas e adequação em medicina esportiva e casos pediátricos.

- Por aplicação

Com base na aplicação, o mercado europeu de fixação de traumas é segmentado em ombro e cotovelo, mão e punho, pélvico, quadril e fêmur, tíbia, craniomaxilofacial, joelho, pé e tornozelo, coluna vertebral e outros. O segmento de quadril e fêmur dominou em 2024 devido à alta incidência de fraturas do colo e da diáfise do fêmur, especialmente entre a população idosa suscetível à osteoporose e lesões relacionadas a quedas.

O segmento craniomaxilofacial deverá crescer rapidamente durante o período previsto devido ao aumento de cirurgias reconstrutivas após traumas faciais, juntamente com avanços em sistemas de placas reabsorvíveis e planejamento cirúrgico assistido por computador.

- Por usuário final

Com base no usuário final, o mercado europeu de fixação de traumas é segmentado em hospitais, centros cirúrgicos ambulatoriais, centros de trauma e outros. O segmento hospitalar deteve a maior participação em 2024, beneficiando-se do alto fluxo de pacientes, da disponibilidade de salas cirúrgicas avançadas, de equipes cirúrgicas multidisciplinares e de serviços abrangentes de atendimento ao trauma.

Espera-se que o segmento de centros cirúrgicos ambulatoriais apresente forte crescimento durante o período previsto, devido à crescente adoção de procedimentos de trauma em creches, à eficiência de custos para sistemas de saúde e à maior preferência dos pacientes por alta e recuperação mais rápidas em ambientes ambulatoriais.

- Por canal de distribuição

Com base no canal de distribuição, o mercado europeu de fixação de traumas é segmentado em licitação direta, vendas no varejo e vendas online. O segmento de licitação direta liderou o mercado em 2024, apoiado por acordos de compra em massa entre grandes hospitais, sistemas de saúde governamentais e fabricantes de dispositivos, garantindo fornecimento consistente e vantagens de preços negociados.

O segmento de vendas on-line deverá crescer mais rapidamente durante o período previsto, impulsionado pelo aumento das compras digitais por unidades de saúde, redes de logística aprimoradas e o papel crescente das plataformas de comércio eletrônico no fornecimento de dispositivos médicos especializados.

Análise regional do mercado de fixação de traumas na Europa

- A Alemanha dominou o mercado europeu de fixação de traumas com a maior participação na receita, 22,5% em 2024, caracterizada por sua infraestrutura avançada de saúde, altos volumes cirúrgicos, forte ambiente de reembolso e presença de grandes fabricantes de dispositivos médicos e centros especializados em traumas.

- O domínio do país é apoiado por altos gastos per capita com saúde, sistemas de reembolso robustos e a ampla adoção de dispositivos de fixação tecnologicamente avançados em hospitais públicos e privados.

- O envelhecimento da população da Alemanha, a crescente incidência de fraturas e o foco crescente em técnicas cirúrgicas minimamente invasivas estão alimentando ainda mais a demanda, posicionando o país como um importante impulsionador da inovação e do crescimento da receita no setor de fixação de traumas da Europa.

Visão geral do mercado de fixação de traumas na Alemanha

A Alemanha foi responsável pela maior fatia da receita do mercado europeu de fixação de traumas em 2024, impulsionada por suas altas taxas de procedimentos cirúrgicos, rede hospitalar avançada e investimentos significativos em pesquisa e inovação ortopédica. A ênfase do país na adoção de implantes tecnologicamente avançados, juntamente com sistemas de reembolso favoráveis, fortaleceu sua posição como líder de mercado. A crescente demanda por técnicas minimamente invasivas, aliada ao rápido envelhecimento da população, está impulsionando a adoção de dispositivos de fixação avançados em ambientes de saúde públicos e privados.

Visão geral do mercado de fixação de traumas no Reino Unido

Prevê-se que o mercado de fixação de traumas do Reino Unido cresça a uma taxa composta de crescimento anual (CAGR) saudável durante o período previsto, impulsionado pelo aumento nas cirurgias ortopédicas, pelo aumento dos casos de fraturas por quedas e acidentes de trânsito e pelo crescente acesso a cuidados especializados em traumas. O forte foco do país na modernização do NHS (Serviço Nacional de Saúde), aliado às inovações tecnológicas e à adoção de dispositivos de fixação leves e duráveis, está acelerando o crescimento do mercado. A maior conscientização sobre a intervenção precoce em fraturas e a expansão dos serviços de saúde privados contribuem ainda mais para a expansão do mercado.

Visão geral do mercado de fixação de traumas na França

O mercado francês de fixação de traumas está testemunhando uma adoção significativa de implantes avançados, apoiado por um sistema de saúde bem desenvolvido e uma sólida base de fabricação de dispositivos ortopédicos. A crescente incidência de fraturas relacionadas à osteoporose, particularmente entre a população idosa, está impulsionando a demanda por sistemas de fixação interna e externa. Iniciativas governamentais para melhorar o acesso a cuidados cirúrgicos de alta qualidade e a integração de ferramentas de planejamento digital em cirurgias ortopédicas estão impulsionando ainda mais a trajetória ascendente do mercado.

Visão geral do mercado de fixação de traumas na Itália

O mercado italiano de fixação de traumas está em constante expansão, impulsionado pelo aumento da participação esportiva, pelo crescimento da população idosa e pelo aumento de casos de fraturas complexas. Investimentos na modernização da infraestrutura de saúde, juntamente com a adoção de materiais de fixação inovadores, como fibra de carbono e implantes bioabsorvíveis, estão contribuindo para o crescimento do mercado. A comunidade ortopédica do país também está adotando cada vez mais técnicas de fixação minimamente invasivas, melhorando o tempo de recuperação e os resultados dos pacientes.

Visão geral do mercado de fixação de traumas na Polônia

O mercado polonês de fixação de traumas está emergindo como o de crescimento mais rápido na Europa, impulsionado por rápidas melhorias na infraestrutura de saúde, crescentes investimentos governamentais em equipamentos cirúrgicos modernos e expansão do acesso a cuidados ortopédicos especializados. O aumento da incidência de acidentes de trânsito, aliado ao aumento de casos de lesões esportivas, está impulsionando a demanda por dispositivos de fixação avançados. A comunidade ortopédica do país está adotando cada vez mais técnicas minimamente invasivas e materiais de implantes inovadores, posicionando a Polônia como um mercado de alto crescimento na região.

Participação no mercado de fixação de traumas na Europa

A indústria de fixação de traumas na Europa é liderada principalmente por empresas bem estabelecidas, incluindo:

- Johnson & Johnson e suas afiliadas (EUA)

- Stryker (EUA)

- Zimmer Biomet (EUA)

- Smith + Nephew (Reino Unido)

- Medtronic (Irlanda)

- B. Braun SE (Alemanha)

- Orthofix Medical Inc. (EUA)

- Wright Medical Group NV (Holanda)

- ConMed Corporation (EUA)

- Acumed LLC (EUA)

- Arthrex, Inc. (EUA)

- DePuy Synthes Companies (EUA)

- OsteoMed (EUA)

- Globus Medical, Inc. (EUA)

- Integra LifeSciences Holdings Corporation (EUA)

- BioPro, Inc. (EUA)

- Medartis AG (Suíça)

- Tecnologia Médica Dupla Inc. (China)

- Citieffe Srl (Itália)

- ChM sp. z oo (Polônia)

Quais são os desenvolvimentos recentes no mercado europeu de fixação de traumas?

- Em agosto de 2025, o Instituto de Pesquisa AO de Davos, em parceria com a QUT (Austrália), está conduzindo ensaios clínicos europeus para a Placa Bifásica, um novo dispositivo de fixação que equilibra a estabilidade mecânica com micromovimentos controlados para promover a formação de calo. O 100º paciente recebeu o implante no final de 2024. A conclusão do acompanhamento de um ano está prevista para 2026, após o qual a produção e a implementação mais ampla poderão ocorrer.

- Em junho de 2025, a Johnson & Johnson MedTech anunciou as primeiras cirurgias parciais de joelho (artroplastia unicompartimental do joelho) da Europa utilizando a plataforma robótica assistida VELYS, aprovada pela CE, combinada com o implante parcial de joelho SIGMA HP. Implementada em nove países, incluindo Alemanha, Reino Unido, França e Itália, essa tecnologia promete alinhamento personalizado e insights cirúrgicos que preservam os tecidos moles, sem depender de tomografias computadorizadas.

- Em abril de 2025, a Zimmer Biomet obteve a certificação CE para seu sistema RibFix Advantage, projetado para fixação, estabilização e fusão toracoscópica minimamente invasiva de fraturas de costelas. O design da placa-ponte pré-montada se adapta à anatomia da costela e permite menos ruptura do tecido, marcando um avanço notável no tratamento de fraturas de costelas na Europa.

- Em fevereiro de 2025, a Bioretec Ltd., pioneira em implantes ortopédicos absorvíveis, obteve a marcação CE para sua linha de parafusos para trauma RemeOs em janeiro de 2025. A aprovação abrange mais de 200 variantes de produtos em quatro linhas, destinadas a membros superiores e inferiores adultos e pediátricos. Fabricados em liga de magnésio patenteada, esses parafusos são absorvíveis, osteopromotores e eliminam a necessidade de remoção do implante, aumentando a relação custo-benefício e o conforto do paciente.

- Em outubro de 2024, o COBRA-OS, um dispositivo de oclusão aórtica para prevenção de sangramento fatal em pacientes com trauma, foi aprovado para uso na Europa em 2024. O dispositivo é menor e mais econômico do que alternativas comparáveis e já estava em uso nos EUA.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.