Europe Self Adhesive Vinyl Films Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

77.59 Billion

USD

108.83 Billion

2024

2032

USD

77.59 Billion

USD

108.83 Billion

2024

2032

| 2025 –2032 | |

| USD 77.59 Billion | |

| USD 108.83 Billion | |

|

|

|

|

Segmentação do mercado de filmes de vinil autoadesivos na Europa, por tipo (opaco, transparente e translúcido), categoria (imprimível e não imprimível), largura (tamanho médio (aprox. 137 cm), tamanho grande (152-160 cm) e tamanho pequeno (abaixo de 110 cm)), processo de fabricação (filmes calandrados e filmes fundidos), tipo de adesivo (filme de vinil autoadesivo removível e filme de vinil autoadesivo permanente), substrato (plásticos, vidro, piso e outros), espessura (fina (2-3 milésimos de polegada) e espessa (mais de 3 milésimos de polegada)), aplicação (gráficos de frota, gráficos de piso, gráficos de janela, envelopamento de carro, etiquetas e adesivos, exposição e adesivos, publicidade externa, decoração de móveis, publicidade e branding, revestimento de parede e outros) - Tendências do setor e previsão para 2032

Tamanho do mercado de filmes de vinil autoadesivos na Europa

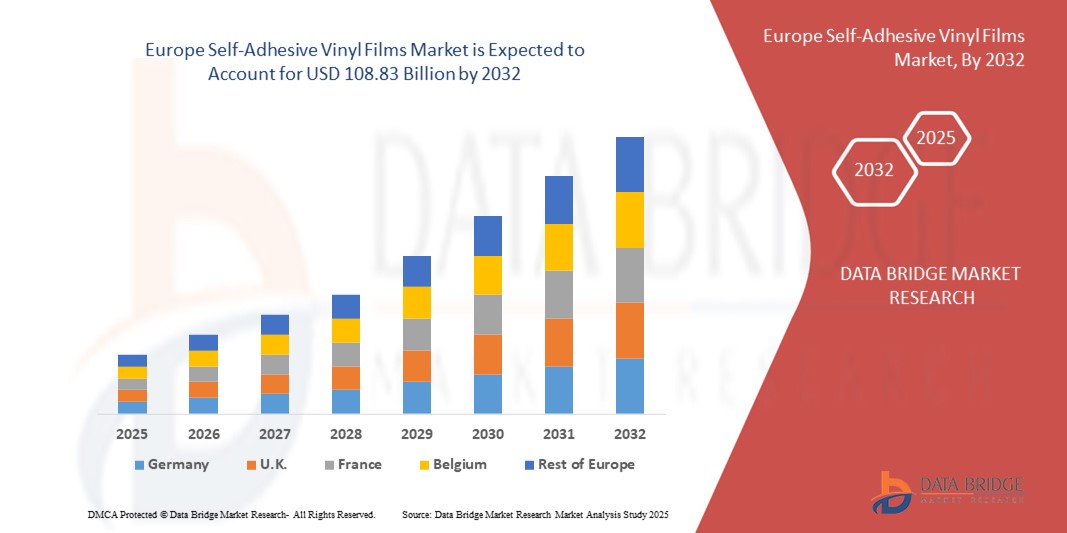

- O tamanho do mercado de filmes de vinil autoadesivos da Europa foi avaliado em US$ 77,59 bilhões em 2024 e está projetado para atingir US$ 108,83 bilhões até 2032 , crescendo a um CAGR de 4,32% durante o período previsto de 2025 a 2032.

- O crescimento do mercado na região é impulsionado principalmente pelo aumento da demanda em setores como publicidade, automotivo e construção, onde os filmes vinílicos são amplamente utilizados em sinalização, envelopamento de veículos e decoração de interiores. Os avanços tecnológicos em impressão digital e adesivos sensíveis à pressão também estão aprimorando o desempenho do produto e a versatilidade da aplicação.

- Além disso, a crescente ênfase na sustentabilidade e em materiais ecologicamente corretos está influenciando a inovação de produtos, à medida que os fabricantes respondem às rigorosas regulamentações ambientais da UE. Isso, combinado com a tendência crescente de personalização de marcas e decoração em espaços comerciais e residenciais, está impulsionando a expansão da indústria de filmes vinílicos autoadesivos em toda a Europa.

Análise do mercado de filmes vinílicos autoadesivos na Europa

- Os filmes de vinil autoadesivos, amplamente utilizados em publicidade, decoração, sinalização e envelopamento de veículos, estão ganhando força significativa na Europa devido à sua facilidade de aplicação, durabilidade e versatilidade nos setores comercial e residencial, bem como à crescente demanda por soluções gráficas removíveis, personalizáveis e econômicas.

- A crescente demanda do mercado é impulsionada em grande parte pela expansão das tecnologias de impressão digital, pelo aumento das atividades de branding e promoção e pelo crescente interesse em projetos de decoração e renovação de interiores.

- O Reino Unido dominou o mercado de filmes de vinil autoadesivos com a maior participação na receita de 46,37% em 2024, impulsionado pela forte demanda nos setores de publicidade, automotivo e decoração de interiores, bem como pela maior ênfase na sustentabilidade e inovação em design.

- O mercado alemão de filmes vinílicos autoadesivos deverá crescer a uma CAGR mais rápida de 10,12% durante o período previsto, apoiado pela forte base industrial do país e pela ênfase em materiais de alta qualidade.

- O segmento opaco dominou o mercado com a maior participação na receita de 54,6% em 2024, impulsionado por seu amplo uso em publicidade externa, outdoors, envelopamentos de veículos e sinalização onde alta visibilidade e durabilidade são essenciais

Escopo do Relatório e Segmentação de Mercado

|

Atributos |

Principais insights de mercado sobre ingredientes de filmes de vinil autoadesivos |

|

Segmentos abrangidos |

|

|

Países abrangidos |

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de filmes vinílicos autoadesivos na Europa

Sustentabilidade e personalização impulsionam a evolução do mercado

- Uma tendência importante e crescente no mercado europeu de filmes vinílicos autoadesivos é a crescente demanda por soluções ecológicas e personalizáveis, impulsionada pelo aumento das regulamentações ambientais e pela evolução das preferências dos consumidores. Esses desenvolvimentos estão influenciando significativamente a inovação e o uso de produtos em setores-chave, como publicidade, automotivo e decoração de interiores.

- Por exemplo, fabricantes líderes como Hexis e Orafol lançaram películas vinílicas autoadesivas sem PVC que atendem aos rigorosos padrões ambientais da UE, mantendo alta durabilidade e desempenho de impressão. Esses produtos ecologicamente corretos são cada vez mais utilizados em aplicações internas, como em lojas de varejo e interiores residenciais, onde materiais de baixa emissão são uma prioridade.

- Além disso, o mercado está testemunhando uma crescente adoção de filmes vinílicos imprimíveis com recursos aprimorados de personalização, permitindo que empresas e consumidores obtenham gráficos personalizados de alta resolução. Isso é particularmente notável em envelopamento de veículos e sinalização promocional, onde filmes vinílicos flexíveis e fáceis de aplicar, como a linha MPI da Avery Dennison, são amplamente utilizados para soluções criativas de branding.

- A expansão das tecnologias de impressão digital também complementa essa tendência, já que os filmes vinílicos autoadesivos agora oferecem melhor compatibilidade de tinta e tempos de produção mais rápidos. Isso permite tiragens curtas e econômicas e prototipagem rápida, atendendo às necessidades de pequenas empresas e aplicações de nicho em toda a Europa.

- Essa mudança em direção a soluções de vinil sustentáveis, adaptáveis e visualmente impactantes está remodelando a forma como marcas e indivíduos se comunicam visualmente, tanto em ambientes temporários quanto de longo prazo. Consequentemente, as empresas estão investindo em materiais recicláveis e adesivos sem solventes para se alinharem aos objetivos da economia circular e às demandas de sustentabilidade do consumidor.

- Com ênfase crescente na conformidade ambiental, flexibilidade de design e aplicação amigável, o mercado europeu de filmes de vinil autoadesivos está pronto para um crescimento contínuo, especialmente em setores como varejo, transporte e design de interiores, onde o apelo visual e a sustentabilidade convergem.

Dinâmica do mercado de filmes vinílicos autoadesivos na Europa

Motorista

Aumento da demanda nos setores de publicidade e decoração de interiores

- O uso crescente de películas vinílicas autoadesivas em publicidade, envelopamento automotivo e decoração de interiores é um fator-chave que impulsiona o mercado europeu. A versatilidade, a durabilidade e a facilidade de aplicação dessas películas as tornam altamente atraentes para uso comercial e pessoal em uma ampla gama de setores.

- Por exemplo, em fevereiro de 2024, a Orafol Europe GmbH expandiu sua linha de filmes para impressão digital com novas variantes ecológicas voltadas para o mercado de design de interiores. Essas inovações estão permitindo que marcas e designers ofereçam soluções personalizáveis e visualmente impactantes, atendendo aos padrões ambientais.

- No setor de publicidade, os filmes vinílicos autoadesivos são amplamente utilizados em sinalização de varejo, displays promocionais e adesivos para veículos, oferecendo impressão de alta resolução e durabilidade a longo prazo em ambientes externos. Isso aumentou a demanda de empresas que buscam aumentar a visibilidade da marca de forma econômica.

- Simultaneamente, o setor de decoração de interiores está adotando vinil autoadesivo para aplicações como murais de parede, revestimentos de móveis e películas para janelas, impulsionado pela demanda do consumidor por soluções de design fáceis de instalar e removíveis. Essas películas permitem atualizações frequentes de design sem alterações permanentes, o que é ideal para espaços de aluguel e interiores comerciais.

- O aumento da demanda por filmes personalizáveis e imprimíveis digitalmente e o aumento de soluções de impressão de curta tiragem estão impulsionando uma adoção mais ampla em diversos segmentos de usuários finais. Além disso, os avanços tecnológicos em adesivos e formulações de filmes estão melhorando a facilidade de uso e o desempenho, impulsionando ainda mais o crescimento do mercado.

Restrição/Desafio

Regulamentações ambientais e volatilidade da matéria-prima

- As rigorosas regulamentações ambientais em toda a Europa relativas ao uso de PVC e adesivos à base de solvente representam um desafio significativo para o mercado de filmes vinílicos autoadesivos. Esses materiais, embora amplamente utilizados, enfrentam crescente escrutínio devido ao seu impacto ecológico durante a produção e o descarte.

- Por exemplo, as diretivas da UE e a legislação nacional que visam a redução de resíduos plásticos estão a obrigar os fabricantes a adotar alternativas mais sustentáveis, o que pode exigir investimentos substanciais em I&D e alterações na produção. Esta transição pode impactar temporariamente a disponibilidade do produto e aumentar os custos para fabricantes e utilizadores finais, como

- Além disso, as flutuações nos preços das matérias-primas, especialmente para insumos derivados de petroquímicos, como PVC e adesivos acrílicos, podem levar a custos de fabricação imprevisíveis, reduzindo as margens e potencialmente limitando a acessibilidade do produto nos segmentos de mercado sensíveis ao preço.

- Embora algumas empresas estejam desenvolvendo soluções adesivas sem PVC e à base de água para atender às metas ambientais, o desempenho dessas alternativas deve ser compatível com o dos materiais tradicionais para garantir ampla adoção. Marcas como Avery Dennison e Hexis estão investindo ativamente em tecnologias mais sustentáveis, mas escalar essas inovações, mantendo preços competitivos, continua sendo um desafio fundamental.

- Navegar pelas regulamentações em evolução, garantir o desempenho do produto e gerenciar os custos da matéria-prima será fundamental para a sustentabilidade e competitividade a longo prazo do mercado europeu de filmes vinílicos autoadesivos.

Escopo do mercado de filmes de vinil autoadesivos na Europa

O mercado é segmentado com base no tipo, categoria, largura, processo de fabricação, tipo de adesivo, substrato, espessura e aplicação.

- Por tipo

Com base no tipo, o mercado de filmes vinílicos autoadesivos é segmentado em opacos, transparentes e translúcidos. O segmento opaco dominou o mercado, com a maior participação na receita, de 54,6% em 2024, impulsionado por seu amplo uso em publicidade externa, outdoors, envelopamento de veículos e sinalização, onde alta visibilidade e durabilidade são essenciais. Os filmes opacos são valorizados por sua forte representação de cores, resistência às intempéries e capacidade de cobrir superfícies subjacentes com eficácia, tornando-os a primeira escolha para branding em ambientes internos e externos. Sua relação custo-benefício e compatibilidade com impressoras de grande formato impulsionam ainda mais sua adoção entre os provedores de serviços de impressão.

Espera-se que o segmento transparente apresente o CAGR mais rápido, de 17,8%, entre 2025 e 2032, impulsionado pela crescente demanda por vitrines, decorações em vidro e displays promocionais. As películas transparentes oferecem flexibilidade estética, permitindo designs criativos transparentes, mantendo a durabilidade, tornando-as altamente atraentes para aplicações de varejo e branding corporativo.

- Por categoria

Com base na categoria, o mercado de filmes vinílicos autoadesivos é segmentado em imprimíveis e não imprimíveis. O segmento imprimível deteve a maior participação de mercado, 62,1% em 2024, impulsionado pelo uso crescente de impressoras digitais e de grande formato para publicidade, sinalização e veiculação de veículos. Os filmes vinílicos imprimíveis são populares devido à sua compatibilidade com tintas UV, solventes, látex e ecossolventes, oferecendo alta resolução para branding detalhado e designs criativos. Sua ampla adoção por gráficas, agências de publicidade e empresas de varejo continua a impulsionar o crescimento do mercado.

O segmento de filmes não imprimíveis deverá registrar o CAGR mais rápido, de 16,5%, entre 2025 e 2032, impulsionado pelo seu uso crescente em decoração de interiores, camadas de proteção e aplicações automotivas onde a impressão direta não é necessária. Filmes não imprimíveis são preferidos por sua relação custo-benefício, fácil aplicação e versatilidade, tornando-os cada vez mais populares para fins industriais e decorativos.

- Por largura

Com base na largura, o mercado é segmentado em largura média (aproximadamente 137 cm), largura grande (152–160 cm) e largura pequena (abaixo de 110 cm). O segmento de largura média dominou o mercado, com a maior participação na receita, de 48,3% em 2024, sendo a dimensão mais utilizada para sinalização, banners e aplicações de publicidade no varejo. Sua ampla compatibilidade com equipamentos de impressão padrão o torna altamente preferido por gráficas comerciais e agências de publicidade. A opção de tamanho médio oferece o equilíbrio certo entre usabilidade, eficiência e custo de material, garantindo forte adoção em diversos setores.

Espera-se que o segmento de vinil de grande formato cresça a uma taxa composta de crescimento anual (CAGR) de 18,2% entre 2025 e 2032, impulsionado por seu uso crescente em publicidade em larga escala, gráficos para frotas e envelopamento de edifícios. Filmes vinílicos de grande formato são cada vez mais adotados por empresas que buscam máxima visibilidade e branding impactante em campanhas externas.

- Por processo de fabricação

Com base no processo de fabricação, o mercado é segmentado em filmes calandrados e filmes fundidos. O segmento de filmes calandrados dominou, com a maior participação, 57,5% em 2024, devido à sua relação custo-benefício, durabilidade e adequação para aplicações de médio prazo, como gráficos de varejo, sinalização de piso e publicidade em ambientes internos. Os filmes calandrados são amplamente preferidos em economias emergentes, onde clientes com orçamento limitado buscam soluções de vinil confiáveis e acessíveis. Sua eficiência de produção e disponibilidade em larga escala os tornam a opção ideal para aplicações em grande volume.

O segmento de filmes fundidos deverá registrar o CAGR mais rápido, de 19,1%, entre 2025 e 2032, devido à sua flexibilidade, longevidade e desempenho superiores em aplicações exigentes, como envelopamento de veículos e publicidade externa. Os filmes fundidos mantêm a estabilidade dimensional, adaptam-se facilmente a superfícies complexas e resistem a condições ambientais extremas, tornando-os uma escolha premium para projetos de branding de alta qualidade.

- Por tipo de adesivo

Com base no tipo de adesivo, o mercado é segmentado em película vinílica autoadesiva removível e película vinílica autoadesiva permanente. O segmento permanente detinha a maior participação, 60,4% em 2024, devido à sua durabilidade e ampla aplicação em sinalização externa, gráficos de frotas e soluções de branding de longo prazo. Os adesivos permanentes proporcionam forte adesão a superfícies como metal, vidro e plástico, garantindo confiabilidade em condições climáticas adversas. Seu uso em branding de infraestrutura e envelopamento automotivo contribui significativamente para o domínio do mercado.

A previsão é de que o segmento de adesivos removíveis apresente o CAGR mais rápido, de 17,6%, entre 2025 e 2032, impulsionado pela crescente demanda por promoções temporárias, campanhas publicitárias sazonais e displays para eventos. As empresas preferem adesivos removíveis por sua fácil instalação e remoção sem deixar resíduos, oferecendo flexibilidade para uma construção de marca de curto prazo, porém impactante.

- Por substrato

Com base no substrato, o mercado de filmes vinílicos autoadesivos é segmentado em plásticos, vidros, pisos e outros. O segmento de plásticos dominou, com uma participação de mercado de 41,7% em 2024, impulsionado por sua ampla aplicação em embalagens, displays de varejo e painéis publicitários. Os substratos plásticos são leves, versáteis e oferecem uma excelente superfície para adesão de vinil, tornando-os os mais utilizados em diversos setores.

A previsão é de que o segmento de vidros cresça a uma taxa composta de crescimento anual (CAGR) de 18,9% entre 2025 e 2032, impulsionado pela tendência crescente de designs de vitrines decorativas, películas de privacidade e vidros arquitetônicos. O aumento dos investimentos em branding corporativo e vitrines de varejo impulsiona ainda mais a adoção de películas vinílicas em substratos de vidro.

- Por espessura

Com base na espessura, o mercado é segmentado em fino (2 a 3 mils) e grosso (mais de 3 mils). O segmento fino dominou o mercado com 55,8% de participação em 2024, pois esses filmes são leves, flexíveis e fáceis de manusear, tornando-os ideais para etiquetas, adesivos e materiais gráficos publicitários. Sua compatibilidade com aplicações internas e externas a um custo relativamente baixo aumenta a adoção.

A projeção é de que o segmento de papéis grossos cresça a uma taxa composta de crescimento anual (CAGR) de 16,8% entre 2025 e 2032, devido à crescente demanda em aplicações pesadas, como gráficos de piso, decoração de móveis e etiquetagem industrial. Sua maior durabilidade e resistência ao desgaste os tornam adequados para ambientes de alto tráfego e para marcas de longo prazo.

- Por aplicação

Com base na aplicação, o mercado de filmes vinílicos autoadesivos é segmentado em: gráficos para frotas, gráficos para pisos, gráficos para janelas, envelopamento de veículos, etiquetas e adesivos, adesivos para exposições, publicidade externa, decoração de móveis, publicidade e branding, revestimentos de parede, entre outros. O segmento de publicidade externa dominou, com a maior participação na receita, de 34,9% em 2024, impulsionado por investimentos crescentes em outdoors, anúncios em trânsito e campanhas de marketing de grande formato. A resistência às intempéries e a versatilidade de impressão do vinil o tornam o meio preferido para promoções externas impactantes.

Espera-se que o segmento de envelopamento de veículos apresente o CAGR mais rápido, de 20,4%, entre 2025 e 2032, impulsionado pela crescente demanda por personalização automotiva, branding de frotas corporativas e proteção de veículos com boa relação custo-benefício. A crescente adoção por PMEs e grandes empresas destaca o envelopamento de veículos como um importante impulsionador da futura expansão do mercado.

Análise regional do mercado europeu de filmes vinílicos autoadesivos

- O Reino Unido dominou o mercado de filmes de vinil autoadesivos com a maior participação na receita de 46,37% em 2024, impulsionado pela forte demanda nos setores de publicidade, automotivo e decoração de interiores, bem como pela maior ênfase na sustentabilidade e inovação em design.

- Países como a Alemanha, a França e o Reino Unido são os principais adotantes, beneficiando-se de indústrias de impressão bem estabelecidas, das altas expectativas dos consumidores por acabamentos de qualidade e da adoção precoce de materiais ecológicos, como filmes de vinil sem PVC.

- A infraestrutura madura da região, as rigorosas regulamentações ambientais e o foco em aplicações de marcas premium continuam a dar suporte ao uso generalizado em ambientes comerciais e residenciais, posicionando os filmes de vinil autoadesivos como um material preferencial para soluções visuais modernas e personalizáveis.

Visão geral do mercado de filmes vinílicos autoadesivos na Alemanha

O mercado alemão de películas vinílicas autoadesivas deverá crescer a uma taxa composta de crescimento anual (CAGR) de 10,12% durante o período previsto, impulsionado pela forte base industrial do país e pela ênfase em materiais de alta qualidade. A demanda é particularmente alta nos setores automotivo e de construção, onde películas duráveis e resistentes às intempéries são utilizadas para proteção de superfícies, identificação de marcas e aplicações decorativas. Além disso, as rigorosas regulamentações ambientais da Alemanha estão impulsionando os fabricantes a buscar inovações em produtos sustentáveis, incluindo películas recicláveis e adesivos sem solventes. O foco do país em edifícios com eficiência energética e estética moderna também promove a aplicação de películas vinílicas em interiores.

Visão geral do mercado de filmes vinílicos autoadesivos na França

O mercado francês de películas vinílicas autoadesivas está em constante expansão, impulsionado pelo uso crescente da impressão digital em publicidade e pela crescente popularidade da decoração personalizada para residências. Os setores de varejo e exposições são os principais contribuintes, utilizando películas vinílicas para vitrines, sinalização e identidade visual de eventos. Os consumidores franceses estão cada vez mais atraídos por soluções fáceis de instalar e reposicionáveis para interiores residenciais. Além disso, os incentivos governamentais que promovem materiais ecológicos estão incentivando uma mudança para produtos vinílicos de baixa emissão, alinhando-se à agenda nacional de sustentabilidade e influenciando as decisões de compra.

Visão geral do mercado de filmes vinílicos autoadesivos na Itália

O mercado italiano de películas vinílicas autoadesivas deverá crescer a um CAGR saudável durante o período previsto, impulsionado pelo florescimento dos setores de design e arquitetura. As películas vinílicas são amplamente utilizadas em decoração de interiores, renovação de móveis e branding comercial, com alta demanda por acabamentos criativos e luxuosos. Fabricantes e designers italianos estão adotando películas autoadesivas tanto para fins funcionais quanto estéticos, especialmente em ambientes modernos de varejo e interiores de hotéis e hotéis. A tendência de reformas residenciais do tipo "faça você mesmo" e de modernizações de design voltadas para o aluguel está impulsionando ainda mais a adoção em todos os segmentos residenciais.

Visão do mercado de filmes vinílicos autoadesivos na Espanha

O mercado espanhol de películas vinílicas autoadesivas apresenta um crescimento promissor, impulsionado pela forte atividade nos setores de construção, turismo e varejo. As películas vinílicas são amplamente utilizadas em publicidade externa, vitrines e envelopamento de veículos em regiões com grande concentração de turistas. Os crescentes investimentos em projetos de infraestrutura e renovação urbana também estão abrindo oportunidades para envelopamento de edifícios e aplicações de vinil arquitetônico. Além disso, a crescente conscientização sobre o design ecologicamente correto está levando a uma mudança gradual para opções de películas vinílicas sustentáveis, gerando nova demanda nos setores público e privado.

Participação no mercado de filmes vinílicos autoadesivos na Europa

Os líderes de mercado de filmes vinílicos autoadesivos na Europa que operam no mercado são:

- 3M (EUA)

- Avery Dennison Corporation (EUA)

- LX HAUSYS (Coreia do Sul)

- ORAFOL Europe GmbH. (Alemanha)

- Metamark (Reino Unido)

- DRYTAC (EUA)

- Achilles USA Inc. (EUA)

- Navratan LLP. (Índia)

- Xangai Hanker Industrial Co., Ltd. (China)

- Sistemas adesivos ATP AG (Suíça)

- Eikon Ltd., uma empresa do Grupo Spandex (Reino Unido)

- Grafityp (Bélgica)

- Formulações Gerais (EUA)

- POLI-TAPE Holding GmbH (Alemanha)

- LINTEC Corporation (Japão)

- UPM (Finlândia)

- Fedrigoni SPA (Itália)

- HEXIS SAS (França)

- KPMF (Holanda)

- Flexcon Company, Inc. (EUA)

- Aquabond Ltd. (EUA)

- Gardiner Graphics Supplies Europa (Reino Unido)

- APASpA (Itália)

Desenvolvimentos recentes no mercado europeu de filmes de vinil autoadesivos

- Em maio de 2023, a Orafol Europe GmbH expandiu seu portfólio de produtos sustentáveis com o lançamento de uma nova linha de películas vinílicas autoadesivas sem PVC, a ORAJET Eco Series. Voltadas para os setores de sinalização e publicidade, essas películas ecológicas atendem aos rigorosos padrões ambientais da UE e oferecem alta qualidade de impressão, flexibilidade e durabilidade. O lançamento reflete o compromisso da Orafol com a sustentabilidade e responde à crescente demanda por materiais ecologicamente corretos em toda a Europa.

- Em abril de 2023, a Avery Dennison Graphics Solutions anunciou a expansão de sua capacidade de produção na Bélgica, aumentando a eficiência da cadeia de suprimentos e reduzindo os prazos de entrega para clientes europeus. Este desenvolvimento atende à crescente demanda por películas vinílicas autoadesivas personalizáveis e de alto desempenho nos setores automotivo e arquitetônico. O investimento também reforça o compromisso da Avery Dennison em atender o mercado europeu com soluções inovadoras e de origem local.

- Em março de 2023, a Hexis SAS, fabricante francesa, apresentou uma nova linha de películas vinílicas para design de interiores, a série Skintac, na FESPA Global Print Expo, em Munique. Essas películas são projetadas para revestimento de móveis, decoração de paredes e renovação de superfícies, oferecendo uma variedade de texturas e acabamentos. A coleção responde à tendência crescente de design de interiores personalizado e reformas residenciais "faça você mesmo" na Europa.

- Em fevereiro de 2023, o Poli-Tape Group, produtor alemão de materiais autoadesivos, lançou uma nova linha de películas vinílicas refletivas para aplicações industriais e de segurança. Essas películas atendem às normas atualizadas de visibilidade e segurança da UE e são projetadas para uso de alto desempenho em transportes e ambientes de trabalho perigosos. A iniciativa destaca o foco da empresa em funcionalidade, conformidade e qualidade no segmento industrial europeu.

- Em janeiro de 2023, a Drytac Europe anunciou uma colaboração estratégica com diversos provedores de serviços de impressão europeus para promover suas linhas SpotOn e ViziPrint de filmes autoadesivos removíveis. Voltados para o varejo e materiais gráficos promocionais, esses produtos oferecem fácil aplicação e remoção sem deixar resíduos, ideais para campanhas de curta duração. A iniciativa reflete a crescente demanda por soluções visuais temporárias, porém impactantes, no setor varejista europeu.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.